Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 24 2025 - 4:11PM

Edgar (US Regulatory)

Filed pursuant to rule 433

Registration No. 333-277306

February 24, 2025

HSBC

Holdings plc

$1,500,000,000 6.950% Perpetual Subordinated Contingent Convertible Securities

(Callable During Any Optional Redemption Period) (the “Securities”)

Pricing Term Sheet:

|

|

|

| Issuer: |

|

HSBC Holdings plc (“HSBC Holdings”) |

|

|

| Sole Structuring Adviser and Book-Running Manager: |

|

HSBC Securities (USA) Inc. (“HSI”) |

|

|

| Co-Managers: |

|

ABN AMRO Capital Markets (USA) LLC Academy

Securities, Inc. Apto Partners, LLC Bancroft Capital, LLC

Barclays Capital Inc. BBVA Securities Inc.

BofA Securities, Inc. BMO Capital Markets Corp.

Cabrera Capital Markets LLC CaixaBank, S.A.

CastleOak Securities L.P. Citigroup Global Markets Inc.

Commerz Markets LLC Credit Agricole Securities (USA) Inc.

Danske Markets Inc. Drexel Hamilton, LLC

Erste Group Bank AG Goldman Sachs & Co. LLC

Independence Point Securities LLC Intesa Sanpaolo IMI Securities

Corp. Lloyds Bank Corporate Markets plc Loop Capital Markets

LLC Mischler Financial Group, Inc. Natixis Securities

Americas LLC Nordea Bank Abp Penserra Securities LLC

Rabo Securities USA, Inc. RBC Capital Markets, LLC

Roberts & Ryan, Inc. Santander US Capital Markets

LLC SMBC Nikko Securities America, Inc. Tigress Financial

Partners LLC. Wells Fargo Securities, LLC |

|

|

| Structure: |

|

Perpetual Subordinated Contingent Convertible Securities |

|

|

|

| Issuer Ratings:* |

|

A3 (stable) (Moody’s) / A- (stable) (S&P) / A+ (stable) (Fitch) |

|

|

| Expected Issue Ratings:* |

|

Baa3 (Moody’s) / BBB (Fitch) |

|

|

| Pricing Date: |

|

February 24, 2025 |

|

|

| Settlement Date: |

|

February 27, 2025 (T+3) (the “Issue Date”) |

|

|

| Maturity Date: |

|

Perpetual, with no fixed maturity or fixed redemption date |

|

|

| Form of Offering: |

|

SEC Registered Global |

|

|

| Selling Restrictions: |

|

The Securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investors in the European Economic Area (“EEA”) or in the United

Kingdom (“UK”). Prospective investors are referred to the sections headed “PRIIPS Regulation—Prohibition of sales to EEA retail investors” and “UK PRIIPS Regulation—Prohibition of sales to UK retail investors”

on page S-3 of the Preliminary Prospectus Supplement (as defined below). |

|

|

|

|

The Securities discussed in this document are complex financial instruments. They are not a suitable or appropriate investment for all investors, especially retail investors. In some jurisdictions, regulatory authorities have

adopted or published laws, regulations or guidance with respect to the offer or sale of securities such as the Securities. Potential investors in the Securities should inform themselves of, and comply with, any applicable laws, regulations or

regulatory guidance with respect to any resale of the Securities (or any beneficial interests therein). |

|

|

|

|

In the UK, the UK Financial Conduct Authority Conduct of Business Sourcebook (“COBS”) requires, in summary, that the Securities should not be offered or sold to retail clients (as defined in COBS 3.4, and each, a

“retail client”) in the UK. Some or all of the underwriters are required to comply with COBS. By purchasing, or making or accepting an offer to purchase, any Securities (or a beneficial interest in such Securities) from HSBC Holdings

and/or the underwriters, each prospective investor represents, warrants, agrees with and undertakes to HSBC Holdings and each of the underwriters that: (i) it is not a retail client in the UK; and (ii) it will not sell or offer the

Securities (or any beneficial interests therein) to retail clients in the UK or communicate (including the distribution of any related prospectus or prospectus supplement) or approve an invitation or inducement to participate in, acquire or

underwrite the Securities (or any beneficial interests therein) where that invitation or inducement is addressed to or disseminated in such a way that it is likely to be received by a retail client in the UK. In selling or offering Securities or

making or approving communications relating to the Securities, potential investors may not rely on the limited exemptions set out in COBS. Potential investors in the Securities should also inform themselves of, and comply with, any applicable laws,

regulations or regulatory guidance with respect to any resale of the Securities (or any beneficial interests therein). |

