Shimmick Corp. (NASDAQ: SHIM), a leading water infrastructure

company, today announced financial results for the third quarter

ended September 27, 2024.

Third Quarter 2024 and Recent

Highlights

- Settlement in the Company’s Golden Gate Bridge ("GGB") Project

which will result in $97 million of cash collected before the end

of 2024 and is the last major outstanding legal claim related to

its Legacy Projects.

- Announced the hiring of Ural Yal as Chief Executive Officer to

replace Steve Richards who is retiring after a 43-year career.

- Reported revenue of $166 million, which includes $101 million

of Shimmick Project revenue.

- Reported Shimmick Project gross margin of 6% for the quarter,

the highest gross margin reported year-to-date.

- Recognized a net loss of $2 million and Adjusted EBITDA of $30

million.

- Backlog is over $834 million as of September 27, 2024, with

over 85% being Shimmick Projects.

- Continued to execute on Transformation Plan.

Golden Gate Bridge Project

Settlement:

- As previously announced, the settlement between a consolidating

joint venture of the Company, Shimmick/Danny’s Joint Venture

("SDJV") and the Golden Gate Bridge, Highway and Transportation

District (the “District”) was entered into on October 31,

2024.

- Under the terms of the settlement, SDJV will receive total

settlement proceeds of $97 million, a contract change order for

reduced scope of work of $6 million and a contract change order for

extension of project completion and costs incurred on the GGB

Project.

- The District is required to pay SDJV $97 million before the end

of 2024.

- After paying subcontractor pass-through claims, Shimmick plans

to use the remaining proceeds for ongoing operations, including

completion of the GGB Project.

- Shimmick is expected to reach substantial completion of its

onsite portions of the project in the third quarter of 2025 with

remaining work after that related to a subcontractor’s offsite

equipment fabrication activities.

Transformation Plan Update

The Company continues to advance its strategic

transformation toward a more capital-efficient business model with

optimized operating costs. In addition to the GGB Project

Settlement, key progress includes:

- Hired Ural Yal to replace Steve Richards, who will be retiring

after a 43-year career. Ural has extensive knowledge of both

the California and the water and critical infrastructure

market. Ural will be starting with Shimmick December 2,

2024.

- Completion of the previously announced sale-leaseback of the

Company’s equipment yard in Tracy, California, which resulted in a

$17 million gain in the third quarter of fiscal

2024.

- A strategic decision to enhance the Company’s current

enterprise resource planning (ERP) system rather than implementing

a new platform which, due to prior investments and remaining

contractual obligations, which resulted in a one-time charge of $16

million in the third quarter of fiscal 2024. The Company expects

this system upgrade to result in reduced overhead in future

periods.

Additional transformation initiatives are

progressing as planned. The Company plans to provide further

updates in future communications.

“We believe the GGB Project settlement is a

major step forward in our progress to a more capital light focused

business focused on capturing the growth opportunity in the

California water and critical infrastructure market,” said Steve

Richards, Chief Executive Officer of Shimmick.

"We don’t expect the election to have a material

impact as infrastructure typically has bipartisan support and the

recently passed $10 billion water-focused California Proposition 4

should provide additional market support," Mr. Richards

continued.

Financial Results

A summary of our results is included in the

table below:

|

|

Three Months Ended |

|

|

Nine Months Ended |

| (In millions, except

per share data) |

September 27, 2024 |

|

|

September 29, 2023 |

|

|

September 27, 2024 |

|

|

September 29, 2023 |

|

Revenue |

$ |

166 |

|

|

$ |

175 |

|

|

$ |

377 |

|

|

$ |

495 |

|

| Gross

margin |

|

12 |

|

|

$ |

17 |

|

|

|

(35 |

) |

|

|

23 |

|

| Net

(loss) income attributable to Shimmick Corporation |

|

(2 |

) |

|

|

35 |

|

|

|

(86 |

) |

|

|

15 |

|

| Adjusted

net income (loss) |

|

24 |

|

|

|

37 |

|

|

|

(50 |

) |

|

|

25 |

|

| Adjusted

EBITDA |

|

30 |

|

|

|

42 |

|

|

|

(34 |

) |

|

|

39 |

|

| Diluted

(loss) income per common share attributable to Shimmick

Corporation |

$ |

(0.05 |

) |

|

$ |

1.58 |

|

|

$ |

(2.96 |

) |

|

$ |

0.68 |

|

| Adjusted

diluted income (loss) per common share attributable to Shimmick

Corporation |

$ |

0.72 |

|

|

$ |

1.67 |

|

|

$ |

(1.72 |

) |

|

$ |

1.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents revenue and gross

margin data for the three and nine months ended September 27, 2024

compared to the three and nine months ended September 29, 2023:

