Raises Total Company Adjusted EBITDA and

Adjusted EPS Guidance

First Quarter 2024 Highlights

(All comparisons against the first quarter of 2023 unless

otherwise noted.)

Strong performance driven by its competitive differentiator -

Ingersoll Rand Execution Excellence (IRX):

- First quarter orders of $1,707 million, down 4%, or down 7%

organic

- On a two-year stack, up 5%, or up 1% organic

- Reported first quarter revenues of $1,670 million, up 3%, or

down 1% organic1

- On a two-year stack, up 24%, or up 20% organic1

- Reported net income attributable to Ingersoll Rand Inc. of $202

million, or earnings of $0.50 per share

- Adjusted net income1 of $320 million, or $0.78 per share

- Adjusted EBITDA1 of $459 million, up 15%, with a margin of

27.5%, up 290 basis points year over year

- Reported operating cash flow of $162 million and free cash

flow1 of $99 million, down 33%

- Liquidity of $3.5 billion as of March 31, 2024, including $1.5

billion of cash on hand and undrawn capacity of $2.0 billion under

available credit facilities

- Backlog remains near historically high levels, up 2% with a

book to bill of 1.02x

Raising 2024 Guidance

- Maintaining organic revenue growth guidance range of 2% to 4%

for the full year

- Raising Adjusted EBITDA1 guidance to a range of $1,940 to

$2,000 million, up 9% to 12% over prior year

- Raising full-year 2024 Adjusted EPS1 guidance to a range of

$3.20 to $3.30, up 8% to 11% over prior year

Ingersoll Rand Inc. (NYSE: IR) reported record first quarter

revenues, Adjusted EBITDA, and Adjusted EPS.

“Our team delivered another strong start to the year with record

first quarter revenue, Adjusted EBITDA, and Adjusted EPS,” said

Vicente Reynal, chairman and chief executive officer of Ingersoll

Rand. “We believe the power of IRX combined with our ownership

mindset and leading portfolios strengthens the durability of our

company while driving long-term value to shareholders.”

First Quarter 2024 Segment Review

(All comparisons against the first quarter of 2023 unless

otherwise noted.)

Industrial Technologies and Services Segment (IT&S):

broad range of compressor, vacuum, blower, and air treatment

solutions as well as industrial technologies including power tools

and lifting equipment

- Reported Orders of $1,398 million, down 4%, or down 7%

organic

- On a two-year stack, up 9%, or up 3% organic

- Book to bill of 1.02x

- Reported Revenues of $1,373 million, up 4%, or flat

organic1

- Reported Segment Adjusted EBITDA of $411 million, up

19%

- Reported Segment Adjusted EBITDA Margin of 29.9%, up 370

basis points, due to continued pricing strength and IRX driving

strong operational execution

- IT&S saw organic orders finish largely in line with

expectations, down 7%, mainly due to tough comparisons to the 10%

organic order growth in the first quarter of the prior year. The

tough comparisons are primarily driven by large, long-cycle orders

taken in the prior year in renewable natural gas (RNG) in Americas,

electric vehicle (EV) battery and solar end markets in China, and

general manufacturing and process gas across all regions. Book to

bill remains on track and consistent with the previous guidance of

above 1.0x in the first half of the year and approximately 1.0x for

the full year.

Precision and Science Technologies Segment (P&ST):

highly specialized fluid management solutions including precision

liquid and gas pumps and niche compression technologies

- Reported Orders of $309 million, down 5%, or down 5%

organic

- On a two-year stack, down 9%, or down 7% organic

- Book to bill of 1.04x

- Reported Revenues of $297 million, down 5%, or down 5%

organic1

- Reported Segment Adjusted EBITDA of $91 million, down

3%

- Reported Segment Adjusted EBITDA Margin of 30.8%, up 50

basis points, driven largely by improvements in pricing versus cost

and strong operational execution driven by IRX

- Order declines were primarily driven by the Life Sciences end

markets and tough comparisons in large, longer cycle orders.

