0000889971false--06-3000008899712025-02-182025-02-18iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

February 18, 2025

Date of Report (Date of earliest event reported)

LIGHTPATH TECHNOLOGIES, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 000-27548 | | 86-0708398 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

2603 Challenger Tech Court, Suite 100

Orlando, Florida 32826

(Address of principal executive office, including zip code)

(407) 382-4003

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 | LPTH | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards providing pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed, LightPath Technologies, Inc. (the “Company”) entered into (i) a Membership Interest Purchase Agreement, dated as of February 13, 2025 (the “Membership Interest Purchase Agreement”), by and among the Company, G5 Infrared, LLC, a New Hampshire limited liability company (“G5 Infrared”), the members of G5 Infrared (the “Sellers”), and Kenneth R. Greenslade, solely in his capacity as Sellers’ Representative, pursuant to which the Company has agreed to acquire from the Sellers all of the issued and outstanding membership interests of G5 Infrared (the “Transaction”), (ii) a Securities Purchase Agreement, dated as of February 13, 2025 (the “Securities Purchase Agreement”), with certain accredited investors (the “Purchasers”), pursuant to which the Company agreed to issue and sell to the Purchasers (a) an aggregate of approximately 24,956 shares (the “Preferred Shares”) of a newly created series of preferred stock, with a stated value of $1,000 per share (the “Preferred Stock”), designated Series G Convertible Preferred Stock, which shall be convertible into shares of Common Stock (the shares of Common Stock issuable upon conversion of the Preferred Shares being referred to as the “Conversion Shares”), in accordance with the terms of the Company’s Certificate of Designations, Preferences and Rights of the Series G Convertible Preferred Stock to be filed with the Delaware Secretary of State (the “Certificate of Designations”), (b) warrants to purchase an aggregate of 4,352,774 shares of Common Stock, with an exercise price of $2.58 per share (the “Warrants; the shares of Common Stock issuable upon exercise of the Warrants being referred to as the “Warrant Shares”), and (c) senior secured promissory notes in the aggregate principal amount of $5,195,205 (the “Notes”), which are convertible into shares of Preferred Stock upon the occurrence of the event specified in the Notes (the “Preferred Conversion Shares”), which are in turn convertible into Conversion Shares (the Preferred Shares, Conversion Shares, Warrants, Warrant Shares, Notes and Preferred Conversion Shares, collectively the “Securities,” and the transactions contemplated by the Securities Purchase Agreement, the “Private Placement”), and (iii) a Securities Purchase Agreement, dated as of February 13, 2025 (the “Class A Common Securities Purchase Agreement”), with Lytton-Kambara Foundation (the “Buyer”), pursuant to which Buyer has agreed to purchase from the Company (x) 455,192 shares of Common Stock at a purchase price of approximately $2.15 per share, plus warrants to purchase 37.5% of the number of shares, or 170,697 shares of Common Stock, with an exercise price of $2.58 per share; and (y) 232,558 shares of Common Stock at a purchase price of approximately $2.15 per share (the “Common Offering”).

On February 18, 2025, the Company completed the Transaction (the “Closing Date”). Each of the Private Placement and the Common Offering closed immediately prior to the closing of the Transaction.

On February 19, 2025, the Company and the Sellers’ Representative, on behalf of the Sellers, executed a First Amendment to Membership Interest Purchase Agreement to correct a scrivener’s error in the Membership Interest Purchase Agreement.

On February 14, 2025, in connection with the closing of the Private Placement, the Company filed the Certificate of Designations with the Delaware Secretary of State.

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on the Closing Date, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which the Company has agreed to register all Conversion Shares and Warrant Shares (the “Registrable Securities”) under the Securities Act of 1933, as amended (the “Securities Act”). The Company agreed to file a registration statement covering the resale of such Registrable Securities within 75 days of the Closing Date. The Company will use its reasonable best efforts to cause such registration statement to be declared effective under the Securities Act as soon as possible but, in any event, no later than 90 days following the date of closing and will use its reasonable best efforts to keep such registration statement continuously effective under the Securities Act. If the Company fails to meet these deadlines, or upon the occurrence of other events set forth in the Registration Rights Agreement, the Company will be subject to liquidated damages payable to the holders of the Registrable Securities in certain circumstances.

The foregoing description of the Registration Rights Agreement is subject to and qualified in its entirety by reference to the Registration Rights Agreement, which is attached as Exhibit 10.3 to this Current Report on Form 8-K and is incorporated by reference into this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets

As discussed in the Introductory Note above, on the Closing Date, the Company completed the previously announced Transaction.

The material terms and conditions of the Membership Interest Purchase Agreement were described in Item 1.01 of the Current Report on Form 8-K filed by the Company on February 13, 2025 (the “Prior Report”), which description is incorporated herein by reference and is qualified in its entirety by reference to the full text of the Membership Interest Purchase Agreement, a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference into this Item 2.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in the Introductory Note above is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in the Introductory Note above is incorporated by reference into this Item 3.02. The Securities described in this Current Report on Form 8-K were offered and issued in reliance upon exemptions from registration provided by Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder and corresponding provisions of state securities laws. Accordingly, none of the securities to be issued in the Transaction, the Private Placement or the Common Offering, will have been registered under the Securities Act as of the closing date of such transactions, and until registered, these securities may not be offered or sold in the United States absent registration or availability of an applicable exemption from registration.

