Brookfield Investments Corporation Announces Third Quarter Financial Results

November 29 2011 - 3:42PM

Marketwired

Brookfield Investments Corporation ("Brookfield Investments" or the

"company") (TSX VENTURE:BRN.PR.A) recorded net income of $37

million or $0.81 per common share for the three months ended

September 30, 2011 compared to $24 million or $0.52 per common

share for the same period in the prior year. Net income in the

current quarter increased primarily as a result a $10 million

increase in the fair value of the company's indirect investment in

Canary Wharf, which is held through its equity accounted investment

in Brookfield Europe L.P., as well as a higher amount of unrealized

foreign currency revaluation gains. These amounts were partially

offset by a decrease in Canary Wharf's dividend by $3 million to $6

million, when compared to the prior year.

The company reported a comprehensive loss of $319 million for

the quarter ended September 30, 2011, which consists of net income

and other comprehensive loss, compared to comprehensive income of

$128 million for the same period last year. The current period loss

was primarily the result of a $348 million unrealized loss on the

company's investment securities, which are recorded at fair

value.

The company's Board of Directors declared the regular quarterly

dividend of C$0.29375 per share on its Senior Preferred Shares,

Series A payable on December 31, 2011 to shareholders of record on

December 20, 2011.

Brookfield Investments Corporation holds investments in the

property and forest products sectors, as well as a portfolio of

preferred shares issued by companies within the Brookfield Asset

Management Inc. group. The common shares of Brookfield Investments

Corporation are wholly owned by Brookfield Asset Management Inc., a

global asset manager focused on property, power and infrastructure

assets.

Consolidated Statements of Operations

Three months ended Nine months ended

(unaudited)

US$ millions, except September 30 September 30 September 30 September 30

per share amounts 2011 2010 2011 2010

----------------------------------------------------------------------------

Investment income

Equity accounted

income from

Brookfield Europe

L.P. $ 19 $ 13 $ 69 $ 28

Equity accounted

income from

Norbord Inc. - - - 3

Dividend and

interest income 10 9 30 25

----------------------------------------------------------------------------

29 22 99 56

----------------------------------------------------------------------------

Expenses

Interest 8 8 23 22

----------------------------------------------------------------------------

21 14 76 34

Foreign exchange

income (loss) 21 10 19 (23)

----------------------------------------------------------------------------

Net income before

income taxes 42 24 95 11

Income tax expense (5) - (9) (4)

----------------------------------------------------------------------------

Net income $ 37 $ 24 $ 86 $ 7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per common

share $ 0.81 $ 0.52 $ 1.87 $ 0.15

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Statements of Comprehensive (Loss) Income

Three months ended Nine months ended

(unaudited) September 30 September 30 September 30 September 30

US$ millions 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income $ 37 $ 24 $ 86 $ 7

Other comprehensive

(loss) income

Foreign currency

translation (7) 16 4 (10)

Available-for-sale

securities (348) 92 (239) 220

Equity accounted

other

comprehensive

(loss) income (2) (1) 4 (2)

Deferred income tax 1 (3) (1) -

----------------------------------------------------------------------------

(356) 104 (232) 208

----------------------------------------------------------------------------

Comprehensive (loss)

income $ (319) $ 128 $ (146) $ 215

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Balance Sheets

(unaudited)

September 30, December 31, January 1,

US$ millions 2011 2010 2010

----------------------------------------------------------------------------

Assets

Current assets

Deposits receivable $ 9 $ - $ 3

Securities 218 227 190

Non-current assets

Investments - Securities

Brookfield Office

Properties Inc. 763 973 672

Brookfield Residential

Properties Inc. 37 - -

Investments - Associates

Brookfield Europe L.P. 413 366 332

Norbord Inc. 72 79 79

----------------------------------------------------------------------------

$ 1,512 $ 1,645 $ 1,276

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities

Current liabilities

Deposits payable $ - $ 27 $ -

Retractable preferred shares 701 708 700

Deferred taxes 52 40 36

Equity 759 870 540

----------------------------------------------------------------------------

$ 1,512 $ 1,645 $ 1,276

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Brookfield Investments Corporation Derek E. Gorgi Vice

President and Chief Financial Officer 416-363-9491

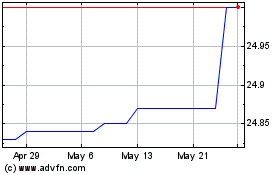

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From May 2024 to Jun 2024

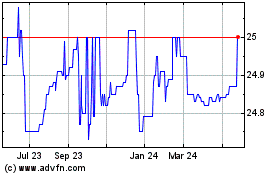

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From Jun 2023 to Jun 2024