0001357615false00013576152025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2025

KBR, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-33146 | 20-4536774 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | |

| 601 Jefferson Street | |

| Suite 3400 | |

| Houston, | Texas | 77002 | |

| (Address of principal executive offices) | |

Registrant's telephone number including area code: (713) 753-2000

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which listed |

| Common Stock, $0.001 par value | KBR | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 24, 2025, KBR, Inc. issued a press release titled, “KBR Reports Fourth Quarter and Fiscal Year 2024 Results.” The full text of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| | KBR, Inc. press release dated February 24, 2025, titled, “KBR Reports Fourth Quarter and Fiscal Year 2024 Results.” |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | KBR, INC. |

| | |

| | |

| February 24, 2025 | | /s/ Sonia Galindo |

| | Sonia Galindo |

| | Executive Vice President, General Counsel & Corporate Secretary |

KBR Reports Fourth Quarter and Fiscal Year 2024 Results

Delivered Strong Financial Performance with Solid Bookings Momentum

Issues Fiscal Year 2025 Guidance for Revenues, Adj. EBITDA, Adj. EPS, and Operating Cash Flows

Fourth Quarter 2024 Highlights

(All comparisons versus prior year period unless noted.)

•Revenues of $2.1 billion, up 23% (15% organic)

•Net income attributable to KBR of $76 million; Adjusted EBITDA2 of $228 million, up 21% with an Adjusted EBITDA2 margin of 10.7%

•Diluted EPS of $0.57; Adjusted EPS2 of $0.91, up 32%

•Bookings and options1 of $2.0 billion with 1.0x book-to-bill1

Fiscal Year 2024 Highlights

(All comparisons versus prior year period unless noted.)

•Revenues of $7.7 billion, up 11% (9% organic)

•Net income attributable to KBR of $375 million; Adjusted EBITDA2 of $870 million, up 16% with an Adjusted EBITDA2 margin of 11.2%

•Diluted EPS of $2.79; Adjusted EPS2 of $3.34, up 15%

•Operating cash flows of $462 million, 103% Operating cash conversion2

•Bookings and options1 of $8.8 billion with 1.1x book-to-bill1

•Returned $297 million of value to shareholders through share repurchases and dividends

HOUSTON, TX - February 24, 2025 - KBR, Inc. (NYSE: KBR) today announced its fourth quarter and fiscal year 2024 results.

“KBR delivered sustained performance throughout the year culminating in a strong fourth quarter, with significant revenue and earnings growth as well as margin expansion,” said Stuart Bradie, President and CEO. “During 2024, we maintained our industry-leading safety record, met or exceeded our full year guidance, and advanced our strategy. In addition, we executed a realignment of our segments to better serve our customers and end markets, reduce costs, and open a larger pipeline of opportunities. We also expanded our capabilities with the acquisition of LinQuest, a leading provider of advanced engineering, data analytics and digital capabilities for national security and military space missions.”

Mr. Bradie continued, “We believe our business portfolio is well aligned with the priorities of the new administration in the U.S., especially in the areas of national security and energy policy. Our unique and diverse global portfolio, which serves both commercial and government clients in mission critical and key operational functions, offers resilience given issues present in the world today. As measured from our fiscal year 2024 results, more than 60% of Adj. EBITDA contribution is from non-U.S. government customers. This positioning enables us to approach our fiscal year 2025 outlook with a high degree of confidence, with more than 75% of our projected Revenues already under contract across our global, diversified contract base.”

1 As used throughout this release, book-to-bill and bookings and options exclude long-term UK PFIs and the Plaquemines LNG project.

2 As used throughout this earnings release, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, Operating cash conversion, and Adjusted operating cash flows and conversion are non-GAAP financial measures. See additional information at the end of this release regarding non-GAAP financial information, including reconciliations to the nearest GAAP measures.

1

Summarized Fourth Quarter and Fiscal Year 2024 Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| January 3, | | December 29, | | January 3, | | December 29, |

| Dollars in millions, except share data | 2025 | | 2023 | | 2025 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Revenues | $ | 2,122 | | | $ | 1,730 | | | $ | 7,742 | | | $ | 6,956 | |

| Operating income | 142 | | | 147 | | | 662 | | | 448 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) attributable to KBR | 76 | | | 21 | | | 375 | | | (265) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Adjusted EBITDA2 | 228 | | | 188 | | | 870 | | | 747 | |

| | | | | | | |

Operating income margin | 6.7 | % | | 8.5 | % | | 8.6 | % | | 6.4 | % |

Adjusted EBITDA2 margin | 10.7 | % | | 10.9 | % | | 11.2 | % | | 10.7 | % |

Earnings per share: | | | | | | | |

Diluted earnings per share | 0.57 | | | 0.15 | | | 2.79 | | | (1.96) | |

Adjusted earnings per share2 | 0.91 | | | 0.69 | | | 3.34 | | | 2.91 | |

| Cash flows: | | | | | | | |

Operating cash flows | 40 | | | 83 | | | 462 | | | 331 | |

Adjusted operating cash flows2 | 40 | | | 83 | | | 462 | | | 463 | |

| | | | | | | |

Return of capital to shareholders: | | | | | | | |

Payments to reacquire common stock | 51 | | | 1 | | | 218 | | | 138 | |

Payments of dividends to shareholders | 20 | | | 19 | | | 79 | | | 72 | |

Leverage: | | | | | | | |

Total gross debt | | | | | 2,594 | | | 1,851 | |

Cash | | | | | 350 | | | 304 | |

Net leverage (Net debt / Adjusted EBITDA2) | | | | | 2.6x | | 2.1x |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fourth Quarter 2024 Consolidated Results Review

