false000161764000016176402025-02-112025-02-110001617640us-gaap:CommonClassAMember2025-02-112025-02-110001617640us-gaap:CommonClassCMember2025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 11, 2025

ZILLOW GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Washington | | 001-36853 | | 47-1645716 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | |

1301 Second Avenue, Floor 36, Seattle, Washington | | 98101 |

| (Address of principal executive offices) | | (Zip Code) |

(206) 470-7000

(Registrant’s telephone number, including area code)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

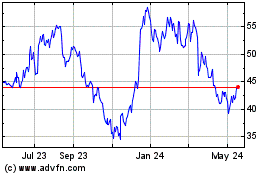

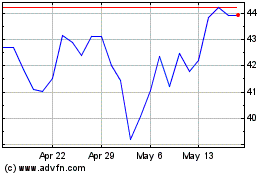

| Class A Common Stock, par value $0.0001 per share | ZG | The Nasdaq Global Select Market |

| Class C Capital Stock, par value $0.0001 per share | Z | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

Zillow Group, Inc. today issued a press release and a shareholder letter announcing its financial results for the fiscal quarter and full year ended December 31, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1, accompanying supporting tables as Exhibit 99.2, and the shareholder letter as Exhibit 99.3 to this Current Report on Form 8-K.

The information in this Item 2.02 and Exhibits 99.1, 99.2 and 99.3 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: February 11, 2025 | | ZILLOW GROUP, INC. |

| | |

| | By: | /s/ JENNIFER ROCK |

| | Name: | Jennifer Rock |

| | Title: | Chief Accounting Officer |

Exhibit 99.1

| | |

| Contacts: |

| Investors |

| Brad Berning |

| ir@zillowgroup.com |

|

| Media |

| Chrissy Roebuck |

| press@zillow.com |

Zillow Group Reports Fourth-Quarter and Full-Year 2024 Financial Results

SEATTLE, Feb. 11, 2025 — Zillow Group, Inc. (NASDAQ: Z and ZG), which is transforming the way people buy, sell, rent and finance homes, today announced its consolidated financial results for the three months and year ended December 31, 2024.

Complete financial results, and outlook for the first quarter of 2025, can be found in our shareholder letter on the Investor Relations section of Zillow Group’s website at https://investors.zillowgroup.com/investors/financials/quarterly-results/default.aspx.

“2024 was a remarkable year for Zillow: We achieved our stated goals for the year — including double-digit revenue growth — and we expect to keep up our momentum in 2025,” said Zillow Chief Executive Officer Jeremy Wacksman. “The results we reported today demonstrate how well we are executing and seizing our opportunity to transform and digitize residential real estate. With the leading brand in our category and a solid foundation for continued growth, we’re excited to serve more buyers, sellers, renters, and real estate professionals this year.”

Recent highlights include:

•Zillow Group’s fourth-quarter results exceeded the company’s outlook for revenue and Adjusted EBITDA.

•Q4 revenue was up 17% year over year to $554 million, above the midpoint of the company’s outlook range by $21 million. Q4 revenue outperformed the residential real estate industry’s year-over-year total transaction value growth of 13% according to NAR1 and 15% according to industry data tracked and estimated by Zillow.2 Full-year 2024 revenue of $2.2 billion was up 15% year over year.

◦For Sale revenue was up 15% year over year to $428 million in Q4.

▪Residential revenue was up 11% year over year in Q4 to $387 million, benefiting primarily from continued conversion improvements and Zillow Showcase expansion.

▪Mortgages revenue increased 86% year over year to $41 million in Q4, due primarily to a 90% increase in purchase loan origination volume to $923 million.

◦Rentals revenue increased 25% year over year to $116 million in Q4, primarily driven by multifamily revenue growing 41% year over year.

•On a GAAP basis, net loss was $52 million and net loss margin was 9% in Q4 2024, compared with net loss of $73 million and net loss margin of 15% in Q4 2023. GAAP net loss was $112 million for the full year 2024 and net loss margin was 5%, a 300 basis point improvement from 8% net loss margin in 2023.

•Q4 Adjusted EBITDA was $112 million, or 20% of revenue, driven primarily by higher-than-expected Residential revenue and strong Rentals revenue. Adjusted EBITDA for the full year 2024 was $498 million and Adjusted EBITDA margin was 22%, up 200 basis points from 20% Adjusted EBITDA margin in 2023.

•Cash and investments at the end of Q4 were $1.9 billion, down from $2.2 billion at the end of Q3, primarily due to the settlement of the company’s 2026 convertible debt in December.

•Traffic to Zillow Group’s mobile apps and sites in Q4 was up 3% year over year to 204 million average monthly unique users. Visits during Q4 were up 3% year over year to 2.1 billion.

1 National Association of Realtors® existing homes sold during Q4 2024 multiplied by the average selling price per home for Q4 2024, compared with the same period in 2023

2 Calculated as the number of existing residential homes sold during Q4 2024 multiplied by the average sales price of existing residential homes sold for Q4 2024 according to industry data collected and estimated by Zillow, as published monthly on our site

Fourth-Quarter and Full-Year 2024 Financial Highlights

The following table sets forth Zillow Group’s financial highlights for the periods presented (in millions, except percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | 2023 to 2024

% Change | | Year Ended

December 31, | | 2023 to 2024

% Change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| Revenue: | | | | | | | | | | | |

For Sale revenue: | | | | | | | | | | | |

| Residential | $ | 387 | | $ | 349 | | 11% | | $ | 1,594 | | $ | 1,452 | | 10% |

| Mortgages | 41 | | 22 | | 86% | | 145 | | 96 | | 51% |

For Sale revenue | 428 | | 371 | | 15% | | 1,739 | | 1,548 | | 12% |

| Rentals | 116 | | 93 | | 25% | | 453 | | 357 | | 27% |

| Other | 10 | | 10 | | —% | | 44 | | 40 | | 10% |

| Total revenue | $ | 554 | | | $ | 474 | | 17% | | $ | 2,236 | | | $ | 1,945 | | 15% |

| Other Financial Data: | | | | | | | | | | | |

| Gross profit | $ | 420 | | $ | 359 | | | | $ | 1,709 | | $ | 1,524 | | |

| Net loss | $ | (52) | | $ | (73) | | | | $ | (112) | | $ | (158) | | |

| Adjusted EBITDA (1) | $ | 112 | | $ | 69 | | | | $ | 498 | | $ | 391 | | |

| Percentage of Revenue: | | | | | | | | | | | |

| Gross profit | 76% | | 76 | % | | | | 76% | | 78 | % | | |

| Net loss | (9)% | | (15) | % | | | | (5)% | | (8) | % | | |

Adjusted EBITDA (1) | 20% | | 15 | % | | | | 22% | | 20 | % | | |

(1) Adjusted EBITDA is a non-GAAP financial measure; it is not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. See below for more information regarding our presentation of Adjusted EBITDA, including a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net loss, for each of the periods presented. |

Conference Call and Webcast Information

Zillow Group will host a live webcast to discuss these results today at 2 p.m. Pacific Time (5 p.m. Eastern Time). Please register for the live event at https://zillow-q4-24-financial-results.open-exchange.net/. A shareholder letter, investor presentation, and link to both the live webcast and recorded replay of the call may be accessed in the Quarterly Results section of Zillow Group’s Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding the future performance and operation of our business, and our business strategies and ability to translate such strategies into financial performance. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “guidance,” “would,” “could,” “strive,” or similar expressions constitute forward-looking statements. Forward-looking statements are made based on assumptions as of February 11, 2025, and although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control.

