Cardinal Energy Ltd. ("Cardinal" or the "Company") (TSX: CJ) is

pleased to announce its operating and financial results for the

fourth quarter and year ended December 31, 2022.

HIGHLIGHTS FROM THE FOURTH QUARTER AND

FULL YEAR OF 2022

- Reduced net

debt(1) by $115.5 million in 2022, a 65% reduction over year-end

2021 which reduces corporate risk and increases Cardinal's

sustainability;

- Reinstated our

monthly dividend in 2022 and subsequently increased it to $0.06 per

share per month in the fourth quarter providing shareholders with

direct returns. In addition, we repurchased and cancelled 3.7

million common shares with our normal course issuer bid ("NCIB") in

2022;

- Expanded our

development drilling inventory with the addition of over 90 Rex

locations in our Central operating area and began the development

of our Tide Lake Ellerslie pool in Southern Alberta where our four

most recent multilateral horizontal wells have delivered initial

production rates after 90 days ("IP90") of over 400 boe/d per

well;

- Reduced our

future abandonment and reclamation obligations ("ARO") in 2022

through a combination of dispositions of non-core assets with a

high ARO and approximately $19.6 million of actual expenditures

further reducing our inactive liabilities;

- For the fourth

quarter and for 2022, production increased 4% and 12%,

respectively, over the same periods in 2021;

- Increased

adjusted funds flow(1) for the fourth quarter and for the full year

of 2022 by 28% and 174%, respectively, over the same periods in

2021.

(1) See

non-GAAP and other financial measures.

The following table summarizes our fourth

quarter and annual 2022 operating and financial highlights:

|

($000's except shares, per share and operating

amounts) |

Three months endedDecember

31 |

|

Year endedDecember 31 |

|

|

|

2022 |

|

|

2021 |

|

% Chg |

|

|

2022 |

|

|

2021 |

|

% Chg |

|

Financial |

|

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

|

154,894 |

|

|

140,409 |

|

10 |

|

|

737,590 |

|

|

445,069 |

|

66 |

|

Cash flow from operating activities |

|

68,685 |

|

|

51,973 |

|

32 |

|

|

337,263 |

|

|

125,121 |

|

170 |

|

Adjusted funds flow (1) |

|

68,248 |

|

|

53,495 |

|

28 |

|

|

362,783 |

|

|

132,507 |

|

174 |

|

per share - basic |

$ |

0.44 |

|

$ |

0.36 |

|

22 |

|

$ |

2.36 |

|

$ |

0.92 |

|

157 |

|

per share - diluted |

$ |

0.43 |

|

$ |

0.33 |

|

30 |

|

$ |

2.30 |

|

$ |

0.86 |

|

167 |

|

Earnings |

|

113,865 |

|

|

38,955 |

|

192 |

|

|

302,687 |

|

|

284,415 |

|

6 |

|

per share - basic |

$ |

0.73 |

|

$ |

0.26 |

|

181 |

|

$ |

1.97 |

|

$ |

1.98 |

|

(1) |

|

per share - diluted |

$ |

0.71 |

|

$ |

0.24 |

|

196 |

|

$ |

1.92 |

|

$ |

1.84 |

|

4 |

|

Development capital expenditures (1) |

|

32,156 |

|

|

18,110 |

|

78 |

|

|

115,422 |

|

|

50,576 |

|

128 |

|

Other capital expenditures (1) |

|

890 |

|

|

621 |

|

43 |

|

|

2,803 |

|

|

1,493 |

|

88 |

|

Property acquisitions less dispositions (1) |

|

1,862 |

|

|

(10,069 |

) |

n/m |

|

|

2,007 |

|

|

(6,041 |

) |

n/m |

|

Total capital expenditures (1) |

|

34,908 |

|

|

8,662 |

|

303 |

|

|

120,232 |

|

|

46,028 |

|

161 |

|

|

|

|

|

|

|

|

|

|

Common shares, net of treasury shares (000s) |

|

155,757 |

|

|

150,442 |

|

4 |

|

|

155,757 |

|

|

150,442 |

|

4 |

|

Dividends declared |

|

28,699 |

|

|

- |

|

n/m |

|

|

60,856 |

|

|

- |

|

n/m |

|

Per share |

|

0.18 |

|

|

- |

|

n/m |

|

|

0.38 |

|

|

- |

|

n/m |

|

Total Payout ratio (1) |

|

89 |

% |

|

34 |

% |

|

|

|

49 |

% |

|

38 |

% |

|

|

|

|

|

|

|

|

|

|

|

Bank debt |

|

|

|

|

|

31,280 |

|

|

142,412 |

|

(78) |

|

Adjusted working capital deficiency (1) |

|

|

|

|

|

31,392 |

|

|

23,235 |

|

35 |

|

Net bank debt (1) |

|

|

|

|

|

62,672 |

|

|

165,647 |

|

(62) |

|

Secured notes |

|

|

|

|

|

- |

|

|

12,546 |

|

(100) |

|

Net debt (1) |

|

|

|

|

|

62,672 |

|

|

178,193 |

|

(65) |

|

Net debt to adjusted fund flow ratio (1) |

|

|

|

|

|

0.2 |

|

|

1.3 |

|

(85) |

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

Average daily production |

|

|

|

|

|

|

|

|

Light oil (bbl/d) |

|

8,051 |

|

|

7,509 |

|

7 |

|

|

8,045 |

|

|

7,293 |

|

10 |

|

Medium/heavy oil (bbl/d) |

|

9,891 |

|

|

9,857 |

|

- |

|

|

10,086 |

|

|

8,533 |

|

18 |

|

NGL (bbl/d) |

|

802 |

|

|

870 |

|

(8) |

|

|

851 |

|

|

915 |

|

(7) |

|

Natural gas (mcf/d) |

|

15,222 |

|

|

13,733 |

|

11 |

|

|

14,933 |

|

|

14,093 |

|

6 |

|

Total (boe/d) |

|

21,281 |

|

|

20,525 |

|

4 |

|

|

21,471 |

|

|

19,090 |

|

12 |

|

Netback ($/boe) (1) |

|

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

|

79.11 |

|

|

74.36 |

|

6 |

|

|

94.12 |

|

|

63.88 |

|

47 |

|

Royalties |

|

(15.43 |

) |

|

(14.67 |

) |

5 |

|

|

(19.14 |

) |

|

(11.49 |

) |

67 |

|

Net operating expenses (1) |

|

(25.72 |

) |

|

(22.29 |

) |

15 |

|

|

(24.88 |

) |

|

(22.22 |

) |

12 |

|

Transportation expenses |

|

(0.87 |

) |

|

(0.73 |

) |

19 |

|

|

(0.80 |

) |

|

(0.49 |

) |

63 |

|

Netback (1) |

|

37.09 |

|

|

36.67 |

|

1 |

|

|

49.30 |

|

|

29.68 |

|

66 |

|

Realized gain/(loss) on commodity contracts |

|

0.85 |

|

|

(4.74 |

) |

n/m |

|

|

0.21 |

|

|

(6.72 |

) |

n/m |

|

Interest and other |

|

(0.67 |

) |

|

(1.26 |

) |

(46) |

|

|

(0.86 |

) |

|

(1.79 |

) |

(52) |

|

G&A |

|

(2.41 |

) |

|

(2.34 |

) |

3 |

|

|

(2.36 |

) |

|

(2.15 |

) |

10 |

|

Adjusted funds flow (1) |

|

34.86 |

|

|

28.33 |

|

23 |

|

|

46.29 |

|

|

19.02 |

|

143 |

|

|

|

|

|

|

|

|

|

(1) See non-GAAP

and other financial measures.n/m Not meaningful or not

calculable

FOURTH QUARTER OVERVIEW

In the fourth quarter of 2022, oil prices

continued to be strong although decreased by 10% over the third

quarter of 2022 with the West Texas Intermediate ("WTI") benchmark

oil price averaging US$82.65/bbl. Canadian oil differentials

widened during the fourth quarter which decreased the Western

Canadian Select ("WCS") benchmark price by approximately 18% over

the third quarter. Production remained above our budget but was

down from the prior quarter as cold weather impacted operations

during the fourth quarter.

Fourth quarter 2022 adjusted funds flow of $68.2

million was 28% higher than the same period in 2021. On a per

diluted share basis, adjusted funds flow was $0.43/share, a 30%

increase over the fourth quarter of 2021. Fourth quarter 2022 free

cash flow of $36.1 million was utilized for increased dividends and

additional asset retirement expenditures further reducing our

environmental footprint to enhance the long-term sustainability of

the Company.

Earnings increased to $113.9 million in the

fourth quarter of 2022 due to a reversal of a prior year impairment

and the recovery of a deferred tax asset combined with increased

revenue. The Company has now recovered all remaining prior year

impairments available for reversal. During the quarter, Cardinal

also recovered its deferred tax asset as there was sufficient

certainty of future utilization. The Company has approximately $1.3

billion of tax pools and based on current forecast pricing does not

expect to be taxable until 2026 or beyond.

