Synchronoss Technologies

Inc. (“Synchronoss” or the “Company”)

(Nasdaq: SNCR), a global leader and innovator in cloud,

messaging, and digital products and platforms, today reported

financial results for its second quarter ended June 30, 2023.

Second Quarter and

Recent Operational Highlights

- Secured a contract

extension with Verizon to provide Synchronoss Cloud through

2030. The agreement builds on a 10-year partnership and

represents the next foundational step in further validating the

Company’s cloud-first strategy.

- Achieved 11% year-over-year

Cloud subscriber growth for the second quarter of 2023.

The thirteenth consecutive quarter of double-digit subscriber

growth has been driven by the continued adoption of the Company’s

Personal Cloud product by its customers’ subscribers, including

Verizon and AT&T.

- Expanded iOS capabilities

for Synchronoss Cloud, including vast improvements in

backup performance, ensuring a faster and more efficient experience

for users when storing large video and media files. The

enhancements leverage asynchronous and parallel processing designs

to ensure users can seamlessly back up photos and videos

simultaneously without taxing their devices.

- Launched Redesigned

Personal Cloud desktop app that offers an enriched user

experience, allowing users to synchronize and backup their digital

content located on laptops and desktops to the Cloud platform. This

launch is a continued progression of the Company’s OS-agnostic

cross platform strategy to protect digital assets on all

devices.

- Launched Enhanced Personal

Cloud Web App with sharing and secure folder features that

offer users the ability to share digital assets and add an extra

layer of protection to sensitive documents and media.

- Earned multiple awards for

the Synchronoss Personal Cloud, including the 2023

‘Product of the Year’ from TMC’s Cloud Computing Magazine and a

‘Favorite New Product’ feature at the 2023 People’s Choice Stevie®

Awards.

- Signed additional

multi-million-dollar Advanced Messaging license with a Japanese

tier one operator, signifying the continuation of

RCS-based messaging in that market.

Management Commentary“During

the second quarter, we drove continued momentum in our core Cloud

business, highlighted by a multi-year renewal through 2030 with our

largest customer in Verizon,” stated Jeff Miller, President and CEO

of Synchronoss. “This year marks the 10-year anniversary of our

partnership with Verizon, and we are looking forward to the

expanded engagement in the years ahead as we support their growing

cloud subscriber base by providing the latest in technology

advancements, including the use of sophisticated deep learning and

generative AI.

“Financially, during the period we also recorded

$46.4 million in invoiced Cloud revenue, a record 24% increase

over last year, driven by professional services contributions

related to an upcoming new customer launch and a one-time favorable

subscriber adjustment. In addition to our double-digit subscriber

growth across our installed base, we expect a return to GAAP

revenue growth and continued positive cash flow in the second half

of this year. We also remain on schedule to launch Synchronoss

Personal Cloud™ with a global Tier One operator in the APAC region

later this year. Put together, through diligent cost management,

continued execution in our core business, and several upcoming

events that we expect to provide significant tailwinds, we are

nearing a turning point in our evolution that will result in

Synchronoss becoming a self-sustaining, cash generative enterprise

over the long term.”

Strategic Review Process

UpdateDuring 2022, the Company engaged UBS Securities, LLC

as its financial advisor to assist in exploring and evaluating

potential strategic transactions involving the Company or certain

of its lines of business, all with the objective of maximizing

value for the Company’s stockholders.

On March 10, 2023, Synchronoss received an

unsolicited, non-binding proposal from B. Riley Financial, to

acquire all outstanding shares of common stock for a price of $1.15

per share, payable in cash. B. Riley, together with its affiliates,

owns approximately 13.9% of the Company’s outstanding common stock

and is the Company’s largest common shareholder. B. Riley also

nominated Mr. Martin Bernstein as one of the Company’s directors

pursuant to a pre-existing agreement with the Company.

Consistent with its fiduciary duties and in

consultation with UBS and its legal advisors, the Company’s Board

of Directors, excluding B. Riley’s designee Mr. Bernstein, is

continuing to carefully review the B. Riley proposal as well as

other potential strategic transactions to determine the course of

action that it believes will maximize value for the Company’s

stockholders.

