Merus N.V. (Nasdaq: MRUS) (Merus, the Company, we, or our), an

oncology company developing innovative, full-length multispecific

antibodies and antibody drug conjugates (Biclonics®, Triclonics®

and ADClonics®), today announced financial results for the fourth

quarter and full year and provided a business update.

“We believe that petosemtamab’s receipt of two Breakthrough

Therapy designations by the FDA – previously as monotherapy in the

2L+ treatment of r/m HNSCC and very recently, based on updated

clinical efficacy, durability and safety of petosemtamab in

combination with pembrolizumab in 1L PD-L1+ r/m HNSCC, indicates

the potential for these treatment regimens to demonstrate

substantial improvement over available therapies,” said Bill

Lundberg, M.D., President, Chief Executive Officer of

Merus. “We look forward to sharing the updated clinical data,

including durability, for petosemtamab with pembrolizumab in 1L

PD-L1+ r/m HNSCC, for the full phase 2 cohort, in the first half of

2025.”

Petosemtamab (MCLA-158: EGFR x LGR5 Biclonics®): Solid

TumorsLiGeR-HN1 phase 3 trial in 1L PD-L1+ r/m head and

neck squamous cell carcinoma (HNSCC) and LiGeR-HN2 phase 3 trial in

2/3L r/m HNSCC enrolling – we expect both trials to be

substantially enrolled by YE25; clinical update on phase 2 trial in

combination with pembrolizumab in 1L PD-L1+ r/m HNSCC planned for

1H25; phase 2 trial in 1L, 2L and 3L+ metastatic colorectal cancer

(mCRC) enrolling; mCRC initial clinical data planned for 2H25

In February 2025, the U.S. Food and Drug Administration (FDA)

granted Breakthrough Therapy designation (BTD) for petosemtamab in

combination with pembrolizumab for the first-line treatment of

adult patients with r/m PD-L1+ HNSCC with CPS ≥ 1. This designation

was detailed in our press release, Petosemtamab granted

Breakthrough Therapy designation by the U.S. FDA for 1L PD-L1

positive head and neck squamous cell carcinoma (February 18,

2025).

In September 2024, Merus announced the first patient was dosed

in LiGeR-HN1, a phase 3 trial evaluating the efficacy and safety of

petosemtamab in combination with pembrolizumab in 1L PD-L1+ r/m

HNSCC compared to pembrolizumab. In this trial, patients will be

randomized to petosemtamab plus pembrolizumab or pembrolizumab

monotherapy. This was detailed in our press release, Merus

Announces First Patient Dosed in LiGeR-HN1, a Phase 3 Trial

Evaluating Petosemtamab in Combination with Pembrolizumab in 1L r/m

HNSCC (September 30, 2024).

Merus provided an interim clinical update on petosemtamab with

pembrolizumab in 1L PD-L1+ r/m HNSCC at the American Society of

Clinical Oncology® (ASCO®) Annual Meeting 2024, demonstrating a 67%

response rate among 24 evaluable patients. The oral presentation

was detailed in our press release, Merus’ Petosemtamab in

Combination with Pembrolizumab Interim Data Demonstrates Robust

Response Rate and Favorable Safety Profile in 1L r/m

HNSCC (May 28, 2024). A clinical update on this cohort is

planned for 1H25.

In July 2024, Merus announced the first patient was dosed in

LiGeR-HN2, a phase 3 trial evaluating the efficacy and safety of

petosemtamab in 2/3L HNSCC compared to standard of care. In this

trial, patients will be randomized to petosemtamab monotherapy or

investigator’s choice of single agent chemotherapy or cetuximab.

This was detailed in our press release, Merus Announces First

Patient Dosed in LiGeR-HN2, a Phase 3 Trial Evaluating Petosemtamab

in 2/3L r/m HNSCC - Merus (July 24, 2024).

