Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Senior Loans 61.7% (b)(c)(d) | |

| | | |

| | |

| Automobiles & Components 3.0% | |

| | | |

| | |

| Clarios Global, LP, 1st Lien Term Loan, 1M SOFR + 2.50%, 7.35%, 05/06/2030 | |

$ | 2,805 | | |

$ | 2,803 | |

| LTI Holdings, Inc., 1st Lien Term Loan, 1M SOFR + 4.75%, 9.60%, 07/29/2029 | |

| 3,943 | | |

| 3,875 | |

| Wand NewCo 3, Inc., 1st Lien Term Loan, 1M SOFR + 3.25%, 8.10%, 01/30/2031 | |

| 3,491 | | |

| 3,485 | |

| | |

| | | |

| 10,163 | |

| Capital Goods 10.7% | |

| | | |

| | |

| Alliance Laundry Systems, LLC, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.35%, 08/19/2031 | |

| 4,339 | | |

| 4,342 | |

| Artera Services, LLC, 1st Lien Term Loan, 3M SOFR + 4.50%, 9.10%, 02/15/2031 | |

| 2,438 | | |

| 2,370 | |

| Chart Industries, Inc., 1st Lien Term Loan, 3M SOFR + 2.50%, 7.09%, 03/15/2030 (e) | |

| 2,511 | | |

| 2,504 | |

| Crown Subsea Communications Holding, Inc., 1st Lien Term Loan, 3M SOFR + 4.00%, 9.25%, 01/30/2031 | |

| 3,621 | | |

| 3,638 | |

| Gulfside Supply, Inc., 1st Lien Term Loan, 3M SOFR + 3.00%, 8.29%, 06/17/2031 | |

| 1,489 | | |

| 1,487 | |

| Kaman Corp., 1st Lien Term Loan, 3M SOFR + 3.50%, 8.10%, 04/21/2031 | |

| 2,000 | | |

| 2,006 | |

| Kodiak BP, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.60%, 03/12/2028 | |

| 1,866 | | |

| 1,868 | |

| Osmosis Buyer Ltd., 1st Lien Term Loan, 1M SOFR + 3.75%, 8.84%, 07/31/2028 | |

| 4,489 | | |

| 4,482 | |

| Pike Corp., 1st Lien Term Loan, 1M SOFR + 3.00%, 7.96%, 01/21/2028 | |

| 1,283 | | |

| 1,288 | |

| TransDigm, Inc., 1st Lien Term Loan, 08/24/2028 (f) | |

| 500 | | |

| 500 | |

| TransDigm, Inc., 1st Lien Term Loan, 3M SOFR + 2.50%, 7.10%, 02/28/2031 | |

| 3,485 | | |

| 3,470 | |

| Traverse Midstream Partners, LLC, 1st Lien Term Loan, 3M SOFR + 3.50%, 8.75%, 02/16/2028 | |

| 2,747 | | |

| 2,748 | |

| Tutor Perini Corp., 1st Lien Term Loan, 1M SOFR + 4.75%, 9.71%, 08/18/2027 | |

| 1,290 | | |

| 1,285 | |

| White Cap Supply Holdings, LLC, 1st Lien Term Loan, 1M SOFR + 3.25%, 8.50%, 10/19/2029 | |

| 2,500 | | |

| 2,481 | |

| Wilsonart, LLC, 1st Lien Term Loan, PRIME + 4.25%, 8.85%, 08/05/2031 | |

| 2,000 | | |

| 1,977 | |

| | |

| | | |

| 36,446 | |

| Commercial & Professional Services 0.7% | |

| | | |

| | |

| ISolved, Inc., 1st Lien Term Loan, 1M SOFR + 3.50%, 8.35%, 10/15/2030 | |

| 2,529 | | |

| 2,534 | |

| Consumer Discretionary Distribution & Retail 1.2% | |

| | | |

| | |

| Peer Holding III B.V., 1st Lien Term Loan (Netherlands), 3M SOFR + 3.25%, 7.85%, 10/28/2030 | |

| 3,980 | | |

| 3,987 | |

| Consumer Durables & Apparel 3.2% | |

| | | |

| | |

| Lakeshore Learning Materials, LLC, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.46%, 09/29/2028 | |

| 3,466 | | |

| 3,466 | |

| Recess Holdings, Inc., 1st Lien Term Loan, 3M SOFR + 4.50%, 9.75%, 02/20/2030 | |

| 4,110 | | |

| 4,121 | |

| Varsity Brands, Inc., 1st Lien Term Loan, 3M SOFR + 3.75%, 8.74%, 08/26/2031 | |

| 3,500 | | |

| 3,475 | |

| | |

| | | |

| 11,062 | |

| Consumer Services 3.9% | |

| | | |

| | |

| Belfor Holdings, Inc., 1st Lien Term Loan, 1M SOFR + 3.75%, 8.60%, 11/01/2030 | |

| 1,189 | | |

| 1,193 | |

| Caesars Entertainment, Inc., 1st Lien Term Loan, 1M SOFR + 2.75%, 7.60%, 02/06/2031 | |

| 3,483 | | |

| 3,478 | |

| Century DE Buyer, LLC, 1st Lien Term Loan, 3M SOFR + 4.00%, 9.26%, 10/30/2030 | |

| 3,483 | | |

| 3,472 | |

| Fugue Finance B.V., 1st Lien Term Loan (Netherlands), 3M SOFR + 3.75%, 8.81%, 02/26/2031 | |

| 1,247 | | |

| 1,253 | |

| Ontario Gaming GTA, LP, 1st Lien Term Loan (Canada), 3M SOFR + 4.25%, 8.89%, 08/01/2030 | |

| 3,970 | | |

| 3,964 | |

| | |

| | | |

| 13,360 | |

| Energy 1.6% | |

| | | |

| | |

| CPPIB OVM Member U.S., LLC, 1st Lien Term Loan, 3M SOFR + 3.25%, 7.85%, 08/20/2031 | |

| 2,500 | | |

| 2,499 | |

| Prairie ECI Acquiror, LP, 1st Lien Term Loan, 1M SOFR + 4.75%, 9.60%, 08/01/2029 | |

| 346 | | |

| 345 | |

| TransMontaigne Operating Company, LP, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.46%, 11/17/2028 | |

| 2,487 | | |

| 2,488 | |

| | |

| | | |

| 5,332 | |

| Financial Services 1.4% | |

| | | |

| | |

| Albion Financing 3 SARL, 1st Lien Term Loan (Luxembourg), 3M SOFR + 4.25%, 9.83%, 08/17/2029 | |

| 1,247 | | |

| 1,251 | |

| Athena Bidco S.A.S., 1st Lien Term Loan (France), 3M EURIBOR + 4.00%, 7.35%, 04/14/2031 | |

€ | 3,020 | | |

| 3,378 | |

| | |

| | | |

| 4,629 | |

| Food & Beverage 2.3% | |

| | | |

| | |

| Chobani, LLC, 1st Lien Term Loan, 1M SOFR + 3.25%, 8.21%, 10/25/2027 | |

$ | 2,939 | | |

| 2,944 | |

| Chobani, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.60%, 10/25/2027 | |

| 1,489 | | |

| 1,492 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Senior Loans 61.7% (b)(c)(d) (continued) | |

| | | |

| | |

| Froneri Lux Finco SARL, 1st Lien Term Loan (Luxembourg), 6M EURIBOR + 2.13%, 5.72%, 01/29/2027 | |

€ | 3,000 | | |

$ | 3,336 | |

| | |

| | | |

| 7,772 | |

| Healthcare Equipment & Services 6.8% | |

| | | |

| | |

| Bausch + Lomb Corp., 1st Lien Term Loan (Canada), 1M SOFR + 3.25%, 8.27%, 05/10/2027 | |

$ | 1,481 | | |

| 1,474 | |

| Bausch + Lomb Corp., 1st Lien Term Loan (Canada), 1M SOFR + 4.00%, 8.85%, 09/29/2028 | |

| 1,980 | | |

| 1,976 | |

| CNT Holdings I Corp., 1st Lien Term Loan, 3M SOFR + 3.50%, 8.75%, 11/08/2027 | |

| 2,408 | | |

| 2,411 | |

| Confluent Medical Technologies, Inc., 1st Lien Term Loan, 3M SOFR + 3.75%, 8.35%, 02/16/2029 | |

| 2,494 | | |

| 2,497 | |

| Ensemble RCM, LLC, 1st Lien Term Loan, 3M SOFR + 3.00%, 8.25%, 08/01/2029 | |

| 3,819 | | |

| 3,821 | |

| Mamba Purchaser, Inc., 1st Lien Term Loan, 1M SOFR + 3.25%, 8.35%, 10/16/2028 | |

| 2,725 | | |

| 2,717 | |

| Medline Borrower, LP, 1st Lien Term Loan, 1M SOFR + 2.75%, 7.60%, 10/23/2028 | |

| 2,243 | | |

| 2,243 | |

| Resonetics, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.72%, 06/18/2031 | |

| 2,636 | | |

| 2,638 | |

| Sotera Health Holdings, LLC, 1st Lien Term Loan, 1M SOFR + 3.25%, 8.10%, 05/30/2031 | |

| 1,750 | | |

| 1,744 | |

| Waystar Technologies, Inc., 1st Lien Term Loan, 1M SOFR + 2.75%, 7.60%, 10/22/2029 | |