|

|

|

|

Three Months Ended |

Nine Months Ended |

|

| (In millions, except

percentage data) |

September 27, 2024 |

|

|

September 29, 2023 |

|

|

September 27, 2024 |

|

|

September 29, 2023 |

|

|

Shimmick Projects(1) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

101 |

|

|

$ |

110 |

|

|

$ |

275 |

|

|

$ |

301 |

|

| Gross

Margin |

|

6 |

|

|

|

15 |

|

|

|

10 |

|

|

|

29 |

|

| Gross

Margin (%) |

|

6 |

% |

|

|

14 |

% |

|

|

4 |

% |

|

|

9 |

% |

|

Foundations Projects(2) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

11 |

|

|

$ |

12 |

|

|

$ |

26 |

|

|

$ |

41 |

|

| Gross

Margin |

|

(2 |

) |

|

|

(1 |

) |

|

|

(8 |

) |

|

|

(7 |

) |

| Gross

Margin (%) |

|

(18 |

)% |

|

|

(12 |

)% |

|

|

(32 |

)% |

|

|

(17 |

)% |

|

Legacy Projects(3) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

54 |

|

|

$ |

54 |

|

|

$ |

75 |

|

|

$ |

153 |

|

| Gross

Margin |

|

8 |

|

|

|

3 |

|

|

|

(37 |

) |

|

|

1 |

|

| Gross

Margin (%) |

|

15 |

% |

|

|

6 |

% |

|

|

(49 |

)% |

|

|

1 |

% |

|

Consolidated Total |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

166 |

|

|

$ |

175 |

|

|

$ |

377 |

|

|

$ |

495 |

|

| Gross

Margin |

|

12 |

|

|

|

17 |

|

|

|

(35 |

) |

|

|

23 |

|

| Gross

Margin (%) |

|

7 |

% |

|

|

10 |

% |

|

|

(9 |

)% |

|

|

5 |

% |

| |

|

(1) Shimmick Projects are those projects started after the AECOM

Sale Transactions that have focused on water infrastructure and

other critical infrastructure. |

|

(2) The Company entered into an agreement to sell the assets of

non-core foundation projects in the second quarter of 2024 and is

winding down any remaining work during the year. As the revenue

will decline during the remainder of the 2024 fiscal year, the

Company is reporting revenue and gross margin related to the

projects separately for the periods presented ("Foundations

Projects"). |

|

(3) Legacy Projects are those projects assumed as part of the AECOM

Sale Transactions, that were started under AECOM ownership.

Shimmick Projects |

| |

Projects started after the AECOM Sale Transactions ("Shimmick

Projects") have focused on water infrastructure and other critical

infrastructure. Revenue recognized on Shimmick Projects was

$101 million and $110 million for the three months ended September

27, 2024 and September 29, 2023, respectively. The $9 million

decrease in revenue was primarily the result of a $28 million

decrease from lower activity on existing jobs and jobs winding down

partially offset by $19 million of revenue from a new water

infrastructure job.

Gross margin recognized on Shimmick Projects was $6 million and

$15 million for the three months ended September 27, 2024 and

September 29, 2023, respectively. The decline in the gross margin

was primarily the result of a $12 million decrease in gross margin

on existing jobs that are winding down and completing partially

offset by a $3 million increase in margin from a new water

infrastructure job.

Foundations Projects

The Company entered into an agreement to sell the assets of our

non-core Foundations Projects in the second quarter of 2024 and

will be winding down any remaining work during the remainder of the

2024 fiscal year. As a result, revenue from Foundations Projects

will decline during the remainder of the 2024 fiscal year.

Revenue recognized on Foundations Projects was $11 million and $12

million for the three months ended September 27, 2024 and September

29, 2023, respectively. The decline in revenue was the result of

timing of jobs winding down.

Gross margin recognized on Foundations Projects was $(2) million

and $(1) million for the three months ended September 27, 2024 and

September 29, 2023, respectively. The decline in gross margin was

the result of cost overruns and jobs winding down.

Legacy Projects

As part of the AECOM Sale Transactions, we assumed the Legacy

Projects and backlog that were started under AECOM. Legacy Projects

revenue was flat at $54 million for each of the three months ended

September 27, 2024 and September 29, 2023. Included in the quarter

is a $31 million adjustment to revenue to reflect the GGB Project

settlement amount. Without the adjustment, Legacy Project

revenue would have declined by $31 million reflecting the continued

wind down of the Legacy Projects.

Gross margin was $8 million and $3 million for the three months

ended September 27, 2024 and September 29, 2023, respectively. The

increase in gross margin was primarily as a result of the GGB

Project settlement which was partially offset by continued impacts

of Legacy Projects winding down, as well as additional legal fees

to pursue contract modifications and recoveries and additional cost

overruns on other Legacy Loss Projects (as defined below).

