ProAssurance Corporation (NYSE: PRA), an industry-leading

specialty insurer with extensive expertise in medical professional

liability and a core small-cap value equity in the financials

sector, today reported net income of $16.2 million, or $0.31 per

diluted share, and operating income(1) of $18.3 million, or $0.36

per diluted share, for the three months ended December 31, 2024.

For full-year 2024, ProAssurance reported net income of $52.7

million, or $1.03 per diluted share, and operating income(1) of

$48.6 million, or $0.95 per diluted share.

Fourth Quarter 2024(2) Highlights

- Specialty P&C segment combined ratio(1) of 100.9%

demonstrates another quarter of progress from management’s ongoing

actions focused on achieving sustained profitability

- Net investment income increased 9% as we take advantage of the

current interest rate environment as the portfolio matures

- Earnings benefited from solid returns from limited partnership

investments (reported as equity in earnings of unconsolidated

subsidiaries)

- Book value per share was $23.49 at December 31, 2024, up $1.67

from $21.82 at year-end 2023 due to net income of $53 million for

2024 as well as after-tax unrealized holding gains of $26 million

from our fixed maturity portfolio; non-GAAP adjusted book value per

share(1) rose to $26.86 from $25.83

(1)

Represents a Non-GAAP financial measure

that excludes certain items that are not indicative of the

performance of our ongoing core operations, including net

investment gains and losses, foreign currency exchange rate gains

and losses, and results of non-core operations. Non-core operations

include the net results from our previous participation in Lloyd's

Syndicates operations, which is currently in run-off. See a

reconciliation of the Non-GAAP financial measure to its GAAP

counterpart under the heading “Non-GAAP Financial Measures” that

follows.

(2)

Comparisons are to the fourth quarter of

2023 unless otherwise noted.

Management Commentary & Results of Operations

“The ongoing core operations in our Specialty P&C segment

delivered a full-year combined ratio(1) of 104.0%, including net

favorable prior accident year reserve development of 5.9 points,”

said Ned Rand, President and Chief Executive Officer of

ProAssurance. He added, “This segment, which is largely made up of

our Medical Professional Liability line of business, represents

more than 75% of total earned premium. We believe we are ahead of

many in this space in achieving rate levels that put us on track to

outpace severity trends that remain challenging.

“Specialty P&C renewal premium increases of 8% this quarter

are part of the cumulative +65% premium change we have accomplished

since 2018,” Rand added. “We continue to forgo renewal and new

business opportunities that we believe do not meet our expectation

of rate adequacy in the current loss environment, although

retention for the Specialty P&C segment was a solid 84% for

2024, including 87% for our standard physicians Medical

Professional Liability book of business. In this loss environment,

we will continue to focus on our targeted healthcare market

segments with disciplined claims management and underwriting.”

Rand noted, “We are confident that the cyclical insurance

markets we have served for many years will respond to our efforts.

However, before turning our focus to growth, we believe it is

prudent to continue to shrink in some areas where market conditions

remain a headwind, which will help us reach our target for

long-term sustained profitability across all business

segments.”

CONSOLIDATED INCOME STATEMENT

HIGHLIGHTS

Selected consolidated financial data for

each period is summarized in the table below.

Three Months Ended December

31

Year Ended December 31

($ in thousands, except per share

data)

2024

2023

Change

2024

2023

Change

Revenues

Gross premiums written(1)

$

207,673

$

208,795

(0.5

%)

$

1,050,867

$

1,082,279

(2.9

%)

Net premiums written

$

188,545

$

195,016

(3.3

%)

$

953,675

$

985,994

(3.3

%)

Net premiums earned

$

241,074

$

247,329

(2.5

%)

$

968,250

$

977,397

(0.9

%)

Net investment income

36,811

33,705

9.2

%

144,538

128,419

12.6

%

Equity in earnings (loss) of

unconsolidated subsidiaries

5,820

1,341

334.0

%

22,203

6,791

226.9

%

Net investment gains (losses)(2)

(3,243

)

10,672

(130.4

%)

1,903

13,828

(86.2

%)

Other income (expense)(1)

9,638

3,913

146.3

%

13,510

10,777

25.4

%

Total revenues(1)

290,100

296,960

(2.3

%)

1,150,404

1,137,212

1.2

%

Expenses

Net losses and loss adjustment

expenses

182,410

195,248

(6.6

%)

739,435

800,494

(7.6

%)

Underwriting, policy acquisition and

operating expenses(1)

80,927

81,965

(1.3

%)

319,339

300,744

6.2

%

SPC U.S. federal income tax expense

(benefit)