2

|

|

|

| |

|

The obligations in the preceding paragraph are in addition to the need to comply at all times with other applicable laws, regulations and regulatory guidance (whether inside or outside the EEA or the UK) relating to the promotion,

offering, distribution and/or sale of the Securities (or any beneficial interests therein), whether or not specifically mentioned in any related prospectus or prospectus supplement including (without limitation) any requirements under Directive

2014/65/EU (as amended, “MiFID II”) or the FCA Handbook as to determining the appropriateness and/or suitability of an investment in the Securities (or any beneficial interests therein) for investors in any relevant jurisdiction. By

purchasing, or making or accepting an offer to purchase, any Securities (or a beneficial interest in such Securities) from HSBC Holdings and/or the underwriters, each prospective investor represents, warrants, agrees with and undertakes to HSBC

Holdings that it will comply at all times with all such other applicable laws, regulations and regulatory guidance. Where acting as agent on behalf of a disclosed or undisclosed client when purchasing, or making or accepting an offer to purchase,

any Securities (or any beneficial interests therein) from HSBC Holdings and/or the underwriters, the foregoing representations, warranties, agreements and undertakings will be given by and be binding upon both the agent and its underlying

client. |

|

|

|

|

The Securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person

who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as

defined in point (10) of Article 4(1) of MiFID II. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Securities or otherwise making

them available to retail investors in the EEA has been prepared and therefore offering or selling the Securities or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. |

|

|

|

|

The Securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For these purposes, a retail investor means a person

who is one (or more) of: (i) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law in the UK by virtue of the European Union (Withdrawal) Act 2018 (as amended, the

“EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (the “FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer

would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law in the UK by virtue of the EUWA. Consequently, no key information document required by

Regulation (EU) No 1286/2014 as it forms part of domestic law in the UK by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Securities or otherwise making them available to retail investors in the UK has been

prepared and therefore offering or selling the Securities or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation. |

3

|

|

|

| Notice to Investors: |

|

Each securityholder (which, for these purposes, includes each beneficial owner) acknowledges that The Stock Exchange of Hong Kong Limited (the “HKSE”) and the Securities and Futures Commission of Hong Kong (the

“SFC”) may request HSBC Holdings to report certain information with respect to such securityholder (which may be obtained from the underwriters), including, among other things, such securityholder’s name, countries of operation and

allotment sizes, that HSBC Holdings may provide the HKSE and the SFC with any such requested information with respect to such securityholder and that HSBC Holdings’ major securityholders (which may include those who have invested in the

Securities) and their respective interests may be disclosed in HSBC Holdings’ annual and interim reports (which disclosure as of the date hereof would be required by those who have an interest in 5% or more of any class of HSBC Holdings’

voting shares, including any interest in unissued shares that may be issuable upon conversion of the Securities) and/or other public filings as may be required to be made in the future by HSBC Holdings in accordance with applicable stock exchange

rules or regulatory requirements. |

|

|

| Transaction Details: |

|

|

|

|

| Principal Amount: |

|

$1,500,000,000 |

|

|

| Benchmark Treasury: |

|

UST 4.375% due January 31, 2032 |

|

|

| Benchmark Treasury Yield: |

|

4.315% |

|

|

| Benchmark Treasury Price: |

|

100-11 1/4 |

|

|

| Re-offer Yield: |

|

6.950% |

|

|

| Initial Interest Rate: |

|

From (and including) the Issue Date to (but excluding) February 27, 2032, the interest rate on the Securities will be 6.950% per annum (the “Initial Interest Rate”). |

4

|

|

|

| Interest Rate Following Any Reset Date: |

|

From (and including) each Reset Date (as defined below) to (but excluding) the next following Reset Date, the applicable per annum interest rate will be equal to the sum of the applicable Reference Rate on the relevant Reset

