AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON FEBRUARY 28, 2025

REGISTRATION NO. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BROOKFIELD BUSINESS PARTNERS L.P.

(Exact name of registrant as specified in its charter)

| |

Bermuda

|

|

|

Not applicable

|

|

| |

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

73 Front Street, 5th Floor

Hamilton, HM 12, Bermuda

+1 (441) 295-1443

(Address and Telephone Number of Registrant’s Principal Executive Offices)

Brookfield BBP US Holdings LLC

Brookfield Place

250 Vesey Street, 15th Floor

New York, NY 10281-1023

(212) 417-7000

(Name, Address and Telephone Number of Agent for Service)

Copies to:

Mile T. Kurta, Esq.

Christopher R. Bornhorst, Esq.

Torys LLP

1114 Avenue of the Americas, 23rd Floor

New York, NY 10036

(212) 880-6000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends the Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) of the Securities Act of 1933, as amended, may determine.

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

This registration statement on Form F-3 (this “Registration Statement”) registers up to 132,683,978 non-voting limited partnership units (the “units”) of Brookfield Business Partners L.P. (the “partnership”) that may be issued by the partnership or delivered by Brookfield Business Corporation (“BBUC”) to satisfy any exchange, redemption or acquisition of class A exchangeable subordinate voting shares (the “exchangeable shares”) of BBUC (including, if applicable, in connection with liquidation, dissolution or winding up of BBUC).

Pursuant to Rule 415(a)(6) under the Securities Act (“Rule 415(a)(6)”), the securities being registered hereunder include 132,683,978 units previously registered by the partnership’s registration statement on Form F-3 (File No. 333-264630), which was declared effective by the Securities and Exchange Commission on May 12, 2022, under the Securities Act (the “Prior Registration Statement”), but were not issued or delivered to satisfy exchanges, redemptions or acquisitions of exchangeable shares, and accordingly such units constitute “unsold securities” (within the meaning of Rule 415(a)(6)) as of the date hereof (collectively, the “Unsold Securities”). The aggregate filing fee paid in connection with such Unsold Securities was $470,789.10. Pursuant to Rule 415(a)(6), (i) the registration fee applicable to the Unsold Securities is being carried forward to this Registration Statement and will continue to be applied to the Unsold Securities, and (ii) the offering of the Unsold Securities registered on the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. If the partnership issues or delivers any of the Unsold Securities pursuant to the Prior Registration Statement after the date of the initial filing, and prior to the date of effectiveness, of this Registration Statement, the partnership will file a pre-effective amendment to this Registration Statement, which will reduce the number of Unsold Securities included on this Registration Statement.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion dated February 28, 2025

BROOKFIELD BUSINESS PARTNERS L.P.

132,683,978 Limited Partnership Units

This prospectus relates to the registration of up to 132,683,978 non-voting limited partnership units (the “units”) of Brookfield Business Partners L.P. (the “partnership”) that from time to time may be (i) issued by the partnership or delivered by Brookfield Business Corporation (“BBUC”) to satisfy any exchange, redemption or acquisition of class A exchangeable subordinate voting shares (the “exchangeable shares”) of BBUC (including, if applicable, in connection with liquidation, dissolution or winding up of BBUC) that is made in accordance with the terms of the exchangeable shares as provided in the BBUC articles (as defined herein); or (ii) delivered by our affiliate, Brookfield Corporation, as the selling securityholder named herein (“Brookfield” or the “selling securityholder”) to satisfy any exchange by holders of exchangeable shares from time to time in the event that neither BBUC nor the partnership has satisfied such exchange, as provided pursuant to the terms of the Rights Agreement (as defined herein) and the BBUC articles. Brookfield indirectly controls Brookfield Business Partners Limited, our general partner. See “Exchange of Exchangeable Shares for Units”.

The 132,683,978 units being registered hereunder include (i) 72,683,978 units in respect of exchangeable shares that are issued and outstanding as of February 25, 2025 and (ii) up to 60,000,000 units in respect of any additional exchangeable shares that may from time to time be issued by BBUC in the future pursuant to Regulation S under the Securities Act of 1933, as amended (the “Securities Act”) or pursuant to one or more U.S. registration statements.

Pursuant to the BBUC articles, each exchangeable share is exchangeable at the option of the holder thereof for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at our election), as more fully described in this prospectus. Whether the units are issued by the partnership or delivered by BBUC will be determined by us in our sole discretion. Either (i) BBUC will deliver units or its cash equivalent to satisfy its exchange obligation or (ii) the partnership may elect to satisfy BBUC’s exchange obligation by acquiring any tendered exchangeable shares in exchange for units or its cash equivalent. Under the Rights Agreement and the BBUC articles, in the event that neither BBUC nor the partnership has issued or delivered units or the cash equivalent upon exchange of exchangeable shares, then Brookfield will satisfy, until March 15, 2027, such exchange by paying such cash amount or delivering such units pursuant to this prospectus (up to the maximum number of units that may be offered hereby). See “Selling Securityholder”.

None of the partnership, BBUC or the selling securityholder will receive any cash proceeds from the issuance or delivery of any units upon exchange, redemption or acquisition, as applicable, of exchangeable shares pursuant to this prospectus.

The units are listed on the New York Stock Exchange (the “NYSE”) under the trading symbol “BBU” and the Toronto Stock Exchange (“TSX”) under the symbol “BBU.UN.”

Investing in the units involves risks. Please see “Risk Factors” beginning on page 4 of this prospectus, and in similarly-captioned sections in the documents incorporated by reference herein, for a discussion of risk factors you should consider before investing in the units.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025

TABLE OF CONTENTS

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

iii |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

16 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

18 |

|

|

| |

|

|

|

|

|

18 |

|

|

| |

|

|

|

|

|

25 |

|

|

| |

|

|

|

|

|

29 |

|

|

| |

|

|

|

|

|

29 |

|

|

| |

|

|

|

|

|

29 |

|

|

| |

|

|

|

|

|

30 |

|

|

| |

|

|

|

|

|

31 |

|

|

| |

|

|

|

|

|

32

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we have filed with the SEC under the Securities Act with respect to units that may be (i) issued by the partnership or delivered by BBUC to satisfy any exchange, redemption or acquisition of exchangeable shares (including, if applicable, in connection with liquidation, dissolution or winding up of BBUC or the partnership) that is made in accordance with the terms of the exchangeable shares as provided in the BBUC articles; or (ii) delivered by our affiliate, Brookfield, as the selling securityholder named herein to satisfy any exchange by holders of exchangeable shares from time to time in the event that neither BBUC nor the partnership have satisfied such exchange, as provided pursuant to the terms of the Rights Agreement and the BBUC articles. See “Exchange of Exchangeable Shares for Units”. Exchanges registered hereby include exchanges of exchangeable shares at the election of the holders of exchangeable shares in accordance with the terms thereof as provided in the BBUC articles and if applicable, the Rights Agreement. See “Exchange of Exchangeable Shares for Units — Primary Exchange Rights” and “Exchanges of Exchangeable Shares for Units — Secondary Exchange Rights”. In addition, this prospectus registers the issuance or delivery of units upon redemption or acquisition by us of exchangeable shares in accordance with the BBUC articles, as described in “Exchanges of Exchangeable Shares for Units — Redemption”, “Exchanges of Exchangeable Shares for Units — Liquidation of BBUC” and “Exchanges of Exchangeable Shares for Units — Automatic Redemption upon Liquidation of the Partnership”.