| 1,859 | | |

| 1,858 | |

| | |

| | | |

| 23,379 | |

| Insurance 2.1% | |

| | | |

| | |

| Acrisure, LLC, 1st Lien Term Loan, 1M SOFR + 3.25%, 8.21%, 11/06/2030 | |

| 1,248 | | |

| 1,234 | |

| HIG Finance 2, Ltd., 1st Lien Term Loan (Great Britain), 1M SOFR + 3.50%, 8.35%, 02/15/2031 | |

| 2,488 | | |

| 2,488 | |

| HUB International, Ltd., 1st Lien Term Loan, 3M SOFR + 3.00%, 7.60%, 06/20/2030 | |

| 3,498 | | |

| 3,493 | |

| | |

| | | |

| 7,215 | |

| Materials 2.8% | |

| | | |

| | |

| AAP Buyer, Inc., 1st Lien Term Loan, 3M SOFR + 3.25%, 7.85%, 09/09/2031 (e) | |

| 1,685 | | |

| 1,691 | |

| Derby Buyer, LLC, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.70%, 11/01/2030 | |

| 1,493 | | |

| 1,493 | |

| Nouryon Finance B.V., 1st Lien Term Loan (Netherlands), 3M SOFR + 3.50%, 8.63%, 04/03/2028 | |

| 2,049 | | |

| 2,049 | |

| Nouryon Finance B.V., 1st Lien Term Loan (Netherlands), 3M SOFR + 3.50%, 8.82%, 04/03/2028 | |

| 990 | | |

| 991 | |

| WR Grace Holdings, LLC, 1st Lien Term Loan, 3M SOFR + 3.25%, 7.85%, 09/22/2028 | |

| 3,251 | | |

| 3,256 | |

| | |

| | | |

| 9,480 | |

| Media & Entertainment 4.8% | |

| | | |

| | |

| Altice Financing S.A., 1st Lien Term Loan (Luxembourg), 3M SOFR + 5.00%, 10.30%, 10/31/2027 | |

| 2,481 | | |

| 2,248 | |

| AVSC Holding Corp., 1st Lien Term Loan, 1M SOFR + 3.25%, 8.85%, 03/03/2025 (f) | |

| 2,995 | | |

| 2,978 | |

| Creative Artists Agency, LLC, 1st Lien Term Loan, PRIME + 3.00%, 11.00%, 11/27/2028 | |

| 4,275 | | |

| 4,271 | |

| Gray Television, Inc., 1st Lien Term Loan, 1M SOFR + 3.00%, 8.32%, 12/01/2028 | |

| 3,225 | | |

| 2,967 | |

| Univision Communications, Inc., 1st Lien Term Loan, 3M SOFR + 4.25%, 8.85%, 06/24/2029 | |

| 980 | | |

| 963 | |

| Virgin Media Bristol, LLC, 1st Lien Term Loan, 6M SOFR + 3.25%, 8.66%, 03/31/2031 | |

| 3,000 | | |

| 2,862 | |

| | |

| | | |

| 16,289 | |

| Pharmaceuticals, Biotechnology & Life Sciences 1.6% | |

| | | |

| | |

| Catalent Pharma Solutions, Inc., 1st Lien Term Loan, 1M SOFR + 3.00%, 7.92%, 02/22/2028 (e) | |

| 2,736 | | |

| 2,736 | |

| Packaging Coordinators Midco, Inc., 1st Lien Term Loan, 1M SOFR + 3.25%, 8.10%, 11/30/2027 | |

| 2,887 | | |

| 2,885 | |

| | |

| | | |

| 5,621 | |

| Software & Services 9.4% | |

| | | |

| | |

| Access CIG, LLC, 1st Lien Term Loan, 3M SOFR + 5.00%, 10.25%, 08/18/2028 | |

| 2,233 | | |

| 2,239 | |

| Asurion, LLC, 1st Lien Term Loan, 1M SOFR + 3.25%, 8.21%, 07/31/2027 | |

| 997 | | |

| 982 | |

| Asurion, LLC, 1st Lien Term Loan, 1M SOFR + 4.00%, 8.95%, 08/19/2028 | |

| 2,469 | | |

| 2,426 | |

| BEP Intermediate Holdco, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.60%, 04/25/2031 (e) | |

| 3,072 | | |

| 3,080 | |

| Boost Newco Borrower, LLC, 1st Lien Term Loan, 3M SOFR + 2.50%, 7.10%, 01/31/2031 | |

| 3,000 | | |

| 2,999 | |

| Conservice Midco, LLC, 1st Lien Term Loan1st Lien Term Loan, 05/13/2027 (f) | |

| 2,500 | | |

| 2,502 | |

| Genesys Cloud Services Holdings II, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.71%, 12/01/2027 | |

| 2,985 | | |

| 2,985 | |

| Ivanti Software, Inc., 1st Lien Revolving Loan, 3M SOFR + 3.75%, 8.60%, 12/01/2025 (e)(g) | |

| 109 | | |

| 70 | |

| Open Text Corp., 1st Lien Term Loan (Canada), 1M SOFR + 2.25%, 7.10%, 01/31/2030 | |

| 1,861 | | |

| 1,867 | |

| Project Boost Purchaser, LLC, 1st Lien Term Loan, 3M SOFR + 3.50%, 8.79%, 07/16/2031 | |

| 4,713 | | |

| 4,709 | |

| Proofpoint, Inc., 1st Lien Term Loan, 1M SOFR + 3.00%, 7.85%, 08/31/2028 | |

| 3,970 | | |

| 3,967 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Senior Loans 61.7% (b)(c)(d) (continued) | |

| | | |

| | |

| Quartz Acquireco, LLC, 1st Lien Term Loan, 3M SOFR + 2.75%, 7.35%, 06/28/2030 (f) | |

$ | 4,471 | | |

$ | 4,463 | |

| | |

| | | |

| 32,289 | |

| Telecommunication Services 0.8% | |

| | | |

| | |

| Delta TopCo, Inc., 1st Lien Term Loan, 6M SOFR + 3.50%, 8.20%, 11/30/2029 | |

| 1,746 | | |

| 1,741 | |

| Lumen Technologies, Inc., 1st Lien Term Loan, 1M SOFR + 6.00%, 10.85%, 06/01/2028 | |

| 901 | | |

| 866 | |

| | |

| | | |

| 2,607 | |

| Transportation 2.5% | |

| | | |

| | |

| AAdvantage Loyality IP, Ltd., 1st Lien Term Loan, 3M SOFR + 4.75%, 10.29%, 04/20/2028 | |

| 2,885 | | |

| 2,963 | |

| Apple Bidco, LLC, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.35%, 09/22/2028 | |

| 2,216 | | |

| 2,220 | |

| Hertz Corp., 1st Lien Term Loan, 1M SOFR + 3.50%, 8.46%, 06/30/2028 | |

| 468 | | |

| 418 | |

| Hertz Corp., 1st Lien Term Loan, 1M SOFR + 3.50%, 8.88%, 06/30/2028 | |

| 2,404 | | |

| 2,146 | |

| SkyMiles IP, Ltd., 1st Lien Term Loan, 3M SOFR + 3.75%, 9.03%, 10/20/2027 | |

| 797 | | |

| 812 | |

| | |

| | | |

| 8,559 | |

| Utilities 2.9% | |

| | | |

| | |

| CPV Fairview, LLC, 1st Lien Term Loan, 1M SOFR + 3.50%, 8.35%, 08/14/2031 | |

| 1,500 | | |

| 1,505 | |

| Hamilton Projects Acquiror, LLC, 1st Lien Term Loan, 1M SOFR + 3.75%, 8.60%, 05/31/2031 | |