Merus provided updated interim clinical data on petosemtamab in

2L+ r/m HNSCC at the European Society for Medical Oncology Asia

Congress, demonstrating a 36% response rate among 75 evaluable

patients. The oral presentation was detailed in our press

release, Merus’ Petosemtamab Monotherapy Interim Data

Continues to Demonstrate Clinically Meaningful Activity in 2L+ r/m

HNSCC (Dec. 7, 2024).

In May 2024, the FDA granted BTD for petosemtamab for the

treatment of patients with recurrent or metastatic HNSCC whose

disease has progressed following treatment with platinum based

chemotherapy and an anti-programmed cell death receptor-1 (PD-1) or

anti-programmed death ligand 1 (PD-L1) antibody. This designation

was detailed in our press release, Petosemtamab granted

Breakthrough Therapy Designation by

the U.S. FDA (May 13, 2024).

Merus believes a randomized registration trial in HNSCC with an

overall response rate endpoint could potentially support

accelerated approval and the overall survival results from the same

study could potentially verify its clinical benefit to support

regular approval.

In the third quarter 2024, Merus announced the first patient was

dosed in a phase 2 trial evaluating petosemtamab in combination

with standard chemotherapy in 2L mCRC. This was detailed in our

press release, Merus Announces First Patient Dosed in Phase 2

Trial of Petosemtamab in 2L CRC (July 8, 2024). In the fourth

quarter 2024, Merus announced the first patient was dosed in a

phase 2 trial evaluating petosemtamab monotherapy in heavily

pretreated (3L+) mCRC. This was detailed in our press release,

Merus announces First Patient Dosed in Phase 2 Trial of

Petosemtamab in 3L+ mCRC (Dec. 16, 2024). In January 2025, the

first patient was dosed in a phase 2 trial evaluating petosemtamab

in combination with standard chemotherapy in 1L mCRC. We expect to

provide initial clinical data for petosemtamab in mCRC in 2H25.

BIZENGRI® (zenocutuzumab-zbco: HER2 x HER3

Biclonics®)Approved by FDA for adults with pancreatic

adenocarcinoma or non–small cell lung cancer (NSCLC) that are

advanced unresectable or metastatic and harbor a neuregulin 1

(NRG1) gene fusion who have disease progression on or after prior

systemic therapy

In December 2024, the FDA approved BIZENGRI®

(zenocutuzumab-zbco), the first and only treatment indicated for

adults with pancreatic adenocarcinoma or NSCLC that are advanced

unresectable or metastatic and harbor a NRG1 gene fusion who have

disease progression on or after prior systemic therapy. These

indications are approved under accelerated approval based on

overall response rate (ORR) and duration of response (DOR).

Continued approval for these indications may be contingent upon

verification and description of clinical benefit in a confirmatory

trial(s). BIZENGRI® has a Boxed WARNING for Embryo-Fetal

Toxicity and warnings for infusion-related reactions (IRRs),

hypersensitivity and anaphylactic reactions, interstitial lung

disease (ILD)/pneumonitis, and left

ventriculardysfunction.1 See Important Safety Information

below. This was detailed in our press release, Merus Announces FDA

Approval of BIZENGRI® (zenocutuzumab-zbco) for NRG1+ Pancreatic

Adenocarcinoma and NRG1+ Non–Small Cell Lung Cancer (NSCLC) Based

on Safety and Efficacy Data From the eNRGy Study (December 4,

2024).

Merus has exclusively licensed to Partner Therapeutics the right

to commercialize BIZENGRI® for the treatment of NRG1+ cancer

in the U.S. This was detailed in our press release, Merus and

Partner Therapeutics Announce License Agreement for the U.S.

Commercialization of Zenocutuzumab in NRG1 Fusion-Positive Cancer

(December 2, 2024).

MCLA-129 (EGFR x c-MET Biclonics®): Solid

Tumors

Investigation of MCLA-129 is ongoing in METex14 NSCLC; phase 2

trial in combination with chemotherapy in 2L+ EGFR mutant (EGFRm)

NSCLC enrolling

In the third quarter 2024, Merus announced the first patients

were dosed in the phase 2 trial evaluating MCLA-129 in combination

with chemotherapy in 2L+ EGFRm NSCLC, with a cohort receiving

MCLA-129 and paclitaxel and carboplatin, and another cohort

receiving MCLA-129 and docetaxel. We remain interested in

partnering MCLA-129 to sufficiently resource the development of

MCLA-129 and the potential benefit it may have for patients.

