0000059478false00000594782025-01-142025-01-140000059478us-gaap:CommonClassAMember2025-01-142025-01-140000059478lly:A718NotesDueJune12025Member2025-01-142025-01-140000059478lly:A1.625NotesDueJune22026Member2025-01-142025-01-140000059478lly:A2.125NotesDueJune32030Member2025-01-142025-01-140000059478lly:A625Notesdue2031Member2025-01-142025-01-140000059478lly:A500NotesDue2033Member2025-01-142025-01-140000059478lly:A6.77NotesDueJanuary12036Member2025-01-142025-01-140000059478lly:A1625NotesDue2043Member2025-01-142025-01-140000059478lly:A1.700Notesdue2049Member2025-01-142025-01-140000059478lly:A1125NotesDue2051Member2025-01-142025-01-140000059478lly:A1375NotesDue2061Member2025-01-142025-01-14

| | | | | | | | |

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 | |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 14, 2025

ELI LILLY AND COMPANY

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Indiana | | 001-06351 | | 35-0470950 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | |

| | | | | | | | | | | | | | |

| Lilly Corporate Center | | | |

| Indianapolis, | Indiana | 46285 | | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (317) 276-2000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock (no par value) | | LLY | | New York Stock Exchange |

| 7 1/8% Notes due 2025 | | LLY25 | | New York Stock Exchange |

| 1.625% Notes due 2026 | | LLY26 | | New York Stock Exchange |

| 2.125% Notes due 2030 | | LLY30 | | New York Stock Exchange |

| 0.625% Notes due 2031 | | LLY31 | | New York Stock Exchange |

| 0.500% Notes due 2033 | | LLY33 | | New York Stock Exchange |

| 6.77% Notes due 2036 | | LLY36 | | New York Stock Exchange |

| 1.625% Notes due 2043 | | LLY43 | | New York Stock Exchange |

| 1.700% Notes due 2049 | | LLY49A | | New York Stock Exchange |

| 1.125% Notes due 2051 | | LLY51 | | New York Stock Exchange |

| 1.375% Notes due 2061 | | LLY61 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 14, 2025, at approximately 5:15 p.m. Eastern time, Eli Lilly and Company (the “Company”) will participate in a fireside chat at the 2025 J.P. Morgan Healthcare Conference. During the discussion, Lilly will provide an update on earnings guidance for 2024, will share its 2025 revenue guidance range, and will discuss overall market trends. Lilly issued a press release relating to the update, attached hereto as Exhibit 99.1, and incorporated herein by reference. A live audio webcast of the conference discussion, press release and associated presentation, will be available on the "Webcasts & Presentations" section of Lilly's Investor website at https://investor.lilly.com/webcasts-and-presentations. A replay of the presentation will be available on this same website for approximately 30 days.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933 or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | |

| ELI LILLY AND COMPANY |

| (Registrant) |

| |

| By: | | /s/ Lucas Montarce |

| Name: | | Lucas Montarce |

| Title: | | Executive Vice President and Chief Financial Officer |

| Date: | | January 14, 2025 |

January 14, 2025

For Release: Immediately

Refer to: Carrie Munk; munk_carrie@lilly.com; 317-416-2393 (Media)

Michael Czapar; czapar_michael_c@lilly.com; 317-617-0983 (Investors)

Lilly provides update on 2024 revenue guidance, announces 2025 revenue guidance

2024 revenue is expected to be approximately $45.0 billion for the full year, $4.0 billion above the midpoint of first-time 2024 financial guidance

Q4 2024 revenue is expected to be approximately $13.5 billion, approximately $400 million below the low end of recently issued financial guidance

The company anticipates 2025 revenue to be in the range of $58.0 billion to $61.0 billion, growth of 32% at the midpoint compared to expected 2024 revenue

INDIANAPOLIS, January 14, 2025 -- Eli Lilly and Company (NYSE: LLY) today announced that it expects 2024 full-year worldwide revenue to be approximately $45.0 billion, which represents growth of 32% compared to the previous year. The company also shared 2025 revenue guidance, anticipating sales will be between $58.0 billion and $61.0 billion.