Despite the expected year over year declines, Life Sciences saw a

15% sequential improvement in orders for Q1 2024 as compared to Q4

2023. In the industrial businesses, short cycle orders grew 9%

sequentially, driven by demand generation activities and the use of

IRX.

Balance Sheet and Cash Flow

Ingersoll Rand remains in a strong financial position with ample

liquidity of $3.5 billion. On a reported basis, the Company

generated $162 million of cash flow from operating activities and

invested $62 million in capital expenditures, resulting in free

cash flow1 of $99 million, compared to cash flow from operating

activities of $170 million and free cash flow1 of $148 million in

the prior year period. The year over year decline in free cash flow

was driven primarily by the timing of capital expenditures of

approximately $40 million and interest payments of approximately

$20 million on our recently issued bonds which require interest

payments two times per year as compared to our prior indebtedness

structure, which generally required even repayment over the course

of the year. Net debt to Adjusted EBITDA leverage1 was 0.7x for the

first quarter, which was an improvement of 0.4x as compared to the

prior year.

The Board also authorized a $1 billion increase to the Company’s

share repurchase program. This increase is incremental to the

amount remaining on the existing $750 million authorization, which

is expected to be exhausted by the end of 2024. These

authorizations do not have any expiration date. The program

authorizes Ingersoll Rand to repurchase shares from time to time,

in the open market at prevailing market prices (including through

Rule 10b5-1 plans), in privately negotiated transactions, a

combination thereof, or through other transactions. The actual

timing, number, manner, and value of any shares repurchased will

depend on several factors, including the market price of the

Company’s stock, general market and economic conditions, the

Company’s liquidity requirements, applicable legal requirements,

and other business considerations.

Consistent with our comprehensive capital allocation strategy

led by M&A, in the first quarter of 2024, Ingersoll Rand

deployed $143 million to M&A. Ingersoll Rand closed on the

acquisition of Controlled Fluidics, a specialized manufacturer of

thermoplastic, high-performance plastic bonding, and custom plastic

assembly products for life sciences, medical, aerospace, and

industrial applications. In addition, the Company closed on the

acquisition of Ethafilter s.r.l., a leading producer of filters and

filter elements that can be used with all major brands in the

compressed air sector. The Company also returned $81 million to

shareholders through $73 million in share repurchases and $8

million through its quarterly dividend payment in the first

quarter.

__________________ 1 Non-GAAP measure (definitions and/or

reconciliations in tables below)

Raising 2024 Guidance

Ingersoll Rand is raising its guidance for full-year 2024

Adjusted EBITDA and Adjusted EPS ranges based on the strong

performance in the first quarter, and its expectations of continued

strong commercial and operational performance for the balance of

the year:

Key Metrics2

Initial Guidance as of

2/15/24

Revised Guidance as of

5/2/24

Revenue - Total Ingersoll Rand

5-7%

4-6%

Ingersoll Rand (Organic)1

2-4%

2-4%

Industrial Technologies & Services

(Organic)

2-4%

2-4%

Precision & Science Technologies

(Organic)

2-4%

2-4%

FX Impact3

~1%

~Flat

M&A4

~$160M

~$170M

Corporate Costs

(~$160M)

(~$170M)

Adjusted EBITDA1

$1,915M - $1,975M (+7% - +11%

YoY)

$1,940M - $2,000M (+9% - +12%

YoY)

Adjusted EPS1

$3.14 - $3.24 (+6% - +9% YoY)

$3.20 - $3.30 (+8% - +11%

YoY)

Reconciliations of non-GAAP measures related to full-year 2024

guidance have not been provided due to the unreasonable efforts it

would take to provide such reconciliations due to the high

variability, complexity and uncertainty with respect to forecasting

and quantifying certain amounts that are necessary for such

reconciliations, including net income (loss) and adjustments that

could be made for acquisitions-related expenses, restructuring and

other business transformation costs, gains or losses on foreign

currency exchange and the timing and magnitude of other amounts in

the reconciliation of historic numbers. For the same reasons, we

are unable to address the probable significance of the unavailable

information, which could have a potentially unpredictable, and

potentially significant, impact on our future GAAP financial

results.