The Company’s recent long-term renewal of its

relationship with Verizon was a key area of focus for Synchronoss

management over the last several weeks both for the long-term

growth of its business and for the purposes of advancing its

discussions with interested parties. Synchronoss management

believes the stability provided by securing this agreement will

enable the Company to continue to advance discussions in a

productive manner going forward.

Key Performance Indicators

("KPIs")

- Cloud subscriber growth of 11%

continued the Company’s ongoing performance of year-over-year

double-digit subscriber growth. Second quarter GAAP Cloud revenue

decreased 7.0% year over year as a result of expected deferred

revenue run-off and a previous sunsetting of a legacy cloud

offering.

- Invoiced Cloud revenue increased

24.0% year over year to $46.4 million in the second quarter. On a

trailing twelve-month basis, invoiced Cloud revenue increased 13.1%

from the comparable period. The results were partially driven by a

$3.2 million benefit from a subscriber reconciliation.

Removing this impact, invoiced Cloud revenue increased 15.4%

compared to the prior year period. This non-GAAP measure,

reconciled within the financial statements below, is intended to

provide greater transparency in the underlying Cloud revenue trends

as it is not impacted by changes in deferred and unbilled

revenue.

- Quarterly recurring revenue was

83.8% of total revenue, a decrease from 86.6% of total revenue in

the first quarter of 2023 and the same 86.6% in the second quarter

of last year. The slight decrease in recurring revenue is due to

deferred revenue impacts in the Company’s Cloud business as well as

an increasing contribution percentage from the Company’s Messaging

business. This period marks the twelfth consecutive quarter of

recurring revenue at 80.0% or greater.

GAAP revenue breakdown by product is included

below:

| |

Q2 2023 vs Q2 2022 |

|

(in thousands) |

Q2 2023Revenue |

|

Q2 2022Revenue |

|

% Increase/(Decrease) |

|

% of TotalRevenue |

|

Cloud |

$40,437 |

|

$43,477 |

|

(7.0)% |

|

67.7% |

|

NetworkX |

7,834 |

|

10,437 |

|

(24.9)% |

|

13.1% |

|

Messaging |

11,442 |

|

11,322 |

|

1.1% |

|

19.2% |

|

Total |

$59,713 |

|

$65,236 |

|

|

|

100.0% |

Second Quarter

2023 Financial Results:Results

compare 2023 fiscal second quarter end (June 30, 2023) to 2022

fiscal second quarter end (June 30, 2022) unless otherwise

indicated.

- Total revenue

decreased 8.5% to $59.7 million from $65.2 million in the prior

year period. The decline in revenue was primarily due to

$4.7 million of deferred revenue recognized in Q2 2022 as well

as revenue recognized from the DXP and Activation assets prior to

the divestiture in Q2 2022.

- Gross profit

decreased 12.0% to $31.4 million (52.5% of total revenue) from

$35.6 million (54.6% of total revenue) in the prior year period.

Gross margins decreased as a result of Gross margins decreased as a

result of the previously noted changes in revenue, which had

positively impacted gross margin in Q2 2022, as well as a higher

contribution as a percentage of overall revenue from the Company’s

Messaging business.

- (Loss) income from

operations was $(3.9) million compared to $4.9 million in

2022. The increase in operating loss was primarily the result of

the previously noted changes in revenue, increased R&D spend

from higher employee costs and a lease impairment charge in the

current period, and increased SG&A costs related to a lease

impairment charge, and non-recurring professional fees.

- Net (loss) income

was $(11.0) million, or $(0.13) per share, compared to $5.3

million, or $0.06 per share, in the prior year period. The increase

in net loss was primarily due to the previously noted changes in

revenue, increased R&D and SG&A spend, a $4.5 million

change in the impact of non-cash foreign exchange, and a

$2.6 million gain on divestiture recognized only in the prior

year period.