724

278

160.4

%

1,766

1,629

8.4

%

SPC dividend expense (income)

1,965

3,064

(35.9

%)

4,444

6,234

(28.7

%)

Interest expense

5,339

6,672

(20.0

%)

22,342

23,150

(3.5

%)

Goodwill impairment

—

—

nm

—

44,110

nm

Total expenses(1)

271,365

287,227

(5.5

%)

1,087,326

1,176,361

(7.6

%)

Income (loss) before income taxes

18,735

9,733

92.5

%

63,078

(39,149

)

261.1

%

Income tax expense (benefit)

2,566

3,356

(23.5

%)

10,334

(545

)

1,996.1

%

Net income (loss)

$

16,169

$

6,377

153.6

%

$

52,744

$

(38,604

)

236.6

%

Non-GAAP operating income (loss)(3)

$

18,268

$

(2,765

)

760.7

%

$

48,592

$

(9,014

)

639.1

%

Weighted average number of common

shares outstanding

Basic

51,156

50,969

51,097

52,642

Diluted

51,411

51,153

51,266

52,788

Earnings (loss) per share

Net income (loss) per diluted share

$

0.31

$

0.12

$

0.19

$

1.03

$

(0.73

)

$

1.76

Non-GAAP operating income (loss) per

diluted share

$

0.36

$

(0.05

)

$

0.41

$

0.95

$

(0.17

)

$

1.12

(1)

Consolidated totals include inter-segment

eliminations. The eliminations affect individual line items only

and have no effect on net income (loss). See Note 16 of the Notes

to Consolidated Financial Statements in our December 31, 2024

report on Form 10-K for amounts by line item.

(2)

This line item typically includes both

realized and unrealized investment gains and losses, investment

impairments losses, and the change in the fair value of the

contingent consideration in relation to the NORCAL acquisition.

Detailed information regarding the components of net investment

gains (losses) are included in Note 3 of the Notes to Consolidated

Financial Statements in our December 31, 2024 report on Form

10-K.

(3)

See a reconciliation of net income (loss)

to non-GAAP operating results under the heading “Non-GAAP Financial

Measures” that follows.

The abbreviation “nm” indicates that the information or the

percentage change is not meaningful.

BALANCE SHEET HIGHLIGHTS

($ in thousands, except per share

data)

December

31, 2024

December

31, 2023

Total investments

$

4,367,427

$

4,349,781

Total assets

$

5,574,273

$

5,631,925

Total liabilities

$

4,372,524

$

4,519,945

Common shares (par value $0.01)

$

638

$

636

Retained earnings

$

1,434,725

$

1,381,981

Treasury shares

$

(469,694

)

$

(469,702

)

Shareholders’ equity

$

1,201,749

$

1,111,980

Book value per share

$

23.49

$

21.82

Non-GAAP adjusted book value per

share(1)

$

26.86

$

25.83

(1)

Adjusted book value per share is a

Non-GAAP financial measure. See a reconciliation of book value per

share to Non-GAAP adjusted book value per share under the heading

“Non-GAAP Financial Measures” that follows.

CONSOLIDATED KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2024

2023

2024

2023

Current accident year net loss ratio

80.4

%

80.0

%

80.5

%

81.3

%

Effect of prior accident years’ reserve

development

(4.7

%)

(1.1

%)

(4.1

%)

0.6

%

Net loss ratio

75.7

%

78.9

%

76.4

%

81.9

%

Underwriting expense ratio

33.6

%

33.1

%

33.0

%

30.8

%

Combined ratio

109.3

%

112.0

%

109.4

%

112.7

%

Operating ratio

94.0

%

98.4

%

94.5

%

99.6

%

Return on equity(1)

5.3

%

2.4

%

4.6

%

(3.5

%)

Non-GAAP operating return on

equity(1)(2)

6.0

%

(1.0

%)

4.2

%

(0.8

%)

Combined ratio, excluding Lloyd’s

Syndicates Operations(3)

106.6

%

112.2

%

109.0

%

113.0

%

(1)

Quarterly amounts are annualized. Refer to

our December 31, 2024 report on Form 10-K under the heading

“Non-GAAP Operating ROE” in the Executive Summary of Operations

section for details on our calculation.

(2)

See a reconciliation of ROE to Non-GAAP

operating ROE under the heading “Non-GAAP Financial Measures” that

follows.