A subset of Legacy Projects ("Legacy Loss Projects") have

experienced significant cost overruns due to the COVID pandemic,

design issues, legal costs and other factors. In the Legacy Loss

Projects, we have recognized the estimated costs to complete and

the loss expected from these projects. If the estimates of costs to

complete fixed-price contracts indicate a further loss, the entire

amount of the additional loss expected over the life of the project

is recognized as a period cost in the cost of revenue. As these

Legacy Loss Projects continue to wind down to completion, no

further gross margin will be recognized and in some cases, there

may be additional costs associated with these projects. Revenue

recognized on these Legacy Loss Projects was $49 million and $27

million for the three months ended September 27, 2024 and September

29, 2023, respectively. The increase was primarily as a result of

the GGB Project settlement discussed above, partially offset by

continued impacts of other Legacy Loss Projects winding down. Gross

margin recognized on these Legacy Loss Projects was $10 million and

$(1) million for the three months ended September 27, 2024 and

September 29, 2023, respectively, the increase of which is

primarily as a result of the GGB Project settlement.

Selling, general and administrative expenses

Selling, general and administrative expenses remained

approximately flat period over period.

Equity in earnings of unconsolidated joint ventures

Equity in earnings of unconsolidated joint ventures was $1

million, compared to earnings of $3 million in the prior year

period. The decrease was primarily driven by increased costs due to

schedule extensions experienced during the nine months ended

September 27, 2024.

Gain on sale of assets

Gain on sale of assets decreased by $13 million primarily due to

the gain recognized on the sale of non-core business contracts for

$30 million during the three months ended September 29, 2023 that

did not reoccur during the nine months ended September 27, 2024,

partially offset by the $17 million gain recognized on the

transaction for the sale-leaseback of our equipment yard in Tracy,

California during the three months ended September 27, 2024.

ERP pre-implementation asset impairment and associated costs

ERP pre-implementation asset impairment and associated costs

increased by $16 million due to the strategic decision to enhance

the Company’s current ERP system rather than implementing a new

platform which, due to prior capitalized costs and remaining

contractual obligations, resulted in a one-time charge of $16

million recorded in the three months ended September 27, 2024.

Interest expense

Interest expense increased by $2 million primarily due to

interest charges on the Credit Facility which was not entered into

until May 20, 2024.

Other expense, net

Other expense, net remained approximately flat period over

period.

Income tax expense

Income tax expense was flat period over period. Due to an

expected tax loss for fiscal year ending 2024, no taxable income or

tax expense is anticipated for 2024, and no taxable income was

recorded for the prior year three months ended September 29,

2023.

Net (loss) income

Net (loss) income decreased by $36 million to a net loss of $2

million for the three months ended September 27, 2024, primarily

due to an increase in ERP pre-implementation asset impairment and

associated costs of $16 million, a decrease in gain on the sale of

assets of $13 million, decrease in gross margin of $5 million,

increase of interest expense of $2 million and decrease in equity

in earnings of unconsolidated joint ventures of $2 million all as

described above.

Diluted loss per common share was $(0.05) for

the three months ended September 27, 2024, compared to diluted

income per common share of $1.58 for the same period in 2023.

Adjusted net income was $24 million for the three months ended

September 27, 2024, compared to an adjusted net income of $37

million for the same period in 2023.

Adjusted diluted income per common share was

$0.72 for the three months ended September 27, 2024, compared to

$1.67 for the same period in 2023.

Adjusted EBITDA was $30 million for the three

months ended September 27, 2024, compared to $42 million for the

same period in 2023.

Fiscal Year 2024 Guidance

For the full 2024 fiscal year, we now

expect:

- After excluding Foundations Projects revenue of $64 million for

the fiscal year ending December 29, 2023, Shimmick Projects revenue

to remain generally flat with gross margin between 4 to 7

percent

- Legacy Projects revenue of $90 to $95 million with negative

gross margin of (40%) to (50%), due to the Legacy Loss Project

settlement, additional costs recorded for a Legacy Loss Project

related to pending change orders and other cost

overruns

Conference Call and Webcast Information

Shimmick will host an investor conference call

Tuesday, November 12, at 8:30 am EST. Interested parties are

invited to listen to the conference call which can be accessed live

over the phone by dialing (877)-869-3847, or for international

callers, (201)-689-8261. A replay will be available two hours after

the call and can be accessed by dialing (877)-660-6853, or for

international callers, (201)-612-7415. The passcode for the live

call and the replay is 13749091. The replay will be available until

11:59 p.m. (ET) December 3, 2024. Interested investors and

other parties may also listen to a simultaneous webcast of the

conference call by visiting the Investors section of the Company’s

website at www.shimmick.com. The online replay will be available

for a limited time beginning immediately following the call.

About Shimmick Corporation

Shimmick Corporation ("Shimmick", the "Company")

(NASDAQ: SHIM) is a leading provider of water and critical

infrastructure solutions throughout California and nationwide.