| 1,995 | | |

| 2,007 | |

| South Field, LLC, 1st Lien Term Loan, 3M SOFR + 3.75%, 8.35%, 08/29/2031 | |

| 3,000 | | |

| 3,010 | |

| Thunder Generation Funding, LLC, 1st Lien Term Loan, 10/14/2031 (e)(f) | |

| 3,413 | | |

| 3,408 | |

| | |

| | | |

| 9,930 | |

| Total Senior Loans (Cost: $210,316) | |

| | | |

| 210,654 | |

| Corporate Bonds 49.1% | |

| | | |

| | |

| Automobiles & Components 0.6% | |

| | | |

| | |

| Clarios Global, LP, 8.50%, 05/15/2027 (d) | |

| 1,500 | | |

| 1,504 | |

| Wand NewCo 3, Inc., 7.63%, 01/30/2032 (d) | |

| 500 | | |

| 527 | |

| | |

| | | |

| 2,031 | |

| Capital Goods 4.4% | |

| | | |

| | |

| Bombardier, Inc., (Canada), 8.75%, 11/15/2030 (d) | |

| 2,500 | | |

| 2,744 | |

| Builders FirstSource, Inc., 6.38%, 03/01/2034 (d) | |

| 3,150 | | |

| 3,271 | |

| Chart Industries, Inc., 7.50%, 01/01/2030 (d) | |

| 1,000 | | |

| 1,054 | |

| Chart Industries, Inc., 9.50%, 01/01/2031 (d) | |

| 250 | | |

| 272 | |

| Specialty Building Products Holdings, LLC, 6.38%, 09/30/2026 (d) | |

| 3,000 | | |

| 2,989 | |

| Standard Building Solutions, Inc., 6.50%, 08/15/2032 (d) | |

| 1,500 | | |

| 1,553 | |

| United Rentals, Inc., 6.13%, 03/15/2034 (d) | |

| 2,000 | | |

| 2,067 | |

| Wilsonart, LLC, 11.00%, 08/15/2032 (d) | |

| 1,000 | | |

| 1,000 | |

| | |

| | | |

| 14,950 | |

| Consumer Discretionary Distribution & Retail 1.5% | |

| | | |

| | |

| Bath & Body Works, Inc., 6.63%, 10/01/2030 (d) | |

| 1,000 | | |

| 1,019 | |

| Bath & Body Works, Inc., 9.38%, 07/01/2025 (d) | |

| 1,151 | | |

| 1,181 | |

| Constellation Automotive Financing PLC, (Great Britain), 4.88%, 07/15/2027 | |

£ | 2,500 | | |

| 2,943 | |

| | |

| | | |

| 5,143 | |

| Consumer Durables & Apparel 0.7% | |

| | | |

| | |

| Ashton Woods USA, LLC, 6.63%, 01/15/2028 (d) | |

$ | 2,500 | | |

| 2,522 | |

| Consumer Services 4.5% | |

| | | |

| | |

| Caesars Entertainment, Inc., 8.13%, 07/01/2027 (d) | |

| 2,773 | | |

| 2,830 | |

| Hilton Domestic Operating Co., Inc., 5.75%, 05/01/2028 (d) | |

| 3,500 | | |

| 3,516 | |

| International Game Technology PLC, (Great Britain), 6.25%, 01/15/2027 (d) | |

| 1,000 | | |

| 1,021 | |

| Lottomatica SpA, (Italy), 7.13%, 06/01/2028 (d) | |

€ | 2,482 | | |

| 2,908 | |

| MGM Resorts International, 6.50%, 04/15/2032 | |

$ | 2,500 | | |

| 2,547 | |

| Six Flags Theme Parks, Inc., 7.00%, 07/01/2025 (d) | |

| 1,379 | | |

| 1,380 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Corporate Bonds 49.1% (continued) | |

| | | |

| | |

| Station Casinos, LLC, 6.63%, 03/15/2032 (d) | |

$ | 1,200 | | |

$ | 1,227 | |

| | |

| | | |

| 15,429 | |

| Consumer Staples Distribution & Retail 0.4% | |

| | | |

| | |

| Albertsons Cos., Inc., 7.50%, 03/15/2026 (d) | |

| 1,500 | | |

| 1,513 | |

| Energy 11.8% | |

| | | |

| | |

| Antero Resources Corp., 7.63%, 02/01/2029 (d) | |

| 2,222 | | |

| 2,292 | |

| Archrock Partners, LP, 6.88%, 04/01/2027 (d) | |

| 898 | | |

| 901 | |

| Ascent Resources Utica Holdings, LLC, 8.25%, 12/31/2028 (d) | |

| 2,501 | | |

| 2,562 | |

| Blue Racer Midstream, LLC, 6.63%, 07/15/2026 (d) | |

| 1,500 | | |

| 1,498 | |

| Blue Racer Midstream, LLC, 7.00%, 07/15/2029 (d) | |

| 1,500 | | |

| 1,559 | |

| Citgo Petroleum Corp., 7.00%, 06/15/2025 (d) | |

| 3,500 | | |

| 3,498 | |

| DCP Midstream Operating, LP, 8.13%, 08/16/2030 | |

| 3,330 | | |

| 3,918 | |

| Kodiak Gas Services, LLC, 7.25%, 02/15/2029 (d) | |

| 1,150 | | |

| 1,190 | |

| Moss Creek Resources Holdings, Inc., 8.25%, 09/01/2031 (d) | |

| 3,685 | | |

| 3,634 | |

| Occidental Petroleum Corp., 8.88%, 07/15/2030 | |

| 3,500 | | |

| 4,138 | |

| Parkland Corp., (Canada), 6.63%, 08/15/2032 (d) | |

| 2,000 | | |

| 2,030 | |

| Sunoco, LP, 7.25%, 05/01/2032 (d) | |

| 3,125 | | |

| 3,313 | |

| Tallgrass Energy Partners, LP, 7.38%, 02/15/2029 (d) | |

| 1,500 | | |

| 1,519 | |

| Transocean, Inc., (Cayman Islands), 6.80%, 03/15/2038 | |

| 1,061 | | |

| 866 | |

| Transocean, Inc., (Cayman Islands), 8.75%, 02/15/2030 (d) | |

| 638 | | |

| 665 | |

| Western Midstream Operating, LP, 5.25%, 02/01/2050 | |

| 2,125 | | |

| 1,929 | |

| Williams Cos., Inc., 8.75%, 03/15/2032 | |

| 4,000 | | |

| 4,891 | |

| | |

| | | |

| 40,403 | |

| Equity Real Estate Investment Trusts (REITs) 2.1% | |

| | | |

| | |

| HAT Holdings I, LLC, 8.00%, 06/15/2027 (d) | |

| 3,778 | | |

| 4,003 | |

| VICI Properties LP, 5.75%, 02/01/2027 (d) | |

| 3,000 | | |

| 3,052 | |

| | |

| | | |

| 7,055 | |

| Financial Services 3.3% | |

| | | |

| | |

| Ally Financial, Inc., 8.00%, 11/01/2031 | |

| 2,000 | | |

| 2,263 | |

| CHS/Community Health Systems, Inc., 10.88%, 01/15/2032 (d) | |

| 1,500 | | |

| 1,653 | |

| Ford Motor Credit Co., LLC, 6.80%, 05/12/2028 | |

| 2,500 | | |

| 2,618 | |

| Ford Motor Credit Co., LLC, 6.95%, 06/10/2026 | |

| 1,000 | | |

| 1,029 | |

| Ford Motor Credit Co., LLC, 7.35%, 11/04/2027 | |

| 1,465 | | |

| 1,555 | |

| Summit Midstream Holdings, LLC, 8.63%, 10/31/2029 (d) | |

| 2,200 | | |

| 2,301 | |

| | |

| | | |

| 11,419 | |

| Healthcare Equipment & Services 1.4% | |

| | | |

| | |

| HCA, Inc., 7.69%, 06/15/2025 | |

| 4,750 | | |

| 4,836 | |

| Insurance 0.8% | |

| | | |

| | |

| Acrisure, LLC, 7.50%, 11/06/2030 (d) | |

| 1,081 | | |

| 1,112 | |

| Howden U.K. Refinance PLC, (Great Britain), 7.25%, 02/15/2031 (d) | |

| 1,400 | | |

| 1,453 | |

| | |

| | | |

| 2,565 | |

| Materials 3.0% | |

| | | |

| | |

| Crown Cork & Seal Co., Inc., 7.38%, 12/15/2026 | |

| 4,350 | | |

| 4,579 | |

| Kobe U.S. Midco 2, Inc., 9.25%, 11/01/2026 (d) | |

| 1,471 | | |

| 1,226 | |

| Summit Materials, LLC, 6.50%, 03/15/2027 (d) | |

| 2,750 | | |

| 2,753 | |

| Trident TPI Holdings, Inc., 12.75%, 12/31/2028 (d) | |

| 1,500 | | |

| 1,665 | |

| | |

| | | |

| 10,223 | |

| Media & Entertainment 3.9% | |

| | | |

| | |

| Belo Corp., 7.25%, 09/15/2027 | |

| 3,250 | | |

| 3,357 | |

| Charter Communications Operating, LLC, 6.10%, 06/01/2029 | |

| 1,650 | | |

| 1,707 | |

| Charter Communications Operating, LLC, 6.55%, 06/01/2034 | |

| 1,650 | | |

| 1,716 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Corporate Bonds 49.1% (continued) | |