Determination Date and 2.635% (the “Margin”). |

|

|

| Exchange Rate: |

|

£1.00 = $1.2647 |

|

|

| Issue Price: |

|

100.000% |

|

|

| Gross Fees: |

|

1.00% |

|

|

| Net Price: |

|

99.00% |

|

|

| Net Proceeds to Issuer: |

|

$1,485,000,000 |

|

|

| Interest Payment Dates: |

|

Interest on the Securities, if any, will be payable in arrear on February 27 and August 27 of each year, beginning on August 27, 2025. |

|

|

| Reset Dates: |

|

February 27, 2032 and each fifth anniversary date thereafter (each such date, a “Reset Date”). |

|

|

|

|

Each period from (and including) a Reset Date to (but excluding) the following Reset Date will be a “Reset Period.” |

|

|

| Reset Determination Dates: |

|

The second business day immediately preceding a Reset Date (each, a “Reset Determination Date”). |

|

|

|

|

The term “business day” means a day on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in London,

England and in New York City, United States. |

|

|

| Reference Rate: |

|

The “Reference Rate” means, with respect to any Reset Period for which such rate applies: |

|

|

|

|

(1) the rate per annum (expressed as a decimal) equal to the yield which represents the average for the week immediately prior to the related Reset Determination Date in the most recent H.15, (a) under the caption “Treasury

Constant Maturities” and (b) for the maturity of five years; |

|

|

|

|

(2) if such release (or any successor release) is not published during the week immediately prior to the related Reset Determination Date or does not contain such yields, the Reference Treasury Rate for such Reset Period;

or |

|

|

|

|

(3) if the Reference Rate cannot be determined, for whatever reason, as described under (1) or (2) above, “Reference Rate” means the rate per annum (expressed as a decimal) equal to the yield on U.S. Treasury

securities having a maturity of five years as set forth in the most recent H.15 under the caption “Treasury constant maturities” for the maturity of five years at 5:00 p.m. (New York City time) on the last available date preceding the

related Reset Determination Date on which such rate was set forth in such release (or any successor release). |

|

|

|

|

The Reference Rate shall be calculated by the calculation agent. |

5

|

|

|

|

|

| Discretionary Interest Payments: |

|

HSBC Holdings will have sole and absolute discretion at all times and for any reason to cancel (in whole or in part) any interest payment that would otherwise be payable on any interest payment date (the

“Discretionary Interest Payment Right”). |

|

|

| Restrictions on Interest Payments: |

|

Without prejudice to the Discretionary Interest Payment Right or the prohibition contained in Rule 4.3(2) of Chapter 4 of the “CRR Firms – Capital Buffers” Part of the PRA Rulebook (or any succeeding

provision(s) amending or replacing such Chapter) (“Chapter 4”) on the making of payments on the Securities before the Maximum Distributable Amount has been calculated, subject to the extent permitted in the following paragraph in respect

of partial interest payments in respect of the Securities, HSBC Holdings will not make an interest payment on any interest payment date (and such interest payment will therefore be deemed to have been cancelled and thus will not be due and payable

on such interest payment date) if: |

|

|

|

|

|

(a) |

|

the amount of Relevant Distributions exceeds the amount of Distributable Items as of such interest payment date; |

|

|

|

|

|

(b) |

|

the aggregate of (x) the interest amount payable in respect of the Securities and (y) the amounts of any distributions of the kind referred to in Rule 4.3(2) of Chapter 4 exceeds the Maximum Distributable Amount (if any)

applicable to HSBC Holdings as of such interest payment date; |

|

|

|

|

|

(c) |

|

the Solvency Condition is not satisfied in respect of such interest payment; or |

|

|

|

|

|

(d) |

|

the Relevant Regulator orders HSBC Holdings to cancel (in whole or in part) the interest otherwise payable on such interest payment date. |

|

|

|

|

HSBC Holdings may, in its discretion, elect to make a partial interest payment on the Securities on any interest payment date, only to the extent that such partial interest payment may be made without breaching the

restrictions in the preceding paragraph. For the avoidance of doubt, the portion of interest not paid on the relevant interest payment date will be deemed to have been cancelled and thus will not be due and payable on such interest payment

date. |

|

|

| Notice of Interest Cancellation: |

|

If practicable, HSBC Holdings will provide notice of any cancellation or deemed cancellation of interest (in each case, in whole or in part) to the securityholders through the Depository Trust Company (“DTC”)

(or, if the Securities are held in definitive form, to the securityholders at their addresses shown on the register for the Securities) and to the trustee and the paying agent directly on or prior to the relevant interest payment date. If

practicable, HSBC Holdings will endeavor to do so at least five business days prior to the relevant interest payment date. Failure to provide such notice will have no impact on the effectiveness of, or otherwise invalidate, any such cancellation or

deemed cancellation of interest (and accordingly, such interest will not be due and payable), or give the securityholders any rights as a result of such failure. |