(3)

Our consolidated combined ratio as

reported for the three months and year ended December 31, 2024

includes an underwriting loss of $6.3 million and $4.7 million,

respectively, as compared to an underwriting loss of $0.2 million

and underwriting income of $0.6 million for the same respective

periods in 2023 within in our Specialty P&C segment associated

with our Lloyd's Syndicates operations, which is currently in

run-off. Further, underwriting results reflect our acceleration of

certain aviation-related losses into the fourth quarter of 2024.

Refer to our December 31, 2024 report on Form 10-K under the

heading “Losses and Loss Adjustment Expenses” in the Segment

Results - Specialty Property & Casualty section for details.

Given these underwriting results are irrelevant to our ongoing

operations and do not qualify for Discontinued Operations under

GAAP, we have excluded their impact from our calculation of the

consolidated combined ratio in the table above.

SPECIALTY P&C SEGMENT

RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2024

2023

%

Change

2024

2023

%

Change

Gross premiums written

$

161,561

$

161,770

(0.1

%)

$

807,463

$

835,430

(3.3

%)

Net premiums written

$

148,293

$

154,636

(4.1

%)

$

737,502

$

762,580

(3.3

%)

Net premiums earned

$

185,805

$

193,611

(4.0

%)

$

747,942

$

755,817

(1.0

%)

Other income (expense)

1,015

1,589

(36.1

%)

4,373

4,695

(6.9

%)

Total revenues

186,820

195,200

(4.3

%)

752,315

760,512

(1.1

%)

Net losses and loss adjustment

expenses

(143,924

)

(148,620

)

(3.2

%)

(578,486

)

(624,809

)

(7.4

%)

Underwriting, policy acquisition and

operating expenses

(49,790

)

(54,356

)

(8.4

%)

(203,207

)

(195,303

)

4.0

%

Total expenses

(193,714

)

(202,976

)

(4.6

%)

(781,693

)

(820,112

)

(4.7

%)

Segment results

$

(6,894

)

$

(7,776

)

11.3

%

$

(29,378

)

$

(59,600

)

50.7

%

SPECIALTY P&C SEGMENT KEY

RATIOS(1)

Three Months Ended December

31

Year Ended December 31

2024

2023

2024

2023

Current accident year net loss ratio

82.9

%

78.0

%

82.8

%

83.5

%

Effect of prior accident years’ reserve

development

(8.7

%)

(1.2

%)

(5.9

%)

(0.3

%)

Net loss ratio

74.2

%

76.8

%

76.9

%

83.2

%

Underwriting expense ratio

26.7

%

28.0

%

27.1

%

25.6

%

Combined ratio

100.9

%

104.8

%

104.0

%

108.8

%

(1)

Represents Non-GAAP financial measures.

See a reconciliation to their GAAP counterparts under the heading

“Non-GAAP Financial Measures” that follows.

ProAssurance is a leader in the competitive Medical Professional

Liability market, which made up over 90% of Specialty P&C

segment gross written premiums for the year ended December 31,

2024.

The combined ratio from the segment’s ongoing core operations

improved 3.9 percentage points compared to last year’s fourth

quarter, while the full-year combined ratio improved 4.8 percentage

points. We are benefiting from our continued focus on price

adequacy and disciplined underwriting as well as our ability to

target segments within healthcare where there are opportunities to

write business that we believe will meet our profitability

objectives.

- Premiums: Renewal pricing remained strong at 8% for the quarter

and 9% for the full-year while retention remained solid. New

business was below last year for the quarter and the full-year as

we focus on risk selection and pricing levels that support progress

toward our profitability targets.

- Current accident year loss ratio: Underwriting and pricing

actions taken over the past 12 months had a positive impact on both

the fourth quarter and full year 2024 current accident year loss

ratios for the Medical Professional Liability business. However, in

the fourth quarter, that progress was overshadowed by a prior year

decrease to our estimate of unallocated loss adjustment expenses, a

year-over-year change in premiums ceded to reinsurers as well as

recognition of loss severity trends in a few select

jurisdictions.

- Net loss ratio: The full-year net loss ratio improved primarily

because of the impact of 5.9 percentage points of favorable prior

accident year reserve development. Reserve development was

favorable for both the fourth quarter and full-year, largely

reflecting favorable claims-closing trends in the Medical

Professional Liability business.

- Underwriting expense ratio: The full year ratio rose 1.5

percentage points largely due to higher compensation costs.

However, the fourth-quarter underwriting expense ratio improved

over last year’s fourth quarter due to an adjustment in the prior

year quarter for full year unallocated loss adjustment expenses,

with no impact to our combined ratio.