Factors that may contribute to such differences include, but are not limited to: the health and stability of the economy and United States residential real estate industry, including changes in inflationary conditions, interest rates, housing availability and affordability, labor shortages and supply chain issues; our ability to manage advertising and product inventory and pricing and maintain relationships with our real estate partners; our ability to establish or maintain relationships with listing and data providers, which affects traffic to our mobile applications and websites; our ability to comply with current and future rules and requirements promulgated by the National Association of REALTORS®, multiple listing services, or other real estate industry groups or governing bodies, or decisions to repeal, amend, or not enforce such rules and requirements; our ability to navigate industry changes, including as a result of past, pending or future class-action lawsuits, settlements or government investigations, which may include lawsuits, settlements or investigations in which we are not a named party, such as the National Association of REALTORS® settlement agreement entered into on March 15, 2024; uncertainties related to changes resulting from the November 2024 elections in the United States; our ability to continue to innovate and compete to attract customers and real estate partners; our ability to effectively invest resources to pursue new strategies, develop new products and services and expand existing products and services into new markets; our ability to operate and grow Zillow Home Loans’ mortgage operations, including the ability to obtain or maintain sufficient financing to fund the origination of mortgages, meet customers’ financing needs with product offerings, continue to grow origination operations and resell originated mortgages on the secondary market; the duration and impact of natural disasters, climate change, geopolitical events, and other catastrophic events (including public health crises) on our ability to operate, demand for our products or services, or general economic conditions; our targets and disclosures related to environmental, social, and governance matters; our ability to maintain adequate security controls or technology systems, or those of third parties on which we rely, to protect data integrity and the information and privacy of our customers and other third parties; our ability to navigate any significant disruption in service on our mobile applications or websites or in our network; the impact of past, pending or future litigation and other disputes or enforcement actions, which may include lawsuits or investigations to which we are not a party; our ability to attract, engage, and retain a highly skilled workforce; acquisitions, investments, strategic partnerships, capital-raising activities, or other corporate transactions or commitments by us or our competitors; our ability to continue relying on third-party services to support critical functions of our business; our ability to protect and continue using our intellectual property and prevent others from copying, infringing upon, or developing similar intellectual property, including as a result of generative artificial intelligence; our ability to comply with domestic and international laws, regulations, rules, contractual obligations, policies and other obligations, or to obtain or maintain required licenses to support our business and operations; our ability to pay our debt, settle conversions of our convertible senior notes, or repurchase our convertible senior notes upon a fundamental change; our ability to raise additional capital or refinance our indebtedness on acceptable terms, or at all; actual or anticipated fluctuations in quarterly and annual results of operations and financial position; actual or perceived inaccuracies in the assumptions, estimates and internal or third-party data that we use to calculate business, performance and operating metrics; and volatility of our Class A common stock and Class C capital stock prices.

The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors” described in Zillow Group’s publicly available filings with the United States Securities and Exchange Commission. Except as may be required by law, Zillow Group does not intend and undertakes no duty to update this information to reflect future events or circumstances.

About Zillow Group, Inc.

Zillow Group, Inc. (Nasdaq: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing, and renting experiences.

Zillow Group’s affiliates, subsidiaries, and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+SM, Spruce®, and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2025 MFTB Holdco, Inc., a Zillow affiliate.

Please visit https://investors.zillowgroup.com, www.zillowgroup.com/news, www.x.com/zillowgroup, and www.linkedin.com/company/zillow, where Zillow Group discloses information about the company, its financial information, and its business that may be deemed material.

The Zillow Group logo is available at https://zillowgroup.mediaroom.com/logos-photos.

(ZFIN)

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, this press release includes references to Adjusted EBITDA, a non-GAAP financial measure. We have provided a reconciliation below of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure. We have not provided a quantitative reconciliation of forecasted GAAP net income (loss) to forecasted Adjusted EBITDA within this press release because we are unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to: income taxes that are directly impacted by unpredictable fluctuations in the market price of the company’s capital stock; depreciation and amortization from new acquisitions; impairments of assets; gains or losses on extinguishment of debt; and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss), are inherently uncertain and depend on various factors, many of which are outside of our control. We have not provided a reconciliation of forecasted Adjusted EBITDA margin to net income (loss) margin, the most directly comparable GAAP financial measure, for the same reasons.

Adjusted EBITDA is a key metric used by our management and board of directors to measure operating performance and trends and to prepare and approve our annual budget. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis.

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider this measure in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

•Adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or contractual commitments;

•Adjusted EBITDA does not reflect impairment and restructuring costs;

•Adjusted EBITDA does not reflect acquisition-related costs;

•Adjusted EBITDA does not reflect gain (loss) on extinguishment of debt;

•Adjusted EBITDA does not reflect interest expense or other income, net;

•Adjusted EBITDA does not reflect income taxes; and

•Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently from the way we do, limiting its usefulness as a comparative measure.

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash-flow metrics, net loss and our other GAAP results.

Adjusted EBITDA

The following table presents a reconciliation of Adjusted EBITDA to net loss for each of the periods presented (in millions, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Adjusted EBITDA to Net Loss: | | | | | | | |

| Net loss | $ | (52) | | | $ | (73) | | | $ | (112) | | | $ | (158) | |

| Income taxes | 1 | | | 3 | | | 5 | | | 4 | |

| Other income, net | (26) | | | (43) | | | (127) | | | (151) | |

| Depreciation and amortization | 62 | | | 53 | | | 240 | | | 187 | |

| Share-based compensation | 119 | | | 109 | | | 448 | | | 451 | |

| Impairment and restructuring costs | — | | | 10 | | | 6 | | | 19 | |

| Acquisition-related costs | — | | | 2 | | | 1 | | | 4 | |

| Loss (gain) on extinguishment of debt | — | | | (1) | | | 1 | | | (1) | |

| Interest expense | 8 | | | 9 | | | 36 | | | 36 | |

| Adjusted EBITDA | $ | 112 | | | $ | 69 | | | $ | 498 | | | $ | 391 | |

Exhibit 99.2

Reported Consolidated Results

ZILLOW GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, unaudited) | | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,082 | | | $ | 1,492 | |

