Company cash, cash equivalents, and investments

of $88.8 million as of December 31, 2024; pro forma cash position

of $128.6 million including debt refinancing and equity issuance

provides cash runway beyond FDA approval

Verastem Oncology (Nasdaq: VSTM), a biopharmaceutical company

committed to advancing new medicines for patients with RAS/MAPK

pathway-driven cancers, today announced a new credit facility for

up to $150 million along with an equity investment of $7.5 million

with Oberland Capital Management LLC (Oberland Capital). In

addition, the Company announced a strategic collaboration with

IQVIA Inc. (IQVIA) to leverage IQVIA’s world-class infrastructure

and established commercialization solutions to complement its

launch strategy for the investigational combination of avutometinib

plus defactinib for the treatment of recurrent KRAS mutant

low-grade serous ovarian cancer (LGSOC) planned for mid-2025.

“The Oberland Capital transaction, coupled with our strategic

partnership with IQVIA, enables us to launch avutometinib plus

defactinib for recurrent LGSOC from a position of financial

strength and with commercialization solutions to accelerate our

launch. The additional capital will help us create a commercial

revenue stream to support our pipeline with new approaches for

patients needing treatments for complex and rare cancers,” said Dan

Paterson, president and chief executive officer of Verastem

Oncology.

Verastem’s commercialization efforts are in anticipation of

potential U.S. Food and Drug Administration (FDA) approval of

avutometinib plus defactinib in recurrent KRAS mutant LGSOC. The

Company announced on December 30, 2024, that the FDA set a

Prescription Drug User Fee Act (PDUFA) action date for its NDA

submission of June 30, 2025.

Under the terms of the note purchase agreement with Oberland

Capital, Verastem will issue an initial $75 million of notes at

closing, which is expected to occur on January 13, 2025. The

Company then has the ability to access up to an additional $75

million in notes upon achievement of certain pre-determined

milestones related to the potential regulatory approval and

commercialization of avutometinib plus defactinib for the treatment

of LGSOC. The notes carry an interest-only period of six years and

will bear interest at a floating rate, which is subject to both a

floor and a cap. The note purchase agreement also provides for

revenue participation pursuant to which Oberland Capital will

initially be entitled to 1.0% of the first $100 million of net

sales in each calendar year of certain of the Company’s products,

subject to pro-rata increase upon potential future draw downs.

In addition, the Company has entered into a stock purchase

agreement with affiliates of Oberland Capital for the private

placement of 1,416,939 shares of the Company’s common stock issued

at closing, representing $7.5 million of gross proceeds based on

the trailing 30-trading days volume-weighted average price or VWAP

of $5.2931 per share. Additionally, Oberland has the option to

participate in certain future equity offerings that may be

consummated by the Company within the three years from closing, for

up to $2.5 million at the same price per share in such offering.

Closing of the stock purchase agreement is expected to occur

concurrently with the closing of the note purchase agreement on

January 13, 2025. A portion of the proceeds from the notes and

equity investment will be used to fully repay amounts owed under

the Company’s existing loan with Oxford Finance ($42.7 million),

which has been terminated.

The Company had a preliminary unaudited cash, cash equivalents,

and short term investment balance of $88.8 million as of December

31, 2024. Taking into account the initial $75.0 million of notes

and $7.5 million of equity to be purchased by Oberland Capital at

closing, and the repayment of amounts owed under the Company’s

existing loan with Oxford Finance, the Company would have had

pro-forma cash, cash equivalents, and short-term investment balance

of $128.6 million as of December 31, 2024. Both the actual and pro

forma December 31, 2024 balances stated herein are preliminary,

unaudited estimates and subject to revision upon completion of the

Company's closing and audit processes and do not present all

information necessary for an understanding of the Company’s

financial condition as of, and its results of operations for the

fiscal year ended December 31, 2024. Additional details regarding

this financing will be available in a Current Report on Form 8-K to

be filed by the Company with the Securities and Exchange

Commission.

The agreement between Verastem and IQVIA allows Verastem to tap

into IQVIA’s industry-leading expertise and resources while

maintaining strategic oversight through the commercialization

process and launch. IQVIA will help accelerate key launch

capabilities resulting in significant savings while delivering a

world-class product launch.

About the Avutometinib and Defactinib Combination

Avutometinib is an oral RAF/MEK clamp that potentially inhibits

MEK1/2 kinase activities and induces inactive complexes of MEK with

ARAF, BRAF, and CRAF, potentially creating a more complete and

durable anti-tumor response through maximal RAS/MAPK pathway

inhibition. In contrast to currently available MEK-only inhibitors,

avutometinib blocks both MEK kinase activity and the ability of RAF

to phosphorylate MEK. This unique mechanism allows avutometinib to

block MEK signaling without the compensatory activation of MEK that

appears to limit the efficacy of the MEK-only inhibitors.