- Adjusted EBITDA (a

non-GAAP metric reconciled below) decreased 27% to $10.3 million

(17.3% of total revenue) from $14.2 million (21.8% of total

revenue) in the prior year period. The decrease in adjusted EBITDA

and adjusted EBITDA margin was primarily attributable to the change

in revenues as previously outlined.

- Cash and cash

equivalents were $19.3 million at June 30, 2023, compared

to $15.6 million at March 31, 2023 and $21.9 million at

December 31, 2022. Free cash flow was $6.4 million and adjusted

free cash flow was $9.6 million. The Company did not receive

additional tax refunds during the period, leaving its remaining

balance due at approximately $28 million, which is expected to

be received in the coming quarters. Management does not anticipate

needing to raise additional capital for the foreseeable

future.

Financial CommentaryCFO Lou

Ferraro added: “Our commitment to driving Cloud growth and

operating efficiency has propelled us towards achieving our revenue

and cash flow targets for 2023. In the second quarter, our efforts

translated into $6.4 million of fully levered free cash flow, which

is an 80% increase year-over-year and a more than $10 million jump

sequentially. In the second half, we expect to return to GAAP

revenue growth as well as to continue generating positive cash

flows. Additionally, there are several material expenditures coming

off our books in the next few quarters, namely datacenter hosting

costs, legacy settlement payments, and various legal fees, that,

when resolved, should demonstrably improve our profitability and

enable us to unlock the true earning potential of our

business.”

Third Quarter and 2023 Financial

OutlookCompared to the second quarter of 2023, management

expects third quarter revenue and adjusted EBITDA to moderately

improve. Based on the continued strong performance within the

Company’s core Cloud business as well as improvements in

operational expense management, Synchronoss is reiterating its

expectation to be cash flow positive, on an unadjusted basis, for

2023. The current expectation is to generate cash flow in the

single-digit millions for the full year. Additionally, after

factoring in anticipated revenue growth and the expiration of

certain existing payment obligations, along with other general

costs, management expects cash flow generation to significantly

improve in 2024.

The Company also expects Cloud subscriber growth

to continue at a double-digit rate on a year-over-year basis in

2023.

For the fiscal year ending December 31, 2023,

the Company expects GAAP revenue to range between $242.0 million

and $255.0 million. The comparable 2022 pro forma GAAP revenue is

$240.4 million after adjusting for the deferred revenue run-off and

$4.8 million in revenue recognized prior to the sale of the

Company’s DXP and Activation assets. The net contribution to GAAP

revenue from non-cash deferred revenue is expected to be $7.4

million less in 2023 than it was in 2022, most of which is related

to the first half of the year. The Company expects to return to

total revenue growth on a GAAP basis for the second half of the

year and in 2024.

The Company expects adjusted EBITDA to range

between $44.0 million and $55.0 million in 2023.

A reconciliation of GAAP to non-GAAP results has

been provided in the financial statement tables included in this

press release. An explanation of these measures is included below

under the heading "Non-GAAP Financial Measures." With respect to

forward looking statements related to adjusted EBITDA, the Company

has relied upon the exception in item 10(e)(1)(i)(B) of Regulation

S-K and has not provided a quantitative reconciliation of

forecasted adjusted EBITDA to forecasted GAAP net income (loss)

attributable to Synchronoss or to forecasted GAAP income (loss)

from operations, before taxes, within this earnings release because

the Company is unable, without making unreasonable efforts, to

calculate certain reconciling items with confidence. These items

include, but are not limited to, other income, other expense,

(provision) benefit for income taxes, depreciation and amortization

expense, stock-based compensation expense, restructuring charges,

gain (loss) on divestitures, net (loss) income attributable to

redeemable noncontrolling interests.

Conference CallSynchronoss will

hold a conference call today, August 8, 2023, at 4:30 p.m.

Eastern time (1:30 p.m. Pacific time) to discuss these results.

Synchronoss management will host the call,

followed by a question-and-answer period.

