REE Automotive Ltd. (Nasdaq: REE), an automotive technology company

and provider of full by-wire electric trucks and platforms, today

announced the closing of its previously announced underwritten

public offering of 2,300,000 Class A ordinary shares (the “ordinary

shares”), which includes the full exercise of the underwriter’s

overallotment option. Each ordinary share was sold at a public

offering price of $6.50 per share.

The gross proceeds to REE from the offering are approximately

$14.95 million, before deducting the placement agent’s fees and

other offering expenses payable by REE. REE intends to use the net

proceeds from the offering primarily for working capital and

general corporate purposes, including continued product development

and commercialization. Multiple investors participated in the

offering, led by M&G Investment Management Limited (“M&G”),

one of Europe’s largest investment firms and REE’s largest

shareholder. Through its long history of investing in the global

auto industry, M&G has a valuable network of industry

connections which can offer significant value to REE.

“REE remains financially and operationally disciplined. We are

highly motivated by the confidence and continued support of our

customers and our investors, including our largest shareholder,

M&G. We continue to execute upon our business plans, as

evidenced by the recent FMVSS certification milestone and continued

growth in our order book. In a market with significant structural

demand and limited supply options, we are seeing customer interest

continuing to build,” said Daniel Barel, co-founder and CEO of REE

Automotive.

“We continue to be very impressed with REE’s execution and its

technological achievements. Let’s not lose sight of the fact that

REE’s x-by-wire technology, which sits at the heart of its

offering, is unlike anything else commercially available today,”

said Carl Vine, co-head of APAC Equity Investing at M&G. “REE’s

business model has always been differentiated from other companies

that we have seen come and go in this space. By only ever intending

to supply the critical, technology-driven aspects of its flexible

vehicle-platform, REE has always held the promise of strong unit

economics with only modest capital needs.”

The securities were offered pursuant to an effective shelf

registration statement on Form F-3 (File No. 333-266902), including

a base prospectus, filed with the Securities and Exchange

Commission (the "SEC") on August 16, 2022, and declared effective

by the SEC on August 25, 2022. A final prospectus supplement has

been filed with the SEC and, when available, copies of the final

prospectus supplement and accompanying base prospectus may be

obtained from Roth Capital Partners, LLC, 888 San Clemente, Suite

400, Newport Beach, CA 92660, (800) 678-9147 or by accessing the

SEC's website, www.sec.gov. Before investing in this offering,

interested parties should read in their entirety the final

prospectus supplement and the accompanying prospectus and the other

documents that the Company has filed with the SEC that are

incorporated by reference in such final prospectus supplement and

the accompanying prospectus, which provide more information about

the Company and such offering.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

To learn more about REE Automotive’s patented technology and

unique value proposition that position the company to break new

ground in e-mobility, visit www.ree.auto.

About REE AutomotiveREE Automotive (Nasdaq:

REE) is an automotive technology company that allows companies to

build electric vehicles of various shapes and sizes on their

modular platforms. With complete design freedom, vehicles Powered

by REE® are equipped with the revolutionary REEcorner®, which packs

critical vehicle components (steering, braking, suspension,

powertrain and control) into a single compact module positioned

between the chassis and the wheel. As the first company to FMVSS

certify a fully by-wire vehicle in the U.S., REE’s proprietary

by-wire technology for drive, steer and brake control eliminates

the need for mechanical connection. Using four identical

REEcorners® enables REE to make the industry’s flattest EV

platforms with more room for passengers, cargo and batteries. REE

platforms are future proofed, autonomous capable, offer a low TCO,

and drastically reduce the time to market for fleets looking to

electrify. To learn more visit www.ree.auto.

