Canadian Premium Sand Inc. ("

CPS"

or the "

Company") (TSXV: CPS) is pleased to

announce that it has closed its previously announced brokered and

concurrent non-brokered private placements (the

"

Offerings"). Pursuant to the Offerings, the

Company issued an aggregate of 32,100,000 units of the Company

(each, a "

Unit"”) at a price of $0.30 per Unit for

gross proceeds to the Company of $9,630,000.

Each Unit consists of one common share of the

Company (a "Common Share") and one common share

purchase warrant (a "Warrant"). Each Warrant

entitles the holder thereof to purchase one Common Share at an

exercise price of $0.40 for a period of twenty-four (24) months

following closing.

In the event that the 30-day volume weighted

average trading price of the Common Shares on the TSX Venture

Exchange is at or greater than $0.90 per Common Share, the Company

may accelerate the expiry date of the Warrants by giving notice to

the holders thereof, and in such case, the Warrants will expire on

the 30th day after the date on which such notice is given by the

Company.

Management and directors of CPS, as well as

certain of the Company’s largest shareholders, including Paramount

Resources Ltd. and David J. Wilson, subscribed for approximately

50% of the Offering, to maintain their current ownership position

in the Company.

The net proceeds of the Offerings will be used

to advance the Company’s vertically integrated patterned solar

glass manufacturing facility to a shovel-ready state, such that it

is ready to commence construction by Q1 2023.

Pursuant to the Offerings, a total of 32,100,000

Common Shares and 32,100,000 Warrants were issued to subscribers.

In connection with the Offerings, the Company paid commissions and

fees totaling $448,006.

The Offerings are subject to the final

acceptance of the TSX Venture Exchange. The Common Shares were

distributed in certain Canadian jurisdictions in reliance upon

exemptions set forth in National Instrument 45-106 - Prospectus

Exemptions. The Common Shares issued pursuant to the Offerings are

subject to a statutory hold period expiring January 1, 2023.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”) or any state

securities laws and accordingly may not be offered or sold within

the United States or to “U.S. persons”, as such term is defined in

Regulation S promulgated under the U.S. Securities Act (“U.S.

Persons”), except in compliance with the registration requirements

of the U.S. Securities Act and applicable state securities

requirements or pursuant to exemptions therefrom. This news release

does not constitute an offer to sell or a solicitation of an offer

to buy any of the Company’s securities to, or for the account of

benefit of, persons in the United States or U.S. Persons.

The issuances of Common Shares to insiders

pursuant to the Offerings will also be considered related party

transactions within the meaning of TSXV Policy 5.9 and Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). CPS relied on exemptions from

the formal valuation and minority approval requirements in sections

5.5(c) and 5.7(b) of MI 61-101 in respect of such insider

participation on the basis that neither the fair market value of

the securities to be distributed in the Offerings nor the

consideration to be received for those securities, in so far as the

Offerings involved the Insiders, exceeded $2,500,000. Further

details will be provided in the Company’s material change report to

be filed on SEDAR.

About Canadian Premium Sand

Inc.

The Company is developing manufacturing capacity

for ultra high-clarity patterned solar glass through a

Company-owned facility to be located in Selkirk, Manitoba that

utilizes the high-purity, low-iron silica sand from its wholly

owned Wanipigow quarry leases and renewable Manitoba

hydroelectricity. The Company is a reporting issuer in Ontario,

Alberta and British Columbia. Its shares trade on the TSXV under

the symbol "CPS".

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT

INFORMATION:

|

Canadian Premium Sand Inc. |

|

|

Glenn Leroux |

Cam Deller |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

glenn.leroux@cpsmail.com |

cam.deller@cpsmail.com |

|

|

|

|

Investor Relations |

|

|

IR@cpsmail.com |

|

|

587.355.3714 |

|

|

www.cpsglass.com |

|

Forward-Looking Information

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and the

Company’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“estimates”, “forecasts”, “intends”, “anticipates”, “believes”,

“plans”, “seeks”, “projects” or variations of such words and

phrases, or state that certain actions, events or results “may” or

“will” be taken, occur or be achieved. Such forward-looking

statements reflect the Company's beliefs, estimates and opinions

regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change. Forward-looking statements are

necessarily based upon a number of estimates and assumptions made

by the Company that are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Forward-looking statements are not guarantees of

future performance. In particular, this press release contains

forward-looking statements pertaining, but not limited, to: the use

of proceeds of the Offerings; timing for the commencement of

construction for the facility; future development and construction

plans; industry conditions pertaining to the solar glass

manufacturing industry; the ability of and manner by which the

Company expects to meet its capital needs; and the Company's

objectives, strategies and competitive strengths. By their nature,

forward-looking statements involve numerous current assumptions,

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to differ materially from those anticipated by the Company

and described in the forward-looking statements.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; effects of fluctuations in the

price of glass products and raw materials input costs; risks

related to indebtedness and liquidity, including the Company's

capital requirements; risks related to interest rate fluctuations

and foreign exchange rate fluctuations; changes in general

economic, financial, market and business conditions in the markets

in which the Company operates; the Company's ability to obtain,

maintain and renew required permits, licenses and approvals from

regulatory authorities; the stringent requirements of and potential

changes to applicable legislation, regulations and standards; the

ability of the Company to comply with unexpected costs of

government regulations; liabilities resulting from the Company's

operations; the results of litigation or regulatory proceedings

that may be brought against the Company; uninsured and underinsured

losses; risks related to the transportation of the Company's

products, including potential rail line interruptions or a

reduction in rail car availability; supply chain risks and risks

relating to rising interest rates and inflationary pressures; the

geographic and customer concentration of the Company; the ability

of the Company to retain and attract qualified management and staff

in the markets in which the Company operates; labor disputes and

work stoppages and risks related to employee health and safety;

general risks associated with the glass manufacturing and sand

quarry industries, loss of markets, consumer and business spending

and borrowing trends; limited, unfavorable, or a lack of access to

capital markets; uncertainties inherent in estimating quantities of

products; processing problems; the use and suitability of the

Company's accounting estimates and judgments; and the other risk

factors outlined in CPS’s most recent Management’s Discussion and

Analysis which is available on SEDAR at www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in its forward-looking statements, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

forward-looking statements will materialize or prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The

forward-looking statements contained in this press release are

expressly qualified by this cautionary statement. Readers should

not place undue reliance on forward-looking statements. These

statements speak only as of the date of this press release. Except

as may be required by law, the Company expressly disclaims any

intention or obligation to revise or update any forward-looking

statements or information whether as a result of new information,

future events or otherwise. Any financial outlook and

future-oriented financial information contained in this press

release regarding prospective financial performance, financial

position, cash flows or EBITDA projections are based on assumptions

about future events, including economic conditions and proposed

courses of action based on management’s assessment of the relevant

information that is currently available. Projected operational

information contains forward-looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company's operations for any period will likely vary from the

amounts set forth in these projections and such variations may be

material. Actual results will vary from projected results. Readers

are cautioned that any such financial outlook and future-oriented

financial information contained herein should not be used for

purposes other than those for which it is disclosed herein. The

forward-looking information and statements contained in this

document speak only as of the date hereof and the Company does not

assume any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be required pursuant to

applicable laws.

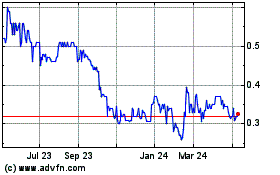

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025