In the fourth quarter of 2022, the Company

invested $34.9 million in capital expenditures focused on the

expansion of our Tide Lake, Southern Alberta Ellerslie development

along with increasing our land position on the Wainwright, Central

Alberta Rex oil prospect. At Tide Lake, the final five (5.0 net)

commitment wells were drilled, completed and brought on stream late

in the fourth quarter through our newly commissioned and expanded

infrastructure. In particular the success of the fourth quarter

2022 four (4.0 net) Ellerslie wells has further expanded the

prospective long term development area. The Company has identified

40 potential locations in the Ellerslie development at Tide Lake

with eight undeveloped locations recognized in our year-end reserve

report. As development continues over the next several years we

anticipate the potential of significant future reserve

bookings.

Over the past several months, Cardinal has been

successful in consolidating its land position covering the

prospective area associated with the Wainwright Rex oil discovery.

Between October of 2022 and February of this year, through a

combination of Crown land sales, freehold leasing and acquisitions,

the Company has added over 20 sections of prospective acreage

within the play boundaries and now has identified 90 future

drilling locations, of which three were booked at year end on this

emerging multilateral oil prospect.

Cardinal continues to be responsible stewards of

its capital in enhancing shareholder value. Although our 2022 year

end reserve report release on February 27, 2023 disclosed proved

producing reserves per share increasing in 2022 on both a barrel

equivalent (8%) and a present value 10% discounted basis (34%),

Cardinal continued with its prudent booking practices. Proved

producing reserves accounted for over 68% of total reserve volumes.

The future capital which is reflected in booked reserves represents

less than two times our capital expenditures for 2022. Both metrics

are among the best exhibited by our oil and gas industry peers. The

drilling locations embedded in our report represent less than 15%

of internally identified economic locations on our lands.

Supporting our low base decline, the Company

continued with its well reactivation program on recompletions and

workovers throughout its operating areas and continued with the

enhanced oil recovery program with CO2 injection at Midale,

Saskatchewan. In the fourth quarter, Cardinal also closed net

acquisitions of $1.9 million which included an increase in a unit

working interest in the North area partially offset by a $0.4

million disposition of approximately 300 boe/d of high cost heavy

oil with associated decommissioning obligations of $8.0

million.

Fourth quarter 2022 net operating expenses per

boe were 4% lower than the prior quarter at $25.72/boe due to lower

fourth quarter Alberta electricity costs and reduced workover

activity. In 2022, net operating expenses were higher than

historical levels as Alberta power prices have significantly

increased over 2021. In 2022, average Alberta power prices

increased approximately 60% averaging over $162/MWh, which elevated

net operating costs by over $2.00/boe as compared to 2021. To

mitigate increasing future power costs, Cardinal has entered into

power contracts that fix the price of over 70% of the Company's

average monthly Alberta power usage at an average price of $85/MWh

which is 48% lower than the average price in 2022.

Cardinal's net debt closed 2022 at $62.7 million

which included $31.3 million of bank debt and $31.4 million of a

working capital deficiency. The $31.3 million of bank debt

represents drawings of 20% on our $155 million credit facility.

During the fourth quarter, the Company chose to reduce our credit

facility by $30 million in order to reduce standby fees which has

contributed to a 46% decrease in interest and other costs per boe

over the same period in 2021.

In the fourth quarter of 2022, Cardinal

increased its dividend by 20% to $0.06 per common share for a total

of $28.7 million of dividends. In 2022, Cardinal has returned over

$106 million to shareholders in the form of dividends, treasury

share purchases and common share cancellations through our

NCIB.

(1) See non-GAAP

and other financial measures.

OPERATIONS

Cardinal's average production was 21,471 boe/d

in 2022. The Company drilled 26 (24.8 net) wells in the year

consisting of 23 (22.3 net) producing wells, two (1.5 net)

injection wells and one (1.0 net) unsuccessful exploratory well. In

aggregate, the 23 producing wells have delivered production at

rates above expectations with average capital efficiency based upon

IP90 rates of approximately $10,000/boe per day. Cardinal's entire

drill, complete, equip and tie-in development capital paid out in

2022 from the income generated from the wells drilled. Drilling

results across our asset base outperformed expectations with select

highlights as follows:

- At Tide Lake,

we continued to see successful drill results throughout 2022 with

average drill, complete, equip and tie-in development capital costs

of $1.8 million per well on our four (4.0 net) Tide Lake Ellerslie

multilateral oil wells which delivered average IP90 rates over 400

boe/d per well. The infrastructure expansion in this area through

the last half of the year created capacity to accommodate all of

our 2021 and 2022 drilling and future drilling. Over the past two

years our production within the Tide Lake area has grown from

approximately 500 boe/d to over 3,000 boe/d;

- After being on

stream for over ten months our four (4.0 net) Clearwater (Nipisi)

multilateral wells continue to exceed our forecasts with current

aggregate production of approximately 550 boe/d. These wells have

paid out over two times to date;

- Brought on

stream in August, our Wainwright Central Alberta Rex multilateral

discovery well continues to produce above expectation with current

rates over 125 boe/d. With our existing land position expanded

through additional acquisitions in 2022 and 2023 the Company has

identified over 90 potential multi-lateral follow up locations on

this play trend to develop over the next several years;

- At Midale,

Saskatchewan our 2022 drills consisting of two (1.5 net) injector

wells and two (1.5 net) producing wells continue to supplement the

long life low decline oil production.

Optimization efforts through the first quarter

across our asset base have continued to support Cardinal’s top

decile base decline rate. To date, in 2023, Cardinal has drilled

three (3.0 net) multi-leg Clearwater oil wells at Nipisi of the

four (4.0 net) wells planned on a single padsite. These wells are

expected to be on-stream early in the second quarter of 2023.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

("ESG")

Cardinal's strong corporate emissions

performance has continued in 2022 with ongoing CO2 sequestration in

Saskatchewan and further implementation of projects aimed at

reducing emissions from our operations across Alberta. Through

our world class Carbon Capture and Sequestration ("CCS") enhanced

oil recovery ("EOR") operation at Midale, the Company sequestered

approximately 292,000 tonnes of CO2 equivalent in 2022. This amount

of carbon sequestration far exceeds our scope 1 emissions. To date,

the Midale CCS EOR project has sequestered over five million tonnes

of CO2 and has reduced oil production decline rates from this

project to approximately 3%.

Cardinal's safety record continues to be in the

top tier of the industry, as is our regulatory compliance

level.

In 2022, Cardinal continued its commitment to

responsible, sustainable operations spending $19.6 million towards

ARO. The government funded programs ended in 2022; however,

Cardinal utilized approximately $30 million of gross funding along

with its own combined spend to abandon 556 (482 net) wells in the

last three years. Reclamation and returning the surface to its

original use remains an ongoing focus. Cardinal has reclaimed 271

(237 net) sites and continues with the ongoing vegetation

monitoring and moving these sites forward to closure. We minimize

our environmental footprint through multi-well padsites for new

drilling, with only 40% of drills on new leases.

In 2022, Cardinal disposed of approximately $11

million of undiscounted future ARO liability from interests in 281

well licenses and nine facilities. In 2023, Cardinal continues to

high-grade our assets and has disposed of, or has agreements in

place to dispose of, interests in 59 (27 net) well licenses and

eight facility licenses, reducing our undiscounted future ARO by

$4.9 million.

Cardinal will continue with our commitment to

reduce our environmental footprint with $23 million in our 2023

budget for ARO, more than 2.5 times our required regulatory spend

requirements.

OUTLOOK

2022 was a very successful year for Cardinal and

its shareholders. When we prepared our 2022 budget in late 2021,

our focus was to accomplish three things: reduce the risk in our

business, improve our sustainability and provide returns to

shareholders.

Our single largest achievement in 2022 was the

significant reduction in our debt. At current debt levels we no

longer view debt as a significant risk factor but will strive to

reduce it to zero as appropriate.

Sustainability was dramatically improved in 2022

with large increases to our development drilling inventory

throughout our asset base.

In our Central operating area, we were able to

identify and test an oil zone using new multi-leg technology

resulting in the successful drilling of a well which, with further

land acquisitions in 2022 and 2023, has given us an estimated 90

development drilling locations. The success of this play not only

gives the area a large inventory of future locations but has the

added benefit of reducing the operating costs on existing

production and facilities through economies of scale. Cardinal

plans to drill six to eight wells on this play in 2023 which, if

successful, we expect will reduce operating costs on the existing

property by $8-$9/boe based on approximately 1,100 boe/d of current

production. Although this is one example of true half cycle

economics, we are doing similar projects in our Southern Alberta

business unit and receive this benefit in our other operating areas

as well.

Our overall focus for 2023 will not change from

2022. Continue to improve our sustainability, reduce risk and

ensure returns to shareholders utilizing our NCIB, dividends and

special dividends when appropriate.

On behalf of the Board of Directors, management

and employees, we would like to thank our shareholders for their

continued support.

ANNUAL FILINGS

Cardinal also announces the filing of its

Audited Financial Statements for the year ended December 31, 2022

and related Management's Discussion and Analysis with the Canadian

securities regulatory authorities on the System for Electronic

Analysis and Retrieval ("SEDAR"). In addition, Cardinal will file

its Annual Information Form for the year ended December 31, 2022 on

SEDAR on or prior to March 31, 2023. Electronic copies may be

obtained on Cardinal's website at www.cardinalenergy.ca and on

Cardinal's SEDAR profile at www.sedar.com.

Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to: the Company's expectation

of the potential of significant future reserve bookings as

development continues at the Ellerslie development at Tide Lake,

that Cardinal's Clearwater oil wells at Nipisi are expected to be

on-stream late in the first quarter or early in the second quarter

of 2023, Cardinal's intention to continue with its commitment to

reduce its environmental footprint with $23 million in its 2023

budget for ARO, matters set forth under "Outlook" including that

the Company will strive to reduce debt to zero as appropriate, that

Cardinal plans to drill six to eight wells in its Central operating

area in 2023 which, if successful, it expects will reduce operating

costs on the existing property by $8-$9/boe based on approximately

1,100 boe/d of production, Cardinal's intention to continue to

improve its sustainability, reduce risk and ensure returns to

shareholders utilizing our NCIB, dividends and special dividends

when appropriate, our business strategies, plans and objectives,

plans to continue with our debt reduction strategy, our 2023

capital program and spending plans, our drilling and completion

plans, expectations with respect to ongoing new wells and our

drilling inventory, the sufficiency of our infrastructure at Tide

Lake, the quality of our asset base and decline rates, that the

Company does not expect to be taxable until 2026 or beyond, our

abandonment and reclamation program, expectations with respect to

future operating costs, our future ESG performance, plans to

upgrade our drilling inventory, dividend plans, NCIB plans and

strategies, plans to operate our assets in a responsible and

environmentally sensitive manner, our plans to reduce risk and

return capital to shareholders (including through dividends and

share buybacks), strategies with respect to Cardinal's share based

compensation programs, and our future forecasted and targeted debt

levels.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, current and future commodity

prices and exchange rates, effects of inflation, applicable royalty

rates, tax laws, industry conditions, availability of government

subsidies and abandonment and reclamation programs, future well

production rates and reserve volumes, future operating costs, the

performance of existing and future wells, the success of our

exploration and development activities, the sufficiency and timing

of budgeted capital expenditures in carrying out planned

activities, the timing and success of our cost cutting initiatives

and power projects, the availability and cost of labor and

services, the impact of competition, conditions in general economic

and financial markets, availability of drilling and related

equipment, effects of regulation by governmental agencies, the

ability to obtain financing on acceptable terms which are subject

to change based on commodity prices, market conditions and drilling

success and potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions and exploration and development programs;

competition from other producers; the lack of availability of

qualified personnel, drilling rigs or other services; changes in

income tax laws or changes in royalty rates and incentive programs

relating to the oil and gas industry including abandonment and

reclamation programs; hazards such as fire, explosion, blowouts,

and spills, each of which could result in substantial damage to

wells, production facilities, other property and the environment or

in personal injury; and ability to access sufficient capital from

internal and external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this press release and Cardinal disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Supplemental Information Regarding Product

Types

This news release includes references to 2022

and 2021 production. The Company discloses crude oil production

based on the pricing index that the oil is priced off of. The

following table is intended to provide the product type composition

as defined by NI 51-101.

|

|

Light/Medium Crude Oil |

Heavy Oil |

NGL |

Conventional Natural Gas |

Total (boe/d) |

|

Q4/22 |

49% |

35% |

4% |

12% |

21,281 |

|

Q4/21 |

51% |

34% |

4% |

11% |

20,525 |

|

2022 |

50% |

34% |

4% |

12% |

21,471 |

|

2021 |

54% |

29% |

5% |

12% |

19,090 |

|

Tide Lake |

- |

89% |

- |

11 |

400 |

|

nipisi |

- |

97% |

- |

3 |

550 |

|

Central AB Rex |

- |

100% |

- |

- |

125 |

|

Disposed |

- |

100% |

- |

- |

300 |

Non-GAAP and Other Financial

Measures

This news release contains certain specified

measures consisting of non-GAAP financial measures, capital

management measures, non-GAAP financial ratios, and supplementary

financial measures. Since these specified financial measures may

not have a standardized meaning, they must be clearly defined and,

where required, reconciled with their nearest GAAP measure and may

not be comparable with the calculation of similar financial

measures disclosed by other entities.

Non-GAAP Financial Measures

Net operating expenses

Net operating expenses is calculated as

operating expense less processing and other revenue primarily

generated by processing third party volumes at processing

facilities where the Company has an ownership interest, and can be

expressed on a per boe basis. As the Company’s principal business

is not that of a midstream entity, management believes this is a

useful supplemental measure to reflect the true cash outlay at its

processing facilities by utilizing spare capacity to process third

party volumes.

|

|

Three months ended |

Year ended |

|

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

|

Operating expenses |

51,301 |

|

42,932 |

|

199,197 |

|

158,529 |

|

|

Less: Processing and other revenue |

(950 |

) |

(842 |

) |

(4,250 |

) |

(3,686 |

) |

|

Net operating expenses |

50,351 |

|

42,090 |

|

194,947 |

|

154,843 |

|

Netback

Cardinal utilizes netback as key performance

indicator and is utilized by Cardinal to better analyze the

operating performance of its petroleum and natural gas assets

against prior periods. Netback is calculated as petroleum and

natural gas revenue deducted by royalties, net operating expenses,

and transportation expenses. The following table reconciles

petroleum and natural gas revenue to netback:

|

|

Three months ended |

Year ended |

|

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

|

Petroleum and natural gas revenue |

154,894 |

|

140,409 |

|

737,590 |

|

445,069 |

|

|

Royalties |

(30,201 |

) |

(27,693 |

) |

(150,001 |

) |

(80,051 |

) |

|

Net operating expenses |

(50,351 |

) |

(42,090 |

) |

(194,947 |

) |

(154,843 |

) |

|

Transportation expenses |

(1,699 |

) |

(1,378 |

) |

(6,275 |

) |

(3,406 |

) |

|

Netback |

72,643 |

|

69,248 |

|

386,367 |

|

206,769 |

|

Capital expenditures and development capital

expenditures

Cardinal utilizes capital expenditures as a

measure of capital investment on property, plant and equipment

compared to the annual budgeted capital expenditure. Capital

expenditures is calculated as cash flow from investing activities

excluding change in non-cash working capital and corporate

acquisition.

Cardinal utilizes development capital

expenditures as a measure of capital investment on property, plant

and equipment excluding capitalized G&A, other assets and

property acquisitions and is compared to the annual budgeted

capital expenditures. Other capital expenditures includes

capitalized G&A and office expenditures. The following table

reconciles cash flow from investing activities to total capital

expenditures to total development capital expenditures:

|

|

Three months ended |

Year ended |

|

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

|

Cash flow from investing activities |

30,186 |

|

3,540 |

|

116,181 |

|

46,571 |

|

|

Change in non-cash working capital |

4,722 |

|

5,122 |

|

4,051 |

|

15,268 |

|

|

Corporate acquisition |

- |

|

- |

|

- |

|

(15,811 |

) |

|

Capital expenditures |

34,908 |

|

8,662 |

|

120,232 |

|

46,028 |

|

|

Less: |

|

|

|

|

|

Capitalized G&A |

(495 |

) |

(567 |

) |

(1,949 |

) |

(1,339 |

) |

|

Other assets |

(395 |

) |

(54 |

) |

(854 |

) |

(154 |

) |

|

Property acquisitions |

(2,287 |

) |

(306 |

) |

(2,432 |

) |

(4,334 |

) |

|

Property dispositions |

425 |

|

10,375 |

|

425 |

|

10,375 |

|

|

Development capital expenditures |

32,156 |

|

18,110 |

|

115,422 |

|

50,576 |

|

Adjusted working capital deficiency

Management utilizes adjusted working capital to

monitor its capital structure, liquidity, and its ability to fund

current operations. Adjusted working capital is calculated as

current liabilities less current assets (adjusted for the fair

value of financial instruments, current decommissioning obligation,

and current lease liabilities). The following table reconciles

working capital to adjusted working capital:

|

As at |

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Working capital deficiency |

39,919 |

|

30,086 |

|

Lease liabilities |

1,487 |

|

1,371 |

|

Decommissioning obligation |

8,573 |

|

5,480 |

|

Fair value of financial instruments, net |

(1,533 |

) |

- |

|

Adjusted working capital deficiency |

31,392 |

|

23,235 |

Net debt

Management utilizes net debt to analyze the

financial position, liquidity and leverage of Cardinal. Net debt is

calculated as bank debt plus secured notes and adjusted working

capital.

Net bank debt

Management utilizes net bank debt to analyze the

financial position, liquidity, leverage and borrowing capacity on

Cardinal’s bank line. Net bank debt is calculated as net debt less

the secured notes.

The following table reconciles bank debt to net

bank debt and net debt:

|

As at |

Dec 31, 2022 |

Dec 31, 2021 |

|

Bank debt |

31,280 |

142,412 |

|

Adjusted working capital deficiency |

31,392 |

23,235 |

|

Net bank debt |

62,672 |

165,647 |

|

Secured notes |

- |

12,546 |

|

Net debt |

62,672 |

178,193 |

Funds flow

Management utilizes funds flow as a useful

measure of Cardinal’s ability to generate cash not subject to

short-term movements in non-cash operating working capital. As

shown below, funds flow is calculated as cash flow from operating

activities excluding the change in non-cash working capital.

Adjusted funds flow

Management utilizes adjusted funds flow as a key

measure to assess the ability of the Company to generate the funds

necessary for financing activities, operating activities, capital

expenditures and shareholder returns. As shown below, adjusted

funds flow is calculated as funds flow excluding transaction costs,

decommissioning expenditures since Cardinal believes the timing of

payment or incurrence of these items involves a high degree of

discretion and variability. Expenditures on decommissioning

obligations vary from period to period depending on the maturity of

the Company’s operating areas and availability of adjusted funds

flow and are viewed as part of the Company’s capital budgeting

process.

Free cash flow

Management utilizes free cash flow as a measure

to assess Cardinal’s ability to generate cash, after taking into

account the development capital expenditures, to increase returns

to shareholders, repay debt, or for other corporate purposes. As

shown below, free cash flow is calculated as adjusted funds flow

less development capital expenditures.

The following table reconciles cash flow from

operating activities, funds flow, adjusted funds flow, and free

cash flow:

|

|

Three months ended |

Year ended |

|

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

|

Cash flow from operating activities |

68,685 |

|

51,793 |

|

337,263 |

|

125,121 |

|

|

Change in non-cash working capital |

(5,159 |

) |

(789 |

) |

5,910 |

|

414 |

|

|

Funds flow |

63,526 |

|

51,184 |

|

343,173 |

|

125,535 |

|

|

Decommissioning expenditures |

4,722 |

|

2,260 |

|

19,610 |

|

6,302 |

|

|

Transaction costs |

- |

|

51 |

|

- |

|

670 |

|

|

Adjusted funds flow |

68,248 |

|

53,495 |

|

362,783 |

|

132,507 |

|

|

Total development capital expenditures |

(32,156 |

) |

(18,110 |

) |

(115,422 |

) |

(50,576 |

) |

|

Free cash flow |

36,092 |

|

35,385 |

|

247,361 |

|

81,931 |

|

Non-GAAP Financial Ratios

Netback per boe

Cardinal utilizes operating netback per boe to

assess the Company's operating performance of its petroleum and

natural gas assets on a per unit of production basis. Netback per

boe is calculated as netback divided by total production for the

applicable period. The following table details the calculation of

netback per boe:

|

|

Three months ended |

Year ended |

|

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

Dec 31, 2022 |

|

Dec 31, 2021 |

|

|

Petroleum and natural gas revenue |

79.11 |

|

74.36 |

|

94.12 |

|

63.88 |

|

|

Royalties |

(15.43 |

) |

(14.67 |

) |

(19.14 |

) |

(11.49 |

) |

|

Net operating expenses |

(25.72 |

) |

(22.29 |

) |

(24.88 |

) |

(22.22 |

) |

|

Transportation expenses |

(0.87 |

) |

(0.73 |

) |

(0.80 |

) |

(0.49 |

) |

|

Netback per boe |

37.09 |

|

36.67 |

|

49.30 |

|

29.68 |

|

Net debt to adjusted funds flow ratio

Cardinal utilizes net debt to adjusted funds

flow to measure the Company's overall debt position and to measure

the strength of the Company's balance sheet. Cardinal monitors this

ratio and uses this as a key measure in making decisions regarding

financing, capital expenditures and shareholder returns. Net debt

to adjusted funds flow is calculated as net debt divided by

annualized adjusted funds flow for the applicable period.

Total payout ratio

Cardinal utilizes this ratio as key measure to

assess the Company's ability to fund financing activities,

operating activities, and capital expenditures. Total payout ratio

is calculated as the sum of dividends declared plus development

capital expenditures divided by adjusted funds flow.

Net operating expenses per boe

Cardinal utilizes net operating expenses per boe

to assess Cardinal’s operating efficiency of its petroleum and

natural gas assets on a per unit of production basis. Net operating

expense per boe is calculated as net operating expenses divided by

total production for the applicable period.

Adjusted funds flow per boe

Cardinal utilizes adjusted funds flow per boe as

a measure to assess the ability of the Company to generate the

funds necessary for financing activities, operating activities,

capital expenditures and shareholder returns on a per boe basis.

Adjusted funds flow per boe is calculated using adjusted funds flow

divided by total production for the applicable period.

Adjusted funds flow per basic share

Cardinal utilizes adjusted funds flow per share

as a measure to assess the ability of the Company to generate the

funds necessary for financing activities, operating activities,

capital expenditures and shareholder returns on a per basic share

basis. Adjusted funds flow per basic share is calculated using

adjusted funds flow divided by the weighted average basic shares

outstanding.

Adjusted funds flow per diluted share

Cardinal utilizes adjusted funds flow per share

as a measure to assess the ability of the Company to generate the

funds necessary for financing activities, operating activities,

capital expenditures and shareholder returns on a per diluted share

basis. Adjusted funds flow per diluted share is calculated using

adjusted funds flow divided by the weighted average diluted shares

outstanding.

Supplementary Financial

Measures

NI 52-112 defines a supplementary financial

measure as a financial measure that: (i) is, or is intended to be,

disclosed on a periodic basis to depict the historical or expected

future financial performance, financial position or cash flow of an

entity; (ii) is not disclosed in the financial statements of the

entity; (iii) is not a non-GAAP financial measure; and (iv) is not

a non-GAAP ratio. The supplementary financial measures used in this

news release are either a per unit disclosure of a corresponding

GAAP measure, or a component of a corresponding GAAP measure,

presented in the financial statements. Supplementary financial

measures that are disclosed on a per unit basis are calculated by

dividing the aggregate GAAP measure (or component thereof) by the

applicable unit for the period. Supplementary financial measures

that are disclosed on a component basis of a corresponding GAAP

measure are a granular representation of a financial statement line

item and are determined in accordance with GAAP.

Oil and Gas Metrics

The term "boe" or barrels of oil equivalent may

be misleading, particularly if used in isolation. A boe conversion

ratio of six thousand cubic feet of natural gas to one barrel of

oil equivalent (6 Mcf: 1 bbl) is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Additionally,

given that the value ratio based on the current price of crude oil,

as compared to natural gas, is significantly different from the

energy equivalency of 6:1; utilizing a conversion ratio of 6:1 may

be misleading as an indication of value.

"Payout" means the anticipated years of

production from a well required to fully pay for all capital spent

to drill, complete, equip and tie-in a well.

Initial Production

Any references in this news release to initial

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter. While encouraging, readers are cautioned not to place

reliance on such rates in calculating the aggregate production for

Cardinal.

Drilling Locations

This news release discloses Cardinal's inventory

of 90 potential locations Wainwright Central Alberta Rex and 40

potential locations in the Ellerslie development at Tide Lake, of

which in respect of Wainwright Central Alberta Rex 2 locations are

booked proved undeveloped, 1 net is booked probable undeveloped

locations and 87 net are unbooked and in respect of Ellerslie 1

location is booked proved undeveloped, 7 net are booked probable

undeveloped locations and 32 net are unbooked. The booked locations

are derived from the Company's year-end 2022 reserves evaluation by

GLJ Ltd. with an effective date of December 31, 2022 and account

for drilling locations that have associated proved and/or probable

reserves, as applicable. Unbooked locations are internal estimates

based on the Company's prospective acreage and an assumption as to

the number of wells that can be drilled per section based on

industry practice and internal review. Unbooked locations do not

have attributed reserves. Unbooked locations have been identified

by management as an estimation of the Company's multi-year drilling

activities based on evaluation of applicable geologic, seismic,

engineering, production and reserves information. There is no

certainty that the Company will drill all unbooked drilling

locations and if drilled there is no certainty that such locations

will result in additional oil and gas reserves, resources or

production. The drilling locations on which the Company will

actually drill wells, including the number and timing thereof is

ultimately dependent upon the availability of funding, regulatory

approvals, seasonal restrictions, oil and natural gas prices,

costs, actual drilling results, additional reservoir information

that is obtained and other factors. While a certain number of the

unbooked drilling locations have been derisked by drilling existing

wells in relative close proximity to such unbooked drilling

locations, the majority of other unbooked drilling locations are

farther away from existing wells where management has less

information about the characteristics of the reservoir and

therefore there is more uncertainty whether wells will be drilled

in such locations and if drilled there is more uncertainty that

such wells will result in additional oil and gas reserves,

resources or production.

About Cardinal Energy Ltd.

Cardinal works to continually improve its

Environmental, Social and Governance profile and operates its

assets in a responsible and environmentally sensitive manner. As

part of this mandate, Cardinal injects and conserves more carbon

than it directly emits making us one of the few Canadian energy

companies to have a negative carbon footprint.

Cardinal is a Canadian oil and natural gas

company with operations focused on low decline oil in Western

Canada.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.caPhone: (403) 234-8681

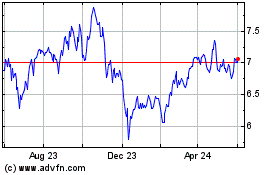

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

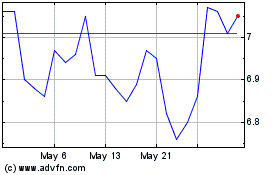

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jan 2024 to Jan 2025