As allowed by the SEC rules, this prospectus does not contain all the information included in the registration statement. For further information, you are referred to the registration statement, including its exhibits, as well as any applicable prospectus supplement and any documents incorporated by reference herein or therein. You should read this prospectus together with any applicable prospectus supplement thereto, and in any free writing prospectus that we may provide to you, and any documents incorporated by reference herein or therein and any additional information you may need to make your investment decision. You should also read and carefully consider the information in the documents we have referred you to in “Where You Can Find More Information” and “Incorporation by Reference” below. Information incorporated by reference after the date of this prospectus is considered a part of this prospectus and may add, update or change information contained in this prospectus. The information in this prospectus or any document incorporated by reference herein by reference is accurate only as of the date contained on the cover of such documents. Neither the delivery of this prospectus nor any delivery of units made under this prospectus will, under any circumstances, imply that the information in this prospectus is correct as of any date after this prospectus. Our business, financial condition and results of operations may have changed since that date. Any information in such subsequent filings that is inconsistent with this prospectus will supersede the information in this prospectus.

You should rely only on the information incorporated by reference or provided in this prospectus and any accompanying prospectus supplement, and in any free writing prospectus that we may provide to you. We and the selling securityholder have not authorized anyone else to provide you with other information. We and the selling securityholder are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

Unless the context requires otherwise, when used in this prospectus, the term “partnership” refers to Brookfield Business Partners L.P.; the terms “Brookfield Business Partners”, “we”, “us” and “our” refer to, collectively, (i) the partnership, (ii) Brookfield Business L.P. (“Holding LP”), (iii) the primary holding subsidiaries of Holding LP, from time to time, through which the partnership holds its interest in the operating businesses (the “Holding Entities”) and (iv) the businesses in which the Holding Entities hold interests and that directly or indirectly hold the partnership’s operations and assets, other than entities in which the Holding Entities hold interests for investment purposes only of less than 5% of the outstanding equity securities of that entity, and any other direct or indirect subsidiary of a Holding Entity (but excluding BBUC); and the term “general partner” refers to Brookfield Business Partners Limited, the partnership’s general partner. References to “our group” mean, collectively, Brookfield Business Partners and BBUC. The term “Brookfield” refers to Brookfield Corporation. The term “Brookfield Holders” means Brookfield, Brookfield Wealth Solutions Ltd. (formerly Brookfield Reinsurance Ltd.) (“Brookfield Wealth Solutions”) and their related parties.

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because the partnership is formed under the laws of Bermuda, certain of the directors of our general partner as well as certain of the experts named in this prospectus are residents of Canada or another non-U.S.

jurisdiction and a substantial portion of the partnership’s assets and the assets of those directors and experts may be located outside the United States.

The financial information contained or incorporated by reference in this prospectus is presented in United States dollars and unless otherwise indicated has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”). Information prepared in accordance with IFRS Accounting Standards may differ from financial information prepared in accordance with U.S. GAAP and therefore may not be comparable.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This prospectus and the documents incorporated by reference in this prospectus contain “forward-looking information” within the meaning of provincial Canadian securities laws and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of Brookfield Business Partners, as well as regarding recently completed and proposed acquisitions, dispositions and other transactions, and the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets”, “projects”, “forecasts”, “views”, “potential”, “likely”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, investors and other readers should not place undue reliance on forward-looking statements and information because they involve assumptions, known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause the actual results, performance or achievements of Brookfield Business Partners to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements and information. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and result of operations and our plans and strategies may vary materially from those expressed in the forward-looking statements and forward-looking information herein.

Factors that could cause our actual results to differ materially from those contemplated or implied by forward-looking statements in this prospectus and the documents incorporated by reference in this prospectus include, but are not limited to:

•

the cyclical nature of our operating businesses and general economic conditions and risks relating to the economy, including unfavorable changes in interest rates, foreign exchange rates, inflation, commodity prices and volatility in the financial markets;

•

the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits;

•

business competition, including competition for acquisition opportunities;

•

strategic actions including our ability to complete dispositions and achieve the anticipated benefits therefrom;

•

restrictions on our ability to engage in certain activities or make distributions due to our indebtedness;

•

global equity and capital markets and the availability of equity and debt financing and refinancing within these markets;

•

changes to U.S. laws or policies, including changes in U.S. domestic and economic policies and foreign trade policies and tariffs;

•

changes to our credit ratings;

•

technological change;

•

the ability to obtain insurance for our business operations;

•

labor disruptions and economically unfavorable collective bargaining agreements;

•

litigation;

•

investments in jurisdictions with less developed legal systems;

•

we do not have control over all of the businesses in which we own investments;

•

changes to the market price of any investments in public companies;

•

our compliance with environmental laws and the broader impacts of climate change;

•

cybersecurity incidents;

•

the possible impact of international conflicts, wars and related developments including terrorist acts and cyber terrorism;

•

the effectiveness of our internal controls over financial reporting;

•

the market price of our units may be volatile;

•

we are exempt from certain requirements of Canadian securities laws and we are not subject to the same disclosure requirements as a U.S. domestic issuer;

•

political instability and unfamiliar cultural factors;

•

changes in government policy and legislation;

•

federal, state and foreign anti-corruption and trade sanctions laws and restrictions on foreign direct investment applicable to us and our operating businesses create the potential for significant liabilities and penalties, the inability to complete transactions, imposition of significant costs and burdens, and reputational harm;

•

operational or business risks that are specific to any of our business services operations, infrastructure services operations or industrials operations;

•

reliance on third party service providers;

•

catastrophic events, such as earthquakes, hurricanes and pandemics/epidemics;

•

Brookfield’s significant influence over us;

•

the lack of an obligation of Brookfield to source acquisition opportunities to us;

•

the departure of some or all of Brookfield’s professionals;

•

control of our company and/or the general partner may be transferred to a third party without unitholder consent;

•

Brookfield may increase its ownership in our company;

•

our amended and restated master services agreement dated January 23, 2024 among Brookfield, the partnership, Holding LP and others (the “Master Services Agreement”) and our other arrangements with Brookfield do not impose on Brookfield any fiduciary duties to act in the best interests of our unitholders;

•

conflicts of interest between our company and our unitholders, on the one hand, and Brookfield, on the other hand;

•

our arrangements with Brookfield may contain terms that are less favorable than those which otherwise might have been unrelated parties;

•

the general partner may be unable or unwilling to terminate our Master Services Agreement;

•

the limited liability of, and our indemnification of, the partnership’s service providers;

•

Brookfield’s relationship with Oaktree Capital Group, LLC, together with its affiliates;

•

our company is a holding entity that relies on its subsidiaries to provide us with the funds necessary to our financial obligations;

•

we may be subject to the risks commonly associated with a separation of economic interest from control or the incurrence of debt at multiple levels within an organizational structure;

•

our company may become regulated as an investment company under the U.S. Investment Company Act of 1940, as amended;

•

the inability of unitholders to vote on or otherwise take part in the management of Brookfield Business Partners;

•

future sales or issuances of our securities will result in dilution of existing holders and even the perception of such sales or issuances taking place could depress the trading price of the units or exchangeable shares;

•

limits on unitholders’ ability to obtain favorable judicial forum for disputes related to Brookfield Business Partners or to enforce judgements against us;

•

changes in tax law and practice; and

•

other risks and factors described under the heading “Risk Factors” in this prospectus, any prospectus supplement, and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2023, filed with the SEC on March 1, 2024 (our “Annual Report on Form 20-F”), including, but not limited to, those described under Item 3.D. “Risk Factors”.