6

|

|

|

| Agreement to Interest Cancellation: |

|

By its acquisition of the Securities, each securityholder (which, for these purposes, includes each beneficial owner) will acknowledge and agree to the provisions described under “Description of the

Securities—Interest—Interest Cancellation—Agreement to Interest Cancellation” in the Preliminary Prospectus Supplement. |

|

|

| Subordination: |

|

The Securities will constitute HSBC Holdings’ direct, unsecured and subordinated obligations, ranking equally without any preference among themselves. The rights and claims of the securityholders in respect of, or arising from,

the Securities will be subordinated to the claims of Senior Creditors. |

|

|

|

|

“Senior Creditors” means HSBC Holdings’ creditors (i) who are unsubordinated creditors; (ii) whose claims are, or are expressed to be, subordinated to the claims of HSBC Holdings’ unsubordinated

creditors but not further or otherwise; or (iii) whose claims are, or are expressed to be, junior to the claims of HSBC Holdings’ other creditors, whether subordinated or unsubordinated, other than those whose claims rank, or are expressed to

rank, pari passu with, or junior to, the claims of the securityholders in a winding up occurring prior to a Capital Adequacy Trigger Event. For the avoidance of doubt, holders of any of HSBC Holdings’ existing or future Tier 2 capital

instruments will be Senior Creditors. |

|

|

| Capital Adequacy Trigger Event: |

|

A “Capital Adequacy Trigger Event” will occur if at any time the non-transitional CET1 Ratio is less than 7.0%. Whether a Capital Adequacy Trigger Event has occurred at any time will

be determined by HSBC Holdings, the Relevant Regulator or any agent of the Relevant Regulator appointed for such purpose by the Relevant Regulator. |

|

|

|

|

“non-transitional CET1 Ratio” means, as of any date, the ratio of CET1 Capital to the Risk Weighted Assets, in each case as of such date, expressed as a percentage. |

|

|

|

|

“CET1 Capital” means, as of any date, the sum, expressed in U.S. dollars, of all amounts that constitute common equity Tier 1 capital of the HSBC Group as of such date, less any deductions from common equity Tier 1 capital

required to be made as of such date, in each case as calculated by HSBC Holdings on a consolidated basis and without applying the transitional provisions set out in Part Ten (Transitional Provisions, Reports, Reviews and Amendments) of UK CRR (or in

any successor provisions thereto or any equivalent provisions of the Relevant Rules which replace or supersede such provisions) in accordance with the Relevant Rules applicable to HSBC Holdings as of such date (which calculation will be binding on

the trustee, the paying agent and the securityholders). For the purposes of this definition, the term “common equity Tier 1 capital” will have the meaning assigned to such term in the Capital Instruments Regulations (as defined under

“Description of the Securities— Definitions” in the Preliminary Prospectus Supplement and as the same may be amended or replaced from time to time) as interpreted and applied in accordance with the Relevant Rules then

applicable to the HSBC Group or by the Relevant Regulator. “Risk Weighted Assets” means, as of any date, the aggregate amount, expressed in U.S. dollars, of the risk weighted assets of the HSBC Group as of such date, as calculated by HSBC

Holdings on a consolidated basis and without applying the transitional provisions set out in Part Ten of UK CRR (or in any successor provisions thereto or any equivalent provisions of the Relevant Rules which replace or supersede such provisions) in

accordance with the Relevant Rules applicable to HSBC Holdings as of such date (which calculation will be binding on the trustee, the paying agent and the securityholders). For the purposes of this definition, the term “risk weighted

assets” means the risk weighted assets or total risk exposure amount, as calculated by HSBC Holdings in accordance with the Relevant Rules applicable to it as of such date. |

7

|

|

|

| Automatic Conversion upon a Capital Adequacy Trigger Event: |

|

If a Capital Adequacy Trigger Event occurs, then an Automatic Conversion will occur without delay (but no later than one month following the date on which it is determined such Capital Adequacy Trigger Event has occurred), as

described under “Description of the Securities—Automatic Conversion Upon Capital Adequacy Trigger Event—Procedure—Automatic Conversion Procedure” in the Preliminary Prospectus Supplement, at which point all of