Media ContactMalory Van GuilderSkyya PR for REE

Automotive+1 651-335-0585ree@skyya.com

Investor ContactKamal HamidVP Investor

Relations | REE Automotive+1 303-670-7756investors@ree.auto

Caution About Forward-Looking StatementsThis

communication includes certain forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include, but are not limited to, statements regarding

REE or its management team’s expectations, hopes, beliefs,

intentions or strategies regarding the future. For example, REE is

using forward-looking statements when it discusses the proposed use

of proceeds and its belief that it continues to successfully

execute its business plan. In addition, any statements that refer

to plans, projections, forecasts or other characterizations of

future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “aim”

“anticipate,” “appear,” “approximate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “foresee,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“seek,” “should,” “would”, “designed,” “target” and similar

expressions (or the negative version of such words or expressions)

may identify forward-looking statements, but the absence of these

words does not mean that a statement is not forward-looking. All

statements, other than statements of historical facts, may be

forward-looking statements. Forward-looking statements in this

communication may include, among other things, statements about

REE’s strategic and business plans, technology, relationships and

objectives, including its ability to meet certification

requirements, the impact of trends on and interest in our business,

or product, intellectual property, REE’s expectation for growth,

and its future results, operations and financial performance and

condition.

These forward-looking statements are based on REE’s current

expectations and assumptions about future events and are based on

currently available information as of the date of this

communication and current expectations, forecasts, and assumptions.

Although REE believes that the expectations reflected in

forward-looking statements are reasonable, such statements involve

an unknown number of risks, uncertainties, judgments, and other

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by forward-looking

statements. These factors are difficult to predict accurately and

may be beyond REE’s control. Forward-looking statements in this

communication speak only as of the date made and REE undertakes no

obligation to update its forward-looking statements, whether as a

result of new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities

and other applicable laws. In light of these risks and

uncertainties, investors should keep in mind that results, events

or developments discussed in any forward-looking statement made in

this communication may not occur.

Uncertainties and risk factors that could affect REE’s future

performance and could cause actual results to differ include, but

are not limited to: REE’s ability to commercialize its strategic

plan, including its plan to successfully evaluate, obtain

regulatory approval, produce and market its P7 lineup; REE’s

ability to maintain and advance relationships with current Tier 1

suppliers and strategic partners; development of REE’s advanced

prototypes into marketable products; REE’s ability to grow and

scale manufacturing capacity through relationships with Tier 1

suppliers; REE’s estimates of unit sales, expenses and

profitability and underlying assumptions; REE’s reliance on its UK

Engineering Center of Excellence for the design, validation,

verification, testing and homologation of its products; REE’s

limited operating history; risks associated with building out of

REE’s supply chain; risks associated with plans for REE’s initial

commercial production; REE’s dependence on potential suppliers,

some of which will be single or limited source; development of the

market for commercial EVs; risks associated with data security

breach, failure of information security systems and privacy

concerns; risks related to lack of compliance with Nasdaq’s minimum

bid price requirement; future sales of our securities by existing

material shareholders or by us could cause the market price for the

Class A Ordinary Shares to decline; potential disruption of

shipping routes due to accidents, political events, international

hostilities and instability, piracy or acts by terrorists; intense

competition in the e-mobility space, including with competitors who

have significantly more resources; risks related to the fact that

REE is incorporated in Israel and governed by Israeli law; REE’s

ability to make continued investments in its platform; the impact

of the COVID-19 pandemic, interest rate changes, the ongoing

conflict between Ukraine and Russia and any other worldwide health

epidemics or outbreaks that may arise and adverse global

conditions, including macroeconomic and geopolitical uncertainty;

the global economic environment, the general market, political and

economic conditions in the countries in which we operate; the

ongoing military conflict in Israel; fluctuations in interest rates

and foreign exchange rates; the need to attract, train and retain

highly-skilled technical workforce; changes in laws and regulations

that impact REE; REE’s ability to enforce, protect and maintain

intellectual property rights; REE’s ability to retain engineers and

other highly qualified employees to further its goals; and other

risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in REE’s annual report filed with the U.S. Securities and Exchange

Commission (the “SEC”) on March 28, 2023 and in subsequent filings

with the SEC.

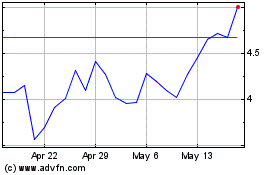

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Dec 2024 to Jan 2025

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Jan 2024 to Jan 2025