(All comparisons against the fourth quarter 2023 unless noted.)

Revenues were $2.1 billion, up 23% or $392 million, primarily driven by on-contract growth across all Government Solutions business units, contributions from the LinQuest acquisition, and growing demand in Sustainable Technology Solutions from engineering and professional services and technology licensing.

Operating income was $142 million, down 4% or $5 million, primarily due to a $26 million resolution of an outstanding contract dispute associated with a legacy U.S. government project.

Net income attributable to KBR was $76 million, up 262% or $55 million, primarily due to a $66 million non-cash charge in the prior year period related to the election of cash as the settlement method for our Convertible Notes that did not recur in the current year period.

Diluted earnings per share were $0.57, up 280% or $0.42, primarily due to higher Net income attributable to KBR noted above and lower diluted weighted average common shares outstanding in the current year period.

Adjusted EBITDA2 was $228 million, up 21% or $40 million, generally in line with the growth in Revenues. Adjusted EBITDA2 margin was 10.7%, generally in line with the prior period.

Adjusted earnings per share2 were $0.91, up 32% or $0.22, due to the increase in Adjusted EBITDA2 noted above, favorable Other non-operating income results from foreign exchange, and lower adjusted weighted average common shares outstanding; partially offset by higher interest expense.

Backlog and options as of the fiscal year end totaled $21.2 billion. Book-to-bill1 was 1.0x for the quarter and 1.1x on a trailing-twelve-months basis.

1 As used throughout this release, book-to-bill excludes long-term UK PFIs and the Plaquemines LNG project. Bookings and options exclude long-term UK PFIs and the Plaquemines LNG project.

2 As used throughout this earnings release, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, Operating cash conversion, and Adjusted operating cash flows and conversion are non-GAAP financial measures. See additional information at the end of this release regarding non-GAAP financial information, including reconciliations to the nearest GAAP measures.

2

Summarized Fourth Quarter and Fiscal Year 2024 Segment Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| January 3, | | December 29, | | January 3, | | December 29, |

| Dollars in millions, Backlog in billions | 2025 | | 2023 | | 2025 | | 2023 |

| Revenues | $ | 2,122 | | | $ | 1,730 | | | $ | 7,742 | | | $ | 6,956 | |

| Government Solutions | 1,598 | | | 1,328 | | | 5,871 | | | 5,353 | |

| Sustainable Technology Solutions | 524 | | | 402 | | | 1,871 | | | 1,603 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Adjusted EBITDA2 | 228 | | | 188 | | | 870 | | | 747 | |

| Government Solutions | 150 | | | 128 | | | 587 | | | 536 | |

| Sustainable Technology Solutions | 108 | | | 85 | | | 398 | | | 336 | |

| Corporate | (30) | | | (25) | | | (115) | | | (125) | |

Adjusted EBITDA2 margin | 10.7 | % | | 10.9 | % | | 11.2 | % | | 10.7 | % |

| Government Solutions | 9.4 | % | | 9.6 | % | | 10.0 | % | | 10.0 | % |

| Sustainable Technology Solutions | 20.6 | % | | 21.1 | % | | 21.3 | % | | 21.0 | % |

| Backlog | | | | | 17,264 | | | 17,335 | |

| | | | | | | |

| Government Solutions | | | | | 13,554 | | | 12,790 | |

| Sustainable Technology Solutions | | | | | 3,710 | | | 4,545 | |

| Backlog and options | | | | | 21,239 | | | 21,732 | |

| Government Solutions | | | | | 17,529 | | | 17,187 | |

| Sustainable Technology Solutions | | | | | 3,710 | | | 4,545 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fourth Quarter 2024 Segment Results Review

(All comparisons against the fourth quarter 2023 unless noted.)

Government Solutions (GS)

Revenues were $1,598 million, up 20% or $270 million, driven by new and on-contract growth across all business units and $140 million from the LinQuest acquisition.

Operating income was $91 million, down 12% or $12 million, primarily due to a $26 million resolution of an outstanding contract dispute associated with a legacy U.S. government project. Operating income margin was 5.7%.

Adjusted EBITDA2 was $150 million, up 17% or $22 million, generally in line with the growth in Revenues. Adjusted EBITDA2 margin was 9.4%, generally in line with the prior year period.

