Table of Contents

The registrant is submitting

this draft offering statement for non-public review pursuant to

Rule 252(d) of Regulation

A under the Securities Act of 1933, as amended.

Preliminary Offering Circular dated

July 15, 2024

An offering statement pursuant to

Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”).

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall

not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in

which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may

elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular

was filed may be obtained.

INTERNATIONAL STAR, INC.

2,000,000,000 Units

By this Offering Circular, International Star,

Inc., a Nevada corporation (the “Company”) is offering for sale a maximum (the “Maximum Offering”) of

2,000,000,000 Units (the “Units”), at a purchase price of $0.001 USD per Unit, pursuant to Tier 1 of Regulation A

of the United States Securities and Exchange Commission (the “SEC”). Each Unit is comprised of one share of common stock,

par value $0.001 (a “Common Stock”), and one Common Share purchase warrant (each whole warrant, a “Warrant”)

to purchase one additional Common Share (a “Warrant Share”) at an exercise price of $0.001 USD per Warrant

Share, subject to certain adjustments, over a 60-month exercise period following the date of issuance of the Warrant. This offering is

being conducted on a best-efforts basis, which means that there is no minimum number of Units that must be sold by us for this offering

to close; thus, we may receive no or minimal proceeds from this offering. The minimum investment established for each investor is $50,000,

unless such minimum is waived by the Company in its sole discretion. All proceeds from this offering will become immediately available

to us and may be used as they are accepted. Purchasers of the Units will not be entitled to a refund and could lose their entire investments.

Please see the “Risk Factors” section, beginning on page 5, for a discussion of the risks associated

with a purchase of the Units.

We estimate that this offering will commence

within two days of qualification; this offering will terminate at the earliest of (a) the date on which the Maximum Offering has been

sold, or (b) the date which is one year from this offering being qualified by the SEC. (See “Plan of Distribution”).

| Title of Each Class of Securities to be Qualified |

|

Amount to be Qualified |

|

|

Price to

Public (1) |

|

|

Underwriting Discount and Commissions (2) |

|

|

Proceeds to the Company (3) |

|

| Units, each consisting of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| One Common Share and One Warrant |

|

|

2,000,000,000 |

|

|

$ |

0.001 |

|

|

$ |

0.00 |

|

|

$ |

2,000,000 |

|

| Common Shares underlying Warrants |

|

|

2,000,000,000 |

|

|

$ |

0.001 |

|

|

$ |

0.00 |

|

|

$ |

2,000,000 |

|

| Total Maximum Offering (3) |

|

|

|

|

|

$ |

4,000,000 |

|

|

$ |

0.00 |

|

|

$ |

4,000,000 |

|

| 1) |

All amounts in this chart

and circular are in U.S. dollars unless otherwise indicated. The Offering is being made directly to investors by the management of

the Company on a “best efforts” basis. Accordingly, there are no underwriting fees or commissions currently associated

with this offering; however, the Company may engage sales associates after this offering commences and we reserve the right to offer

the Units through broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”). |

| |

|

| (2) |

We may offer the Units

through registered broker-dealers and we may pay finders. Information as to any such broker-dealer or finder shall be disclosed in

an amendment to this Offering Circular. |

| |

|

| (3) |

The amounts shown are before

deducting our organization and offering costs, which include legal, accounting, printing, due diligence, marketing, selling and other

costs incurred in the Offering of the Units (See “Use of Proceeds” and “Plan of Distribution”). We expect

to incur approximately $50,000 in expenses relating to this offering. The Total Maximum Offering amounts include the aggregate

price and future aggregate potential proceeds of $2,000,000 with respect to the Warrant Shares if all 2,000,000,000 Units

are sold and all 2,000,000,000 Warrant Shares are sold upon exercise of the Warrants issued in the Offering. |

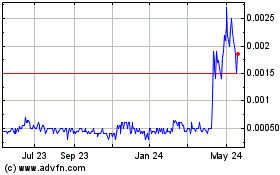

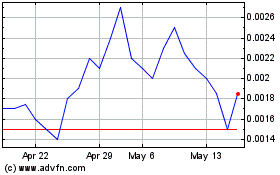

Our common stock trades under the symbol “ILST”

in the OTC Pink marketplace of OTC Link. On July 15, 2024, the closing price of our common stock was $.0014 per share.

Investing in the Units is speculative and

involves substantial risks, including the superior voting rights of our outstanding shares of Special 2021 Series A Preferred Stock,

which preclude current and future owners of our common stock, including the Units, from influencing any corporate decision. The Special

2021 Series A Preferred Stock has the following voting rights: the shares of Special 2021 Series A Preferred Stock shall vote together

with the shares of our common stock and other voting securities as a single class and represent 60% of all votes entitled to be voted

at any annual or special meeting of our shareholders. ILST Holdco LLC, a Delaware limited liability company, is the owner of all of the

outstanding shares of the Special 2021 Series A Preferred Stock. Avi Minkowitz, a Director of the Company, is the Manager of ILST Holdco

LLC, and will therefore be able to control the management and affairs of our Company, as well as matters requiring the approval by our

shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any

other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Units”).

THE SEC DOES NOT PASS UPON THE MERITS OF,

OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED IN, OR THE TERMS OF, THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS

OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION. HOWEVER,

THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this

offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment

in Units.

No sale may be made to you in this offering

if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution-State

Law Exemption” and “The Offering - Investor Suitability Standards” (page 17). Before making

any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of

Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure

format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is July

15, 2024.

TABLE OF CONTENTS

We are offering to sell,

and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the

information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information

contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless

of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale

or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this

Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities

laws.

Unless otherwise indicated,

data contained in this Offering Circular concerning the business of the Company are based on information from various public sources.

Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations

based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such

data, estimates or expectations.

In this Offering Circular,

unless the context indicates otherwise, references to “International Star, Inc.,” “we,” the “Company,”

“our,” and “us” refer to the activities of and the assets and liabilities of the business and operations

of International Star, Inc.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,”

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results

of Operations,” “Our Business” and elsewhere in this Offering Circular constitute forward-looking

statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events

or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such

as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “should,”

“will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward-looking

statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere,

identify important factors which you should consider in evaluating our forward-looking statements. The risk factors are contained under

the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

Although the forward-looking statements in this

Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to

us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor

by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be

material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise

make public statements updating our forward-looking statements.