WORKERS’ COMPENSATION INSURANCE SEGMENT

RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2024

2023

%

Change

2024

2023

%

Change

Gross premiums written

$

46,112

$

47,033

(2.0

%)

$

243,404

$

246,857

(1.4

%)

Net premiums written

$

29,559

$

28,005

5.5

%

$

166,223

$

162,285

2.4

%

Net premiums earned

$

42,918

$

38,328

12.0

%

$

167,610

$

160,034

4.7

%

Other income (expense)

403

289

39.4

%

1,887

1,854

1.8

%

Total revenues

43,321

38,617

12.2

%

169,497

161,888

4.7

%

Net losses and loss adjustment

expenses

(32,503

)

(37,508

)

(13.3

%)

(128,483

)

(139,322

)

(7.8

%)

Underwriting, policy acquisition and

operating expenses

(17,990

)

(14,139

)

27.2

%

(61,999

)

(55,061

)

12.6

%

Total expenses

(50,493

)

(51,647

)

(2.2

%)

(190,482

)

(194,383

)

(2.0

%)

Segment results

$

(7,172

)

$

(13,030

)

45.0

%

$

(20,985

)

$

(32,495

)

35.4

%

WORKERS’ COMPENSATION INSURANCE SEGMENT

KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2024

2023

2024

2023

Current accident year net loss ratio

77.0

%

97.9

%

77.0

%

81.3

%

Effect of prior accident years’ reserve

development

(1.3

%)

—

%

(0.3

%)

5.8

%

Net loss ratio

75.7

%

97.9

%

76.7

%

87.1

%

Underwriting expense ratio

41.9

%

36.9

%

37.0

%

34.4

%

Combined ratio

117.6

%

134.8

%

113.7

%

121.5

%

ProAssurance is a specialty regional underwriter of workers’

compensation products and services. The Workers’ Compensation

Insurance segment combined ratio improved 17.2 percentage points

compared to the fourth quarter of 2023 and improved 7.8 percentage

points for the full year.

- Premiums: Higher audit premiums were the primary reason for the

increase in net written premiums for the quarter and year. We

continue to carefully manage our underwriting appetite due to

market conditions. Retention in the fourth quarter was 83% although

we saw improved renewal pricing. New business in our traditional

book was $3.0 million, down from $5.0 million in last year’s fourth

quarter.

- Net loss ratio: Current accident year net loss ratio of 77.0%

for the fourth quarter and full year improved 4.3 percentage points

from 81.3% for full-year 2023. We continue to observe and reflect

the higher medical loss cost trends that we initially saw in the

second half of 2023, although they have begun to moderate this

year. Fourth quarter and full year net favorable prior accident

year reserve development was $0.5 million. In 2023, the segment

strengthened reserves due to the higher than expected loss trends

observed at that time.

- Underwriting expense ratio: The segment underwriting expense

ratio rose 5.0 percentage points from the prior year fourth quarter

and 2.6 percentage points for the full year, largely due to an

adjustment in ceding commissions charged to our segregated

portfolio cells relating to prior periods as well as higher

compensation costs.

SEGREGATED PORTFOLIO CELL REINSURANCE

SEGMENT RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2024

2023

%

Change

2024

2023

%

Change

Gross premiums written

$

12,437

$

14,335

(13.2

%)

$

57,904

$

70,259

(17.6

%)

Net premiums written

$

10,693

$

12,375

(13.6

%)

$

49,950

$

61,129

(18.3

%)

Net premiums earned

$

12,351

$

15,390

(19.7

%)

$

52,698

$

61,546

(14.4

%)

Net investment income

921

664

38.7

%

3,608

2,289

57.6

%

Net investment gains (losses)

42

1,850

(97.7

%)

2,369

3,680

(35.6

%)

Other income (expense)

18

2

800.0

%

19

5

280.0

%

Net losses and loss adjustment

expenses

(5,983

)

(9,120

)

(34.4

%)

(32,466

)

(36,363

)

(10.7

%)

Underwriting, policy acquisition and

operating expenses

(3,959

)

(5,213

)

(24.1

%)

(18,063

)

(20,457

)

(11.7

%)

SPC U.S. federal income tax (expense)

benefit(1)

(724

)

(278

)

160.4

%

(1,766

)

(1,629

)

8.4

%

SPC net results

2,666

3,295

(19.1

%)

6,399

9,071

(29.5

%)

SPC dividend (expense) income (2)

(1,965

)

(3,064

)

(35.9

%)

(4,444

)

(6,234

)

(28.7

%)

Segment results (3)

$

701

$

231

203.5

%

$

1,955

$

2,837

(31.1

%)

(1)

Represents the provision for U.S. federal

income taxes for SPCs at Inova Re, which have elected to be taxed

as a U.S. corporation under Section 953(d) of the Internal Revenue

Code. U.S. federal income taxes are included in the total SPC net

results and are paid by the individual SPCs.