| | | |

| | |

| Live Nation Entertainment, Inc., 6.50%, 05/15/2027 (d) | |

$ | 3,250 | | |

$ | 3,315 | |

| Univision Communications, Inc., 6.63%, 06/01/2027 (d) | |

| 1,000 | | |

| 1,002 | |

| Univision Communications, Inc., 8.00%, 08/15/2028 (d) | |

| 2,000 | | |

| 2,045 | |

| | |

| | | |

| 13,142 | |

| Semiconductors & Semiconductor Equipment 0.7% | |

| | | |

| | |

| Amkor Technology, Inc., 6.63%, 09/15/2027 (d) | |

| 2,500 | | |

| 2,517 | |

| Software & Services 2.0% | |

| | | |

| | |

| Leidos, Inc., 7.13%, 07/01/2032 | |

| 2,500 | | |

| 2,787 | |

| Open Text Corp., (Canada), 6.90%, 12/01/2027 (d) | |

| 1,500 | | |

| 1,583 | |

| SS&C Technologies, Inc., 6.50%, 06/01/2032 (d) | |

| 2,500 | | |

| 2,584 | |

| | |

| | | |

| 6,954 | |

| Technology Hardware & Equipment 1.3% | |

| | | |

| | |

| Dell International, LLC, 6.02%, 06/15/2026 | |

| 875 | | |

| 896 | |

| Dell International, LLC, 6.10%, 07/15/2027 | |

| 1,500 | | |

| 1,575 | |

| Insight Enterprises, Inc., 6.63%, 05/15/2032 (d) | |

| 1,500 | | |

| 1,566 | |

| Sensata Technologies, Inc., 6.63%, 07/15/2032 (d) | |

| 500 | | |

| 521 | |

| | |

| | | |

| 4,558 | |

| Telecommunication Services 3.5% | |

| | | |

| | |

| Altice France Holding S.A., (Luxembourg), 10.50%, 05/15/2027 (d) | |

| 2,000 | | |

| 690 | |

| Altice France S.A., (France), 8.13%, 02/01/2027 (d) | |

| 500 | | |

| 409 | |

| Iliad Holding S.A.S, (France), 6.50%, 10/15/2026 (d) | |

| 3,000 | | |

| 3,033 | |

| Iliad Holding S.A.S, (France), 7.00%, 10/15/2028 (d) | |

| 1,000 | | |

| 1,017 | |

| Level 3 Financing, Inc., 11.00%, 11/15/2029 (d) | |

| 1,250 | | |

| 1,385 | |

| Sprint, LLC, 7.63%, 03/01/2026 | |

| 5,250 | | |

| 5,423 | |

| | |

| | | |

| 11,957 | |

| Transportation 2.6% | |

| | | |

| | |

| GLP Capital, LP, 5.38%, 04/15/2026 | |

| 3,000 | | |

| 3,012 | |

| Mileage Plus Holdings, LLC, 6.50%, 06/20/2027 (d) | |

| 3,163 | | |

| 3,202 | |

| Uber Technologies, Inc., 7.50%, 09/15/2027 (d) | |

| 1,000 | | |

| 1,020 | |

| Uber Technologies, Inc., 8.00%, 11/01/2026 (d) | |

| 1,500 | | |

| 1,502 | |

| | |

| | | |

| 8,736 | |

| Utilities 0.6% | |

| | | |

| | |

| CQP Holdco, LP, 7.50%, 12/15/2033 (d) | |

| 1,750 | | |

| 1,899 | |

| Total Corporate Bonds (Cost: $165,850) | |

| | | |

| 167,852 | |

| | |

| | | |

| | |

| Collateralized Loan Obligations 52.5% (d)(e) | |

| | | |

| | |

| Collateralized Loan Obligations - Debt 33.4% (b)(c) | |

| | | |

| | |

| Investment Funds and Vehicles 33.4% | |

| | | |

| | |

| AMMC CLO XI, Ltd., (Cayman Islands), 3M LIBOR + 6.06%, 11.32%, 04/30/2031 | |

| 2,000 | | |

| 2,009 | |

| AMMC CLO XXII, Ltd., (Cayman Islands), 3M LIBOR + 5.76%, 11.05%, 04/25/2031 | |

| 3,000 | | |

| 3,015 | |

| Atrium XIV, LLC, (Cayman Islands), 3M LIBOR + 6.50%, 11.40%, 10/16/2037 | |

| 2,800 | | |

| 2,815 | |

| Atrium XV, (Cayman Islands), 3M LIBOR + 6.50%, 11.84%, 07/16/2037 | |

| 1,188 | | |

| 1,191 | |

| Bain Capital Credit CLO 2020-1, Ltd., (Cayman Islands), 3M LIBOR + 7.15%, 12.43%, 04/18/2033 | |

| 1,000 | | |

| 1,010 | |

| Bain Capital Credit CLO, Ltd. 2021-5, (Cayman Islands), 3M LIBOR + 6.76%, 12.04%, 10/23/2034 | |

| 2,000 | | |

| 1,882 | |

| Ballyrock CLO 26, Ltd., (Cayman Islands), 3M LIBOR + 6.10%, 11.43%, 07/25/2037 | |

| 950 | | |

| 952 | |

| Benefit Street Partners CLO XIV, Ltd., (Cayman Islands), 3M LIBOR + 6.15%, 10.74%, 10/20/2037 | |

| 2,750 | | |

| 2,764 | |

| Benefit Street Partners CLO XXXIV, Ltd., (Cayman Islands), 3M LIBOR + 6.70%, 11.98%, 07/25/2037 | |

| 500 | | |

| 506 | |

| Benefit Street Partners CLO XXXV, Ltd., (Jersey), 3M LIBOR + 6.10%, 11.43%, 04/25/2037 | |

| 750 | | |

| 762 | |

| Brookhaven Park CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.50%, 11.79%, 04/19/2037 | |

| 500 | | |

| 505 | |

| Canyon Capital CLO, Ltd. 2018-1, (Cayman Islands), 3M LIBOR + 6.01%, 11.31%, 07/15/2031 | |

| 750 | | |

| 726 | |

| Canyon Capital CLO, Ltd. 2019-1, (Cayman Islands), 3M LIBOR + 7.50%, 12.80%, 07/15/2037 | |

| 325 | | |

| 320 | |

| Captree Park CLO, Ltd., (Jersey), 3M LIBOR + 6.00%, 11.33%, 07/20/2037 | |

| 875 | | |

| 891 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Collateralized Loan Obligations 52.5% (d)(e) (continued) | |

| | | |

| | |

| Carlyle US CLO 2024-1, Ltd., 3M LIBOR + 6.92%, 12.21%, 04/15/2037 | |

$ | 548 | | |

$ | 559 | |

| Carlyle US CLO 2024-2, Ltd., (Cayman Islands), 3M LIBOR + 6.85%, 12.17%, 04/25/2037 | |

| 1,000 | | |

| 1,008 | |

| Carlyle US CLO 2024-3, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.70%, 07/25/2036 | |

| 1,600 | | |

| 1,618 | |

| Carlyle US CLO, 2019-3 Ltd., (Cayman Islands), 3M LIBOR + 7.34%, 12.62%, 04/20/2037 | |

| 1,650 | | |

| 1,661 | |

| Carlyle US CLO, 2021 11A Ltd., (Cayman Islands), 3M LIBOR + 6.50%, 11.82%, 07/25/2037 | |

| 500 | | |

| 503 | |

| Carlyle US CLO, 2022-5 Ltd., (Cayman Islands), 3M LIBOR + 7.10%, 12.20%, 10/15/2037 | |

| 2,095 | | |

| 2,101 | |

| Carlyle US CLO, Ltd. 2021-10, (Cayman Islands), 3M LIBOR + 6.76%, 12.04%, 10/20/2034 | |

| 1,000 | | |

| 999 | |

| Cedar Funding CLO II, Ltd., (Cayman Islands), 3M LIBOR + 7.56%, 12.84%, 04/20/2034 | |

| 1,750 | | |

| 1,755 | |

| CIFC Funding Ltd. 2021-1A, (Cayman Islands), 3M LIBOR + 6.00%, 11.34%, 07/25/2037 | |

| 1,150 | | |

| 1,165 | |

| CIFC Funding, Ltd. 2019-4A, (Cayman Islands), 3M LIBOR + 6.86%, 12.16%, 10/15/2034 | |

| 1,500 | | |

| 1,509 | |

| CIFC Funding, Ltd. 2021-VI, (Cayman Islands), 3M LIBOR + 6.51%, 11.81%, 10/15/2034 | |

| 2,000 | | |

| 1,999 | |

| CIFC Funding, Ltd. 2021-VII, (Cayman Islands), 3M LIBOR + 6.61%, 11.89%, 01/23/2035 | |

| 2,406 | | |

| 2,419 | |

| Crestline Denali CLO XIV, Ltd., (Cayman Islands), 3M LIBOR + 6.61%, 11.89%, 10/23/2031 | |

| 2,000 | | |

| 1,961 | |

| Denali Capital CLO XII, Ltd., (Cayman Islands), 3M LIBOR + 6.16%, 11.46%, 04/15/2031 | |

| 2,500 | | |

| 2,425 | |

| Dryden 104 CLO, Ltd., (Cayman Islands), 3M LIBOR + 7.40%, 12.40%, 08/20/2034 | |

| 2,878 | | |

| 2,890 | |

| Dryden 115 CLO, Ltd., (Jersey), 3M LIBOR + 7.10%, 12.40%, 04/18/2037 | |

| 1,000 | | |

| 1,018 | |

| Elmwood CLO 20, Ltd., (Cayman Islands), 3M LIBOR + 6.00%, 11.29%, 01/17/2037 | |

| 2,000 | | |

| 2,016 | |

| Elmwood CLO 28, Ltd., (Cayman Islands), 3M LIBOR + 6.00%, 11.34%, 04/17/2037 | |

| 500 | | |

| 510 | |

| Elmwood CLO I, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.68%, 04/20/2037 | |

| 3,000 | | |

| 3,036 | |

| Elmwood CLO II, Ltd., (Cayman Islands), 3M LIBOR + 7.06%, 12.34%, 04/20/2034 | |

| 1,650 | | |

| 1,665 | |

| Elmwood CLO IV, Ltd., (Cayman Islands), 3M LIBOR + 6.15%, 11.47%, 04/18/2037 | |

| 1,257 | | |

| 1,269 | |

| Elmwood CLO VIII, Ltd., (Cayman Islands), 3M LIBOR + 6.25%, 11.53%, 04/20/2037 | |

| 2,514 | | |

| 2,560 | |

| Flatiron CLO 21 Ltd., (Cayman Islands), 3M LIBOR + 5.90%, 10.99%, 10/19/2037 | |

| 250 | | |

| 253 | |

| Generate Clo 11, Ltd., (Cayman Islands), 3M LIBOR + 7.30%, 12.14%, 10/20/2037 | |

| 1,129 | | |

| 1,135 | |

| Generate CLO 14, Ltd., (Cayman Islands), 3M LIBOR + 6.75%, 12.03%, 04/22/2037 | |

| 500 | | |

| 507 | |

| Generate CLO 16, Ltd., (Cayman Islands), 3M LIBOR + 6.15%, 11.47%, 07/20/2037 | |