Statements relating to “reserves” are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described herein can be profitably produced in the future. We qualify any and all of our forward-looking statements by these cautionary factors.

The foregoing factors and others are discussed in detail under the heading “Risk Factors” in our Annual Report on Form 20-F and in the other documents incorporated by reference herein. We caution that the foregoing list of important factors that may affect future results is not exhaustive. New risk factors may arise from time to time and it is not possible to predict all of those risk factors or the extent to which any factor or combination of factors may cause actual results, performance or achievements of our company to be materially different from those contained in forward-looking statements or information. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Given these risks and uncertainties, investors and other readers should not place undue reliance on forward-looking statements or information as a prediction of actual results. Although the forward-looking statements and information contained in this prospectus and the documents incorporated by reference herein are based upon what we believe to be reasonable assumptions, we cannot assure investors that actual results will be consistent with these forward-looking statements and information. These forward-looking statements and information are made as of the date of this prospectus, and except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in units. You should read this entire prospectus carefully, including the “Risk Factors” section and the documents incorporated by reference herein.

Brookfield Business Partners L.P.

We are a Bermuda exempted limited partnership that was formed on January 18, 2016, under the provisions of the Bermuda Limited Partnership Act 1883, as amended, and the Bermuda Exempted Partnerships Act 1992, as amended. Our head and registered office is 73 Front Street, 5th Floor, Hamilton HM 12, Bermuda, and the telephone number is +1-441-295-1443.

The partnership is an owner and operator of business services and industrials operations on a global basis. The partnership’s principal operations include business services operations such as a residential mortgage insurer, a dealer software and technology services operation, healthcare services and a construction operation. The partnership’s industrials operations include an advanced energy storage operation and an engineered components manufacturing operation, among others. The partnership’s infrastructure services operations include offshore oil services, a lottery services operation, modular building leasing services and work access services. The partnership’s operations are primarily located in the United States, Europe, Australia, Brazil, Canada and the United Kingdom. The partnership’s sole direct investment is a managing general partnership interest in Brookfield Business L.P. (“Holding LP”), through which the partnership holds all its interests in its operating businesses.

The units are listed on the NYSE under the symbol “BBU” and the TSX under the symbol “BBU.UN”. For additional information, see our Annual Report on Form 20-F and the other documents that are incorporated by reference into this prospectus.

Brookfield Business Corporation

BBUC is a corporation incorporated under, and governed by, the laws of British Columbia, Canada. BBUC was established by the partnership to be an alternative investment vehicle for investors who prefer owning the partnership’s operations in a corporate entity. BBUC’s head office is located at 250 Vesey Street, 15th Floor, New York NY 10281 and its registered office is located at 1055 West Georgia Street, Suite 1500, P.O Box 11117, Vancouver, British Columbia V6E 4N7.

The exchangeable shares were distributed to existing unitholders of the partnership pursuant to a special distribution on March 15, 2022 (the “Special Distribution”). As of February 25, 2025, there were 72,683,978 exchangeable shares issued and outstanding. Each exchangeable share has been structured with the intention of providing an economic return equivalent to one unit (subject to adjustment to reflect certain capital events). BBUC will target to pay dividends per exchangeable share that are identical to the distributions paid on each unit, and each exchangeable share will be exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent, as more fully described in this prospectus. Whether the units are issued by the partnership or delivered by BBUC will be determined by us in our sole discretion. Either (i) BBUC will deliver units or its cash equivalent to satisfy its exchange obligation or (ii) the partnership may elect to satisfy BBUC’s exchange obligation by acquiring any tendered exchangeable shares in exchange for units or its cash equivalent. See “Exchange of Exchangeable Shares for Units — Primary Exchange Rights — Adjustments to Reflect Certain Capital Events.”

Brookfield is party to an amended and restated rights agreement (the “Rights Agreement”) pursuant to which Brookfield has agreed that, until March 15, 2027 (the fifth anniversary of the date of the Special Distribution), in the event that, on the applicable specified exchange date with respect to any subject exchangeable shares, (i) BBUC has not satisfied its obligation under its articles and notice of articles (the “BBUC articles”) of delivering the unit amount or its cash equivalent amount and (ii) we have not, upon our election in our sole and absolute discretion, acquired such subject exchangeable shares from the holder thereof and delivered the unit amount or its cash equivalent, Brookfield will satisfy, or cause to be satisfied, the obligations pursuant to the BBUC articles to exchange such subject exchangeable shares for the unit amount

or its cash equivalent. The holders of exchangeable shares have a right to receive the unit amount or its cash equivalent in such circumstances. The partnership will pay all expenses of effecting the exchanges pursuant to this prospectus. See “Exchange Rights of Exchangeable Shares for Units” for more information.

BBU Units

As of February 25, 2025, there were 90,855,473 units and 51,599,716 redeemable-exchangeable partnership units of Holding LP (each, a “redemption-exchange unit”) outstanding.

The redemption-exchange units are subject to a redemption-exchange mechanism pursuant to which units may be issued in exchange for redemption-exchange units on a one-for-one basis. All of the redemption-exchange units are currently owned by Brookfield.

For more information regarding the units and securities directly or indirectly exchangeable for units, see “Description of the Partnership’s Capital Structure” and “Exchange of Exchangeable Shares for Units”.

Exchanges Pursuant to This Prospectus

This prospectus relates to the registration of up to 132,683,978 units that may be (i) issued by the partnership or delivered by BBUC to satisfy any exchange, redemption or acquisition of exchangeable shares (including, if applicable, in connection with liquidation, dissolution or winding up of BBUC or the partnership) from time to time made in accordance with the terms of the exchangeable shares as provided in the BBUC articles; or (ii) delivered by the selling securityholder to satisfy any exchange by holders of exchangeable shares from time to time in the event that neither BBUC nor the partnership has satisfied such exchange, as provided pursuant to the terms of the Rights Agreement and the BBUC articles. Exchanges registered hereby include exchanges of exchangeable shares at the election of the holders of exchangeable shares in accordance with the terms thereof as provided in the BBUC articles and, if applicable, the Rights Agreement. See “Exchange of Exchangeable Shares for Units — Primary Exchange Rights” and “Exchanges of Exchangeable Shares for Units — Secondary Exchange Rights”. In addition, this prospectus registers the issuance or delivery of units upon redemption or acquisition by us of exchangeable shares in accordance with the BBUC articles, as described in “Exchanges of Exchangeable Shares for Units — Redemption”, “Exchanges of Exchangeable Shares for Units — Liquidation” and “Exchanges of Exchangeable Shares for Units — Automatic Redemption upon Liquidation of the Partnership”.

