0001777393false00017773932025-03-042025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): March 4, 2025

ChargePoint Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39004 | | 84-1747686 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

240 East Hacienda Avenue Campbell, CA | | 95008 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 841-4500(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 | | CHPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 4, 2025, ChargePoint Holdings, Inc. (the “Company”) issued a press release announcing its financial results for its fiscal fourth quarter and full fiscal year ended January 31, 2025. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CHARGEPOINT HOLDINGS, INC. |

| |

| By: | | /s/ Mansi Khetani |

| | Name: Mansi Khetani |

| | Title: Chief Financial Officer |

Date: March 4, 2025

Exhibit 99.1

ChargePoint Reports Fourth Quarter and Full Fiscal Year 2025 Financial Results

•Fourth quarter fiscal 2025 revenue of $102 million and full fiscal year revenue of $417 million

•Fourth quarter fiscal 2025 GAAP gross margin of 28% and non-GAAP gross margin of 30%; full fiscal year GAAP gross margin of 24% and non-GAAP gross margin of 26%

•Fourth quarter fiscal 2025 subscription revenue of $38 million representing 14% year-over-year growth; full fiscal year subscription revenue of $144 million representing 20% year-over-year growth

•Fourth quarter fiscal 2025 GAAP operating expense of $84 million and non-GAAP operating expense of $52 million, representing 27% and 30% year-over-year reduction; full year fiscal 2025 GAAP operating expense of $354 million and non-GAAP operating expense of $243 million, both representing 26% year-over-year reduction

•ChargePoint guides to first quarter fiscal 2026 revenue of $95 million to $105 million

Campbell, Calif. – March 4, 2025 – ChargePoint Holdings, Inc. (NYSE:CHPT) (“ChargePoint”), a leading provider of networked solutions for charging electric vehicles (EVs), today reported results for its fourth quarter and full fiscal year ended January 31, 2025.

“We delivered significant sequential improvement in cash usage throughout fiscal 2025," said Mansi Khetani, CFO of ChargePoint. "Cash used for operating activities, a close proxy for our total cash consumption, declined significantly to $3 million in the fourth quarter, down from $31 million in the third quarter. This was due to higher gross margins, lower operating expenses, reduced inventory and other improvements to working capital. ChargePoint’s focus on operational excellence is delivering results."

Fourth Quarter Fiscal 2025 Financial Overview

•Revenue. Fourth quarter revenue was $101.9 million, down 12% from $115.8 million in the prior year’s same quarter. Networked charging systems revenue for the fourth quarter was $52.6 million, down 29% from $74.0 million in the prior year’s same quarter. Subscription revenue was $38.3 million, up 14% from $33.5 million in the prior year’s same quarter.

•Gross Margin. Fourth quarter GAAP gross margin was 28% as compared to 19% in the prior year's same quarter, and non-GAAP gross margin was 30% as compared to 22% in the prior year's same quarter.

•Operating Expenses. Fourth quarter GAAP operating expenses were $83.6 million, down 27% from $115.3 million in the prior year's same quarter. Non-GAAP operating expenses were $52.0 million, down 30% from $74.7 million in the prior year's same quarter.

•Net Income/Loss. Fourth quarter GAAP net loss was $64.6 million, down 32% from $94.7 million in the prior year's same quarter. Non-GAAP pre-tax net loss was $30.2 million, down 41% from $51.6 million in the prior year's same quarter. Non-GAAP Adjusted EBITDA Loss was $17.3 million, down 62% from $45.3 million in the prior year's same quarter.

•Liquidity. As of January 31, 2025, cash and cash equivalents on the balance sheet was $225.0 million, ChargePoint's $150.0 million revolving credit facility remains undrawn and ChargePoint has no debt maturities until 2028.

•Shares Outstanding. As of January 31, 2025, the Company had approximately 456 million shares of common stock outstanding.

Full Fiscal 2025 Financial Overview

•Revenue. For the full year, revenue was $417.1 million, down 18% from $506.6 million in the prior year. Networked charging systems revenue for the full year was $234.8 million, down 35% from $360.8 million in the prior year, and subscription revenue was $144.3 million, up 20% from $120.4 million in the prior year.