| 500 | | |

| 506 | |

| Generate CLO 4, Ltd., (Cayman Islands), 3M LIBOR + 6.90%, 12.18%, 07/20/2037 | |

| 1,200 | | |

| 1,208 | |

| Generate CLO VIII, Ltd., (Cayman Islands), 3M LIBOR + 7.21%, 12.49%, 10/20/2034 | |

| 1,000 | | |

| 1,004 | |

| Golub Capital Partners CLO 60B, Ltd., (Cayman Islands), 3M LIBOR + 6.00%, 11.28%, 10/25/2034 | |

| 1,250 | | |

| 1,235 | |

| Invesco CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.41%, 11.71%, 07/15/2034 | |

| 1,000 | | |

| 978 | |

| KKR CLO 45A Ltd, (Cayman Islands), 3M LIBOR + 7.30%, 12.60%, 04/15/2035 | |

| 1,000 | | |

| 1,007 | |

| KKR CLO 46, Ltd., (Cayman Islands), 3M LIBOR + 7.00%, 12.19%, 10/20/2037 | |

| 250 | | |

| 251 | |

| Madison Park Funding LIX, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.68%, 04/18/2037 | |

| 1,350 | | |

| 1,356 | |

| Madison Park Funding LV, Ltd., (Cayman Islands), 3M LIBOR + 6.00%, 11.28%, 07/18/2037 | |

| 1,000 | | |

| 1,006 | |

| Madison Park Funding LVII, Ltd., (Cayman Islands), 3M LIBOR + 6.70%, 11.80%, 07/27/2034 | |

| 1,185 | | |

| 1,189 | |

| Madison Park Funding LXIX Ltd., (Cayman Islands), 3M LIBOR + 6.25%, 11.58%, 07/25/2037 | |

| 1,000 | | |

| 1,016 | |

| Madison Park Funding XIV, Ltd., (Cayman Islands), 3M LIBOR + 8.03%, 13.31%, 10/22/2030 | |

| 2,500 | | |

| 2,136 | |

| Madison Park Funding XXVIII, Ltd., (Cayman Islands), 3M LIBOR + 7.86%, 13.16%, 07/15/2030 | |

| 1,000 | | |

| 955 | |

| Madison Park Funding XXXI, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.74%, 07/23/2037 | |

| 775 | | |

| 780 | |

| Madison Park Funding XXXII, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.68%, 07/22/2037 | |

| 3,000 | | |

| 3,012 | |

| Madison Park Funding XXXIV Ltd., (Cayman Islands), 3M LIBOR + 6.50%, 11.61%, 10/16/2037 | |

| 850 | | |

| 855 | |

| Madison Park Funding XXXV, Ltd., (Cayman Islands), 3M LIBOR + 6.36%, 11.64%, 04/20/2032 | |

| 1,500 | | |

| 1,508 | |

| Madison Park Funding XXXVI, Ltd., (Cayman Islands), 3M LIBOR + 7.05%, 12.35%, 04/15/2035 | |

| 1,000 | | |

| 1,006 | |

| Madison Park Funding XXXVII, Ltd., (Cayman Islands), 3M LIBOR + 6.60%, 11.90%, 04/15/2037 | |

| 500 | | |

| 502 | |

| Magnetite XIX, Ltd., (Cayman Islands), 3M LIBOR + 6.66%, 11.95%, 04/17/2034 | |

| 2,000 | | |

| 2,007 | |

| Magnetite XXIV, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 11.70%, 04/15/2035 | |

| 2,750 | | |

| 2,760 | |

| Magnetite XXIX, Ltd., (Cayman Islands), 3M LIBOR + 6.00%, 11.24%, 07/15/2037 | |

| 250 | | |

| 252 | |

| Northwoods Capital XII-B, Ltd., (Cayman Islands), 3M LIBOR + 6.05%, 11.00%, 06/15/2031 | |

| 2,000 | | |

| 1,852 | |

| Oak Hill Credit Partners X-R, Ltd., (Cayman Islands), 3M LIBOR + 6.51%, 11.79%, 04/20/2034 | |

| 1,500 | | |

| 1,512 | |

| Octagon Investment Partners 49, Ltd., (Cayman Islands), 3M LIBOR + 7.33%, 12.63%, 04/15/2037 | |

| 1,000 | | |

| 1,005 | |

| OHA Credit Funding 12, Ltd. 2022-12, (Bermuda), 3M LIBOR + 8.00%, 13.28%, 07/20/2036 | |

| 1,975 | | |

| 2,041 | |

| OHA Credit Funding 3, Ltd., (Cayman Islands), 3M LIBOR + 6.51%, 11.79%, 07/02/2035 | |

| 1,000 | | |

| 1,008 | |

| OHA Credit Funding 4, Ltd., (Cayman Islands), 3M LIBOR + 6.66%, 11.94%, 10/22/2036 | |

| 1,000 | | |

| 1,009 | |

| OHA Credit Partners VII, Ltd., (Cayman Islands), 3M LIBOR + 6.51%, 11.64%, 02/20/2034 | |

| 3,000 | | |

| 3,029 | |

| OHA Credit Partners XIII, Ltd., (Cayman Islands), 3M LIBOR + 5.75%, 10.83%, 10/21/2037 | |

| 610 | | |

| 613 | |

| OHA Loan Funding 2013-1, Ltd., (Cayman Islands), 3M LIBOR + 5.90%, 11.22%, 04/23/2037 | |

| 1,500 | | |

| 1,518 | |

| RR 6, Ltd., (Cayman Islands), 3M LIBOR + 6.11%, 11.41%, 04/15/2036 | |

| 900 | | |

| 871 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Collateralized Loan Obligations 52.5% (d)(e) (continued) | |

| | | |

| | |

| Sixth Street CLO XX, Ltd, (Cayman Islands), 3M LIBOR + 6.41%, 11.69%, 10/20/2034 | |

$ | 1,500 | | |

$ | 1,509 | |

| Sound Point CLO XXVI, Ltd., (Cayman Islands), 3M LIBOR + 7.12%, 12.40%, 07/20/2034 | |

| 1,000 | | |

| 940 | |

| Symphony CLO 36, Ltd., (Bermuda), 3M LIBOR + 7.00%, 11.64%, 10/24/2037 | |

| 560 | | |

| 563 | |

| Tallman Park CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.61%, 11.89%, 04/20/2034 | |

| 2,000 | | |

| 2,006 | |

| TCI-Flatiron CLO, Ltd. 2018-1, (Cayman Islands), 3M LIBOR + 6.41%, 11.68%, 01/29/2032 | |

| 3,000 | | |

| 3,013 | |

| TICP CLO VI, Ltd. 2016-2, (Cayman Islands), 3M LIBOR + 6.51%, 11.81%, 01/15/2034 | |

| 2,250 | | |

| 2,256 | |

| TICP CLO XIII, Ltd., (Cayman Islands), 3M LIBOR + 6.46%, 11.76%, 04/15/2034 | |

| 1,250 | | |

| 1,258 | |

| Trimaran Cavu 2021-1, Ltd., (Cayman Islands), 3M LIBOR + 7.00%, 12.28%, 07/23/2037 | |

| 625 | | |

| 624 | |

| Voya CLO, Ltd. 2013-3, (Cayman Islands), 3M LIBOR + 6.16%, 11.44%, 10/18/2031 | |

| 2,750 | | |

| 2,711 | |

| | |

| | | |

| 113,756 | |

| Collateralized Loan Obligations - Equity 19.1% | |

| | | |

| | |

| Investment Funds and Vehicles 19.1% | |

| | | |

| | |

| AIMCO CLO XI, Ltd., (Cayman Islands), 21.58%, 10/17/2034 (h) | |

| 2,180 | | |

| 1,945 | |

| AIMCO CLO XVI, Ltd., (Cayman Islands), 16.13%, 07/17/2037 | |

| 1,208 | | |

| 986 | |

| AIMCO CLO XX, Ltd., (Jersey), 14.37%, 10/16/2036 | |

| 1,588 | | |

| 1,371 | |

| AIMCO CLO XXII, Ltd., (Jersey), 15.31%, 04/19/2037 | |

| 410 | | |

| 398 | |

| Allegro CLO V, Ltd., (Cayman Islands), 10/16/2030 | |

| 2,000 | | |

| 26 | |

| Atrium XIV, LLC, (Cayman Islands), 25.05%, 10/16/2037 | |

| 6,744 | | |

| 3,779 | |

| Bain Capital Credit CLO 2024-2, Ltd., (Cayman Islands), 15.57%, 07/15/2037 | |

| 960 | | |

| 884 | |

| Bain Capital Credit CLO, Ltd. 2020-2, (Cayman Islands), 48.10%, 07/19/2034 | |

| 1,250 | | |

| 585 | |

| Bain Capital Credit CLO, Ltd. 2022-1, (Cayman Islands), 15.09%, 04/18/2035 | |

| 1,500 | | |

| 800 | |

| Blueberry Park CLO, Ltd., (Cayman Islands), 10/20/2037 (h) | |

| 3,680 | | |

| 1,626 | |

| Carlyle Global Market Strategies CLO, Ltd. 2018-3, (Cayman Islands), 10/15/2030 | |

