Slate Includes Sleep Number’s Former Chairman

and Interim CEO and Director Candidates with Significant

Shareholdings, Capital Allocation and Product Innovation Expertise

and Track Records Overseeing Value-Enhancing Turnarounds

Contends that its Director Candidates – Patrick

A. Hopf, Jeffrey T. Jackson, Jessica M. Prager and Kevin Baker –

Are Best Positioned to Identify Sleep Number’s Next CEO and Put the

Company Back on the Path to Growth and Profitability

Stadium Capital Management, LLC (together with certain of its

affiliates, “Stadium Capital” or “we”) is the largest shareholder

of Sleep Number Corporation (NASDAQ: SNBR) (“Sleep Number” or the

“Company”), owning approximately 11.7% of the Company’s outstanding

shares. Today, Stadium Capital issued the below letter to

shareholders regarding its nomination of four highly qualified,

independent candidates for election to the Company’s Board of

Directors (the “Board”) at the 2025 Annual Meeting of Shareholders

(the “Annual Meeting”).

***

December 2, 2024

Fellow Shareholders:

Stadium Capital is Sleep Number’s largest shareholder, holding

approximately 11.7% of the Company’s outstanding shares. Last week,

we expressed our grave concerns with Sleep Number’s financial

underperformance, corporate governance and flawed CEO search

process and made specific proposals to solve these pressing issues.

Based on the conversations we had with many of you both before and

after the publication of our letter, we are confident the majority

of you share our frustrations. That is why it was so surprising to

see the Board respond by vehemently defending its actions, instead

of pursuing the path of private collaboration with its largest

shareholder (as we have done with Sleep Number previously).

Today we are writing to inform you that we have nominated four

exceptionally qualified directors with capital allocation, product

innovation, business turnaround and unrivaled industry experience

for election to Sleep Number’s Board at the upcoming Annual

Meeting. We did not come to this decision lightly, as we strongly

prefer private engagement with the management teams and boards of

our portfolio companies on ideas for value creation and improved

governance. In this case, our hand has been forced because Sleep

Number’s Board is unwilling to work with its largest shareholder to

add new directors to the boardroom to ensure an independent CEO

search, and most concerningly, seems intent on continuing on its

current perilous path. This was made particularly evident by the

Board’s decision to reject our November 12th and November 25th

proposals (seemingly without entertaining them whatsoever) that

would have ensured a truly independent CEO search process.

Concerningly, the Board’s obstinance is occurring in the face of

investors embracing the prospect of change, with Sleep Number’s

shares appreciating 20% since we highlighted the path to enhanced

value in our letter last week.

Most troubling in the Board’s response, which failed to address

any of our concerns, was its characterization of our request as

“unusual” for direct participation in the CEO search – the most

consequential decision facing the Company over the next decade.

Under standard circumstances, we believe a willing and experienced

owner who holds more stock than the entire Board by many multiples

should have a seat at the table for such a momentous decision. In

these specific circumstances, where the long-tenured directors

directly involved in this critical decision have such abysmal track

records of value destruction, it is especially vital. A thoughtful

and open-minded Board should welcome the input of a diligent,

patient and large owner who brings a valuable and differentiated

perspective to this enormously consequential decision.

Unfortunately for this Board, the facts are starkly obvious:

Sleep Number’s long-tenured directors (Shelly Ibach, Stephen Gulis,

Brenda Lauderback, Michael Harrison and Barbara Matas, in

particular) have failed all of us as fiduciaries. They have not

only harmed but are now also insulting key constituents – the

shareholders they are supposed to represent and the employees who

are the heart and soul of the organization they govern – by wasting

our money to protect their lucrative roles as directors for as long

as possible. Their indefensible long-term record and recent

self-serving actions make it overwhelmingly clear that they cannot

be trusted with the important decisions that lie ahead.

To fix this broken situation, we have nominated four highly

qualified individuals who have the necessary expertise and

independence to address Sleep Number’s most pressing issues. Our

nominees are:

Patrick A. Hopf

Mr. Hopf is the former Interim CEO and Chairman of Sleep Number

and a successful private investor in consumer-oriented companies.

He will bring a positive track record of value creation as well as

strategic change and board development experience.

