The acquisition enhances Shift4’s unified

commerce capabilities and extends its reach to the 400,000+ retail

and hospitality locations utilizing Global Blue’s specialized

technology solutions supporting cross-border luxury shopping.

Shift4 (NYSE: FOUR), the leader in integrated payments and

commerce technology, and Global Blue (NYSE: GB), the leading

specialty payments and technology platform enabling tax-free

shopping, dynamic currency conversion, and payments solutions to

the world’s largest retail brands, today announced they have

entered into a definitive agreement under which Shift4 will acquire

Global Blue for $7.50 per common share in cash, representing an 15%

premium to Global Blue’s closing share price as of February 14,

2025, and a ~$2.5 billion enterprise value.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250218353027/en/

Shift4 to acquire Global Blue (Graphic:

Business Wire)

With over 40 years of history, Global Blue is a market leader at

the intersection of travel and luxury retail across Europe, Asia,

and South America. More than 400,000 premium retail and hospitality

locations rely on Global Blue’s tax-refund and currency conversion

technology, including the world’s most iconic luxury and premium

retailers as well as other large retail electronics, sportswear and

fast fashion brands.

“This acquisition continues a bold tradition of introducing

transformative capabilities to exceptional customers along with a

massive embedded cross-sell opportunity,” said Shift4 President

Taylor Lauber. “It fits perfectly in the Shift4 playbook:

delivering an enormous volume conversion opportunity while

unlocking significant new revenue opportunities and capabilities

that open entirely new markets for us. Integrating Global Blue into

our unified payments platform positions Shift4 as a leading unified

commerce payment provider around the world.”

Global Blue’s merchant solutions will be added to Shift4’s

global payments platform to deliver an enhanced end-to-end

experience for its merchants. The addition of tax refund and

currency conversion capabilities enhances Shift4’s position as an

innovative vendor and trusted partner. Global Blue is the most

comprehensive two-sided network in its category, connecting

millions of affluent international shoppers to its merchants and

directly engaging with international shoppers through its

proprietary app, creating powerful network effects and allowing for

further product innovation, such as loyalty, digital marketing, and

more.

“Uniting with Shift4 represents the next phase of Global Blue’s

growth journey, enhancing our integrated value proposition to our

marquee merchants globally,” said Global Blue CEO Jacques Stern.

“Most importantly, we’re excited, alongside Shift4, to continue our

track-record of innovation to deliver better experiences for all

stakeholders in the shopping ecosystem.”

As part of the transaction, Shift4 is also announcing that two

current shareholders of Global Blue, Ant International and Tencent,

are exploring strategic partnerships with Shift4 and intend to

remain shareholders in the combined business. The partnership will

build on their existing relationship with Global Blue and explore

collaboration with Shift4 on global e-commerce payment products.

This will include the distribution of unified gateway service

Alipay+, which connects global merchants with 1.6 billion user

accounts of over 35 digital payment methods across the world, and

Weixin Pay, the most widely used mobile payment service in China,

throughout the Shift4 ecosystem, including hospitality and venues.

This partnership highlights these shareholders’ confidence in

Shift4’s ability to become a global leader in unified commerce

solutions for retail merchants.

“At Ant International we provide innovative payments,

digitization and financial services to drive the development of

global commerce and inclusive growth for SMEs. Our strategic

investment in Shift4 is highly consistent with that mission,” said

Douglas Feagin, President of Ant International, “We’ve been

impressed by Shift4’s emergence as a global omni-channel payment

partner in just the last few years and we’re excited to cement this

relationship early in their international expansion journey. We

extend our sincere gratitude to Jared Isaacman, Taylor Lauber and

Thomas Farley for their visionary decision that made this strategic

partnership possible. We look forward to future collaboration

across a broader ecosystem co-created by our two companies to

empower businesses of all sizes to thrive in the digital era.”

James Mitchell, Chief Strategy Officer and Senior Executive Vice

President of Tencent, added: “We are excited to continue supporting

Global Blue under Shift4’s new ownership. With Jared Isaacman and

Taylor Lauber at the helm, the company has become an impressive

integrated payments and commerce technology leader. We are pleased

to make a strategic investment in Shift4 and look forward to

exploring partnership opportunities globally.”

Transaction Details

Under the terms of the definitive agreement, Shift4 intends to

acquire Global Blue for $7.50 per common share in cash,

representing a 15% premium to Global Blue’s closing share price as

of February 14, 2025, through a tender offer and a subsequent

statutory squeeze-out merger. Upon completion of the transaction,

Global Blue’s common and preferred stock will no longer be listed

on any public stock exchange. Global Blue warrant holders will be

able to exercise their warrants, ahead of their maturity in August

2025.

The acquisition has been unanimously approved by the boards of

directors of Shift4 and Global Blue. It is expected to close by the

third quarter of calendar year 2025, subject to receipt of

regulatory approvals, other customary closing conditions, and a

minimum tender of at least 90% of Global Blue’s issued and

outstanding common shares and preferred shares on a combined basis.

Certain Global Blue shareholders have entered into tender and

support agreements, pursuant to which such shareholders agreed,

among other things, to tender their shares in the tender offer

subject to the terms and conditions of such agreements. The Global

Blue shareholders who entered into such tender and support

agreements own, in the aggregate, approximately 90% of Global

Blue’s issued and outstanding common shares and preferred shares on

a combined basis.

Shift4 expects to finance the acquisition with cash on hand and

a 364-day $1,795 million bridge loan facility entered in connection

with the transaction.