| 3,223 | | |

| 1,051 | |

| Carlyle US CLO 2024-3, Ltd., (Cayman Islands), 07/25/2036 | |

| 2,250 | | |

| 2,021 | |

| Carlyle US CLO 2024-5, Ltd., (Cayman Islands), 10/25/2036 (h) | |

| 1,580 | | |

| 1,410 | |

| CIFC Funding 2024-III, Ltd., (Cayman Islands), 14.52%, 07/21/2037 | |

| 400 | | |

| 390 | |

| CIFC Funding 2024-IV, Ltd., (Cayman Islands), 10/16/2037 (h) | |

| 1,830 | | |

| 1,714 | |

| CIFC Funding, Ltd. 2020-3A, (Cayman Islands), 21.25%, 10/20/2034 | |

| 1,750 | | |

| 1,339 | |

| CIFC Funding, Ltd. 2021-5A, (Cayman Islands), 15.86%, 07/15/2034 | |

| 2,250 | | |

| 1,481 | |

| Dryden 98 CLO, Ltd., (Cayman Islands), 15.69%, 04/20/2035 | |

| 1,100 | | |

| 687 | |

| Elmwood CLO 26, Ltd., (Cayman Islands), 13.35%, 04/18/2037 | |

| 500 | | |

| 424 | |

| Elmwood CLO 32, Ltd., (Cayman Islands), 10/18/2037 | |

| 1,770 | | |

| 1,629 | |

| Elmwood CLO XI, Ltd., (Cayman Islands), 18.06%, 10/20/2034 | |

| 1,200 | | |

| 1,056 | |

| Invesco CLO 2021-3, Ltd., (Cayman Islands), 10/22/2034 | |

| 113 | | |

| 29 | |

| Invesco CLO 2021-3, Ltd., (Cayman Islands), 14.66%, 10/22/2034 | |

| 1,130 | | |

| 573 | |

| KKR CLO 50 Ltd, (Cayman Islands), 12.31%, 04/20/2037 | |

| 1,151 | | |

| 950 | |

| LCM XV, LP, (Cayman Islands), 07/20/2030 | |

| 5,875 | | |

| 296 | |

| Madison Park Funding LIII, Ltd., (Cayman Islands), 12.74%, 04/21/2035 | |

| 2,188 | | |

| 1,545 | |

| Madison Park Funding LIX, Ltd., (Cayman Islands), 11.97%, 04/18/2037 | |

| 2,762 | | |

| 2,112 | |

| Madison Park Funding LXVII, Ltd., (Cayman Islands), 11.27%, 04/25/2037 | |

| 250 | | |

| 246 | |

| Madison Park Funding XII, Ltd., (Cayman Islands), 07/20/2026 | |

| 4,000 | | |

| 8 | |

| Madison Park Funding XXII, Ltd., (Cayman Islands), 16.57%, 01/15/2033 | |

| 4,500 | | |

| 2,389 | |

| Madison Park Funding XXXI, Ltd., (Cayman Islands), 14.78%, 07/23/2037 | |

| 2,000 | | |

| 1,183 | |

| Madison Park Funding XXXII, Ltd., (Cayman Islands), 20.36%, 01/22/2048 | |

| 2,472 | | |

| 1,632 | |

| Madison Park Funding, Ltd., (Cayman Islands), 11.84%, 04/21/2035 | |

| 1,500 | | |

| 1,180 | |

| Magnetite XLIV Ltd., 10/15/2037 (h) | |

| 2,400 | | |

| 2,160 | |

| Magnetite XXVIII, Ltd., (Cayman Islands), 21.69%, 01/20/2035 | |

| 2,500 | | |

| 1,890 | |

| Magnetite XXXVIII, Ltd., 10.41%, 04/15/2037 | |

| 250 | | |

| 224 | |

| Oaktree CLO, Ltd. 2015-1, (Cayman Islands), 10/20/2027 | |

| 4,000 | | |

| 87 | |

| OCP CLO 2024-34, Ltd., 10/15/2037 | |

| 450 | | |

| 392 | |

| OHA Credit Funding 1, Ltd., (Cayman Islands), 11.36%, 04/20/2037 | |

| 5,700 | | |

| 4,823 | |

| OHA Credit Partners VII, Ltd., (Cayman Islands), 16.09%, 02/20/2034 | |

| 2,672 | | |

| 1,496 | |

| OHA Credit Partners XI, Ltd., (Cayman Islands), 11.40%, 04/20/2037 | |

| 400 | | |

| 275 | |

| OHA Credit Partners XIV, Ltd., (Cayman Islands), 07/21/2037 | |

| 380 | | |

| 317 | |

| OHA Credit Partners XVI, (Cayman Islands), 19.84%, 10/18/2034 | |

| 1,675 | | |

| 1,344 | |

| OHA Loan Funding, Ltd. 2016-1, (Cayman Islands), 12.44%, 07/20/2037 | |

| 3,613 | | |

| 2,828 | |

| RR 19, Ltd., (Cayman Islands), 15.88%, 10/15/2035 | |

| 2,350 | | |

| 1,783 | |

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

(in thousands, except shares, percentages

and as otherwise noted)

| | |

Principal

Amount (a) | | |

Value (a) | |

| Collateralized Loan Obligations 52.5% (d)(e) (continued) | |

| | | |

| | |

| RRX 7 Ltd. 2022-7, (Cayman Islands), 11.43%, 07/15/2122 | |

$ | 3,875 | | |

$ | 2,507 | |

| Signal Peak CLO VIII, Ltd., (Cayman Islands), 10.55%, 04/20/2033 | |

| 4,000 | | |

| 2,172 | |

| Signal Peak CLO XI Ltd., (Cayman Islands), 07/18/2037 | |

| 1,750 | | |

| 1,608 | |

| Voya CLO 2024-1, Ltd., (Cayman Islands), 13.88%, 04/15/2037 | |

| 2,142 | | |

| 1,952 | |

| Wellman Park CLO, Ltd., (Cayman Islands), 07/15/2034 | |

| 6,070 | | |

| 163 | |

| Wellman Park CLO, Ltd., (Cayman Islands), 16.28%, 07/20/2037 | |

| 2,500 | | |

| 1,881 | |

| West CLO, Ltd. 2013-1, (Cayman Islands), 11/07/2025 | |

| 500 | | |

| — | |

| | |

| | | |

| 65,647 | |

| Total Collateralized Loan Obligations (Cost: $185,049) | |

| | | |

| 179,403 | |

Total Investments - 163.3%

(Cost: $561,215) | |

| | | |

$ | 557,909 | |

| Liabilities in Excess of Other Assets - (63.3%) | |

| | | |

| (216,343 | ) |

| Net Assets - 100.0% | |

| | | |

$ | 341,566 | |

| Footnotes: |

| (a) |

Investment holdings in foreign currencies are converted to U.S. Dollars using period end spot rates. Investments are in United States enterprises and all principal balances shown are in U.S. Dollars unless otherwise noted. |

| (b) |

Variable rate loans bear interest at a rate that may be determined by reference to the Secured Overnight Financing Rate ("SOFR"), the London Interbank Offered Rate ("LIBOR"), Euro InterBank Offered Rate ("EURIBOR"), the U.S. Prime Rate ("PRIME"), or an alternate base rate (commonly based on the Federal Funds Rate or the Prime Rate), at the borrower's option, which reset annually, semi-annually, quarterly, bi-monthly, monthly or daily. SOFR based contracts may include a credit spread adjustment that is charged in addition to the base rate and the stated spread. For each such loan, Ares Dynamic Credit Allocation Fund, Inc. (the "Fund") has provided the interest rate in effect on the date presented. |

| (c) |

Variable rate coupon rate shown as of September 30, 2024. |

| (d) |

Senior Loans, Collateralized Loan Obligations and Corporate Bonds exempt from registration under Rule 144A, which as of September 30, 2024 represented 146.2% of the Fund's net assets or 89.5% of the Fund's total assets, are subject to legal restrictions on sales. |

| (e) |

Investments whose values were determined using significant unobservable inputs (Level 3) (See Note 3 of the Notes to Schedule of Investments). |

| (f) |

This loan or a portion of this loan represents an unsettled loan purchase. The interest rate will be determined at the time of settlement and will be based upon a spread plus the applicable reference rate determined at the time of purchase. |

| (g) |

As of September 30, 2024, the Fund had entered into the following commitment to fund a revolving senior secured loan. Such commitment is subject to the satisfaction of certain conditions set forth in the documents governing this loan and there can be no assurance that such conditions will be satisfied. See Note 2 of the Notes to Schedule of Investments for further information on revolving loan commitments |

| Unfunded Issuer |

|

Total Revolving

commitments |

|

|

Less: drawn

commitments |

|

|

Total undrawn

commitments |

|

| Ivanti Software, Inc. |

|

$ |

250 |

|

|

$ |

(109 |

) |

|

$ |

141 |

|

| (h) |

When-Issued or delayed delivery security based on typical market settlement convention for such security. |

| |

|

| |

As of September 30, 2024, the aggregate cost of securities for Federal income tax purposes was $561,219. Unrealized appreciation and depreciation on investments for Federal income tax purposes are as follows: |

| Gross unrealized appreciation | |

$ | 9,273 | |

| Gross unrealized depreciation | |

| (12,583 | ) |

| Net unrealized depreciation | |

$ | (3,310 | ) |

| Currencies: |

| £ |

British Pounds |

| € |

Euro Currency |

| $ |

U.S. Dollars |

| |

|

| Abbreviations: |

| 144A |

Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid. |

| CLO |

Collateralized Loan Obligation |

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

(1) Organization

Ares Dynamic Credit Allocation Fund, Inc. (NYSE:

ARDC) ("ARDC" or the "Fund") is a corporation incorporated under the laws of the State of Maryland and registered

with the U.S. Securities and Exchange Commission (the "SEC") under the Investment Company Act of 1940, as amended (the "Investment

Company Act"), as a closed-end, diversified, management investment company, and intends to qualify each year to be treated as a Regulated

Investment Company ("RIC"), under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund commenced operations

on November 27, 2012.

