Barnes Group Inc. (NYSE: B) (“Barnes” or “the Company”), a

global provider of highly engineered products, differentiated

industrial technologies and innovative solutions, today announced

that its shareholders voted to approve the Company’s previously

announced acquisition by funds managed by affiliates of Apollo

Global Management, Inc. (NYSE: APO) (“Apollo”) (the “Apollo Funds”)

at the Company’s Special Meeting of Shareholders (the “Special

Meeting”). Under the terms of the merger agreement, subject to the

completion of the transaction, Barnes stockholders will receive

$47.50 per share in cash for every share of Barnes common stock

they own immediately prior to the effective time of the merger.

Approximately 99% of the total shares voted at the Special

Meeting were voted in favor of the transaction, which represented

approximately 80% of the total outstanding shares of Barnes common

stock as of December 6, 2024, the record date for the Special

Meeting.

“We are pleased with the support of our shareholders for our

transaction with Apollo Funds,” said Thomas Hook, CEO of Barnes.

“In partnership with Apollo, we look forward to accelerating our

transformation strategy, enhancing our capabilities, creating new

opportunities for innovation investment, and better meeting the

diverse and evolving needs of our customers for aerospace and

industrial products, systems and solutions.”

The transaction is expected to close before the end of Q1 2025,

subject to customary closing conditions, including receipt of

required regulatory approvals.

Barnes will file the final voting results, as certified by an

independent Inspector of Election, on a Form 8-K with the U.S.

Securities and Exchange Commission.

Advisors

Goldman Sachs & Co. LLC and Jefferies LLC are serving as

financial advisors and Wachtell, Lipton, Rosen & Katz is

serving as legal counsel to Barnes. Latham & Watkins LLP and

Paul, Weiss, Rifkind, Wharton & Garrison LLP are serving as

legal counsel to Apollo Funds.

Forward-Looking Statements

This release contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements often contain words such as

“anticipate,” “believe,” “expect,” “plan,” “estimate,” “project,”

“continue,” “will,” “should,” “may,” and similar terms. These

forward-looking statements do not constitute guarantees of future

performance and are subject to a variety of risks and uncertainties

that may cause actual results to differ materially from any future

results expressed or implied by the forward-looking statements. In

addition, we have based some of these forward-looking statements on

assumptions about future events that may prove to be inaccurate.

Such factors, risks and uncertainties include: (1) the occurrence

of any event, change or other circumstances that could give rise to

the termination of the merger agreement between the parties to the

proposed transaction or extend the anticipated timetable for

completion of the proposed transaction; (2) the failure to obtain

certain required regulatory approvals or the failure to satisfy any

of the other closing conditions to the completion of the proposed

transaction within the expected timeframes or at all; (3) risks

related to disruption of management’s attention from Barnes’

ongoing business operations due to the proposed transaction; (4)

the effect of the announcement of the proposed transaction on the

ability of Barnes to retain and hire key personnel and maintain

relationships with its customers, suppliers and others with whom it

does business, or on its operating results and business generally;

(5) the ability of Barnes to meet expectations regarding the timing

and completion of the transaction; (6) the impacts resulting from

the conflict in Ukraine, the Middle East or any other geopolitical

tensions; and (7) the impacts of any pandemics, epidemics or

infectious disease outbreaks.

For additional information and detailed discussion of these

risks, uncertainties, and other potential factors that could affect

our business and performance and cause actual results or outcomes

to differ materially from the results, performance or achievements

addressed in our forward-looking statements is included in our

other filings with the SEC, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of our most recently filed periodic

reports on Form 10-K and Form 10-Q and subsequent filings. Barnes

assumes no obligation to update its forward-looking statements,

which speak as of their respective dates, whether as a result of

new information, future events, or otherwise.

About BARNES

Barnes Group Inc. (NYSE: B) leverages world-class manufacturing

capabilities and market-leading engineering to develop advanced

processes, automation solutions, and applied technologies for

industries ranging from aerospace and medical & personal care

to mobility and packaging. With a celebrated legacy of pioneering

excellence, Barnes delivers exceptional value to customers through

advanced manufacturing capabilities and cutting-edge industrial

technologies. Barnes Aerospace specializes in the production and

servicing of intricate fabricated and precision-machined components

for both commercial and military turbine engines, nacelles, and

airframes. Barnes Industrial excels in advancing the processing,

control, and sustainability of engineered plastics and delivering

innovative, custom-tailored solutions for industrial automation and

metal forming applications. Established in 1857 and headquartered

in Bristol, Connecticut, USA, the Company has manufacturing and

support operations around the globe. For more information, visit

please visit www.onebarnes.com.

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade credit to private equity. For more than three

decades, our investing expertise across our fully integrated

platform has served the financial return needs of our clients and

provided businesses with innovative capital solutions for growth.

Through Athene, our retirement services business, we specialize in

helping clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of September 30, 2024, Apollo had

approximately $733 billion of assets under management. To learn

more, please visit www.apollo.com.

Category: General

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250109034990/en/

Barnes Contact Media and Investors William Pitts

Vice President Investor Relations (860) 973-2144

wpitts@onebarnes.com

Apollo Contacts Noah Gunn Global Head of Investor

Relations Apollo Global Management, Inc. (212) 822-0540

IR@apollo.com

Joanna Rose Global Head of Corporate Communications Apollo

Global Management, Inc. (212) 822-0491

Communications@apollo.com

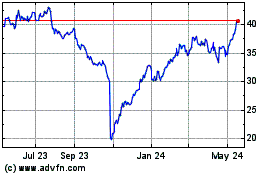

Barnes (NYSE:B)

Historical Stock Chart

From Dec 2024 to Jan 2025

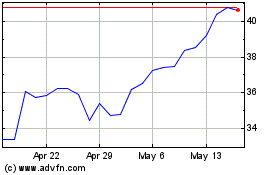

Barnes (NYSE:B)

Historical Stock Chart

From Jan 2024 to Jan 2025