(2)

Represents the net (profit) loss

attributable to external cell participants.

(3)

Represents our share of the net profit

(loss) and OCI of the SPCs in which we participate.

SEGREGATED PORTFOLIO CELL REINSURANCE

SEGMENT KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2024

2023

2024

2023

Current accident year net loss ratio

58.1

%

68.0

%

66.8

%

65.5

%

Effect of prior accident years’ reserve

development

(9.7

%)

(8.7

%)

(5.2

%)

(6.4

%)

Net loss ratio

48.4

%

59.3

%

61.6

%

59.1

%

Underwriting expense ratio

32.1

%

33.9

%

34.3

%

33.2

%

Combined ratio

80.5

%

93.2

%

95.9

%

92.3

%

Segregated Portfolio Cell Reinsurance segment results include

underwriting profit or loss plus investment results, net of U.S.

federal income taxes of segregated portfolio cells in which we

participate. For the fourth quarter, the segment reported a profit

of $0.7 million compared to $0.2 million in last year’s fourth

quarter. The fourth quarter of 2024 segment results improved

reflecting an increase in reported loss activity during the prior

year quarter; however, the full-year segment result was lower in

2024, reflecting an increase in severity-related claim

activity.

CORPORATE SEGMENT

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2024

2023

%

Change

2024

2023

%

Change

Net investment income

$

35,890

$

33,041

8.6

%

$

140,930

$

126,130

11.7

%

Equity in earnings (loss) of

unconsolidated subsidiaries:

All other investments, primarily

investment fund LPs/LLCs

4,986

1,452

243.4

%

21,532

9,196

134.1

%

Tax credit partnerships

834

(111

)

851.4

%

671

(2,405

)

127.9

%

Total equity in earnings (loss) of

unconsolidated subsidiaries:

5,820

1,341

334.0

%

22,203

6,791

226.9

%

Net investment gains (losses)

(3,285

)

8,322

(139.5

%)

(7,206

)

5,148

(240.0

%)

Other income (expense)

9,208

2,960

211.1

%

11,489

8,307

38.3

%

Operating expenses

(10,194

)

(9,184

)

11.0

%

(40,008

)

(34,007

)

17.6

%

Interest expense

(5,339

)

(6,672

)

(20.0

%)

(22,342

)

(23,150

)

(3.5

%)

Income tax (expense) benefit

(2,566

)

(3,356

)

(23.5

%)

(10,401

)

545

2008.4

%

Segment results

$

29,534

$

26,452

11.7

%

$

94,665

$

89,764

5.5

%

Consolidated effective tax rate

13.7

%

34.5

%

16.4

%

1.4

%

The Corporate segment, which includes investment results for our

Specialty P&C and Workers’ Compensation Insurance segments,

continues to contribute meaningfully to operating results and

reported earnings of $29.5 million for the quarter.

- Net investment income: The current interest rate environment

continues to benefit our net investment income, which increased

again in the quarter, driven by higher average book yields on our

fixed maturity investments. During the quarter, we reinvested at an

average new money rate of approximately 5.8% for the consolidated

portfolio, exceeding the rate on maturing assets and our

consolidated average book yield of 3.5%.

- Equity in earnings of unconsolidated subsidiaries: Our

investments in limited partnerships, typically reported to us on a

one-quarter lag, continued to produce strong returns in the quarter

and full-year.

- Other income (expense): Reflected changes in exchange rates for

foreign currency denominated loss reserves, which are not included

in our operating results.

- Operating expenses: The year-over-year increase in expenses in

the quarter and full-year was largely due to higher

compensation-related costs.

- Net investment gains and losses: While not included in our

operating results, net investment losses in the quarter were driven

by unrealized holding losses from changes in the fair value of our

equity investments while net investment losses for the year largely

were due to credit-related impairment losses and, to a lesser

extent, net losses from the sale of certain available-for-sale

fixed maturity securities.