HSBC Holdings’ obligations under the Securities will be irrevocably and automatically released in consideration of its issuance of the Conversion Shares to the Conversion Shares Depository on behalf of the securityholders (or to the relevant

recipient in accordance with the terms of the Securities) on the date on which the Automatic Conversion will take place, or has taken place, as applicable (such date, the “Conversion Date”), in accordance with the terms of the Securities

and the Indenture, and under no circumstances will such released obligations be reinstated. |

|

|

After a Capital Adequacy Trigger Event, subject to the conditions described under “Description of the Securities— Automatic Conversion Upon Capital Adequacy Trigger Event— Procedure” in the

Preliminary Prospectus Supplement, HSBC Holdings expects the Conversion Shares Depository to deliver to the securityholders on the Settlement Date either (i) Conversion Shares or (ii) if HSBC Holdings elects, in its sole and absolute

discretion, that a Conversion Shares Offer be made, the Conversion Shares Offer Consideration. |

8

|

|

|

|

|

The Securities will not be convertible into Conversion Shares at the option of the securityholders at any time. |

|

|

|

|

“Conversion Shares” means HSBC Holdings’ ordinary shares to be issued to the Conversion Shares Depository on behalf of the securityholders (or to the relevant recipient in accordance with the terms of the Securities)

following an Automatic Conversion, which ordinary shares will be in such number as is determined by dividing the aggregate principal amount of the Securities then outstanding immediately prior to the Automatic Conversion on the Conversion Date by

the Conversion Price rounded down, if necessary, to the nearest whole number of ordinary shares. The “Conversion Price” is fixed initially at $3.4147 per Conversion Share and is subject to certain anti-dilution adjustments as described

under “Description of the Securities—Anti-dilution— Adjustment of Conversion Price and Conversion Shares Offer Price” in the Preliminary Prospectus Supplement. |

|

|

|

|

“Conversion Shares Offer” means, HSBC Holdings’ election, at its sole and absolute discretion, that the Conversion Shares Depository make an offer of all or some of the Conversion Shares to all or some of HSBC

Holdings’ ordinary shareholders at a cash price per Conversion Share equal to the Conversion Shares Offer Price, subject to the conditions described further under “Description of the Securities—Automatic Conversion Upon

Capital Adequacy Trigger Event—Procedure” in the Preliminary Prospectus Supplement. |

|

|

|

|

“Conversion Shares Offer Price” is fixed initially at £2.70 per Conversion Share and is subject to certain anti-dilution adjustments as described under “Description of the Securities—

Anti-dilution— Adjustment of Conversion Price and Conversion Shares Offer Price” in the Preliminary Prospectus Supplement. On the Issue Date, the Conversion Shares Offer Price and the Conversion Price will be equal (based on an

exchange rate of £1.00 = $1.2647). |

|

|

|

|

“Conversion Shares Offer Consideration” means in respect of each Security (i) if all the Conversion Shares are sold in the Conversion Shares Offer, the pro rata share of the cash proceeds from such sale

attributable to such Security converted from pounds sterling (or any such other currency in which HSBC Holdings’ ordinary shares are denominated) into U.S. dollars at the Prevailing Rate as of the date that is three Depository Business Days

prior to the relevant Settlement Date as determined by the Conversion Shares Depository (less the pro rata share of any foreign exchange transaction costs) (the “pro rata cash component”), (ii) if some but not

all of the Conversion Shares are sold in the Conversion Shares Offer, (x) the pro rata cash component and (y) the pro rata share of the Conversion Shares not sold pursuant to the Conversion Shares Offer attributable to such

Security rounded down to the nearest whole number of Conversion Shares, and (iii) if no Conversion Shares are sold in a Conversion Shares Offer, the relevant Conversion Shares attributable to such Security rounded down to the nearest whole

number of Conversion Shares, subject in the case of (i) and (ii)(x) above to deduction from any such cash proceeds of an amount equal to the pro rata share of any stamp duty, stamp duty reserve tax, or any other capital, issue, transfer,

registration, financial transaction or documentary tax that may arise or be paid as a consequence of the transfer of any interest in the Conversion Shares to the Conversion Shares Depository on behalf of the securityholders (or to the relevant

recipient in accordance with the terms of the Securities) in order for the Conversion Shares Depository (or the relevant recipient in accordance with the terms of the Securities) to conduct the Conversion Shares

Offer. |

9

|

|

|

| Agreement with Respect to a Capital Adequacy Trigger Event: |

|

By its acquisition of the Securities, each securityholder (which, for these purposes, includes each beneficial owner) will (i) consent to all of the terms and conditions of the Securities, including (x) the occurrence of a