Defactinib is an oral, selective inhibitor of focal adhesion

kinase (FAK) and proline-rich tyrosine kinase-2 (Pyk2), the two

members of the focal adhesion kinase family of non-receptor protein

tyrosine kinases. FAK and Pyk2 integrate signals from integrin and

growth factor receptors to regulate cell proliferation, survival,

migration, and invasion. FAK activation has been shown to mediate

resistance to multiple anti-cancer agents, including RAF and MEK

inhibitors.

Verastem Oncology is currently conducting clinical trials with

avutometinib with and without defactinib in RAS/MAPK-driven tumors

as part of its Raf And Mek Program or

RAMP. Verastem is currently enrolling patients and activating sites

for RAMP 301 (GOG-3097/ENGOT-ov81/NCRI) (NCT06072781), an

international Phase 3 confirmatory trial evaluating the combination

of avutometinib and defactinib versus standard chemotherapy or

hormonal therapy for the treatment of recurrent low-grade serous

ovarian cancer (LGSOC).

Verastem was granted Priority Review and a Prescription Drug

User Fee Act (PDUFA) date of June 30, 2025, for its New Drug

Application (NDA) to the U.S. Food and Drug Administration (FDA),

for the investigational combination of avutometinib and defactinib

in adults with recurrent KRAS mutant LGSOC who received at least

one prior systemic therapy. Verastem initiated a rolling NDA in May

2024 to the FDA and completed its NDA submission in October 2024.

The FDA granted Breakthrough Therapy Designation for the treatment

of patients with recurrent LGSOC after one or more prior lines of

therapy, including platinum-based chemotherapy, in May 2021.

Avutometinib alone or in combination with defactinib was also

granted Orphan Drug Designation by the FDA for the treatment of

LGSOC.

Verastem Oncology has established a clinical collaboration with

Amgen to evaluate LUMAKRAS™ (sotorasib) in combination with

avutometinib and defactinib in both treatment-naïve patients and in

patients whose KRAS G12C mutant non-small cell lung cancer

progressed on a G12C inhibitor as part of the RAMP 203 trial

(NCT05074810). Verastem has received Fast Track Designation from

the FDA for the triplet combination in April 2024. RAMP 205

(NCT05669482), a Phase 1b/2 clinical trial evaluating avutometinib

and defactinib with gemcitabine/nab-paclitaxel in patients with

front-line metastatic pancreatic cancer, is supported by the PanCAN

Therapeutic Accelerator Award. FDA granted Orphan Drug Designation

to the avutometinib and defactinib combination for the treatment of

pancreatic cancer.

About Verastem Oncology

Verastem Oncology (Nasdaq: VSTM) is a late-stage development

biopharmaceutical company committed to the development and

commercialization of new medicines to improve the lives of patients

diagnosed with RAS/MAPK pathway-driven cancers. Our pipeline is

focused on novel small molecule drugs that inhibit critical

signaling pathways in cancer that promote cancer cell survival and

tumor growth, including RAF/MEK inhibition and FAK inhibition. For

more information, please visit www.verastem.com and follow us on

LinkedIn.

About Oberland Capital

Oberland Capital is a private investment firm formed in 2013

with assets under management in excess of $3.0 billion. The firm is

focused exclusively on investing in the global healthcare industry

and specializing in flexible investment structures customized to

meet the specific needs of its transaction partners. Oberland

Capital's broad suite of financing solutions includes monetization

of royalty streams, acquisition of future product revenues,

creation of project-based financing structures, and investments in

traditional debt and equity. With a combination of deep industry

knowledge and extensive structured finance experience, the Oberland

Capital team has a history of creating value for its transaction

partners. For more information, please visit

www.oberlandcapital.com or contact Johnna Schifilliti at (212)

257-5850.

Forward-Looking Statements

This press release includes forward-looking statements about,

among other things, Verastem Oncology’s programs and product

candidates, strategy, future plans and prospects, including

statements related to the anticipated timing of closing an funding

of the transactions with Oberland Capital, the expected outcome and

benefits of the collaboration and the agreement between Verastem

and IQVIA, the expected timing of further FDA action on the New

Drug Application (NDA) for the avutometinib and defactinib

combination product in KRAS-mutant and recurrent low-grade serous

ovarian cancer, the potential clinical value of various of the

Company’s clinical trials, interactions with regulators, the

potential for and timing of commercialization of product candidates

and potential for additional development programs involving

Verastem Oncology’s lead compound. The words "anticipate,"

"believe," "estimate," "expect," "intend," "may," "plan,"

"predict," "project," "target," "potential," "will," "would,"

"could," "should," "continue," “can,” “promising” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words.