Registration Link: Click here to register

Please register online at least 10 minutes prior

to the start time. Upon registration, the webcast platform will

provide dial-in numbers and a unique access code. If you have any

difficulty with registration or connecting to the conference call,

please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and

available for replay here and via the Investor Relations section of

Synchronoss' website.

Non-GAAP Financial

MeasuresSynchronoss has provided in this release selected

financial information that has not been prepared in accordance with

GAAP although this non-GAAP financial information is derived from

numbers that have been prepared in accordance with GAAP. This

information includes historical non-GAAP revenues, adjusted gross

profit, adjusted gross margin, adjusted EBITDA, effective tax rate,

non-GAAP net income (loss) attributable to Synchronoss, diluted

non-GAAP net income (loss) per share, free cash flow, invoiced

cloud revenue and adjusted free cash flow (which excludes cash

payments and receipts related to non-core business activities). The

Company believes that the exclusion of non-routine cash-settled

expenses, such as Litigation and Remediation costs (net) and

Restructuring costs in the calculation of adjusted free cash flow

which do not correlate to the operation of its business, provide

for more useful period-to-period comparisons of the Company’s

results. Synchronoss uses these non-GAAP financial measures

internally in analyzing its financial results and believes they are

useful to investors, as a supplement to GAAP measures, in

evaluating Synchronoss’ ongoing operational performance.

Synchronoss believes that the use of these non-GAAP financial

measures provides an additional tool for investors to use in

evaluating ongoing operating results and trends, and in comparing

its financial results with other companies in Synchronoss’

industry, many of which present similar non-GAAP financial measures

to investors. As noted, the non-GAAP financial results discussed

above add back fair value stock-based compensation expense,

acquisition-related costs, restructuring, transition and cease-use

lease expense, litigation, remediation and refiling costs and

depreciation and amortization, interest income, interest expense,

loss (gain) on divestitures, other (income) expense, provision

(benefit) for income taxes, and net loss (income) attributable to

noncontrolling interests, and preferred dividends.

Non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. Investors are

encouraged to review the reconciliation of these non-GAAP measures

to their most directly comparable GAAP financial measures as

detailed above. Investors are encouraged to also review the Balance

Sheet, Statement of Operations, and Statement of Cash Flow. As

previously mentioned, a reconciliation of GAAP to non-GAAP results

has been provided in the financial statement tables included in

this press release.

Forward-Looking StatementsThis

press release includes statements concerning Synchronoss and its

future expectations, plans and prospects that constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. For this purpose, any

statements contained herein that are not statements of historical

fact may be deemed to be forward-looking statements. Without

limiting the foregoing, the words “may,” “should,” “expects,”

“plans,” “anticipates,” “could,” “intends,” “believes,” “potential”

or “continue” or other similar expressions are intended to identify

forward-looking statements. Synchronoss has based these

forward-looking statements largely on its current expectations and

projections about future events and financial trends that it

believes may affect its business, financial condition and results

of operations. These forward-looking statements speak only as of

the date of this press release and are subject to a number of

risks, uncertainties and assumptions including, without limitation,

risks relating to the Company’s ability to sustain or increase

revenue from its larger customers and generate revenue from new

customers, the Company’s expectations regarding expenses and

revenue, the sufficiency of the Company’s cash resources, the

impact of legal proceedings involving the Company, including the

investigations by the Securities and Exchange Commission and the

Department of Justice described in the Company’s most recent SEC

filings, and other risks and factors that are described in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2022, and the Company’s Quarterly Report on Form 10-Q for the

period ended March 31, 2023, which are on file with the SEC and

available on the SEC’s website at www.sec.gov. The company does not

undertake any obligation to update any forward-looking statements

contained in this press release as a result of new information,

future events or otherwise.

About SynchronossSynchronoss

Technologies (Nasdaq: SNCR) builds software that empowers companies

around the world to connect with their subscribers in trusted and

meaningful ways. The company’s collection of products helps

streamline networks, simplify onboarding, and engage subscribers to

unleash new revenue streams, reduce costs and increase speed to

market. Hundreds of millions of subscribers trust Synchronoss

products to stay in sync with the people, services, and content

they love. Learn more at www.synchronoss.com.