OFFERING SUMMARY

This summary highlights selected information

contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should

consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the

risks associated with an investment in the Company discussed in the “Risk Factors” section of

this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements.

See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained in this Offering Circular. You must not rely on any unauthorized information

or representations. This Offering Circular is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in this Offering Circular is current only as of its date.

We are offering to sell, and seeking offers to

buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained

in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in

this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of

its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of

our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular.

This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Unless otherwise indicated, data contained in

this Offering Circular concerning the business of the Company are based on information from various public sources. Although we believe

that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data

involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

As used in this Offering Circular, unless the

context indicates otherwise, the terms “Company,” “we,” “our,” “us,” “ILST,”

or words of like import mean the activities of and the assets and liabilities of the business and operations of International Star, Inc.,

and its direct and indirect subsidiaries. All references in this Offering Circular to “years” and “fiscal years”

means the twelve-month period ended December 31.

This Offering Circular contains a fair summary

of the material terms of documents summarized herein. All concepts, goals, estimates and business intentions are revealed and disclosed

as such are known to management as of the date of this Offering Circular. Circumstances may change so as to alter the information presented

herein at a later date. This material will be updated by Amendment to this document and by means of press releases or other communications

to Shareholders. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company

discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision.

Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary

Statement Regarding Forward-Looking Statements.”

Industry And Market Data

Although we are responsible for all disclosure

contained in this Offering Circular, in some cases we have relied on certain market and industry data obtained from third-party sources

that we believe to be reliable. Market estimates are calculated by using independent industry publications in conjunction with our assumptions

regarding the machine vision for manufacturing industry and market. While we are not aware of any misstatements regarding any market,

industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors,

including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements”

and “Risk Factors” in this Offering Circular.

Overview of the Company

International Star Inc. has historically been focused

on mineral property interests. In June 2022, a controlling stake in International Star was acquired by ILST Holdco LLC.

On August 24, 2022, the Company entered into a transaction

to acquire Budding Equity, Inc. (the “Acquiree” or “Budding”), a Canadian company that partners with movie studios

and celebrities to monetize their intellectual property (IP) in the burgeoning global cannabis industry, using best in class manufacturers

and distributors. The Company closed on an initial interest of 6% in the common stock of Budding and secured an option to acquire the

remaining 94% within 12 months (the “Transaction”). On November 9, 2022, the Company acquired an additional 1.5% of Budding’s

common stock, bringing its total interest in the common stock of Budding to 7.5%.

On February 14, 2023, the Company completed its acquisition

of Budding (the “Acquisition”), and the Company became the sole owner of all of Budding’s outstanding shares, making

Budding the Company’s wholly-owned subsidiary. As of February 14, 2023, upon the completion of the Acquisition, the Company ceased

to be a shell company. With the Budding acquisition, the Company is now operating an established cannabis royalty business with significant

licensing agreements in place. This business generates royalty revenues from both the sale of celebrity cannabis strains (in multiple

states) as well as licensed and branded cannabis-related hardware.

Additional information on the Company can be

found within this Offering Circular.

Regulation A+

We are offering our Common Stock pursuant to

recently adopted rules of the Securities and Exchange Commission mandated under the Jumpstart Our Business Startups Act of 2012, or the

JOBS Act. These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 1”

of Regulation A+, which allows us to offer of up to $20 million in a 12-month period.

The Offering

| |

|

|

| Issuer: |

|

International Star, Inc. |

| |

|

|

| Securities Offered: |

|

A maximum of 2,000,000,000 units (the “Units”) at an offering price

of $0.001 USD per Unit, each Unit being comprised of:

·one

share of common stock, $.001 par value per shares (the “Common Shares”) of the Company; and

·one

Common Share purchase warrant (each a “Warrant”) to purchase one additional Common Share (a “Warrant Share”)

at an exercise price of $0.001 USD per share, subject to customary adjustments, over a 60-month exercise period following the date

of issuance of the Warrant, as described in the Warrant Agreement, attached hereto as Exhibit 6.1. |

| |

|

|

| Common Stock outstanding

before the Offering: |

|

1,936,364,391 shares issued

and outstanding as of the date hereof. |

| |

|

|

| Warrant Shares Offered: |

|

A maximum of 2,000,000,000

Warrant Shares at an exercise price of $0.001 USD per Warrant Share, subject to customary adjustments, over a 60-month

exercise period following the date of issuance of the Warrant, as described in the Warrant Agreement, attached hereto as Exhibit

6.1. |

| |

|

|

| Common Stock outstanding

after the Offering: |

|

5,936,364,391 shares of

Common Stock if the Maximum Offering is sold and all Warrants are exercised. |

| |

|

|

| Minimum Number of Units

to Be Sold in This Offering: |

|

None. |

| |

|

|

| Disparate Voting Rights: |

|

Our outstanding shares

of Special 2021 Series A Preferred Stock possess superior voting rights, which preclude current and future owners of our common stock,

including the Units, from influencing any corporate decision. The Special 2021 Series A Preferred Stock has the following voting

rights: the shares of Special 2021 Series A Preferred Stock shall vote together with the shares of our common stock and other voting

securities as a single class and shall represent 60% of all votes entitled to be voted at any annual or special meeting of our shareholders.

ILST Holdco LLC, a Delaware limited liability company, is the owner of all of the outstanding shares of the Special 2021 Series

A Preferred Stock. Avi Minkowitz, a Director of the Company, is the Manager of ILST Holdco LLC, and will therefore, be able to control

the management and affairs of our Company, as well as matters requiring approval by our shareholders, including the election of directors,

any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See

“Risk Factors—Risks Related to a Purchase of the Units,” “Security

Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Transactions.”) |

| |

|

|

| Investor

Suitability Standards: |

|

The Units may only be purchased

by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income

of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of

$250,000, exclusive of automobile, home and home furnishings. |

| |

|

|

| Market for Common Stock: |

|

Our common stock is quoted

in the over-the-counter market under the symbol “ILST” in the OTC Pink marketplace of OTC Link. |

| Termination of this Offering: |

|

This offering will terminate at the earliest

of (a) the date on which the Maximum Offering has been sold and (b) the date which is one year from this offering circular being

qualified by the SEC. |

| |

|

|

| Use of Proceeds: |

|

We

will use the net proceeds for working capital, and such other purposes described in the “Use

of Proceeds” section of this Offering Circular. |

| |

|

|

| Risk Factors: |

|

Investing in our Common Stock involves a high degree

of risk. See “Risk Factors.” |

| |

|

|

| Corporate Information: |

|

Our principal executive

offices are located at The Green, STE 13940, Dover, DE, 19901; our corporate website is located at www.ilstinc.com. No information

found on our company’s website is part of this Offering Circular |

Continuing Reporting Requirements Under Regulation A

As a Tier 1 issuer under Regulation A, we will

be required to update certain issuer information by electronically filing a Form 1-Z exit report with the Commission on EDGAR not later

than 30 calendar days after the termination or completion of an offering. We will not be required to file any other reports with the

SEC following this offering.

