FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of February

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

19 February 2025

HSBC Holdings plc 2024

results

Georges Elhedery, Group CEO, said:

"Our strong 2024 performance provides firm financial foundations

upon which to build for the future, as we prioritise delivering

sustainable strategic growth and the best outcomes for our

customers. Since becoming CEO, I have focused on simplifying how we

operate and injected energy and intent into the way we deliver our

strategy. We are creating a simple, more agile, focused bank built

on our core strengths. We continue to take deliberate and decisive

steps. This includes creating four complementary, clearly

differentiated businesses, aligning our structure to our strategy

and reshaping our portfolio at pace and with purpose. I have put in

place a smaller, core team of exceptionally talented leaders driven

by a growth orientated mindset and a firm focus on dynamically

managing our costs and capital. We are embedding this approach

across the organisation to ensure we are continually focused on

these two important principles. Each targeted action we are taking

is designed to unlock HSBC's full potential. We look to the future

with confidence and clarity of purpose."

2024 financial performance (vs 2023)

- Profit

before tax rose by $2.0bn to $32.3bn, including

a $1.0bn net favourable impact from notable items. In 2024, these

included a gain of $4.8bn on the disposal of our banking business

in Canada, the impacts of the disposal of our business in

Argentina, comprising a $1.0bn loss on disposal, and the recycling

of foreign currency reserve losses and other reserves of $5.2bn. In

2023, notable items included an impairment of $3.0bn on our

associate, Bank of Communications Co., Limited ('BoCom'), disposal

losses of $1.0bn on Treasury repositioning and risk management and

a $1.6bn gain recognised on the acquisition of Silicon Valley Bank

UK Limited ('SVB UK'). Profit after

tax increased by $0.4bn to $25.0bn.

- Constant

currency profit before tax excluding notable items increased by

$1.4bn to $34.1bn, primarily

reflecting revenue growth in Wealth and Personal Banking ('WPB')

and Global Banking and Markets ('GBM'), partly offset by a rise in

operating expenses, in line with our cost growth

targets.

- Revenue

of $65.9bn was stable. There

was growth in revenue from higher customer activity in Wealth in

WPB, and in Equities and Securities Financing in GBM. In addition,

2023 included disposal losses of $1.0bn related to Treasury

repositioning and risk management. This was offset by the net

adverse impact of certain strategic transactions described above,

as well as a $0.2bn loss on the early redemption of legacy

securities.

- Constant

currency revenue excluding notable items rose by $2.9bn to

$67.4bn.

- Net

interest income ('NII') decreased by $3.1bn, reflecting

the impact of business disposals and higher funding costs

associated with the redeployment of our commercial surplus to the

trading book, where the related revenue is recognised in 'net

income from financial instruments held for trading or managed on a

fair value basis', partly offset by higher NII in HSBC UK,

reflecting the benefit of our structural

hedge. Banking NII of

$43.7bn fell by $0.4bn or 1% compared with 2023, as increased deployment of

our commercial surplus to the trading book only partly mitigated

the reductions in NII.

- Net

interest margin ('NIM') of 1.56% decreased by 10 basis points

('bps'), mainly

due to increased deployment of our commercial surplus to the

trading book.

- Expected

credit losses and other credit impairment charges ('ECL') of $3.4bn

were stable. ECL

were $1.8bn in Commercial Banking ('CMB') and $0.2bn in GBM. This

included stage 3 charges relating to the commercial real estate

sector in mainland China ($0.4bn), the onshore Hong Kong real

estate sector ($0.1bn), and a charge related to a single CMB

customer in the UK. ECL in WPB were $1.3bn and primarily related to

our legal entities in Mexico, Hong Kong and the

UK. ECL were 36bps

of average gross loans, including loans and advances classified as

held for sale (2023:

32bps).

- Operating

expenses grew by $1.0bn or 3% to $33.0bn, mainly

due to higher spend and investment in technology and the impacts of

inflation, partly offset by reductions related to our business

disposals in Canada and France, and from lower levies in the UK and

the US.

- Target

basis operating expenses rose by 5%, in line with our cost growth

target. This

increase primarily reflected higher spend and investment in

technology, and the impact of inflation. This is measured on a

constant currency basis, excluding notable items, the impact of

retranslating the prior year results of hyperinflationary economies

at constant currency, and the direct costs from the sales of our

French retail banking operations and our banking business in

Canada.

- Customer

lending balances fell by $8bn on a reported basis but rose by $14bn

on a constant currency basis. Growth

included lending balance growth in CMB and higher mortgage balances

in WPB.

- Customer

accounts rose by $43bn on a reported basis, and $75bn on a constant

currency basis, with

growth across all of our global businesses, primarily in

Asia.

- Common

equity tier 1 ('CET1') capital ratio of 14.9% rose by 0.1 of a

percentage point, mainly

due to capital generation and a reduction in RWAs through strategic

transactions, offset by dividends, share buy-backs and organic

balance sheet growth.

- The

Board has approved a fourth interim

dividend of $0.36 per share, resulting in a total of $0.87 per

share in respect of 2024, inclusive of a special

dividend of $0.21 per share. We also intend

to initiate a share buy-back of up to $2bn, which we expect to complete

by our first quarter 2025 results

announcement.

4Q24 financial performance (vs 4Q23)

- Reported

profit before tax up $1.3bn to

$2.3bn. The increase reflected the

non-recurrence of an impairment charge in 4Q23 of $3.0bn relating

to the investment in our associate BoCom. This was partly offset by

a reduction in revenue, which included the recycling of foreign

currency losses and other reserves of $5.2bn recognised following

the completion of sale of our business in Argentina in 4Q24, while

4Q23 included the impact of an impairment relating to the sale of

our retail banking operations in France of $2.0bn as we

reclassified these operations as held for

sale. On a constant

currency basis, profit before tax up $1.5bn to $2.3bn. Reported

profit after tax up $0.4bn to $0.6bn.

- Reported

revenue down 11% to $11.6bn, due

to the recycling of foreign currency losses and other reserves

relating to the sale of our business in Argentina, as mentioned

above. This was partly offset by the non-recurrence of a 4Q23

impairment relating to the sale of our retail banking operations in

France, disposal losses relating to Treasury repositioning and risk

management, and the impact of hyperinflationary accounting in

Argentina. In addition, revenue increased in Wealth in WPB and in

Markets and Securities Services ('MSS') in

GBM. Constant

currency revenue excluding notable items increased by $1.2bn to

$16.5bn.

- Reported

ECL up $0.3bn to $1.4bn. ECL

in 4Q24 comprised charges in CMB of $0.8bn, primarily related to

stage 3 exposures which included charges relating to the commercial

real estate sector in mainland China of $0.2bn and a charge

relating to a single exposure in the UK. Charges in WPB of $0.4bn

were concentrated in our legal entities in Mexico and Hong

Kong.

- Reported

operating expenses stable at $8.6bn, as

higher spend and investment in technology and inflation were

broadly offset by lower levies in the UK and the US, a reduction in

performance related pay and lower costs due to the impact of our

disposals in Canada and France.

Outlook

- We

have announced measures to simplify the Group and we are focused on

opportunities that build on our strong platform for

growth.