Media Relations

Contact:Domenick

CileaSpringboarddcilea@springboardpr.com

Investor Relations Contact:Matt

Glover and Tom ColtonGateway Group, Inc.SNCR@gateway-grp.com

-Financial Tables to Follow-

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) (In thousands) |

| |

|

|

|

| |

June 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

19,329 |

|

$ |

21,921 |

|

Accounts receivable, net |

|

39,841 |

|

|

47,024 |

|

Operating lease right-of-use assets |

|

17,529 |

|

|

20,863 |

|

Goodwill |

|

212,125 |

|

|

210,889 |

|

Other assets |

|

95,305 |

|

|

97,375 |

|

Total assets |

$ |

384,129 |

|

$ |

398,072 |

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Accounts payable and accrued expenses |

$ |

63,250 |

|

$ |

66,324 |

|

Deferred revenues |

|

23,646 |

|

|

14,183 |

|

Debt, non-current |

|

135,379 |

|

|

134,584 |

|

Operating lease liabilities, non-current |

|

26,806 |

|

|

29,637 |

|

Other liabilities |

|

3,052 |

|

|

4,399 |

|

Preferred stock |

|

68,348 |

|

|

68,348 |

|

Redeemable noncontrolling interest |

|

12,500 |

|

|

12,500 |

|

Stockholders’ equity |

|

51,148 |

|

|

68,097 |

|

Total liabilities and stockholders’ equity |

$ |

384,129 |

|

$ |

398,072 |

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) (In thousands, except per share

data) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net revenues |

$ |

59,713 |

|

|

$ |

65,236 |

|

|

$ |

117,421 |

|

|

$ |

131,102 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of revenues1 |

|

21,782 |

|

|

|

22,316 |

|

|

|

42,163 |

|

|

|

47,155 |

|

|

Research and development |

|

15,043 |

|

|

|

13,460 |

|

|

|

29,778 |

|

|

|

29,251 |

|

|

Selling, general and administrative |

|

19,875 |

|

|

|

15,288 |

|

|

|

38,184 |

|

|

|

33,185 |

|

|

Restructuring charges |

|

21 |

|

|

|

1,019 |

|

|

|

366 |

|

|

|

1,704 |

|

|

Depreciation and amortization |

|

6,939 |

|

|

|

8,259 |

|

|

|

14,459 |

|

|

|

16,293 |

|

|

Total costs and expenses |

|

63,660 |

|

|

|

60,342 |

|

|

|

124,950 |

|

|

|

127,588 |

|

| (Loss) income from

operations |

|

(3,947 |

) |

|

|

4,894 |

|

|

|

(7,529 |

) |

|

|

3,514 |

|

|

Interest income |

|

127 |

|

|

|

118 |

|

|

|

222 |

|

|

|

210 |

|

|

Interest expense |

|

(3,461 |

) |

|

|

(3,343 |

) |

|

|

(6,915 |

) |

|

|

(6,668 |

) |

|

Gain on divestiture |

|

— |

|

|

|

2,622 |

|

|

|

— |

|

|

|

2,622 |

|

|

Other (expense) income, net |

|

(454 |

) |

|

|

4,065 |

|

|

|

(3,385 |

) |

|

|

5,769 |

|

| (Loss) income from operations,

before taxes |

|

(7,735 |

) |

|

|

8,356 |

|

|

|

(17,607 |

) |

|

|

5,447 |

|

|

Provision for income taxes |

|

(783 |

) |

|

|

(435 |

) |

|

|

(1,842 |

) |

|

|

(563 |

) |

| Net (loss) income |

|

(8,518 |

) |

|

|

7,921 |

|

|

|

(19,449 |

) |

|

|

4,884 |

|

|

Net income (loss) attributable to redeemable noncontrolling

interests |

|

14 |

|

|

|

(75 |

) |

|

|

28 |

|

|

|

(190 |

) |

|

Preferred stock dividend |

|

(2,475 |

) |

|

|

(2,519 |

) |

|

|

(4,949 |

) |

|

|

(4,957 |

) |

| Net (loss) income attributable

to Synchronoss |

$ |

(10,979 |

) |

|

$ |

5,327 |

|

|

$ |

(24,370 |

) |

|

$ |

(263 |

) |

| |

|

|

|

|

|

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.13 |

) |

|

$ |

0.06 |

|

|

$ |

(0.28 |

) |

|

$ |

— |

|

|

Diluted |

$ |

(0.13 |

) |

|

$ |

0.06 |

|

|

$ |

(0.28 |

) |

|

$ |

— |

|

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

86,785 |

|

|

|

87,124 |

|

|

|

86,644 |

|

|

|

86,031 |

|

|

Diluted |

|

86,785 |

|

|

|

89,249 |

|

|

|

86,644 |

|

|

|

86,031 |

|

_________________________________1 Cost of

revenues excludes depreciation and amortization which are shown

separately.

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited) (In thousands) |

| |

|

| |

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

Net (loss) income from continuing operations |

$ |

(19,449 |

) |

|

$ |

4,884 |

|

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Non-cash items |

|

20,727 |

|

|

|

17,432 |

|

|

Changes in operating assets and liabilities |

|

11,278 |

|

|

|

(15,588 |

) |

|

Net cash provided by operating activities |

|

12,556 |

|

|

|

6,728 |

|

| |

|

|

|

|

Investing activities: |

|

|

|

|

Purchases of fixed assets |

|

(994 |

) |

|

|

(573 |

) |

|

Purchases of intangible assets and capitalized software |

|

(9,350 |

) |

|

|

(10,695 |

) |

|

Other investing activities |

|

— |

|

|

|

7,500 |

|

|

Net cash used in investing activities |

|

(10,344 |

) |

|

|

(3,768 |

) |

| |

|

|

|

|

Net cash used in financing activities |

|

(4,904 |

) |

|

|

(8,517 |

) |

|

Effect of exchange rate changes on cash |

|

100 |

|

|

|

(435 |

) |

|

Net decrease in cash and cash equivalents |

|

(2,592 |

) |

|

|

(5,992 |

) |

| |

|

|

|

| Cash and cash equivalents,

beginning of period |

|

21,921 |

|

|

|

31,504 |

|

| Cash and cash equivalents, end

of period |

$ |

19,329 |

|

|

$ |

25,512 |

|

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

|

(Unaudited) (In thousands, except per share

data) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Non-GAAP financial measures

and reconciliation: |

|

|

|

|

|

|

|

|

GAAP Revenue |

$ |

59,713 |

|

|

$ |

65,236 |

|

|

$ |

117,421 |

|

|

$ |

131,102 |

|

|

Less: Cost of revenues |

|

21,782 |

|

|

|

22,316 |

|

|

|

42,163 |

|

|

|

47,155 |

|

|

Less: Restructuring1 |

|

— |

|

|

|

14 |

|

|

|

92 |

|

|

|

356 |

|

|

Less: Depreciation and Amortization2 |

|

6,574 |

|

|

|

7,282 |

|

|

|

13,737 |

|

|

|

14,443 |

|

| Gross Profit |

|

31,357 |

|

|

|

35,624 |

|

|

|

61,429 |

|

|

|

69,148 |

|

| |

|

|

|

|

|

|

|

| Add / (Less): |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

189 |

|

|

|

139 |

|

|

|

413 |

|

|

|

360 |

|

|

Restructuring, transition and cease-use lease expense |

|

414 |

|

|

|

162 |

|

|

|

597 |

|

|

|

1,327 |

|

|

Depreciation and Amortization2 |

|

6,574 |

|

|

|

7,282 |

|

|

|

13,737 |

|

|

|

14,443 |

|

| Adjusted Gross Profit |

$ |

38,534 |

|

|

$ |

43,207 |

|

|

$ |

76,176 |

|

|

$ |

85,278 |

|

| Adjusted Gross Margin |

|

64.5 |

% |

|

|

66.2 |

% |

|

|

64.9 |

% |

|

|

65.0 |

% |

_________________________________1 Amounts

associated with cost of revenues.2 Depreciation

and Amortization contains a reasonable allocation for expenses

associated with cost of revenues.