As of February 25, 2025, there were 72,683,978 exchangeable shares issued and outstanding, which may be exchanged for units pursuant to this prospectus. In addition, from time to time, BBUC may issue additional exchangeable shares that may be exchanged for units pursuant to this prospectus. This prospectus relates to up to 60,000,000 units that may be issued by the partnership or delivered by BBUC or the selling securityholder in respect of such additional exchangeable shares, as set forth on the cover of this prospectus. Any such future issuances of exchangeable shares will have been issued pursuant to either Regulation S under the Securities Act or another effective registration statement under the Securities Act.

Tax Consequences of Exchanges and Ownership of Units

Please see “Material Canadian Federal Income Tax Considerations” and “Material United States Federal Income Tax Considerations” for a summary of material Canadian and U.S. federal income tax considerations that may be relevant to holders of exchangeable shares if such holders exchange their exchangeable shares for units. Because the specific tax consequences to such holders will depend upon their specific circumstances, holders are strongly urged to consult their own tax advisors regarding any Canadian and/or U.S. federal, state and local tax consequences specific to such holders.

Recent Developments

Chemelex Transaction

On January 30, 2025, together with institutional partners, we completed the acquisition of Chemelex, a leading manufacturer of electric heat tracing systems, through a carve-out from a larger industrial company for total consideration of approximately $1.7 billion. The investment was funded with approximately

$830 million of equity and $860 million of subsidiary debt financing. Our economic interest in the investment is approximately 25%.

Advanced Energy Storage Operation

In January 2025, our advanced energy storage operation raised $5 billion of new first lien debt. $4.5 billion of the proceeds were used to fund a special distribution to owners, of which the partnership’s share was approximately $1.2 billion.

Offshore Oil Services

On January 16, 2025, our offshore oil services completed the previously announced sale of its shuttle tanker operation for consideration of approximately $484 million. Please see the unaudited pro forma financial statements included in the Form 6-K filed by the partnership on February 28, 2025, which is incorporated by reference herein.

Unit Repurchase Program

On August 15, 2024, the TSX accepted a notice of the partnership’s intention to renew its normal course issuer bid (“NCIB”) in connection with our units, which permits the partnership to repurchase up to 3,714,088 issued and outstanding units. In January 2025, we allocated up to $250 million of capital to accelerate the repurchase of our securities under our existing NCIB. The price to be paid for our units under the NCIB will be the market price at the time of purchase or such other price as may be permitted. The actual number of units to be purchased and the timing of such purchases will be determined by the partnership, and all purchases will be made through the facilities of the TSX and the NYSE or alternative trading systems in Canada and the United States.

RISK FACTORS

An investment in units involves a high degree of risk. Before making an investment decision, you should carefully consider the risks incorporated by reference from our Annual Report on Form 20-F and the other information incorporated by reference in this prospectus, as updated by our subsequent filings with the SEC, pursuant to Sections 13(a), 14 or 15(d) of the Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated in this prospectus. See “Where You Can Find More Information” and “Incorporation by Reference”. The risks and uncertainties described therein and herein are not the only risks and uncertainties we face. In addition, please consider the following risks before making an investment decision:

The exchange of exchangeable shares for units may result in the U.S. federal income taxation of any gain realized by a U.S. holder.

Depending on the facts and circumstances, a U.S. holder’s exchange of exchangeable shares for units may result in the U.S. federal income taxation of any gain realized by the U.S. holder. In general, a U.S. holder exchanging exchangeable shares for units pursuant to the exercise of the exchange right will recognize capital gain or loss (i) if the exchange request is satisfied by the delivery of units by Brookfield pursuant to the Rights Agreement or (ii) if the exchange request is satisfied by the delivery of units by BBUC and the exchange is, within the meaning of Section 302(b) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), in “complete redemption” of the U.S. holder’s equity interest in BBUC, a “substantially disproportionate” redemption of stock, or “not essentially equivalent to a dividend” applying certain constructive ownership rules that take into account not only the exchangeable shares and other equity interests in BBUC actually owned but also other equity interests in BBUC treated as constructively owned by the U.S. holder for U.S. federal income tax purposes. If an exchange request satisfied by the delivery of units by BBUC is not treated as a sale or exchange under the foregoing rules, then it will be treated as a distribution equal to the amount of cash and the fair market value of the units received, taxable under the rules generally applicable to distributions on stock of a corporation.

In general, if the partnership satisfies an exchange request by delivering units to a U.S. holder pursuant to the partnership’s exercise of the partnership call right, then the U.S. holder’s exchange of exchangeable shares for units will qualify as tax-free under Section 721(a) of the Code, unless, at the time of such exchange, the partnership (i) is a publicly traded partnership treated as a corporation for U.S. federal income tax purposes or (ii) would be an “investment company” if it were incorporated for purposes of Section 721(b) of the Code. In the case described in (i) or(ii) of the preceding sentence, a U.S. holder may recognize gain upon the exchange. The general partner of the partnership believes that the partnership will be treated as a partnership and not as a corporation for U.S. federal income tax purposes. In addition, based on the shareholders’ rights in the event of the liquidation or dissolution of BBUC (or the partnership) and the terms of the exchangeable shares, which are intended to provide an economic return equivalent to the economic return on units (including identical distributions), and taking into account the expected relative values of the partnership’s assets and its ratable share of the assets of its subsidiaries for the foreseeable future, the general partner of the partnership currently expects that a U.S. holder’s exchange of exchangeable shares for units pursuant to the exercise of the partnership call right will not be treated as a transfer to an investment company for purposes of Section 721(b) of the Code. Accordingly, the general partner of the partnership currently expects a U.S. holder’s exchange of exchangeable shares for units pursuant to the partnership’s exercise of the partnership call right to qualify as tax-free under Section 721(a) of the Code. However, no definitive determination can be made as to whether any such future exchange will qualify as tax-free under Section 721(a) of the Code, as this will depend on the facts and circumstances at the time of the exchange. Many of these facts and circumstances are not within the control of the partnership, and no assurance can be provided as to the position, if any, taken by the general partner of the partnership with regard to the U.S. federal income tax treatment of any such exchange. Nor can any assurance be given that the U.S. Internal Revenue Service (the “IRS”) will not assert, or that a court would not sustain, a position contrary to any future position taken by the partnership. If Section 721(a) of the Code does not apply, then a U.S. holder who exchanges exchangeable shares for units pursuant to the partnership’s exercise of the partnership call right will be treated as if the holder had sold its exchangeable shares to the partnership in a taxable transaction for cash in an amount equal to the value of the units received.