Capital Adequacy Trigger Event and any related Automatic Conversion following a Capital Adequacy Trigger Event and (y) the appointment of the Conversion Shares Depository (or the relevant recipient in accordance with the terms of the

Securities), the issuance of the Conversion Shares to the Conversion Shares Depository on behalf of the securityholders (or to the relevant recipient in accordance with the terms of the Securities) and the potential sale of the Conversion Shares

pursuant to a Conversion Shares Offer, (ii) acknowledge and agree that effective upon, and following, a Capital Adequacy Trigger Event, other than any amounts payable in the case of HSBC Holdings’ winding up or the appointment of an

administrator for HSBC Holdings’ administration as described under “Description of the Securities—Subordination” in the Preliminary Prospectus Supplement, no securityholder will have any rights against HSBC Holdings

with respect to repayment of the principal amount of the Securities or payment of interest or any other amount on or in respect of such Securities, in each case that is not due and payable, which liabilities will be automatically released,

(iii) acknowledge and agree that events in, and related to, clause (i) may occur without any further action on the part of such securityholder (or beneficial owner), the trustee or the paying agent, (iv) authorize, direct and request

DTC and any direct participant in DTC or other intermediary through which it holds such Securities to take any and all necessary action, if required, to implement the Automatic Conversion without any further action or direction on the part of such

securityholder (or beneficial owner), the trustee or the paying agent and (v) waive, to the extent permitted by the Trust Indenture Act of 1939, as amended, any claim against the trustee arising out of its acceptance of its trusteeship for the

Securities, including, without limitation, claims related to or arising out of or in connection with a Capital Adequacy Trigger Event and/or any Automatic Conversion. |

10

|

|

|

| Agreement with Respect to any Conversion Shares Offer: |

|

If HSBC Holdings elects, in its sole and absolute discretion, that a Conversion Shares Offer be conducted, by its acquisition of the Securities, each securityholder (which, for these purposes, includes each beneficial owner) will:

(i) consent to (x) any Conversion Shares Offer and to the Conversion Shares Depository’s using the Conversion Shares to settle any Conversion Shares Offer in accordance with the terms of the Securities, notwithstanding that such

Conversion Shares are held by the Conversion Shares Depository on behalf of the securityholders and (y) the transfer of the beneficial interest it holds in the Conversion Shares to the Conversion Shares Depository in connection with the

Conversion Shares Offer in accordance with the terms of the Securities, and (ii) irrevocably agree that (x) HSBC Holdings, the Conversion Shares Depository (or the relevant recipient in accordance with the terms of the Securities) and the

Conversion Shares Offer Agent, if any, may take any and all actions necessary to conduct the Conversion Shares Offer in accordance with the terms of the Securities, and (y) neither HSBC Holdings, the trustee, the paying agent, the Conversion

Shares Depository nor the Conversion Shares Offer Agent, if any, will, to the extent permitted by applicable law, incur any liability to the securityholders in respect of the Conversion Shares Offer (except for the obligations of the Conversion

Shares Depository in respect of the securityholders’ entitlement to any Conversion Shares Offer Consideration). |

|

|

| Optional Redemption: |

|

The Securities will not be redeemable at the option of the securityholders at any time. |

|

|

|

|

The Securities may be redeemed in whole (but not in part) at HSBC Holdings’ option in its sole discretion on any business day during any Optional Redemption Period (an “Optional Redemption Date”), at a redemption

price equal to 100% of the principal amount plus any accrued and unpaid interest to (but excluding) the date of redemption (which interest will exclude any interest that is cancelled or deemed to have been cancelled as described under

“Description of the Securities— Interest— Interest Cancellation” in the Preliminary Prospectus Supplement). Any redemption of the Securities is subject to the restrictions described under “Description of the

Securities— Redemption—Redemption Conditions” in the Preliminary Prospectus Supplement. |

|

|

|

|

“Optional Redemption Period” means the period commencing on the date falling six calendar months prior to a Reset Date and ending on such Reset Date (both dates

inclusive). |

11

|

|

|

| Special Event Redemption: |

|

The Securities may be redeemed in whole (but not in part) at HSBC Holdings’ option in its sole discretion upon the occurrence of a Tax Event or a Capital Disqualification Event, as described under “Description of the