NON-GAAP FINANCIAL MEASURES

Non-GAAP Operating Income

(Loss)

Non-GAAP operating income (loss) is a financial measure that is

widely used to evaluate performance within the insurance sector. In

calculating Non-GAAP operating income (loss), we have excluded the

effects of the items listed in the following table that do not

reflect normal results. We believe Non-GAAP operating income (loss)

presents a useful view of the performance of our ongoing core

insurance operations; however, it should be considered in

conjunction with net income (loss) computed in accordance with

GAAP. The following table reconciles net income (loss) to Non-GAAP

operating income (loss):

RECONCILIATION OF NET INCOME (LOSS) TO

NON-GAAP OPERATING INCOME (LOSS)

Three Months Ended December

31

Year Ended December

31

($ in thousands, except per share

data)

2024

2023

2024

2023

Net income (loss)

$

16,169

$

6,377

$

52,744

$

(38,604

)

Items excluded in the calculation of

Non-GAAP operating income (loss):

Net investment (gains) losses (1)

3,243

(10,672

)

(1,903

)

(13,828

)

Net investment gains (losses) attributable

to SPCs in which no profit/loss is retained (2)

30

1,504

1,773

2,925

Transaction-related costs (3)

—

—

320

—

Goodwill impairment

—

—

—

44,110

Foreign currency exchange rate (gains)

losses (4)

(8,140

)

3,484

(6,731

)

2,993

Non-operating income (5)

—

(5,416

)

—

(6,878

)

Guaranty fund assessments

(recoupments)

(2

)

28

(873

)

57

Non-core operations (6)

6,010

(217

)

3,331

(1,683

)

Pre-tax effect of exclusions

1,141

(11,289

)

(4,083

)

27,696

Tax effect, at 21% (7)

958

2,147

(69

)

1,894

After-tax effect of exclusions

2,099

(9,142

)

(4,152

)

29,590

Non-GAAP operating income (loss)

$

18,268

$

(2,765

)

$

48,592

$

(9,014

)

Per diluted common share:

Net income (loss)

$

0.31

$

0.12

$

1.03

$

(0.73

)

Effect of exclusions

0.05

(0.17

)

(0.08

)

0.56

Non-GAAP operating income (loss) per

diluted common share

$

0.36

$

(0.05

)

$

0.95

$

(0.17

)

(1)

Net investment gains (losses) recognized

in earnings are primarily driven by changes in the value of

investments that are marked to fair value each period, the nature

and timing of which are unrelated to our normal operating results.

Net investment gains (losses) for the year ended December 31, 2024

include the $6.5 million decrease to the contingent consideration

liability during the second quarter of 2024. Net investment gains

(losses) during the quarter and year ended December 31, 2023,

include gains of $0.5 million and $5.0 million, respectively,

related to the remeasurement of the contingent consideration

liability to fair value. See further discussion around the

contingent consideration in Notes 2 and 8 of the Notes to

Consolidated Financial Statements in our December 31, 2024 report

on From 10-K.

(2)

Net investment gains (losses) on

investments related to SPCs are recognized in our Segregated

Portfolio Cell Reinsurance segment. SPC results, including any net

investment gain or loss, that are attributable to external cell

participants are reflected in the SPC dividend expense (income). To

be consistent with our exclusion of net investment gains (losses)

recognized in earnings, we are excluding the portion of net

investment gains (losses) that is included in the SPC dividend

expense (income) which is attributable to the external cell

participants.

(3)

Transaction-related costs are attributable

to actuarial consulting fees paid during the second quarter of 2024

in relation to the final determination of contingent consideration

associated with the NORCAL acquisition. We are excluding these

costs as they do not reflect normal operating results and are

unique and non-recurring in nature.

(4)

Foreign currency exchange rate movements

relate to foreign currency denominated loss reserves predominately

associated with premium assumed from an international medical

professional liability insured in our Specialty P&C segment.

Our participation in this program has grown in recent years which

has led to greater volatility in our results of operations even

with nominal movements in exchange rates given the size of the

reserve. We mitigate foreign exchange rate exposure on our

Consolidated Balance Sheet by generally matching the currency and

duration of associated investments to the corresponding loss

reserves as well as utilizing foreign currency forward contracts.

When we invest in foreign currency denominated available-for-sale

fixed maturities, in accordance with GAAP, the change in market

value due to changes in foreign currency exchange rates is

reflected as a part of OCI. Conversely, the impact of changes in

foreign currency exchange rates on loss reserves is reflected

through net income (loss) as a component of other income (expense).

Therefore, we believe foreign currency exchange rate gains (losses)

in our Consolidated Statements of Income and Comprehensive Income

in isolation are not indicative of our operating performance. To be

consistent with our exclusion of foreign currency exchange rate

gains (losses) recognized in earnings, we are excluding the

associated foreign currency forward contract. Additional

information regarding our foreign currency forward contract is

provided in Note 11 of the Notes to the Consolidated Financial

Statements in our December 31, 2024 report on From 10-K.