The material terms and conditions of the form of Warrant, the form of Note, the Securities Purchase Agreement and the Class A Common Securities Purchase Agreement were described in Item 1.01 of the Prior Report, which descriptions are incorporated herein by reference and are qualified in their entirety by reference to the full text of the form of Warrant, the form of Note, the Securities Purchase Agreement and the Class A Common Securities Purchase Agreement, copies of which are included as Exhibits 4.1, 4.2, 10.2 and 10.4 to this Current Report on Form 8-K and incorporated by reference into this Item 3.02.

Item 3.03 Material Modifications to Rights of Security Holders.

The information included in Item 1.01 above is incorporated by reference into this Item 3.03.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously disclosed, effective upon the Closing Date, the Company’s Board of Directors has appointed Thomas Ellis, an affiliate of the Lead Investor (as defined in the Securities Purchase Agreement), to serve as a Class II Director until his successor is duly elected and qualified or until his death, resignation, or removal.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in the Introductory Note above is incorporated by reference into this Item 5.03.

The material terms of the Certificate of Designation were described in Item 1.01 of the Prior Report, which description is incorporated herein by reference and is qualified in its entirety by reference to the full text of the Certificate of Designations, a copy of which is included as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference into this Item 5.03.

Item 7.01 Regulation FD Disclosure.

On February [18], 2025, the Company issued a press release announcing the closings of the Transaction, the Private Placement and Common Offering. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward Looking Statement

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements regarding: future expectations, plans and prospects for the Company, G5 Infrared and the combined company following the consummation of the Transaction; the anticipated benefits of the Transaction; and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” “will,” “working” and similar expressions. Any forward-looking statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements. The combined company may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. These risks and uncertainties include, but are not limited to, important risks and uncertainties associated with: the effect of the announcement of the closing of the acquisition on the Company’s or G5 Infrared’s business relationships, operating results and business generally; the ability of the combined company to timely and successfully achieve or recognize the anticipated benefits of the acquisition; the outcome of any legal proceedings that may be instituted against the Company or G5 Infrared following any announcement of the proposed acquisition and related transactions; costs related to the proposed acquisition, including unexpected costs, charges or expenses resulting from the acquisition; changes in applicable laws or regulation; the possibility that the Company or G5 Infrared may be adversely affected by other economic, business and/or competitive factors; competitive responses to the transactions; achieving the Company’s other business objectives. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company’s actual results to differ materially from those contained in the forward-looking statements, see the “Risk Factors” section, as well as discussions of potential risks, uncertainties and other important factors, in the Company’s most recent filings with the SEC. In addition, the forward looking statements included in this Current Report on Form 8-K represent the Company’s views as of the date hereof and should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

The financial statements required by this Item, with respect to the Transaction described herein, will be filed as soon as practicable, and in any event not later than 71 days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(b) Pro Forma Financial Information.

The pro forma financial information required by this Item, with respect to the Transaction described herein, will be filed as soon as practicable, and in any event not later than 71 days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(d) Exhibits.

Exhibit No. | | Description |

3.1 | | Certificate of Designations, Preferences and Rights of Series G Convertible Preferred Stock, dated February 14, 2025 |

4.1 | | Form of Warrant (incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K, filed with the SEC on February 13, 2025) |

4.2 | | Form of Note (incorporated by reference to Exhibit 4.2 of the Company’s Current Report on Form 8-K, filed with the SEC on February 13, 2025) |

10.1* | | Membership Interest Purchase Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc., G5 Infrared, LLC, the members of G5 Infrared, LLC, and Kenneth R. Greenslade, solely in his capacity as Sellers’ Representative. |

10.2* | | Securities Purchase Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc. and the investors listed on the Schedule of Buyers attached thereto. |

10.3 | | Registration Rights Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc. and each of the several purchasers signatory thereto. |

10.4* | | Securities Purchase Agreement, dated February 13, 2025, by and between LightPath Technologies, Inc. and Lytton-Kambara Foundation. |

10.5 | | First Amendment to Membership Interest Purchase Agreement, dated February 19, 2025, by and between LightPath Technologies, Inc. and Kenneth R. Greenslade, as Sellers’ Representative on behalf of the Sellers |

99.1 | | Press Release of LightPath Technologies, Inc., dated February 19, 2025. |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Schedules and certain exhibits have been omitted pursuant to Items 601(a)(5) and/or 601(b)(10)(iv) of Regulation S-K. The issuer hereby undertakes to furnish supplementally a copy of any omitted schedule or exhibit to such agreement to the U.S. Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Report to be signed in its behalf by the undersigned, thereunto duly authorized.

| LIGHTPATH TECHNOLOGIES, INC. | |

| | | |

Dated: February 21, 2025 | By: | /s/ Albert Miranda | |

| | Albert Miranda, Chief Financial Officer | |

nullnullnullnullnullnullnullnullnull

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

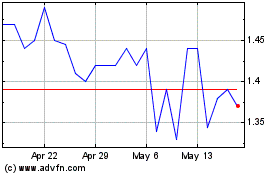

Lightpath Technologies (NASDAQ:LPTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

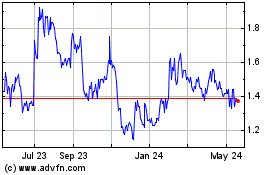

Lightpath Technologies (NASDAQ:LPTH)

Historical Stock Chart

From Feb 2024 to Feb 2025