However, during the pendency of this offering

and following this offering, we intend to file quarterly and annual financial reports and, as appropriate, other supplemental reports,

with OTC Markets, which will be available at www.otcmarkets.com.

All of our future periodic reports, whether filed

with OTC Markets or the SEC, will not be required to include the same information as analogous reports required to be filed by companies

whose securities are listed on the NYSE or NASDAQ, for example.

RISK FACTORS

An investment in our Common Stock involves

a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in

this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial

condition, or results of operations could suffer. In that case, the trading price of our shares of Common Stock could decline and you

may lose all or part of your investment. See “Cautionary Statement Regarding Forward-Looking Statements”

above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.

Risks Related to Our Business

OUR ABILITY TO CONTINUE AS A GOING CONCERN

IS IN SUBSTANTIAL DOUBT ABSENT OUR OBTAINING ADEQUATE NEW DEBT OR EQUITY FINANCINGS. Our continued existence is dependent upon us

obtaining adequate working capital to fund all of our planned operations and acquisitions. Working capital limitations continue to impinge

on our day-to-day operations, thus contributing to continued operating losses. If we are unable to raise funds to fund our acquisitions

we may not be able to continue as a going concern and you would lose your investment. We have incurred accumulated operating losses since

inception and, as of December 31, 2023, we had an accumulated deficit of $8,653,481 (unaudited). If the Company is able to raise the

necessary funds to execute its business plan or if the Company earns any revenues from its business operations, some of these funds will

have to be used to pay off the outstanding debt of the Company.

Any losses in the future could cause the quoted

price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they

become due, and on our cash flows.

WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING

OPERATIONS, AND WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS OR CEASE OPERATIONS

ALTOGETHER. We need additional capital to fund our operations and we may not be able to obtain such capital, which would cause us

to limit or cease our operations entirely. The conditions of the global credit markets may adversely affect our ability to raise capital

in the future. If adequate additional financing is not available on reasonable terms or at all, we may not be able to execute our business

plans and may have to modify them accordingly or even suspend them.

Even if we do find a source of additional capital,

we may not be able to negotiate favorable terms and conditions for receiving the additional capital. Any future capital investments will

dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or debt

securities issued by us to obtain financing could have rights, preferences and privileges senior to our Common Stock. We cannot give

you any assurance that any additional financing will be available to us or, if available, will be on terms favorable to us.

LOSS OF KEY PERSONNEL CRITICAL FOR MANAGEMENT

DECISIONS WOULD HAVE AN ADVERSE IMPACT ON OUR BUSINESS. Our success depends upon the continued contributions of our executive officers

and/or key employees, particularly with respect to providing the critical management decisions and contacts necessary to manage acquisitions,

product development, marketing, and growth within our industry. Competition for qualified personnel can be intense and there are a limited

number of people with the requisite knowledge and experience. Under these conditions, we could be unable to attract and retain these

personnel. The loss of the services of any of our executive officers or other key employees for any reason could have a material adverse

effect on our business, operating results, financial condition, and cash flows.

UNPREDICTABLE EVENTS, SUCH AS THE COVID-19

OUTBREAK, AND ASSOCIATED BUSINESS DISRUPTIONS COULD SERIOUSLY HARM OUR FUTURE REVENUES AND FINANCIAL CONDITION, DELAY OUR OPERATIONS,

INCREASE OUR COSTS AND EXPENSES, AND AFFECT OUR ABILITY TO RAISE CAPITAL. Unpredictable events, such as extreme weather conditions,

acts of God and medical epidemics such as the COVID-19 outbreak, and other natural or manmade disasters or business interruptions may

cause damage or disruption to our operations, international commerce and the global economy, and thus could have a strong negative effect

on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond

our control. In December 2019, a novel strain of coronavirus, COVID-19, was reported in Wuhan, China. The World Health Organization

has since declared the outbreak to constitute a pandemic. The extent of the impact of COVID-19 on our operational and financial performance

will depend on certain developments, including the duration and spread of the outbreak, impact on our customers and our sales cycles,

impact on our customer, employee or industry events, and effect on our vendors, all of which are uncertain and cannot be predicted.

At this point, the extent to which COVID-19 may

impact our financial condition or results of operations is uncertain. Additionally, COVID-19 has caused significant disruptions to the

global financial markets, which could impact our ability to raise additional capital. There is also a risk that other countries or regions

may be less effective at containing COVID-19, or it may be more difficult to contain if the outbreak reaches a larger population or broader

geography, in which case the risks described herein could be elevated significantly.

Risks Related to Our Acquisition of Budding Equity, Inc.

On

February 14, 2023, the Company completed its acquisition of Budding (the “Acquisition”),

and the Company became the sole owner of all of Budding’s outstanding shares, making

Budding the Company’s wholly-owned subsidiary. As of February 14, 2023, upon the completion

of the Acquisition, the Company ceased to be a shell company. With the Budding acquisition,

the Company is now operating an established cannabis royalty business with significant licensing

agreements in place.

Budding currently generates royalties via sales

in two segments: royalty revenue generated from celebrity cannabis strains (the “Cannabis Segment”) that are sold across

various states, and royalty revenue generated by sales of licensed and branded hardware (the “Hardware Segment”).

The following risk factors relate to our wholly owned subsidiary, Budding

Equity, Inc.

DUE TO OUR INVOLVEMENT IN THE CANNABIS INDUSTRY,

WE MAY HAVE A DIFFICULT TIME OBTAINING THE VARIOUS INSURANCES THAT ARE DESIRED TO OPERATE OUR BUSINESS, WHICH MAY EXPOSE US TO ADDITIONAL

RISK AND FINANCIAL LIABILITIES. Insurance that is otherwise readily available, such as workers' compensation, general liability,

and directors and officer's insurance, is more difficult for us to find and more expensive, because we are a service provider to companies

in the cannabis industry. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be

affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may

inhibit our growth, and may expose us to additional risk and financial liabilities. We do not carry general liability insurance. Because

we may be limited in the types of insurance coverage we can obtain, if we are made a party of a legal action, we may not have sufficient

funds to defend the litigation. If that occurs a judgment could be rendered against us that could cause us to cease operations or result

in other negative material impacts to our business.