Forward-looking statements are not guarantees of future

performance and are subject to risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied in such statement. Applicable risks and uncertainties

include the risks and uncertainties, among other things, regarding:

the success in the development and potential commercialization of

our product candidates, including avutometinib in combination with

other compounds, including defactinib, LUMAKRAS™ and others; the

uncertainties inherent in research and development, such as

negative or unexpected results of clinical trials, the occurrence

or timing of applications for our product candidates that may be

filed with regulatory authorities in any jurisdictions; whether and

when regulatory authorities in any jurisdictions may approve or

reject any such applications that may be filed for our product

candidates, and, if approved, whether our product candidates will

be commercially successful in such jurisdictions; our ability to

obtain, maintain and enforce patent and other intellectual property

protection for our product candidates; the scope, timing, and

outcome of any legal proceedings; decisions by regulatory

authorities regarding trial design, labeling and other matters that

could affect the timing, availability or commercial potential of

our product candidates; whether preclinical testing of our product

candidates and preliminary or interim data from clinical trials

will be predictive of the results or success of ongoing or later

clinical trials; the uncertainty around the timing, scope and rate

of reimbursement for our product candidates; internal and

third-party estimates about the market opportunities of our drug

candidates may prove to be incorrect; third-party payors (including

government agencies) may not reimburse; there may be competitive

developments affecting our product candidates; data may not be

available when expected; that enrollment of clinical trials may

take longer than expected, which may delay our development

programs, including delays in review by the FDA of our NDA

submission in recurrent KRAS mutant LGSOC if enrollment in our

confirmatory trial is not well underway at the time of submission,

or that the FDA may require the Company to have completed

enrollment or to enroll additional patients in the Company’s

ongoing RAMP-301 confirmatory Phase 3 clinical trial prior to the

FDA taking action on our NDA seeking accelerated approval; risks

associated with preliminary and interim data, which may not be

representative of more mature data, including with respect to

interim duration of therapy data; our product candidates may cause

adverse safety events and/or unexpected concerns may arise from

additional data or analysis, or result in unmanageable safety

profiles as compared to their levels of efficacy; we may be unable

to successfully validate, develop and obtain regulatory approval

for companion diagnostic tests for our product candidates that

require or would commercially benefit from such tests, or

experience significant delays in doing so; the mature RAMP 201 data

and associated discussions with the FDA may not support the scope

of our NDA submission for the avutometinib and defactinib

combination in LGSOC, including with respect to both recurrent KRAS

mutant and recurrent KRAS wild type LGSOC; our product candidates

may experience manufacturing or supply interruptions or failures;

any of our third party contract research organizations, contract

manufacturing organizations, clinical sites, or contractors, among

others, who we rely on may fail to fully perform; we face

substantial competition, which may result in others developing or

commercializing products before or more successfully than we do

which could result in reduced market share or market potential for

our product candidates; we may be unable to successfully initiate

or complete the clinical development and eventual commercialization

of our product candidates; the development and commercialization of

our product candidates may take longer or cost more than planned,

including as a result of conducting additional studies or our

decisions regarding execution of such commercialization; we may not

have sufficient cash to fund our contemplated operations, including

certain of our product development programs; we may not attract and

retain high quality personnel; we or Chugai Pharmaceutical Co.,

Ltd. may fail to fully perform under the avutometinib license

agreement; the total addressable and target markets for our product

candidates might be smaller than we are presently estimating; we or

Secura Bio, Inc. (Secura) may fail to fully perform under the asset

purchase agreement with Secura, including in relation to milestone

payments; we may not see a return on investment on the payments we

have and may continue to make pursuant to the collaboration and

option agreement with GenFleet Therapeutics (Shanghai), Inc.

(GenFleet), or that GenFleet may fail to fully perform under the

agreement; we may not be able to establish new or expand on

existing collaborations or partnerships, including with respect to

in-licensing of our product candidates, on favorable terms, or at

all; we may be unable to obtain adequate financing in the future

through product licensing, co-promotional arrangements, public or

private equity, debt financing or otherwise; we may not pursue or

submit regulatory filings for our product candidates; our product

candidates may not receive regulatory approval, become commercially

successful products, or result in new treatment options being

offered to patients; and that our final audited cash, cash

equivalents, and short-term investments for the year ended December

31, 2024 may differ materially from the preliminary and unaudited

amount reported herein.

Other risks and uncertainties include those identified under the

heading “Risk Factors” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, as filed with the Securities

and Exchange Commission (SEC) on March 14, 2024 and in any

subsequent filings with the SEC, which are available at

www.sec.gov. As a result of these and other factors, we may not

achieve the plans, intentions or expectations disclosed in our

forward-looking statements, and you should not place undue reliance

on our forward-looking statements. The forward-looking statements

contained in this press release reflect Verastem Oncology’s views

as of the date hereof, and the Company does not assume and

specifically disclaims any obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113992572/en/

For Investor and Media Inquiries: Julissa Viana Vice

President, Corporate Communications and Investor Relations

investors@verastem.com or media@verastem.com

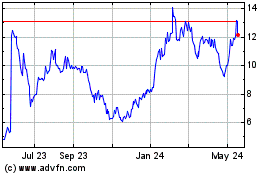

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Dec 2024 to Jan 2025

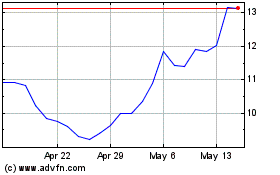

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Jan 2024 to Jan 2025