Valley National Bancorp Declares Its Regular Quarterly Preferred and Common Stock Dividends

November 18 2024 - 5:14PM

Valley National Bancorp (

NASDAQ:VLY) (“Valley”),

the holding company for Valley National Bank, announced today its

regular preferred and common dividends. The declared quarterly

dividends to shareholders of record on December 13, 2024 are as

follows:

- A cash dividend of $0.390625 per share to be paid December 30,

2024 on Valley’s Non-Cumulative Perpetual Preferred Stock Series

A;

- A cash dividend of $0.533568 per share to be paid December 30,

2024 on Valley’s Non-Cumulative Perpetual Preferred Stock Series

B;

- A cash dividend of $0.515625 per share to be paid December 30,

2024 on Valley’s Non-Cumulative Perpetual Preferred Stock Series C;

and

- A cash dividend of $0.11 per share will be paid January 2, 2025

on Valley’s common stock.

The common stock cash dividend amount per share

was unchanged as compared to the previous quarter dividend. The

common cash dividend should not be used as an indicator of future

dividends to Valley’s common stockholders.

About Valley

As the principal subsidiary of Valley National

Bancorp, Valley National Bank is a regional bank with over $62

billion in assets. Valley is committed to giving people and

businesses the power to succeed. Valley operates many convenient

branch locations and commercial banking offices in New Jersey, New

York, Florida, Alabama, California, and Illinois and is committed

to providing the most convenient service, the latest innovations

and an experienced and knowledgeable team dedicated to meeting

customer needs. Helping communities grow and prosper is the heart

of Valley’s corporate citizenship philosophy. To learn more about

Valley, go to www.valley.com or call our Customer Care Center at

800-522-4100.

Forward Looking Statements

The foregoing contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are not historical facts and

include expressions about management’s confidence and strategies

and management’s expectations about Valley’s business, new and

existing programs and products, acquisitions, relationships,

opportunities, taxation, technology, market conditions and economic

expectations. These statements may be identified by such

forward-looking terminology as “intend,” “should,” “expect,”

“believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,”

“typically,” “usually,” “anticipate,” “may,” “estimate,” “outlook,”

“project,” or similar statements or variations of such terms. Such

forward-looking statements involve certain risks and uncertainties.

Valley’s actual results may differ materially from such

forward-looking statements. Factors that may cause actual results

to differ materially from those contemplated by such

forward-looking statements include, but are not limited to those

risk factors disclosed in Valley’s Annual Report on Form 10-K for

the year ended December 31, 2023.

|

Contact: |

Travis

Lan |

| |

Executive Vice President and |

| |

Deputy Chief Financial Officer |

| |

(973) 686-5007 |

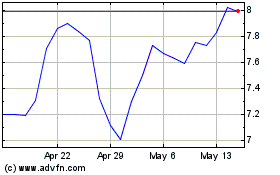

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Dec 2023 to Dec 2024