•Gross Margin. Full year GAAP gross margin was 24% as compared to 6% in the prior year. Full year non-GAAP gross margin was 26% as compared to 8% in the prior year.

•Operating Expenses. Full year GAAP operating expenses were $353.7 million, down 26% from $480.1 million in the prior year. Non-GAAP operating expenses were $243.4 million, down 26% from $330.0 million in the prior year.

•Net Income/Loss. Full year GAAP net loss was $282.9 million as compared to $457.6 million in the prior year. Full year non-GAAP pre-tax net loss was $159.2 million as compared to $296.7 million in the prior year. Non-GAAP Adjusted EBITDA Loss was $116.5 million as compared to $272.7 million in the prior year.

For reconciliation of GAAP and non-GAAP results, please see the tables below.

Business Highlights

•ChargePoint and General Motors collaborated to accelerate EV charging infrastructure growth in North America, with plans to install hundreds of ultra-fast charging ports at strategic locations across the country in 2025.

•ChargePoint and the Colorado Energy Office announced the completion of six EV fast charging corridors along Colorado highways, doubling the coverage of DC fast charging across the state.

•ChargePoint introduced two innovative solutions to combat EV charger vandalism, including the industry’s first cut-resistant charger cable, and ChargePoint® Protect, an alarm system designed to increase charging station security.

First Quarter of Fiscal 2026 Guidance

For the first fiscal quarter ending April 30, 2025, ChargePoint expects revenue of $95 million to $105 million.

ChargePoint remains committed to its plans of achieving positive non-GAAP Adjusted EBITDA during a quarter in fiscal year 2026.

ChargePoint is not able to present a reconciliation of its forward-looking non-GAAP Adjusted EBITDA goal to the corresponding GAAP measure because certain potential future adjustments, which may be significant and may include, among other items, stock-based compensation expense, are uncertain or out of its control, or cannot be reasonably predicted without unreasonable effort. The actual amounts of such reconciling items could have a significant impact on ChargePoint's GAAP Net Loss.

Conference Call Information

ChargePoint will host a webcast today at 1:30 p.m. Pacific / 4:30 p.m. Eastern to review its fourth quarter and full fiscal year 2025 financial results.

Investors may access the webcast, supplemental financial information and investor presentation at ChargePoint’s investor relations website (investors.chargepoint.com) under the “Events and Presentations” section. A replay will be available after the conclusion of the webcast and archived for one year.