Even if a U.S. holder’s transfer of exchangeable shares in exchange for units pursuant to the partnership’s exercise of the partnership call right qualifies as tax-free under Section 721(a) of the Code, the U.S. holder will

be subject to special rules that may result in the recognition of additional taxable gain or income. Under Section 704(c)(1) of the Code, if appreciated property is contributed to a partnership, the contributing partner must recognize any gain that was realized but not recognized for U.S. federal income tax purposes with respect to the property at the time of the contribution (referred to as “built-in gain”) if the partnership sells such property (or otherwise transfers such property in a taxable exchange) at any time thereafter or distributes such property to another partner within seven years of the contribution in a transaction that does not otherwise result in the recognition of built-in gain by the partnership. Under Section 737 of the Code, the U.S. holder could be required to recognize built-in gain if the partnership were to distribute any property of the partnership other than money (or, in certain circumstances, exchangeable shares) to such former holder of exchangeable shares within seven years of exercise of the partnership call right. Under Section 707(a) of the Code, the U.S. holder could also be required to recognize built-in gain if the partnership were to make distributions (other than “operating cash flow distributions,” unless another exception were to apply) to the U.S. holder within two years of exercise of the partnership call right. If a distribution to a U.S. holder within two years of the transfer of exchangeable shares in exchange for units is treated as part of a deemed sale transaction under Section 707(a) of the Code, the U.S. holder will recognize gain or loss in the year of the transfer of exchangeable shares in exchange for units, and, if the U.S. holder has already filed a tax return for such year, the holder may be required to file an amended return. In such a case, the U.S. holder may also be required to report some amount of imputed interest income.

For a more complete discussion of the U.S. federal income tax consequences of the exchange of exchangeable shares for units, see “Material United States Federal Income Tax Considerations” below. The U.S. federal income tax consequences of exchanging exchangeable shares for units are complex, and each U.S. holder should consult its own tax advisor regarding such consequences in light of the holder’s particular circumstances.

Canadian federal income tax considerations described herein may be materially and adversely impacted by certain events.

There can be no assurance that Canadian federal income tax laws respecting the treatment of BBUC, the partnership and the exchange of exchangeable shares for units as described in this prospectus will not be changed in a manner that adversely affects shareholders or unitholders, or that such tax laws will not be administered in a way that is less advantageous to BBUC, the partnership, shareholders or unitholders.

Your investment may change upon an exchange of exchangeable shares for units.

If you exchange exchangeable shares pursuant to the terms set forth in the BBUC articles or the Rights Agreement, you may receive units or cash in exchange for such exchangeable shares. To the extent that you receive units in any such exchange, you will become a holder of limited partnership units of a Bermuda limited partnership rather than a holder of a security of a British Columbia corporation. We are formed as an exempted limited partnership under the laws of Bermuda, whereas BBUC is organized as a British Columbia corporation. Therefore, recipients of units following an exchange of exchangeable shares for units will have different rights and obligations, including voting rights, from those that they had prior to the consummation of the exchange as a holder of exchangeable shares. See “Comparison of Rights of Holders of Our Exchangeable Shares and the Partnership’s Units” in BBUC’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the SEC on March 1, 2024. Although the exchangeable shares are intended to provide an economic return, including with respect to distributions, equivalent to units, we can provide no assurance that the units will trade at comparable market prices to the exchangeable shares.

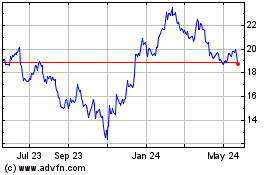

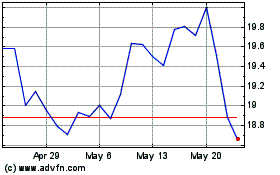

The units may not trade at the same price as the exchangeable shares.

Although the exchangeable shares are intended to provide an economic return that is equivalent to units, there can be no assurance that the market price of units will be equal to the market price of exchangeable shares at any time. For example, as of the close of trading on February 25, 2025, the closing price of the units was $25.24 per unit and C$36.10 per unit on the NYSE and TSX, respectively, and the closing price of the exchangeable shares was $27.26 per share and C$38.93 per share on the NYSE and TSX, respectively. If BBUC redeems the exchangeable shares (which can be done without the consent of the holders) at a time

when the trading price of the exchangeable shares is greater than the trading price of the units, holders will receive units (or its cash equivalent) with a lower trading price. Factors that could cause differences in such market prices may include:

•

perception and/or recommendations by analysts, investors and/or other third parties that these securities should be priced differently;

•

actual or perceived differences in dividends to holders of exchangeable shares versus distributions to holders of units, including as a result of any legal prohibitions;

•

business developments or financial performance or other events or conditions that may be specific to only the partnership or BBUC; and

•

difficulty in the exchange mechanics between exchangeable shares and units, including any delays or difficulties experienced by the transfer agent in processing the exchange requests.

Any holder requesting an exchange of their exchangeable shares for which BBUC or the partnership elects to provide units in satisfaction of the exchange amount may experience a delay in receiving such units, which may affect the value of the units the holder receives in an exchange.

Any holder who exchanges exchangeable shares for which BBUC or the partnership elects to provide units will receive a number of units that is equal to the number of exchangeable shares to be exchanged, but will not receive such units for up to ten (10) business days after the applicable request is received. During this period, the market price of units may decrease. Any such decrease would affect the value of the consideration to be received by the holder of exchangeable shares on the effective date of the exchange. However, in the event cash is used to satisfy an exchange request, the amount of cash payable per exchangeable share will be equal to the NYSE closing price of one unit on the date that the request for exchange is received by the transfer agent. As a result, any increase in the value of the units after that date will not increase the amount of cash to be paid.

Further, the partnership is required to maintain an effective registration statement in the United States in order to exchange any exchangeable shares for units. If a registration statement with respect to the units issuable upon any exchange, redemption or acquisition of exchangeable shares (including in connection with any liquidation, dissolution or winding up of BBUC) is not current or is suspended for use by the SEC, no exchange or redemption of exchangeable shares for units may be effected during such period.

Exchanges of exchangeable shares for units may negatively affect the market price of units, and additional issuances of exchangeable shares would be dilutive to units.

If the partnership issues or BBUC delivers units in satisfaction of any such exchange request, a significant number of additional units may be issued from time to time which could have a negative impact on the market price for units. Additionally, any exchangeable shares issued by BBUC in the future will also be exchangeable for units, and, accordingly, any future exchanges satisfied by the delivery of units would dilute the percentage interest of existing holders of units and may reduce the market price of units.

Our group has the right to elect whether holders of exchangeable shares receive cash or units upon a liquidation or exchange event.