For Q4 2024, Lilly now expects worldwide revenue to be approximately $13.5 billion, representing growth of 45% compared to Q4 2023. This includes approximately $3.5 billion for Mounjaro® and $1.9 billion for Zepbound®. In addition to the uptake of Mounjaro and Zepbound, Lilly saw strong performance from its oncology, immunology and neuroscience medicines in Q4 of 2024. In total, non-incretin revenue grew by 20% compared to Q4 2023. However, the company’s expected 2024 revenue is $400 million, or about 3%, below the guidance range issued on October 30, 2024, as part of the Q3 2024 earnings call.

“While the U.S. incretin market grew 45% compared to the same quarter last year, our previous guidance had anticipated even faster acceleration of growth for the quarter. That, in addition to lower-than-expected channel inventory at year-end, contributed to our Q4 results. We continued to make progress on our manufacturing build-out, and U.S. supply across all doses of tirzepatide was

available throughout Q4,” said David A. Ricks, Lilly chair and CEO. “The rest of our medicines performed within our expectations.”

Lilly anticipates revenue growth contributions in 2025 from new Lilly medicines such as Jaypirca®, Ebglyss™, Omvoh® and Kisunla™; approvals of new indications for existing Lilly medicines; launches of Mounjaro in additional worldwide markets, as well as potential launches of new medicines such as imlunestrant for metastatic breast cancer. Incretin market and channel dynamics have been factored into the 2025 revenue guidance range.

“2024 was a pivotal and highly successful year for Lilly, and we expect to continue our momentum in 2025 with strong financial and operational performance,” continued Ricks. “Sales of Mounjaro and Zepbound posted robust sales growth in Q4, and we expect a continuation of that trend into 2025. We’ll also bring additional manufacturing capacity online and expect to produce at least 60% more salable doses of incretins in the first half of the year compared to the first half of 2024.”

As announced previously, Ricks will participate in a fireside chat at the J.P. Morgan Healthcare Conference later today at 5:15 p.m. Eastern time. A live audio webcast of Ricks’ discussion will be available on the “Webcasts & Presentations” section of Lilly’s Investor website at https://investor.lilly.com/webcasts-and-presentations. A replay of the presentation will be available on this same website for approximately 30 days.

The company currently plans to share its full Q4 2024 financial results, including with respect to other metrics included in its financial guidance, and 2025 financial guidance on February 6, 2025.

Preliminary Information

The unaudited financial information presented in this press release is preliminary and may change as a result of, among other factors, Lilly’s financial closing procedures and as a result, the company’s final results may vary materially from the preliminary results included in this press release. The preliminary financial information included in this press release reflects the company’s current estimates based on information available as of the date of this press release and has been prepared by company management. This preliminary information should not be viewed as a substitute for full financial information prepared in accordance with GAAP and is not necessarily indicative of the results to be achieved for any future periods. This preliminary information could be impacted by the effects of financial closing procedures, final adjustments, and other developments.

About Lilly

Lilly is a medicine company turning science into healing to make life better for people around the world. We’ve been pioneering life-changing discoveries for nearly 150 years, and today our medicines help tens of millions of people across the globe. Harnessing the power of biotechnology, chemistry and genetic medicine, our scientists are urgently advancing new discoveries to solve some of the world’s most significant health challenges: redefining diabetes care; treating obesity and curtailing its most devastating long-term effects; advancing the fight against Alzheimer’s disease; providing solutions to some of the most debilitating immune system disorders; and transforming the most difficult-to-treat cancers into manageable diseases. With each step toward a healthier world, we’re motivated by one thing: making life better for millions more people. That includes delivering innovative clinical trials that reflect the diversity of our world and working to ensure our medicines are accessible and affordable. To learn more, visit Lilly.com and Lilly.com/news, or follow us on Facebook, Instagram, and LinkedIn. F-LLY