MCLA-129 is subject to a collaboration and license agreement

with Betta Pharmaceuticals Co. Ltd. (Betta), which permits Betta to

develop MCLA-129, and potentially commercialize exclusively

in China, while Merus retains global rights outside

of China.

Collaborations

Incyte CorporationSince 2017, Merus has been

working with Incyte Corporation (Incyte) under a global

collaboration and license agreement focused on the research,

discovery and development of bispecific antibodies utilizing Merus’

proprietary Biclonics® technology platform. For each program under

the collaboration, Merus receives reimbursement for research

activities and is eligible to receive potential development,

regulatory and commercial milestones and sales royalties for any

products, if approved.

Eli Lilly and CompanyIn January

2021, Merus and Eli Lilly and Company (Lilly) announced a

research collaboration and exclusive license agreement to develop

up to three CD3-engaging T-cell re-directing bispecific antibody

therapies utilizing Merus’ Biclonics® platform and proprietary

CD3 panel along with the scientific and rational drug design

expertise of Lilly. The collaboration is progressing well with

three programs advancing through preclinical development.

Gilead SciencesIn March 2024, Merus and

Gilead Sciences announced a collaboration to discover novel

antibody based trispecific T-cell engagers using Merus’ patented

Triclonics® platform. Under the terms of the agreement, Merus will

lead early-stage research activities for two programs, with an

option to pursue a third. Gilead will have the right to exclusively

license programs developed under the collaboration after the

completion of select research activities. If Gilead exercises its

option to license any such program from the collaboration, Gilead

will be responsible for additional research, development and

commercialization activities for such program. Merus received an

equity investment by Gilead of $25 million in Merus

common shares and an upfront payment of $56 million.

Ono PharmaceuticalIn 2018, the Company

granted Ono Pharmaceutical Co., Ltd. (Ono) an exclusive, worldwide,

royalty-bearing license, with the right to sublicense, research,

test, make, use and market a limited number of bispecific antibody

candidates based on Merus’ Biclonics® technology platform

directed to an undisclosed target combination. During the third

quarter of 2024, Merus achieved and received a milestone payment

based on the filing of an Investigational New Drug (IND)

application in Japan.

BiohavenIn January 2025, Merus and Biohaven

announced a research collaboration and license agreement to

co-develop three novel bispecific antibody drug conjugates (ADCs),

leveraging Merus’ leading Biclonics® technology platform, and

Biohaven’s next-generation ADC conjugation and payload platform

technologies. Under the terms of the agreement, Biohaven is

responsible for the preclinical ADC generation of three Merus

bispecific antibodies under mutually agreed research plans. The

agreement includes two Merus bispecific programs generated using

the Biclonics® platform, and one program under preclinical research

by Merus. Each program is subject to mutual agreement for

advancement to further development, with the parties then sharing

subsequent external development costs and commercialization, if

advanced.

Cash Runway, existing cash, cash equivalents and

marketable securities expected to fund Merus’ operations into

2028

As of December 31, 2024, Merus had $724.0

million cash, cash equivalents and marketable securities.

Based on the Company’s current operating plan, the existing cash,

cash equivalents and marketable securities are expected to fund

Merus’ operations into 2028.

Full Year 2024 Financial Results

Collaboration revenue for the year ended December 31, 2024

decreased $7.8 million as compared to the year ended December 31,

2023, primarily as a result of decreases in Lilly revenue of $8.4

million and Incyte revenue of $6.4 million, offset by increases in

Gilead revenue of $4.8 million, and Other revenue of $2.2 million.