The Fund’s investment objective is to seek an attractive risk

adjusted level of total return, primarily through current income and, secondarily, through capital appreciation. The Fund seeks to achieve

its investment objective by investing primarily in a broad, dynamically managed portfolio of (i) senior secured loans ("Senior

Loans") made primarily to companies whose debt is rated below investment grade, (ii) corporate bonds ("Corporate Bonds")

that are primarily high yield issues rated below investment grade, (iii) other fixed-income instruments of a similar nature that

may be represented by derivatives, and (iv) securities issued by entities commonly referred to as collateralized loan obligations

("CLOs") and other asset-backed securities. Debt instruments that are rated below investment grade are often referred to as

"high yield" securities or "junk bonds." The Fund’s investments in CLOs may include investments in subordinated

tranches of CLO securities. The Adviser (as defined below) will dynamically allocate the Fund’s portfolio among investments in the

various targeted credit markets, to seek to manage interest rate and credit risk and the duration of the Fund’s portfolio. Under

normal market conditions, the Fund will not invest more than (i) 45% of its Managed Assets (as defined below) in CLOs and other asset-backed

securities, or (ii) 15% of its Managed Assets in subordinated (or residual) tranches of CLO securities. "Managed Assets"

means the total assets of the Fund (including any assets attributable to any preferred shares that may be issued or to indebtedness) minus

the Fund’s liabilities other than liabilities relating to indebtedness.

The

Fund is externally managed by Ares Capital Management II LLC (the "Adviser") pursuant to an investment advisory and management

agreement. The Adviser was registered as an investment adviser with the SEC under the Investment Advisers Act of 1940 on June 9,

2011 and serves as the investment adviser to the Fund. The Adviser oversees the management of the Fund's activities and is responsible

for making investment decisions for the Fund's portfolio. Ares Operations LLC, a subsidiary of Ares Management Corporation, provides certain

administrative and other services necessary for the Fund to operate.

(2) Significant Accounting Policies

Basis of Presentation

The accompanying schedule of investments has been prepared on the accrual

basis of accounting in conformity with U.S. generally accepted accounting principles ("GAAP"), and includes the accounts of

the Fund. The Fund is an investment company following accounting and reporting guidance in Accounting Standards Codification ("ASC")

Topic 946, Financial Services — Investment Companies.

Cash

and Cash Equivalents

Cash and cash equivalents include funds from time to time deposited

with financial institutions. Cash and cash equivalents are carried at cost, which approximates fair value.

Concentration of Credit Risk

The Fund places its cash and cash equivalents with financial institutions

and, at times, cash held in depository or money market accounts may exceed the Federal Deposit Insurance Corporation insured limit.

Investment Transactions

Investment

transactions are accounted for on the trade date. Realized gains and losses are reported on the

specific identification method without regard to unrealized gains or losses previously recognized, and include investments

charged off during the period, net of recoveries. Unrealized gains or losses primarily reflect the change in investment values,

including the reversal of previously recorded unrealized gains or losses when gains or losses are realized.

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments (continued)

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

Pursuant to Rule 2a-5 under the Investment Company Act, the Fund's

board of directors (the "Board") designated the Fund's Adviser as the Fund's valuation designee (the “Valuation Designee”)

to perform the fair value determinations for investments held by the Fund without readily available market quotations, subject to the

oversight of the Board. All investments are recorded at their fair value. See Note 3 for more information on the Fund's valuation process.

Interest Income Recognition

Interest

income is recorded on an accrual basis and includes the accretion of discounts, amortization of premiums and payment-in-kind ("PIK")

interest. Discounts from and premiums to par value on investments purchased are accreted/amortized into interest income over the

life of the respective security using the effective yield method. To the extent loans contain PIK provisions,

PIK interest, computed at the contractual rate specified in each applicable agreement, is accrued and recorded as interest income

and added to the principal balance of the loan. PIK interest income added to the principal balance is

generally collected upon repayment of the outstanding principal. To maintain the Fund's tax treatment as a RIC, this non-cash source of

income must be paid out to shareholders in the form of dividends for the year the income was earned, even though the Fund has not yet

collected the cash. The amortized cost of investments represents the original cost adjusted for any accretion of discounts, amortization

of premiums and PIK interest.

Loans are generally placed on non-accrual status when principal or

interest payments are past due 30 days or more or when there is reasonable doubt that principal or interest will be collected in full.

Accrued and unpaid interest is generally reversed when a loan is placed on non-accrual status. Interest payments received on non-accrual

loans may be recognized as income or applied to principal depending upon the Fund’s judgment regarding collectability. Non-accrual

loans are restored to accrual status when past due principal and interest are paid or there is no longer any reasonable doubt that such

principal or interest will be collected in full and, in the Fund's judgment, are likely to remain current. The Fund may make exceptions

to this policy if the loan has sufficient collateral value (i.e., typically measured as enterprise value of the portfolio company) or

is in the process of collection.

CLO equity investments recognize investment income by utilizing an

effective interest methodology based upon an effective yield to maturity utilizing projected cash flows, as required by ASC Topic 325-40,

Beneficial Interest in Securitized Financial Assets.

Foreign Currency Transactions

Amounts denominated in foreign currencies are translated

into U.S. dollars on the following basis: (i) investments and other assets and liabilities denominated in foreign currencies are

translated into U.S. dollars based upon currency exchange rates effective on the date of valuation; and (ii) purchases and sales

of investments and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon currency exchange

rates prevailing on transaction dates.

The Fund does not isolate that portion of the results

of operations resulting from the changes in foreign exchange rates on investments from fluctuations arising from changes in market prices

of securities held. Such fluctuations are included within the “net realized and unrealized gain (loss) on investments” in

the statement of operations.

Reported net realized foreign exchange gains or losses

arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates of securities transactions,

and the difference between the amounts of income and expense items recorded on the Fund's books and the U.S. dollar equivalent of the

amounts actually received or paid. Net unrealized foreign currency gains and losses arise from the changes in fair values of assets and

liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Investments in foreign companies and securities of

foreign governments may involve special risks and considerations not typically associated with investing in U.S. companies and securities

of the U.S. government. These risks include, among other things, revaluation of currencies, less reliable information about issuers, different

transaction clearance and settlement practices, and potential future adverse political and economic developments. Moreover, investments

in foreign companies and securities of foreign governments and their markets may be less liquid and their prices more volatile than those

of comparable U.S. companies and the U.S. government.

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments (continued)

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

Commitments and Contingencies

In the normal course of business, the Fund's investment activities

involve executions, settlement and financing of various transactions resulting in receivables from, and payables to, brokers, dealers

and the Fund's custodian. These activities may expose the Fund to risk in the event that such parties are unable to fulfill contractual

obligations. Management does not anticipate any material losses from counterparties with whom it conducts business. Consistent with standard

business practice, the Fund enters into contracts that contain a variety of indemnifications, and is engaged from time to time in various

legal actions. The maximum exposure of the Fund under these arrangements and activities is unknown. However, the Fund expects the risk

of material loss to be remote.

Commitments to extend credit include loan proceeds the Fund is obligated

to advance, such as delayed draws or revolving credit arrangements. Commitments generally have fixed expiration dates or other termination

clauses. Unrealized gains or losses associated with unfunded commitments are recorded in the financial statements and reflected as an

adjustment to the fair value of the related security in the Schedule of Investments. The par amount of the unfunded commitments is not

recognized by the Fund until it becomes funded.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with GAAP requires

the Adviser to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results

could differ from those estimates and such differences may be material.

(3) Fair

Value of Financial Instruments

The Fund follows ASC 825-10, Recognition and Measurement of Financial

Assets and Financial Liabilities ("ASC 825-10"), which provides companies the option to report selected financial assets

and liabilities at fair value. ASC 825-10 also establishes presentation and disclosure requirements designed to facilitate comparisons

between companies that choose different measurement attributes for similar types of assets and liabilities and a better understanding

of the effect of the company's choice to use fair value on its earnings. ASC 825-10 also requires entities to display the fair value of

the selected assets and liabilities on the face of the balance sheet. The Fund has not elected the ASC 825-10 option to report selected

financial assets and liabilities at fair value. With the exception of the line items entitled "other assets", "mandatory

redeemable preferred shares", and "debt," which are reported at amortized cost, the carrying value of all other assets

and liabilities approximate fair value.

The Fund also follows ASC 820-10, Fair Value Measurements and Disclosures

("ASC 820-10"), which expands the application of fair value accounting. ASC 820-10 defines fair value, establishes a framework

for measuring fair value in accordance with GAAP and expands disclosure of fair value measurements. ASC 820-10 determines fair value to

be the price that would be received for an investment in a current sale, which assumes an orderly transaction between market participants

on the measurement date. ASC 820-10 requires the Fund to assume that the portfolio investment is sold in its principal market to market

participants or, in the absence of a principal market, the most advantageous market, which may be a hypothetical market. Market participants

are defined as buyers and sellers in the principal or most advantageous market that are independent, knowledgeable, and willing and able

to transact. In accordance with ASC 820-10, the Fund has considered its principal market as the market in which the Fund exits its portfolio

investments with the greatest volume and level of activity. ASC 820-10 specifies a hierarchy of valuation techniques based on whether

the inputs to those valuation techniques are observable or unobservable. In accordance with ASC 820-10, these inputs are summarized in

the three broad levels listed below:

· Level 1 — Valuations based on quoted prices

in active markets for identical assets or liabilities that the Fund has the ability to access.