- We

are now targeting a mid-teens return on average tangible equity

('RoTE') in each of the three years from 2025 to

2027 excluding

notable items, while acknowledging the outlook for interest rates

remains volatile and uncertain, particularly in the medium

term.

- We

expect banking NII of around $42bn in 2025. Our

current expectation reflects modelling of a number of

market-dependent factors. If changes in these factors impact the

output of our modelling, we would update our expectation for 2025

Banking NII in future quarterly results

announcements.

- We

retain a Group-wide focus on cost

discipline. We are

targeting growth in target basis operating expenses of

approximately 3% in 2025 compared with 2024.

- Our

target basis operating expenses for 2025 excludes the direct cost

impact of the business disposals in Canada and Argentina, notable

items and the impact of retranslating the prior year results of

hyperinflationary economies at constant

currency.

- Our

cost target includes the impact of simplification-related saves

associated with our announced reorganisation, which aims to

generate approximately $0.3bn of cost

reductions in 2025, with a commitment to

an annualised

reduction of $1.5bn in our cost base expected by the end of

2026. To

deliver these reductions, we plan to incur severance and other

up-front costs of $1.8bn over 2025 and 2026, which will be

classified as notable items. We are focused on opportunities where

we have a clear competitive advantage and accretive returns, and we

aim to redeploy around $1.5bn of additional costs from

non-strategic activities into these areas, over the medium

term.

- We

expect ECL charges as a percentage of average gross loans to

continue to be within our medium-term planning range of 30bps to

40bps in 2025 (including

lending held for sale balances).

- Over

the medium to long term, we continue to

expect mid-single

digit percentage growth for year-on-year customer lending

balances.

- We

expect double-digit

percentage average annual growth in fee and other income in

Wealth over the

medium-term.

- We

intend to continue to manage the CET1 capital ratio within our

medium-term target range of 14% to 14.5%, with a dividend payout

ratio target basis of 50% for 2025, excluding

material notable items and related impacts.

Our targets and expectations reflect our current outlook for

the global macroeconomic environment and market-dependent factors,

such as market-implied interest rates (as of mid-January 2025) and

rates of foreign exchange, as well as customer behaviour and

activity levels.

We do not reconcile our forward guidance on RoTE

excluding the impact of notable items, target basis operating

expenses, dividend payout ratio target basis or banking NII to

their equivalent reported measures.

|

Key financial metrics

|

|

|

|

|

|

For the year ended

|

|

Reported results

|

2024

|

2023

|

2022

|

|

Profit before tax ($m)

|

32,309

|

30,348

|

17,058

|

|

Profit after tax ($m)

|

24,999

|

24,559

|

16,249

|

|

Revenue ($m)

|

65,854

|

66,058

|

50,620

|

|

Cost efficiency ratio (%)

|

50.2

|

48.5

|

64.6

|

|

Net interest margin (%)

|

1.56

|

1.66

|

1.42

|

|

Basic earnings per share ($)

|

1.25

|

1.15

|

0.72

|

|

Diluted earnings per share ($)

|

1.24

|

1.14

|

0.72

|

|

Dividend per ordinary share (in respect of the period)

($)1

|

0.87

|

0.61

|

0.32

|

|

Dividend payout ratio (%)2

|

50

|

50

|

44

|

|

|

|

|

|

|

Alternative performance measures

|

|

|

|

|

Constant currency profit before tax ($m)

|

32,309

|

29,903

|

16,302

|

|

Constant currency revenue ($m)

|

65,854

|

64,912

|

49,587

|

|

Constant currency cost efficiency ratio (%)

|

50.2

|

48.5

|

65.0

|

|

Constant currency profit before tax excluding notable items

($m)

|

34,122

|

32,680

|

23,057

|

|

Constant currency revenue excluding notable items ($m)

|

67,434

|

64,489

|

53,383

|

|

Constant currency profit before tax excluding notable items and

strategic transactions ($m)

|

34,037

|

32,217

|

N/A

|

|

Constant currency revenue excluding notable items and strategic

transactions ($m)

|

67,256

|

63,043

|

N/A

|

|

Expected credit losses and other credit impairment charges ('ECL')

as % of average gross loans and advances to customers

(%)

|

0.36

|

0.34

|

0.36

|

|

Expected credit losses and other credit impairment charges ('ECL')

as % of average gross loans and advances to customers, including

held for sale (%)

|

0.36

|

0.32

|

0.36

|

|

Basic earnings per share excluding material notable items and

related impacts ($)

|

1.31

|

1.22

|

N/A

|

|

Return on average ordinary shareholders' equity (%)

|

13.6

|

13.6

|

9.0

|

|

Return on average tangible equity (%)

|

14.6

|

14.6

|

10.0

|

|

Return on average tangible equity excluding notable items

(%)

|

16.0

|

16.2

|

11.8

|

|

Target basis operating expenses ($m)

|

32,648

|

31,074

|

N/A

|

|

|

At 31 December

|

|

Balance sheet

|

2024

|

2023

|

2022

|

|

Total assets ($m)

|

3,017,048

|

3,038,677

|

2,949,286

|

|

Net loans and advances to customers ($m)

|

930,658

|

938,53

|

923,561

|

|

Customer accounts ($m)

|

1,654,955

|

1,611,647

|

1,570,303

|

|

Average interest-earning assets ($m)

|

2,099,285

|

2,161,746

|

2,143,758

|

|

Loans and advances to customers as % of customer accounts

(%)

|

56.2

|

58.2

|

58.8

|

|

Total shareholders' equity ($m)

|

184,973

|

185,329

|

177,833

|

|

Tangible ordinary shareholders' equity ($m)

|

154,295

|

155,710

|

146,927

|

|

Net asset value per ordinary share at period end ($)

|

9.26

|

8.82

|

8.01

|

|

Tangible net asset value per ordinary share at period end

($)

|

8.61

|

8.19

|

7.44

|

|

|

|

|

|

|

Capital, leverage and liquidity

|

|

|

|

|

Common equity tier 1 capital ratio (%)3,4

|

14.9

|

14.8

|

14.2

|

|

Risk-weighted assets ($m)3,4

|

838,254

|

854,114

|

839,720

|

|

Total capital ratio (%)3,4

|

20.6

|

20.0

|

19.3

|

|

Leverage ratio (%)3,4

|

5.6

|

5.6

|

5.8

|

|

High-quality liquid assets (liquidity value)

($m)4,5

|

649,210

|

647,505

|

647,046

|

|

Liquidity coverage ratio (%)4,5,6

|

138

|

136

|

132

|

|

Net stable funding ratio (%)4,5,6,7

|

143

|

138

|

141

|

|

Share count

|

|

|

|

|

Period end basic number of $0.50 ordinary shares outstanding, after

deducting own shares held (millions)

|

17,918

|

19,006

|

19,739

|

|

Period end basic number of $0.50 ordinary shares outstanding and

dilutive potential ordinary shares, after deducting own shares held

(millions)

|

18,062

|

19,135

|

19,876

|

|

Average basic number of $0.50 ordinary shares outstanding, after

deducting own shares held (millions)

|

18,357

|

19,478

|

19,849

|

For reconciliation and analysis of our reported results on a

constant currency basis, including lists of notable items, see page

99 of the Annual Report and Accounts 2024. Definitions and

calculations of other alternative performance measures are included

in 'Reconciliation of alternative performance measures' on page 120

of the Annual Report and Accounts 2024.

