UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 001-35297

Fortuna Mining Corp.

(Translation of registrant’s name into English)

200 Burrard Street, Suite 650, Vancouver, British

Columbia, Canada V6C 3L6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fortuna Mining Corp. |

| |

(Registrant) |

| |

|

| Date: January 15, 2025 |

By: |

/s/ "Jorge Ganoza Durant" |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

99.1 News release dated January 15, 2025

Exhibit 99.1

NEWS RELEASE

Fortuna announces sale of non-core

San Jose Mine, Mexico

Vancouver,

January 15, 2025: Fortuna Mining Corp. (NYSE: FSM | TSX: FVI) is pleased to announce it has entered into a binding letter

agreement (the “Letter Agreement”) to sell (the “Transaction”) its 100 percent interest in Compañia Minera Cuzcatlan S.A. de C.V. (“Cuzcatlan”)

to Minas del Balsas S.A. de C.V. (“MDB”), a private Mexican company. Cuzcatlan is the owner of a 100 percent interest

in the San Jose Mine in the state of Oaxaca, Mexico. Following the sale, Fortuna will cease to have any interest in the San Jose Mine,

other than the net smelter return royalty described below. The San Jose Mine was scheduled to initiate a progressive closure process starting

in early 2025.

Jorge A. Ganoza, President and CEO of

Fortuna, commented, “Fortuna successfully built, expanded, and operated the underground San Jose mine for thirteen years, developing

it into one of the 12 largest primary silver producers in the world for several years.” Mr. Ganoza added, “Today,

San Jose is no longer a core asset in our portfolio, and we believe Minera del Balsas is well suited to continue extracting value, benefiting

both employees and local stakeholders.” Mr. Ganoza concluded, “This transaction allows us to focus management’s

efforts on higher value opportunities within our portfolio.”

Details of the Transaction

Under the terms of the Letter Agreement,

MDB will acquire all of the issued and outstanding shares of Cuzcatlan held by Fortuna’s subsidiaries for the aggregate consideration

of:

| · | US$2 million payable on closing of the Transaction; |

| · | a further US$2 million payable on the first anniversary

of closing the Transaction; |

| · | a final US$2 million payable on the second anniversary

of closing the Transaction; and |

| · | the right to receive up to approximately US$11

million upon the completion of certain conditions. |

In addition, Fortuna will receive a 1.0

percent net smelter royalty on production from the San Jose Mine concessions, for a 5-year term as of the start of production.

The completion of the Transaction is subject

to customary conditions of closing and is expected to be completed in the first quarter of 2025. INFOR Financial Inc. acted as financial

advisor to Fortuna.

About Fortuna Mining Corp.

Fortuna

Mining Corp. is a Canadian precious metals mining company with five operating mines in Argentina, Burkina Faso, Côte d'Ivoire,

Mexico, and Peru, as well as the preliminary economic assessment stage Diamba Sud Gold Project located in Senegal. Sustainability is

integral to all our operations and relationships. We produce gold and silver and generate shared value over the long- term for our stakeholders

through efficient production, environmental protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Mining Corp.

Investor Relations:

Carlos

Baca | info@fmcmail.com | fortunamining.com | X | LinkedIn | YouTube

Forward-looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation

and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements

of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could

cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements

in this news release include, without limitation, statements about the ability of the Company or any of its subsidiaries to complete the

sale of the shares of Cuzcatlan; the anticipated receipt of future cash payments at closing and on the applicable anniversary in addition

to the net smelter returns royalty and Fortuna's right to receive certain additional payments upon the completion of certain conditions

post-closing; the timing of the progressive closing process for the San Jose Mine; and the Company’s business strategy, plans and

outlook. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”,

“potential”, “open”, “future”, “assumed”, “projected”, “used”,

“detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”,

“containing”, “remaining”, “to be”, or statements that events, “could” or “should”

occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve

known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company

to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, among others, changes in general economic conditions and financial markets; changes in prices for gold,

silver, and other metals; the timing and success of the Company’s proposed exploration programs; technological and operational hazards

in Fortuna’s mining and mine development activities; risks inherent in mineral exploration; fluctuations in prices for energy, labor,

materials, supplies and services; fluctuations in currencies; uncertainties inherent in the estimation of mineral reserves, mineral resources,

and metal recoveries; the Company’s ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner;

governmental and other approvals; political unrest or instability in countries where Fortuna is active; labor relations issues; as well

as those factors discussed under “Risk Factors” in the Company's Annual Information Form for the financial year ended

December 31, 2023. Although the Company has attempted to identify important factors that could cause actual actions, events or results

to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results

to differ from those anticipated, estimated or intended.

Forward-looking Statements contained

herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to, expectations regarding

the Company completing the sale of its interest in the San Jose Mine in accordance with, and on the timeline contemplated by, the terms

and conditions of the relevant agreements, on a basis consistent with the Company’s current expectations; that any future payments

in connection with the cash consideration, the net smelter returns royalty or in respect of any future additional payments, will be paid

to the Company; expected trends in mineral prices and currency exchange rates; that the Company’s activities will be in accordance

with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company or its

properties; that all required approvals will be obtained; that there will be no significant disruptions affecting operations and such

other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation

to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except as required

by law. There can be no assurance that Forward-looking Statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking

Statements.

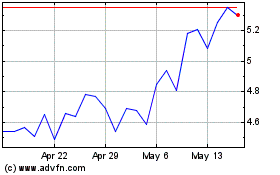

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Dec 2024 to Jan 2025

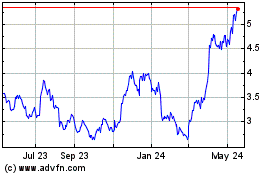

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Jan 2024 to Jan 2025