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments (continued)

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

· Level 2 — Valuations based on quoted prices

in markets that are not active or for which all significant inputs are observable either directly or indirectly.

· Level 3 — Valuations based on inputs that

are unobservable and significant to the overall fair value measurement.

In addition to using the above inputs in investment valuations, the

Valuation Designee continues to employ the net asset valuation policy and procedures that have been reviewed by the Board in connection

with their designation of the Adviser as the Fund’s valuation designee and are consistent with the provisions of Rule 2a-5

under the Investment Company Act and ASC 820-10 (see Note 2 for more information). Consistent with its valuation policies and procedures,

the Valuation Designee evaluates the source of inputs, including any markets in which the Fund's investments are trading (or any markets

in which securities with similar attributes are trading), in determining fair value. For investments where there is not a readily available

market value, the fair value of these investments must typically be determined using unobservable inputs.

The investments classified as Level 1 or Level 2 are

typically valued based on quoted market prices, forward foreign exchange rates, dealer quotations or alternative pricing sources supported

by observable inputs. The Valuation Designee obtains prices from independent pricing services which generally utilize broker quotes and

may use various other pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type

of issue, trading characteristics and other data. The Valuation Designee is responsible for all inputs and assumptions related to the

pricing of securities. The Valuation Designee has internal controls in place that support its reliance on information received from third-party

pricing sources. As part of its internal controls, the Valuation Designee obtains, reviews, and tests information to corroborate prices

received from third-party pricing sources. For any security, if market or dealer quotations are not readily available, or if the Valuation

Designee determines that a quotation of a security does not represent a fair value, then the security is valued at a fair value as determined

in good faith by the Valuation Designee, subject to the oversight of the Board and will be classified as Level 3. In such instances, the

Valuation Designee will use valuation techniques consistent with the market or income approach to measure fair value and will give consideration

to all factors which might reasonably affect the fair value.

Senior

loans and corporate debt: The fair value of Senior Loans and Corporate Bonds is estimated based on quoted market prices, forward

foreign exchange rates, dealer quotations or alternative pricing sources supported by observable inputs and are generally classified within

Level 2 or 3. The Valuation Designee obtains prices from independent pricing services which generally

utilize broker quotes and may use various other pricing techniques which take into account appropriate factors such as yield, quality,

coupon rate, maturity, type of issue, trading characteristics and other data. If the pricing services are only able to obtain a single

broker quote or utilize a pricing model the securities will be classified as Level 3. If the pricing services are unable to provide prices,

the Valuation Designee will attempt to obtain one or more broker quotes directly from a dealer and

price such securities at the last bid price obtained; such securities are classified as Level 3.

Collateralized

loan obligations: The fair value of CLOs is estimated based on various valuation models from third-party pricing services.

The provided prices are checked using internally developed models. The valuation models generally utilize discounted cash flows and take

into consideration prepayment and loss assumptions, based on historical experience and projected performance, economic factors, the characteristics

and condition of the underlying collateral, comparable yields for similar securities and recent trading activity. These securities are

classified as Level 3.

Common

stock and warrants: The fair value of common stock and warrants are estimated using either broker quotes or an analysis of

the enterprise value ("EV") of the portfolio company. EV means the entire value of the portfolio company to a market participant,

including the sum of the values of debt and equity securities used to capitalize the enterprise at a point in time. The primary method

for determining EV uses a multiple analysis whereby appropriate multiples are applied to the portfolio company's EBITDA (generally defined

as net income before net interest expense, income tax expense, depreciation and amortization). EBITDA multiples are typically determined

based upon review of market comparable transactions and publicly traded comparable companies, if any. The Valuation

Designee may also employ other valuation multiples to determine EV, such as revenues. The second method for determining EV uses

a discounted cash flow analysis whereby future expected cash flows of the portfolio company are discounted to determine a present value

using estimated discount rates (typically a weighted average cost of capital based on costs of debt and equity consistent with current

market conditions). The EV analysis is performed to determine the value of equity investments, the value of debt investments in portfolio

companies where the Fund has control or could gain control through an option or warrant security, and to determine if there is credit

impairment for debt investments. If debt investments are credit impaired, an EV analysis may be used to value such debt investments; however,

in addition to the methods outlined above, other methods such as a liquidation or wind down analysis may be utilized to estimate EV.

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments (continued)

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

The following table is a summary of inputs used

as of September 30, 2024 in valuing the Fund's investments carried at fair value:

| | |

Level 1 -

Quoted

Prices ($) | | |

Level 2 -

Other

Significant

Observable

Inputs ($) | | |

Level 3 -

Significant

Unobservable

Inputs ($) | | |

Total ($) | |

| Senior Loans | |

| — | | |

| 197,165 | | |

| 13,489 | | |

| 210,654 | |

| Corporate Bonds | |

| — | | |

| 167,852 | | |

| — | | |

| 167,852 | |

| Collateralized Loan Obligations | |

| — | | |

| — | | |

| 179,403 | | |

| 179,403 | |

| Total Investments | |

| — | | |

| 365,017 | | |

| 192,892 | | |

| 557,909 | |

The following table is a reconciliation of the Fund’s investments

in which significant unobservable inputs (Level 3) were used in determining fair value for the nine months ended September 30, 2024:

| | |

Senior Loans ($) | | |

Collateralized

Loan Obligations ($) | | |

Total ($) | |

| Balance as of December 31, 2023 | |

| 12,181 | | |

| 154,507 | | |

| 166,688 | |

| Purchases | |

| 12,894 | | |

| 84,655 | | |

| 97,549 | |

| Sales and principal redemptions | |

| (11,882 | ) | |

| (63,610 | ) | |

| (75,492 | ) |

| Net realized and unrealized gains | |

| 280 | | |

| 3,626 | | |

| 3,906 | |

| Accrued discounts | |

| 16 | | |

| 225 | | |

| 241 | |

| Balance as of September 30, 2024 | |

| 13,489 | | |

| 179,403 | | |

| 192,892 | |

| Net change in unrealized gains/(losses) from investments held at September 30, 2024 | |

| 279 | | |

| 10,323 | | |

| 10,602 | |

Investments were transferred out of Level 3 during the nine months

ended September 30, 2024. Transfers between Levels 2 and 3 were as a result of changes in the observability of significant inputs

or available market data for certain portfolio companies.

The following table summarizes the significant unobservable inputs

the Valuation Designee used to value the majority of the Fund's investments categorized within Level 3 as of September 30,

2024. The table is not intended to be all-inclusive, but instead to capture the significant unobservable inputs relevant to the

Valuation Designee's determination of fair values.

| | |

| | |

| |

Unobservable Input |

| Asset Category | |

Fair Value ($) | | |

Valuation Technique | |

Input | |

Range | |

Weighted

Average(a) |

| Senior Loans | |

| 13,419 | | |

Broker Quotes and/or 3rd Party Pricing Services | |

N/A | |

N/A | |

N/A |

| Senior Loans | |

| 70 | | |

Yield Analysis | |

Market Yield | |

15.4% | |

15.4% |

| Collateralized Loan Obligations | |

| 175,833 | | |

Broker Quotes and/or 3rd Party Pricing Services | |

N/A | |

N/A | |

N/A |

| Collateralized Loan Obligations | |

| 3,570 | | |

Transaction Cost | |

N/A | |

N/A | |

N/A |

| Total Level 3 Investments | |

| 192,892 | | |

| |

| |

| |

|

(a) Unobservable inputs were weighted by the relative fair value

of investments.

Changes in market yields may change the fair value of certain of the

Fund’s investments. Generally, an increase in market yields may result in a decrease in the fair value of certain of the Fund’s

investments.

Ares

Dynamic Credit Allocation Fund, Inc.

Notes

to Schedule of Investments (continued)

September 30,

2024 (Unaudited)

(in thousands,

except percentages and as otherwise noted)

Due to the inherent uncertainty of determining the fair value of investments

that do not have a readily available market value, the fair value of the investments may fluctuate from period to period. Additionally,

the fair value of the investments may differ significantly from the values that would have been used had a ready market existed for such

investments and may differ materially from the values

that the Fund may ultimately realize. Further, such investments are

generally subject to legal and other restrictions on resale or otherwise are less liquid than publicly traded securities. If the Fund

was required to liquidate a portfolio investment in a forced or liquidation sale, it could realize significantly less than the value at

which the Fund has recorded it.

In addition, changes in the market environment and other events that

may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different than

the unrealized gains or losses reflected in the valuations currently assigned.

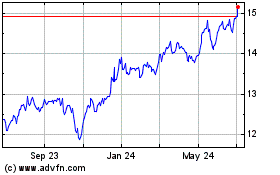

Ares Dynamic Credit Allo... (NYSE:ARDC)

Historical Stock Chart

From Dec 2024 to Jan 2025

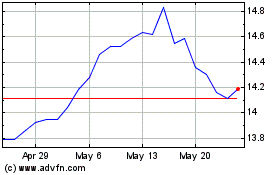

Ares Dynamic Credit Allo... (NYSE:ARDC)

Historical Stock Chart

From Jan 2024 to Jan 2025