About ChargePoint

ChargePoint is creating a new fueling network to move people and goods on electricity. Since 2007, ChargePoint has been committed to making it easy for businesses and drivers to go electric with one of the largest EV charging networks and a comprehensive portfolio of charging solutions. The ChargePoint cloud subscription platform and software-defined charging hardware are designed to include options for every charging scenario from home and multifamily to workplace, parking, hospitality, retail and transport fleets of all types. Today, one ChargePoint account provides access to hundreds of thousands of places to charge in North America and Europe. For more information, visit the ChargePoint pressroom, the ChargePoint Investor Relations site, or contact the ChargePoint press office or Investor Relations.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks, uncertainties, and assumptions including statements regarding our plans to expand charging infrastructure with General Motors in North America, our projected revenue for the first quarter of fiscal year 2026 and our goal to achieve positive non-GAAP Adjusted EBITDA during a quarter in our fiscal year 2026. There are a significant number of factors that could cause actual results to differ materially from the statements made in this press release, including: macroeconomic trends including changes in or sustained inflation, interest rate volatility, or other events beyond our control on the overall economy which may reduce demand for our products and services, geopolitical events and conflicts, adverse impacts to our business and those of our customers and suppliers, including due to supply chain disruptions, tariffs, component shortages, and associated logistics expense increases; our limited operating history as a public company; our ability as an organization to successfully acquire, integrate or partner with other companies, products or technologies in a successful manner; our dependence on widespread acceptance and adoption of EVs, including auto manufacturers' plans and strategies to transition to predominately manufacture EV and any corresponding increased demand for installation of charging stations; our current dependence on sales of charging stations for the majority of our revenues; overall demand for EV charging and the potential for reduced demand for EVs if governmental policies, rebates, tax credits and other financial incentives are reduced, modified or eliminated or governmental mandates to increase the use of EVs or decrease the use of vehicles powered by fossil fuels, either directly or indirectly through mandated limits on carbon emissions, are reduced, modified or eliminated; our ability, and our reliance on our customers, to successfully implement, construct and manage state, federal and local charging infrastructure programs in accordance with the respective terms of such program in order to validly secure and obtain awarded funding and win additional grant opportunities; our ability to successfully partner with third-party charge point operators and identify sufficient suitable locations for the expansion of our charging infrastructure program with General Motors, our reliance on contract manufacturers, including those located outside the United States, may result in supply chain interruptions, delays and expense increases which may adversely affect our sales, revenue and gross margins; our ability to expand our operations and market share in Europe; the need to attract additional fleet operators as customers; potential adverse effects on our revenue and gross margins due to delays and costs associated with new product introductions, inventory obsolescence, component shortages and related expense increases; adverse impact to our revenues and gross margins if customers increasingly claim clean energy credits and, as a result, they are no longer available to be claimed by us; the effects of competition; risks related to our dependence on our intellectual property; and the risk that our technology could have undetected defects or errors. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on December 6, 2024, which is available on our website at investors.chargepoint.com and on the SEC’s website at www.sec.gov. Additional information will also be set forth in other filings that we make with the SEC from time to time. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable law.

Use of Non-GAAP Financial Measures

ChargePoint has provided financial information in this press release that has not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). ChargePoint uses these non-GAAP financial measures internally in analyzing its financial results. ChargePoint believes that the use of these non-GAAP financial measures is useful to investors to evaluate ongoing operating results and trends and believes they provide meaningful supplemental information to investors regarding ChargePoint’s underlying operating performance because they exclude items ChargePoint believes are unrelated to, and may not be indicative of, its core operating results.

The presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with ChargePoint’s consolidated financial statements prepared in accordance with GAAP. A reconciliation of ChargePoint’s historical non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included in this press release, and investors are encouraged to review these reconciliations.

Non-GAAP Gross Profit (Gross Margin). ChargePoint defines non-GAAP gross profit as gross profit excluding stock-based compensation expense, restructuring costs for severances and employment-related termination costs, and facility and other contract terminations, and amortization expense of acquired intangible assets Non-GAAP gross margin is non-GAAP gross profit as a percentage of revenue.

Non-GAAP Cost of Revenue and Operating Expenses (includes Non-GAAP research and development, Non-GAAP sales and marketing and Non-GAAP general and administrative). ChargePoint defines non-GAAP cost of revenue and operating expenses as cost of revenue and operating expenses excluding stock-based compensation expense, restructuring costs for severances and employment-related termination costs, and facility and other contract terminations, amortization expense of acquired intangible assets, non-cash charges related to tax liabilities and litigation settlements, including associated non-recurring legal expenses and professional service fees related to the modification of convertible debt.

Non-GAAP Net Loss. ChargePoint defines non-GAAP net loss as net loss excluding stock-based compensation expense, restructuring costs for severances and employment-related termination costs, and facility and other contract terminations, amortization expense of acquired intangible assets, non-cash charges related to tax liabilities and litigation settlements, including associated non-recurring legal expenses and professional service fees related to the modification of convertible debt. These amounts reflect the impact of any related tax effects. Non-GAAP pre-tax net loss is non-GAAP net loss adjusted for provision for income taxes.

Non-GAAP Adjusted EBITDA Loss. ChargePoint defines non-GAAP adjusted EBITDA loss as net loss excluding stock-based compensation expense, restructuring costs for severances and employment-related termination costs, and facility and other contract terminations, amortization expense of acquired intangible assets, non-cash charges related to tax liabilities and litigation settlements, including associated non-recurring legal expenses and professional service fees related to the modification of convertible debt, and further adjusted for provision of income taxes, depreciation, interest income and expense, and other income and expense (net).