Backlog and options as of the fiscal year end totaled $17.5 billion. Book-to-bill1 was 0.9x for the quarter and 1.1x on a trailing-twelve months basis.

The following new business awards were announced:

•Awarded $187 million U.S. State Department Task Order for Medical Support Services in Iraq

•Awarded $445 million DoD Contract for Joint Mission Environment Test Capability Program

•Awarded $88 million Contract to Provide Rapid Prototyping for Naval Air Systems Command

Sustainable Technology Solutions (STS)

Revenues were $524 million, up 30% or $122 million, driven by increasing demand for sustainable technologies and services.

Operating income was $93 million, up 15% or $12 million, generally in line with the growth in Revenues but partially offset by a $10 million non-cash charge recorded in Equity in earnings (losses) of unconsolidated affiliates

1 As used throughout this release, book-to-bill excludes long-term UK PFIs and the Plaquemines LNG project. Bookings and options exclude long-term UK PFIs and the Plaquemines LNG project.

2 As used throughout this earnings release, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, Operating cash conversion, and Adjusted operating cash flows and conversion are non-GAAP financial measures. See additional information at the end of this release regarding non-GAAP financial information, including reconciliations to the nearest GAAP measures.

3

in the current quarter related to foreign currency remeasurement of a contingent liability on the legacy Ichthys project. Operating income margin was 17.7%.

Adjusted EBITDA2 was $108 million, up 27% or $23 million, generally in line with the growth in Revenues. Adjusted EBITDA2 margin was 20.6%, generally in line with the prior year period.

Backlog as of the fiscal year end totaled $3.7 billion. Book-to-bill1 was 1.3x for the quarter and 1.1x on a trailing-twelve months basis.

The following new business awards were announced:

•Selected to Provide Technology Licensing and Proprietary Engineering Design for Lithium Extraction Demonstration Plant in the UK

•Awarded Contract to Support Sustainable Energy Production in Saudi Arabia

•Awarded Global Agreement with BP to Provide EPCM Services

•Awarded FEED Contract for LNG Project in Sur, Oman

•Ammonia Technology Selected by KazAzot, Kazakhstan

•Ammonia Technology Selected by AMUFERT, Angola

Balance Sheet, Cash Flow, and Capital Deployment

Liquidity as of January 3, 2025, totaled approximately $1 billion, comprising $655 million in borrowing capacity under the revolving credit facility and $350 million cash on hand. Net leverage ratio as of January 3, 2025, was 2.6x.

Operating cash flows for the fiscal year were $462 million with Operating cash conversion2 of 103%. Operating cash flows in the fourth quarter and fiscal year were reduced due to a pre-funding of our 2025 pension obligation to our U.K pension plan for approximately £17 million ($21 million at exchange rate as of January 3, 2025).

During the fiscal year, KBR returned $297 million in capital to shareholders, consisting of $218 million in share repurchases and $79 million in regular dividends.

On February 20, 2025, the Board of Directors approved a 10% increase to the dividend, resulting in a quarterly dividend of $0.165 per share, or $0.66 per share annualized. The dividend is payable April 15, 2025, to shareholders of record on March 14, 2025. In addition, the Board increased the total amount authorized and available for repurchase under the share repurchase program to $750 million.

Segment Realignment

To streamline and optimize our processes, we realigned our segments effective for fiscal 2025. As part of this realignment, our Government Solutions reportable segment has been renamed Mission Technology Solutions, while Sustainable Technology Solutions has retained its name. The international business contained within Government Solutions has been integrated into both Mission Technology Solutions and Sustainable Technology Solutions. The Company will begin reporting the new segment information beginning the first fiscal quarter of 2025.

1 As used throughout this release, book-to-bill excludes long-term UK PFIs and the Plaquemines LNG project. Bookings and options exclude long-term UK PFIs and the Plaquemines LNG project.

2 As used throughout this earnings release, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, Operating cash conversion, and Adjusted operating cash flows and conversion are non-GAAP financial measures. See additional information at the end of this release regarding non-GAAP financial information, including reconciliations to the nearest GAAP measures.

4

Fiscal Year 2025 Guidance

KBR issues the following outlook for fiscal year 2025:

| | | | | | | | | |

| Fiscal Year 2025 Guidance | Growth | |

| Revenues | $8.7B - $9.1B | + 12% - 18%, up 15% at the midpoint | |

| Adjusted EBITDA | $950M - $990M | + 9% - 14%, up 11% at the midpoint | |

| | | |

| Adjusted EPS | $3.71 - $3.95 | + 11% - 18%, up 15% at the midpoint | |

| | | |

| Operating cash flows | $500M - $550M | + 8% - 19%, up 14% at the midpoint | |

The company does not provide reconciliations of Adjusted EBITDA and Adjusted EPS to the most comparable GAAP financial measures on a forward-looking basis because the company is unable to predict with reasonable certainty the ultimate outcome of legal proceedings, unusual gains and losses, and acquisition-related expenses without unreasonable effort, which could be material to the company’s results computed in accordance with GAAP.