UNFAVORABLE PUBLICITY OR CONSUMER PERCEPTION

OF BUDDING’S PRODUCTS OR ANY SIMILAR PRODUCTS DISTRIBUTED BY OTHER COMPANIES COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS

AND FINANCIAL CONDITION. We believe Budding’s product sales will be highly dependent on consumer perception of the safety,

quality and efficacy of the products as well as similar or other products distributed and sold by other companies. Consumer perception

of the products can be significantly influenced by scientific research or findings, regulatory investigations, litigation, national media

attention, and other publicity including publicity regarding the legality, safety or quality of particular ingredients or products and

cannabis markets in general. From time to time, there is unfavorable publicity, scientific research or findings, litigation, regulatory

proceedings and other media attention regarding our industry. There can be no assurance that future publicity, scientific research or

findings, litigation, regulatory proceedings, or media attention will be favorable to the cannabis markets or any particular product

or ingredient, or consistent with earlier publicity, scientific research or findings, litigation, regulatory proceedings or media attention.

Adverse publicity, scientific research or findings, litigation, regulatory proceedings or media attention, whether or not accurate, could

have a material adverse effect on our business and financial condition. In addition, adverse publicity, reports or other media attention

regarding the safety, quality, or efficacy of our products or ingredients of cannabis products in general, or associating the use of

our products or ingredients in general with illness or other adverse effects, whether or not scientifically supported or accurate, could

have a material adverse effect on our business and financial condition.

LAWS AND REGULATIONS AFFECTING THE REGULATED

INDUSTRIAL HEMP INDUSTRY ARE IN A CONSTANT STATE OF FLUX, WHICH COULD NEGATIVELY AFFECT OUR BUSINESS, AND WE CANNOT PREDICT THE IMPACT

THAT FUTURE REGULATIONS MAY HAVE ON US. Local, state and federal industrial hemp laws and regulations are broad in scope and subject

to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter our business. In addition,

violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our

business operations. In addition, it is likely that regulations may be enacted in the future that will be directly applicable to our

Cannabis related businesses. We are unable to predict the nature of any future laws, regulations, interpretations or applications, nor

are we able to determine the effect any such additional governmental regulations or administrative policies and procedures, when and

if promulgated, could have on our Cannabis related business.

Because Budding operates in the Cannabis industry,

it is possible that, in the future, we may have difficulty accessing the service of banks. Budding operates in the Cannabis industry

and this could cause us to have difficulty securing services from banks, in the future.

If our trademarks and other proprietary rights

are not adequately protected to prevent use or appropriation by competitors, the value of our brands may be diminished, and our business

adversely affected. We rely, and expect to continue to rely, on a combination of confidentiality and license agreements with employees,

consultants and third parties with whom we have relationships, as well as trademark protection laws, to protect our proprietary rights.

If the protection of our intellectual property rights is inadequate to prevent use or misappropriation by third parties, the value of

our brands may be diminished, and the perception of our products may become confused in the marketplace. In such circumstance, our business

could be adversely affected.

We could be subject to product liability claims.

The sale of our products involves, and will involve, the risk of injury to customers and others. There can be no assurance that the

use or consumption of any of one of our products will not cause a health-related illness or that it will not be subject to claims or

lawsuits relating to such matters. Any claims or liabilities might not be covered by our insurance. Thus, there is no assurance that

we would not incur claims or liabilities for which we are not insured or that exceed the amount of our insurance coverage, resulting

in cash outlays that could, if significant enough in nature, materially and adversely affect our results of operations and financial

condition.

Risks Related to Compliance and Regulation

WE WILL NOT HAVE REPORTING OBLIGATIONS UNDER

SECTIONS 14 OR 16 OF THE SECURITIES EXCHANGE ACT OF 1934; NOR WILL ANY SHAREHOLDERS BE SUBJECT TO REPORTING REQUIREMENTS OF REGULATION

13D, 13G OR REGULATION 14D. So long as our common shares are not registered under the Exchange Act, our directors and executive officers

and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange Act. Section

16(a) of the Exchange Act requires executive officers and directors and persons who beneficially own more than 10% of a registered class

of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports

concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our

directors, executive officers and beneficial holders will only be available, if at all, through periodic reports we file with OTC Markets.

Our common stock is not registered under the

Exchange Act and we do not intend to register our common stock under the Exchange Act for the foreseeable future; provided, however,

that we will register our common stock under the Exchange Act if we have, after the last day of any fiscal year, more than either (1)

2,000 persons; or (2) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act.

Further, as long as our common stock is not registered

under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that

have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders

and filing with the SEC a proxy statement and form of proxy complying with the proxy rules.

The reporting required by Section 14(d) of the

Exchange Act provides information to the public about persons other than the company who is making the tender offer. A tender offer is

a broad solicitation by a company or a third party to purchase a substantial percentage of a company’s common stock for a limited

period of time. This offer is for a fixed price, usually at a premium over the current market price, and is customarily contingent on

shareholders tendering a fixed number of their shares.

In addition, as long as our common stock is not

registered under the Exchange Act, our company will not be subject to the reporting requirements of Regulation 13D and Regulation 13G,

which require the disclosure of any person who, after acquiring directly or indirectly the beneficial ownership of any equity securities

of a class, becomes, directly or indirectly, the beneficial owner of more than 5% of the class.

THERE MAY BE DEFICIENCIES WITH OUR INTERNAL

CONTROLS THAT REQUIRE IMPROVEMENTS. Our company is not required to provide a report on the effectiveness of our internal controls

over financial reporting. We are in the process of evaluating whether our internal control procedures are effective and, therefore, there

is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared to issuers that

have conducted such independent evaluations.