Shimmick has a long history of working on all types of complex

projects, ranging from the world’s largest wastewater recycling and

purification system in California to the iconic Hoover Dam.

According to Engineering News Record, in 2024, Shimmick was

nationally ranked as a top ten builder of water supply (#8), dams

and reservoirs (#6), and water treatment and desalination plants

(#7). Shimmick consistently achieves project excellence through its

experienced and dedicated workforce and a continued commitment

towards delivering on our client’s goals.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended (the "Exchange Act"). These forward-looking statements are

often characterized by the use of words such as “may,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “targets,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these terms or other

similar words. Forward-looking statements are only predictions

based on our current expectations and our projections about future

events, and we undertake no obligation to update any

forward-looking statement to reflect events or circumstances,

including, but not limited to, unanticipated events, after the date

on which such statement is made, unless otherwise required by

law. Forward-looking statements contained in this release

include, but are not limited to, statements about: expected future

financial performance (including the assumptions related thereto),

including our revenue, net loss and EBITDA; our growth prospects;

our expectations regarding profitability; ; our expectations

regarding reducing overhead in future periods by enhancing our

current enterprise resource planning system to; our strategic

transformation towards becoming more capital-efficient business;

our plans to use the proceeds from the GGB settlement; our

expectations regarding substantially completing our onsite portions

of the GGB project; our continued successful adjustment to being a

public company following our initial public offering; our

expectations regarding successful partnerships with our new

investors; our capital plans and expectations related thereto, and

our statements regarding our CEO transition. These statements

involve risks and uncertainties, and actual results may differ

materially from any future results expressed or implied by the

forward-looking statements. Forward-looking statements are only

predictions based on our current expectations and our projections

about future events, and we undertake no obligation to update any

forward-looking statement to reflect events or circumstances,

including, but not limited to, unanticipated events, after the date

on which such statement is made, unless otherwise required by

law.

We wish to caution readers that, although we

believe any forward-looking statements are based on reasonable

assumptions, certain important factors may have affected and could

in the future affect our actual financial results and could cause

our actual financial results for subsequent periods to differ

materially from those expressed in any forward-looking statement

made by or on our behalf, including, but not limited to, the

following: our ability to accurately estimate risks, requirements

or costs when we bid on or negotiate a contract; the impact of our

fixed-price contracts; qualifying as an eligible bidder for

contracts; the availability of qualified personnel, joint venture

partners and subcontractors; inability to attract and retain

qualified managers and skilled employees and the impact of loss of

key management; higher costs to lease, acquire and maintain

equipment necessary for our operations or a decline in the market

value of owned equipment; subcontractors failing to satisfy their

obligations to us or other parties or any inability to maintain

subcontractor relationships; marketplace competition; our limited

operating history as an independent company following our

separation from AECOM; our inability to obtain bonding; our

relationship and transactions with our prior owner, AECOM, and

requirements to make future payments to AECOM; AECOM defaulting on

its contractual obligations to us or under agreements in which we

are beneficiary; our limited number of customers; dependence on

subcontractors and suppliers of materials; any inability to secure

sufficient aggregates; an inability to complete a merger or

acquisition or to integrate an acquired company’s business;

adjustments in our contact backlog; accounting for our revenue and

costs involves significant estimates, as does our use of the input

method of revenue recognition based on costs incurred relative to

total expected costs; any failure to comply with covenants under

any current indebtedness, and future indebtedness we may incur; the

adequacy of sources of liquidity; cybersecurity attacks against,

disruptions, failures or security breaches of, our information

technology systems; seasonality of our business; pandemics and

health emergencies; commodity products price fluctuations and

inflation and/or elevated interest rates; liabilities under

environmental laws, compliance with immigration laws, and other

regulatory matters, including changes in regulations and laws;

climate change; deterioration of the U.S. economy; uncertain

political conditions (including as a result of the 2024 elections)

and geopolitical risks, including those related to the war between

Russia and Ukraine and the conflict in the Gaza Strip and the

conflict in the Red Sea Region; our ability to timely file reports

with the Securities and Exchange Commission; and other risks

detailed in our filings with the Securities and Exchange

Commission, including the “Risk Factors” section in our Annual

Report on Form 10-K for the fiscal year ended December 29, 2023 and

those described from time to time in our future reports with the

SEC.

Non-GAAP Definitions This press

release includes unaudited non-GAAP financial measures, adjusted

EBITDA and adjusted net loss and adjusted diluted loss per common

share. For definitions of these non-GAAP financial measures and

reconciliations to the most comparable GAAP measures, see

"Explanatory Notes" and tables that follow in this press release.

The presentation of non-GAAP financial measures is not intended to

be a substitute for, and should not be considered in isolation

from, the financial measures reported in accordance with GAAP.