__________________

1 Non-GAAP measure (definitions and/or

reconciliations in tables below)

2 All revenue outlook commentary expressed

in percentages and based on growth as compared to 2023

3 Based on March 2024 FX rates; does not

include impact of FX on M&A

4 Reflects all completed and closed

M&A as of May 1, 2024

Conference Call

Ingersoll Rand will host a live earnings conference call to

discuss the first quarter results on Friday, May 3, 2024 at 8:00

a.m. (Eastern Time). To participate in the call, please dial

1-888-330-3073, domestically, or 1-646-960-0683, internationally,

and use access Code 8970061. A real-time audio webcast of the

presentation can be accessed via the Events and Presentations

section of the Ingersoll Rand Investor Relations website

(https://investors.irco.com), where related materials will be

posted prior to the conference call. A replay of the webcast will

be available after conclusion of the conference and can be accessed

on the Ingersoll Rand Investor Relations website.

Forward-Looking Statements

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements related to Ingersoll Rand Inc.’s (the

“Company” or “Ingersoll Rand”) expectations regarding the

performance of its business, its financial results, its liquidity

and capital resources and other non-historical statements. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,”

“forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,”

“intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,”

“would,” “will be,” “on track to” “will continue,” “will likely

result,” “guidance” or the negative thereof or variations thereon

or similar terminology generally intended to identify

forward-looking statements. All statements other than historical

facts are forward-looking statements.

These forward-looking statements are based on Ingersoll Rand’s

current expectations and are subject to risks and uncertainties,

which may cause actual results to differ materially from these

current expectations. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements. The inclusion of

such statements should not be regarded as a representation that

such plans, estimates or expectations will be achieved. Important

factors that could cause actual results to differ materially from

such plans, estimates or expectations include, among others, (1)

adverse impact on our operations and financial performance due to

natural disaster, catastrophe, global pandemics, geopolitical

tensions, cyber events, or other events outside of our control; (2)

unexpected costs, charges or expenses resulting from completed and

proposed business combinations; (3) uncertainty of the expected

financial performance of the Company; (4) failure to realize the

anticipated benefits of completed and proposed business

combinations; (5) the ability of the Company to implement its

business strategy; (6) difficulties and delays in achieving revenue

and cost synergies; (7) inability of the Company to retain and hire

key personnel; (8) evolving legal, regulatory and tax regimes; (9)

changes in general economic and/or industry specific conditions;

(10) actions by third parties, including government agencies; and

(11) other risk factors detailed in Ingersoll Rand’s most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”), as such factors may be updated from time to

time in its periodic filings with the SEC, which are available on

the SEC’s website at http://www.sec.gov. The foregoing list of

important factors is not exclusive.

Any forward-looking statements speak only as of the date of this

release. Ingersoll Rand undertakes no obligation to update any

forward-looking statements, whether as a result of new information

or developments, future events or otherwise, except as required by

law. Readers are cautioned not to place undue reliance on any of

these forward-looking statements.

About Ingersoll Rand Inc.

Ingersoll Rand Inc. (NYSE:IR), driven by an entrepreneurial

spirit and ownership mindset, is dedicated to Making Life Better

for our employees, customers, shareholders, and planet. Customers

lean on us for exceptional performance and durability in

mission-critical flow creation and industrial solutions. Supported

by over 80+ respected brands, our products and services excel in

the most complex and harsh conditions. Our employees develop

customers for life through their daily commitment to expertise,

productivity, and efficiency. For more information, visit

www.IRCO.com.

Non-U.S. GAAP Measures of Financial Performance

In addition to consolidated GAAP financial measures, Ingersoll

Rand reviews various non-GAAP financial measures, including

“Organic Revenue Growth/(Decline),” “Two-Year Stack (for Organic

Revenue Growth/(Decline)),” “Adjusted EBITDA,” “Adjusted Net

Income,” “Adjusted Diluted EPS” and “Free Cash Flow.”