1 In 2024, dividend per share includes the special

dividend of $0.21 per ordinary share arising from the proceeds of

the sale of our banking business in Canada to Royal Bank of

Canada.

2 In 2024 and 2023, our dividend payout ratio was

adjusted for material notable items and related impacts, including

all associated income statement impacts relating to those items. In

2022, our dividend payout ratio was adjusted for the loss on

classification to held for sale of our retail banking business in

France, items relating to the sale of our banking business in

Canada, and the recognition of certain deferred tax

assets.

3 Unless otherwise stated, regulatory capital ratios

and requirements are based on the transitional arrangements of the

Capital Requirements Regulation in force at the time. References to

EU regulations and directives (including technical standards)

should, as applicable, be read as references to the UK's version of

such regulation or directive, as onshored into UK law under the

European Union (Withdrawal) Act 2018, and as may be subsequently

amended under UK law.

4 Regulatory numbers and ratios are as presented at

the date of reporting. Small changes may exist between these

numbers and ratios and those submitted in regulatory filings. Where

differences are significant, we may restate in subsequent

periods.

5 The liquidity coverage ratio is based on the

average value of the preceding 12 months. The net stable funding

ratio is based on the average value of four preceding

quarters.

6 We enhanced our liquidity consolidation process in

2Q24 by revising provisions that addressed historical limitations.

As our Group LCR and NSFR are reported on an average basis, the

benefit of these changes incrementally increased our LCR and NSFR

by circa 3% and 11% during the year, respectively. Compared to year

ended 31 December 2023, the increase in LCR was mainly driven by

these enhancements. The associated NSFR increase driven by these

changes was partly offset by higher required stable funding

primarily due to a rise in financial investments and derivatives

activities.

7 We have enhanced our calculation processes during

1Q24 and our NSFR comparatives have been restated.

Highlights

|

|

Year ended 31 Dec

|

|

|

2024

|

2023

|

|

|

$m

|

$m

|

|

Reported

|

|

|

|

Revenue1,3

|

65,854

|

66,058

|

|

Change in expected credit losses and other credit impairment

charges

|

(3,414)

|

(3,447)

|

|

Operating expenses5

|

(33,043)

|

(32,070)

|

|

Share of profit in associates and joint ventures less

impairment6

|

2,912

|

(193)

|

|

Profit before tax

|

32,309

|

30,348

|

|

Tax charge

|

(7,310)

|

(5,789)

|

|

Profit after tax

|

24,999

|

24,559

|

|

Constant currency2

|

|

|

|

Revenue1,3

|

65,854

|

64,912

|

|

Change in expected credit losses and other credit impairment

charges

|

(3,414)

|

(3,259)

|

|

Operating expenses5

|

(33,043)

|

(31,494)

|

|

Share of profit in associates and joint ventures less

impairment6

|

2,912

|

(256)

|

|

Profit before tax

|

32,309

|

29,903

|

|

Tax charge

|

(7,310)

|

(5,567)

|

|

Profit after tax

|

24,999

|

24,336

|

|

Notable items

|

|

|

|

Revenue

|

|

|

|

Disposals, acquisitions and related costs3,4

|

(1,343)

|

1,298

|

|

Fair value movements on financial instruments

|

-

|

14

|

|

Disposal losses on Markets Treasury repositioning

|

-

|

(977)

|

|

Early redemption of legacy securities

|

(237)

|

-

|

|

Operating expenses

|

|

|

|

Disposals, acquisitions and investment in new

businesses

|

(199)

|

(321)

|

|

Restructuring and other related costs5

|

(34)

|

136

|

|

Impairment of interest in

associate6

|

-

|

(3,000)

|

|

Tax

|

|

|

|

Tax credit on notable items

|

108

|

207

|

|

Uncertain tax positions

|

-

|

427

|

1 Net operating income before change in expected

credit losses and other credit impairment charges, also referred to

as revenue.

2 Constant currency performance is computed by

adjusting reported results of comparative periods for the effects

of foreign currency translation differences, which distort

period-on-period comparisons.

3 The amount in 2024 includes a $1.0bn loss on

disposal and a $5.2bn loss on the recycling in foreign currency

translation reserve losses and other reserves arising on sale of

our business in Argentina.This was partly offset by a gain of

$4.8bn gain on disposal of our banking business in Canada,

inclusive of a $0.3bn gain on the foreign exchange hedging of the

sales proceeds, the recycling of $0.6bn in foreign currency

translation reserve losses and $0.4bn of other reserves

losses.

4 The amount in 2023 includes the gain of $1.6bn

recognised in respect of the acquisition of SVB UK and the impact

of the sale of our retail banking operations in

France.

5 Amounts relate to restructuring provisions

recognised in 2024 and reversals of restructuring provisions

recognised during 2022.

6 Relates to an impairment loss of $3.0bn recognised

in respect of the Group's investment in BoCom. See Note 18 on page

401 to 402 of the Annual Report and Accounts 2024.

Group Chairman's shareholder letter

In 2024, global economic growth was mixed. In the West, the US

remained an outperformer, while growth across Europe was

disappointing. In Asia and the Middle East, there was broadly

steady growth. With inflation falling and with signs of the labour

market softening, the US Federal Reserve was able to start cutting

rates, as did most advanced economies.

This was against a backdrop of significant geopolitical

uncertainty, heightened by numerous and consequential elections

across the world. The war in Ukraine, now entering its fourth year,

and the conflicts and continuing tensions in the Middle East, have

had a tragic human impact. Our thoughts are with all those who have

suffered and continue to experience the devastating

consequences.

In this context, our focus is on our customers, leveraging our

global network to help them navigate the challenges and capture the

opportunities that emerge. That approach, combined with the

disciplined execution of our strategy, delivered another strong

financial performance and increased returns in 2024.

And we are very well positioned for the future.

HSBC's 160th Anniversary

2025 will mark HSBC's 160th anniversary.

In 1865, HSBC's founders started out with a clear and simple

objective: to establish a bank in Hong Kong and Shanghai that would

facilitate local and international trade, connecting East and West,

and the many places in-between.

That objective is as relevant and significant today as it was

then.

2024 progress and performance

In 2024, we delivered profit before tax of $32.3bn - an increase of

$2.0bn compared with 2023. Our return on average tangible equity

was 14.6%, or 16% excluding the impact of notable

items.

We delivered increased returns for our shareholders. The Board

approved a fourth quarterly dividend of $0.36 per share, bringing

the total dividend announced for 2024 to $0.87 per share. This

includes the special dividend of $0.21 per share that was paid in

June following the completion of the sale of HSBC Bank Canada. In

addition, we announced three share buy-backs in respect of 2024

worth a total of $9bn. And today, we announced a further share

buy-back of up to $2bn.

Since the start of 2023, we have repurchased 11% of the issued

share count. Combined with our sustained levels of profitability,

this led to greater earnings and dividends per share for our

shareholders.