Securities— Redemption— Special Event Redemption” in the Preliminary Prospectus Supplement. In each case, the redemption price for the Securities will be equal to 100% of their principal amount plus any accrued and unpaid

interest to (but excluding) the date of redemption (which interest will exclude any interest that is cancelled or deemed to have been cancelled as described under “Description of the Securities—Interest—Interest

Cancellation” in the Preliminary Prospectus Supplement). Any redemption of the Securities is subject to the conditions described under “Description of the Securities—Redemption—Redemption Conditions” in the

Preliminary Prospectus Supplement. |

|

|

| Redemption Conditions: |

|

Any redemption of the Securities is subject to the restrictions described under “Description of the Securities—Redemption— Redemption Conditions” in the Preliminary Prospectus Supplement. |

|

|

| Notice of Redemption: |

|

Any redemption of the Securities will be subject to HSBC Holdings’ giving prior notice to the securityholders as described under, and subject to the provisions of, “Description of the

Securities—Redemption—Notice of Redemption” in the Preliminary Prospectus Supplement. |

|

|

| Agreement with Respect to the Exercise of UK Bail-in Power: |

|

The provisions in the Preliminary Prospectus Supplement in the section “Description of the Securities—Agreement with Respect to the Exercise of UK Bail-in Power”

are applicable. |

|

|

| U.S. Federal Income Taxation of Interest Payments with respect to the Securities (QDI eligibility): |

|

As more fully described in the Preliminary Prospectus Supplement, interest payments by the issuer with respect to the Securities are generally expected to be taxable to certain non- corporate U.S. holders as qualified dividend

income, provided that the non-corporate U.S. holder meets certain holding period requirements and the issuer is not a “passive foreign investment company” in either the taxable year of the issuer in

which such interest payment is made or in the preceding taxable year. |

|

|

| Governing Law: |

|

The Indenture and the Securities will be governed by, and construed in accordance with, the laws of the State of New York, except that the subordination provisions and the waiver of set- off provisions of the Indenture and of the

Securities will be governed by, and construed in accordance with, the laws of England and Wales. |

|

|

| Day Count Convention: |

|

30/360 (following, unadjusted) |

|

|

| Minimum Denomination: |

|

$200,000 and integral multiples of $1,000 in excess thereof. |

|

|

| Listing: |

|

Application has been made to list the Securities on the Global Exchange Market of Euronext Dublin |

|

|

| Documentation: |

|

Preliminary prospectus supplement dated February 24, 2025 (the “Preliminary Prospectus Supplement”) incorporating the Prospectus dated February 23, 2024 relating to the Securities. If there is any discrepancy or

contradiction between this Pricing Term Sheet and the Preliminary Prospectus Supplement, this Pricing Term Sheet shall prevail. |

12

|

|

|

|

|

| Paying Agent: |

|

HSBC Bank USA, National Association. |

|

|

| Calculation Agent: |

|

HSBC Bank USA, National Association. |

|

|

| Trustee: |

|

The Bank of New York Mellon, London Branch. |

|

|

| CUSIP: |

|

404280 EV7 |

|

|

| ISIN: |

|

US404280EV79 |

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus Supplement.

| * |

A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. |

HSBC

Holdings has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents HSBC Holdings

has filed with the SEC for more complete information about HSBC Holdings and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, HSBC Holdings or HSI will arrange to send you the

prospectus if you request it by calling toll-free 1-866-811-8049.

It is expected that delivery of the Securities will be made to investors on or about February 27, 2025, which will be the third business day following

the date of the Preliminary Prospectus Supplement (such settlement being referred to as “T+3”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market are

generally required to settle in one business day, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities prior to one business day before delivery will be required, by virtue of the fact

that the Securities initially settle in T+3, to specify an alternate settlement cycle at the time of any trade to prevent a failed settlement. Purchasers of the Securities who wish to trade the Securities prior to one business day before delivery

should consult their advisors.

Hong Kong SFC Code of Conduct (Para 21 – Bookbuilding and Placing) – In the context of this offering of

the Securities, certain of the underwriters and other intermediaries are “capital market intermediaries” (“CMIs”) subject to Paragraph 21 of the Code of Conduct for Persons Licensed by or Registered with the Securities and

Futures Commission (the “SFC Code”). Certain CMIs may also be acting as “overall coordinators” (“OCs”) for this offering and are subject to additional requirements under the SFC Code.