Ingersoll Rand believes Adjusted EBITDA, Adjusted Net Income,

and Adjusted Diluted EPS are helpful supplemental measures to

assist management and investors in evaluating the Company’s

operating results as they exclude certain items that are unusual in

nature or whose fluctuation from period to period do not

necessarily correspond to changes in the operations of Ingersoll

Rand’s business. Ingersoll Rand believes Organic Revenue

Growth/(Decline) and Two-Year Stack (for Organic Revenue

Growth/(Decline)) are helpful supplemental measure to assist

management and investors in evaluating the Company’s operating

results as it excludes the impact of foreign currency and

acquisitions on revenue growth. Adjusted EBITDA represents net

income before interest, taxes, depreciation, amortization and

certain non-cash, non-recurring and other adjustment items.

Adjusted Net Income is defined as net income including interest,

depreciation and amortization of non-acquisition related intangible

assets and excluding other items used to calculate Adjusted EBITDA

and further adjusted for the tax effect of these exclusions.

Organic Revenue Growth/(Decline) is defined as As Reported Revenue

growth less the impacts of Foreign Currency and Acquisitions.

Two-Year Stack with respect to Organic Revenue is defined as the

sum of current year and prior year Organic Revenue

Growth/(Decline). Ingersoll Rand believes that the adjustments

applied in presenting Adjusted EBITDA and Adjusted Net Income are

appropriate to provide additional information to investors about

certain material non-cash items and about non-recurring items that

the Company does not expect to continue at the same level in the

future. Adjusted Diluted EPS is defined as Adjusted Net Income

divided by Adjusted Diluted Average Shares Outstanding.

Incrementals/Decrementals are defined as the change in Adjusted

EBITDA versus the prior year period divided by the change in

revenue versus the prior year period.

Ingersoll Rand uses Free Cash Flow to review the liquidity of

its operations. Ingersoll Rand measures Free Cash Flow as cash

flows from operating activities less capital expenditures.

Ingersoll Rand believes Free Cash Flow is a useful supplemental

financial measures for management and investors in assessing the

Company’s ability to pursue business opportunities and investments

and to service its debt. Free Cash Flow is not a measure of our

liquidity under GAAP and should not be considered as an alternative

to cash flows from operating activities.

Management and Ingersoll Rand’s board of directors regularly use

these measures as tools in evaluating the Company’s operating and

financial performance and in establishing discretionary annual

compensation. Such measures are provided in addition to, and should

not be considered to be a substitute for, or superior to, the

comparable measures under GAAP. In addition, Ingersoll Rand

believes that Organic Revenue Growth/(Decline), Two-Year Stack (for

Organic Revenue Growth/(Decline)), Adjusted EBITDA, Adjusted Net

Income, Adjusted Diluted EPS, Incrementals/Decrementals and Free

Cash Flow are frequently used by investors and other interested

parties in the evaluation of issuers, many of which also present

Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and

Free Cash Flow when reporting their results in an effort to

facilitate an understanding of their operating and financial

results and liquidity.

Organic Revenue Growth/(Decline), Two-Year Stack (for Organic

Revenue Growth/(Decline)), Adjusted EBITDA, Adjusted Net Income,

Adjusted Diluted EPS and Free Cash Flow should not be considered as

alternatives to revenue growth, net income, diluted earnings per

share or any other performance measure derived in accordance with

GAAP, or as alternatives to cash flow from operating activities as

a measure of our liquidity. Organic Revenue Growth/(Decline),

Two-Year Stack (for Organic Revenue Growth/(Decline)), Adjusted

EBITDA, Adjusted Net Income, Adjusted Diluted EPS and Free Cash

Flow have limitations as analytical tools, and you should not

consider such measures either in isolation or as substitutes for

analyzing Ingersoll Rand’s results as reported under GAAP.