Risks Related to Our Organization and Structure

AS A NON-LISTED COMPANY CONDUCTING AN EXEMPT

OFFERING PURSUANT TO REGULATION A, WE ARE NOT SUBJECT TO A NUMBER OF CORPORATE GOVERNANCE REQUIREMENTS, INCLUDING THE REQUIREMENTS FOR

INDEPENDENT BOARD MEMBERS. As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject to

a number of corporate governance requirements that an issuer conducting an offering on Form S-1 or listing on a national stock exchange

would be. Accordingly, we are not required to have (a) a board of directors of which a majority consists of independent directors under

the listing standards of a national stock exchange, (b) an audit committee composed entirely of independent directors and a written audit

committee charter meeting a national stock exchange’s requirements, (c) a nominating/corporate governance committee composed entirely

of independent directors and a written nominating/ corporate governance committee charter meeting a national stock exchange’s requirements,

(d) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements

of a national stock exchange, and (e) independent audits of our internal controls. Accordingly, you may not have the same protections

afforded to shareholders of companies that are subject to all of the corporate governance requirements of a national stock exchange.

OUR HOLDING COMPANY STRUCTURE MAKES US DEPENDENT

ON OUR SUBSIDIARIES FOR OUR CASH FLOW AND COULD SERVE TO SUBORDINATE THE RIGHTS OF OUR SHAREHOLDERS TO THE RIGHTS OF CREDITORS OF OUR

SUBSIDIARIES, IN THE EVENT OF AN INSOLVENCY OR LIQUIDATION OF ANY SUCH SUBSIDIARY. Our company acts as a holding company and, accordingly,

substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct legal entities.

As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the

distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide our company

with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our

shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full

from the sale or other disposal of the assets of those subsidiaries before our company, as a shareholder, would be entitled to receive

any distribution from that sale or disposal.

Risks Related to a Purchase

of the Units

THE OFFERING PRICE OF THE UNITS WAS ARBITRARILY

DETERMINED, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SHARES. THEREFORE, THE OFFERING PRICE

BEARS NO RELATIONSHIP TO THE ACTUAL VALUE OF THE COMPANY, AND MAY MAKE OUR SHARES DIFFICULT TO SELL. The terms of this offering were

determined arbitrarily by us. The offering price for the Units does not necessarily bear any relationship to our company’s assets,

book value, earnings or other established criteria of valuation. Accordingly, the offering price of the Units should not be considered

as an indication of any intrinsic value of such securities. (See “Dilution.”)

THERE MAY BE LITTLE TO NO VOLUME IN THE TRADING

OF OUR COMMON STOCK. There can no assurance that our Common Stock shares will maintain a sufficient trading market sufficient for

the shares in this offering. If no active trading market for our Common Stock is sustained following this Offering, you may be unable

to sell your shares when you wish to sell them or at a price that you consider attractive or satisfactory. The lack of an active market

may also adversely affect our ability to raise capital by selling securities in the future or impair our ability to license or acquire

other product candidates, businesses, or technologies using our shares as consideration.

OUR STOCK PRICE MAY BE VOLATILE, AND YOU MAY

NOT BE ABLE TO SELL YOUR SHARES FOR MORE THAN WHAT YOU PAID OR AT ALL. Our stock price may be subject to significant volatility,

and you may not be able to sell shares of Common Stock at or above the price you paid for them or at all. The market for low priced securities

is generally less liquid and more volatile than securities traded on national stock markets. Wide fluctuations in market prices are not

uncommon. No assurance can be given that the market for our common stock will continue. The price of our common stock may be subject

to wide fluctuations in response to factors such as the following, some of which are beyond our control:

| · | quarterly

variations in our operating results; |

| · | operating

results that vary from the expectations of investors; |

| · | changes

in expectations as to our future financial performance, including financial estimates by

investors; |

| · | reaction

to our periodic filings, or presentations by executives at investor and industry conferences; |

| · | changes

in our capital structure; |

| · | announcements

of innovations or new services by us or our competitors; |

| · | announcements

by us or our competitors of significant contracts, acquisitions, strategic partnerships,

joint ventures or capital commitments; |

| · | lack

of success in the expansion of our business operations; |

| · | announcements

by third parties of significant claims or proceedings against our company or adverse developments

in pending proceedings; |

| · | additions

or departures of key personnel; |

| · | asset

impairment; |

| · | temporary

or permanent inability to operate our retail location(s); and |

| · | rumors

or public speculation about any of the above factors. |

Further, price and volume fluctuations result

in volatility in the price of our common stock, which could cause a decline in the value of our Common Stock. Price volatility of our

common stock might worsen if the trading volume of our Common Stock is low. The realization of any of the above risks or any of a broad

range of other risks, including those described in these “Risk Factors,” could have a dramatic and material adverse impact

on the market price of our Common Stock.

YOU MAY NEVER REALIZE ANY

ECONOMIC BENEFIT FROM A PURCHASE OF THE UNITS. Because our common stock is volatile and thinly traded, there is no assurance that

you will ever realize any economic benefit from your purchase of the Units.

OUR SHARES OF COMMON STOCK ARE PENNY STOCK,

WHICH MAY IMPAIR TRADING LIQUIDITY. Disclosure requirements pertaining to penny stocks may reduce the level of trading activity in

the market for our common stock and investors may find it difficult to sell their shares. Trades of our common stock will be subject

to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject to the rule to persons

other than established customers and accredited investors. For transactions covered by the rule, broker-dealers must make a special suitability

determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale.

The SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally

are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted

on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by

the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt

from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level

of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny

stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market

value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation

information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer

in writing before or with the customer’s confirmation.

THE MARKET FOR PENNY STOCKS HAS SUFFERED IN

RECENT YEARS FROM PATTERNS OF FRAUD AND ABUSE. Stockholders should be aware that, according to SEC Release No. 34-29093, the market

for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| · | control

of the market for the security by one or a few broker-dealers that are often related to the

promoter or issuer; |

| · | manipulation

of prices through prearranged matching of purchases and sales and false and misleading press

releases; |

| · | boiler

room practices involving high-pressure sales tactics and unrealistic price projections by

inexperienced salespersons; |

| · | excessive

and undisclosed bid-ask differential and markups by selling broker-dealers; and |

| · | the

wholesale dumping of the same securities by promoters and broker-dealers after prices have

been manipulated to a desired level, along with the resulting inevitable collapse of those

prices and with consequential investor losses. |

AS AN ISSUER OF PENNY STOCK, THE PROTECTION

PROVIDED BY THE FEDERAL SECURITIES LAWS RELATING TO FORWARD LOOKING STATEMENTS DOES NOT APPLY TO US. Although federal securities

laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws,

this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection

in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was

misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

Such an action could hurt our financial condition.