| Short-term investments | 776 | | | 1,318 | |

| Accounts receivable, net | 104 | | | 96 | |

| Mortgage loans held for sale | 159 | | | 100 | |

| Prepaid expenses and other current assets | 210 | | | 140 | |

| Restricted cash | 3 | | | 3 | |

| Total current assets | 2,334 | | | 3,149 | |

| Contract cost assets | 25 | | | 23 | |

| Property and equipment, net | 360 | | | 328 | |

| Right of use assets | 59 | | | 73 | |

| Goodwill | 2,823 | | | 2,817 | |

| Intangible assets, net | 207 | | | 241 | |

| Other assets | 21 | | | 21 | |

| Total assets | $ | 5,829 | | | $ | 6,652 | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 30 | | | $ | 28 | |

| Accrued expenses and other current liabilities | 105 | | | 107 | |

| Accrued compensation and benefits | 57 | | | 47 | |

| Borrowings under credit facilities | 145 | | | 93 | |

| Deferred revenue | 62 | | | 52 | |

| Lease liabilities, current portion | 14 | | | 37 | |

| Convertible senior notes, current portion | 418 | | | 607 | |

| Total current liabilities | 831 | | | 971 | |

| Lease liabilities, net of current portion | 83 | | | 95 | |

| Convertible senior notes, net of current portion | — | | | 1,000 | |

| Other long-term liabilities | 67 | | | 60 | |

| Total liabilities | 981 | | | 2,126 | |

| Shareholders’ equity: | | | |

Class A common stock | — | | | — | |

Class B common stock | — | | | — | |

Class C capital stock | — | | | — | |

| Additional paid-in capital | 6,733 | | | 6,301 | |

| Accumulated other comprehensive loss | (3) | | | (5) | |

| Accumulated deficit | (1,882) | | | (1,770) | |

| Total shareholders’ equity | 4,848 | | | 4,526 | |

| Total liabilities and shareholders’ equity | $ | 5,829 | | | $ | 6,652 | |

ZILLOW GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except share data, which are presented in thousands, and per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 554 | | | $ | 474 | | | $ | 2,236 | | | $ | 1,945 | |

Cost of revenue (1) | 134 | | | 115 | | | 527 | | | 421 | |

| Gross profit | 420 | | | 359 | | | 1,709 | | | 1,524 | |

| Operating expenses: | | | | | | | |

Sales and marketing (1) | 202 | | | 165 | | | 790 | | | 658 | |

Technology and development (1) | 149 | | | 141 | | | 585 | | | 560 | |

General and administrative (1) | 138 | | | 146 | | | 524 | | | 553 | |

| Impairment and restructuring costs | — | | | 10 | | | 6 | | | 19 | |

| Acquisition-related costs | — | | | 2 | | | 1 | | | 4 | |

| Total operating expenses | 489 | | | 464 | | | 1,906 | | | 1,794 | |

Loss from operations | (69) | | | (105) | | | (197) | | | (270) | |

| Gain (loss) on extinguishment of debt | — | | | 1 | | | (1) | | | 1 | |

| Other income, net | 26 | | | 43 | | | 127 | | | 151 | |

| Interest expense | (8) | | | (9) | | | (36) | | | (36) | |

| Loss before income taxes | (51) | | | (70) | | | (107) | | | (154) | |

| Income tax expense | (1) | | | (3) | | | (5) | | | (4) | |

| Net loss | $ | (52) | | | $ | (73) | | | $ | (112) | | | $ | (158) | |

| | | | | | | |

| | | | | | | |

| Net loss per share - basic and diluted | $ | (0.22) | | | $ | (0.32) | | | $ | (0.48) | | | $ | (0.68) | |

| | | | | | | |

| | | | | | | |

| Weighted-average shares outstanding - basic and diluted | 236,329 | | | 232,972 | | | 234,077 | | | 233,575 | |

| | | | | | | |

| (1) Includes share-based compensation expense as follows: | | | | | | | |

| Cost of revenue | $ | 3 | | | $ | 4 | | | $ | 14 | | | $ | 16 | |

| Sales and marketing | 20 | | | 17 | | | 77 | | | 70 | |

| Technology and development | 41 | | | 43 | | | 165 | | | 166 | |

| General and administrative | 55 | | | 45 | | | 192 | | | 199 | |

| Total share-based compensation | $ | 119 | | | $ | 109 | | | $ | 448 | | | $ | 451 | |

| Adjusted EBITDA (2) | $ | 112 | | | $ | 69 | | | $ | 498 | | | $ | 391 | |

(2) Adjusted EBITDA is a non-GAAP financial measure; it is not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. See Exhibit 99.1 for more information regarding our presentation of Adjusted EBITDA and for a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure, for each of the periods presented. |

ZILLOW GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions, unaudited) | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| Operating activities | | | |

| Net loss | $ | (112) | | | $ | (158) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 240 | | | 187 | |

| Share-based compensation | 448 | | | 451 | |

| Amortization of right of use assets | 10 | | | 35 | |

| Amortization of contract cost assets | 19 | | | 21 | |

| Amortization of debt issuance costs | 4 | | | 5 | |

| Loss (gain) on extinguishment of debt | 1 | | | (1) | |

Impairment costs | 6 | | | 16 | |

| Accretion of bond discount | (27) | | | (35) | |

| Other adjustments to reconcile net loss to net cash provided by operating activities | 14 | | | (2) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (8) | | | (24) | |

| Mortgage loans held for sale | (59) | | | (59) | |

| Prepaid expenses and other assets | (74) | | | (17) | |

| Contract cost assets | (21) | | | (21) | |

| Lease liabilities | (35) | | | (30) | |

| Accounts payable | 2 | | | 6 | |

| Accrued expenses and other current liabilities | — | | | (18) | |

| Accrued compensation and benefits | 10 | | | (1) | |

| Deferred revenue | 8 | | | 1 | |

| Other long-term liabilities | 2 | | | (2) | |

| Net cash provided by operating activities | 428 | | | 354 | |

| Investing activities | | | |

| Proceeds from maturities of investments | 1,042 | | | 1,287 | |

| Proceeds from sales of investments | 237 | | | — | |

| Purchases of investments | (706) | | | (664) | |

| Purchases of property and equipment | (143) | | | (135) | |

| Purchases of intangible assets | (28) | | | (30) | |

| Cash paid for acquisitions, net | (7) | | | (433) | |

| Net cash provided by investing activities | 395 | | | 25 | |

| Financing activities | | | |

| Net borrowings on warehouse line of credit and repurchase agreements | 52 | | | 56 | |

| Repurchases of Class A common stock and Class C capital stock | (301) | | | (424) | |

| Settlement of long-term debt | (1,196) | | | (56) | |

| Proceeds from exercise of stock options | 212 | | | 72 | |

| Net cash used in financing activities | (1,233) | | | (352) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash during period | (410) | | | 27 | |

| Cash, cash equivalents and restricted cash at beginning of period | 1,495 | | | 1,468 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 1,085 | | | $ | 1,495 | |

| Supplemental disclosures of cash flow information | | | |

| Cash paid for interest | $ | 35 | | | $ | 28 | |

| Cash paid for taxes | 6 | | | 6 | |

| Noncash transactions: | | | |

| Write-off of fully depreciated property and equipment | $ | 85 | | | $ | 63 | |

| Capitalized share-based compensation | 72 | | | 73 | |

| Write-off of fully amortized intangible assets | 24 | | | 5 | |

| Initial fair value of contingent consideration recognized in connection with an acquisition | — | | | 81 | |

| Value of Class C capital stock issued in connection with an acquisition | — | | | 20 | |