Reconciliations of Organic Revenue Growth/(Decline), Two-Year

Stack (for Organic Revenue Growth/(Decline)), Adjusted EBITDA,

Adjusted Net Income, Adjusted Diluted EPS and Free Cash Flow to

their most comparable U.S. GAAP financial metrics for historical

periods are presented in the tables below.

Reconciliations of non-GAAP measures related to full-year 2024

guidance have not been provided due to the unreasonable efforts it

would take to provide such reconciliations due to the high

variability, complexity and uncertainty with respect to forecasting

and quantifying certain amounts that are necessary for such

reconciliations, including net income (loss) and adjustments that

could be made for acquisitions-related expenses, restructuring and

other business transformation costs, gains or losses on foreign

currency exchange and the timing and magnitude of other amounts in

the reconciliation of historic numbers. For the same reasons, we

are unable to address the probable significance of the unavailable

information, which could have a potentially unpredictable, and

potentially significant, impact on our future GAAP financial

results.

INGERSOLL RAND INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited; in millions, except

per share amounts)

For the Three Month Period

Ended March 31,

2024

2023

Revenues

$

1,670.1

$

1,629.3

Cost of sales

923.8

965.1

Gross Profit

746.3

664.2

Selling and administrative expenses

336.3

311.1

Amortization of intangible assets

91.6

92.4

Other operating expense, net

25.2

20.4

Operating Income

293.2

240.3

Interest expense

36.8

38.9

Other income, net

(13.2

)

(9.6

)

Income Before Income Taxes

269.6

211.0

Provision for income taxes

54.4

48.1

Income (loss) on equity method

investments

(10.7

)

0.3

Net Income

204.5

163.2

Less: Net income attributable to

noncontrolling interests

2.3

2.1

Net Income Attributable to Ingersoll

Rand Inc.

$

202.2

$

161.1

Basic earnings per share

0.50

0.40

Diluted earnings per share

0.50

0.39

INGERSOLL RAND INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in millions, except

share amounts)

March 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

1,452.3

$

1,595.5

Accounts receivable, net of allowance for

credit losses of $55.3 and $53.8, respectively

1,245.2

1,234.2

Inventories

1,051.8

1,001.1

Other current assets

257.5

219.6

Total current assets

4,006.8

4,050.4

Property, plant and equipment, net of

accumulated depreciation of $518.5 and $500.8, respectively

742.2

711.4

Goodwill

6,609.9

6,609.7

Other intangible assets, net

3,589.6

3,611.1

Deferred tax assets

32.7

31.5

Other assets

547.8

549.4

Total assets

$

15,529.0

$

15,563.5

Liabilities and Stockholders'

Equity

Current liabilities:

Short-term borrowings and current

maturities of long-term debt

$

31.3

$

30.6

Accounts payable

694.0

801.2

Accrued liabilities

999.3

995.5

Total current liabilities

1,724.6

1,827.3

Long-term debt, less current

maturities

2,687.0

2,693.0

Pensions and other postretirement

benefits

149.5

150.0

Deferred income tax liabilities

624.2

612.6

Other liabilities

424.0

433.9

Total liabilities

$

5,609.3

$

5,716.8

Stockholders' equity:

Common stock, $0.01 par value;

1,000,000,000 shares authorized; 429,651,459 and 428,589,061 shares

issued as of March 31, 2024 and December 31, 2023, respectively

4.3

4.3

Capital in excess of par value

9,569.8

9,550.8

Retained earnings

1,891.3

1,697.2

Accumulated other comprehensive loss

(302.6

)

(227.6

)

Treasury stock at cost; 25,926,540 and

25,241,667 shares as of March 31, 2024 and December 31, 2023,

respectively

(1,307.5

)

(1,240.9

)

Total Ingersoll Rand stockholders'

equity

$

9,855.3

$

9,783.8

Noncontrolling interests

64.4

62.9

Total stockholders' equity

$

9,919.7

$

9,846.7

Total liabilities and stockholders'

equity

$

15,529.0

$

15,563.5

INGERSOLL RAND INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited; in millions)