Management has provided the following assumptions related to fiscal year 2025 guidance:

•Adjusted weighted average common shares outstanding: ~133 million

•Depreciation & amortization: ~$165 million (includes ~$45 million purchased intangibles amortization)

•Capital expenditures: ~$50 - 65 million

•Effective tax rate: 25% - 27%

•Adjusted EPS phasing: 47% 1H / 53% 2H

Conference Call Details

The company will host a conference call to discuss its fourth quarter and fiscal year 2024 results on Monday, February 24, 2025, at 3:00 p.m. Central Time. The conference call will be webcast simultaneously through the Investor Relations section of KBR’s website at investors.kbr.com. A replay of the webcast will be available shortly after the call on KBR’s website or by telephone at +1.866.813.9403, passcode: 718317.

About KBR

We deliver science, technology and engineering solutions to governments and companies around the world. KBR employs approximately 38,000 people worldwide with customers in more than 80 countries and operations in over 29 countries. KBR is proud to work with its customers across the globe to provide technology, value-added services, and long-term operations and maintenance services to ensure consistent delivery with predictable results. At KBR, We Deliver.

Visit www.kbr.com

1 As used throughout this release, book-to-bill excludes long-term UK PFIs and the Plaquemines LNG project. Bookings and options exclude long-term UK PFIs and the Plaquemines LNG project.

2 As used throughout this earnings release, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, Operating cash conversion, and Adjusted operating cash flows and conversion are non-GAAP financial measures. See additional information at the end of this release regarding non-GAAP financial information, including reconciliations to the nearest GAAP measures.

5

Forward-Looking Statements

The statements in this press release that are not historical statements, including statements regarding our expectations for our future financial performance, effective tax rate, operating cash flows, contract revenues, award activity and backlog, program activity, our business strategy, business opportunities, interest expense, our plans for raising and deploying capital and paying dividends, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond the company’s control that could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: uncertainty, delays or reductions in government funding, appropriations and payments, including as a result of continuing resolution funding mechanisms, government shutdowns or changing budget priorities; developments and changes in government laws, regulations and regulatory requirements and policies that may require us to pause, delay or abandon new and existing projects; changes in the priorities, focus, authority and budgets of government agencies under the new administration that may impact our existing projects and/or our ability to win new contracts; the ongoing conflict between Russia and Ukraine and volatility and continued unrest in the Middle East and the related impacts on our business; potential adverse economic and market conditions, such as interest rate and currency exchange rate fluctuations, the company’s ability to manage its liquidity; the outcome of and the publicity surrounding audits and investigations by domestic and foreign government agencies and legislative bodies; potential adverse proceedings by such agencies and potential adverse results and consequences from such proceedings; changes in capital spending by the company’s customers; the company’s ability to obtain contracts from existing and new customers and perform under those contracts; structural changes in the industries in which the company operates; escalating costs associated with and the performance of fixed-fee projects and the company’s ability to control its cost under its contracts; claims negotiations and contract disputes with the company’s customers; changes in the demand for or price of oil and/or natural gas; protection of intellectual property rights; compliance with environmental laws; compliance with laws related to income taxes; unsettled political conditions, war and the effects of terrorism; foreign operations and foreign exchange rates and controls; the development and installation of financial systems; the possibility of cyber and malware attacks; increased competition for employees; the ability to successfully complete and integrate acquisitions; investment decisions by project owners; and operations of joint ventures, including joint ventures that are not controlled by the company.

The company's most recently filed Annual Report on Form 10-K, any subsequent 8-Ks, and other U.S. Securities and Exchange Commission filings discuss some of the important risk factors that the company has identified that may affect its business, results of operations and financial condition. Except as required by law, the company undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

For further information, please contact:

Investors

Jamie DuBray

Vice President, Investor Relations

713-753-2133

Investors@kbr.com

Media

Philip Ivy

Vice President, Global Communications

713-753-3800

Mediarelations@kbr.com

KBR, Inc.

Consolidated Statements of Operations

(In millions, except for per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| January 3, | | December 29, | | January 3, | | December 29, |

| 2025 | | 2023 | | 2025 | | 2023 |

| | | | | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Government Solutions | $ | 1,598 | | | $ | 1,328 | | | $ | 5,871 | | | $ | 5,353 | |

| Sustainable Technology Solutions | 524 | | | 402 | | | 1,871 | | | 1,603 | |

| Total revenues | 2,122 | | | 1,730 | | | 7,742 | | | 6,956 | |

| Gross profit | 293 | | | 237 | | | 1,103 | | | 977 | |

| Equity in earnings (losses) of unconsolidated affiliates | 10 | | | 36 | | | 107 | | | 114 | |

| Selling, general and administrative expenses | (154) | | | (118) | | | (544) | | | (488) | |

| | | | | | | |

| | | | | | | |

| Legal settlement of legacy matter | — | | | — | | | — | | | (144) | |

| Gain (loss) on disposition of assets and investments | — | | | (7) | | | 7 | | | (7) | |

| Other | (7) | | | (1) | | | (11) | | | (4) | |

| Operating income: | | | | | | | |

| Government Solutions | 91 | | | 103 | | | 453 | | | 285 | |

| Sustainable Technology Solutions | 93 | | | 81 | | | 370 | | | 324 | |

| Corporate | (42) | | | (37) | | | (161) | | | (161) | |

| Total operating income | 142 | | | 147 | | | 662 | | | 448 | |

| Interest expense | (44) | | | (30) | | | (144) | | | (115) | |

| | | | | | | |

| Charges associated with Convertible Notes | — | | | (66) | | | — | | | (494) | |