Associated Orders and Proprietary Orders: Prospective investors who are the directors, employees or major shareholders of the issuer, a CMI or any of

its group companies will be considered under the SFC Code as having an association with the issuer, the relevant CMI or the relevant group company. Prospective investors associated with the issuer or any CMI (including any of its group companies)

should specifically disclose whether they have any such association to a CMI and the underwriters (and such CMI and the underwriters may be required to pass such information to the issuer and certain other CMIs) when placing an order for the

Securities and should disclose, at the same time, if such orders may negatively impact the price discovery process in relation to this offering. Prospective investors who do not disclose their associations are hereby deemed not to be so associated.

Where prospective investors disclose such associations but do not disclose that such order may negatively impact the price discovery process in relation to this offering, such order is hereby deemed not to negatively impact the price discovery

process in relation to this offering.

13

If a prospective investor is an asset management arm affiliated with any underwriter, such prospective

investor should indicate when placing an order if it is for a fund or portfolio where such underwriter or its group company has more than 50% interest, in which case it will be classified as a “proprietary order” and subject to appropriate

handling by CMIs in accordance with the SFC Code and should disclose, at the same time, if such “proprietary order” may negatively impact the price discovery process in relation to this offering. Prospective investors who do not indicate

this information when placing an order are hereby deemed to confirm that their order is not a “proprietary order”. If a prospective investor is otherwise affiliated with any underwriter, such that its order may be considered to be a

“proprietary order” (pursuant to the SFC Code), such prospective investor should indicate to the relevant underwriter when placing such order. Prospective investors who do not indicate this information when placing an order are hereby

deemed to confirm that their order is not a “proprietary order”. Where prospective investors disclose such information but do not disclose that such “proprietary order” may negatively impact the price discovery process in

relation to this offering, such “proprietary order” is hereby deemed not to negatively impact the price discovery process in relation to this offering.

Order Book Transparency: Prospective investors should ensure, and by placing an order prospective investors are deemed to confirm, that orders placed

are bona fide, are not inflated and do not constitute duplicated orders (i.e. two or more corresponding or identical orders placed via two or more CMIs). In addition, any other CMIs (including private banks) submitting orders with the underwriters

should disclose the identities of all investors when submitting orders for the Securities with the underwriters (except for omnibus orders where underlying investor information may need to be provided to any OCs when submitting orders). When placing

an order for the Securities, private banks should disclose, at the same time, if such order is placed other than on a “principal” basis (whereby it is deploying its own balance sheet for onward selling to investors). Private banks who do

not provide such disclosure are hereby deemed to be placing their order on such a “principal” basis. Otherwise, such order may be considered to be an omnibus order (see further below) pursuant to the SFC Code. Private banks should be aware

that placing an order on a “principal” basis may require the relevant underwriter(s) (if any) to categorise it as a proprietary order and apply the “proprietary orders” requirements of the SFC Code to such order.

In the case of omnibus orders placed with the underwriters, CMIs (including private banks) that are subject to the SFC Code should disclose underlying

investor information (name, unique identification number, whether the underlying investor has any associations (as used in the SFC Code), whether any underlying investor is a proprietary order and whether any underlying investor order is a duplicate

order) in the format and to the relevant recipients indicated to such CMIs (including private banks) by the underwriters at the relevant time. Failure to provide such information may result in that order being rejected. In sharing such underlying

investor information, which may be personal and/or confidential in nature, you (i) should take appropriate steps to safeguard the transmission of such information; (ii) are deemed to have obtained the necessary consents to disclose such

information; and (iii) are deemed to have authorised the collection, disclosure, use and transfer of such information by the underwriters, other CMIs and/or any other third parties as may be required by the SFC Code. In addition, prospective

investors should be aware that certain information may be disclosed by the underwriters and other CMIs (including private banks) which is personal and/or confidential in nature to the prospective investor. By placing an order with the underwriters,

prospective investors are deemed to have authorised the collection, disclosure, use and transfer of such information by the underwriters to the issuer, certain other CMIs, relevant regulators and/or any other third parties as may be required by the

SFC Code, it being understood and agreed that such information shall only be used in connection with this offering.

14

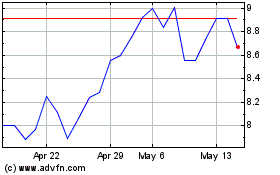

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Jan 2025 to Feb 2025

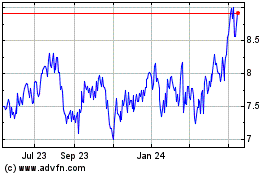

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Feb 2024 to Feb 2025