Three Month Period Ended March

31,

2024

2023

Cash Flows From Operating

Activities:

Net income

$

204.5

$

163.2

Adjustments to reconcile net income to net

cash provided by operating activities:

Amortization of intangible assets

91.6

92.4

Depreciation

25.6

21.6

Non-cash restructuring charges

—

0.9

Stock-based compensation expense

14.1

12.1

Income (loss) on equity method

investments

10.7

(0.3

)

Foreign currency transaction losses

(gains), net

(0.7

)

1.0

Non-cash adjustments to carrying value of

LIFO inventories

6.7

7.8

Other non-cash adjustments

1.4

2.9

Changes in assets and liabilities:

Receivables

(11.5

)

(83.7

)

Inventories

(58.2

)

(45.3

)

Accounts payable

(101.5

)

(70.6

)

Accrued liabilities

(1.8

)

56.5

Other assets and liabilities, net

(19.3

)

11.8

Net cash provided by operating

activities

161.6

170.3

Cash Flows Used In Investing

Activities:

Capital expenditures

(62.3

)

(22.4

)

Net cash paid in acquisitions

(143.3

)

(566.4

)

Disposals of property, plant and

equipment

—

7.3

Net cash used in investing activities

(205.6

)

(581.5

)

Cash Flows Used In Financing

Activities:

Principal payments on long-term debt

(7.1

)

(11.0

)

Purchases of treasury stock

(72.9

)

(77.0

)

Cash dividends on common shares

(8.1

)

(8.1

)

Proceeds from stock option exercises

11.2

9.2

Payments of deferred and contingent

acquisition consideration

(2.2

)

(1.9

)

Other financing

(0.5

)

(0.5

)

Net cash used in financing activities

(79.6

)

(89.3

)

Effect of exchange rate changes on cash

and cash equivalents

(19.6

)

6.8

Net decrease in cash and cash

equivalents

(143.2

)

(493.7

)

Cash and cash equivalents, beginning of

period

1,595.5

1,613.0

Cash and cash equivalents, end of

period

$

1,452.3

$

1,119.3

INGERSOLL RAND INC. AND

SUBSIDIARIES

UNAUDITED ADJUSTED FINANCIAL

INFORMATION

(Dollars in millions)

For the Three Month Period

Ended March 31,

2024

2023

Ingersoll Rand

Revenues

$

1,670.1

$

1,629.3

Adjusted EBITDA

$

458.5

$

400.1

Adjusted EBITDA Margin

27.5

%

24.6

%

INGERSOLL RAND INC. AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME ATTRIBUTABLE TO

INGERSOLL RAND AND ADJUSTED DILUTED EARNINGS PER SHARE

(Unaudited; in millions)

For the Three Month Period

Ended March 31,

2024

2023

Net Income

$

204.5

$

163.2

Plus:

Provision for income taxes

54.4

48.1

Amortization of acquisition related

intangible assets

89.5

89.8

Restructuring and related business

transformation costs

10.7

4.3

Acquisition and other transaction related

expenses and non-cash charges

15.3

18.0

Stock-based compensation

14.1

12.1

Foreign currency transaction losses

(gains), net

(0.7

)

1.0

Loss (income) on equity method

investments

10.7

(0.3

)

Adjustments to LIFO inventories

6.8

7.8

Cybersecurity incident costs

0.6

—

Other adjustments

0.4

(1.4

)

Minus:

Income tax provision, as adjusted

86.4

75.6

Adjusted Net Income

319.9

267.0

Less: Net income attributable to

noncontrolling interest

2.3

2.1

Adjusted Net Income Attributable to

Ingersoll Rand Inc.

$

317.6

$

264.9

Adjusted Basic Earnings Per

Share1

$

0.79

$

0.66

Adjusted Diluted Earnings Per

Share2

$

0.78

$

0.65

Average shares outstanding:

Basic, as reported

403.5

405.0

Diluted, as reported

407.9

409.2

Adjusted diluted2

407.9

409.2

1 Basic and diluted earnings (loss) per

share (as reported) are calculated by dividing net income (loss)

attributable to Ingersoll Rand Inc. by the basic and diluted

average shares outstanding for the respective periods.