(5)

Non-operating income includes proceeds

associated with the sale of our remaining ownership interest in the

underwriting and operations entity associated with Syndicate 1729

to unrelated third parties recognized in other income in our

Corporate segment. We are excluding these costs as they do not

reflect normal operating results and are unique and non-recurring

in nature.

(6)

Non-core operations includes the net

results from our Lloyd's Syndicates operations from our previous

participation in Syndicate 1729 and Syndicate 6131 at Lloyd's of

London, which is currently in run off. Net investment gains

(losses) recognized in earnings associated with these investments

are included in the adjustment for consolidated net investment

gains (losses) as described in footnote 1. We are excluding these

results from our Lloyd's Syndicates operations as they are

irrelevant to our ongoing operations and do not qualify for

Discontinued Operations under GAAP.

(7)

Our statutory tax rate was applied to

these items in calculating net income (loss), excluding the 2023

goodwill impairment loss which is not tax deductible. Changes in

the contingent consideration liability are non-taxable and

therefore had no associated income tax impact. The taxes associated

with the net investment gains (losses) related to SPCs in our

Segregated Portfolio Cell Reinsurance segment are paid by the

individual SPCs and are not included in our consolidated tax

provision or net income (loss); therefore, both the net investment

gains (losses) from our Segregated Portfolio Cell Reinsurance

segment and the adjustment to exclude the portion of net investment

gains (losses) included in the SPC dividend expense (income) in the

table above are not tax effected. There are no taxes associated

with our Lloyd’s Syndicates operations in our consolidated tax

provision due to the availability of net operating losses and the

full valuation allowance recorded against the deferred tax assets.

Accordingly, both the net investment gains (losses) and the

adjustment to exclude the underwriting results and net investment

income associated with our previous participation included in

Lloyd's Syndicates operations in the table above are not tax

effected.

Non-GAAP Operating ROE

The following table is a reconciliation of ROE to Non-GAAP

operating ROE for the quarter and year ended December 31, 2024 and

2023:

Three Months Ended

December 31

Year Ended

December 31

2024

2023

2024

2023

ROE(1)

5.3

%

2.4

%

4.6

%

(3.5

%)

Effect of items excluded in the

calculation of Non-GAAP operating ROE

0.7

%

(3.4

%)

(0.4

%)

2.7

%

Non-GAAP operating ROE

6.0

%

(1.0

%)

4.2

%

(0.8

%)

(1)

Quarterly amounts are annualized. Refer to

our December 31, 2024 report on Form 10-K under the heading

“Non-GAAP Operating ROE” in the Executive Summary of Operations

section for details on our calculation.

Non-GAAP Adjusted Book Value per

Share

The following table is a reconciliation of our book value per

share to Non-GAAP adjusted book value per share at December 31,

2024 and December 31, 2023:

Book Value Per Share

Book Value Per Share at December 31,

2023

$

21.82

Less: AOCI Per Share(1)

(4.01

)

Non-GAAP Adjusted Book Value Per Share at

December 31, 2023

25.83

Increase (decrease) to Non-GAAP Adjusted

Book Value Per Share during the year ended December 31, 2024

attributable to:

Net income (loss)

1.03

Non-GAAP Adjusted Book Value Per Share

at December 31, 2024

26.86

Add: AOCI Per Share(1)

(3.37

)

Book Value Per Share at December 31,

2024

$

23.49

(1)

Primarily the impact of accumulated

unrealized investment gains (losses) on our available-for-sale

fixed maturity investments. See Note 12 of the Notes to

Consolidated Financial Statements in our December 31, 2024 report

on Form 10-K for additional information.

SPECIALTY P&C SEGMENT KEY

RATIOS

Our Specialty P&C segment results as reported for the three

months and year ended December 31, 2024 and 2023 includes the

underwriting results from our previous participation in Syndicate

1729 and Syndicate 6131 at Lloyd's of London, which is currently in

run-off. Given these underwriting results are irrelevant to our

ongoing operations and do not qualify for Discontinued Operations

under GAAP, we have excluded the impact from our calculation of

Specialty P&C segment key ratios; however, these ratios should

be considered in conjunction with ratios computed in accordance

with GAAP. The following table is a reconciliation of our Specialty

P&C segment key ratios to Non-GAAP adjusted ratios at December

31, 2024 and December 31, 2023:

Three Months Ended December

31

2024

2023

Segment As Reported

Lloyd’s Syndicates Operations

Non-GAAP Adjusted Ratios

Segment As Reported

Lloyd’s Syndicates Operations

Non-GAAP Adjusted Ratios

Current accident year net loss ratio

82.7%

0.2 pts

82.9%

77.5%

0.5 pts

78.0%

Effect of prior accident years’ reserve

development

(5.2%)