OUR SECURITIES ARE CURRENTLY TRADED ON THE

OTCMARKETS®, WHICH MAY NOT PROVIDE AS MUCH LIQUIDITY FOR OUR INVESTORS AS MORE RECOGNIZED SENIOR EXCHANGES SUCH AS THE NASDAQ STOCK

MARKET OR OTHER NATIONAL OR REGIONAL EXCHANGES. Our Common Stock is currently listed on the OTCMarkets®, with a trading symbol

of ILST. The OTC Markets are inter-dealer, over-the-counter markets that provide significantly less liquidity than the NASDAQ Stock Market

or other national or regional exchanges. Securities traded on the OTC Markets are usually thinly traded, highly volatile, have fewer

market makers and are not followed by analysts. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not

apply to securities quoted on the OTC Markets. Quotes for stocks included on the OTC Markets are not listed in newspapers. Therefore,

prices for securities traded solely on the OTC Markets may be difficult to obtain and holders of our securities may be unable to resell

their securities at or near their original acquisition price, or at any price.

FINANCIAL INDUSTRY REGULATORY AUTHORITY (“FINRA”)

SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT A STOCKHOLDER’S ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE

OF OUR COMMON STOCK. FINRA has adopted rules that require a broker-dealer to have reasonable grounds for believing that the investment

is suitable for that customer before recommending an investment to a customer. Prior to recommending speculative low-priced securities

to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial

status, tax status, investment objectives, and other information. Under interpretations of these rules, FINRA believes that there is

a high probability that speculative low-priced securities will not be suitable for at least some customers. Thus, the FINRA requirements

make it more difficult for broker-dealers to recommend that their customers buy our Common Stock, which may limit your ability to buy

and sell our shares of Common Stock, have an adverse effect on the market for our shares of Common Stock, and thereby depress our price

per share of Common Stock.

BECAUSE DIRECTORS AND OFFICERS CURRENTLY AND

FOR THE FORESEEABLE FUTURE WILL CONTINUE TO CONTROL ILST, IT IS NOT LIKELY THAT YOU WILL BE ABLE TO ELECT DIRECTORS OR HAVE ANY SAY IN

THE POLICIES OF ILST. Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and

all other matters requiring shareholder approval will be decided by majority vote. ILST Holdco LLC, owns all of the outstanding shares

of our Special 2021 Series A Preferred Stock. ILST Holdco LLC is managed by a director of the Company. The Special 2021 Series A Preferred

Stock has the following voting rights: the shares of Special 2021 Series A Preferred Stock shall vote together with the shares of our

common stock and other voting securities as a single class and shall represent 60% of all votes entitled to be voted at any annual or

special meeting of our shareholders. Therefore, ILST Holdco LLC will be able to control the management and affairs of our company, as

well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of

all or substantially all of our assets, and any other significant corporate transaction. (See “Security Ownership

of Certain Beneficial Owners and Management”).

A SIGNIFICANT NUMBER OF OUR SHARES WILL BE

ELIGIBLE FOR SALE AND THEIR SALE OR POTENTIAL SALE MAY CAUSE THE PRICE OF OUR COMMON STOCK TO DECLINE. As additional shares of our

Common Stock become available for resale in the public market pursuant to this offering, and otherwise, the supply of our Common Stock

will increase, which could decrease its price. If our stockholders sell, or the market perceives that our stockholders intend to sell

for various reasons, substantial amounts of our Common Stock in the public market, including shares issued in connection with the exercise

of outstanding options or warrants, the market price of our Common Stock could fall. Sales of a substantial number of shares of our Common

Stock may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable

or appropriate.

FUTURE SALES OF OUR COMMON STOCK, OR THE PERCEPTION

IN THE PUBLIC MARKETS THAT THESE SALES MAY OCCUR, COULD REDUCE THE MARKET PRICE OF OUR COMMON STOCK. In general, our officers and

directors and major shareholders, as affiliates, under Rule 144 may not sell more than one percent of the total issued and outstanding

shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The availability

for sale of substantial amounts of our common stock under Rule 144 or otherwise could reduce prevailing market prices for our common

stock.

AN INVESTMENT IN THE COMPANY’S COMMON

STOCK IS EXTREMELY SPECULATIVE AND THERE CAN BE NO ASSURANCE OF ANY RETURN ON ANY SUCH INVESTMENT. Our Common Stock is currently

quoted on the OTC Pink Tier 1 maintained by OTC Markets Group, Inc. under the symbol “ILST”; however, an investment in the

Company’s Common Stock is extremely speculative and there is no assurance that investors will obtain any return on their investment.

Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The market price of our Common Stock is subject to significant fluctuations in response to variations in our quarterly operating results,

general trends in the market and other factors, many of which we have little or no control over. In addition, broad market fluctuations,

as well as general economic, business and political conditions, may adversely affect the market for our Common Stock, regardless of our

actual or projected performance.

WE MAY NOT BE ABLE TO MAINTAIN A LISTING OF

OUR COMMON STOCK. To maintain our listing on the OTCPNK exchange, we must meet certain financial and liquidity criteria to maintain

such listing. If we violate the maintenance requirements for continued listing of our Common Stock, our Common Stock may be delisted.

In addition, our board may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits

of such listing. A delisting of our Common Stock from the OTCPNK Market may materially impair our stockholders’ ability to buy

and sell our Common Stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our

Common Stock. In addition, in order to maintain our listing, we will be required to, among other things, file our regular quarterly reports

on otcmarkets.com. The post-qualification amendment of the Offering Statement is subject to review by the SEC, and there is no guarantee

that such amendment will be qualified promptly after filing. Any delay in the qualification of the post-qualification amendment may cause

a delay in the trading of offering Shares. For all of the foregoing reasons, you may experience a delay between the closing of your purchase

of shares of our Common Stock and the commencement of exchange trading of our Common Stock. In addition, the delisting of our Common

Stock could significantly impair our ability to raise capital.

WE DO NOT EXPECT TO DECLARE OR PAY DIVIDENDS

IN THE FORESEEABLE FUTURE. We do not expect to declare or pay dividends in the foreseeable future, as we anticipate that we will

invest future earnings in the development and growth of our business. Therefore, holders of our Common Stock will not receive any return

on their investment unless they sell their securities, and holders may be unable to sell their securities on favorable terms or at all.

OUR FAILURE TO MAINTAIN EFFECTIVE INTERNAL

CONTROLS OVER FINANCIAL REPORTING COULD HAVE AN ADVERSE IMPACT ON US. We are required to establish and maintain appropriate internal

controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely

impact our public disclosures regarding our business, financial condition or results of operations. In addition, management’s assessment

of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls

over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that

need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls

over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment

of our internal controls over financial reporting may have an adverse impact on the price of our Common Stock.