2 Adjusted diluted share count and

adjusted diluted earnings per share include incremental dilutive

shares, using the treasury stock method, which are added to average

shares outstanding.

INGERSOLL RAND INC. AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

TO ADJUSTED EBITDA AND ADJUSTED NET INCOME AND CASH FLOWS FROM

OPERATING ACTIVITIES TO FREE CASH FLOW

(Unaudited; in millions)

For the Three Month Period

Ended March 31,

2024

2023

Net Income

$

204.5

$

163.2

Plus:

Interest expense

36.8

38.9

Provision for income taxes

54.4

48.1

Depreciation expense

24.7

20.7

Amortization expense

91.6

92.4

Restructuring and related business

transformation costs

10.7

4.3

Acquisition and other transaction related

expenses and non-cash charges

15.3

18.0

Stock-based compensation

14.1

12.1

Foreign currency transaction losses

(gains), net

(0.7

)

1.0

Loss (income) on equity method

investments

10.7

(0.3

)

Adjustments to LIFO inventories

6.8

7.8

Cybersecurity incident costs

0.6

—

Interest income on cash and cash

equivalents

(11.4

)

(4.7

)

Other adjustments

0.4

(1.4

)

Adjusted EBITDA

$

458.5

$

400.1

Minus:

Interest expense

36.8

38.9

Income tax provision, as adjusted

86.4

75.6

Depreciation expense

24.7

20.7

Amortization of non-acquisition related

intangible assets

2.1

2.6

Interest income on cash and cash

equivalents

(11.4

)

(4.7

)

Adjusted Net Income

$

319.9

$

267.0

Free Cash Flow:

Cash flows from operating activities

$

161.6

$

170.3

Minus:

Capital expenditures

62.3

22.4

Free Cash Flow

$

99.3

$

147.9

INGERSOLL RAND INC. AND

SUBSIDIARIES

RECONCILIATION OF SEGMENT

ADJUSTED EBITDA TO NET INCOME

(Unaudited; in millions)

For the Three Month Period

Ended March 31,

2024

2023

Orders

Industrial Technologies and Services

$

1,398.4

$

1,450.3

Precision and Science Technologies

309.0

326.5

Total Orders

$

1,707.4

$

1,776.8

Revenue

Industrial Technologies and Services

$

1,373.4

$

1,317.2

Precision and Science Technologies

296.7

312.1

Total Revenue

$

1,670.1

$

1,629.3

Segment Adjusted EBITDA

Industrial Technologies and Services

$

411.1

$

345.6

Precision and Science Technologies

91.4

94.5

Total Segment Adjusted EBITDA

$

502.5

$

440.1

Less items to reconcile Segment Adjusted

EBITDA to Income Before Income Taxes:

Corporate expenses not allocated to

segments

$

44.0

$

40.0

Interest expense

36.8

38.9

Depreciation and amortization expense

116.3

113.1

Restructuring and related business

transformation costs

10.7

4.3

Acquisition and other transaction related

expenses and non-cash charges

15.3

18.0

Stock-based compensation

14.1

12.1

Foreign currency transaction losses

(gains), net

(0.7

)

1.0

Adjustments to LIFO inventories

6.8

7.8

Cybersecurity incident costs

0.6

—

Interest income on cash and cash

equivalents

(11.4

)

(4.7

)

Other adjustments

0.4

(1.4

)

Income Before Income Taxes

269.6

211.0

Provision for income taxes

54.4

48.1

Income (loss) on equity method

investments

(10.7

)

0.3

Net Income

$

204.5

$

163.2

INGERSOLL RAND INC. AND

SUBSIDIARIES

ORDERS GROWTH (DECLINE) BY

SEGMENT1

For the Three Month Period

Ended March 31,

Two-Year Stack2

2024

2023

Ingersoll Rand

Organic growth (decline)