- Proven Value Creator with Deep Knowledge of Sleep

Number: At St. Paul Venture Capital – one of the ten largest

venture capital firms in the U.S. at its peak – Mr. Hopf led the

firm’s investment in Sleep Number (then called Select Comfort) in

1991 and later became the Company’s Interim CEO and Chairman. Mr.

Hopf oversaw multiple turnarounds at Sleep Number and during his

leadership, Sleep Number’s market value grew to over $1.4 billion.

He started the direct response sales channel at Sleep Number,

helped launch the retail channel and Roadshow channel, and was

instrumental in establishing the internet channel in the late

1990s.

- Experience in Board Development and CEO Searches: Mr.

Hopf has been on the boards of more than 30 private companies and

was the Chairman of many of them, including Sleep Number, where he

led three separate CEO searches for Sleep Number.

- Strong Alignment with Shareholders: Mr. Hopf has

steadfastly represented shareholder interests as a public market

investor, private investor, board member and operating manager for

over 40 years. Mr. Hopf also has a significant personal investment

in Sleep Number.

Jeffrey T. Jackson

Mr. Jackson is an experienced CEO and public company director

with an outstanding record of value creation and extensive

experience managing cyclical companies across market cycles, which

will be particularly relevant for Sleep Number.

- Proven Value Creator: After Mr. Jackson was named CEO of

PGT Innovations (“PGT”), the company’s shareholder returns

annualized in the high-teens and PGT more than doubled EBITDA

through organic growth and M&A activity.

- Extensive Experience Managing a Cyclical Business Across All

Phases of Growth: Prior to ascending to the CEO role, Mr.

Jackson also served as PGT’s CFO, where he helped guide the

business through the housing boom, bust and subsequent recovery,

including effectively managing its cost structure to successfully

position the company to capitalize on value-enhancing opportunities

when the market recovered.

- Experience Selling Products Through Multiple Distribution

Channels: Mr. Jackson drove accretive growth across PGT’s

portfolio of brands by selling its various products through

company-owned retail stores, third-party retailers and independent

dealers.

Jessica M. Prager

Ms. Prager has extensive experience building and scaling

high-performing, culturally relevant brands. Her expertise in

leveraging consumer data, driving product innovation and bridging

digital and physical touchpoints will be particularly relevant in

helping Sleep Number achieve its growth potential.

- Proven Value Creator: Ms. Prager is Senior Vice

President of Product at Roman Health Ventures (“Ro”), where she was

one of the company’s first 10 employees and has been instrumental

in scaling the company, which is now valued at $7 billion. She has

helped drive Ro’s significant growth and cement its position as a

leader in the consumer healthcare technology space.

- Expertise in Leveraging Consumer Data and Insights to Drive

Growth: Ms. Prager has a proven track record of using consumer

data at scale and analyzing consumer insights to refine customer

experiences and optimize growth marketing strategies. She has deep

experience in demand generation, direct-response marketing

strategies, brand building and optimizing ecommerce platforms from

her roles at Ro, ClassPass, Bain & Company and PepsiCo.

- Track Record of Marrying Brand Vision with Consumer

Experience: At ClassPass, Ms. Prager helped redefine how

consumers access fitness and wellness, connecting digital discovery

with physical participation. At Warby Parker, she supported the

launch of the company’s first permanent physical retail store,

creating an omnichannel model that set new industry standards.

Across Ro, ClassPass and Warby Parker, she has demonstrated an

ability to scale businesses while maintaining brand integrity and

cultural relevance.

Kevin Baker

Mr. Baker is a Managing Partner at Stadium Capital, Sleep

Number’s largest owner, and will bring a much-needed ownership

perspective to Sleep Number’s boardroom.

- Shareholder Perspective with a Clear Understanding of Sleep

Number’s Business: Exceptionally deep research and due

diligence is a centerpiece of Stadium Capital’s patient investment

strategy. As part of Stadium Capital’s investment team, Mr. Baker

has led extensive due diligence spanning a decade on Sleep Number

and the mattress industry. Mr. Baker will bring the largest

shareholder’s perspective to the boardroom and be laser-focused on

driving value for all shareholders.

- Capital Allocation and Financial Markets Expertise: Mr.

Baker has 14 years of experience as an investor in public

companies, with significant experience working directly with the

leadership teams of Stadium Capital’s portfolio companies on

value-enhancing capital allocation and capital structure

decisions.

