AM Best Affirms Credit Ratings of Colonnade Insurance S.A.

January 10 2025 - 10:47AM

Business Wire

AM Best has affirmed the Financial Strength Rating of A-

(Excellent) and the Long-Term Issuer Credit Rating of “a-”

(Excellent) of Colonnade Insurance S.A. (Colonnade) (Luxembourg), a

member of the Fairfax Financial Holdings Limited (Fairfax) [TSX:

FFH] group of companies. The outlook of these Credit Ratings

(ratings) is stable.

The ratings reflect Colonnade’s balance sheet strength, which AM

Best assesses as strong, as well as its adequate operating

performance, neutral business profile and appropriate enterprise

risk management (ERM).

Colonnade benefits from the explicit and implicit support

provided by Fairfax. Examples of explicit support include the

provision of investment support and occasional capital

contributions. Fairfax’s commitment to Colonnade’s strong balance

sheet assessment was evident in multiple capital contributions over

its early operating history, though in recent years, capital

generation has been through investment returns and profitable

underwriting. Going forward, AM Best expects that Colonnade will

continue to support its business needs through organic capital

generation, as it implements growth plans and continues to invest

in company infrastructure.

Colonnade’s premium volume grew over 20% year over year driven

by continued growth of the core book of business, bolstered by rate

improvement. There is an expectation that the growth in premiums

will continue over the next couple of years.

Colonnade’s adequate operating performance has been driven by

its very favorable loss performance, which is offset somewhat by a

higher expense ratio. As Colonnade continues to mature, investments

in underwriting efficiencies are expected to continue to contribute

to greater profitability. Colonnade has generated an underwriting

profit consistently in recent years.

The company’s neutral business profile reflects its

concentration in Central and Eastern Europe, with the three largest

countries – Poland, Hungary and the Czech Republic – representing

approximately 75% of the premium written. Concentration risk is

offset by the dispersion of the remaining 25% of its business in

three other central European countries and Colonnade’s diverse

product offering.

AM Best considers the company’s risk management capability to be

in line with its risk profile, and it is supported by Colonnade’s

focus on maintaining geographic and by-line diversified business,

conservative reserving and per-risk reinsurance limits, supporting

the assessment of appropriate. The company benefits from a

comprehensive and well-documented ERM program and continues to grow

more independent in its risk management functions, while continuing

to benefit from the risk management expertise of its ultimate

parent.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2025 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110310463/en/

Patrick Cyphers Financial Analyst +1 908 882 1719

patrick.cyphers@ambest.com Gregory Dickerson Director +1 908 882

1737 gregory.dickerson@ambest.com Christopher Sharkey

Associate Director, Public Relations +1 908 882 2310

christopher.sharkey@ambest.com Al Slavin Senior Public Relations

Specialist +1 908 882 2318 al.slavin@ambest.com

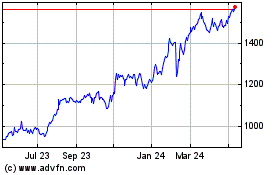

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Feb 2025 to Mar 2025

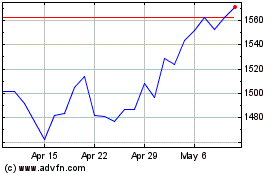

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Mar 2024 to Mar 2025