Other non-operating income (expense) | 3 | | | (4) | | | (7) | | | (5) | |

| Income (loss) before income taxes | 101 | | | 47 | | | 511 | | | (166) | |

| Provision for income taxes | (23) | | | (26) | | | (130) | | | (95) | |

| Net income (loss) | 78 | | | 21 | | | 381 | | | (261) | |

| Less: Net income attributable to noncontrolling interests | 2 | | | — | | | 6 | | | 4 | |

| Net income (loss) attributable to KBR | $ | 76 | | | $ | 21 | | | $ | 375 | | | $ | (265) | |

Adjusted EBITDA1 | $ | 228 | | | $ | 188 | | | $ | 870 | | | $ | 747 | |

| Diluted EPS | $ | 0.57 | | | $ | 0.15 | | | $ | 2.79 | | | $ | (1.96) | |

Adjusted EPS1 | $ | 0.91 | | | $ | 0.69 | | | $ | 3.34 | | | $ | 2.91 | |

| Diluted weighted average common shares outstanding | 133 | | | 137 | | | 134 | | | 135 | |

| Adjusted weighted average common shares outstanding | 133 | | | 135 | | | 134 | | | 136 | |

1 See additional information at the end of this release regarding non-GAAP financial information, including a reconciliation to the nearest GAAP measure |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

KBR, Inc.

Consolidated Balance Sheets

(In millions, except share data) | | | | | | | | | | | | | | |

| | January 3, | | December 29, |

| | 2025 | | 2023 |

| | (Unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 350 | | | $ | 304 | |

Accounts receivable, net of allowance for credit losses of $9 and $8 | | 1,071 | | | 981 | |

| Contract assets | | 273 | | | 177 | |

| | | | |

| Other current assets | | 179 | | | 189 | |

| Total current assets | | 1,873 | | | 1,651 | |

| | | | |

| Pension Assets | | 82 | | | — | |

Property, plant, and equipment, net of accumulated depreciation of $474 and $458 (including net PPE of $57 and $36 owned by a variable interest entity) | | 289 | | | 239 | |

| Operating lease right-of-use assets | | 203 | | | 138 | |

| Goodwill | | 2,630 | | | 2,109 | |

Intangible assets, net of accumulated amortization of $427 and $382 | | 763 | | | 618 | |

| Equity in and advances to unconsolidated affiliates | | 192 | | | 206 | |

| Deferred income taxes | | 209 | | | 239 | |

| Other assets | | 422 | | | 365 | |

| Total assets | | $ | 6,663 | | | $ | 5,565 | |

| | | | |

| Liabilities and Shareholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 777 | | | $ | 593 | |

| | | | |

| Contract liabilities | | 336 | | | 359 | |

| Accrued salaries, wages and benefits | | 353 | | | 340 | |

| | | | |

| Current maturities of long-term debt | | 36 | | | 31 | |

| | | | |

| Other current liabilities | | 280 | | | 249 | |

| Total current liabilities | | 1,782 | | | 1,572 | |

| | | | |

| Employee compensation and benefits | | 135 | | | 120 | |

| Income tax payable | | 122 | | | 106 | |

| Deferred income taxes | | 83 | | | 106 | |

| | | | |

| | | | |

| | | | |

| Long-term debt | | 2,533 | | | 1,801 | |

| | | | |

| Operating lease liabilities | | 228 | | | 176 | |

| Other liabilities | | 313 | | | 290 | |

| Total liabilities | | 5,196 | | | 4,171 | |

| Commitments and Contingencies | | | | |

| KBR shareholders’ equity: | | | | |

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, none issued | | — | | | — | |

Common stock, $0.001 par value 300,000,000 shares authorized, 182,469,230 and 181,713,586 shares issued, and 132,435,609 and 135,067,562 shares outstanding, respectively | | — | | | — | |

| Paid-in capital in excess of par | | 2,526 | | | 2,505 | |

| Retained earnings | | 1,367 | | | 1,072 | |

Treasury stock, 50,033,621 shares and 46,646,024 shares, at cost, respectively | | (1,494) | | | (1,279) | |

| Accumulated other comprehensive loss | | (946) | | | (915) | |

| Total KBR shareholders’ equity | | 1,453 | | | 1,383 | |

| Noncontrolling interests | | 14 | | | 11 | |

| Total shareholders’ equity | | 1,467 | | | 1,394 | |

| Total liabilities and shareholders’ equity | | $ | 6,663 | | | $ | 5,565 | |

KBR, Inc.