In the event that (i) there is a liquidation, dissolution or winding up of BBUC or the partnership, (ii) BBUC or the partnership exercises its right to redeem (or cause the redemption of) all of the then outstanding exchangeable shares, or (iii) a holder of exchangeable shares requests an exchange of exchangeable shares, holders of exchangeable shares shall be entitled to receive one unit per exchangeable share held (subject to adjustment to reflect certain capital events and certain other payment obligations in the case of a liquidation, dissolution or winding up of BBUC or the partnership) or its cash equivalent. The form of payment will be determined at the election of our group so holders of exchangeable shares will not know whether cash or units will be delivered in connection with any of the events described above. BBUC and the partnership currently intend to satisfy any exchange requests on the exchangeable shares through the delivery of units rather than cash.

BBUC or the partnership may issue additional exchangeable shares or units, respectively, in the future, including in lieu of incurring indebtedness, which may dilute holders of our group’s equity securities. BBUC or the partnership may also issue securities that have rights and privileges that are more favorable than the rights and privileges accorded to our group’s equity holders.

Subject to the terms of any of BBUC securities then outstanding, BBUC may issue additional securities, including exchangeable shares, BBUC class B shares, BBUC class C shares, preference shares, options, rights and warrants for any purpose and for such consideration and on such terms and conditions as BBUC’s board may determine. Subject to the terms of any of BBUC securities then outstanding, BBUC’s board will be able to determine the class, designations, preferences, rights, powers and duties of any additional securities, including any rights to share in BBUC’s profits, losses and dividends, any rights to receive BBUC’s assets upon its dissolution or liquidation and any redemption, conversion and exchange rights. Subject to the terms of any of BBUC securities then outstanding, BBUC’s board may use such authority to issue such additional securities, which would dilute holders of such securities, or to issue securities with rights and privileges that are more favorable than those of the exchangeable shares.

Similarly, under our limited partnership agreement, subject to the terms of any preferred units then outstanding, the general partner may issue additional partnership securities, including units, preferred units, options, rights, warrants and appreciation rights relating to partnership securities for any purpose and for such consideration and on such terms and conditions as the board of the general partner may determine. Subject to the terms of any partnership securities then outstanding, the board of the general partner will be able to determine the class, designations, preferences, rights, powers and duties of any additional partnership securities, including any rights to share in partnership’s profits, losses and dividends, any rights to receive the partnership’s assets upon its dissolution or liquidation and any redemption, conversion and exchange rights. Subject to the terms of any partnership securities then outstanding, the board of the general partner may use such authority to issue such additional partnership securities, which would dilute holders of such securities, or to issue securities with rights and privileges that are more favorable than those of units.

The sale or issuance of a substantial number of exchangeable shares, units or other equity securities of BBUC or the partnership in the public markets, or the perception that such sales or issuances could occur, could depress the market price of units and impair the partnership’s ability to raise capital through the sale of additional units. We cannot predict the effect that future sales or issuances of exchangeable shares, units or other equity securities would have on the market price of units. Subject to the terms of any of our securities then outstanding, holders of units will not have any pre-emptive right or any right to consent to or otherwise approve the issuance of any securities or the terms on which any such securities may be issued.

The Rights Agreement may terminate on March 15, 2027.

This Rights Agreement will terminate on March 15, 2027 unless the Rights Agreement is otherwise terminated pursuant to its terms. After such date, holders of exchangeable shares may no longer have the benefit of protections provided for by the Rights Agreement and will be reliant on the rights provided for in the BBUC articles. In the event that BBUC or the partnership fails to satisfy a request for exchange after the expiry of the Rights Agreement, a tendering holder will not be entitled to rely on the Secondary Exchange Rights (as defined herein). See “Exchange of Exchangeable Shares for Units — Secondary Exchange Rights”.

USE OF PROCEEDS

None of the partnership, BBUC or the selling securityholder will receive any cash proceeds from the issuance or delivery of any units upon exchange, redemption or acquisition, as applicable, of exchangeable shares pursuant to this prospectus. See “Exchange of Exchangeable Shares for Units” below.

CAPITALIZATION

The following table sets forth the partnership’s capitalization as at September 30, 2024. Our capitalization set forth below does not reflect transactions occurring after September 30, 2024, as described in the footnotes below. You should read this table in conjunction with the financial statements and pro forma financial information that are incorporated by reference in this prospectus.

|

US$ MILLIONS, EXCEPT PER UNIT AMOUNTS

|

|

|

As at

September 30,

2024(1)

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

Corporate borrowings

|

|

|

|

$ |

1,978 |

|

|

|

Non-recourse borrowings in subsidiaries of the partnership(2)

|

|

|

|

|

39,571 |

|

|

|

Other current and non-current liabilities(3)

|

|

|

|

|

19,346 |

|

|

|

Total liabilities

|

|

|

|

$ |

60,895 |

|

|

|

Equity

|

|

|

|

|

|

|

|

|

Limited partners

|

|

|

|

|

|

|

|

|

Limited partners(4)(5)

|

|

|

|

$ |

1,980 |

|

|

|

Non-controlling interest

|

|

|

|

|

|

|

|

|

Redemption-exchange units held by Brookfield(5)

|

|

|

|

|

1,858 |

|

|

|

Special limited partners

|

|

|

|

|

— |

|

|

|

BBUC exchangeable shares

|

|

|

|

|

1,945 |

|

|

|

Preferred shares

|

|

|

|

|

740 |

|

|

|

Interest of others in operating subsidiaries

|

|

|

|

|

12,838 |

|

|

|

Total equity

|

|

|

|

$ |

19,361 |

|

|

|

Total Capitalization

|

|

|

|

$ |

80,256 |

|

|

(1)

Does not reflect any transactions since September 30, 2024. See “Summary — Recent Developments” in this prospectus.

(2)

Does not reflect (i) approximately $5 billion of subsidiary debt raised at the partnership’s advanced energy storage operation in January 2025 or (ii) approximately $860 million of subsidiary debt raised to fund the acquisition of Chemelex in January 2025. See “Summary — Recent Developments” for further information.

(3)

Includes the deferred income tax liability of the partnership as of September 30, 2024.

(4)

Does not reflect repurchases under our NCIB since September 30, 2024. See “Summary — Recent Developments” for further information.

(5)

Does not reflect the conversion on February 25, 2025, of 18,105,781 redemption-exchange units held by subsidiaries of Brookfield Wealth Solutions.

EXCHANGE OF EXCHANGEABLE SHARES FOR UNITS

The exchange rights relating to the exchangeable shares are set forth in the BBUC articles and the Rights Agreement, which are filed as exhibits to the registration statement of which this prospectus forms a part. Upon exchange, holders of exchangeable shares will receive, with respect to each exchanged share, either (i) one unit or (ii) cash in an amount equivalent to the market value of one unit, in each case as described in further detail below.