The decrease in Lilly revenue is primarily the result of decreases

in upfront payment amortization of $4.8 million and reimbursement

revenue of $3.6 million. The decrease in Incyte revenue is

primarily the result of decreases in milestone revenue of $5.0

million and reimbursement revenue of $1.4 million. Gilead revenue

increased due to the start of the collaboration agreement in 2024

which resulted in an increase in upfront payment amortization of

$4.8 million. The increase in Other revenue is primarily the result

of increases in milestone revenue of $2.1 million.

Research and development expense for the year ended December 31,

2024 increased $84.7 million as compared to the year ended December

31, 2023, primarily as a result of increases in external clinical

services and drug manufacturing costs of $66.6 million, which

primarily includes costs to advance our petosemtamab program and

costs to fulfill our obligations under our collaboration agreements

related to our programs, increases in personnel related expenses

including share-based compensation of $11.8 million due to an

increase in employee headcount and an increase in share price,

consultancy expenses of $5.5 million, facilities expenses and other

related expenses of $0.7 million, and consumables expenses of $0.2

million, offset by decreases in depreciation and amortization of

$0.1 million.

General and administrative expense for the year ended December

31, 2024 increased $23.0 million as compared to the year ended

December 31, 2023, primarily as a result of increases in personnel

related expenses including share-based compensation of $12.6

million due to an increase in employee headcount and an increase in

share price, consultancy expenses of $6.8 million, legal expenses

of $1.8 million, facilities and depreciation expense of $1.2

million, and intellectual property and licenses expenses of $0.7

million. Other income, net consists of interest earned on our cash

and cash equivalents held on account, accretion of investment

earnings and net foreign exchange gains or losses on our foreign

denominated cash, cash equivalents and marketable securities, and

payables and receivables.