Investors are cautioned that there are a number of limitations associated with the use of non-GAAP financial measures to analyze financial results and trends. In particular, many of the adjustments to ChargePoint’s GAAP financial measures reflect the exclusion of items that are recurring and will be reflected in its financial results for the foreseeable future, such as stock-based compensation, which is an important part of ChargePoint’s employees’ compensation and impacts hiring, retention and performance. Furthermore, these non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP, and the components that ChargePoint excludes in its calculation of non-GAAP financial measures may differ from the components that other companies exclude when they report their non-GAAP results. In the future, ChargePoint may also exclude other expenses it determines do not reflect the performance of ChargePoint’s operating results.

CHPT-IR

Contacts

Investor Relations

Nandan Amladi

Vice President, Finance and Investor Relations

nandan.amladi@chargepoint.com

investors@chargepoint.com

Press

John Paolo Canton

Vice President, Communications

JP.Canton@chargepoint.com

AJ Gosselin

Director, Corporate Communications

AJ.Gosselin@chargepoint.com

media@chargepoint.com

ChargePoint Holdings, Inc.

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Twelve Months Ended January 31, |

| | 2025 | | 2024 | | 2025 | | 2024 |

| Revenue | | | | | | | |

| Networked charging systems | $ | 52,620 | | | $ | 74,034 | | | $ | 234,802 | | | $ | 360,822 | |

| Subscriptions | 38,272 | | | 33,510 | | | 144,325 | | | 120,445 | |

| Other | 10,997 | | | 8,289 | | | 37,956 | | | 25,372 | |

| Total revenue | 101,889 | | | 115,833 | | | 417,083 | | | 506,639 | |

| Cost of revenue | | | | | | | |

| Networked charging systems | 50,199 | | | 68,814 | | | 223,351 | | | 386,149 | |

| Subscriptions | 17,406 | | | 20,099 | | | 71,218 | | | 73,595 | |

| Other | 5,584 | | | 4,515 | | | 21,833 | | | 16,777 | |

| Total cost of revenue | 73,189 | | | 93,428 | | | 316,402 | | | 476,521 | |

Gross profit | 28,700 | | | 22,405 | | | 100,681 | | | 30,118 | |

| Operating expenses | | | | | | | |

| Research and development | 30,415 | | | 55,219 | | | 141,276 | | | 220,781 | |

| Sales and marketing | 24,514 | | | 33,641 | | | 130,890 | | | 150,186 | |

| General and administrative | 28,720 | | | 26,475 | | | 81,514 | | | 109,102 | |

| Total operating expenses | 83,649 | | | 115,335 | | | 353,680 | | | 480,069 | |

| Loss from operations | (54,949) | | | (92,930) | | | (252,999) | | | (449,951) | |

| Interest income | 1,417 | | | 3,435 | | | 8,347 | | | 9,603 | |

| Interest expense | (8,008) | | | (6,600) | | | (30,494) | | | (16,273) | |

Other income (expense), net | (2,299) | | | 1,165 | | | (3,389) | | | (1,009) | |

| Net loss before income taxes | (63,839) | | | (94,930) | | | (278,535) | | | (457,630) | |

Provision for income taxes | 805 | | | (183) | | | 4,372 | | | (21) | |

| Net loss | $ | (64,644) | | | $ | (94,747) | | | $ | (282,907) | | | $ | (457,609) | |

| Net loss per share, basic and diluted | $ | (0.14) | | | $ | (0.23) | | | $ | (0.65) | | | $ | (1.22) | |

| Weighted average shares outstanding, basic and diluted | 447,583,115 | | | 419,185,407 | | | 433,489,800 | | | 375,529,883 | |

ChargePoint Holdings, Inc.