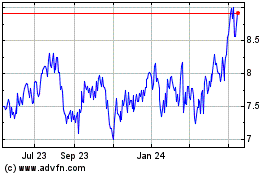

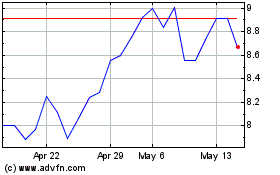

Dividends paid in 2024, together with a more than 20% increase in

the share price, delivered a total shareholder return for the year

of more than 30%.

Our performance demonstrates that our strategy is working. To

maintain, and indeed accelerate, the momentum, we are being very

deliberate in creating investment capacity for priority areas,

focusing on long-term strategic growth.

Optimising cost and capital allocation, we completed the sale of

our businesses in Canada, Russia, Argentina, and Armenia, as well

as our retail banking operations in France and Mauritius. We

announced the planned sale of our business in South Africa and of

our private banking business in Germany, as well as the planned

sale of our life insurance business in France.

In parallel, our strategic investments are yielding significant

results. In Wealth, for instance, revenue grew by 18% in 2024,

including a 21% increase in fee and other income. The continued

inflow of Net New Invested Assets and growth in total customers

point to the material upside opportunity. In Hong Kong, for

instance, we added approximately 800k new-to-bank

customers.

At the same time, we secured multiple additional licences to expand

our operations in mainland China. In India, we received an approval

earlier this year to open bank branches in 20 new cities that are

at the centre of the expanding wealth and international

opportunity.

We will continue to focus on and invest in growth opportunities

where we have a clear competitive advantage.

Leadership and Board Changes

Following Noel Quinn's decision to retire as Group Chief Executive,

the Board ran a rigorous and robust process to appoint his

successor.

I would like to once again pay tribute to Noel's exceptional

leadership and thank him for his unwavering commitment and

dedication to HSBC during his 37 years of service. We wish him the

very best in all of his future endeavours.

In September, Georges Elhedery became our Group Chief Executive. He

brings a wealth of experience and an outstanding track record of

delivery, achieved over a career spent working in Asia, the Middle

East and Europe.

In a little over five months, he has already made his

mark.

From 1 January 2025, we began operating through four businesses:

Hong Kong, the UK, Corporate and Institutional Banking, and

International Wealth and Premier Banking. The objective is to

create a simpler and more dynamic organisation - with faster

decision-making and clear lines of accountability.

Georges was succeeded as Group Chief Financial Officer by Pam Kaur,

who joined the Board as an Executive Director, having previously

served as Group Chief Risk and Compliance Officer.

At the 2024 Annual General Meeting ('AGM'), David Nish retired from

the Board. David made invaluable contributions over eight years,

particularly as Chair of the Group Audit Committee and as Senior

Independent Director. Ann Godbehere took over as Senior Independent

Director. Ann's extensive financial services experience, over a

30-year career spanning insurance, retail and private banking, and

wealth management, positions her very well for this role. Brendan

Nelson took over as Chair of the Group Audit Committee. His UK and

international financial and auditing expertise and experience are

enormously valuable.

In 2024, the Board held meetings in mainland China, Dubai,

Singapore, New York, and London. On each occasion, we had the

privilege and pleasure to meet with valued clients, government

officials, regulators, and colleagues.

Our AGM in London and the Informal Meeting of our Hong Kong

Shareholders provided substantive opportunities to engage with our

shareholders, on important issues related to the

Group.

Global outlook

The economic outlook remains uncertain with potential downside

risks to global growth from trade frictions and supply chain

disruptions. Inflation has declined but is proving stubborn and

could be impacted by oil and gas prices, as well as any trade

tariffs.

Global growth is expected to remain fairly stable in 2025, with the

US still likely to remain the major engine of growth. However,

policy priorities are adding to uncertainties regarding growth

prospects around the world. Already, it appears that the

improvement in world trade growth may be starting to

falter.

In China, the package of fiscal and monetary measures announced in

the final quarter of 2024 was welcome and helped it reach its

annual target of 'around 5%' GDP growth. Aided by its

transformation to a consumption-led and innovation-focused economic

model, we expect it to deliver a comparable performance in 2025.

Hong Kong should also continue to expand, with its growth directly

linked to mainland China.

Elsewhere in Asia, changing supply chains and resilient local

demand helped to drive growth in a number of markets, including

India. Over the longer term, the demographic dividend will benefit

countries like India and markets across South and Southeast

Asia.

As this happens, we also continue to see great potential in the

fast-growing corridor between Asia and the Middle East, where

strong demographics combine with large scale capital spending on

infrastructure and further diversification, which are set to

continue.

In Europe, with inflation pressures easing and interest rates on a

downward trajectory, consumer spending should rise. As a result, we

expect the Eurozone to expand this year. Meanwhile, the new UK

government is pursuing a pro-growth agenda, which we fully

support.

Our people

I want to end by expressing the Board's immense appreciation and

gratitude to all our colleagues for driving our Group

forward.

All that we delivered in 2024 was only made possible by their

sustained efforts, energies, and execution focus. They are the

lifeblood of the HSBC Group, serving our customers and creating

value for shareholders.

Sir Mark E Tucker

Group Chairman

19 February 2025

Group CEO's shareholder letter

Dear fellow shareholders,

The opportunity to lead HSBC is a privilege. Even more so as we

celebrate our 160th anniversary. Like each of my predecessors, I

see my responsibility as delivering sustainable strategic growth

for our shareholders. This begins by putting our customers at the

centre of everything we do. Our financial strength, international

network, heritage, and brand mean we build upon firm

foundations.

We look to the future with confidence.

We begin from a position of strength, which is reinforced by our

2024 performance. During the year, we delivered a return on average

tangible equity ('RoTE') of 14.6%. This includes several notable

items, in particular related to strategic disposals. Excluding

these, our RoTE was 16.0%, achieving our 'mid-teens' target. Our

common equity tier 1 ('CET1') capital ratio was 14.9%, reflecting

our long-standing financial strength. With our continued focus on

cost discipline, we managed cost growth on our target basis of

around 5%, which was in line with our targeted cost growth. This

strong performance enabled us to announce $26.9 billion in returns

to our shareholders through dividends and share buy-backs, which we

expect to remain central to our strategy.

Simple, more agile, focused

The world in which we operate is changing quickly. We are adapting

to help our customers navigate new complexities. By doing so, we

will open up a world of opportunity as we serve their needs,

delivering on our strategy.

Since assuming the role in September, I have focused on injecting

energy and intent into the way we deliver our strategy. We are

being more agile in the way we allocate our resources and invest to

prepare for the future. That includes retiring non-strategic assets

and embracing the productive power of new technologies and tools to

modernise HSBC and enhance the way we serve our

customers.

We have renewed vigour in finding the efficiencies that will

optimise our resource allocation, be that geographical, business

line or balance sheet. This will enhance the way we actively and

dynamically manage costs and capital, and target

investments.