|

|

|

MERUS N.V.CONSOLIDATED BALANCE

SHEETS (Amounts in thousands, except share and per

share data) |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

293,294 |

|

|

$ |

204,246 |

|

|

Marketable securities |

|

|

243,733 |

|

|

|

150,130 |

|

|

Accounts receivable |

|

|

1,261 |

|

|

|

2,429 |

|

|

Prepaid expenses and other current assets |

|

|

30,784 |

|

|

|

12,009 |

|

|

Total current assets |

|

|

569,072 |

|

|

|

368,814 |

|

| Marketable securities |

|

|

187,008 |

|

|

|

57,312 |

|

| Property and equipment,

net |

|

|

10,770 |

|

|

|

12,135 |

|

| Operating lease right-of-use

assets |

|

|

9,254 |

|

|

|

11,362 |

|

| Intangible assets, net |

|

|

1,679 |

|

|

|

1,800 |

|

| Deferred tax assets |

|

|

1,520 |

|

|

|

1,199 |

|

| Other assets |

|

|

3,390 |

|

|

|

2,872 |

|

| Total assets |

|

$ |

782,693 |

|

|

$ |

455,494 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,164 |

|

|

$ |

4,602 |

|

|

Accrued expenses and other liabilities |

|

|

43,957 |

|

|

|

38,482 |

|

|

Income taxes payable |

|

|

7,317 |

|

|

|

1,646 |

|

|

Current portion of lease obligation |

|

|

1,704 |

|

|

|

1,674 |

|

|

Current portion of deferred revenue |

|

|

29,934 |

|

|

|

22,685 |

|

|

Total current liabilities |

|

|

87,076 |

|

|

|

69,089 |

|

| Lease obligation |

|

|

8,208 |

|

|

|

10,488 |

|

| Deferred revenue, net of

current portion |

|

|

39,482 |

|

|

|

19,574 |

|

| Total liabilities |

|

|

134,766 |

|

|

|

99,151 |

|

| Commitments and contingencies

(Note 10) |

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

Common shares, €0.09 par value; 105,000,000 and 67,500,000 shares

authorized at December 31, 2024 and 2023, respectively; 68,828,749

and 57,825,879 shares issued and outstanding at December 31, 2024

and 2023, respectively |

|

|

6,957 |

|

|

|

5,883 |

|

|

Additional paid-in capital |

|

|

1,664,822 |

|

|

|

1,126,054 |

|

|

Accumulated deficit |

|

|

(968,387 |

) |

|

|

(753,061 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

(55,465 |

) |

|

|

(22,533 |

) |

|

Total shareholders’ equity |

|

|

647,927 |

|

|

|

356,343 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

782,693 |

|

|

$ |

455,494 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

MERUS N.V.CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS (Amounts in

thousands, except share and except per share data) |

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

|

Collaboration revenue |

|

$ |

36,133 |

|

|

|

43,947 |

|

|

|

41,586 |

|

| Total revenue |

|

|

36,133 |

|

|

|

43,947 |

|

|

|

41,586 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

225,368 |

|

|

|

140,658 |

|

|

|

149,424 |

|

|

General and administrative |

|

|

82,832 |

|

|

|

59,836 |

|

|

|

52,200 |

|

| Total operating expenses |

|

|

308,200 |

|

|

|

200,494 |

|

|

|

201,624 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(272,067 |

) |

|

|

(156,547 |

) |

|

|

(160,038 |

) |

| Other income (loss), net: |

|

|

|

|

|

|

|

|

|

|

Interest (expense) income, net |

|

|

30,789 |

|

|

|

14,510 |

|

|

|

2,722 |

|

|

Foreign exchange (losses) gains, net |

|

|

34,103 |

|

|

|

(9,710 |

) |

|

|

26,022 |

|

|

Other (losses) gains, net |

|

|

— |

|

|

|

— |

|

|

|

1,059 |

|

| Total other income (loss),

net |

|

|

64,892 |

|

|

|

4,800 |

|

|

|

29,803 |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax

expense |

|

|

(207,175 |

) |

|

|

(151,747 |

) |

|

|

(130,235 |

) |

|

Income tax expense |

|

|

8,151 |

|

|

|

3,192 |

|

|

|

959 |

|

| Net loss |

|

$ |

(215,326 |

) |

|

$ |

(154,939 |

) |

|

$ |

(131,194 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

Currency translation adjustment |

|

|

(32,932 |

) |

|

|

7,915 |

|

|

|

(21,227 |

) |

| Comprehensive loss |

|

$ |

(248,258 |

) |

|

$ |

(147,024 |

) |

|

$ |

(152,421 |

) |

| Net loss per share allocable

to common shareholders: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(3.35 |

) |

|

$ |

(3.00 |

) |

|

$ |

(2.92 |

) |

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

64,220,765 |

|

|

|

51,605,444 |

|

|

|

44,919,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please see full Prescribing Information, including Boxed

WARNING, at BIZENGRI.com/pi.

Reference: 1. BIZENGRI. Prescribing information. Merus N.V.;

2024.

About Merus N.V.

Merus is an oncology company developing innovative full-length

human bispecific and trispecific antibody therapeutics, referred to

as Multiclonics®. Multiclonics® are manufactured using industry

standard processes and have been observed in preclinical and

clinical studies to have several of the same features of

conventional human monoclonal antibodies, such as long half-life

and low immunogenicity. For additional information, please visit

Merus’ website, and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation,

statements regarding the content and timing of clinical trials,

data readouts and clinical, regulatory, strategy and development

updates for our product candidates; our ongoing LiGeR-HN1,

LiGeR-HN2 and phase 2 mCRC trials for petosemtamab, our planned

update in the 1H 2025 on the phase 2 cohort of 1L r/m PD-L1+ HNSCC;