(6.9

%)

7.6

%

0.7

%

Impact of foreign currency

(0.1

%)

(3.8

%)

(3.9

%)

Impact of acquisitions

3.1

%

5.2

%

8.3

%

Total orders growth (decline)

(3.9

%)

9.0

%

5.1

%

Industrial Technologies &

Services

Organic growth (decline)

(7.2

%)

10.0

%

2.8

%

Impact of foreign currency

(0.2

%)

(3.9

%)

(4.1

%)

Impact of acquisitions

3.8

%

6.1

%

9.9

%

Total orders growth (decline)

(3.6

%)

12.2

%

8.6

%

Precision & Science

Technologies

Organic decline

(5.4

%)

(1.7

%)

(7.1

%)

Impact of foreign currency

—

%

(3.2

%)

(3.2

%)

Impact of acquisitions

—

%

1.8

%

1.8

%

Total orders decline

(5.4

%)

(3.1

%)

(8.5

%)

1 Organic growth/(decline), impact of

foreign currency, and impact of acquisitions are non-GAAP measures.

References to “impact of acquisitions” refer to GAAP sales from

acquired businesses recorded prior to the first anniversary of the

acquisition. The portion of GAAP revenue attributable to currency

translation is calculated as the difference between (a) the

period-to-period change in revenue (excluding acquisition sales)

and (b) the period-to-period change in revenue (excluding

acquisition sales) after applying prior year foreign exchange rates

to the current year period.

2 Two-year stack is defined as the sum of

current year growth/(decline) and prior year growth/(decline).

INGERSOLL RAND INC. AND

SUBSIDIARIES

REVENUE GROWTH (DECLINE) BY

SEGMENT1

For the Three Month Period

Ended March 31,

Two-Year Stack2

2024

2023

Ingersoll Rand

Organic growth (decline)

(0.8

%)

20.4

%

19.6

%

Impact of foreign currency

(0.1

%)

(4.3

%)

(4.4

%)

Impact of acquisitions

3.4

%

5.8

%

9.2

%

Total revenue growth

2.5

%

21.9

%

24.4

%

Industrial Technologies &

Services

Organic growth (decline)

0.2

%

24.5

%

24.7

%

Impact of foreign currency

(0.1

%)

(4.5

%)

(4.6

%)

Impact of acquisitions

4.2

%

6.7

%

10.9

%

Total revenue growth

4.3

%

26.7

%

31.0

%

Precision & Science

Technologies

Organic growth (decline)

(5.0

%)

6.0

%

1.0

%

Impact of foreign currency

0.1

%

(3.5

%)

(3.4

%)

Impact of acquisitions

—

%

2.4

%

2.4

%

Total revenue growth (decline)

(4.9

%)

4.9

%

—

%

1 Organic growth/(decline), impact of

foreign currency, and impact of acquisitions are non-GAAP measures.

References to “impact of acquisitions” refer to GAAP sales from

acquired businesses recorded prior to the first anniversary of the

acquisition. The portion of GAAP revenue attributable to currency

translation is calculated as the difference between (a) the

period-to-period change in revenue (excluding acquisition sales)

and (b) the period-to-period change in revenue (excluding

acquisition sales) after applying prior year foreign exchange rates

to the current year period.

2 Two-year stack is defined as the sum of

current year growth/(decline) and prior year growth/(decline).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502467870/en/

Investor Relations: Matthew Fort Matthew.Fort@irco.com

Media: Sara Hassell Sara.Hassell@irco.com

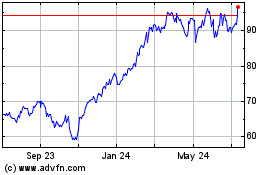

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Dec 2024 to Jan 2025

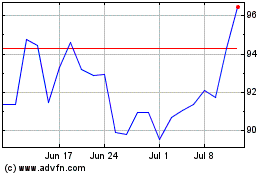

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Jan 2024 to Jan 2025