Primary Exchange Rights

Holders of exchangeable shares shall have the right to exchange all or a portion of their exchangeable shares for one unit per exchangeable share held (subject to adjustment in the event of certain dilutive or other capital events by BBUC or the partnership as described below in “— Adjustments to Reflect Certain Capital Events”) or its cash equivalent based on the NYSE closing price of one unit on the date that the request for exchange is received by BBUC’s transfer agent (or if not a trading day, the next trading day thereafter) plus, in each case, a cash amount for each tendered exchangeable share equal to any unpaid dividends per exchangeable share. The form of payment to holders of exchangeable shares — whether units or cash — will be determined at the sole election of BBUC (other than any unpaid dividends, which will be paid for only in cash). In the event the partnership ceases to be a publicly listed entity, the value of a unit will be determined by (i) the last available bid price from an independent source such as an over-the-counter market or an independent investment banking firm; or (ii) if (i) is not applicable, then the amount that a holder of a unit would receive upon the liquidation of the partnership and sale of its assets in accordance with the terms of its limited partnership agreement. Holders of exchangeable shares that hold such shares through a broker must contact their brokers to request an exchange on their behalf. Holders of exchangeable shares that are registered holders must contact BBUC’s transfer agent and follow the process described below. BBUC currently intends to satisfy any exchange, redemption or acquisition of exchangeable shares through the delivery of units rather than cash.

Each holder of exchangeable shares who wishes to exchange one or more of his or her exchangeable shares for units or its cash equivalent is required to complete and deliver a notice of exchange in the form available from BBUC’s transfer agent. The transfer agent will promptly notify BBUC, the partnership and, until such time as the Rights Agreement is terminated, Brookfield of the receipt of a notice of exchange. Upon receipt of a notice of exchange, BBUC shall be obligated, within ten (10) business days after the date that the notice of exchange is received by BBUC’s transfer agent, deliver to the tendering holder of exchangeable shares, in accordance with instructions set forth in the notice of exchange, one unit per exchangeable share held (subject to adjustment in the event of certain dilutive or other capital events by BBUC or the partnership as described below in “— Adjustments to Reflect Certain Capital Events”) or its cash equivalent based on the NYSE closing price of one unit on the date that the request for exchange is received by BBUC’s transfer agent (or if not a trading day, the next trading day thereafter) (the form of payment to be determined at the sole election of BBUC), plus, in each case, a cash amount for each tendered exchangeable share equal to any unpaid dividends per tendered exchangeable share. The units that BBUC would be obligated to deliver following an exchange request as set forth in the preceding sentence will be issued by the partnership to BBUC, and BBUC in turn will deliver such units to such holder. As described in the next paragraph, the partnership may also elect to satisfy such exchange request by issuing units or paying cash directly to the tendering holder of exchangeable shares. Upon completion of the exchange of any exchangeable shares as described herein, the holder of exchangeable shares who has exchanged their exchangeable shares will have no further right, with respect to any exchangeable shares so exchanged, to receive any dividends on exchangeable shares with a record date on or after the date on which such exchangeable shares are exchanged.

In lieu of BBUC delivering units or paying cash as described in the preceding paragraph, the partnership, in its sole discretion, may elect to satisfy BBUC’s exchange obligation by acquiring all of the tendered exchangeable shares in exchange for issuing directly to such tendering holder one unit per exchangeable share held (subject to adjustment in the event of certain dilutive or other capital events by BBUC or the partnership as described below in “— Adjustments to Reflect Certain Capital Events”) or delivering its cash equivalent based on the NYSE closing price of one unit on the date that the request for exchange is received by BBUC’s transfer agent (or if not a trading day, the next trading day thereafter) (the form of payment to be determined at the sole election of the partnership), plus, in each case, a cash amount for each tendered exchangeable share

equal to any unpaid dividends per tendered exchangeable share. If the partnership elects to satisfy BBUC’s exchange obligation directly (in lieu of BBUC delivering units or cash as described above), it shall, within three (3) business days from the receipt of the holder’s notice of exchange, provide written notice to BBUC and BBUC’s transfer agent of its intention to satisfy the exchange obligation and shall satisfy such obligation within ten (10) business days from the date that the notice of exchange is received by BBUC’s transfer agent by delivering to such holder of exchangeable shares the units or its cash equivalent. Our unitholders are not entitled to vote on the partnership’s exercise of the overriding call right described in the preceding sentences. The partnership currently intends to satisfy any exchange, redemption or acquisition of exchangeable shares through the delivery of units rather than cash.

In the event that a tendering holder of exchangeable shares has not received the number of units or its cash equivalent in satisfaction of the tendered exchangeable shares, then such tendering holder of exchangeable shares will be entitled to receive the equivalent of such cash amount or units amount from Brookfield pursuant to the Rights Agreement until March 15, 2027. In this scenario, the tendered exchangeable shares will be delivered to the rights agent (as defined below) in exchange for the delivery of the equivalent of the cash amount or units amount from a collateral account of Brookfield administered by the rights agent. See the section entitled “— Secondary Exchange Rights” for a further description of the Rights Agreement. The partnership has agreed to indemnify Brookfield, in its capacity as selling securityholder, for certain liabilities under applicable securities laws concerning selling securityholders, in connection with any units delivered by Brookfield pursuant to the Rights Agreement.

No Fractional Units. No fractional units will be issued or delivered upon exchange of exchangeable shares. In lieu of any fractional units to which the tendering holder of exchangeable shares would otherwise be entitled at our group’s election, our group will pay an amount in cash equal to the unit value on the trading day immediately preceding the exchange date multiplied by such fraction of a unit.

Conversion of Tendered Exchangeable Shares. The partnership is entitled at any time to have any or all exchangeable shares acquired by the partnership converted into BBUC class C shares on a one-for-one basis.

Adjustments to Reflect Certain Capital Events. The conversion factor (which as of the date of this prospectus is one) is subject to adjustment in accordance with the BBUC articles to reflect certain capital events, including (i) if the partnership and/or BBUC declares or pays a distribution to its unitholders consisting wholly or partly of units or a dividend to its shareholders consisting wholly or partly of exchangeable shares, as applicable, without a corresponding distribution or dividend, as applicable, being declared or paid by the other entity; (ii) if the partnership or BBUC splits, subdivides, reverse-splits or combines its outstanding units or exchangeable shares, as applicable, without a corresponding event occurring at the other entity; (iii) if the partnership and/or BBUC distributes any rights, options or warrants to all or substantially all holders of its units or exchangeable shares to convert into, exchange for or subscribe for or to purchase or to otherwise acquire units or exchangeable shares (or other securities or rights convertible into, exchangeable for or exercisable for units or exchangeable shares), as applicable, without a corresponding distribution of rights, options or warrants by the other entity; (iv) if the partnership distributes to all or substantially all holders of units evidences of its indebtedness or assets (including securities), or assets or rights, options or warrants to convert into, exchange for or subscribe for or to purchase or to otherwise acquire such securities but excluding all distributions where a comparable distribution (or the cash equivalent) is made by BBUC; or (v) if the partnership or one of its subsidiaries makes a payment in respect of a tender or exchange offer for the units (but excluding for all purposes any exchange or tender offer to exchange units for exchangeable shares or any other security economically equivalent to units), to the extent that the cash and value of any other consideration included in the payment per unit exceeds certain thresholds.