our planned initial clinical data update on the phase 2

investigation of petosemtamab in mCRC; our belief that

petosemtamab’s receipt of two BTDs by the FDA – previously as

monotherapy in the 2L+ treatment of r/m HNSCC and very

recently, based on updated clinical efficacy, durability and

safety of petosemtamab in combination with pembrolizumab in 1L

PD-L1+ r/m HNSCC, indicates the potential for these treatment

regimens to demonstrate substantial improvement over available

therapies; the potential benefits of BTD for petosemtamab’s

development, if any; our looking forward to sharing the updated

clinical data, including durability, for petosemtamab with

pembrolizumab in 1L PD-L1+ r/m HNSCC, for the full phase 2 cohort,

in the first half of 2025; our expectation that the LiGeR-HN1 and

LiGeR-HN2 studies will be substantially enrolled by year-end; our

belief that a randomized registration trial in HNSCC with an

overall response rate endpoint could potentially support

accelerated approval and the overall survival results from the same

study could potentially verify its clinical benefit to support

regular approval; statements regarding the sufficiency of our cash,

cash equivalents and marketable securities, and expectation that it

will fund the Company into 2028; the continued investigation of

MCLA-129 in monotherapy in Met ex14 NSCLC, and enrolling of

patients in the investigation of MCLA-129 in combination with

chemotherapy in 2L+ EGFRm NSCLC; our interest in partnering

MCLA-129 to sufficiently resource the development of MCLA-129 and

the potential benefit it may have for patients; the benefits of the

license from Merus to PTx for the commercialization of Bizengri® in

the US for NRG1+ cancer, collaborations between Incyte and Merus,

Lilly and Merus, Gilead and Merus, Biohaven and Merus, and license

agreement between Ono and Merus; and the potential of those

licenses and collaborations for future value generation, including

whether and when Merus will receive any future payments, including

milestones or royalties, and the amounts of such payments; whether

any programs under the collaboration will be successful; and our

collaboration and license agreement with Betta, which permits Betta

to develop MCLA-129 and potentially commercialize exclusively

in China, while Merus retains full ex-China rights,

including any future clinical development by Betta of MCLA-129.

These forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: our need for additional funding, which may not be

available and which may require us to restrict our operations or

require us to relinquish rights to our technologies or antibody

candidates; potential delays in regulatory approval, which would

impact our ability to commercialize our product candidates and

affect our ability to generate revenue; the lengthy and expensive

process of clinical drug development, which has an uncertain

outcome; the unpredictable nature of our early stage development

efforts for marketable drugs; potential delays in enrollment of

patients, which could affect the receipt of necessary regulatory

approvals; our reliance on third parties to conduct our clinical

trials and the potential for those third parties to not perform

satisfactorily; impacts of the volatility in the global economy,

including global instability, including the ongoing conflicts

in Europe and the Middle East; we may not identify

suitable Biclonics® or bispecific antibody candidates under our

collaborations or our collaborators may fail to perform adequately

under our collaborations; our reliance on third parties to

manufacture our product candidates, which may delay, prevent or

impair our development and commercialization efforts; protection of

our proprietary technology; our patents may be found invalid,

unenforceable, circumvented by competitors and our patent

applications may be found not to comply with the rules and

regulations of patentability; we may fail to prevail in potential

lawsuits for infringement of third-party intellectual property; and

our registered or unregistered trademarks or trade names may be

challenged, infringed, circumvented or declared generic or

determined to be infringing on other marks.

These and other important factors discussed under the caption

“Risk Factors” in our Quarterly Report on Form 10-K for the period

ended December 31, 2024, filed with the Securities and

Exchange Commission, or SEC, on February 27, 2025, and

our other reports filed with the SEC, could cause actual

results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change, except as required under applicable law. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Bizengri®, Multiclonics®, Biclonics®, Triclonics® and ADClonics®

are registered trademarks of Merus N.V.

Investor and Media Inquiries:

Sherri Spear

Merus N.V.

SVP Investor Relations and Strategic Communications

617-821-3246

s.spear@merus.nl

Kathleen Farren

Merus N.V.

Investor Relations and Corporate Communications

617-230-4165

k.farren@merus.nl

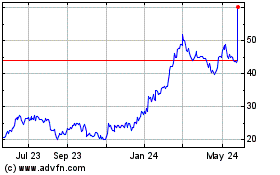

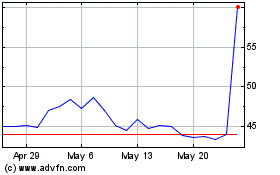

Merus NV (NASDAQ:MRUS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Merus NV (NASDAQ:MRUS)

Historical Stock Chart

From Mar 2024 to Mar 2025