Please refer to the Reconciliation between Net

loss Attributable to Shimmick Corporation and Adjusted net loss and

Adjusted diluted loss per common share included within Table A and

the Reconciliation between Net Loss Attributable to Shimmick

Corporation and Adjusted EBITDA included within Table B below.

We do not provide forward-looking guidance for

certain financial measures on a U.S. GAAP basis because we are

unable to predict certain items contained in the U.S. GAAP measures

without unreasonable efforts. These items may include legal fees

and other costs for a legacy loss project, acquisition-related

costs, litigation charges or settlements, and certain other unusual

adjustments.

Investor Relations Contact1-949-704-2350

IR@shimmick.com

|

Shimmick CorporationConsolidated Balance

Sheets (In thousands, except share

data)(unaudited) |

|

|

|

|

|

September 27, |

|

|

December 29, |

|

|

|

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT

ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,962 |

|

|

$ |

62,939 |

|

| Restricted cash |

|

|

611 |

|

|

|

971 |

|

| Accounts receivable, net |

|

|

53,516 |

|

|

|

54,178 |

|

| Contract assets, current |

|

|

127,518 |

|

|

|

125,943 |

|

| Prepaids and other current

assets |

|

|

13,582 |

|

|

|

13,427 |

|

| |

|

|

|

|

|

|

| TOTAL CURRENT

ASSETS |

|

|

221,189 |

|

|

|

257,458 |

|

| |

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

|

21,396 |

|

|

|

46,373 |

|

| Intangible assets, net |

|

|

7,312 |

|

|

|

9,244 |

|

| Contract assets,

non-current |

|

|

49,159 |

|

|

|

48,316 |

|

| Lease right-of-use assets |

|

|

25,996 |

|

|

|

23,855 |

|

| Investment in unconsolidated

joint ventures |

|

|

19,936 |

|

|

|

21,283 |

|

| Deferred tax assets |

|

|

- |

|

|

|

17,252 |

|

| Other assets |

|

|

1,749 |

|

|

|

2,871 |

|

| |

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

346,737 |

|

|

$ |

426,652 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

| Accounts payable |

|

$ |

69,441 |

|

|

$ |

81,589 |

|

| Contract liabilities,

current |

|

|

97,627 |

|

|

|

115,785 |

|

| Accrued salaries, wages and

benefits |

|

|

29,400 |

|

|

|

26,911 |

|

| Accrued expenses |

|

|

62,782 |

|

|

|

33,897 |

|

| Other current liabilities |

|

|

18,926 |

|

|

|

13,071 |

|

| |

|

|

|

|

|

|

| TOTAL CURRENT

LIABILITIES |

|

|

278,176 |

|

|

|

271,253 |

|

| |

|

|

|

|

|

|

| Long-term debt, net |

|

|

39,903 |

|

|

|

29,627 |

|

| Lease liabilities,

non-current |

|

|

17,117 |

|

|

|

15,045 |

|

| Contract liabilities,

non-current |

|

|

- |

|

|

|

3,215 |

|

| Contingent consideration |

|

|

4,718 |

|

|

|

15,488 |

|

| Deferred tax liabilities |

|

|

- |

|

|

|

17,252 |

|

| Other liabilities |

|

|

5,850 |

|

|

|

4,282 |

|

| |

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

|

345,764 |

|

|

|

356,162 |

|

| |

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

| Common stock, $0.01 par value,

100,000,000 shares authorized as of September 27, 2024 and December

29, 2023; 33,738,739 and 25,493,877 shares issued and outstanding

as of September 27, 2024 and December 29, 2023, respectively |

|

|

338 |

|

|

|

255 |

|

| Additional

paid-in-capital |

|

|

40,543 |

|

|

|

24,445 |

|

| Retained (deficit)

earnings |

|

|

(39,749 |

) |

|

|

46,537 |

|

| Non-controlling interests |

|

|

(159 |

) |

|

|

(747 |

) |

| |

|

|

|

|

|

|

| TOTAL STOCKHOLDERS'

