false

0001163739

0001163739

2024-07-17

2024-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 17, 2024

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in

its charter)

| Bermuda |

|

001-32657 |

|

98-0363970 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda |

|

N/A |

| (Address of principal executive offices) |

|

(Zip Code) |

(441) 292-1510

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which

registered |

| Common shares |

|

NBR |

|

NYSE |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results

of Operations and Financial Condition.

On July 17, 2024, Nabors Industries Ltd. (the “Company”)

issued a press release in which the Company reported certain preliminary operating results for the second quarter ended June 30, 2024.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 2.02 by reference.

The Company will provide full second-quarter financial results

during its previously announced earnings conference call at 10:00 a.m. CT on Wednesday, July 24, 2024. Quarterly earnings results will

be released after the market closes on July 23, 2024.

The information in this Item 2.02 and Exhibit 99.1 attached hereto

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended

(the “Securities Act”), nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities

Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NABORS INDUSTRIES LTD. |

| |

|

|

| Date: July 17, 2024 |

By: |

/s/ Mark D. Andrews |

| |

|

Name: Mark D. Andrews |

| |

|

Title: Corporate Secretary |

Exhibit 99.1

| NEWS

RELEASE |

Nabors Announces

Preliminary Operating Results for the Quarter Ended June 30, 2024

HAMILTON, Bermuda,

July 17, 2024 /PRNewswire/-- Nabors Industries Ltd. (NYSE: NBR) (“Nabors” or “the Company”) announced today certain

preliminary operating results for the second quarter ended June 30, 2024.

Nabors preliminary

results for the second quarter continued to highlight the ongoing international expansion and relatively stable activity and pricing

in its U.S. markets. Revenue and EBITDA estimates met the Company’s expectations with adjusted free cash flow somewhat stronger

than anticipated. The Company expects that for the three months ended June 30, 2024: (i) operating revenue to be approximately $735 million,

(ii) income (loss) before income taxes of between ($5) million and $5 million, (iii) adjusted EBITDA of approximately $218 million and

(iv) adjusted free cash flow of between $55 million and $60 million. During the same quarter, Nabors averaged 68.7 rigs operating in

the Lower 48 at an average gross margin of $15,598 per rig day and averaged 84.4 rigs operating internationally at an average gross margin

of $16,050 per rig day. Nabors plans to release its full second-quarter financial results after the market closes on July 23, 2024, followed

by its previously announced earnings conference call at 10:00 a.m. CT on Wednesday, July 24, 2024.

Nabors is currently

finalizing its financial results for the three and six months ended June 30, 2024. The financial results discussed above and below for

the three months ended June 30, 2024 are preliminary, based upon estimates and subject to completion of financial and operating closing

procedures. Such preliminary operating results do not represent a comprehensive statement of financial results or operating metrics for

this period and actual results and metrics may differ materially from these estimates following the completion of Nabors’ financial

and operating closing procedures, or as a result of other adjustments or developments that may arise before the results for this period

are finalized. In addition, even if actual results and metrics are consistent with these preliminary results, those results or developments

may not be indicative of results or developments in subsequent periods.

Nabors has provided

a range for certain of the preliminary results described above because the financial closing procedures for the quarter ended June 30,

2024 are not yet complete. As a result, there is a possibility that Nabors’ final results will vary from these preliminary estimates.

Nabors currently expects that its financial results will be within the ranges described above. It is possible, however, that final results

will not be within the ranges currently estimated.

About Nabors Industries

Nabors

Industries (NYSE: NBR) is a leading provider of advanced technology for the energy industry. With presence in more than 20 countries,

Nabors has established a global network of people, technology and equipment to deploy solutions that deliver safe, efficient and responsible

energy production. By leveraging its core competencies, particularly in drilling, engineering, automation, data science and manufacturing,

Nabors aims to innovate the future of energy and enable the transition to a lower-carbon world. Learn more about Nabors and its energy

technology leadership: www.nabors.com.

Forward-looking

Statements

The

information included in this press release includes forward-looking statements within the meaning of the Securities Act of 1933 and the

Securities Exchange Act of 1934. Such forward-looking statements are subject to a number of risks and uncertainties, as disclosed by

Nabors from time to time in its filings with the Securities and Exchange Commission. As a result of these factors, Nabors' actual results

may differ materially from those indicated or implied by such forward-looking statements. The forward-looking statements contained

in this press release reflect management's estimates and beliefs as of the date of this press release. Nabors does not undertake

to update these forward-looking statements.

| NEWS

RELEASE |

Non-GAAP

Disclaimer

This press release presents certain

“non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined

in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA

represents income (loss) from continuing operations before income taxes, interest expense, depreciation and amortization expenses, investment

income (loss), and other, net. In addition, adjusted EBITDA excludes certain cash expenses that Nabors is obligated to make.

Adjusted free cash flow represents net

cash provided by operating activities less cash used for capital expenditures, net of proceeds from sales of assets. Management

believes that adjusted free cash flow is an important liquidity measure for Nabors and that it is useful to investors and management

as a measure of Nabors’ ability to generate cash flow, after reinvesting in the company for future growth, that could be available

for paying down debt or other financing cash flows, such as dividends to shareholders. Management believes that this non-GAAP measure

is useful information to investors when comparing our cash flows with the cash flows of other companies.

Each of these non-GAAP measures has

limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However,

management evaluates the performance of its operating segments and the consolidated company based on several criteria, including Adjusted

EBITDA and adjusted free cash flow, because it believes that these financial measures accurately reflect Nabors’ ongoing profitability

and performance. Securities analysts and investors also use these measures as some of the metrics on which they analyze Nabors’

performance. Other companies in this industry may compute these measures differently. Reconciliations of consolidated adjusted EBITDA

and adjusted free cash flow, are included in the tables below.

Nabors Industries Ltd. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

| | |

Three Months Ended

June 30, 2024 |

| Income (loss) from continuing operations before income taxes | |

$ (5) - 5 |

| Depreciation and amortization | |

160 |

| Investment (income) loss | |

(8) |

| Interest expense | |

51 |

| Other, net | |

10 - 20 |

| Adjusted EBITDA | |

$218 |

| | |

|

| Cash provided by operating activities | |

$ 185 - 195 |

| Capital expenditures, net of proceeds from sales of assets | |

(130) - (135) |

| Adjusted free cash flow | |

$ 55 - 60 |

*********

Investor Contacts: William C.

Conroy, CFA, Vice President of Corporate Development & Investor Relations, +1 281-775-2423 or via e-mail william.conroy@nabors.com,

or Kara Peak, Director of Corporate Development & Investor Relations, +1 281-775-4954 or via email kara.peak@nabors.com.

To request investor materials, contact Nabors' corporate headquarters in Hamilton, Bermuda at +441-292-1510 or via e-mail mark.andrews@nabors.com.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

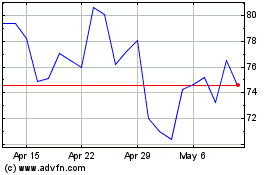

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

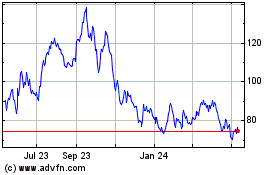

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Jul 2023 to Jul 2024