UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

|

|

[ ]

|

Preliminary Information Statement

|

|

|

[ ]

|

Confidential, for Use of Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

[X]

|

Definitive Information Statement

|

THEGLOBE.COM,

INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate

box):

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

[ ]

|

Fee paid previously with preliminary materials:

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or

the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement no.:

|

NOTICE OF ACTION BY WRITTEN CONSENT

Dear Stockholders:

This information statement is being furnished to the stockholders of theglobe.com, inc., a Delaware corporation (“Company,” “we” or “us”), as of the close of business on July 9, 2019 (the “Record Date”). The purpose of this information statement is to inform our stockholders that, on June 28, 2019, we received a written consent in lieu of a meeting of stockholders (the “Written Consent”) from Delfin Midstream, Inc., the holder of a majority of our voting stock as of the Record Date, to re-elect Frederick Jones, our current director, to serve until the next Annual Meeting of Stockholders and until his successor is elected and qualified. The corporate action described herein will be effective forty (40) days after this information statement is made publicly available,

or August 21, 2019.

Under Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) and pursuant to our By-Laws, any action required or permitted by the DGCL to be taken at an annual or special meeting of stockholders of a Delaware corporation may be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Prompt notice of the approval of the action must be given to those stockholders who have not consented in writing to the action and who, if the action had been taken at a meeting, would otherwise have been entitled to notice of the meeting.

Important Notice Regarding the Availability of Information Statement Materials and the Form 10-K

This Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The entire cost of furnishing this Information Statement will be borne by the Company.

Our Annual Report for the year ended December 31, 2018 on Form 10-K (the “Form 10-K”) was made available on the Internet to stockholders on March 29, 2019. The Form 10-K is not to be regarded as proxy soliciting material or as a communication by means of which any solicitation of proxies is to be made.

We

mailed a Notice of Internet Availability containing instructions on how to access our Information Statement and Annual Report

on Form 10-K for the fiscal year ended December 31, 2018 on or about July 12, 2019. Such materials are available at https://www.astproxyportal.com/ast/TGLO.

If

you want to receive a paper or e-mail copy of these documents, you must request one. There is no charge to you for

requesting a paper or e-mail copy. Please make your request for a copy by one of the following methods on or before August

16, 2019 to facilitate timely delivery.

|

-

|

E-mail to f.jones@iegag.com

|

|

-

|

Mail to theglobe.com, inc., 5949 Sherry Lane, Suite 950, Dallas, Texas 75225; or

|

|

-

|

Telephone call to (214) 369-5695.

|

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

|

|

By Order of the Board of Directors,

|

|

|

|

/s/ Frederick Jones

|

|

|

|

Frederick Jones

Dated: July 12, 2019

|

|

THEGLOBE.COM, INC.

5949 Sherry Lane, Suite 950

Dallas, Texas 75225

(214) 369-5695

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

General Information

This

information statement is being furnished to the stockholders of theglobe.com, inc., a Delaware corporation (the “Company,”

“we,” “us,” or “our”), as of the close of business on July 9, 2019 (the “Record Date”)

in connection with the action by written consent in lieu of a meeting of stockholders (the “Written Consent”), dated

June 28, 2019, in accordance with Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”),

taken by Delfin Midstream, Inc. (“Delfin”), the holder of a majority of the shares of our outstanding common stock,

par value $0.001 per share (the “Common Stock”), to re-elect Frederick Jones, our current director, to serve until

the next Annual Meeting of Stockholders and until his successor is elected and qualified. Delfin beneficially owns 312,825,952

shares of our Common Stock, representing approximately 70.9% of the 441,480,473 shares of our Common Stock issued and outstanding

as of the Record Date.

Because a stockholder holding at least a majority of the voting rights of our outstanding Common Stock has voted in favor of the foregoing action, and has sufficient voting power to approve such action through its ownership of Common Stock, no other stockholder consents will be solicited in connection with such matter. Our board of directors (the “Board”) is not soliciting proxies in connection with the adoption of the resolutions included in the Written Consent, and proxies are not requested from stockholders.

This information statement is first being mailed or furnished to our stockholders on or about July 12, 2019 in order to comply with the requirements of Section 14(c) of the Exchange Act. We will pay all costs associated with the preparation and distribution of this information statement, including all mailing and printing expenses.

1

Director & Executive Compensation

Directors who are also our employees or officers receive no compensation for serving on our Board and we do not maintain any executive compensation plans or programs. Neither Mr. Jones nor Mr. Nichols received a salary, bonus or awards in 2018 for their service on the Board. We reimburse non-employee/non-management directors for all travel and other expenses incurred in connection with attending Board meetings. In addition, all of our stock option plans have been terminated and there were no unexercised equity awards outstanding as of December 31, 2018 and no Named Executive Officer (as defined below) exercised equity awards during 2018.