Non-GAAP Net Income per Share

Our presentation of non-GAAP net income per share excludes the impact of the results of share-based compensation, impairment and restructuring costs, acquisition-related costs, loss (gain) on extinguishment of debt and income taxes. This measure is not a key metric used by our management or board of directors to measure operating performance or otherwise manage the business. However, we provide non-GAAP net income per share as supplemental information to investors, as we believe the exclusion of the results of share-based compensation, impairment and restructuring costs, acquisition-related costs, loss (gain) on extinguishment of debt and income taxes facilitates investors’ operating performance comparisons on a period-to-period basis. You should not consider non-GAAP net income per share in isolation or as a substitute for analysis of our results as reported under GAAP.

The following table sets forth a reconciliation of non-GAAP net income, adjusted, to net loss, as reported on a GAAP basis, and the calculation of non-GAAP net income per share - basic and diluted, for each of the periods presented (in millions, except share data, which are presented in thousands, and per share data, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Net loss, as reported | $ | (52) | | | $ | (73) | | | $ | (112) | | | $ | (158) | |

| Share-based compensation | 119 | | | 109 | | | 448 | | | 451 | |

Impairment and restructuring costs | — | | | 10 | | | 6 | | | 19 | |

Acquisition-related costs | — | | | 2 | | | 1 | | | 4 | |

Loss (gain) on extinguishment of debt | — | | | (1) | | | 1 | | | (1) | |

| Income taxes | 1 | | | 3 | | | 5 | | | 4 | |

| Net income, adjusted | $ | 68 | | | $ | 50 | | | $ | 349 | | | $ | 319 | |

| Non-GAAP net income per share: | | | | | | | |

| Basic | $ | 0.29 | | | $ | 0.21 | | | $ | 1.49 | | | $ | 1.37 | |

| Diluted | $ | 0.27 | | | $ | 0.20 | | | $ | 1.38 | | | $ | 1.26 | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 236,329 | | | 232,972 | | | 234,077 | | | 233,575 | |

| Diluted | 259,488 | | | 261,727 | | | 261,299 | | | 263,179 | |

Diluted non-GAAP net income per share for the periods presented is calculated using diluted weighted-average shares outstanding, which includes potential shares of Class C capital stock for the periods in which their effect would have been dilutive. The potential shares of Class C capital stock were excluded from the calculation of non-GAAP net income per share for certain periods presented if their effect would have been antidilutive. The following table reconciles the denominators used in the basic and diluted non-GAAP net income per share calculations (in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Denominator for basic calculation | 236,329 | | | 232,972 | | | 234,077 | | | 233,575 | |

| Effect of dilutive securities: | | | | | | | |

| Option awards | 8,933 | | | 1,493 | | | 4,206 | | | 1,776 | |

| Unvested restricted stock units | 4,382 | | | 1,816 | | | 2,669 | | | 2,382 | |

| Convertible senior notes due in 2024 and 2026 | 9,844 | | | 25,446 | | | 20,347 | | | 25,446 | |

| Denominator for dilutive calculation | 259,488 | | | 261,727 | | | 261,299 | | | 263,179 | |

Key Metrics

The following table presents our visits and average monthly unique users for the periods presented (in millions, except percentages), recast for prior periods, as described in our Form 10-K for the fiscal year ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | 2023 to 2024

% Change | | Year Ended

December 31, | | 2023 to 2024

% Change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

Visits (1) | 2,057 | | | 1,988 | | | 3% | | 9,308 | | 8,983 | | 4% |

Average monthly unique users (2) | 204 | | | 199 | | | 3% | | 221 | | | 220 | | | —% |

| (1) Visits includes groups of interactions by users with the Zillow, Trulia and StreetEasy mobile apps and websites. Zillow and StreetEasy measure visits with an internal measurement tool and Trulia measures visits with Adobe Analytics. |

| (2) Zillow, StreetEasy and HotPads measure unique users with an internal measurement tool and Trulia measures unique users with Adobe Analytics. |

The following table presents our For Sale revenue per Total Transaction Value (“TTV”) for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | 2023 to 2024

% Change | | Year Ended

December 31, | | 2023 to 2024

% Change |

| 2024 | | 2023 | | | 2024 | | 2023 | |

| For Sale revenue (in millions) | $ | 428 | | | $ | 371 | | | 15% | | $ | 1,739 | | | $ | 1,548 | | | 12% |

Total transaction value (in trillions) (1) | $ | 0.4 | | | $ | 0.4 | | | 15% | | $ | 1.7 | | | $ | 1.6 | | | 6% |

| For Sale revenue per total transaction value (in basis points) | 10.7 | | 9.3 | | 15% | | 10.1 | | 9.6 | | 5% |

| | | | | | | | | | | |

(1) TTV is calculated as the number of existing residential homes sold during the relevant period multiplied by the average sales price of existing residential homes sold during the same period according to residential real estate data collected and estimated by Zillow Group, as published monthly on our site. Estimate for three months and year ended December 31, 2024 is as of January 2025. |

The following table presents loan origination volume by purpose and in total for Zillow Home Loans for the periods presented (in millions, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | 2023 to 2024

% Change | | Year Ended

December 31, | | 2023 to 2024

% Change |

| 2024 | | 2023 | | | 2024 | | 2023 | |

| Purchase loan origination volume | $ | 923 | | | $ | 487 | | | 90% | | $ | 3,092 | | | $ | 1,534 | | | 102% |

| Refinance loan origination volume | 13 | | | 4 | | | 225% | | 27 | | | 16 | | | 69% |

| Total loan origination volume | $ | 936 | | | $ | 491 | | | 91% | | $ | 3,119 | | | $ | 1,550 | | | 101% |

Feb. 11, 2025 Dear Shareholders, Zillow is delivering value to movers and real estate professionals with our products and services, and that’s translating to strong performance across our business. We have the leading brand in residential real estate with the largest and most engaged audience, a significant addressable market, and we are executing well on our differentiated housing super app strategy. We believe all of this positions us to deliver sustainable profitable growth for our shareholders. We had an excellent 2024 and as we continue our momentum, we expect to generate positive GAAP net income in 2025, an important milestone for the company. We’ve also released a new investor presentation1 to provide an update on how we’ve been executing our strategy and why we are confident in our ability to achieve our goals. We believe we have a clear path to $5 billion in revenue and 45% Adjusted EBITDA margin2 in a normalized housing market. 2024 RESULTS We achieved our stated goals for 2024: We met our target of double-digit revenue growth for the full year 2024 — up 15% year over year to $2.2 billion, against a housing market that saw 6% total transaction value3 growth. Net loss was $112 million for the full year 2024, and net loss margin was 5%, a 300 basis point improvement from 2023. Adjusted EBITDA for the full year 2024 was $498 million, and Adjusted EBITDA margin was 22%, up 200 basis points and meeting our target for expanded Adjusted EBITDA margins in 2024. 3Please see the “Use of Operating Metrics” section below for more information about our calculation of total transaction value (TTV). 2Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures; they are not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about our presentation of Adjusted EBITDA and Adjusted EBITDA margin, including, for historical values, a reconciliation to the most directly comparable GAAP financial measure for the relevant period. Zillow Group has not provided a quantitative reconciliation of forecasted Adjusted EBITDA margin to the most directly comparable GAAP measure within this communication because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. See footnote 13 for more information. 1https://investors.zillowgroup.com/investors/financials/quarterly-results/default.aspx 1 | Q4 2024