EQUITY |

|

|

973 |

|

|

|

70,490 |

|

| |

|

|

|

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

$ |

346,737 |

|

|

$ |

426,652 |

|

| |

|

Shimmick CorporationConsolidated

Statements of Operations(In thousands, except per

share data)(unaudited) |

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 27, |

|

|

September 29, |

|

|

September 27, |

|

|

September 29, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

166,035 |

|

|

$ |

175,448 |

|

|

$ |

376,684 |

|

|

$ |

494,744 |

|

| Cost of revenue |

|

|

153,846 |

|

|

|

158,436 |

|

|

|

411,485 |

|

|

|

471,967 |

|

| Gross

margin |

|

|

12,189 |

|

|

|

17,012 |

|

|

|

(34,801 |

) |

|

|

22,777 |

|

| Selling, general and

administrative expenses |

|

|

12,985 |

|

|

|

14,022 |

|

|

|

47,878 |

|

|

|

47,841 |

|

| ERP pre-implementation asset

impairment and associated costs |

|

|

15,708 |

|

|

|

— |

|

|

|

15,708 |

|

|

|

— |

|

|

Total operating expenses |

|

|

28,693 |

|

|

|

14,022 |

|

|

|

63,586 |

|

|

|

47,841 |

|

| Equity in earnings (loss) of

unconsolidated joint ventures |

|

|

812 |

|

|

|

2,577 |

|

|

|

(779 |

) |

|

|

9,570 |

|

| Gain on sale of assets |

|

|

16,896 |

|

|

|

30,069 |

|

|

|

20,585 |

|

|

|

31,749 |

|

| Income (loss) from

operations |

|

|

1,204 |

|

|

|

35,636 |

|

|

|

(78,581 |

) |

|

|

16,255 |

|

| Interest expense |

|

|

1,977 |

|

|

|

412 |

|

|

|

4,370 |

|

|

|

1,020 |

|

| Other expense, net |

|

|

791 |

|

|

|

393 |

|

|

|

3,335 |

|

|

|

48 |

|

| Net (loss) income

before income tax |

|

|

(1,564 |

) |

|

|

34,831 |

|

|

|

(86,286 |

) |

|

|

15,187 |

|

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net (loss)