We will be guided by three overarching priorities:

- Focus

on our customers, delivering high levels of

satisfaction;

- Drive

long-term growth by focusing on our strengths, increasing our

leadership and market share in the areas where we can generate

attractive returns;

- Simplify

our structure and operating model. Reshape and rationalise our

portfolio, to meet the needs of a fast-changing

world.

To achieve this, I have put in place a smaller, core team of

exceptionally talented leaders. They are each committed to

fostering a culture of excellence for our colleagues, driven by a

growth-orientated mindset. HSBC's many talented colleagues around

the world are key to delivering the exceptional customer experience

that will drive our future growth.

We have also simplified the organisation in two important

ways.

First, by moving away from a complex matrix governance structure

built around three business lines and five geographical regions to

create four new businesses. Each firmly rooted in our core

strengths:

- Corporate

and Institutional Banking, which combines our two wholesale

businesses;

- International

Wealth and Premier Banking, to focus on accelerating the build out

of our global wealth proposition;

- Our

two home markets of Hong Kong and the UK, where we have scale and

market-leading positions.

HSBC's supporting infrastructure is being simplified and realigned

to enable these four businesses to grow.

Simply put, we are aligning our structure to our

strategy.

Second, we are significantly improving our operating model, led by

a tighter team at the Group Operating Committee, that

will:

- Provide

clarity of accountability, empower colleagues to make faster

decisions and accelerate the pace at which we generate greater

productivity;

- Make

HSBC simple, with fewer management lines and layers, and less

committees, designed to reduce bureaucracy, create closer

collaboration, emphasise teamwork, and facilitate the flow of ideas

and innovation;

- Adapt

quickly to the factors that are shaping the economies and

industries in which our customers operate;

- Sharpen

and strengthen our focus on capital efficiency and firm-wide risk

management.

This will create a step change in the way we work, the way we serve

customers and the way we generate sustainable strategic growth,

driving higher returns for our shareholders.

In short, unlocking HSBC's full potential.

Designed to deliver strong, sustainable strategic

growth

For 160 years, HSBC has been defined by its financial strength and

international network. Both remain enablers of everything we do.

What is changing is the clarity, speed and intensity with which we

are repositioning HSBC around our four complementary, clearly

differentiated businesses.

Corporate and Institutional Banking ('CIB') is an international

wholesale bank with significant competitive advantages. It has a

powerful deposit franchise with financing capabilities supported by

the strength of our balance sheet and our network. It has the

products and skills required to serve the global banking needs of

international corporate clients, particularly in transaction

banking where we continue to invest. This positions us to better

capture global and intra-regional flows as supply chains

reconfigure, new trade routes emerge, economies grow, and

customers' expectations of financial services evolve.

The future economy will require financing and investment in sectors

such as advanced technologies, specifically digitalisation,

computing and generative AI, as well as clean energy and

healthcare. CIB is well positioned to facilitate this by helping

entrepreneurs to secure the capital they need to build the

businesses of the future and by supporting our customers as they

look to decarbonise.

International Wealth and Premier Banking ('IWPB') is ideally placed

to capture the increasing number of affluent and high-net-worth

customers. Especially those with international banking needs who

seek new investment opportunities to help them to protect and grow

their wealth. Our recognised brand, financial strength and

complementary footprints across Asia and the Middle East serve to

reinforce HSBC's position in the world's fastest-growing wealth

markets. We also have an asset management business with distinct

specialism in both regions offering customers access to investment

opportunities across asset classes.

The Hong Kong and UK businesses give us strong platforms in our

home markets. We serve personal banking customers and small and

medium enterprises in these businesses. In Hong Kong specifically,

where HSBC was founded, Hang Seng Bank, a customer-centric

community bank, is a strategically important investment of the HSBC

Group, which enhances the strength of our franchise and

market-leading position. We also have a fast-growing insurance

manufacturing business in Hong Kong, leveraging the inflows that

are propelling Hong Kong to become the leading international wealth

hub. In the UK, we have a leading retail, commercial and

innovation-focused bank which continues to build market

share.

Customers in Hong Kong and the UK with global banking needs will be

able to access the power of our international network through our

CIB and IWPB businesses, that are anchored in these two leading

international financial centres.

Delivering on our priorities to customers and

shareholders

HSBC is a highly connected, global organisation. Our international

network is a significant differentiator.

By refocusing on our core strengths, we are creating a simple, more

agile, focused organisation structured to better serve our

customers and deliver for our shareholders.

We have taken the first deliberate and decisive steps. We continue

to move at pace and with a relentless focus on actively managing

our costs. Not as a one off, but as an embedded

mindset.

How we deliver on our three priorities is equally important. We are

instilling a culture of excellence, leadership and accountability

throughout the firm. We are also undergoing a comprehensive

transformation of our operations, modernising our infrastructure,

and investing in technology such as AI, generative AI, data and

analytics. This will enhance customer experience as well as drive

operational excellence.

The aim being to create a refocused, reinvigorated HSBC, firmly

rooted in four complementary businesses with the ambition to

generate high levels of total shareholder returns.

Today's actions define a confident future

I am confident about our future and what we can

achieve.

As we celebrate our 160th anniversary,

our history and heritage stand us in good stead. In so many ways,

adapting to new economic realities and technologies is what we have

always done. It brings out the best in our people and culture,

especially when acting as a trusted advisor to our customers as

they navigate the world's economic uncertainties and look towards

new opportunities.

As we look to the future, our strategic priorities are clear, our

leadership team is now in place, supported by a simplified

structure that enables action.

We have clarity on who we are and what we seek to achieve. We are

driven by a precision of purpose that guides the way we do

business, the values we uphold and the way we serve our customers,

colleagues and communities.

We are prioritising a high-performance culture where employees are

passionate about what they can achieve and rewarded for their

strong customer focus, skills, ambition and initiative. We will

invest in our people, one of our most valuable assets, providing

them with expansive career opportunities and supporting them in

developing future-focused skills, establishing HSBC as an employer

of choice and a great place to work.

A strong culture and effective leadership will be key to our

long-term success.

I would like to thank all of my colleagues for their valuable

contributions to our results. It is a privilege to work with such

talented people. Their dedication, commitment, and desire to

deliver for our customers differentiates HSBC and is key to

delivering long-term growth.

The actions we are taking will have clear and tangible impact. Our

ambition is to unlock HSBC's full potential for the benefit of all

our stakeholders, provide excellent customer outcomes that enhance

our franchise and brand, generating the strategic growth that will

deliver attractive returns for you, our shareholders.