Consolidated Statements of Cash Flows

(In millions)(Unaudited) | | | | | | | | | | | |

| Year Ended |

| January 3, | | December 29, |

| 2025 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 381 | | | $ | (261) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Charges associated with Convertible Notes | — | | | 494 | |

| | | |

| Depreciation and amortization | 156 | | | 141 | |

| Equity in (earnings) losses of unconsolidated affiliates | (107) | | | (114) | |

| Deferred income tax expense | 1 | | | 14 | |

| Loss (gain) on disposition of assets | (7) | | | 7 | |

| | | |

| | | |

| | | |

| Other | 41 | | | 46 | |

| Changes in operating assets and liabilities, net of acquired businesses: | | | |

| Accounts receivable, net of allowance for credit losses | (1) | | | (32) | |

| Contract assets | (96) | | | 44 | |

| | | |

| Accounts payable | 148 | | | (49) | |

| Contract liabilities | (27) | | | 82 | |

| Accrued salaries, wages and benefits | (6) | | | 22 | |

| Payments on operating lease liabilities | (71) | | | (65) | |

| | | |

| Payments from unconsolidated affiliates, net | 9 | | | 18 | |

| Distributions of earnings from unconsolidated affiliates | 163 | | | 74 | |

| | | |

| Pension funding | (62) | | | (9) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other assets and liabilities | (60) | | | (81) | |

| Total cash flows provided by operating activities | $ | 462 | | | $ | 331 | |

| Cash flows from investing activities: | | | |

| Purchases of property, plant and equipment | $ | (77) | | | $ | (80) | |

| Net proceeds from sale of assets or investments | 7 | | | — | |

| Return of equity method investments, net | 36 | | | 60 | |

| Acquisition of business, net of cash acquired | (738) | | | — | |

| Funding in other investment | (5) | | | (39) | |

| | | |

| Other | 1 | | | (11) | |

| | | |

| Total cash flows (used in) provided by investing activities | $ | (776) | | | $ | (70) | |

| | | |

| Cash flows from financing activities: | | | |

| Borrowings on short-term and long-term debt | 574 | | | — | |

| Borrowings on Revolver | 393 | | | 785 | |

| Payments on short-term and long-term debt | (124) | | | (17) | |

| Payments on Revolver | (98) | | | (340) | |

| Payments on settlement of warrants | (33) | | | (217) | |

| Proceeds from the settlement of note hedge | — | | | 493 | |

| Payments to settle Convertible Notes | — | | | (843) | |

| Debt issuance costs | (18) | | | — | |

| | | |

| Payments of dividends to shareholders | (79) | | | (72) | |

| Payments to reacquire common stock | (218) | | | (138) | |

| Acquisition of noncontrolling interest | (10) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other | (13) | | | (10) | |

| Total cash flows provided by (used in) financing activities | $ | 374 | | | $ | (359) | |

| Effect of exchange rate changes on cash | (14) | | | 13 | |

| Increase (decrease) in cash and cash equivalents | 46 | | | (85) | |

| Cash and cash equivalents at beginning of period | 304 | | | 389 | |

| Cash and equivalents at end of period | $ | 350 | | | $ | 304 | |

| Supplemental disclosure of cash flows information: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Noncash financing activities | | | |

| Dividends declared | $ | 20 | | | $ | 18 | |

Unaudited Non-GAAP Financial Information

The following information provides reconciliations of certain non-GAAP financial measures presented in the press release to which this reconciliation is attached to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). The company has provided the non-GAAP financial information presented in the press release as information supplemental and in addition to the financial measures presented in the press release that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the press release. The non-GAAP financial measures in the press release may differ from similar measures used by other companies.

Adjusted EBITDA

We evaluate performance based on Adjusted EBITDA and Adjusted EBITDA margin. Adjusted EBITDA is defined as Net income (loss) attributable to KBR, plus Interest expense; Accretion of Convertible Notes debt discounts; Other non-operating expense (income); Provision for income taxes; Depreciation and amortization; and certain discrete items as identified by Management to be non-recurring in nature as set forth below. Adjusted EBITDA can also be defined as Operating income less Net income attributable to noncontrolling interests; plus Depreciation and amortization; and certain discrete items as identified by Management to be non-recurring in nature as set forth below. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Revenues. Adjusted EBITDA and Adjusted EBITDA margin for each of the three- and twelve-month periods ended January 3, 2025 and December 29, 2023 are considered non-GAAP financial measures under SEC rules because Adjusted EBITDA excludes certain amounts included in the calculation of Net income (loss) attributable to KBR in accordance with GAAP for such periods. Management believes Adjusted EBITDA and Adjusted EBITDA margin afford investors a view of what management considers KBR's core performance for each of the three- and twelve-month periods ended January 3, 2025 and December 29, 2023 and also affords investors the ability to make a more informed assessment of such core performance for the comparable periods.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended | | |

| January 3, | | December 29, | | January 3, | | December 29, | | |

| Dollars in millions | 2025 | | 2023 | | 2025 | | 2023 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) attributable to KBR | $ | 76 | | | $ | 21 | | | $ | 375 | | | $ | (265) | | | |

| | | | | | | | | |

•Interest expense | 44 | | | 30 | | | 144 | | | 115 | | | |

•Accretion of Convertible Notes debt discounts | — | | | 40 | | | — | | | 282 | | | |