income |

|

|

(1,564 |

) |

|

|

34,831 |

|

|

|

(86,286 |

) |

|

|

15,187 |

|

| Net income

attributable to non-controlling interests |

|

|

— |

|

|

|

264 |

|

|

|

— |

|

|

|

257 |

|

|

Net (loss) income attributable to Shimmick

Corporation |

|

$ |

(1,564 |

) |

|

$ |

34,567 |

|

|

$ |

(86,286 |

) |

|

$ |

14,930 |

|

|

Net (loss) income attributable to Shimmick Corporation per

common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.05 |

) |

|

$ |

1.58 |

|

|

$ |

(2.96 |

) |

|

$ |

0.68 |

|

|

Diluted |

|

$ |

(0.05 |

) |

|

$ |

1.58 |

|

|

$ |

(2.96 |

) |

|

$ |

0.68 |

|

|

|

|

Shimmick CorporationConsolidated

Statements of Cash Flows(In

thousands)(unaudited) |

|

|

|

|

|

Nine Months Ended |

|

|

|

|

September 27, |

|

|

September 29, |

|

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Cash Flows From

Operating Activities |

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(86,286 |

) |

|

$ |

15,187 |

|

| Adjustments to reconcile net

(loss) income to net cash used in operating activities: |

|

|

|

|

|

|

|

Stock-based compensation |

|

|

3,304 |

|

|

|

1,547 |

|

|

Depreciation and amortization |

|

|

11,646 |

|

|

|

13,186 |

|

|

Equity in loss (earnings) of unconsolidated joint ventures |

|

|

779 |

|

|

|

(9,570 |

) |

|

Return on investment in unconsolidated joint ventures |

|

|

610 |

|

|

|

14,220 |

|

|

ERP pre-implementation asset impairment |

|

|

10,428 |

|

|

|

- |

|

|

Gain on sale of assets |

|

|

(20,585 |

) |

|

|

(31,749 |

) |

|

Other |

|

|

1,892 |

|

|

|

111 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

663 |

|

|

|

(12,012 |

) |

|

Contract assets |

|

|

(2,418 |

) |

|

|

(10,134 |

) |

|

Accounts payable |

|

|

(12,149 |

) |

|

|

24,221 |

|

|

Contract liabilities |

|

|

(18,157 |

) |

|

|

(41,797 |

) |

|

Accrued salaries, wages and benefits |

|

|

2,489 |

|

|

|

(2,073 |

) |

|

Accrued expenses |

|

|

34,165 |

|

|

|

(22,042 |

) |

|

Other assets and liabilities |

|

|

7,436 |

|

|

|

(3,871 |

) |

|

Net cash used in operating activities |

|

|

(66,183 |

) |

|

|

(64,776 |

) |

| Cash Flows From

Investing Activities |

|

|

|

|

|

|

| Purchases of property, plant

and equipment |

|

|

(9,963 |

) |

|

|

(6,140 |

) |

| Proceeds from sale of

assets |

|

|

31,608 |

|

|

|

34,983 |

|

| Unconsolidated joint venture

equity contributions |

|

|

(3,460 |

) |

|

|

(19,670 |

) |

| Return of investment in

unconsolidated joint ventures |

|

|

204 |

|

|

|

3,980 |

|

|

Net cash provided by investing activities |

|

|

18,389 |

|

|

|

13,153 |

|

| Cash Flows From

Financing Activities |

|

|

|

|

|

|

| Net borrowings on Credit

Facility |

|

|

42,000 |

|

|

|

— |

|

| Net (repayments of) borrowings

on Revolving Credit Facility |

|

|

(29,619 |

) |

|

|

33,722 |

|

| Other, net |

|

|

(1,924 |

) |

|

|

(1,028 |

) |

|

Net cash provided by financing activities |

|

|

10,457 |

|

|

|

32,694 |

|

| Net decrease in cash, cash

equivalents and restricted cash |

|

|

(37,337 |

) |

|

|

(18,929 |

) |

|

Cash, cash equivalents and restricted cash, beginning of

period |

|

|

63,910 |

|

|

|

82,085 |

|

|

Cash, cash equivalents and restricted cash, end of period |

|

$ |

26,573 |

|

|

$ |

63,156 |

|

| Reconciliation of

cash, cash equivalents and restricted cash to the |

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

25,962 |

|

|

$ |

61,862 |

|

| Restricted cash |

|

|

611 |

|

|

|

1,294 |

|

| Total cash, cash equivalents

and restricted cash |

|

$ |

26,573 |

|

|

$ |

63,156 |

|

| |

EXPLANATORY NOTESNon-GAAP Financial

Measures

Adjusted Net income and Adjusted Diluted Earnings Per Common

Share

Adjusted net income represents Net (loss) income attributable to

Shimmick Corporation adjusted to eliminate stock-based

compensation, ERP pre-implementation asset impairment and

associated costs, legal fees and other costs for Legacy Projects

and other costs. We have also made an adjustment for transformation

costs we have incurred including advisory costs as we settle

outstanding claims, exit the Legacy Projects and transform the

Company into a water-focused business.

We have included Adjusted net income in this press release

because it is a key measure used by our management and board of

directors to understand and evaluate our core operating performance

and trends, to prepare and approve our annual budget and to develop

short and long-term operational plans. In particular, we believe

that the exclusion of the income and expenses eliminated in

calculating Adjusted net income can provide a useful measure for

period-to-period comparisons of our core business. Accordingly, we

believe that Adjusted net income provides useful information to

investors and others in understanding and evaluating our results of

operations.

Our use of Adjusted net income as an analytical tool has

limitations, and you should not consider it in isolation or as a

substitute for analysis of our financial results as reported under

GAAP. Some of these limitations are:

- Adjusted net income does not reflect changes in, or cash

requirements for, our working capital needs,

- Adjusted net income does not reflect the potentially dilutive

impact of stock-based compensation, and

- other companies, including companies in our industry, might

calculate Adjusted net income or similarly titled measures

differently, which reduces their usefulness as comparative

measures.

Because of these and other limitations, you should consider

Adjusted net income alongside Net (loss) income attributable to

Shimmick Corporation, which is the most directly comparable GAAP

measure.

Table A

|

Reconciliation between Net (loss) income attributable

to Shimmick Corporation and Adjusted net

income(unaudited) |

| |

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 27, |

|

|

September 29, |

|

|

September 27, |

|

|

September 29, |

|

|

(In thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net (loss) income attributable to Shimmick Corporation |

$ |

(1,564 |

) |

|

$ |

34,567 |

|

|

$ |

(86,286 |

) |

|

$ |

14,930 |

|

|

Transformation costs (1) |

|

1,924 |

|

|

|

- |

|

|

|

4,532 |

|

|

|

- |

|

|

Stock-based compensation |

|

1,337 |

|

|

|

496 |

|

|

|

3,304 |

|

|

|

1,547 |

|

| ERP

pre-implementation asset impairment and associated costs(2) |

|

15,708 |

|

|

|

- |

|

|

|

15,708 |

|

|

|

- |

|

| Legal

fees and other costs for Legacy Projects (3) |

|

6,436 |

|

|

|

1,708 |

|

|

|

11,796 |

|

|

|

6,346 |

|

| Other

(4) |

|

414 |

|

|

|

(109 |

) |

|

|

860 |

|

|

|

1,808 |

|

| Adjusted

net income |

$ |

24,255 |

|

|

$ |

36,662 |

|

|

$ |

(50,086 |

) |

|

$ |

24,631 |

|

| Adjusted

net income attributable to Shimmick Corporation per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.72 |

|

|

$ |

1.67 |

|

|

$ |

(1.72 |

) |

|

$ |

1.12 |

|

|

Diluted |

$ |

0.72 |

|

|

$ |

1.67 |

|

|

$ |

(1.72 |

) |

|

$ |

1.12 |

|

| |

| (1) Consists of

transformation-related costs we have incurred including advisory

costs as we settle outstanding claims, exit the Legacy Projects and

transform the Company into a water-focused business. |

| (2) Reflects a

strategic decision to enhance the Company’s current ERP system

rather than implementing a new platform which, due to prior

investments and remaining contractual obligations, resulted in a

one-time charge of approximately $16 million in the third quarter

of fiscal 2024. |

| (3) Consists of

legal fees and other costs incurred in connection with claims

relating to Legacy Projects. |

| (4) Consists of

transaction-related costs and changes in fair value of contingent

consideration remaining after the impact of transactions with

AECOM. |

| |

Adjusted EBITDA

Adjusted EBITDA represents our Net (loss) income attributable to

Shimmick Corporation before interest expense, income tax expense

and depreciation and amortization, adjusted to eliminate

stock-based compensation, ERP pre-implementation asset impairment

and associated costs, legal fees and other costs for Legacy

Projects and other costs. We have also made an adjustment for

transformation costs we have incurred including advisory costs as

we settle outstanding claims, exit the Legacy Projects and

transform the Company into a water-focused business.

