Dejour Energy Reports YE 2014 Reserve Volumes and Values

February 11 2015 - 4:05PM

Business Wire

Dejour Energy Inc. (NYSE MKT: DEJ / TSX: DEJ) (“Dejour” or the

“Company”), an independent oil and natural gas exploration and

production company operating in North America's Piceance Basin and

Peace River Arch regions, is pleased to announce that today it has

received the Year End 2014 Reserve Evaluations in accordance with

Canada’s National Instrument 51-101* Standards of Disclosure. The

current and forecast prices are based on YE 2014 spot and NYMEX

futures strips prices adjusted for appropriate transportation

differentials, realizable natural gas liquids (NGL’s) value

contribution and regional processing costs.

Summary of 2014 Year-End Reserves and Values

to the Company’s Working Interests

Reserves Category

NI 51-101* Case

Canada / US

Light Oil/NGL/

Condensate

(Barrels)

Natural Gas

(Millions of Cubic Feet)

Net Present Value of BeforeTax

Cash Flow Discountedat 10% ($C =$US 0.8620)

Proved - PDP/PUD Canada 178,500 1556 $3.826 mm US 2,456,500

39,971.7 $36.997 mm Total 2,635,000 41,527.7

$40.823 mm

Probable Canada 37,300 856 $1.872 mm US 1,354,700 22,044.5

$18.209 mm Total 1,392,000 22,900.5

$20.081

mm

Total

Proved Plus Probable

4,027,000

64,428.2

$60.904 mm

Forecast Pricing

SEC Case

Canada/US

Light Oil/NGL/

Condensate

(Barrels)

Natural Gas

(Millions of Cubic Feet)

Net Present Value of BeforeTax

Cash Flow Discountedat 10% ($C=$US.8620)

Proved

Canada 178,600 1587

$7.303 mm US 1,965,400 30,322.8

$60.792 mm Total 2,144,000 31,909.8

$68.095 mm

Flat Pricing

*Reserves are defined as the Company’s working interest share of

gross reserves before royalty interest reserves.

In Canada, all Proved and Probable Reserves, provided by

Calgary, Alberta based GLJ Petroleum Consultants (GLJ) are

attributed to the Company’s Woodrush NE BC leasehold interests.

In the US, all Proved and Probable Reserves provided by Boulder,

Colorado based Gustavson Associates are attributed solely to the

Williams Fork (WF) Formation underlying the Company’s revised 25%

working interest following the disposition of 46.43% of its 71.43%

working interest at Kokopelli in mid-2014. In this area, the WF is

a 3500 ft. thick section of tight gas sands, where economic

ultimate recovery approximates 1.25 Billion Cubic Feet (BCFE)

equivalent of wet gas per well. Gustavson has identified 143 PDP

and PUD locations and 77 Probable Undeveloped locations for the WF

in the NI 51-101 case and 143 PDP/PUD locations, only, for the SEC

case. The NI 51-101 case provides a broader view of the recovery of

hydrocarbons from the Kokopelli leasehold.

"We are pleased to report the significant value retention at YE

2014 of the reserves at our core projects over YE 2013, following a

strategic sale in Q2 2014. We look forward to updating reports in

2015 to include our current development progress. With the

completion and tie in of the eight new wells at Kokopelli

anticipated for mid-year 2015 we are comfortable with our target

production forecast of 1200+ BOEPD on a Company-wide basis and

prepare for the next opportunity to expand our production base and

enterprise value during these volatile times,” states Robert L.

Hodgkinson, Chairman & CEO.

About Dejour Energy Inc.

Dejour Energy Inc. is an independent oil and natural gas

exploration and production company operating projects in North

America’s Piceance Basin (43,500 net acres) and Peace River Arch

regions (16,222 net acres). Dejour maintains offices in Denver,

USA, Calgary and Vancouver.

Statements Regarding Forward-Looking Information: This

news release contains statements about oil and gas production and

operating activities that may constitute "forward-looking

statements" or “forward-looking information” within the meaning of

applicable securities legislation as they involve the implied

assessment that the resources described can be profitably produced

in the future, based on certain estimates and assumptions.

Forward-looking statements are based on current expectations,

estimates and projections that involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from those anticipated by Dejour and described in

the forward-looking statements. These risks, uncertainties and

other factors include, but are not limited to, adverse general

economic conditions, operating hazards, drilling risks, inherent

uncertainties in interpreting engineering and geologic data,

competition, reduced availability of drilling and other well

services, fluctuations in oil and gas prices and prices for

drilling and other well services, government regulation and foreign

political risks, fluctuations in the exchange rate between Canadian

and US dollars and other currencies, as well as other risks

commonly associated with the exploration and development of oil and

gas properties.

Additional information on these and other factors, which could

affect Dejour’s operations or financial results, are included in

Dejour’s reports on file with Canadian and United States securities

regulatory authorities. We assume no obligation to update

forward-looking statements should circumstances or management's

estimates or opinions change unless otherwise required under

securities law.

The TSX does not accept responsibility for the adequacy or

accuracy of this news release.

Follow Dejour Energy’s latest developments on Facebook

http://facebook.com/dejourenergy and Twitter @dejourenergy

Dejour Energy Inc.Robert L. HodgkinsonChairman &

CEOorDavid Matheson, 604-638-5050CFOinvestor@dejour.comorCraig

Allison, 914-882-0960Investor Relations - New

Yorkcallison@dejour.com

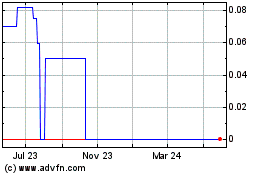

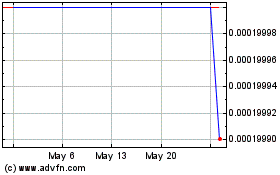

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Oct 2024 to Nov 2024

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Nov 2023 to Nov 2024