Xtra-Gold Announces 2015 Normal Course Issuer Bid and Results of 2014 Bid

October 30 2015 - 8:00AM

Xtra-Gold Resources Corp. ("Xtra- Gold" or the

"Company") (TSX:XTG) (OTCQB:XTGRF) is pleased to announce

today it intends to proceed with a normal course issuer bid to

purchase up to 4,000,000 common shares of the Company (the "2015

Bid").

The Company is commencing the 2015 Bid because it believes that

the current market price of its common shares may not fully reflect

the underlying value of the Company's business and its future

business prospects. The Company believes that the purchase of

common shares for cancellation is in the best interests of the

Company's shareholders by increasing the respective proportionate

shareholdings and therefore increasing the respective equity

interest in the Company for all remaining shareholders.

As of October 19, 2015 the Company had 45,726,417 common shares

issued and outstanding. The 4,000,000 common shares that may be

purchased by the Company under the 2015 Bid represent approximately

9.4% of the public float (42,412,562) of the Company. The 2015 Bid

will commence on November 3, 2015 and will terminate on November 2,

2016 or at such earlier date in the event that the number of shares

sought in the 2015 Bid has been repurchased. The Company reserves

the right to terminate the 2015 Bid earlier if it feels that it is

appropriate to do so.

All shares will be purchased on the open market through the

facilities of the TSX, and payment for the common shares will be in

accordance with TSX policies. The price paid for the common shares

will be the market price at the time of purchase. Purchasing may be

suspended at any time, and no purchases will be made other than by

means of open market transactions during the term of the 2015

Bid.

The maximum number of common shares that may be purchased on a

daily basis is 2,596 common shares representing 25% of the average

daily trading volume of 10,385 shares for the last six calendar

months, except where purchases are made in accordance with "block

purchases" exemptions under applicable TSX policies. The common

shares purchased by the Company will be cancelled.

The Company has engaged Haywood Securities Inc to act as broker

through which the 2015 Bid will be conducted.

Previous purchases were made by the Company under a prior normal

course issuer bid (the "2014 Bid"), the results of which are noted

hereunder.

Results of 2014 Bid

Xtra-Gold acquired 533,500 common shares at an average price of

$0.27 per share under the 2014 Bid which commenced on February 17,

2014 and expired on February 16, 2015.

About Xtra-Gold Resources Corp.

Xtra-Gold is a gold exploration company with a substantial land

position in the Kibi Gold Belt. The Kibi Gold Belt, which exhibits

many similar geological features to Ghana's main gold belt, the

Ashanti Belt, has been the subject of very limited modern

exploration activity targeting lode gold deposits as virtually all

past gold mining activity and exploration efforts focused on the

extensive alluvial gold occurrences in many river valleys

throughout the Kibi area.

Xtra-Gold holds 5 Mining Leases totaling approximately 226 sq km

(22,600 ha) at the northern extremity of the Kibi Gold Belt. The

Company's exploration efforts to date have focused on the Kibi

Project located on the Apapam Concession (33.65 sq km), along the

eastern flank of the Kibi Gold Belt. The NI 43-101 Technical

Report entitled "Independent Technical Report, Apapam Concession,

Kibi Project, Eastern Region, Ghana", prepared by SEMS Explorations

and dated October 31, 2012, is filed under the Company's profile on

SEDAR at www.sedar.com.

Forward-Looking Statements

The TSX does not accept responsibility for the adequacy or

accuracy of this release. No stock exchange, securities commission

or other regulatory authority has approved or disapproved the

information contained herein. This news release includes

certain "forward-looking statements". These statements are

based on information currently available to the Company and the

Company provides no assurance that actual results will meet

management's expectations. Forward- looking statements

include estimates and statements that describe the Company's future

plans, objectives or goals, including words to the effect that the

Company or management expects a stated condition or result to

occur. Forward-looking statements may be identified by

such terms as "believes", "anticipates", "expects", "estimates",

"may", "could", "would", "will", or "plan". Since

forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results relating to,

among other things, results of exploration, project development,

reclamation and capital costs of the Company's mineral properties,

and the Company's financial condition and prospects, could differ

materially from those currently anticipated in such statements for

many reasons such as: changes in general economic conditions and

conditions in the financial markets; changes in demand and prices

for minerals; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments;

technological and

operational difficulties encountered in connection

with the activities of the Company; and other matters

discussed in this news release. This list is not

exhaustive of the factors that may affect any of the Company's

forward-looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

the Company's forward-looking statements. The Company does not

undertake to update any forward-looking statement that may be made

from time to time by the Company or on its behalf, except in

accordance with applicable securities laws.

CONTACT: James Longshore, Chief Executive Officer

Telephone: 416 366-4227

E-mail: info@xtragold.com

Website: www.xtragold.com

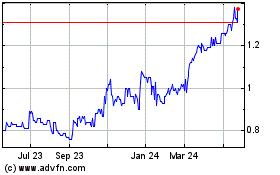

Xtra Gold Resources (TSX:XTG)

Historical Stock Chart

From Dec 2024 to Jan 2025

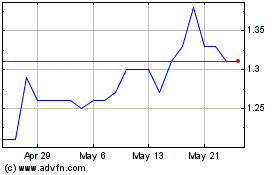

Xtra Gold Resources (TSX:XTG)

Historical Stock Chart

From Jan 2024 to Jan 2025