(3.5 pts)

(8.7%)

(0.7%)

(0.5 pts)

(1.2%)

Net loss ratio

77.5%

(3.3 pts)

74.2%

76.8%

— pts

76.8%

Underwriting expense ratio

26.8%

(0.1 pts)

26.7%

28.1%

(0.1 pts)

28.0%

Combined ratio

104.3%

(3.4 pts)

100.9%

104.9%

(0.1 pts)

104.8%

Year Ended December 31

2024

2023

Segment As Reported

Lloyd’s Syndicates Operations

Non-GAAP Adjusted Ratios

Segment As Reported

Lloyd’s Syndicates Operations

Non-GAAP Adjusted Ratios

Current accident year net loss ratio

82.3%

0.5 pts

82.8%

82.6%

0.9 pts

83.5%

Effect of prior accident years’ reserve

development

(5.0%)

(0.9 pts)

(5.9%)

0.1%

(0.4 pts)

(0.3%)

Net loss ratio

77.3%

(0.4 pts)

76.9%

82.7%

0.5 pts

83.2%

Underwriting expense ratio

27.2%

(0.1 pts)

27.1%

25.8%

(0.2 pts)

25.6%

Combined ratio

104.5%

(0.5 pts)

104.0%

108.5%

0.3 pts

108.8%

Conference Call Information

ProAssurance management will discuss fourth quarter and full

year 2024 results during a conference call at 10:00 a.m. ET on

Tuesday, February 25, 2025. Preregistration for the call is

available here and the dial-in numbers are (833) 470-1428 (toll

free) or (404) 975-4839, access code 927016.

Investors are encouraged to listen to the live audio webcast of

the call that can also be accessed via the Events page of the

Company’s website. A replay of the call will be available at the

same location later in the day on February 25.

About ProAssurance

ProAssurance Corporation is an industry-leading specialty

insurer with extensive expertise in medical professional liability

and products liability for medical technology and life sciences.

The Company also is a provider of workers’ compensation insurance

in the eastern U.S. ProAssurance Group is rated “A” (Excellent) by

AM Best.

For the latest on ProAssurance and its industry-leading suite of

products and services, cutting-edge risk management and practice

enhancement programs, visit our website at ProAssuranceGroup.com

with investor content available at Investor.ProAssurance.com. Our

YouTube channel regularly presents insightful videos that

communicate effective practice management, patient safety and risk

management strategies.

Caution Regarding Forward-Looking Statements

Any statements in this news release that are not historical

facts or explicitly stated as an opinion are specifically

identified as forward-looking statements. These statements are

based upon our estimates and anticipation of future events and are

subject to significant risks, assumptions and uncertainties that

could cause actual results to differ materially from the expected

results described in the forward-looking statements.

Forward-looking statements are identified by words such as, but not

limited to, “anticipate,” “believe,” “estimate,” “expect,” “hope,”

“hopeful,” “intend,” “likely,” “may,” “optimistic,” “possible,”

“potential,” “preliminary,” “project,” “should,” “will,” and other

analogous expressions.

Although it is not possible to identify all of these risks and

factors, they include, among others, the following: inadequate loss

reserves to cover the Company's actual losses; inherent uncertainty

of models resulting in actual losses that are materially different

than the Company's estimates; adverse economic factors; a decline

in the Company's financial strength rating; loss of one or more key

executives; loss of a group of agents or brokers that generate

significant portions of the Company's business; failure of any of

the loss limitations or exclusions the Company employs, or change

in other claims or coverage issues; adverse performance of the

Company's investment portfolio; adverse market conditions that

affect its excess and surplus lines insurance operations; and other

risks described in the Company's filings with the Securities and

Exchange Commission. These forward-looking statements speak only as

of the date of this release and the Company does not undertake and

specifically declines any obligation to update or revise any

forward-looking information to reflect changes in assumptions, the

occurrence of unanticipated events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224077088/en/

Heather J. Wietzel • SVP, Investor Relations 800-282-6242 •

205-776-3028 • InvestorRelations@ProAssurance.com

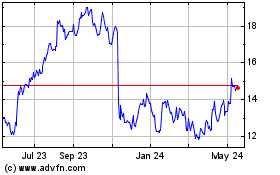

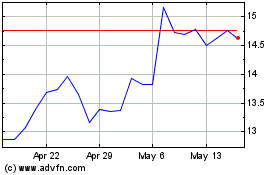

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Feb 2024 to Feb 2025