•Other non-operating expense (income) | (3) | | | 4 | | | 7 | | | 5 | | | |

•Provision for income taxes | 23 | | | 26 | | | 130 | | | 95 | | | |

•Depreciation and amortization | 44 | | | 37 | | | 156 | | | 141 | | | |

| | | | | | | | | |

| | | | | | | | | |

•Acquisition, integration and restructuring | 8 | | | 4 | | | 23 | | | 10 | | | |

•Ichthys commercial dispute cost | 10 | | | (5) | | | 11 | | | 1 | | | |

•Legacy legal fees and settlements | 26 | | | 1 | | | 24 | | | 155 | | | |

•(Benefits) Provisions related to exit from Russian commercial projects | — | | | 4 | | | — | | | (4) | | | |

•Loss on derivative bifurcation | — | | | — | | | — | | | 104 | | | |

•Loss on debt extinguishment | — | | | — | | | — | | | 70 | | | |

•Loss on settlement of warrants | — | | | 26 | | | — | | | 38 | | | |

| Adjusted EBITDA | $ | 228 | | | $ | 188 | | | $ | 870 | | | $ | 747 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended | | |

| January 3, | | December 29, | | January 3, | | December 29, | | |

| Dollars in millions | 2025 | | 2023 | | 2025 | | 2023 | | |

| | | | | | | | | |

| Operating income - GS | $ | 91 | | | $ | 103 | | | $ | 453 | | | $ | 285 | | | |

| | | | | | | | | |

•Depreciation and amortization | 31 | | | 24 | | | 105 | | | 96 | | | |

| | | | | | | | | |

| | | | | | | | | |

•Acquisition, integration and restructuring | 2 | | | — | | | 5 | | | — | | | |

•Legacy legal fees and settlements | 26 | | | 1 | | | 24 | | | 155 | | | |

| Adjusted EBITDA - GS | $ | 150 | | | $ | 128 | | | $ | 587 | | | $ | 536 | | | |

| | | | | | | | | |

| Operating income - STS | $ | 93 | | | $ | 81 | | | $ | 370 | | | $ | 324 | | | |

•Net income attributable to noncontrolling interests | (2) | | | — | | | (6) | | | (4) | | | |

•Depreciation and amortization | 5 | | | 5 | | | 21 | | | 19 | | | |

| | | | | | | | | |

| | | | | | | | | |

•Acquisition, integration and restructuring | 2 | | | — | | | 2 | | | — | | | |

•Ichthys commercial dispute cost | 10 | | | (5) | | | 11 | | | 1 | | | |

•(Benefits) provisions related to exit from Russian commercial projects | — | | | 4 | | | — | | | (4) | | | |

| Adjusted EBITDA - STS | $ | 108 | | | $ | 85 | | | $ | 398 | | | $ | 336 | | | |

| | | | | | | | | |

| Operating income - Corporate | $ | (42) | | | $ | (37) | | | $ | (161) | | | $ | (161) | | | |

•Depreciation and amortization | 8 | | | 8 | | | 30 | | | 26 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

•Acquisition, integration and restructuring | 4 | | | 4 | | | 16 | | | 10 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA - Corporate | $ | (30) | | | $ | (25) | | | $ | (115) | | | $ | (125) | | | |

| | | | | | | | | |

| Operating income - KBR | $ | 142 | | | $ | 147 | | | $ | 662 | | | $ | 448 | | | |

•Noncontrolling interest | (2) | | | — | | | (6) | | | (4) | | | |

•Depreciation and amortization | 44 | | | 37 | | | 156 | | | 141 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

•Acquisition, integration and restructuring | 8 | | | 4 | | | 23 | | | 10 | | | |

•Legacy legal fee and settlements | 26 | | | 1 | | | 24 | | | 155 | | | |

•Ichthys commercial dispute cost | 10 | | | (5) | | | 11 | | | 1 | | | |

•(Benefits) provisions related to exit from Russian commercial projects | — | | | 4 | | | — | | | (4) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA - KBR | $ | 228 | | | $ | 188 | | | $ | 870 | | | $ | 747 | | | |

