Exploration Results Meyas Sand Gold Project - Sudan

May 26 2024 - 9:10PM

EXPLORATION UPDATE FOR MEYAS SAND GOLD PROJECT -

SUDAN

Perth, Western Australia/ May 27,

2024/Perseus Mining Limited (ASX/TSX: PRU) is pleased to

provide an update on exploration activities and studies completed

to date at its Meyas Sands Gold Project (MSGP) in Sudan.

The full release with drill results tables and

figures is available on www.perseusmining.com, www.asx.com.au and

www.sedarplus.ca.

Since acquiring the MSGP in May 2022, Perseus

has focussed on the development of the Galat Sufur South (GSS)

deposit, and when possible, has conducted infill resource

definition drilling, sterilisation trenching and drilling, a

passive seismic survey, hydrogeological, metallurgical, and

geotechnical work in preparation for the inclusion of data in a

Front-End Engineering and Design (FEED) Study and a Final

Investment Decision (FID) for the project.

With the outbreak of hostilities in Sudan in

April 2023, exploration activities on the MSGP site were

temporarily suspended but recently, Perseus’s personnel have

re-established facilities to support on-site exploration activities

and in-house security teams at the MSGP camp.

With this restoration work well advanced,

Perseus is pleased to announce that drilling at the MSGP

recommenced on 20 May 2024. This initial drill program is aimed at

testing high priority exploration targets in the vicinity of the

GSS deposit to follow up the drilling results that have been

received to date. These results have confirmed the grade and tenor

of the GSS deposit, and while incomplete, are considered very

encouraging. More significant results include:

|

GSRD00883B:

4.1m @ 5.48

g/t Au from 181.9m including 2.1m @ 9.42 g/t Au from

181.9m |

|

|

77m @ 3.47

g/t Au from 191m including 3.6m @ 3.06 g/t Au from 196.4m, 9.9m @

14.56 g/t Au from 214.1m and 7m @ 4.67 g/t Au from

260m |

|

|

GSRD00882A: 37m

@ 4.56 g/t from 32m including 7m @ 6.91 g/t Au from 32m, 1m @ 3.96

g/t Au from 51m and 5m @ 15.82 g/t Au from 64m |

|

|

13.4m @

2.88 g/t from 73m including 5m @ 6.3 g/t Au from 76m |

|

|

13.55m @

1.72 g/t Au from 125.15m including 0.8m @ 10.05 g/t Au from

135.6m |

|

|

20.7m @

1.17 g/t Au from 150.3m including 1m @ 6.11 g/t Au from

166m |

|

|

43.8m @

1.54 g/t from 201m including 1.25m @ 3.43 g/t Au from 203.75m and

1m @ 3.74 g/t Au from 207m |

|

|

GSRC00974:

20m @ 3.12

g/t Au from 32m including 4m @ 11.25 g/t Au from 43m |

|

|

GSRD00902A:

81m @ 2.02

g/t from 0m including 6m @ 6.54 g/t Au from 16m, 1m @ 3.68 g/t Au

from 34m, 1m @ 5.73 g/t Au from 55m, 1m @ 3.57 g/t Au from 59m and

1m @ 7.77 g/t Au from 74m |

|

|

GSDD00870:

2.6m @ 7.16

g/t Au from 180.65m including 1.8m @ 10.03 g/t Au from

181.45m |

|

|

6.85m @

14.38 g/t from 195.25m including 5.85m @ 16.66 g/t Au from

196.25m |

|

|

28.65m @

4.83 g/t from 205.15m including 3.55m @ 6.78 g/t Au from 205.15m

and 16.55m @ 6.28 g/t Au from 216.25m |

|

|

20.8m @

2.28 g/t from 256.9m including 0.95m @ 4.71 g/t Au from 259.05m,

1.8m @ 4.89 g/t Au from 267.9m and 3.5m @ 4.93 g/t Au from

274.2m |

|

|

GSRD00885:

18m @ 7.88

g/t Au from 16m including 16m @ 8.7 g/t Au from 19m |

|

|

4m @ 6.24

g/t Au from 52m including 2m @ 11.08 g/t Au from 52m |

|

|

6m @

4.52g/t Au from 62m including 4m @ 6.47 g/t Au from

62m |

|

|

GSRD00884A: 16.05m

@ 1.96 g/t Au from 95m including 3.7m @ 5.13 g/t Au from 98m and

1.9m @ 3.87 g/t Au from 108.3m |

|

|

17.65m @

1.61 g/t Au from 128.35m including 1m @ 3.7 g/t Au from 135m, 1m @

3.69 g/t Au from 141.3 and 0.5m @ 3.06 g/t Au from

144.5m |

|

|

12m @ 2.67

g/t Au from 279m including 3.6m @ 3.99 g/t Au from 279m, 1m @ 4.84

g/t Au, 1m @ 4.18 g/t Au from 287m and 1m @ 3.33 g/t Au from

290m |

|

|

18.05m @

1.48 g/t Au from 294.95m including 2m @ 3.67 g/t Au from 296m and

13m @ 5.4 g/t Au from 317m |

|

|

43m @ 2.62

g/t from 317m including 13m @ 5.36 g/t Au from 317m, 1m @ 4.24 g/t

Au from 333m and 2m @ 4.4 g/t Au from 351m |

|

|

35.4m @

1.02 g/t Au from 363.2m including 1m @ 4.02 g/t Au from

395m |

|

|

GSRD00880:

33m @ 3.34

g/t from 44m including 21m @ 4.45 g/t Au from 46m |

|

|

GSRC00938:

6m @ 2.76

g/t Au from 6m including 4m @ 3.69 g/t from 6m |

|

|

38m @ 2.27

g/t from 43m including 12m @ 3.95 g/t Au from 51m and 2m @ 4.12 g/t

Au from 68m |

|

|

GSRC00933A:

6m @ 10.12

g/t from 42m including 4m @ 14.79 g/t Au from 42m |

|

|

GSRC00931:

24m @ 1.79

g/t from 4m including 2m @ 4.11 g/t Au from 9m, 2m @ 3.69 g/t Au

from 25m and 2m @ 4.58 g/t Au from 64m |

|

|

GSRD00900:

25m @ 1.27

g/t Au from 40m including 2m @ 3.6 g/t Au from 61m |

|

|

GSRD00901:

20m @ 1.49

g/t Au from 0m including 1m @ 3.23 g/t Au from 3m |

|

|

GSRC00881B:

17m @ 1.72

g/t Au from 37m |

|

|

GSRC00932A:

17m @ 1.57

g/t Au from 0m including 1m @ 3.47 g/t Au from 4m and 1m @ 3.05 g/t

Au from 12m |

|

|

2m @ 10.2

g/t Au from 83m |

|

Perseus’s Chairman and CEO Jeff Quartermaine

said:

“When Perseus acquired the Meyas Sand Gold

Project in 2022 through the acquisition of Orca Gold Inc, we were

very excited by the prospects of developing a large scale, low

cost, long life gold mine in northern Sudan that would add a

further high quality mine to Perseus’s multi mine,

multi-jurisdiction asset portfolio.

The outbreak of hostilities in the south and

west of Sudan in 2023 represented a serious setback for Perseus’s

ambitions for MSGP, but the recent recommencement of drilling

activities is considered a positive step forward that hopefully

will lead to the development of MSGP when peace is finally restored

throughout the country.

The confirmatory drilling results that have been

achieved by our team to date at MSGP are very encouraging and we

are now looking forward to returning further strong results that

will lead to the conversion of the published Foreign Reserve

Estimate for MSGP into an updated Ore Reserve reported in

accordance with JORC 2012 on which a FEED study can be confidently

based.”

Plate 1: Reverse circulation drilling Kwandagawi

Prospect located some 4km north west of GSS Main deposit.

NEXT STEPS AT GSS

It is intended that as soon as practical,

Perseus will convert the published Foreign Reserve Estimate for the

Meyas Sand Project, into an Ore Reserve prepared in accordance with

the requirements of JORC 2012. Exploration drilling will be also

conducted on the broader Block B exploration license.

This announcement has been approved for

release by Perseus’s Chairman and Chief Executive Officer, Jeff

Quartermaine.

Competent

Person Statement:

The information in this report and the

attachments that relate to exploration drilling results at the

Meyas Sand Gold Project is based on, and fairly represents,

information and supporting documentation prepared by Mr Glen

Edwards, a Competent Person who is a Chartered Professional

Geologist. Mr Edwards is the General Manager of Exploration of the

Company. Mr Edwards has sufficient experience, which is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity being undertaken, to qualify as a Competent

Person as defined in the 2012 Edition of the ‘Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves’”) and to qualify as a “Qualified Person” under National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”). Mr Edwards consents to the inclusion in this report

of the matters based on his information in the form and context in

which it appears.

Caution

Regarding Forward Looking

Information:This report contains forward-looking

information which is based on the assumptions, estimates, analysis

and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments,

as well as other factors that management of the Company believes to

be relevant and reasonable in the circumstances at the date that

such statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other

things: the price of gold, continuing commercial production at the

Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine

without any major disruption due to the COVID-19 pandemic or

otherwise, the receipt of required governmental approvals, the

accuracy of capital and operating cost estimates, the ability of

the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management

believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate. Forward-looking information involves known and

unknown risks, uncertainties, and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company’s publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

|

ASX/TSX CODE: PRUREGISTERED

OFFICE:Level 2437 Roberts RoadSubiaco WA 6008Telephone:

+61 8 6144 1700www.perseusmining.com |

CONTACTS:Jeff

QuartermaineManaging Director &

CEOjeff.quartermaine@perseusmining.comStephen

FormanInvestor Relations+61 484 036

681stephen.forman@perseusmining.comNathan

RyanMedia Relations+61 420 582

887nathan.ryan@nwrcommunications.com.au |

- 20240527 TSX Release_Sudan Update_Final

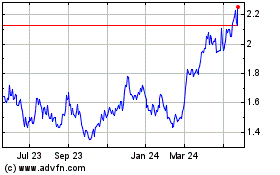

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

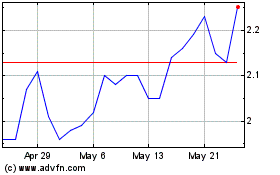

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025