PRELIMINARY CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, unaudited)

| | | | | | | | | | | |

| January 31, 2025 | | January 31, 2024 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 224,571 | | | $ | 327,410 | |

| Restricted cash | 400 | | | 30,400 | |

| | | |

| Accounts receivable, net | 95,906 | | | 124,049 | |

| Inventories | 209,262 | | | 198,580 | |

| Prepaid expenses and other current assets | 36,435 | | | 62,244 | |

| Total current assets | 566,574 | | | 742,683 | |

| Property and equipment, net | 35,361 | | | 42,446 | |

| Intangible assets, net | 66,175 | | | 80,555 | |

| Operating lease right-of-use assets | 14,680 | | | 15,362 | |

| Goodwill | 207,540 | | | 213,750 | |

| Other assets | 7,845 | | | 8,567 | |

| Total assets | $ | 898,175 | | | $ | 1,103,363 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 64,050 | | | $ | 71,081 | |

| Accrued and other current liabilities | 124,679 | | | 159,104 | |

| Deferred revenue | 105,017 | | | 99,968 | |

| | | |

| Total current liabilities | 293,746 | | | 330,153 | |

| Deferred revenue, noncurrent | 134,198 | | | 131,471 | |

| Debt, noncurrent | 300,395 | | | 283,704 | |

| Operating lease liabilities | 15,267 | | | 17,350 | |

| Deferred tax liabilities | 12,036 | | | 11,252 | |

| Other long-term liabilities | 10,903 | | | 1,757 | |

| Total liabilities | 766,545 | | | 775,687 | |

| Stockholders' equity: | | | |

| Common stock | 46 | | | 42 | |

| Additional paid-in capital | 2,054,296 | | | 1,957,932 | |

| Accumulated other comprehensive loss | (25,433) | | | (15,926) | |

| Accumulated deficit | (1,897,279) | | | (1,614,372) | |

| Total stockholders' equity | 131,630 | | | 327,676 | |

| Total liabilities and stockholders' equity | $ | 898,175 | | | $ | 1,103,363 | |

ChargePoint Holdings, Inc.

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

| | | | | | | | | | | |

| | Twelve Months Ended January 31, |

| | 2025 | | 2024 |

| Cash flows from operating activities | | | |

| Net loss | $ | (282,907) | | | $ | (457,609) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 29,192 | | | 28,486 | |

| Non-cash operating lease cost | 3,535 | | | 4,343 | |

| Stock-based compensation | 75,651 | | | 117,327 | |

| Amortization of deferred contract acquisition costs | 3,207 | | | 2,859 | |

| | | |

| | | |

| | | |

| | | |

Inventory impairment | — | | | 70,000 | |

| Non-cash interest expense | 21,611 | | | — | |

Reserves and other | 26,556 | | | 8,439 | |

Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 17,371 | | | 36,510 | |

| Inventories | (17,048) | | | (173,661) | |

| Prepaid expenses and other assets | 2,274 | | | 7,002 | |

| Accounts payable, operating lease liabilities, and accrued and other liabilities | (35,631) | | | (5,466) | |

| Deferred revenue | 9,242 | | | 32,829 | |

| Net cash used in operating activities | (146,947) | | | (328,941) | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (12,073) | | | (19,424) | |

| | | |

| | | |

| Maturities of investments | — | | | 105,000 | |

| | | |

| Net cash provided by (used in) investing activities | (12,073) | | | 85,576 | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Debt issuance costs related to the revolving credit facility | — | | | (2,882) | |

| | | |

| Proceeds from the issuance of common stock under employee equity plans, net of tax withholding | 10,507 | | | 12,054 | |

Proceeds from issuance of common stock in connection with ATM offerings, net of issuance costs | 10,214 | | | 287,198 | |

| Change in driver funds and amounts due to customers | 7,817 | | | 13,691 | |

| Settlement of contingent earnout liability | — | | | (3,537) | |

| Net cash provided by financing activities | 28,538 | | | 306,524 | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (2,357) | | | 89 | |

Net decrease in cash, cash equivalents, and restricted cash | (132,839) | | | 63,248 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 357,810 | | | 294,562 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 224,971 | | | $ | 357,810 | |

