Alpine Income Property Trust Announces Updated Year-To-Date 2024 Transaction Activity

August 02 2024 - 5:30AM

Alpine Income Property Trust, Inc. (NYSE: PINE) (the “Company”)

today announced updated year-to-date 2024 investment and

disposition activities.

2024 Investment Activity

- During the third

quarter, the Company acquired four net leased retail properties for

$37.5 million at a weighted average initial cap rate of 8.8%. Three

properties, all located in the greater Tampa Bay, FL area, were

purchased for $31.4 million as a sale-leaseback transaction with a

subsidiary of Beachside Hospitality Group at an initial cap rate of

9.0%. The leases have a lease term of 30 years and include 2.0%

annual escalations. The fourth property, an outparcel to the West

Broad Village shopping center in Richmond, VA, was purchased for

$6.1 million and is 100% leased to Golf Galaxy and guaranteed by

Dick’s Sporting Goods.

- The Company’s

year-to-date total investment activity as of August 2, 2024, which

includes its acquisition and structured investment activities,

totaled $66.4 million at a weighted average initial investment

yield of 9.2%.

- After adjusting

for the announced transaction activity, PINE’s weighted average

remaining lease term has increased from 6.6 years as of June 30,

2024, to approximately 8.35 years as of August 2, 2024.

- Finally, the

Company’s property in Hermantown, MN that was leased to Camping

World was assigned to Bass Pro Shops. Bass Pro Shops intends to

complete full renovation of the existing property and open in

mid-to-late 2025. There will be no impact to the required rental

payments during the renovation.

2024 Disposition Activity

- During the third

quarter, the Company sold two net leased retail properties, leased

to Lowe’s Home Improvement and Walgreens for a total disposition

volume of $15.6 million, at a weighted average exit cap rate of

5.7%.

- The Company’s year-to-date

disposition volume as of August 2, 2024, inclusive of property and

structured investment sales totals $35.8 million at yield of

6.8%.

“We are pleased to have acquired these

attractive net leased properties at very accretive yields to our

recycled asset sales while increasing our weighted average lease

term,” said John P. Albright, President and Chief Executive Officer

of Alpine Income Property Trust.

About Alpine Income Property Trust,

Inc.

Alpine Income Property Trust, Inc. (NYSE: PINE)

is a publicly traded real estate investment trust that seeks to

deliver attractive risk-adjusted returns and dependable cash

dividends by investing in, owning and operating a portfolio of

single tenant net leased properties that are predominately leased

to high-quality publicly traded and credit-rated tenants.

We encourage you to review our most recent

investor presentation which is available on our website at

http://www.alpinereit.com.

Safe Harbor

This press release may contain “forward-looking

statements.” Forward-looking statements include statements that may

be identified by words such as “could,” “may,” “might,” “will,”

“likely,” “anticipates,” “intends,” “plans,” “seeks,” “believes,”

“estimates,” “expects,” “continues,” “projects” and similar

references to future periods, or by the inclusion of forecasts or

projections. Forward-looking statements are based on the Company’s

current expectations and assumptions regarding capital market

conditions, the Company’s business, the economy and other future

conditions. Because forward-looking statements relate to the

future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, the Company’s actual results may

differ materially from those contemplated by the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include general business and economic conditions, continued

volatility and uncertainty in the credit markets and broader

financial markets, risks inherent in the real estate business,

including tenant defaults, potential liability relating to

environmental matters, credit risk associated with the Company

investing in first mortgage investments, illiquidity of real estate

investments and potential damages from natural disasters, the

impact of epidemics or pandemics (such as the COVID-19 Pandemic and

its variants) on the Company’s business and the business of its

tenants and the impact of such epidemics or pandemics on the U.S.

economy and market conditions generally, other factors affecting

the Company’s business or the business of its tenants that are

beyond the control of the Company or its tenants, and the factors

set forth under “Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023 and other risks and

uncertainties discussed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission. Any

forward-looking statement made in this press release speaks only as

of the date on which it is made. The Company undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

|

Contact: |

Philip R. MaysSenior Vice President, Chief Financial Officer &

Treasurer(407) 904-3324pmays@alpinereit.com |

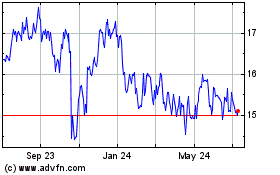

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Nov 2024 to Dec 2024

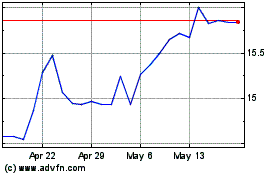

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Dec 2023 to Dec 2024