MANAGEMENT DISCRETION AS TO THE ACTUAL USE

OF THE PROCEEDS DERIVED FROM THIS OFFERING. The net proceeds from this Offering will be used for the purposes described under “Use

of Proceeds.” However, we reserve the right to use the funds obtained from this Offering for other similar purposes not presently

contemplated which we deem to be in the best interests of the Company and our shareholders in order to address changed circumstances

or opportunities. As a result of the foregoing, our success will be substantially dependent upon the discretion and judgment of the Board

of Directors with respect to application and allocation of the net proceeds of this Offering. Investors who purchase our Common Stock

will be entrusting their funds to our Board of Directors, upon whose judgment and discretion the investors must depend.

GENERAL SECURITIES INVESTMENT RISKS. All

investments in securities involve the risk of loss of capital. No guarantee or representation is made that an investor will receive a

return of its capital. The value of our Common Stock can be adversely affected by a variety of factors, including development problems,

regulatory issues, technical issues, commercial challenges, competition, legislation, government intervention, industry developments

and trends, and general business and economic conditions.

MULTIPLE SECURITIES OFFERINGS AND POTENTIAL

FOR INTEGRATION OF OUR OFFERINGS. We are currently and will in the future be involved in one or more additional offers of our securities

in other unrelated securities offerings. Any two or more securities offerings undertaken by us could be found by the SEC, or a state

securities regulator, agency, to be “integrated” and therefore constitute a single offering of securities, which finding

could lead to a disallowance of certain exemptions from registration for the sale of our securities in such other securities offerings.

Such a finding could result in disallowance of one or more of our exemptions from registration, which could give rise to various legal

actions on behalf of a federal or state regulatory agency and the Company.

THE OFFERING IS NOT REVIEWED BY INDEPENDENT

PROFESSIONALS. We have not retained any independent professionals to review or comment on this Offering or otherwise protect the

interest of the investors hereunder. Although we have retained our own counsel, neither such counsel nor any other counsel has made,

on behalf of the investors, any independent examination of any factual matters represented by management herein. Therefore, for purposes

of making a decision to purchase our Common Stock, you should not rely on our counsel with respect to any matters herein described. Prospective

investors are strongly urged to rely on the advice of their own legal counsel and advisors in making a determination to purchase our

Common Stock.

WE CANNOT GUARANTEE THAT WE WILL SELL ANY

SPECIFIC NUMBER OF COMMON SHARES IN THIS OFFERING. There is no minimum offering and no commitment by anyone to purchase all or any

part of the Units offered hereby and, consequently, we can give no assurance that all of the Units shares in this Offering will be sold.

Additionally, there is no underwriter for this Offering; therefore, you will not have the benefit of an underwriter’s due diligence

efforts that would typically include the underwriter being involved in the preparation of this Offering Circular and the pricing of our

Units offered hereunder. Therefore, there can be no assurance that this Offering will be successful or that we will raise enough capital

from this Offering to further our development and business activities in a meaningful manner. Finally, prospective investors should be

aware that we reserve the right to withdraw, cancel, or modify this Offering at any time without notice, to reject any subscription in

whole or in part, or to allot to any prospective purchaser fewer Units than the number for which he or she subscribed.

INVESTORS WILL EXPERIENCE IMMEDIATE AND SUBSTANTIAL

DILUTION IN THE BOOK VALUE OF THEIR INVESTMENT, AND WILL EXPERIENCE ADDITIONAL DILUTION IN THE FUTURE. If you purchase our Common

Stock in this Offering, you will experience immediate and substantial dilution because the price you pay will be substantially greater

than the net tangible book value per share of the shares you acquire. Since we will require funds in addition to the proceeds of this

Offering to conduct our planned business, we will raise such additional funds, to the extent not generated internally from operations,

by issuing additional equity and/or debt securities, resulting in further dilution to our existing stockholders (including purchasers

of our Common Stock in this Offering).

WE MAY BE UNABLE TO MEET OUR CURRENT AND FUTURE

CAPITAL REQUIREMENTS FROM CAPITAL RAISED BY THIS OFFERING. Our capital requirements depend on numerous factors, including but not

limited to the rate and success of our development efforts, marketing efforts, market acceptance of our products and services and other

related services, our ability to establish and maintain our agreements with the services currently operating, our ability to maintain

and expand our user base, the rate of expansion of our user community, the level of resources required to develop and operate our products

and services, information systems and research and development activities, the availability of software and services provided by third-party

vendors and other factors. The capital requirements relating to further acquisitions and the continued and expanding operations of our

business segments will be significant. We cannot accurately predict the timing and amount of such capital requirements. However, we are

dependent on the proceeds of this Offering as well as additional financing that will be required in order to operate our business segments

and execute on our business plans. However, in the event that our plans change, our assumptions change or prove to be inaccurate, or

if the proceeds of this Offering prove to be insufficient to operate our business segments, we would be required to seek additional financing

sooner than currently anticipated. There can be no assurance that any such financing will be available to us on commercially reasonable

terms, or at all. Furthermore, any additional equity financing may dilute the equity interests of our existing shareholders (including

those purchasing shares pursuant to this Offering), and debt financing, if available, may involve restrictive covenants with respect

to dividends, raising future capital and other financial and operational matters. If we are unable to obtain additional financing as

and when needed, we may be required to reduce the scope of our operations or our anticipated business plans, which could have a material

adverse effect on our business, operating results and financial condition.

THE PREPARATION OF OUR FINANCIAL STATEMENTS

INVOLVES THE USE OF ESTIMATES, JUDGEMENTS AND ASSUMPTIONS, AND OUR FINANCIAL STATEMENTS MAY BE MATERIALLY AFFECTED IF SUCH ESTIMATES,

JUDGEMENTS OR ASSUMPTIONS PROVE TO BE INACCURATE. Financial statements prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”) typically require the use of estimates, judgments and assumptions that

affect the reported amounts. Often, different estimates, judgments and assumptions could reasonably be used that would have a material

effect on such financial statements, and changes in these estimates, judgments and assumptions may occur from period to period over time.