FOR SALE By focusing on delighting and empowering customers throughout the moving journey, Zillow has built the largest audience in residential real estate, with four times the app engagement of the next company in our category — a lead we’ve widened in the past year. About two-thirds of the real estate audience uses Zillow somewhere along their journey — more than twice any other company in our category — and 80% of that traffic is coming to us directly and organically. We are now presenting our revenue in two major categories: For Sale and Rentals. The “For Sale” category includes revenue from Residential and Mortgages, which we manage together to best serve the buyers and sellers who work with us. Our current opportunity and focus across For Sale is to capture more of the potential revenue represented by buyers and sellers already engaging in our funnel. The majority of eventual transactors dream and shop on our apps and sites at some point on their moving journey, and one in four of those raises their hand to connect with an agent through Zillow, and yet only a single-digit share of customer transactions4 are currently completed through Zillow and our partners. To capture this significant opportunity in our For Sale category, we are focused on a few key areas. First and foremost, we are building the experience we know buyers, sellers, and industry professionals want — one that is streamlined, tech-enabled, and integrated in Zillow’s housing super app. On Zillow, movers can choose their agent, choose how to sell their current home, and book a tour as easily as they book a restaurant reservation online. With Zillow Home Loans, buyers can shop based on what they can afford with the BuyAbility feature, and get digital pre-approval. And for real estate professionals, Zillow helps agents understand their clients’ needs, manage tours, see how they’re performing, win listings with Zillow Showcase, help clients learn about their financing options, and handle title and closing through dotloop and, increasingly, Spruce. And in select markets, both parties are now able to communicate and collaborate directly in the Zillow app, enabled by Follow Up Boss, an industry-leading agent-customer relationship management system we acquired at the end of 2023. 4Please see the “Use of Operating Metrics” section below for more information about our calculation of customer transaction share. 2 | Q4 2024

Second, we are laser-focused on connecting high-intent buyers on Zillow with high-performing real estate professionals, ultimately converting more shoppers into transactors and increasing Zillow’s share of transactions. Continuously reducing friction has helped us meaningfully outperform the residential real estate market over the past three years. And we see future drivers of conversion across multiple areas of our business going forward. For example, today our Real Time Touring product is nationwide, and 33% of our connections come through Real Time Touring. We’re routing these connections to some of the top agents and teams across the country. And we’re enabling real estate professionals to do their jobs even more effectively with tools like Follow Up Boss, which now has more Zillow data integrated to help agents identify the highest-intent buyers and sellers and serve their clients better. In our Enhanced Markets — the geographic areas where the integrated housing super app experience is most fully realized — more than 80% of connections are being managed through Follow Up Boss. Third, we are focused on integrating Premier Agent with our Zillow Home Loans offering. We are executing this integration well, with consistent customer adoption rates in the mid-teens across our most seasoned Enhanced Markets. Buyers transact through Zillow at an 80% higher rate after connecting with both Zillow Home Loans and a Zillow Premier Agent partner, vs. with a Zillow Premier Agent partner only. By driving adoption of the two offerings together, we’ve seen purchase loan origination volume increase by 2.6x over the past two years, accelerating growth in our Mortgages revenue. In Q4, purchase loan origination volume increased by 90% and Mortgages revenue was up 86% year over year to $41 million. Fourth, we are expanding our addressable market by developing and scaling seller services, as two-thirds of buyers are also sellers. Zillow Showcase, which elevates agents’ brand presence on Zillow and provides a better shopper experience through our home-grown AI-powered rich media and floor plan technologies, is now on 1.7% of all new listings. We aim to reach 5%–10% of all U.S. listings in the intermediate term, which we believe represents a revenue opportunity of $150 million to $300 million. Showcase listings sell faster and for more money5 than similar non-Showcase listings on Zillow — meeting what our research shows 5https://showingtimeplus.com/showcase-facts 3 | Q4 2024

are sellers’ top two priorities.6 Showcase is also helping agents win 30% more listings, making it an attractive offering for real estate professionals. Fifth, we are consistently looking for ways to add new services to make the Zillow experience more integrated and increase our revenue per total transaction value7 along the way. Each step of the move comes with corresponding Zillow products and services, meaning each step represents an additional driver of potential revenue per transaction for us — through buyer and seller referral fees, as well as revenue from loan originations, Showcase listings, and title and closing. All of these efforts come together in our Enhanced Markets, our go-to-market motion that we have been methodically scaling for the past few years. Enhanced Markets covered 21% of all our connections in Q4 2024, and we expect to increase their share of connections to more than 35% by the end of 2025 as we continue our land-and-expand strategy — going deeper in current markets and adding more markets. As we keep working across the business to increase connection and conversion rates, we expect to continue to drive share growth relative to the industry total transaction value in our For Sale revenue. We’ve seen newer Enhanced Markets behave similarly to our earliest markets in terms of share gains, which gives us confidence our strategy is working and our success is repeatable. Looking beyond 2025, we expect 75% of all Zillow transactions will be in the Enhanced Market experience over time. RENTALS Zillow Rentals had a remarkable 2024, gaining more property listings, more traffic, and more revenue than ever. We are eyeing an estimated $25 billion total addressable market in Rentals.8 To go after this opportunity, we’ve built a unique rental platform with a comprehensive suite of 1.9 million active rental listings, as of the end of 2024. That has helped us earn the largest consumer rentals audience, with an average of 29 million unique visitors every 8See Part I, Item 1 in our Annual Report on Form 10-K for the year ended Dec. 31, 2024, for further information on this calculation. 7Please see the “Use of Operating Metrics” section below for more information about our calculation of For Sale revenue per total transaction value. 6Zillow Consumer Housing Trends Report 2024: https://www.zillow.com/research/sellers-housing-trends-report-2024-34385/ 4 | Q4 2024

