ArcelorMittal S.A.: ArcelorMittal completes acquisition of strategic stake in Vallourec

August 06 2024 - 12:28AM

06 August 2024, 07:30 CET

ArcelorMittal today announces that following the

signature of a Share Purchase Agreement on 12 March 2024, and after

the approval of relevant antitrust authorities and clearances under

foreign investment regulations, it has completed the acquisition of

65,243,206 shares, representing c.28.41% equity interest in

Vallourec, for €14.64 per share from funds managed by Apollo Global

Management Inc., for a total consideration of approximately €955

million, subject to successful completion of the settlement.

Following completion of this transaction, the

appointment of Mr. Genuino Magalhaes Christino (Chief Financial

Officer, ArcelorMittal) as director of Vallourec will become

effective, Keith Howell (Chief Operating Officer, ArcelorMittal

USA) will be appointed as director of Vallourec, and Aditya Mittal

as observer of Vallourec, subject to successful completion of the

settlement.

ArcelorMittal does not intend to launch a tender

offer for Vallourec’s remaining shares over the next six months and

will inform the market should this intention change.

Commenting, Aditya Mittal, CEO,

ArcelorMittal, said:

“Vallourec is well established as a producer of

high-quality tubular products, holding a prime position in an

attractive market segment that has potential for growth from new,

clean energy markets. The strategic stake is a welcome addition to

our investment portfolio, and we look forward to supporting

Vallourec’s management team in their efforts to drive further

performance improvement.

“It also supports our ongoing efforts to grow

our business. The acquisitions we have made in recent years in

Brazil and the US are performing well and progress with our suite

of organic growth projects continues apace, with several due to

complete this year. These initiatives will significantly strengthen

our business, expanding our product capabilities and emerging

markets exposure while enhancing our earnings capacity.”

ENDS

About ArcelorMittal

ArcelorMittal is one of the world’s leading integrated steel and

mining companies with a presence in 60 countries and primary

steelmaking operations in 15 countries. It is the largest steel

producer in Europe, among the largest in the Americas, and has a

growing presence in Asia, including India, through its joint

venture AM/NS India.

ArcelorMittal sells its products to a diverse range of customers

including the automotive, engineering, construction and machinery

industries, and in 2023 generated revenues of $68.3 billion,

produced 58.1 million metric tonnes of crude steel and 42.0 million

tonnes of iron ore.

Our purpose is to produce smarter steels for people and planet.

Steels made using innovative processes which use less energy, emit

significantly less carbon and reduce costs. Steels that are

cleaner, stronger and reusable. Steels for the renewable energy

infrastructure that will support societies as they transform

through this century. With steel at our core, our inventive people

and an entrepreneurial culture at heart, we will support the world

in making that change.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit:

http://corporate.arcelormittal.com.

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

1 Stake prior to preferred shares conversion into ordinary

shares that will vest as a result of the completion of the Apollo

block acquisition

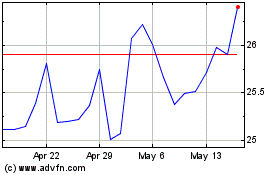

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

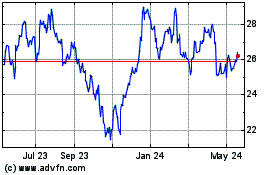

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024