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

|

(Unaudited) (In thousands, except per share

data) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP Net (loss) income attributable to Synchronoss |

$ |

(10,979 |

) |

|

$ |

5,327 |

|

|

$ |

(24,370 |

) |

|

$ |

(263 |

) |

| Add / (Less): |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

1,625 |

|

|

|

964 |

|

|

|

3,364 |

|

|

|

2,891 |

|

|

Restructuring, transition and cease-use lease expense |

|

3,301 |

|

|

|

1,381 |

|

|

|

4,020 |

|

|

|

3,392 |

|

|

Amortization expense1 |

|

1,277 |

|

|

|

2,490 |

|

|

|

3,274 |

|

|

|

5,033 |

|

|

Litigation, remediation and refiling costs, net |

|

2,384 |

|

|

|

(1,292 |

) |

|

|

4,343 |

|

|

|

(315 |

) |

| Non-GAAP Net (loss) income

attributable to Synchronoss |

$ |

(2,392 |

) |

|

$ |

8,870 |

|

|

$ |

(9,369 |

) |

|

$ |

10,738 |

|

| |

|

|

|

|

|

|

|

| Diluted Non-GAAP Net (loss)

income per share |

$ |

(0.03 |

) |

|

$ |

0.10 |

|

|

$ |

(0.11 |

) |

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

| Weighted shares outstanding -

Dilutive |

|

86,785 |

|

|

|

89,249 |

|

|

|

86,644 |

|

|

|

86,031 |

|

_________________________________1 Amortization

from acquired intangible assets.

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

|

(Unaudited) (In thousands) |

| |

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

Jun 30, 2023 |

|

Mar 31, 2023 |

|

Dec 31, 2022 |

|

Sep 30, 2022 |

|

Jun 30, 2022 |

|

Jun 30, 2023 |

|

Jun 30, 2022 |

|

Net (loss) income attributable to Synchronoss |

$ |

(10,979 |

) |

|

$ |

(13,391 |

) |

|

$ |

(15,927 |

) |

|

$ |

(1,278 |

) |

|

$ |

5,327 |

|

|

$ |

(24,370 |

) |

|

$ |

(263 |

) |

| Add / (Less): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

1,625 |

|

|

|

1,739 |

|

|

|

769 |

|

|

|

1,801 |

|

|

|

964 |

|

|

|

3,364 |

|

|

|

2,891 |

|

|

Restructuring, cease-use lease expense and change in contingent

consideration |

|

3,301 |

|

|

|

719 |

|

|

|

3,962 |

|

|

|

557 |

|

|

|

1,381 |

|

|

|

4,020 |

|

|

|

3,392 |

|

|

Litigation, remediation and refiling costs, net |

|

2,384 |

|

|

|

1,959 |

|

|

|

1,892 |

|

|

|

88 |

|

|

|

(1,292 |

) |

|

|

4,343 |

|

|

|

(315 |

) |

|

Depreciation and amortization |

|

6,939 |

|

|

|

7,520 |

|

|

|

7,734 |

|

|

|

7,726 |

|

|

|

8,259 |

|

|

|

14,459 |

|

|

|

16,293 |

|

|

Interest income |

|

(127 |

) |

|

|

(95 |

) |

|

|

(235 |

) |

|

|

(20 |

) |

|

|

(118 |

) |

|

|

(222 |

) |

|

|

(210 |

) |

|

Interest expense |

|

3,461 |

|

|

|

3,454 |

|

|

|

3,509 |

|

|

|

3,463 |

|

|

|

3,343 |

|

|

|

6,915 |

|

|

|

6,668 |

|

|

Loss (gain) on sale of DXP Business |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