month9 — a widening lead over the next company in the category — and the number-one preference among renters. We’re now focused on scaling Rentals revenue, and we expect multifamily properties10 to be the main driver of growth: Today, 50,000 multifamily properties are on our platform, up from 37,000 at the end of 2023 — and there is room to expand, with an estimated 140,000 total multifamily properties across the country. To that end, today we announced a partnership with Redfin to provide all of the multifamily listings on their sites, further expanding the reach of multifamily properties that advertise with us, and giving renters on Zillow access to more apartment listings over time. Zillow Rentals’ growth has been buoyed this year by our successful partnership to distribute multifamily rental listings on Realtor.com®, as well as our multifamily advertising campaign, both exciting developments that we kicked off in 2024. While our marketing spend has been relatively modest, we strengthened our traffic advantage in the rentals category in 2024, according to Comscore data. The growth we saw last year, and expect this year, supports our belief that Zillow Rentals is well on its way toward the billion-dollar-plus revenue opportunity we see in front of us. We are pleased with the progress we made in 2024, which has set us up well for strong execution in 2025 and beyond. Zillow stands in a fortunate position because we have the leading brand in real estate, we have significant growth opportunities in both For Sale and Rentals, we are executing on a strategy that is working well, and we are doing all of this while maintaining cost discipline, which we expect will drive strong GAAP profitability over time. It’s a unique and exciting time to be at Zillow, and we are proud of the team’s efforts to get us here. Jeremy Wacksman Jeremy Hofmann CEO CFO 10Zillow Rentals defines "multifamily" properties as those with 25 or more units. 9Average monthly unique visitors on Zillow Rentals for October–December 2024 according to Comscore data. 5 | Q4 2024

Fourth-Quarter and Full-Year 2024 Highlights Zillow Group’s fourth-quarter results exceeded our outlook for revenue and Adjusted EBITDA. ● Q4 revenue was up 17% year over year to $554 million, above the midpoint of our outlook range by $21 million. Q4 revenue outperformed the residential real estate industry’s year-over-year total transaction value growth of 13% according to NAR and 15% according to industry data tracked and estimated by Zillow.11 Full-year 2024 revenue of $2.2 billion was up 15% year over year. ○ For Sale revenue was up 15% year over year to $428 million in Q4. ■ Residential revenue was up 11% year over year in Q4 to $387 million, benefiting primarily from continued conversion improvements and Zillow Showcase expansion. ■ Mortgages revenue increased 86% year over year to $41 million in Q4, due primarily to a 90% increase in purchase loan origination volume to $923 million. ○ Rentals revenue increased 25% year over year to $116 million in Q4, primarily driven by multifamily revenue growing 41% year over year. ● On a GAAP basis, net loss was $52 million and net loss margin was 9% in Q4 2024, compared with net loss of $73 million and net loss margin of 15% in Q4 2023. GAAP net loss was $112 million for the full year 2024 and net loss margin was 5%, a 300 basis point improvement from 8% net loss margin in 2023. ● Q4 Adjusted EBITDA was $112 million, or 20% of revenue, driven primarily by higher-than-expected Residential revenue and strong Rentals revenue. Adjusted EBITDA for the full year 2024 was $498 million and Adjusted EBITDA margin was 22%, up 200 basis points from 20% Adjusted EBITDA margin in 2023. ● Cash and investments at the end of Q4 were $1.9 billion, down from $2.2 billion at the end of Q3, primarily due to the settlement of our 2026 convertible debt in December. ● Traffic to Zillow Group’s mobile apps and sites in Q4 was up 3% year over year to 204 million average monthly unique users. Visits during Q4 were up 3% year over year to 2.1 billion. 11https://www.zillow.com/research/data/ 6 | Q4 2024

Select Q4 and Full-Year 2024 Results We are now presenting our revenue in two major categories: For Sale and Rentals. The “For Sale” category includes Residential and Mortgages revenue, which we manage together to best serve the buyers and sellers who work with us. FOR SALE For Sale revenue grew 15% year over year to $428 million in Q4 2024. Full year 2024 For Sale revenue grew 12% year over year to $1.7 billion. RESIDENTIAL Residential revenue increased 11% year over year to $387 million in Q4 2024. Residential revenue benefited from continued conversion improvements as more buyers and sellers transacted with Zillow Premier Agent partners; continued expansion of Zillow Showcase, which now represents 1.7% of all new for-sale listings in the country; as well as contributions from Follow Up Boss, ShowingTime+, and our New Construction marketplace. Full-year 2024 Residential revenue was up 10% year over year to $1.6 billion. MORTGAGES Mortgages revenue for Q4 increased 86% year over year to $41 million, driven by 90% growth in our purchase loan origination volume to $923 million. In Q4, in our Enhanced Markets more than six months in age, we continued to see consistent mid-teens adoption rates of buyers using both a Premier Agent partner and Zillow Home Loans, up from 6% in Q1 2023. Full-year 2024 Mortgages revenue was up 51% year over year to $145 million. We accelerated growth in our purchase loan origination volume throughout 2024, ending the year originating a total of $3.1 billion of purchase mortgage loans, up 102% year over year. We made steady progress throughout 2024 to help more of our customers with financing by improving integration between Zillow Home Loans and our Premier Agent partner network, and by increasing customer engagement on our apps and sites. 7 | Q4 2024

RENTALS Q4 Rentals revenue increased 25% year over year to $116 million, primarily driven by our multifamily revenue, which grew 41% year over year in Q4. Full-year 2024 Rentals revenue was up 27% year over year to $453 million, primarily driven by our multifamily revenue, which grew 42% year over year in 2024. We continue to grow our multifamily rentals marketplace, with the number of multifamily properties advertising across Zillow reaching 50,000 at the end of 2024, an increase of 13,000 properties from 37,000 properties at the beginning of the year. Across our entire rentals marketplace, total active rental listings were up 15% year over year to an industry-leading 1.9 million listings as of the end of 2024. NET LOSS AND ADJUSTED EBITDA GAAP net loss was $52 million in Q4, and net loss margin was 9%, compared with a Q4 2023 GAAP net loss of $73 million and net loss margin of 15%. GAAP net loss for the full year 2024 was $112 million, and net loss margin was 5%, a 300 basis point improvement from 8% net loss margin in 2023. Adjusted EBITDA was $112 million in Q4, driven by higher-than-expected Residential revenue and strong Rentals revenue. Adjusted EBITDA margin was 20% for Q4. Full-year 2024 Adjusted EBITDA was $498 million, and Adjusted EBITDA margin was 22%, up 200 basis points from 20% in 2023. Select Operating Expenses and Cost of Revenue Sales and marketing, technology and development, general and administrative expenses (select operating expenses), and cost of revenue totaled $623 million in Q4, flat sequentially and up 10% year over year from Q4 2023. Year-over-year results were impacted by higher sales and marketing expenses, which were up $37 million, and higher cost of revenue, which was up $19 million. The year-over-year increase in sales and marketing expenses was due to the intentional investments we made in our Rentals and Zillow Showcase sales teams, as well as additional loan officers in Zillow Home Loans, to support future expected growth. Cost of revenue was up year over year primarily due to an increase in amortization 8 | Q4 2024

of website development costs as we continue to test and release new products, as well as an increase in mortgage loan processing costs due to higher purchase loan origination volume. Adjusted EBITDA expenses12 were $442 million in Q4 2024, up 9% year over year. Excluding $7 million of expenses related to severance payments that were not contemplated in our Q4 outlook, our Adjusted EBITDA expenses would have been $435 million, in line with our outlook. The following table presents a reconciliation of Adjusted EBITDA expenses to select operating expenses and cost of revenue for the periods presented (in millions, except percentages, unaudited): BALANCE SHEET & CASH FLOW SUMMARY We ended Q4 with cash and investments of $1.9 billion, down $300 million compared to the end of Q3 2024, primarily due to the settlement of our 2026 convertible debt in December, which included aggregate cash payments of $499 million. This was partially offset by net cash provided by operating activities of $122 million. Our available share repurchase authorization was $381 million at the end of Q4. The outstanding principal on our convertible debt was $419 million at the end of Q4. 12Adjusted EBITDA expenses is a non-GAAP financial measure; it is not calculated or presented in accordance with GAAP. Please see the “Use of Non-GAAP Financial Measures” section below for more information about the presentation and calculation of Adjusted EBITDA expenses. 9 | Q4 2024