Secondary Exchange Rights

Brookfield is party to the Rights Agreement with Wilmington Trust, National Association (the “rights agent”), pursuant to which Brookfield has agreed that, until March 15, 2027, upon an exchange of exchangeable shares, in the event that, on the applicable specified exchange date with respect to any subject exchangeable shares, (i) BBUC has not satisfied its obligation under the BBUC articles by delivering the unit amount or its cash equivalent amount and (ii) the partnership has not, upon its election in its sole and absolute discretion, acquired such subject exchangeable share from the holder thereof and delivered the applicable unit or cash amount, Brookfield will satisfy, or cause to be satisfied, the obligations pursuant to the BBUC articles

to exchange such exchangeable shares for the unit amount or its cash equivalent. The holders of exchangeable shares have a right to receive units or the cash amount in such circumstances (“Secondary Exchange Rights”). Brookfield currently intends to satisfy any exchange requests on the exchangeable shares through the delivery of units rather than cash. The Secondary Exchange Rights are a part of the terms of the exchangeable shares and may not be evidenced, transferred or assigned separate or apart from the exchangeable shares.

Brookfield Consent Right. The Master Services Agreement provides, so long as Brookfield is a party to the Rights Agreement, Brookfield shall have a consent right prior to the issuance by BBUC of any exchangeable shares, subject to certain exceptions.

Appointment of Rights Agent. The rights agent has agreed to act as the rights agent for the holders, as a class and not individually, of the exchangeable shares.

Term and Termination. The Rights Agreement will terminate automatically on the earliest of (i) the date on which there are no exchangeable shares outstanding, other than exchangeable shares owned by Brookfield or its affiliates and (ii) the fifth anniversary of date of the Special Distribution, being March 15, 2027. After the expiry of the Rights Agreement, holders of exchangeable shares will continue to have all of the rights provided for in the BBUC articles but will no longer be entitled to rely on the Secondary Exchange Rights.

Satisfaction of Secondary Exchange Rights. In accordance with the Rights Agreement, Brookfield has agreed to satisfy, or cause to be satisfied, the obligations with respect to the Secondary Exchange Rights contained in the BBUC articles. The rights agent established a collateral account in order to enable the rights agent to exchange subject exchangeable shares for the cash amount or the unit amount in accordance with the Rights Agreement.

Pursuant to and subject to the terms and conditions set forth in the BBUC articles, a holder of exchangeable shares may request to exchange each exchangeable share (the “subject exchangeable share”) for one unit per exchangeable share held (subject to adjustment to reflect certain capital events or its cash equivalent (the form of payment to be determined at the election of our group)). See “— Primary Exchange Rights — Adjustments to Reflect Certain Capital Events” above. Upon receipt of a notice of exchange, BBUC shall, within ten (10) business days after the date that the notice of exchange is received by BBUC’s transfer agent (the “specified exchange date”) deliver to the tendering holder of exchangeable shares, such unit or cash amount.

In accordance with the BBUC articles, BBUC is required to deliver a notice (the “BBUC notice”) to the rights agent and Brookfield on the specified exchange date if the conditions to the exercise of the Secondary Exchange Rights with respect to any subject exchangeable shares have been satisfied. The BBUC notice must set forth the unit amount and the cash amount for such subject exchangeable shares and any necessary wire transfer or other delivery instructions. Brookfield may provide notice to the rights agent by the business day immediately following receipt of the BBUC notice, providing that Brookfield has elected, in Brookfield’s sole discretion, to fund the cash amount. If the rights agent has not received such notice from Brookfield, the rights agent must exchange the subject exchangeable shares for a number of units held in the collateral account equal to the unit amount and promptly, and in any event within two (2) business days, deliver such units from the collateral account to the holder of the subject exchangeable shares. If there are not enough units in the collateral account to satisfy the unit amount with respect to one or more of such subject exchangeable shares, the rights agent will exchange such subject exchangeable shares for an amount of cash from the collateral account equal to the cash amount and promptly, and in any event within two (2) business days, deliver the cash amount to the holder of the subject exchangeable shares.

If the holder of subject exchangeable shares has not received the units amount or the cash amount by the specified exchange date, the holder of subject exchangeable shares may deliver, or cause to be delivered, a notice (the “exchanging shareholder notice”) to the rights agent and Brookfield. The exchanging shareholder notice must set forth the number of such subject exchangeable shares and any necessary wire transfer or other delivery instructions and be in a format that is acceptable to the rights agent. As promptly as practicable and in any event on or prior to the next business day following receipt of the exchanging shareholder notice, Brookfield will provide notice to the rights agent (i) setting forth the unit amount and the cash amount for such subject exchangeable shares and (ii) either (a) providing that Brookfield has elected, in Brookfield’s sole discretion, to fund the cash amount or (b) instructing the rights agent to exchange each subject exchangeable

share. Brookfield is not obligated to deliver such notice if it has determined in good faith that the conditions to the exercise of the Secondary Exchange Right have not been satisfied. On or prior to the second business day following receipt by the rights agent of such instruction by Brookfield, the exchanging shareholder notice and the subject exchangeable shares, the rights agent will exchange such subject exchangeable shares for the unit amount from the collateral account or, if there are not enough units in the collateral account, for the cash amount from the collateral account.

With respect to any exchange of subject exchangeable shares, Brookfield may elect to instruct the rights agent to exchange the subject exchangeable shares for the cash amount. If Brookfield makes such an election and there is not a sufficient amount of cash in the collateral account, Brookfield must deposit the required amount into the collateral account simultaneously with such election.

In connection with the exercise by a holder of the Secondary Exchange Rights with respect to any subject exchangeable shares held through the Depository Trust Company (“DTC”), such holder will deliver to the rights agent such subject exchangeable shares pursuant to DTC’s applicable procedures. In addition, such holder will deliver to the rights agent via e-mail on the business day prior to delivery of such subject exchangeable shares a copy of the exchanging shareholder notice, if applicable.

Receipt of Subject Exchangeable Shares; Withholding. Holders of subject exchangeable shares will deliver such shares free and clear of all liens, claims and encumbrances, and should any such liens, claims and encumbrances exist with respect to such subject exchangeable shares, the holder of such subject exchangeable shares will not be entitled to exercise its Secondary Exchange Rights with respect to such shares. Each holder of subject exchangeable shares will pay to Brookfield the amount of any tax withholding due upon the exchange of such shares and, in the event Brookfield elects to acquire some or all of the subject exchangeable shares in exchange for the cash amount, will authorize Brookfield to retain a portion of the cash amount to satisfy tax withholding obligations. If Brookfield elects to acquire some or all of the subject exchangeable shares in exchange for the unit amount, Brookfield may elect to either satisfy the amount of any tax withholding by retaining units with a fair market value equal to the amount of such obligation, or satisfy such tax withholding obligation using amounts paid by Brookfield, which amounts will be treated as a loan by Brookfield to the holder of the subject exchangeable shares, in each case, unless the holder, at the holder’s election, has made arrangements to pay the amount of any such tax withholding.