Treasure Global Inc. (NASDAQ: TGL) (“Treasure Global” or the

“Company”), a leading e-commerce platform operator, today announced

its financial results for the second quarter ended December 31,

2024.

Key Financial Highlights

- Revenue for the second quarter was

$0.30 million, a 46% increase from $0.21 million in the first

quarter of fiscal 2025. However, on a year-on-year basis, revenue

declined 96% from $6.71 million in Q2 2024.

- Gross profit was $0.22 million, up

30% from $0.17 million in Q1 2025. The gross profit margin stood at

74.0%, compared to 83% in Q1 2025 and 5.0% in Q2 2024.

- Operational loss was $0.69 million,

an improvement from $1.09 million in Q2 2024, representing a 36%

reduction.

- Net loss narrowed to $0.23 million,

compared to $0.95 million in Q1 2025 and $1.20 million in Q2 2024,

reflecting 76% and 81% improvements, respectively.

- Loss per share was $0.01, compared

to $0.35 in Q1 2025 and $2.22 in Q2 2024.

Management Commentary

“Our second-quarter results reflect the

continued execution of our strategy to enhance profitability

efficiency,” said Carlson Thow, Chief Executive Officer of Treasure

Global. “While revenue declined year-over-year due to our strategic

shift away from lower-margin operations, we achieved a 46%

quarter-over-quarter revenue increase and improved cost

efficiencies, demonstrating the early impact of our realignment

efforts.”

“Our focus remains on strengthening our digital

commerce ecosystem, expanding high-margin business segments, and

optimizing operations. Continued cost efficiencies have

significantly reduced net loss, positioning us for long-term

financial stability. Additionally, our 51% acquisition of Tien Ming

Distribution enhances fulfillment and logistics capabilities,

unlocking new growth opportunities.”

“As we move forward, we will continue scaling

digital commerce and fulfillment operations while driving

sustainable growth.”

CFO Commentary

“Our second-quarter performance demonstrated

significant financial improvements, with a 76% reduction in net

loss compared to the previous quarter,” said Sook Lee, Chief

Financial Officer of Treasure Global. “While revenue remains lower

than the prior year due to our shift toward a high-margin business

model, we have successfully increased gross profit margin to 74%,

up from just 5% last year. This underscores the effectiveness of

our cost optimization efforts.”

“We remain disciplined in managing expenses

while strategically investing e-commerce marketplace expansion and

fulfillment capabilities through Tien Ming Distribution. These

initiatives position us for continued financial improvement,

focusing on revenue stabilization and operational scalability,” she

added.

Operational Updates

Treasure Global is advancing a new digital

commerce initiative as part of its strategy to expand its ecosystem

and drive value creation. The Company is leveraging

technology-driven solutions to introduce enhanced digital commerce

capabilities in response to evolving market demands.

Additionally, Treasure Global is expanding its

e-commerce marketplace, allowing businesses to list and fulfil

products directly. This initiative strengthens the Company’s

digital commerce presence and supports revenue growth.

Following its 51% acquisition of Tien Ming

Distribution, Treasure Global is working to expand fulfilment and

logistics operations. The Company plans to integrate this

acquisition into its supply chain strategy while leveraging its

partnership with F&N to improve distribution efficiency in the

fast-moving consumer goods (FMCG) sector.

Business Outlook

In the next quarter, Treasure Global aims to

advance its transformation strategy by enhancing its digital

commerce initiative, expanding the e-commerce marketplace, and

strengthening logistics and fulfillment through Tien Ming

Distribution. The Company remains focused on optimizing its

business model, diversifying revenue streams, and enhancing

operational efficiency.

About Treasure Global Inc:

Treasure Global is a technology-driven solutions

provider specializing in e-commerce, fintech, and digital

transformation. The Company is actively enhancing its digital

commerce strategy to drive engagement and operational efficiency.

As of December 2024, 2024, ZCITY boasts over 2.9 million registered

users, positioning itself as a key player in Southeast Asia’s

digital economy.

For more information, please visit:

https://treasureglobal.co

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These statements reflect the Company’s current

expectations, assumptions, and projections about future events and

are subject to risks and uncertainties that could cause actual

results to differ materially from those described in the

forward-looking statements. Forward-looking statements typically

include terminology such as “anticipates,” “believes,” “expects,”

“intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,”

or similar expressions.

Factors that could cause actual results to

differ materially include, without limitation, the Company’s

ability to expand its e-commerce platform, customer acceptance of

new products and services, changes in economic conditions affecting

its operations, the impact of global health crises, supply chain

disruptions, competition, and regulatory risks related to data

privacy and security. These risks, along with other factors, are

discussed in more detail in the Company’s filings with the U.S.

Securities and Exchange Commission.

The forward-looking statements in this press

release speak only as of the date hereof. The Company assumes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as required by law.

CONTACT

Investor and media contact:

Chin Sook Lee

Chief Financial Officer

Treasure Global Inc.

ir_us@treasuregroup.co

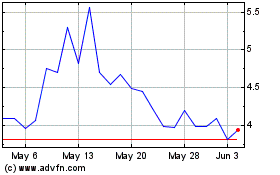

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

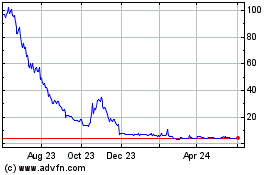

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Feb 2024 to Feb 2025