ChargePoint Holdings, Inc.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended January 31, 2025 | | Three Months Ended January 31, 2024 | | Twelve Months Ended January 31, 2025 | | Twelve Months Ended January 31, 2024 |

| Cost of Revenue: | | | | | | | | | | | | | | | | |

| GAAP cost of revenue (as a percentage of revenue) | | $ | 73,189 | | | 72% | | $ | 93,428 | | | 81% | | $ | 316,402 | | | 76% | | $ | 476,521 | | | 94% |

| Stock-based compensation expense | | (1,233) | | | | | (1,375) | | | | | (5,102) | | | | | (6,154) | | | |

| Amortization of intangible assets | | (748) | | | | | (770) | | | | | (3,049) | | | | | (3,061) | | | |

| | | | | | | | | | | | | | | | |

| Restructuring costs (1) | | — | | | | | (632) | | | | | (960) | | | | | (1,628) | | | |

| Non-GAAP cost of revenue (as a percentage of revenue) | | $ | 71,208 | | | 70% | | $ | 90,651 | | | 78% | | $ | 307,291 | | | 74% | | $ | 465,678 | | | 92% |

| | | | | | | | | | | | | | | | |

| Gross Profit: | | | | | | | | | | | | | | | | |

| GAAP gross profit (gross margin as a percentage of revenue) | | $ | 28,700 | | | 28% | | $ | 22,405 | | | 19% | | $ | 100,681 | | | 24% | | $ | 30,118 | | | 6% |

| Stock-based compensation expense | | 1,233 | | | | | 1,375 | | | | | 5,102 | | | | | 6,154 | | | |

| Amortization of Intangible Assets | | 748 | | | | | 770 | | | | | 3,049 | | | | | 3,061 | | | |

| Restructuring costs (1) | | — | | | | | 632 | | | | | 960 | | | | | 1,628 | | | |

| Non-GAAP gross profit (gross margin as a percentage of revenue) | | $ | 30,681 | | | 30% | | $ | 25,182 | | | 22% | | $ | 109,792 | | | 26% | | $ | 40,961 | | | 8% |

| | | | | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | | | | | |

| GAAP research and development (as a percentage of revenue) | | $ | 30,415 | | | 30% | | $ | 55,219 | | | 48% | | $ | 141,276 | | | 34% | | $ | 220,781 | | | 44% |

| Stock-based compensation expense | | (8,186) | | | | | (11,131) | | | | | (37,050) | | | | | (50,935) | | | |

| Restructuring costs (1) | | — | | | | | (7,540) | | | | | (2,867) | | | | | (11,722) | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Non-GAAP research and development (as a percentage of revenue) | | $ | 22,229 | | | 22% | | $ | 36,548 | | | 32% | | $ | 101,359 | | | 24% | | $ | 158,124 | | | 31% |

| | | | | | | | | | | | | | | | |

| GAAP sales and marketing (as a percentage of revenue) | | $ | 24,514 | | | 24% | | $ | 33,641 | | | 29% | | $ | 130,890 | | | 31% | | $ | 150,186 | | | 30% |

| Stock-based compensation expense | | (1,453) | | | | | (5,541) | | | | | (15,875) | | | | | (22,934) | | | |

| Amortization of intangible assets | | (2,207) | | | | | (2,286) | | | | | (9,036) | | | | | (9,079) | | | |

| Restructuring costs (1) | | — | | | | | (500) | | | | | (5,067) | | | | | (1,843) | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Non-GAAP sales and marketing (as a percentage of revenue) | | $ | 20,854 | | | 20% | | $ | 25,314 | | | 22% | | $ | 100,912 | | | 24% | | $ | 116,330 | | | 23% |

| | | | | | | | | | | | | | | | |

| GAAP general and administrative (as a percentage of revenue) | | $ | 28,720 | | | 28% | | $ | 26,475 | | | 23% | | $ | 81,514 | | | 20% | | $ | 109,102 | | | 22% |

| Stock-based compensation expense | | (3,696) | | | | | (7,345) | | | | | (17,624) | | | | | (37,314) | | | |

| Restructuring costs | | — | | | | | (3,981) | | | | | (933) | | | | | (13,061) | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Other adjustments (2) | | (16,085) | | | | | (2,279) | | | | | (21,814) | | | | | (3,172) | | | |

