Dejour Secures C$2MM Bridge Loan

March 12 2015 - 4:05PM

Business Wire

James Dai Joins Board of Directors

Dejour Energy Inc. (NYSE MKT: DEJ / TSX: DEJ) (“Dejour”

or the “Company”), an independent oil and gas exploration and

production company operating in North America’s Piceance Basin and

Peace River Arch regions, today announced that it has closed the

initial tranche of an industry-standard bridge loan commitment of

up to C$ 2MM from a principal and director of the Company. These

funds will provide a flexible source of capital to support the

current 2015 initiatives of the company. The independent members of

the Board of Directors approved the loan agreement and the

principal and director appropriately abstained from voting in the

loan transaction.

The Company is very pleased to announce that James Dai has been

invited to join the Board of Directors, increasing its membership

from five to six. Mr. Dai, a resident of Vancouver BC, holds both

CPA and CFA designations; a Bachelor of CSc. from UBC, where he

received the Martin Frauendorf Prize for Leadership, subsequently

interning with Panasonic, Microsoft and E-GEMS Research. He has a

graduate degree from MIT where he is Fellow of both the Canadian

National NSERC and MIT Media Lab. Mr. Dai is currently the CFO of

four private and public companies focused in the lumber, O&G,

mining and biotech sectors of Western Canada, where he continues to

represent the interests of international capital including a

prominent Asia-based investor that has been making strategic

investments in the North American market for the last three years.

Prior to this engagement, Mr. Dai completed a corporate finance

tenure with investment dealer Raymond James.

“We are very pleased with both the continued developmental

success of our core projects and Mr. Dai’s addition to the Board of

Directors. He will provide an access to the international community

that could assist Dejour to further maximize the value of our

portfolio of energy properties. This year, we expect to see

production growth from at least 10 new wells, including a strategic

new Mancos/ Niobrara indicated discovery, as we further delineate

our extensive inventory of drillable PUD’s and multiple as yet

untapped exploitation leases offering excellent longer term

potential,” stated Robert L. Hodgkinson, Chairman & CEO.

Pursuant to NYSE MKT Company Guide Section 610(b) the Company

discloses that its audited consolidated financial statements for

the fiscal year ended December 31, 2014, included in the Company's

Form 6-K, which was filed on March 6, 2015 with the Securities and

Exchange Commission, contained an audit opinion from its

independent registered public accounting firm that included a going

concern qualification.

About DejourDejour Energy Inc. is an independent oil and

natural gas exploration and production company operating projects

in North America’s Piceance Basin (43,500 net acres) and Peace

River Arch regions (16,000 net acres). Dejour maintains offices in

Denver, USA, Calgary and Vancouver, Canada. The company is publicly

traded on the New York Stock Exchange Amex (NYSE MKT: DEJ) and

Toronto Stock Exchange (DEJ.TO).

Statements Regarding Forward-Looking Information: This

news release contains statements about oil and gas production and

operating activities that may constitute "forward-looking

statements" or “forward-looking information” within the meaning of

applicable securities legislation as they involve the implied

assessment that the resources described can be profitably produced

in the future, based on certain estimates and assumptions.

Forward-looking statements are based on current expectations,

estimates and projections that involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from those anticipated by Dejour and described in

the forward-looking statements. These risks, uncertainties

and other factors include, but are not limited to, adverse

general economic conditions, operating hazards, drilling risks,

inherent uncertainties in interpreting engineering and geologic

data, competition, reduced availability of drilling and other well

services, fluctuations in oil and gas prices and prices for

drilling and other well services, government regulation and foreign

political risks, fluctuations in the exchange rate between Canadian

and US dollars and other currencies, as well as other risks

commonly associated with the exploration and development of oil and

gas properties. Additional information on these and other factors,

which could affect Dejour’s operations or financial results, are

included in Dejour’s reports on file with Canadian and United

States securities regulatory authorities. Other risks include the

Company’s ongoing review by NYSE MKT (“the Exchange”) to ensure the

Company continues to regain compliance with Section 100 3(a)(iv) of

the Company Guide which addresses a Company’s ability to operate as

a going concern. We assume no obligation to update forward-looking

statements should circumstances or management's estimates or

opinions change unless otherwise required under securities law.

The TSX does not accept responsibility for the adequacy or

accuracy of this news release.

Follow Dejour Energy’s latest developments on: Facebook

http://facebook.com/dejourenergy and Twitter @dejourenergy

Dejour Energy Inc.Robert L. Hodgkinson,

604-638-5050Chairman & CEOFacsimile:

604-638-5051investor@dejour.comorCraig Allison,

914-882-0960Investor Relations – New Yorkcallison@dejour.com

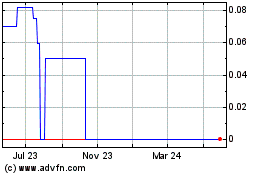

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Oct 2024 to Nov 2024

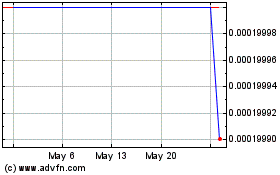

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Nov 2023 to Nov 2024