These estimates, judgments and assumptions are inherently uncertain and, if our estimates were to prove to be wrong, we would face the

risk that charges to income or other financial statement changes or adjustments would be required. Any such charges or changes could

harm our business, including our financial condition and results of operations and the price of our securities. See “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of the accounting estimates, judgments

and assumptions that we believe are the most critical to an understanding of our consolidated financial statements and our business.

IF SECURITIES INDUSTRY ANALYSTS DO NOT PUBLISH

RESEARCH REPORTS ON US, OR PUBLISH UNFAVORABLE REPORTS ON US, THEN THE MARKET PRICE AND MARKET TRADING VOLUME OF OUR COMMON STOCK COULD

BE NEGATIVELY AFFECTED. Any trading market for our Common Stock will be influenced in part by any research reports that securities

industry analysts publish about us. We do not currently have and may never obtain research coverage by securities industry analysts.

If no securities industry analysts commence coverage of us, the market price and market trading volume of our Common Stock could be negatively

affected. In the event we are covered by analysts, and one or more of such analysts downgrade our securities, or otherwise reports on

us unfavorably, or discontinues coverage or us, the market price and market trading volume of our Common Stock could be negatively affected.

OUR MANAGEMENT HAS BROAD DISCRETION AS TO

THE USE OF CERTAIN OF THE NET PROCEEDS FROM THIS OFFERING. We intend to use a significant portion of the net proceeds from this Offering

(if we sell all of the shares being offered) for working capital and other general corporate purposes. However, we cannot specify with

certainty the particular uses of such proceeds. Our management will have broad discretion in the application of the net proceeds designated

for use as working capital or for other general corporate purposes. Accordingly, you will have to rely upon the judgment of our management

with respect to the use of these proceeds. Our management may spend a portion or all of the net proceeds from this Offering in ways that

holders of our Common Stock may not desire or that may not yield a significant return or any return at all. The failure by our management

to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from this offering in

a manner that does not produce income or that loses value. Please see “Use of Proceeds” below for more

information.

The foregoing risk factors are not to be

considered a definitive list of all the risks associated with an investment in our Offered Units. This Offering Circular contains forward-looking

statements that are based on our current expectations, assumptions, estimates, and projections about our business, our industry, and

the industry of our clients. When used in this Offering Circular, the words “expects,” anticipates,” “estimates,”

“intends,” “believes” and similar expressions are intended to identify forward-looking statements. These forward-looking

statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. The cautionary

statements made in this Offering Circular should be read as being applicable to all related forward-looking statements wherever they

appear in this Offering Circular.

DILUTION

If you purchase Units in this offering, your

ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged

for each share in this offering and the net tangible book value per share of our Common Stock after this offering.

Our historical net book value (deficit) as of

December 31, 2023, is ($0.00) per then-outstanding share of our Common Stock. Historical net tangible book value per share equals

the amount of our total tangible assets, less total liabilities, divided by the total number of shares of our Common Stock outstanding,

all as of the date specified.

The following table illustrates the per share

dilution to new investors discussed above, assuming the sale of, respectively, 100%, 75%, 50% and 25% of the shares offered for sale

in this offering:

| Percentage of shares offered that are sold |

|

|

25% |

|

|

|

50% |

|

|

|

75% |

|

|

|

100% |

|

| Price to the public charged for each share in this offering |

|

$ |

0.001 |

|

|

$ |

0.001 |

|

|

$ |

0.001 |

|

|

$ |

0.001 |

|

| Net tangible book value per share as of December 31,

2023 (1) |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

| Increase (Decrease) in net tangible book value per share attributable to new investors in this offering |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

| Net tangible book value per share, after this offering |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

| Dilution per share to new investors |

|

$ |

0.001 |

|

|

$ |

0.001 |

|

|

$ |

0.001 |

|

|

$ |

0.001 |

|

———————

| (1) |

Based on Total

Equity (deficit) as of December 31, 2023, of ($1,242,332) and 1,936,364,391 outstanding shares of Common Stock. |

PLAN OF DISTRIBUTION

The shares are being offered by us on a “best-efforts”

basis by our officers, directors, and employees, and possibly with the assistance of independent consultants, and finders. As of the

date of this Offering Circular, unless otherwise permitted by applicable law, we do not intend to accept subscriptions from investors

in this Offering who reside in certain states, unless and until the Company has complied with each such states’ registration and/or

qualification requirements.

There is no aggregate minimum to be raised for

the Offering to become effective and therefore the Offering will be conducted on a “rolling basis.” This means we

will be entitled to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, offering

expenses, reimbursements, and other uses as more specifically set forth in the “Use of Proceeds”

contained elsewhere in this Offering Circular.

We may pay finder’s fees to persons who

refer investors to us. We may also pay consulting fees to consultants who assist us with the Offering, based on invoices submitted by

them for advisory services rendered. Consulting compensation, and finder’s fees may be paid in cash, Common Stock, or warrants

to purchase our Common Stock. We may also issue shares and grant stock options or warrants to purchase our Common Stock to finders and

consultants and reimburse them for due diligence and marketing costs on an accountable or non-accountable basis.

We have not entered selling agreements with any

broker-dealers to date, though we may engage a FINRA registered broker-dealer firm for offering administrative services. Participating

broker-dealers, if any, and others may be indemnified by us with respect to this offering and the disclosures made in this Offering Circular.

Offering Period and Expiration Date

Our series offerings are conducted as a continuous

offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of a particular series is continuous, active sales

of series interests may happen sporadically over the term of the offering. The term of each series offering will commence within two

calendar days after the qualification date of the offering statement of which this offering circular is a part. This offering will terminate

at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being

qualified by the SEC.

Procedures for Subscribing

If you decide to subscribe for our Common Stock

shares in this Offering, you should:

| |

1. |

Electronically receive,

review, execute, and deliver to us a subscription agreement; and |

| |

2. |

Deliver funds directly

by wire or electronic funds transfer via ACH to the Company’s bank account designated in the Company’s subscription agreement. |

Any potential investor will have ample time to

review the subscription agreement, along with their counsel, prior to making any final investment decision. We shall only deliver such

subscription agreement upon request after a potential investor has had ample opportunity to review this Offering Circular.

Minimum Purchase Requirements

The minimum investment amount is fifty thousand

Dollars ($50,000.00).

Right to Reject Subscriptions

After we receive your complete, executed subscription

agreement and the funds required under the subscription agreement have been transferred to our designated account, we have the right

to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from

rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions

Upon our acceptance of a subscription agreement,

we will countersign the subscription agreement and issue the shares subscribed at closing. Once you submit the subscription agreement