Our nominees’ highly effective and complementary skillsets will

ensure that a refreshed, unbiased Board works constructively to

identify the biggest causes of Sleep Number’s underperformance,

uses those insights to identify the best CEO, and empowers and

incentivizes Sleep Number’s next CEO to reignite the Company’s

growth, profitability and market value. Most importantly, this

refreshed Board will put Sleep Number’s owners’ interests above its

own.

We continue to believe that it is in the best interest of all

shareholders for Sleep Number to collaborate with us by pursuing

the path we articulated in our November 25th letter: work with us

to refresh the Board, appoint an Executive Chairman and ensure a

wholly independent CEO search process to identify the Company’s

next leader. That is certainly the overwhelming message we have

heard from fellow shareholders, and to be clear, that is our

preferred outcome. However, if the Board continues down a

self-serving path and unnecessarily squanders resources to defend

those who are most responsible for the current calamity, then we

will look forward to letting the owners decide the future of our

Company at the Annual Meeting in spring 2025.

Sincerely,

The Stadium Capital Investment Team

***

About Stadium Capital

Stadium Capital Management, LLC seeks to apply a patient,

private equity approach to public market investing, anchored by

deep fundamental research. Since our strategy inception in 1997, we

have invested in a concentrated portfolio of smaller-cap, public

companies across North America and Europe with a long-term

investment horizon and a focus on high-quality businesses with

durable free cash flow. We have almost three decades of deep

investment experience through multiple full market cycles, working

closely and collaboratively with our portfolio companies. For more

information, visit www.StadiumCapital.com.

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

Stadium Capital Partners, L.P. (“SCP”), together with the other participants named

herein (collectively, “Stadium

Capital”), intend to file a preliminary proxy statement and

accompanying WHITE universal proxy card with the Securities

and Exchange Commission (“SEC”) to be

used to solicit votes for the election of Stadium Capital’s slate

of highly-qualified director nominees at the 2025 annual meeting of

shareholders of Sleep Number Corporation, a Minnesota corporation

(the “Company”).

STADIUM CAPITAL STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A

PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO

CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF

THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY

SOLICITOR.

The participants in the anticipated proxy solicitation are

expected to be SCP, Stadium Special Opportunity I, L.P.

(“SSO”), Stadium Capital Management

GP, L.P. (“SCMGP”), Stadium Capital

Management, LLC (“SCM”), Alexander M.

Seaver, Kevin Baker, Patrick A. Hopf, Jeffrey T. Jackson and

Jessica M. Prager.

As of the date hereof, SCP directly beneficially owns 2,215,000

shares of Common Stock, par value $0.01 per share (the

“Common Stock”), of the Company. As of

the date hereof, SSO directly beneficially owns 401,459 shares of

Common Stock. SCMGP, as the general partner of SCP and SSO, may be

deemed to beneficially own the 2,616,459 shares of Common Stock

owned in the aggregate by SCP and SSO. SCM, as the investment

advisor to SCP and SSO and as the general partner of SCMGP, may be

deemed to beneficially own the 2,616,459 shares of Common Stock

owned in the aggregate by SCP and SSO. Mr. Seaver, as the manager

of SCM, may be deemed to beneficially own the 2,616,459 shares of

Common Stock owned in the aggregate by SCP and SSO. As of the date

hereof, Mr. Hopf directly beneficially owns 51,500 shares of Common

Stock, which includes 1,500 shares of Common Stock underlying

certain call options that are currently exercisable. As of the date

hereof, Messrs. Baker and Jackson and Ms. Prager do not

beneficially own any shares of Common Stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202287994/en/

Longacre Square Partners Charlotte Kiaie / Bela Kirpalani,

646-386-0091 ckiaie@longacresquare.com /

bkirpalani@longacresquare.com

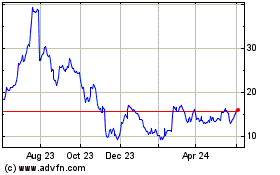

Sleep Number (NASDAQ:SNBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

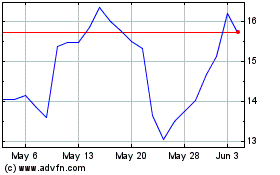

Sleep Number (NASDAQ:SNBR)

Historical Stock Chart

From Jan 2024 to Jan 2025