Georges Elhedery

Group CEO

19 February 2025

Financial summary

|

|

Year ended 31 December

|

|

|

2024

|

2023

|

|

|

$m

|

$m

|

|

For the year

|

|

|

|

Profit before tax

|

32,309

|

30,348

|

|

Profit attributable to:

|

|

|

|

- ordinary shareholders of the parent company

|

22,917

|

22,432

|

|

Dividends on ordinary shares

|

15,348

|

10,492

|

|

|

|

|

|

|

At 31 December

|

|

|

2024

|

2023

|

|

|

$m

|

$m

|

|

Total shareholders' equity

|

184,973

|

185,329

|

|

Total regulatory capital

|

172,386

|

171,204

|

|

Customer accounts

|

1,654,955

|

1,611,647

|

|

Total assets

|

3,017,048

|

3,038,677

|

|

Risk-weighted assets

|

838,254

|

854,114

|

|

|

|

|

|

Per ordinary share

|

$

|

$

|

|

Basic earnings per share

|

1.25

|

1.15

|

|

Dividend per ordinary share (in respect of the period)

|

0.87

|

0.61

|

|

Dividends per ordinary share (paid in the period)

|

0.82

|

0.53

|

|

Net asset value per ordinary share at period end1

|

9.26

|

8.82

|

|

Tangible net asset value per ordinary share at period

end2

|

8.61

|

8.19

|

|

|

|

|

|

Share information

|

|

|

|

Number of $0.50 ordinary shares in issue (millions)

|

17,947

|

19,263

|

|

Basic number of $0.50 ordinary shares outstanding

(millions)

|

17,918

|

19,006

|

|

Basic number of $0.50 ordinary shares outstanding and dilutive

potential ordinary shares (millions)

|

18,062

|

19,135

|

1 The definition of net asset value per

ordinary share is total shareholders' equity, less non-cumulative

preference shares and capital securities, divided by the number of

ordinary shares in issue, excluding own shares held by the company,

including those purchased and held in treasury.

2 The definition of tangible net asset

value per ordinary share is total ordinary shareholders' equity

excluding goodwill and other intangible assets (net of deferred

tax), divided by the number of basic ordinary shares in issue,

excluding own shares held by the company, including those purchased

and held in treasury.

Distribution of results by global business

|

Constant currency profit/(loss) before tax

|

|

|

Year ended 31 Dec

|

|

|

2024

|

2023

|

|

|

$m

|

%

|

$m

|

%

|

|

Wealth and Personal Banking

|

12,182

|

37.7

|

11,625

|

38.9

|

|

Commercial Banking

|

11,860

|

36.7

|

13,155

|

44.0

|

|

Global Banking and Markets

|

7,063

|

21.9

|

5,582

|

18.7

|

|

Corporate Centre

|

1,204

|

3.7

|

(459)

|

(1.6)

|

|

Profit before tax

|

32,309

|

100.0

|

29,903

|

100.0

|

Distribution of results by legal entity

|

Reported profit/(loss) before tax

|

|

|

Year ended 31 Dec

|

|

|

2024

|

2023

|

|

|

$m

|

%

|

$m

|

%

|

|

HSBC UK Bank plc

|

7,213

|

22.2

|

8,270

|

27.2

|

|

HSBC Bank plc

|

2,645

|

8.2

|

2,639

|

8.7

|

|

The Hongkong and Shanghai Banking Corporation Limited

|

20,470

|

63.4

|

16,167

|

53.3

|

|

HSBC Bank Middle East Limited

|

1,114

|

3.4

|

1,239

|

4.1

|

|

HSBC North America Holdings Inc.

|

832

|

2.6

|

518

|

1.7

|

|

HSBC Bank Canada

|

186

|

0.6

|

871

|

2.9

|

|

Grupo Financiero HSBC, S.A. de C.V.

|

730

|

2.3

|

805

|

2.6

|

|

Other trading entities1

|

1,829

|

5.7

|

2,359

|

7.8

|

|

- of which: other Middle East entities (including Oman,

Türkiye, Egypt and Saudi Arabia)

|

833

|

2.6

|

748

|

2.5

|

|

- of which: Saudi Awwal Bank

|

596

|

1.8

|

538

|

1.8

|

|

Holding companies, shared service centres and intra-Group

eliminations

|

(2,710)

|

(8.4)

|

(2,520)

|

(8.3)

|

|

Profit before tax

|

32,309

|

100.0

|

30,348

|

100.0

|

1 Other trading entities includes the

results of entities located in Oman, Türkiye, Egypt and Saudi

Arabia (including our share of the results of Saudi Awwal Bank)

which do not consolidate into HSBC Bank Middle East Limited.

Supplementary analysis is provided on page 120 in the Annual Report

and Accounts 2024 for a fuller picture of the MENAT regional

performance.

HSBC constant currency profit before tax and balance sheet

data

|

|

2024

|

|

|

Wealth and

Personal

Banking

|

Commercial Banking

|

Global Banking and Markets

|

Corporate Centre

|

Total

|

|

|

$m

|

$m

|

$m

|

$m

|

$m

|

|

Net operating income/(expense) before

change in expected credit losses and other credit impairment

charges1

|

28,674

|

21,580

|

17,529

|

(1,929)

|

65,854

|

|

- external

|

20,460

|

21,565

|

30,698

|

(6,869)

|

65,854

|

|

- inter-segment

|

8,214

|

15

|

(13,169)

|

4,940

|

-

|

|

of which: net interest income/(expense)2

|

20,352

|

17,261

|

7,488

|

(12,368)

|

32,733

|

|

Change in expected credit losses and other credit impairment

charges

|

(1,335)

|

(1,815)

|

(235)

|

(29)

|

(3,414)

|

|

Net operating income/(expense)

|

27,339

|

19,765

|

17,294

|

(1,958)

|

62,440

|

|

Total operating expenses

|

(15,204)

|

(7,906)

|

(10,231)

|

298

|

(33,043)

|

|

Operating profit/(loss)

|

12,135

|

11,859

|

7,063

|

(1,660)

|

29,397

|

|

Share of profit in associates and joint ventures less

impairment

|

47

|

1

|

-

|

2,864

|

2,912

|

|

Constant currency profit/(loss) before tax

|

12,182

|

11,860

|

7,063

|

1,204

|

32,309

|

|

|

%

|

%

|

%

|

%

|

%

|

|

Share of HSBC's constant currency profit before tax

|

37.7

|

36.7

|

21.9

|

3.7

|

100.0

|

|

Constant currency cost efficiency ratio

|

53.0

|

36.6

|

58.4

|

15.4

|

50.2

|

|

Constant currency balance sheet data

|

$m

|

$m

|

$m

|

$m

|

$m

|

|

Loans and advances to customers (net)

|

447,085

|

306,926

|

169,516

|

7,131

|

930,658

|

|

Interests in associates and joint ventures

|

558

|

25

|

108

|

28,218

|

28,909

|

|

Total external assets

|

890,080

|

603,841

|

1,388,845

|

134,282

|

3,017,048

|

|

Customer accounts

|

823,267

|

490,475

|

340,898

|

315

|

1,654,955

|

|

Constant currency risk-weighted assets4

|

181,131

|

337,874

|

231,878

|

87,371

|

838,254

|

|

|

|

|

|

|

|

|

|

2023

|

|

Net operating income/(expense) before change in expected credit

losses and other credit impairment charges1

|

26,848

|

22,396

|

15,771

|

(103)

|

64,912

|

|

- external

|

18,669

|

23,686

|

27,618

|

(5,061)

|

64,912

|

|

- inter-segment

|

8,179

|

(1,290)

|

(11,847)

|

4,958

|

-

|

|

of which: net interest income/(expense)2

|

19,902

|

16,289

|

6,860

|

(8,899)

|

34,152

|

|

Change in expected credit losses and other credit impairment

charges

|

(935)

|

(2,006)

|

(317)

|

(1)