We have included Adjusted EBITDA in this press release because

it is a key measure used by our management and board of directors

to understand and evaluate our core operating performance and

trends, to prepare and approve our annual budget and to develop

short and long-term operational plans. In particular, we believe

that the exclusion of the income and expenses eliminated in

calculating Adjusted EBITDA can provide a useful measure for

period-to-period comparisons of our core business. Accordingly, we

believe that Adjusted EBITDA provides useful information to

investors and others in understanding and evaluating our results of

operations.

Our use of Adjusted EBITDA as an analytical tool has

limitations, and you should not consider it in isolation or as a

substitute for analysis of our financial results as reported under

GAAP. Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized might have to be

replaced in the future, and Adjusted EBITDA does not reflect cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements,

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs,

- Adjusted EBITDA does not reflect the potentially dilutive

impact of stock-based compensation,

- Adjusted EBITDA does not reflect interest or tax payments that

would reduce the cash available to us, and

- other companies, including companies in our industry, might

calculate Adjusted EBITDA or similarly titled measures differently,

which reduces their usefulness as comparative measures.

Because of these and other limitations, you should consider

Adjusted EBITDA alongside Net (loss) income attributable to

Shimmick Corporation, which is the most directly comparable GAAP

measure.

Table B

|

Reconciliation between Net (loss) income attributable

to Shimmick Corporation and Adjusted

EBITDA(unaudited) |

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 27, |

|

|

September 29, |

|

|

September 27, |

|

|

September 29, |

|

|

(In thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net (loss) income attributable to Shimmick Corporation |

$ |

(1,564 |

) |

|

$ |

34,567 |

|

|

$ |

(86,286 |

) |

|

$ |

14,930 |

|

|

Depreciation and amortization |

|

3,447 |

|

|

|

4,637 |

|

|

|

11,646 |

|

|

|

13,186 |

|

| Interest

expense |

|

1,977 |

|

|

|

413 |

|

|

|

4,370 |

|

|

|

1,020 |

|

| Income

tax expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Transformation costs (1) |

|

1,924 |

|

|

|

- |

|

|

|

4,532 |

|

|

|

- |

|

|

Stock-based compensation |

|

1,337 |

|

|

|

496 |

|

|

|

3,304 |

|

|

|

1,547 |

|

| ERP

pre-implementation asset impairment and associated costs(2) |

|

15,708 |

|

|

|

- |

|

|

|

15,708 |

|

|

|

- |

|

| Legal

fees and other costs for Legacy Projects (3) |

|

6,436 |

|

|

|

1,708 |

|

|

|

11,796 |

|

|

|

6,346 |

|

| Other

(4) |

|

414 |

|

|

|

(109 |

) |

|

|

860 |

|

|

|

1,808 |

|

| Adjusted

EBITDA |

$ |

29,679 |

|

|

$ |

41,712 |

|

|

$ |

(34,070 |

) |

|

$ |

38,837 |

|

| |

| (1) Consists of

transformation-related costs we have incurred including advisory

costs as we settle outstanding claims, exit the Legacy Projects and

transform the Company into a water-focused business. |

| (2) Reflects a

strategic decision to enhance the Company’s current ERP system

rather than implementing a new platform which, due to prior

investments and remaining contractual obligations, resulted in a

one-time charge of approximately $16 million in the third quarter

of fiscal 2024. |

| (3) Consists of

legal fees and other costs incurred in connection with claims

relating to Legacy Projects. |

| (4) Consists of

transaction-related costs and changes in fair value of contingent

consideration remaining after the impact of transactions with

AECOM. |

| |

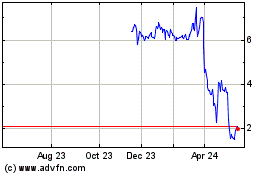

Shimmick (NASDAQ:SHIM)

Historical Stock Chart

From Feb 2025 to Mar 2025

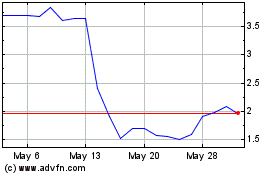

Shimmick (NASDAQ:SHIM)

Historical Stock Chart

From Mar 2024 to Mar 2025