73 |

|

|

|

(2,622 |

) |

|

|

— |

|

|

|

(2,622 |

) |

|

Other expense (income), net |

|

454 |

|

|

|

2,931 |

|

|

|

6,759 |

|

|

|

(4,437 |

) |

|

|

(4,065 |

) |

|

|

3,385 |

|

|

|

(5,769 |

) |

|

Provision (benefit) for income taxes |

|

783 |

|

|

|

1,059 |

|

|

|

181 |

|

|

|

1,115 |

|

|

|

435 |

|

|

|

1,842 |

|

|

|

563 |

|

|

Net (income) loss attributable to noncontrolling interests |

|

(14 |

) |

|

|

(14 |

) |

|

|

(56 |

) |

|

|

66 |

|

|

|

75 |

|

|

|

(28 |

) |

|

|

190 |

|

|

Preferred dividend |

|

2,475 |

|

|

|

2,474 |

|

|

|

2,297 |

|

|

|

2,298 |

|

|

|

2,519 |

|

|

|

4,949 |

|

|

|

4,957 |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

10,302 |

|

|

$ |

8,355 |

|

|

$ |

10,885 |

|

|

$ |

11,452 |

|

|

$ |

14,206 |

|

|

$ |

18,657 |

|

|

$ |

25,775 |

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net Cash provided by (used in) operating activities |

$ |

11,261 |

|

|

$ |

9,421 |

|

|

$ |

12,556 |

|

|

$ |

6,728 |

|

| Add / (Less): |

|

|

|

|

|

|

|

|

Capitalized software |

|

(4,756 |

) |

|

|

(5,450 |

) |

|

|

(9,350 |

) |

|

|

(10,695 |

) |

|

Property and equipment |

|

(118 |

) |

|

|

(419 |

) |

|

|

(994 |

) |

|

|

(573 |

) |

| Free Cashflow |

|

6,387 |

|

|

|

3,552 |

|

|

|

2,212 |

|

|

|

(4,540 |

) |

|

Add: Litigation and remediation costs, net |

|

2,358 |

|

|

|

1,471 |

|

|

|

5,184 |

|

|

|

674 |

|

|

Add: Restructuring |

|

898 |

|

|

|

1,642 |

|

|

|

2,101 |

|

|

|

4,433 |

|

| Adjusted Free Cashflow |

$ |

9,643 |

|

|

$ |

6,665 |

|

|

$ |

9,497 |

|

|

$ |

567 |

|

|

SYNCHRONOSS TECHNOLOGIES, INC. |

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

|

(Unaudited) (In thousands) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP Cloud Revenue |

$ |

40,437 |

|

$ |

43,477 |

|

|

$ |

81,515 |

|

|

$ |

84,978 |

|

|

Increase / (Decrease) Change in Deferred Revenue |

|

140 |

|

|

(4,074 |

) |

|

|

(759 |

) |

|

|

(7,721 |

) |

|

(Increase) / Decrease: Change in Unbilled Receivables &

Contract Assets |

|

5,789 |

|

|

(2,012 |

) |

|

|

5,903 |

|

|

|

(3,837 |

) |

| Invoiced Cloud Revenue |

$ |

46,366 |

|

$ |

37,391 |

|

|

$ |

86,659 |

|

|

$ |

73,420 |

|

Invoiced Cloud Revenue is defined as GAAP

revenue for Cloud disaggregated revenue stream, plus the period

change in deferred revenue balance related to the Cloud revenue

stream, less the period change in Unbilled Receivables and Contract

Assets balance related to the Cloud revenue stream.

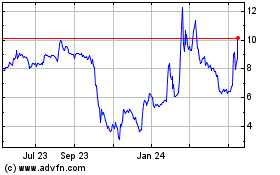

Synchronoss Technologies (NASDAQ:SNCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

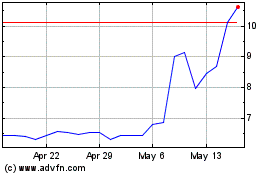

Synchronoss Technologies (NASDAQ:SNCR)

Historical Stock Chart

From Jan 2024 to Jan 2025