Outlook The following table presents our outlook for the three months ending March 31, 2025 (in millions): 1314 ● We expect For Sale revenue growth to be in the mid-single digits year over year, driven by Residential revenue growth of low to mid-single digits and Mortgages revenue growth of approximately 30%. ● We expect a more challenging housing market in Q1, with industry growth remaining relatively flat year over year. ● In Rentals, we expect revenue to grow approximately 30% year over year in Q1 as we benefit from our execution on building our two-sided marketplace. Our multifamily rentals revenue is expected to grow faster than our overall Rentals revenue as we see the benefits of continued property growth. ● Our outlook implies Q1 Adjusted EBITDA expenses will be $450 million, with the sequential increase entirely related to seasonal payroll taxes. 2025 OUTLOOK ● We expect low to mid-teens revenue growth for the full year 2025, with continued Adjusted EBITDA margin expansion. ● We expect to have positive GAAP net income for the full year 2025. 14We have excluded from our outlook for “Weighted-average shares outstanding - diluted” any potentially dilutive impact of the conversion of our convertible senior notes due in 2025 and any potentially anti-dilutive impact of future share repurchases or capped call unwinds. The maximum number of shares underlying the convertible senior notes and capped call transactions is 6.2 million and 5.3 million shares of Class C capital stock, respectively. 13Zillow Group has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this communication because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to: income taxes that are directly impacted by unpredictable fluctuations in the market price of the company’s capital stock, depreciation and amortization from new acquisitions, impairments of assets, gains or losses on extinguishment of debt, and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss), are inherently uncertain and depend on various factors, many of which are outside of Zillow Group’s control. We have not provided a reconciliation of forecasted Adjusted EBITDA expenses to forecasted total select operating expenses and cost of revenue, the most directly comparable GAAP financial measure, for the same reasons. For more information regarding the non-GAAP financial measures discussed in this communication, please see the “Use of Non-GAAP Financial Measures” section below. 10 | Q4 2024

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding our future targets and opportunities; the future growth, performance and operation of our business; our business strategies and ability to translate such strategies into financial performance; and the health of, and our impact on, the residential real estate industry. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “opportunity,” “guidance,” “would,” “could,” “strive,” or similar expressions constitute forward-looking statements. Forward-looking statements are made based on assumptions as of February 11, 2025, and although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to: the health and stability of the economy and United States residential real estate industry, including changes in inflationary conditions, interest rates, housing availability and affordability, labor shortages and supply chain issues; our ability to manage advertising and product inventory and pricing and maintain relationships with our real estate partners; our ability to establish or maintain relationships with listing and data providers, which affects traffic to our mobile applications and websites; our ability to comply with current and future rules and requirements promulgated by National Association of REALTORS®, multiple listing services, or other real estate industry groups or governing bodies, or decisions to repeal, amend, or not enforce such rules and requirements; our ability to navigate industry changes, including as a result of past, pending or future lawsuits, settlements or government investigations, which may include lawsuits, settlements or investigations in which we are not a named party, such as the National Association of REALTORS® settlement agreement entered into on March 15, 2024; uncertainties related to changes resulting from the November 2024 elections in the United States; our ability to continue to innovate and compete to attract customers and real estate partners; our ability to effectively invest resources to pursue new strategies, develop new products and services and expand existing products and services into new markets; our ability to operate and grow Zillow Home Loans’ mortgage operations, including the ability to obtain or maintain sufficient financing to fund the origination of mortgages, meet customers’ financing needs with product offerings, continue to grow origination operations and resell originated mortgages on the secondary market; the duration and impact of natural disasters, climate change, geopolitical events, and other catastrophic events (including public health crises) on our ability to operate, demand for our products or services, or general economic conditions; our targets and disclosures related to environmental, social and governance matters; our ability to maintain adequate security controls or technology systems, or those of third parties on which we rely, to protect data integrity and the information and privacy of our customers and other third parties; our ability to navigate any significant disruption in service on our mobile applications or websites or in our network; the impact of past, pending or future litigation and other disputes or enforcement actions, which may include lawsuits or investigations to which we are not a party; our ability to attract, engage, and retain a highly skilled workforce; acquisitions, investments, strategic partnerships, capital-raising activities, or other corporate transactions or commitments by us or our competitors; our ability to continue relying on third-party services to support critical functions of our business; our ability to protect and continue using our intellectual property and prevent others from copying, infringing upon, or developing similar intellectual property, including as a result of generative artificial intelligence; our ability to comply with domestic and international laws, regulations, rules, contractual obligations, policies and other obligations, or to obtain or maintain required licenses to support our business and operations; our ability to pay our debt, settle conversions of our convertible senior notes, or repurchase our convertible senior notes upon a fundamental change; our ability to raise additional capital or refinance our indebtedness on acceptable terms, or at all; actual or anticipated fluctuations in quarterly and annual results of operations and financial position; actual or perceived inaccuracies in the assumptions, estimates and internal or third-party data that we use to calculate business, performance and operating metrics; and volatility of our Class A common stock and Class C capital stock prices. The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors” described in Zillow Group’s publicly available filings with the United States Securities and 11 | Q4 2024