|

(3,259)

|

|

Net operating income/(expense)

|

25,913

|

20,390

|

15,454

|

(104)

|

61,653

|

|

Total operating expenses

|

(14,352)

|

(7,234)

|

(9,872)

|

(36)

|

(31,494)

|

|

Operating profit/(loss)

|

11,561

|

13,156

|

5,582

|

(140)

|

30,159

|

|

Share of profit/(loss) in associates and joint

ventures3

|

64

|

(1)

|

-

|

(319)

|

(256)

|

|

Constant currency profit/(loss) before tax

|

11,625

|

13,155

|

5,582

|

(459)

|

29,903

|

|

|

%

|

%

|

%

|

%

|

%

|

|

Share of HSBC's constant currency profit before tax

|

38.9

|

44.0

|

18.7

|

(1.6)

|

100.0

|

|

Constant currency cost efficiency ratio

|

53.5

|

32.3

|

62.6

|

(35.0)

|

48.5

|

|

Constant currency balance sheet data

|

$m

|

$m

|

$m

|

$m

|

$m

|

|

Loans and advances to customers (net)

|

444,856

|

301,103

|

170,868

|

262

|

917,089

|

|

Interests in associates and joint ventures

|

539

|

23

|

107

|

26,226

|

26,895

|

|

Total external assets

|

915,062

|

613,124

|

1,298,065

|

146,296

|

2,972,547

|

|

Customer accounts

|

792,710

|

465,095

|

321,226

|

582

|

1,579,613

|

|

Constant currency risk-weighted assets4

|

186,163

|

341,930

|

213,655

|

87,093

|

828,841

|

1 Net operating income before change in

expected credit losses and other credit impairment charges, also

referred to as revenue.

2 Net interest expense recognised in

Corporate Centre includes $11.4bn (2023: $8.7bn) of interest

expense in relation to the internal cost to fund trading and fair

value net assets; and the funding cost of foreign exchange swaps in

our Markets Treasury function.

3 Includes an impairment loss of $3.0bn

recognised in respect of the Group's investment in BoCom in

2023.

4 Constant currency risk-weighted assets

are calculated using reported risk-weighted assets adjusted for the

effects of currency translation differences.

Consolidated income statement

for the year ended 31 December 2024

|

|

2024

|

2023

|

|

|

$m

|

$m

|

|

Net interest income

|

32,733

|

35,796

|

|

- interest income1,2

|

108,631

|

100,868

|

|

- interest expense3

|

(75,898)

|

(65,072)

|

|

Net fee income

|

12,301

|

11,845

|

|

- fee income

|

16,266

|

15,616

|

|

- fee expense

|

(3,965)

|

(3,771)

|

|

Net income from financial instruments held for trading or managed

on a fair value basis4

|

21,116

|

16,661

|

|

Net income/(expense) from assets and liabilities of insurance

businesses, including related derivatives, measured at fair value

through profit or loss

|

5,901

|

7,887

|

|

Insurance finance (expense)/income

|

(5,978)

|

(7,809)

|

|

Insurance service result

|

1,310

|

1,078

|

|

- insurance revenue

|

2,752

|

2,259

|

|

- insurance service expense

|

(1,442)

|

(1,181)

|

|

Gain on acquisition5

|

-

|

1,591

|

|

Gains/(losses) recognised on sale of business

operations6

|

(1,752)

|

(61)

|

|

Other operating income/(expense)7

|

223

|

(930)

|

|

Net operating income before change in

expected credit losses and other credit impairment

charges8

|

65,854

|

66,058

|

|

Change in expected credit losses and other credit impairment

charges

|

(3,414)

|

(3,447)

|

|

Net operating income

|

62,440

|

62,611

|

|

Employee compensation and benefits

|

(18,465)

|

(18,220)

|

|

General and administrative expenses

|

(10,498)

|

(10,383)

|

|

Depreciation and impairment of property, plant and equipment and

right-of-use assets9

|

(1,845)

|

(1,640)

|

|

Amortisation and impairment of intangible assets

|

(2,235)

|

(1,827)

|

|

Total operating expenses

|

(33,043)

|

(32,070)

|

|

Operating profit

|

29,397

|

30,541

|

|

Share of profit in associates and joint ventures

|

2,912

|

2,807

|

|

Impairment of interest in associate

|

-

|

(3,000)

|

|

Profit before tax

|

32,309

|

30,348

|

|

Tax expense

|

(7,310)

|

(5,789)

|

|

Profit for the year

|

24,999

|

24,559

|

|

Attributable to:

|

|

|

|

- ordinary shareholders of the parent company

|

22,917

|

22,432

|

|

- other equity holders

|

1,062

|

1,101

|

|

- non-controlling interests

|

1,020

|

1,026

|

|

Profit for the year

|

24,999

|

24,559

|

|

|

$

|

$

|

|

Basic earnings per ordinary share

|

1.25

|

1.15

|

|

Diluted earnings per ordinary share

|

1.24

|

1.14

|

1 Interest income includes $93,388m (2023:

$88,657m) of interest recognised on financial assets measured at

amortised cost and $15,273m (2023: $12,134m) of interest recognised

on financial assets measured at fair value through other

comprehensive income. It also includes a net $237m loss related to

the early redemption of legacy securities.

2 Interest income is calculated using the

effective interest method and comprises interest recognised on

financial assets measured at either amortised cost or fair value

through other comprehensive income.

3 Interest expense includes $72,594m (2023:

$62,095m) of interest on financial instruments, excluding interest

on debt instruments issued by HSBC for funding purposes that are

designated under the fair value option to reduce an accounting

mismatch and on derivatives managed in conjunction with those debt

instruments included in interest expense.

4 Includes a $255m gain (2023: $315m loss)

on the foreign exchange hedging of the proceeds from the sale of

our banking business in Canada and a $114m mark-to-market gain

(2023:nil) on interest rate hedging of the portfolio of retained

loans post sale of our retail banking business in

France.

5 Gain recognised in respect of the

acquisition of SVB UK.

6 This line item has been updated to

include amounts from Other operating income relating to all sales

of business operations; in the 2023 Annual Report and Accounts,

this line item only reflected the disposal of our France retail

banking business. The amount in 2024 includes a $1.0bn loss

on disposal and a $5.2bn loss on the recycling in foreign currency

translation reserve losses and other reserves arising on sale of

our business in Argentina. This was partly offset by a gain of

$4.6bn, inclusive of the recycling of $0.6bn in foreign currency

translation reserve losses and $0.4bn of other reserves losses but

excluding the $255m gain on the foreign exchange hedging (see

footnote 4 above) on the sale of our banking business in Canada.

The amount in 2023 primarily reflected losses due to restrictions

impacting the recoverability of assets in Russia, partly offset by

a gain on sale of our retail banking operations in

France.

7 Other operating income/(expense) includes

a loss on net monetary positions of $1,187m (2023: $1,667m) as a

result of applying IAS 29 'Financial Reporting in Hyperinflationary

Economies'.

8 Net operating income before change in

expected credit losses and other credit impairment charges also

referred to as revenue.

9 Includes depreciation of the right-of-use

assets of $711m (2023: $663m).