Adjusted EPS

Adjusted earnings per share (Adjusted EPS) for each of the three- and twelve-month periods ended January 3, 2025 and December 29, 2023 is considered a non-GAAP financial measure under SEC rules because Adjusted EPS excludes certain amounts included in the Diluted EPS calculated in accordance with GAAP for such periods. The most directly comparable financial measure calculated in accordance with GAAP is Diluted EPS for the same periods. Management believes that Adjusted EPS affords investors a view of what management considers KBR's core earnings performance for each of the three- and twelve-month periods ended January 3, 2025 and December 29, 2023 and also affords investors the ability to make a more informed assessment of such core earnings performance for the comparable periods.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| January 3, | | December 29, | | January 3, | | December 29, |

| 2025 | | 2023 | | 2025 | | 2023 |

| | | | | | | |

| Diluted EPS | $ | 0.57 | | | $ | 0.15 | | | $ | 2.79 | | | $ | (1.96) | |

| Adjustments | | | | | | | |

•Amortization related to acquisitions | 0.07 | | | 0.04 | | | 0.20 | | | 0.17 | |

•Ichthys commercial dispute cost | 0.08 | | | (0.03) | | | 0.09 | | | 0.01 | |

•Acquisition, integration and restructuring | 0.05 | | | 0.02 | | | 0.13 | | | 0.06 | |

•Impact of convert accounting and Diluted EPS share count1 | — | | | — | | | — | | | 0.01 | |

•Legacy legal fees and settlements | 0.14 | | | — | | | 0.13 | | | 1.03 | |

•Benefits related to exit from Russian commercial projects | — | | | 0.02 | | | — | | | (0.03) | |

•Charges associated with Convertible Notes | — | | | 0.49 | | | — | | | 3.62 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted EPS | $ | 0.91 | | | $ | 0.69 | | | $ | 3.34 | | | $ | 2.91 | |

| Diluted weighted average common shares outstanding | 133 | | | 137 | | | 134 | | | 135 | |

| Adjusted weighted average common shares outstanding | 133 | | | 135 | | | 134 | | | 136 | |

1 For the Year Ended December 29, 2023, adjusted share count includes anti-dilutive shares for warrants excluded from Diluted EPS share count.

Adjusted Operating Cash Flows

Adjusted operating cash flows, Operating cash conversion, and Adjusted operating cash conversion are considered non-GAAP financial measures under SEC rules. Adjusted operating cash flows exclude certain amounts included in the cash flows provided by operating activities calculated in accordance with GAAP. Operating cash conversion and Adjusted operating cash conversion are calculated as Operating cash flows or Adjusted operating cash flows divided by Adjusted weighted average common shares outstanding, which is then divided by Adjusted earnings per share. The most directly comparable financial measure calculated in accordance with GAAP is cash flows provided by operating activities. Management believes that Adjusted operating cash flows afford investors a view of what management considers KBR's core operating cash flow performance for each of the three- and twelve-month periods ended January 3, 2025 and December 29, 2023 and also afford investors the ability to make a more informed assessment of such core operating cash generation performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| January 3, | | December 29, | | January 3, | | December 29, |

| Dollars in millions | 2025 | | 2023 | | 2025 | | 2023 |

| | | | | | | |

| Cash flows provided by operating activities | $ | 40 | | | $ | 83 | | | $ | 462 | | | $ | 331 | |

| Add: Legacy legal settlement (after tax) | — | | | — | | | — | | | 132 | |

| | | | | | | |

| | | | | | | |

| Adjusted operating cash flows | $ | 40 | | | $ | 83 | | | $ | 462 | | | $ | 463 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating cash flow per adjusted share | $ | 0.30 | | | $ | 0.61 | | | $ | 3.45 | | | $ | 2.43 | |

| Adjusted operating cash flow per adjusted share | 0.30 | | | 0.61 | | | 3.45 | | | 3.40 | |

| | | | | | | |

| Adjusted earnings per share | 0.91 | | | 0.69 | | | 3.34 | | | 2.91 | |

| | | | | | | |

| Operating cash conversion | 33 | % | | 88 | % | | 103 | % | | 84 | % |

| Adjusted operating cash conversion | 33 | % | | 88 | % | | 103 | % | | 117 | % |

| | | | | | | |

v3.25.0.1

Cover Page Cover Page

|

Feb. 24, 2025 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Entity Central Index Key |

0001357615

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Period End Date |

Feb. 24, 2025

|

| Document Type |

8-K

|

| Entity Registrant Name |

KBR, Inc.

|

| Entity File Number |

001-33146

|

| Entity Tax Identification Number |

20-4536774

|

| Entity Address, Address Line One |

601 Jefferson Street

|

| Entity Address, Address Line Two |

Suite 3400

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

753-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Trading Symbol |

KBR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

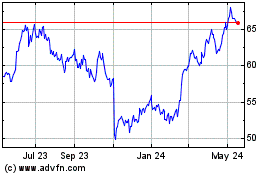

KBR (NYSE:KBR)

Historical Stock Chart

From Jan 2025 to Feb 2025

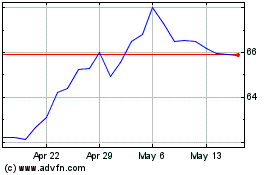

KBR (NYSE:KBR)

Historical Stock Chart

From Feb 2024 to Feb 2025