Tom Farley, Chairman of Global Blue, on behalf of the existing

board of directors including representatives of Silver Lake,

Partners Group, Certares, and Knighthead, said: “We are pleased to

unanimously recommend the transaction, which we believe will

deliver significant, immediate and certain value to Global Blue’s

shareholders. More broadly, we firmly believe that this transaction

is in the best interests of our employees, customers, and

stakeholders, ensuring continued growth and innovation under new

ownership.”

For further information regarding all terms and conditions

contained in the definitive agreement, please see Shift4's Current

Report on Form 8-K, which will be filed in connection with the

transaction.

Advisors

Goldman Sachs & Co. LLC is acting as exclusive financial

advisor to Shift4, Latham & Watkins LLP and Loyens & Loeff

N.V. are acting as legal counsel.

J.P. Morgan Securities LLC is acting as lead financial advisor

for Global Blue, Deutsche Bank Securities, IFBC, Oppenheimer &

Co. Inc., PJT Partners, and UBS are acting as financial advisors

(in alphabetical order), and Simpson Thacher & Bartlett LLP and

Niederer Kraft Frey Ltd are acting as legal counsel.

About Shift4

Shift4 (NYSE: FOUR) is boldly redefining commerce by simplifying

complex payments ecosystems across the world. As the leader in

commerce-enabling technology, Shift4 powers billions of

transactions annually for hundreds of thousands of businesses in

virtually every industry. For more information, visit

shift4.com.

About Global Blue

Global Blue (NYSE: GB) is the business partner for the shopping

journey, providing technology and services to enhance the

experience and drive performance. With over 40 years of expertise,

today we connect thousands of retailers, acquirers, and hotels with

nearly 80 million consumers across 52 countries, in three

industries: Tax Free Shopping, Payments and Post-Purchase

solutions. For more information, visit globalblue.com.

Additional Information and Where to Find It

The tender offer described above has not yet commenced. This

communication is for informational purposes only and is neither an

offer to buy nor a solicitation of an offer to sell any securities

of Global Blue. The solicitation and the offer to buy shares of

Global Blue’s Registered Ordinary Shares, Registered Series A

Convertible Preferred Shares and Registered Series B Convertible

Preferred Shares will only be made pursuant to a tender offer

statement on Schedule TO, including an offer to purchase, a letter

of transmittal and other related materials that Shift4 intends to

file with the Securities and Exchange Commission (“SEC”). In

addition, Global Blue will file with the SEC a

Solicitation/Recommendation Statement on Schedule 14D-9 with

respect to the tender offer. Once filed, investors will be able to

obtain a free copy of these materials and other documents filed by

Shift4 and Global Blue with the SEC at the website maintained by

the SEC at www.sec.gov. Investors may also obtain, at no charge,

any such documents filed with or furnished to the SEC by Shift4

under the “News & Events” section of Shift4’s website at

https://investors.shift4.com/news-events. INVESTORS AND SECURITY

HOLDERS OF GLOBAL BLUE ARE ADVISED TO READ THESE DOCUMENTS WHEN

THEY BECOME AVAILABLE, INCLUDING THE SOLICITATION/RECOMMENDATION

STATEMENT OF GLOBAL BLUE AND ANY AMENDMENTS THERETO, AS WELL AS ANY

OTHER DOCUMENTS RELATING TO THE TENDER OFFER AND THE MERGER THAT

ARE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY PRIOR TO

MAKING ANY DECISIONS WITH RESPECT TO WHETHER TO TENDER THEIR SHARES

INTO THE TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION,

INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Each of Shift4 and Global Blue intend such forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements

contained in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including statements regarding Shift4’s or Global Blue’s, as

applicable, respective expectations associated with the acquisition

of Global Blue by Shift4, including the completion of the

acquisition, the benefits, synergies, efficiencies, and

opportunities arising from the acquisition, and the timing of any

of the foregoing. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause each of our actual results,

performance or achievements, respectively, to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to the substantial and increasingly intense

competition worldwide in the financial services, payments and

payment technology industries; each of our ability to continue to

expand our respective share of the existing payment processing

markets or expand into new markets; additional risks associated

with each of our expansion into international operations, including

compliance with and changes in foreign governmental policies, as

well as exposure to foreign exchange rates; and each of our

respective ability to integrate and interoperate each of our

services and products with a variety of operating systems,

software, devices, and web browsers, and the other important

factors discussed under the caption “Risk Factors” in Part I, Item

1A in Shift4’s Annual Report on Form 10-K for the years ended

December 31, 2023 and December 31, 2024, under the caption “Key

Items – Risk Factors” in Item 3(D) in Global Blue’s Annual Report

on Form 20-F for the year ended March 31, 2024 and each of our

other filings with the SEC, respectively. Any such forward-looking

statements represent management’s expectations as of the date of

this press release. While we may elect to update such

forward-looking statements at some point in the future, each of

Shift4 and Global Blue, disclaim any obligation to do so, even if

subsequent events cause each of our views to change,

respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218353027/en/

Investor Relations Tom McCrohan EVP, Head of Investor

Relations Shift4 investors@shift4.com

Paloma Main Director, Strategy & Investor Relations Shift4

investors@shift4.com

Media Nate Hirshberg SVP, Marketing Shift4

nhirshberg@shift4.com

Alecia Pulman Partner ICR Shift4pr@icrinc.com

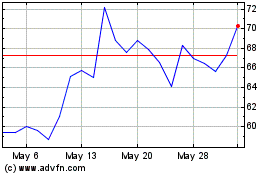

Shift4 Payments (NYSE:FOUR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Shift4 Payments (NYSE:FOUR)

Historical Stock Chart

From Feb 2024 to Feb 2025