Cautionary Statement Regarding Forward-Looking Statements

This press release contains management’s current intentions and expectations for the future, including with respect to Lilly’s anticipated 2024 results and 2025 guidance, and specific product performance and supply, all of which are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “estimate”, “project”, “intend”, “expect”, “believe”, “anticipate”, “may”, “could”, “will”, “continue”, and similar expressions are intended to identify forward-looking statements. Actual results may differ materially due to various factors. The following include some but not all of the factors that could cause actual results or events to differ from those anticipated, including the financial closing procedures, final adjustments, and other developments, significant costs and uncertainties in the pharmaceutical research and development process, including with respect to the timing and process of obtaining regulatory approvals; the impact and uncertain outcome of acquisitions and business development transactions and related costs; intense competition affecting the company’s products, pipeline, or industry; market uptake of launched products and indications; continued pricing pressures and the impact of actions of governmental and private payers affecting pricing of, reimbursement for, and patient access to pharmaceuticals, or reporting obligations related thereto; safety or efficacy concerns associated with the company’s products; dependence on relatively few products or product classes for a significant percentage of the company’s total revenue and an increasingly consolidated supply chain; the expiration of intellectual property protection for certain of the company’s products and competition from generic and biosimilar products, and risks from the proliferation of counterfeit or illegally compounded products; the company’s ability to protect and enforce patents and other intellectual property and changes in patent law or regulations related to data package exclusivity; information technology system inadequacies, inadequate controls or procedures, security breaches, or operating failures; unauthorized access, disclosure, misappropriation, or compromise of confidential information or other data stored in the company’s information technology systems, networks, and facilities, or those of third parties with whom the company shares its data and violations of data protection laws or regulations; issues with product supply and regulatory approvals stemming from manufacturing difficulties, disruptions, or shortages, including as a result of unpredictability and variability in demand, labor shortages, third-party performance, quality, cyber-attacks, or regulatory actions related to the company’s and third-party facilities; reliance on third-party relationships and outsourcing arrangements; the use of artificial intelligence or other emerging technologies in various facets of the company’s operations which may exacerbate competitive, regulatory, litigation, cybersecurity, and other risks; the impact of global macroeconomic conditions, including uneven economic growth or downturns or uncertainty, trade disruptions, international tension, conflicts, regional dependencies, or other costs, uncertainties, and risks related to engaging in business globally; fluctuations in foreign currency exchange

rates or changes in interest rates and inflation; litigation, investigations, or other similar proceedings involving past, current, or future products or activities; changes in tax law and regulations, tax rates, or events that differ from our assumptions related to tax positions; regulatory changes and developments; regulatory actions regarding the company’s operations and products; regulatory compliance problems or government investigations; actual or perceived deviation from environmental-, social-, or governance-related requirements or expectations; asset impairments and restructuring charges; and changes in accounting and reporting standards. For additional information about the factors that could cause actual results or events to differ materially from forward-looking statements, please see the company’s latest Form 10-K and subsequent Forms 8-K and 10-Q filed with the Securities and Exchange Commission. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. Except as is required by law, the company expressly disclaims any obligation to publicly release any revisions to forward-looking statements to reflect events after the date of this release.

The U.S. incretin market includes: Mounjaro, Zepbound, Trulicity, semaglutide and liraglutide.

# # #

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A718NotesDueJune12025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A1.625NotesDueJune22026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A2.125NotesDueJune32030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A625Notesdue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A6.77NotesDueJanuary12036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A1.700Notesdue2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A500NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A1625NotesDue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A1125NotesDue2051Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lly_A1375NotesDue2061Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

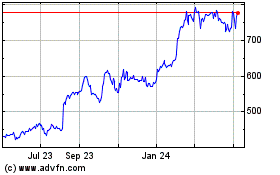

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

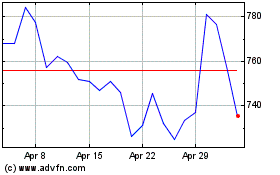

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Jan 2024 to Jan 2025