Exchange Commission (“SEC”). Except as may be required by law, Zillow Group does not intend and undertakes no duty to update this information to reflect future events or circumstances. No Incorporation by Reference This communication includes website addresses and references to additional materials found on those websites, including Zillow Group’s websites. These websites and materials are not incorporated by reference herein or in our other filings with the SEC. Use of Estimates and Statistical Data This communication includes estimates and other statistical data made by independent third parties and by Zillow Group relating to the housing market, the mortgage-rate environment, connections, conversion, engagement, growth, and other data about Zillow Group’s audience and performance and the residential real estate industry and purchase loan origination industry. These data involve a number of assumptions and limitations, which may significantly impair their accuracy, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of future performance are necessarily subject to a high degree of uncertainty and risk. Use of Operating Metrics Zillow Group reviews a number of operating metrics to evaluate its business, measure performance, identify trends, formulate business plans, and make strategic decisions. This communication includes total transaction value (“TTV”), For Sale Revenue Per TTV, and Customer Transactions. Zillow Group uses these operating metrics on a periodic basis to evaluate and provide investors with insight into the performance of Zillow Group’s transaction-based product and service offerings, which include Premier Agent, Zillow Home Loans, Zillow Showcase, and Spruce. For Sale Revenue Per TTV: Zillow Group calculates “For Sale Revenue Per TTV” as total Residential and Mortgages revenue, or For Sale revenue, for the relevant period divided by the aggregate total transaction value for the same period. “TTV” is calculated as the number of existing residential homes sold multiplied by the average sales price of existing residential homes sold during the relevant period according to industry data collected and estimated by Zillow, as published monthly on our site. Customer Transaction Share (or “share of customer transactions”): Unless otherwise indicated, “Customer Transaction Share” or “share of customer transactions” is Customer Transactions divided by the number of total residential real estate transactions, for the relevant period. • Customer Transactions: Zillow Group calculates “Customer Transactions” as each unique purchase or sale transaction in which the homebuyer or seller uses Zillow Home Loans, Zillow Showcase, Spruce and/or involves an agent partner with whom the buyer or seller connected through Zillow Group. In particular: • For agent partners, Zillow Group uses an internal approximation of the number of buy- and/or sell-side transactions, as applicable, that involve an agent partner with whom the buyer or seller connected through Zillow Group. Because of the challenges associated with measuring the conversion of connections to transactions outside of our Premier Agent Flex program, including reliance on the availability and quality of public records and data, these estimates may be inaccurate. • For Zillow Home Loans, Zillow Group counts each unique purchase transaction in which the buyer uses Zillow Home Loans. • For Zillow Showcase, Zillow Group counts each unique sale transaction in which the listing agent or seller uses Zillow Showcase. • For Spruce, Zillow Group counts each unique purchase transaction in which the buyer uses Spruce. 12 | Q4 2024

Use of Non-GAAP Financial Measures To provide investors with additional information regarding our financial results, this communication includes references to non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA expenses. • Adjusted EBITDA Reconciliation We have provided a reconciliation below of Adjusted EBITDA to net loss, the most directly comparable U.S. generally accepted accounting principle (“GAAP”) financial measure. • Adjusted EBITDA Margin Calculation We have provided a calculation below of Adjusted EBITDA margin, as well as net loss margin, the most directly comparable GAAP financial measure. • Adjusted EBITDA Expenses Reconciliation and Calculation We have provided a reconciliation above of Adjusted EBITDA expenses to total select operating expenses and cost of revenue, the most directly comparable GAAP financial measure, and a calculation below of Adjusted EBITDA expenses calculated as revenue less Adjusted EBITDA. Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA expenses are key metrics used by our management and board of directors to measure operating performance and trends and to prepare and approve our annual budget. In particular, the exclusion of certain expenses in calculating these measures facilitates operating performance comparisons on a period-to-period basis. Our use of non-GAAP financial measures has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include, but are not limited to, the fact that such non-GAAP measures: • Do not reflect changes in, or cash requirements for, our working capital needs; • Do not consider the potentially dilutive impact of share-based compensation; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA expenses do not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or contractual commitments; • Do not reflect impairment and restructuring costs; • Do not reflect acquisition-related costs; • Do not reflect the loss (gain) on extinguishment of debt; • Do not reflect interest expense or other income, net; • Do not reflect income taxes; and • Other companies, including companies in our own industry, may calculate these non-GAAP measures differently from the way we do, limiting their usefulness as comparative measures. Because of these limitations, you should consider Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA expenses alongside other financial performance measures, including various cash-flow metrics, net loss, and our other GAAP results. 13 | Q4 2024

The following tables present a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure, and a calculation of Adjusted EBITDA expenses for each of the periods presented (in millions, unaudited): Three Months Ended December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Reconciliation of Adjusted EBITDA to Net Loss: Net loss $ (52) $ (20) $ (17) $ (23) $ (73) Income taxes 1 — 2 2 3 Other income, net (26) (34) (34) (33) (43) Depreciation and amortization 62 63 59 56 53 Share-based compensation 119 108 113 108 109 Impairment and restructuring costs — — — 6 10 Acquisition-related costs — 1 — — 2 Loss (gain) on extinguishment of debt — — 1 — (1) Interest expense 8 9 10 9 9 Adjusted EBITDA $ 112 $ 127 $ 134 $ 125 $ 69 Three Months Ended December 31, 2024 September 30, 2024 December 31, 2023 Calculation of Adjusted EBITDA Expenses: Revenue $ 554 $ 581 $ 474 Less: Adjusted EBITDA (112) (127) (69) Adjusted EBITDA expenses $ 442 $ 454 $ 405 14 | Q4 2024

The following tables present the calculation of Adjusted EBITDA margin and associated year-over-year percentage changes and the most directly comparable GAAP financial measure, which is net loss margin, and related year-over-year percentage changes, for each of the periods presented (in millions, except percentages and margin change basis points, unaudited): Three Months Ended December 31, 2023 to 2024 % Change Year Ended December 31, 2023 to 2024 % Change2024 2023 2024 2023 Revenue: For Sale revenue: Residential $ 387 $ 349 11% $ 1,594 $ 1,452 10% Mortgages 41 22 86% 145 96 51% For Sale revenue 428 371 15% 1,739 1,548 12% Rentals 116 93 25% 453 357 27% Other 10 10 —% 44 40 10% Total revenue $ 554 $ 474 17% $ 2,236 $ 1,945 15% Other Financial Data: Gross profit $ 420 $ 359 17% $ 1,709 $ 1,524 12% Net loss $ (52) $ (73) 29% $ (112) $ (158) 29% Adjusted EBITDA $ 112 $ 69 62% $ 498 $ 391 27% Three Months Ended December 31, 2023 to 2024 % Change 2023 to 2024 Margin Change Basis Points Year Ended December 31, 2023 to 2024 % Change 2023 to 2024 Margin Change Basis Points Percentage of Revenue: 2024 2023 2024 2023 Gross profit 76 % 76 % —% — 76 % 78 % (3) % (200) Net loss (9) % (15) % 40% 600 (5) % (8) % 38 % 300 Adjusted EBITDA 20 % 15 % 33% 500 22 % 20 % 10 % 200 15 | Q4 2024

https://investors.zillowgroup.com

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001617640

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

ZILLOW GROUP, INC.

|

| Entity Incorporation, State or Country Code |

WA

|

| Entity File Number |

001-36853

|

| Entity Tax Identification Number |

47-1645716

|

| Entity Address, Address Line One |

1301 Second Avenue

|

| Entity Address, Address Line Two |

Floor 36

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98101

|

| City Area Code |

206

|

| Local Phone Number |

470-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ZG

|

| Security Exchange Name |

NASDAQ

|

| Common Class C [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class C Capital Stock, par value $0.0001 per share

|

| Trading Symbol |

Z

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |