Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the

“Company”), a commercial-stage medical device company that develops

and markets customizable, incision-free therapies for the ablation

of diseased tissue, today reported unaudited financial results for

the fourth quarter and full year ended December 31, 2024. Unless

specified otherwise, all amounts in this press release are

expressed in U.S. dollars and are presented in accordance with U.S.

generally accepted accounting principles (U.S. GAAP).

Business Highlights

- Q4-2024 revenue growth of 108% over Q4-2023.

- During the fourth quarter, Profound made two key executive

changes to further support growth; Mathieu Burtnyk, PhD, was

promoted to President and Tom Tamberrino was appointed as

Profound’s new Chief Commercial Officer.

- Profound also announced it had entered into non-exclusive

collaboration with Siemens Healthineers designed to further expand

physician and patient access to the TULSA procedure.

- In November 2024, Profound unveiled its next TULSA-AI® module,

‘UA Alignment Assistant’, which removes a whole procedural step

from TULSA, resulting in less mental charge, fewer steps to

remember, and overall procedural simplification for users.

- Profound continued to see a wide variety of prostate disease

patients treated by its TULSA-PRO® customers in the fourth quarter

of 2024:

- 61% were treated for prostate cancer only, 28% were hybrid

patients suffering from both prostate cancer and benign prostatic

hyperplasia (“BPH”), 10% were salvage, and 1% were men with BPH

only;

- For cancer grade, 12% were GG1, 54% were GG2, 23% were GG3, and

11% were GG4 & GG5;

- In terms of ablation, 53% were whole gland; 25% were sub-total

but more than half the gland; and 22% were hemi-ablations or focal

therapy; and

- For prostate size, 5% were < 20cc; 40% were 20 –

40cc; 35% were 40-60cc; 15% were 60-100cc; and 5% were

over 100cc.

- The Level 1 CAPTAIN (A Comparison of TULSA Procedure vs.

Radical Prostatectomy in Participants with Localized Prostate

Cancer) trial has completed patient enrollment and Profound expects

to release available perioperative data from the trial during the

upcoming American Urological Association’s (AUA) 2025 annual

meeting (April 26-29, 2025).

“2024 marked the final year in which we were operating in a

primarily patient-pay environment for TULSA,” said Arun Menawat,

Profound’s CEO and Chairman. “Moving forward, with the TULSA

procedure now being uniquely reimbursed both at Urology APC Level 7

and at an unrivalled number of treatment settings, and with initial

data readouts from our CAPTAIN clinical trial coming this year,

starting at AUA in April, we believe that we are entering into a

stage of anticipated escalating growth.”

Summary Fourth Quarter 2024

Results

For the quarter ended December 31, 2024,

Profound recorded revenue of approximately $4.2 million, with $2.7

million from recurring - non-capital revenue, which consists of the

sale of TULSA-PRO® consumables, lease of capital equipment and

services associated with extended warranties, and $1.5 million from

one-time sale of capital equipment. Fourth quarter 2024 revenue

increased 108% from $2.0 million in the same three-month period a

year ago.

Total operating expenses in the fourth quarter

of 2024 were $11.3 million, compared with $9.8 million in the prior

year period. The increase in operating expenses was primarily due

to expenses to expand the commercial organization with increased

headcount, increased variable compensation expense, increased

travel costs and accelerated research and development

investments.

Fourth quarter 2024 net loss was approximately

$4.9 million, or $0.20 per common share, a 45% improvement compared

to approximately $8.9 million, or $0.42 per common share, in the

three months ended December 31, 2023.

Summary Full Year 2024

Results

For the year ended December 31, 2024, Profound

recorded revenue of approximately $10.7 million, with $8.2 million

from recurring revenue and $2.5 million from the one-time sale of

capital equipment. This compares to revenue of approximately $7.2

million in the year ended December 31, 2023, with $6.8 million from

recurring revenue and $393,000 from the one-time sale of capital

equipment.

Profound’s full year 2024 total operating

expenses were approximately $40.1 million, compared to

approximately $33.0 million in 2023. The increase in operating

expenses was primarily due to increased headcount, increased

enrolment for the CAPTAIN trial and recruitment efforts, higher

material expenditures for R&D initiatives, release of

commercial segments and marketing advertisement campaigns,

increased travel for conferences and costs associated with hosting

Profound’s educational event, PRO-Talk Live!, in September

2024.

Profound recorded a net loss for the year ended

December 31, 2024 of approximately $27.8 million, or $1.12 per

common share, compared to approximately $28.3 million, or $1.34 per

common share, for the year ended December 31, 2023.

Liquidity and Outstanding Share

Capital

As at December 31, 2024, Profound had cash of

approximately $54.9 million.

As at March 6, 2025, Profound had 30,039,809

common shares issued and outstanding.

For complete financial results, please see

Profound’s filings, which will be made available under Profound’s

profile at www.sedarplus.com, www.sec.gov and on Profound’s website

at www.profoundmedical.com under “Financial” in the Investors

section. A hard copy of Profound’s annual report can also be

requested free of charge at the bottom of the Investors section of

its website.

Conference Call Details

Profound Medical is pleased to invite all

interested parties to participate in a conference call today at

4:30 pm ET during which time the results will be discussed.

To participate in the conference call by telephone, please

pre-register via this link to receive the dial-in number and your

unique PIN.

The call will also be broadcast live and

archived on Profound's website at www.profoundmedical.com under

"Webcasts" in the Investors section.

2024 Financial Statements

In conjunction with the Company’s transition to

U.S. GAAP, the Audit Committee of Profound’s Board of Directors

(the "Audit Committee"), after discussion with Profound’s auditors,

has identified an error which overstated revenue by $472,000 in the

first quarter of 2024. The corrected financial information also

increases the U.S. GAAP net loss before tax and net loss attributed

to shareholders by $386,000. The unaudited financial results for

fiscal year ended December 31, 2024 reported herein reflect the

corrected financial information.

In light of the above Audit Committee review

findings to date, Profound determined, on the Audit Committee's

recommendation and after consultation with its independent

auditors, that Profound’s previously issued 2024 Interim Financial

Statements, each prepared in accordance with International

Financial Reporting Standards ("IFRS") as filed on SEDAR+, and

furnished to the U.S. Securities and Exchange Commission on Form

6-K, will be restated and reissued and should no longer be relied

upon. Similarly, any previously filed or furnished reports, related

earnings releases, related management's discussion and analysis,

investor presentations or similar communications of Profound

describing Profound’s financial results or other financial

information for the quarters of 2024, and any previously issued

forecast or guidance for the fiscal year ended December 31, 2024,

should no longer be relied upon. Profound’s 2024 Interim Financial

Statements will be restated to effect the revenue adjustments

described above, as well as other related flow through adjustments.

In addition, the 2024 Interim Financial Statements will be refiled

to reflect Profound’s transition from IFRS to U.S. GAAP, as

required under Canadian securities legislation.

Amendment to CIBC Credit

Facility

Profound also wishes to announce that, on March

3, 2025, Profound Medical Inc. (the “Borrower”), a subsidiary of

Profound, entered into an amended and restated

credit agreement (the “Credit Agreement”), by and among the

Borrower, Profound and certain other affiliates of the Borrower,

and Canadian Imperial Bank of Commerce (“CIBC”), as lender.

The Credit Agreement amended the terms of the

existing credit agreement between the Borrower, Profound and CIBC

entered into on November 3, 2022 (the “Original CIBC Credit

Agreement”) and the existing long-term debt provided under the

Original CIBC Credit Agreement was repaid with proceeds from a

new revolving line of credit provided by CIBC to the Borrower. The

line of credit continues to bear interest at the Wall Street

Journal Prime Rate subject to a floor of 6.25%. As with the

Original CIBC Credit Agreement, the revolving line of credit

matures on March 3, 2027 and provides an option to increase the

amount of the revolving commitment by $5,000,000 within 18 months

from March 3, 2025, subject to achieving a minimum trailing 12

month revenue exceeding $15,000,000. The exercise of the option

would result in the size of the revolving commitment increasing

from $10,000,000 to a maximum of $15,000,000. Additionally, the

Credit Agreement provides that Profound may request a one-time

increase in the principal amount of the revolving line of credit up

to a maximum amount of $10,000,000, which is subject to the

approval of CIBC in its sole discretion.

The Credit Agreement is secured by a general

security agreement over the assets of Profound and its

subsidiaries. Under the Credit Agreement, Profound’s unrestricted

cash must at all times be greater of: (i) to the extent EBITDA is

negative for such period, EBITDA for the most recent nine-month

period or (ii) $7,500,000, reported on a monthly basis; and that

revenue for the most recent reported trailing 12-month period must

be 15% greater than recurring revenue for the same time period in

the prior fiscal year, reported on a quarterly basis. The Credit

Agreement contains other customary terms, including (a)

representations, warranties and affirmative covenants, (b) negative

covenants, including limitations on indebtedness, liens, mergers,

acquisitions, asset sales, distributions and investments, in each

case subject to certain baskets, thresholds and other exceptions,

and (c) customary events of default and creditors’ remedies.

The foregoing description of the Credit

Agreement is only a summary and is qualified in its entirety by

reference to the full text of the Credit Agreement, which will be

filed with the Company’s Annual Report on Form 10-K for the year

ended December 31, 2024.

About Profound Medical

Corp.

Profound is a commercial-stage medical device

company that develops and markets customizable, incision-free

therapies for the ablation of diseased tissue.

Profound is commercializing TULSA-PRO®, a

technology that combines real-time MRI, robotically-driven

transurethral ultrasound and closed-loop temperature feedback

control. The TULSA procedure, performed using the TULSA-PRO®

system, has the potential of becoming a mainstream treatment

modality across the entire prostate disease spectrum; ranging from

low-, intermediate-, or high-risk prostate cancer; to hybrid

patients suffering from both prostate cancer and benign prostatic

hyperplasia (“BPH”); to men with BPH only; and also, to patients

requiring salvage therapy for radio-recurrent localized prostate

cancer. TULSA employs real-time MR guidance for precision to

preserve patients’ urinary continence and sexual function, while

killing the targeted prostate tissue via precise sound absorption

technology that gently heats it to 55-57°C. TULSA is an incision-

and radiation-free “one-and-done” procedure performed in a single

session that takes a few hours. Virtually all prostate shapes and

sizes can be safely, effectively, and efficiently treated with

TULSA. There is no bleeding associated with the procedure; no

hospital stay is required; and most TULSA patients report quick

recovery to their normal routine. TULSA-PRO® is CE marked, Health

Canada approved, and 510(k) cleared by the U.S. Food and Drug

Administration (“FDA”).

Profound is also commercializing Sonalleve®, an

innovative therapeutic platform that is CE marked for the treatment

of uterine fibroids and palliative pain treatment of bone

metastases. Sonalleve® has also been approved by the China National

Medical Products Administration for the non-invasive treatment of

uterine fibroids and has FDA approval under a Humanitarian Device

Exemption for the treatment of osteoid osteoma. Profound is in the

early stages of exploring additional potential treatment markets

for Sonalleve® where the technology has been shown to have clinical

application, such as non-invasive ablation of abdominal cancers and

hyperthermia for cancer therapy.

Forward-Looking Statements

This release includes forward-looking statements

regarding Profound and its business which may include, but is not

limited to, any express or implied statements or guidance regarding

current or future financial performance, including Profound’s

results for the three and 12 months ended December 31, 2024 and

position, the timing and amount of any expected restatement, the

timing of Profound’s filing of its financial statements for the

year ended December 31, 2024, the expectations regarding the

efficacy of Profound’s technology in the treatment of prostate

cancer, BPH, uterine fibroids, palliative pain treatment and

osteoid osteoma; and the success of Profound’s U.S.

commercialization strategy and activities for TULSA-PRO®. Often,

but not always, forward-looking statements can be identified by the

use of words such as "plans", "is expected", "expects",

"scheduled", "intends", "contemplates", "anticipates", "believes",

"proposes" or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved. Such statements are based on the current expectations of

the management of Profound. The forward-looking events and

circumstances discussed in this release, may not occur by certain

specified dates or at all and could differ materially as a result

of known and unknown risk factors and uncertainties affecting

Profound, including risks regarding the medical device industry,

regulatory approvals, reimbursement, economic factors, the equity

markets generally and risks associated with growth and competition,

statements and projections regarding financial guidance and goals

and the attainment of such goals may differ from actual results

based on market factors and Profound’s ability to execute its

operational and budget plans; and actual financial results may not

be consistent with expectations, including that revenue, operating

expenses and cash usage may not be within management's expected

ranges. Although Profound has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results to differ from those anticipated, estimated or intended.

No forward-looking statement can be guaranteed. Other factors and

risks that may cause actual results to differ materially from those

set out in the forward-looking statements are described in

Profound's Annual Report on Form 10-K and other filings made with

US and Canadian securities regulators, available at

www.sedarplus.ca and www.sec.gov. Except as required by applicable

securities laws, forward-looking statements speak only as of the

date on which they are made and Profound undertakes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events, or otherwise, other

than as required by law.

For further information, please

contact:Stephen KilmerInvestor

Relationsskilmer@profoundmedical.com T: 647.872.4849

Profound Medical

Corp.Consolidated Balance SheetsAs at

December 31, 2024 and 2023In USD, Unaudited

(000s)

|

|

|

2024$ |

|

|

2023$ |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash |

|

54,912 |

|

|

26,213 |

|

|

Trade and other receivables, net |

|

7,045 |

|

|

7,288 |

|

|

Inventory |

|

5,801 |

|

|

6,989 |

|

|

Prepaid expenses and deposits |

|

1,307 |

|

|

1,406 |

|

|

Total current assets |

|

69,065 |

|

|

41,896 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

425 |

|

|

909 |

|

|

Intangible assets, net |

|

261 |

|

|

490 |

|

|

Right-of-use assets, net |

|

396 |

|

|

661 |

|

|

Deferred tax assets, net |

|

87 |

|

|

- |

|

|

|

|

70,234 |

|

|

|

|

Total assets |

|

7,045 |

|

|

43,956 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

1,317 |

|

|

865 |

|

|

Accrued expenses and other current liabilities |

|

2,835 |

|

|

2,419 |

|

|

Deferred revenue |

|

419 |

|

|

721 |

|

|

Long-term debt |

|

1,737 |

|

|

2,104 |

|

|

Lease liabilities |

|

257 |

|

|

259 |

|

|

Total current liabilities |

|

6,565 |

|

|

6,368 |

|

|

|

|

|

|

|

|

Deferred tax liabilities, net |

|

- |

|

|

59 |

|

|

Deferred revenue |

|

49 |

|

|

728 |

|

|

Long-term debt |

|

2,924 |

|

|

5,000 |

|

|

Lease liabilities |

|

203 |

|

|

504 |

|

| Other

non-current liabilities |

|

71 |

|

|

73 |

|

|

|

|

|

|

|

|

Total liabilities |

|

9,812 |

|

|

12,732 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

Common shares, no par value, unlimited shares authorized,

30,039,809 and 21,370,565 issued and outstanding at December 31,

2024 and 2023, respectively |

|

281,552 |

|

|

222,205 |

|

|

Additional paid-in capital |

|

21,298 |

|

|

20,808 |

|

|

Accumulated other comprehensive income |

|

2,742 |

|

|

5,565 |

|

|

Accumulated deficit |

|

(245,170 |

) |

|

(217,354 |

) |

|

|

|

|

|

|

|

Total shareholders’ equity |

|

60,422 |

|

|

31,224 |

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

70,690 |

|

|

43,956 |

|

Profound Medical

Corp.Consolidated Statements of Operations and

Comprehensive LossIn USD, Unaudited (000s)

|

|

Three Months endedDecember 31, 2024$ |

|

Three Months endedDecember 31, 2023$ |

|

Year endedDecember 31, 2024$ |

|

Year endedDecember 31, 2023$ |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

Recurring - non-capital |

2,679 |

|

2,009 |

|

8,240 |

|

6,806 |

|

|

Capital equipment |

1,498 |

|

- |

|

2,440 |

|

393 |

|

|

|

4,177 |

|

2,009 |

|

10,680 |

|

7,199 |

|

|

Cost of sales |

1,214 |

|

968 |

|

3,643 |

|

2,887 |

|

|

Gross profit |

2,963 |

|

1,041 |

|

7,037 |

|

4,312 |

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

Research and development |

4,649 |

|

3,978 |

|

16,965 |

|

14,424 |

|

|

Selling, general and administrative |

6,658 |

|

5,854 |

|

23,134 |

|

18,539 |

|

|

Total operating expenses |

11,307 |

|

9,832 |

|

40,099 |

|

32,963 |

|

|

|

|

|

|

|

|

Operating loss |

8,344 |

|

8,791 |

|

33,063 |

|

28,651 |

|

|

|

|

|

|

|

|

Other (income) expenses |

|

|

|

|

|

Net finance (income) expense |

(332 |

) |

(19 |

) |

(1,436 |

) |

(775 |

) |

|

Net foreign exchange (gain) loss |

(2,828 |

) |

364 |

|

(3,808 |

) |

575 |

|

|

Total other (income) expenses |

(3,160 |

) |

345 |

|

(5,244 |

) |

(200 |

) |

|

|

|

|

|

|

|

Net loss before income taxes |

5,184 |

|

9,136 |

|

27,818 |

|

28,451 |

|

|

|

|

|

|

|

|

Income tax (recovery) expense |

(92 |

) |

(288 |

) |

144 |

|

(187 |

) |

|

Deferred tax expense |

(146 |

) |

59 |

|

(146 |

) |

59 |

|

|

Total income tax (recovery) expense |

(238 |

) |

(229 |

) |

(2 |

) |

(128 |

) |

|

|

|

|

|

|

|

Net loss attributed to shareholders for the

period |

4,946 |

|

8,907 |

|

27,816 |

|

28,323 |

|

|

|

|

|

|

|

|

Other comprehensive (income) loss |

|

|

|

|

|

Item that may be reclassified to (income) loss |

|

|

|

|

|

Foreign currency translation adjustment |

1,968 |

|

(620 |

) |

2,823 |

|

(644 |

) |

|

|

|

|

|

|

|

Net loss and other comprehensive loss for the

period |

6,914 |

|

8,287 |

|

30,639 |

|

27,679 |

|

|

|

|

|

|

|

|

Loss per share (note 14) |

|

|

|

|

|

Basic and diluted net loss per common share |

0.20 |

|

0.42 |

|

1.12 |

|

1.34 |

|

|

Basic and diluted weighted average common shares outstanding |

25,770,800 |

|

21,365,813 |

|

24,765,503 |

|

21,182,558 |

|

Profound Medical

Corp.Consolidated Statements of Cash

FlowsFor the year ended December 31, 2024 and

2023In USD, Unaudited (000s)

|

|

2024$ |

|

2023$ |

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

Net loss for the year |

(27,816 |

) |

(28,323 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

Depreciation of property and equipment |

707 |

|

727 |

|

|

Amortization of intangible assets |

229 |

|

202 |

|

|

Non-cash lease expense adjustment |

(38 |

) |

(45 |

) |

|

Share-based compensation |

2,581 |

|

3,417 |

|

|

Interest and accretion expense |

600 |

|

727 |

|

|

Change in amortized cost of trade and other receivables |

(307 |

) |

146 |

|

|

Changes in operating assets and liabilities: |

|

|

|

Trade and other receivables |

186 |

|

(956 |

) |

|

Inventory |

656 |

|

353 |

|

|

Prepaid expenses and deposits |

31 |

|

(158 |

) |

|

Accounts payable, accrued expenses and other liabilities |

815 |

|

1,354 |

|

|

Deferred revenue |

(948 |

) |

187 |

|

|

Income taxes payable |

- |

|

(299 |

) |

|

Deferred tax liabilities |

(58 |

) |

59 |

|

|

Deferred tax assets |

(91 |

) |

- |

|

|

Net cash provided by operating activities |

(23,453 |

) |

(22,609 |

) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

Issuance of commons shares |

62,106 |

|

- |

|

|

Payments of financing costs |

(4,895 |

) |

- |

|

|

Repayments of long-term debt |

(2,560 |

) |

(912 |

) |

|

Proceeds from the exercise of stock options |

45 |

|

245 |

|

|

Proceeds from the exercise of warrants |

- |

|

2,423 |

|

|

Net cash provided by financing activities |

54,696 |

|

1,756 |

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

31,243 |

|

(20,853 |

) |

|

Effect of exchange rate changes on cash |

(2,544 |

) |

549 |

|

|

Cash, beginning of year |

26,213 |

|

46,517 |

|

|

Cash, end of year |

54,912 |

|

26,213 |

|

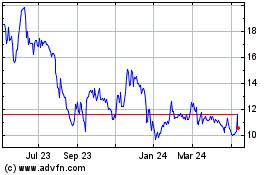

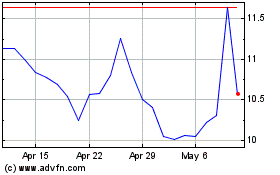

Profound Medical (TSX:PRN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Profound Medical (TSX:PRN)

Historical Stock Chart

From Mar 2024 to Mar 2025