Cadre Holdings Announces Pricing of Public Primary and Secondary Offering of Common Stock

March 14 2024 - 5:40PM

Business Wire

Cadre Holdings, Inc. (NYSE: CDRE) (“Cadre” or “the Company”), a

global leader in the manufacturing and distribution of safety

equipment for professionals, today announced the pricing of the

public offering of 3,638,127 shares of its common stock, including

2,200,000 shares of common stock offered by the Company and

1,438,127 shares of common stock offered by Kanders SAF, LLC (the

“Selling Stockholder”), an entity wholly-owned by Mr. Warren B.

Kanders, the Chairman of the Company’s Board of Directors and Chief

Executive Officer, at a public offering price of $35.00 per share.

In addition, the Company has granted the underwriters a 30-day

option to purchase up to an additional 545,719 shares of common

stock. The offering is expected to close on or about March 19,

2024, subject to the satisfaction of customary closing

conditions.

Cadre intends to use the net proceeds received from the offering

for general corporate purposes. The Selling Stockholder will

receive the net proceeds from the sale of shares of common stock

sold by it in the offering.

BofA Securities is acting as lead book-running manager for the

offering. Jefferies, B Riley Securities and Stephens Inc. are

acting as book-running managers, and Roth Capital Partners, Lake

Street Capital Markets, LLC and Regions Securities LLC are acting

as co-managers.

The Company has filed a registration statement on Form S-3

(Registration No. 333-271328) (including a base prospectus), which

has been declared effective by the Securities and Exchange

Commission (“SEC”). The Company has also filed a preliminary

prospectus supplement with the SEC for the offering. The offering

will be made only by means of a prospectus supplement and an

accompanying prospectus.

You may get these documents for free by visiting EDGAR on the

SEC website at www.sec.gov. Alternatively, copies of the

preliminary prospectus supplement and accompanying prospectus, as

well as copies of the final prospectus supplement, once available,

may be obtained by contacting: BofA Securities, 201 North Tryon

Street, Charlotte, NC 28255, Mail Code NC1-022-02-25, Attention:

Prospectus Department or by email at

dg.prospectus_requests@bofa.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Cadre

Headquartered in Jacksonville, Florida, Cadre is a global leader

in the manufacturing and distribution of safety products. Cadre's

equipment provides critical protection to allow users to safely and

securely perform their duties and protect those around them in

hazardous or life-threatening situations. The Company's core

products include body armor, explosive ordnance disposal equipment,

duty gear and nuclear safety products. Our highly engineered

products are utilized in over 100 countries by federal, state and

local law enforcement, fire and rescue professionals, explosive

ordnance disposal teams, and emergency medical technicians. Our key

brands include Safariland® and Med-Eng®, amongst others.

Forward-Looking Statements

Except for historical information, certain matters discussed in

this press release may be forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include but are not limited to all

projections and anticipated levels of future performance.

Forward-looking statements involve risks, uncertainties and other

factors that may cause our actual results to differ materially from

those discussed herein. Any number of factors could cause actual

results to differ materially from projections or forward-looking

statements, including without limitation, our ability to complete

the common stock offering on the proposed terms, or at all; and our

expectations related to the use of proceeds from the shares of

common stock offered by the Company. More information on potential

factors that could affect the Company’s financial results are more

fully described from time to time in the Company’s public reports

filed with the Securities and Exchange Commission, including the

Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and Current Reports on Form 8-K. All forward-looking

statements included in this press release are based upon

information available to the Company as of the date of this press

release, and speak only as of the date hereof. We assume no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240314025030/en/

Gray Hudkins Cadre Holdings, Inc. 203 550 7148

gray.hudkins@cadre-holdings.com

Investor Relations: The IGB Group Leon Berman / Matt

Berkowitz 212 477 8438 / 212 227 7098 lberman@igbir.com /

mberkowitz@igbir.com

Media: Jonathan Keehner / Andrew Siegel Joele Frank,

Wilkinson Brimmer Katcher 212 355 4449

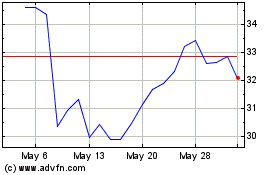

Cadre (NYSE:CDRE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cadre (NYSE:CDRE)

Historical Stock Chart

From Dec 2023 to Dec 2024