Consolidated statement of comprehensive income

for the year ended 31 December 2024

|

|

2024

|

2023

|

|

|

$m

|

$m

|

|

Profit for the year

|

24,999

|

24,559

|

|

Other comprehensive income/(expense)

|

|

|

|

Items that will be reclassified subsequently to profit or loss when

specific conditions are met:

|

|

|

|

Debt instruments at fair value through other comprehensive

income

|

163

|

2,599

|

|

- fair value gains/(losses)

|

41

|

2,381

|

|

- fair value losses/(gains) transferred to the income

statement on disposal

|

69

|

905

|

|

- expected credit (recoveries)/losses recognised in the

income statement

|

(6)

|

59

|

|

- disposal of subsidiary

|

85

|

-

|

|

- income taxes

|

(26)

|

(746)

|

|

Cash flow hedges

|

(52)

|

2,953

|

|

- fair value gains/(losses)

|

(282)

|

2,534

|

|

- fair value (gains)/losses reclassified to the income

statement

|

(135)

|

1,463

|

|

- disposal of subsidiary

|

262

|

-

|

|

- income taxes

|

103

|

(1,044)

|

|

Share of other comprehensive income/(expense) of associates and

joint ventures

|

462

|

47

|

|

- share for the year

|

462

|

47

|

|

Net finance income/(expenses) from insurance contracts

|

(142)

|

(364)

|

|

- before income taxes

|

(191)

|

(491)

|

|

- income taxes

|

49

|

127

|

|

Exchange differences

|

833

|

(204)

|

|

- foreign exchange losses reclassified to the income

statement on disposal of a foreign operation

|

5,816

|

-

|

|

- other exchange differences

|

(4,983)

|

(204)

|

|

Items that will not be reclassified subsequently to profit or

loss:

|

|

|

|

Fair value gains on property revaluation

|

5

|

1

|

|

Remeasurement of defined benefit asset/(liability)

|

(228)

|

(314)

|

|

- before income taxes

|

(342)

|

(413)

|

|

- income taxes

|

114

|

99

|

|

Changes in fair value of financial liabilities designated at fair

value upon initial recognition arising from changes in own credit

risk

|

(439)

|

(1,219)

|

|

- before income taxes

|

(579)

|

(1,617)

|

|

- income taxes

|

140

|

398

|

|

Equity instruments designated at fair value through other

comprehensive income

|

99

|

(120)

|

|

- fair value gains/(losses)

|

141

|

(120)

|

|

- income taxes

|

(42)

|

-

|

|

Effects of hyperinflation

|

1,239

|

1,604

|

|

Other comprehensive income/(expense) for the year, net of

tax

|

1,940

|

4,983

|

|

Total comprehensive income/(expense) for the year

|

26,939

|

29,542

|

|

Attributable to:

|

|

|

|

- ordinary shareholders of the parent company

|

24,833

|

27,397

|

|

- other equity holders

|

1,062

|

1,101

|

|

- non-controlling interests

|

1,044

|

1,044

|

|

Total comprehensive income/(expense) for the year

|

26,939

|

29,542

|

|

Consolidated balance sheet

|

|

|

|

at 31 December 2024

|

|

|

|

|

At

|

|

|

31 Dec 2024

|

31 Dec 2023

|

|

|

$m

|

$m

|

|

Assets

|

|

|

|

Cash and balances at central banks

|

267,674

|

285,868

|

|

Hong Kong Government certificates of indebtedness

|

42,293

|

42,024

|

|

Trading assets

|

314,842

|

289,159

|

|

Financial assets designated and otherwise mandatorily measured at

fair value through profit or loss

|

115,769

|

110,643

|

|

Derivatives

|

268,637

|

229,714

|

|

Loans and advances to banks

|

102,039

|

112,902

|

|

Loans and advances to customers

|

930,658

|

938,535

|

|

Reverse repurchase agreements - non-trading

|

252,549

|

252,217

|

|

Financial investments

|

493,166

|

442,763

|

|

Assets held for sale

|

27,234

|

114,134

|

|

Prepayments, accrued income and other assets1

|

152,740

|

171,597

|

|

Current tax assets

|

1,313

|

1,536

|

|

Interests in associates and joint ventures

|

28,909

|

27,344

|

|

Goodwill and intangible assets

|

12,384

|

12,487

|

|

Deferred tax assets

|

6,841

|

7,754

|

|

Total assets

|

3,017,048

|

3,038,677

|

|

Liabilities

|

|

|

|

Hong Kong currency notes in circulation

|

42,293

|

42,024

|

|

Deposits by banks

|

73,997

|

73,163

|

|

Customer accounts

|

1,654,955

|

1,611,647

|

|

Repurchase agreements - non-trading

|

180,880

|

172,100

|

|

Trading liabilities

|

65,982

|

73,150

|

|

Financial liabilities designated at fair value

|

138,727

|

141,426

|

|

Derivatives

|

264,448

|

234,772

|

|

Debt securities in issue

|

105,785

|

93,917

|

|

Liabilities of disposal groups held for sale

|

29,011

|

108,406

|

|

Accruals, deferred income and other liabilities1

|

130,340

|

143,901

|

|

Current tax liabilities

|

1,729

|

2,777

|

|

Insurance contract liabilities

|

107,629

|

120,851

|

|

Provisions

|

1,724

|

1,741

|

|

Deferred tax liabilities

|

1,317

|

1,238

|

|

Subordinated liabilities

|

25,958

|

24,954

|

|

Total liabilities

|

2,824,775

|

2,846,067

|

|

Equity

|

|

|

|

Called up share capital

|

8,973

|

9,631

|

|

Share premium account

|

14,810

|

14,738

|

|

Other equity instruments

|

19,070

|

17,719

|

|

Other reserves

|

(10,282)

|

(8,907)

|

|

Retained earnings

|

152,402

|

152,148

|

|

Total shareholders' equity

|

184,973

|

185,329

|

|

Non-controlling interests

|

7,300

|

7,281

|

|

Total equity

|

192,273

|

192,610

|

|

Total liabilities and equity

|

3,017,048

|

3,038,677

|

1 In 2023 'Items in the course of

collection from other banks' ($6.3bn) were presented on the face of

the balance sheet but are now reported within 'Prepayments, accrued

income and other assets' in the Annual Report and Accounts 2024.

Similarly, 'Items in the course of transmission to other banks'

($7.3bn) are now presented within 'Accruals, deferred income and

other liabilities'.

Consolidated statement of changes in equity

for the year ended 31 December 2024

|

|

|

|

Other reserves

|

|

|

|

|

|

|

Called up

share capital

and share

premium

|

Other

equity

instru-ments

|

Financial

assets at

FVOCI

reserve

|

Cash

flow

hedging

reserve

|

Foreign

exchange

reserve

|

Merger

and other

reserves1,2

|

Insurance

finance

reserve3

|

Retained earnings

1,4

|

Total

share-

holders'

equity

|

Non-

controlling

interests

|

Total

equity

|

|

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

$m

|

|

At 1 Jan 2024

|

24,369

|

17,719

|

(3,507)

|

(1,033)

|

(33,753)

|

28,601

|

785