Bonaccord Capital Partners Closes on $1.6 Billion for Fund II

January 08 2025 - 7:30AM

P10, Inc. (NYSE: PX), (“P10” or the “Company”), a leading private

markets solutions provider, today announced that its strategy,

Bonaccord Capital Partners (“Bonaccord”), a private equity business

focused on providing growth capital and strategic support to

middle-market private markets sponsors, closed on its second GP

Stakes fund, Bonaccord Capital Partners II (“BCP II” or the

“Fund”), with $1.6 billion in total commitments.

The Fund closed at its revised hard cap and above its target of

$1.25 billion, having grown by 117% compared to its predecessor

fund Bonaccord Capital Partners I (“BCP I”), a 2021 vintage that

closed with $738.95 million.

“Bonaccord’s impressive fund close advances our strategic

roadmap and highlights the strong demand for our attractive middle

and lower middle market focus,” said Luke Sarsfield, P10 Chairman

and Chief Executive Officer. “Looking ahead, Bonaccord will

remain committed to delivering a differentiated approach to

value creation for partner sponsors, while offering investors

differentiated access to GP stake solutions.”

Bonaccord has invested $2.6 billion across 15 investments,

including $1.0 billion of co-investment. BCP II is approximately

60% invested and has completed eight investments in Park Square

Capital, Trivest Partners, Shamrock Capital, VMG Partners, Synova

Capital, Revelstoke Capital Partners, Kayne Anderson Private

Credit, and Lead Edge Capital. Bonaccord is continuing to invest in

team and corporate resources to support this larger fund and

anticipated future initiatives.

“The closing of Bonaccord Capital Partners II is a testament to

the exceptional caliber of our partner sponsors, and we are

grateful to share a vision of long-term growth and partnership with

all of them,” said Ajay Chitkara, Managing Partner at Bonaccord.

“We thank our investors for the confidence they have placed in us

to execute our investment strategy, and we will continually

endeavor to achieve ongoing success for all Bonaccord

stakeholders.”

Fried, Frank, Harris, Shriver & Jacobson LLP served as fund

counsel.

About P10P10 is a leading multi-asset class

private markets solutions provider in the alternative asset

management industry. P10’s mission is to provide its investors

differentiated access to a broad set of investment solutions that

address their diverse investment needs within private markets. As

of September 30, 2024, P10’s products have a global investor base

of more than 3,800 investors across 50 states, 60 countries, and

six continents, which includes some of the world’s largest pension

funds, endowments, foundations, corporate pensions, and financial

institutions. Visit www.p10alts.com.

Forward-Looking StatementsSome of the

statements in this release may constitute “forward-looking

statements” within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Words such as “will,” “expect,” “believe,” “estimate,”

“continue,” “anticipate,” “intend,” “plan” and similar expressions

are intended to identify these forward-looking statements.

Forward-looking statements discuss management’s current

expectations and projections relating to our financial position,

results of operations, plans, objectives, future performance, and

business. The inclusion of any forward-looking information in this

release should not be regarded as a representation that the future

plans, estimates, or expectations contemplated will be achieved.

Forward-looking statements reflect management’s current plans,

estimates, and expectations, and are inherently uncertain. All

forward-looking statements are subject to known and unknown risks,

uncertainties, assumptions and other important factors that may

cause actual results to be materially different; global and

domestic market and business conditions; successful execution of

business and growth strategies and regulatory factors relevant to

our business; changes in our tax status; our ability to maintain

our fee structure; our ability to attract and retain key employees;

our ability to manage our obligations under our debt agreements;

our ability to make acquisitions and successfully integrate the

businesses we acquire; assumptions relating to our operations,

financial results, financial condition, business prospects and

growth strategy; and our ability to manage the effects of events

outside of our control. The foregoing list of factors is not

exhaustive. For more information regarding these risks and

uncertainties as well as additional risks that we face, you should

refer to the “Risk Factors” included in our annual report on

Form 10-K for the year ended December 31, 2023,

filed with the U.S. Securities and Exchange

Commission (“SEC”) on March 13, 2024, and in our

subsequent reports filed from time to time with the SEC. The

forward-looking statements included in this release are made only

as of the date hereof. We undertake no obligation to update or

revise any forward-looking statement as a result of new information

or future events, except as otherwise required by law.

About Bonaccord Capital PartnersBonaccord

Capital Partners ("Bonaccord") is a private equity business focused

on providing growth capital and strategic support to exceptional

mid-market private markets sponsors spanning private equity,

private credit, and real estate and real assets. By leveraging its

strategic relationships, institutional capabilities, and strategic

development expertise, Bonaccord seeks to support transformative

initiatives and portfolio objectives that help its partner sponsors

reach their potential and establish enduring institutions.

Bonaccord is a part of P10, Inc. (NYSE: PX), a leading multi-asset

class private markets solutions provider in the alternative asset

management industry. For more information, please visit

www.bonaccordcapital.com.

P10 Investor Contact:info@p10alts.com

P10 Media Contact:Josh

ClarksonTaylor

Donahuepro-p10@prosek.com

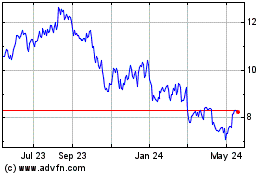

P10 (NYSE:PX)

Historical Stock Chart

From Dec 2024 to Jan 2025

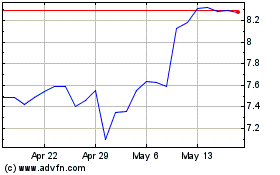

P10 (NYSE:PX)

Historical Stock Chart

From Jan 2024 to Jan 2025