| Non-GAAP general and administrative (as a percentage of revenue) | | $ | 8,939 | | | 9% | | $ | 12,870 | | | 11% | | $ | 41,143 | | | 10% | | $ | 55,555 | | | 11% |

| | | | | | | | | | | | | | | | |

| GAAP Operating Expenses (as a percentage of revenue) | | $ | 83,649 | | | 82% | | $ | 115,335 | | | 100% | | $ | 353,680 | | | 85% | | $ | 480,069 | | | 95% |

| Stock-based compensation expense | | (13,335) | | | | | (24,017) | | | | | (70,549) | | | | | (111,183) | | | |

| Amortization of intangible assets | | (2,207) | | | | | (2,286) | | | | | (9,036) | | | | | (9,079) | | | |

| Restructuring costs (1) | | — | | | | | (12,021) | | | | | (8,867) | | | | | (26,626) | | | |

| Other adjustments (2) | | (16,085) | | | | | (2,279) | | | | | (21,814) | | | | | (3,172) | | | |

| Non-GAAP Operating Expenses (as a percentage of revenue) | | $ | 52,022 | | | 51% | | $ | 74,732 | | | 65% | | $ | 243,414 | | | 58% | | $ | 330,009 | | | 65% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended January 31, 2025 | | Three Months Ended January 31, 2024 | | Twelve Months Ended January 31, 2025 | | Twelve Months Ended January 31, 2024 |

| Net Loss: | | | | | | | | | | | | | | | | |

| GAAP net loss (as a percentage of revenue) | | $ | (64,644) | | | (63)% | | $ | (94,747) | | | (82) | % | | $ | (282,907) | | | (68)% | | $ | (457,609) | | | (90)% |

| Stock-based compensation expense | | 14,568 | | | | | 25,392 | | | | | 75,651 | | | | | 117,337 | | | |

| Amortization of intangible assets | | 2,955 | | | | | 3,056 | | | | | 12,085 | | | | | 12,140 | | | |

| Restructuring costs (1) | | — | | | | | 12,653 | | | | | 9,827 | | | | | 28,254 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other adjustments (2) | | 16,085 | | | | | 2,279 | | | | | 21,814 | | | | | 3,172 | | | |

| Non-GAAP net loss (as a percentage of revenue) | | $ | (31,036) | | | (30)% | | $ | (51,367) | | | (44) | % | | $ | (163,530) | | | (39)% | | $ | (296,706) | | | (59)% |

| Provision for income taxes | | 805 | | | | | (183) | | | | | 4,372 | | | | | (21) | | | |

| Non-GAAP pre-tax net loss (as a percentage of revenue) | | $ | (30,231) | | | (30)% | | $ | (51,550) | | | (45) | % | | $ | (159,158) | | | (38)% | | $ | (296,727) | | | (59)% |

| Depreciation | | 4,032 | | | | | 4,270 | | | | | 17,107 | | | | | 16,345 | | | |

| Interest income | | (1,417) | | | | | (3,435) | | | | | (8,347) | | | | | (9,603) | | | |

| Interest expense | | 8,008 | | | | | 6,600 | | | | | 30,494 | | | | | 16,273 | | | |

| Other expense (income), net | | 2,299 | | | | | (1,165) | | | | | 3,389 | | | | | 1,009 | | | |

| Non-GAAP Adjusted EBITDA Loss (as a percentage of revenue) | | $ | (17,309) | | | (17)% | | $ | (45,280) | | | (39) | % | | $ | (116,515) | | | (28)% | | $ | (272,703) | | | (54)% |

(1)Consists of restructuring costs for severances and employment-related termination costs, and facility and other contract terminations.

(2)Consists of non-cash charges related to tax liabilities and litigation settlements, including associated non-recurring legal expenses and professional service fees related to the modification of the convertible debt.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

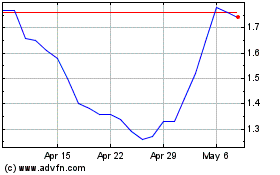

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Mar 2024 to Mar 2025