Summary Compensation Table

The following table sets forth information concerning compensation for services in all capacities awarded to, earned by or paid by us to those persons serving as the principal executive officer at any time for the years ended December 31, 2018 and 2017 (collectively, the “Named Executive Officers”):

|

NAME AND

PRINCIPAL

POSITION

|

|

YEAR

|

|

|

SALARY

|

|

|

BONUS

|

|

|

OPTION

AWARDS

|

|

|

ALL

OTHER

|

|

|

TOTAL

|

|

|

Frederick Jones President, Chief Executive Officer, and Chief Financial Officer

(1)

|

|

|

2018

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William R. Nichols

|

|

|

2018

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

60,000

|

|

|

$

|

60,000

|

|

|

|

|

|

2017

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Former President, Former Chief Executive Officer, and Former Chief Financial Officer

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Effective June 29, 2018, Mr. Jones was appointed to his positions.

|

|

(2)

|

Mr. Nichols served in his positions from December 31, 2017 until June 29, 2018, when he resigned from all positions. In connection with his resignation, Mr. Nichols was granted $60,000 cash as severance.

|

We do not currently have any employment agreements with any of the Named Executive Officers.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our Common Stock as of the Record Date by (i) each person who owns beneficially more than 5% of our Common Stock, (ii) each of our directors, (iii) each of our “Named Executive Officers” and (iv) all directors and executive officers as a group. A total of 441,480,473 shares of our Common Stock were issued and outstanding on the Record Date.

The

amounts and percentages of Common Stock beneficially owned are reported on the basis of regulations of the Securities and Exchange

Commission (the “SEC”) governing the determination of beneficial ownership of securities. Under the rules of the SEC,

a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,”

which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the

power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities

of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be

deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which

such person has no economic interest. Unless otherwise indicated below, the address of each person named in the table below is

in care of: theglobe.com, inc., 5949 Sherry Lane, Suite 950, Dallas, TX 75225.

2

|

|

|

SHARES BENEFICIALLY OWNED

|

|

|

DIRECTORS AND NAMED EXECUTIVE OFFICERS

|

|

NUMBER

|

|

|

PERCENT

|

|

|

TITLE OF CLASS

|

|

|

Frederick Jones

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William R. Nichols

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (2 persons)

|

|

|

—

|

|

|

|

—

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% STOCKHOLDERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael S. Egan

(2)

|

|

|

22,018,000

|

|

|

|

4.99

|

%

|

|

|

Common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delfin Midstream Inc.

(3)

|

|

|

312,825,952

|

|

|

|

70.9

|

%

|

|

|

Common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Mr. Nichols resigned from his director and executive officer positions effective June 29, 2018. His beneficial ownership information included in this information statement is derived from Company records existing at the time of his resignation.

|

|

(2)

|

Mr. Egan’s address is P.O. Box 029006, Fort Lauderdale, Florida 33302. Includes the shares that Mr. Egan is deemed to beneficially own as the controlling investor of E&C Capital Partners, LLLP, E&C Capital Partners II, LLLP and The Registry Management Company, LLC. Also includes 14,000 shares of our Common Stock held by Mr. Egan’s wife, as to which he disclaims beneficial ownership.

|

3

Election of Directors

Effective June 29, 2018, William R. Nichols resigned from his director and officer positions and our Board appointed Frederick Jones as director of the Company. Mr. Jones was also appointed President, Chief Executive Officer, and Chief Financial Officer of the Company.

Vote Required

In general, pursuant to our By-Laws, the affirmative vote of the holders of a plurality of the votes cast by the shares entitled to vote in the election of directors at a meeting at which quorum is present is required to elect directors. However, in accordance with DGCL §211 and our By-Laws, action required or permitted to be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice, and without a vote, if the action is taken by the holders of outstanding stock of each voting group entitled to vote thereon having not less than the minimum number of votes with respect to each voting group that would be necessary to authorize or take such action at a meeting at which all voting groups and shares entitled to vote thereon were present and voted. As a result, Delfin Midstream, Inc. (“Delfin”) which holds shares representing approximately 70.9% of our shares of Common Stock outstanding as of the Record Date voted to elect Mr. Jones as director of the Company by the Written Consent.

The election will be effective on or about August 21, 2019 which is forty days after the first mailing of this information statement to the Company’s stockholders. Thereafter, Mr. Jones will remain a director until the next annual meeting of the stockholders as provided for in our By-laws and until his successor is elected and qualified.

Outstanding Voting Shares

As of the Record Date, there were 441,480,473 shares of Common Stock issued and outstanding. The shares of Common Stock constitute the only issued and outstanding class of voting securities of the Company. Each share of Common Stock entitles the holder thereof to one (1) vote on all matters submitted to stockholders.

Dissenters’ Rights of Appraisal

The DGCL does not provide for appraisal or dissenters’ rights in connection with the election of directors.

Board of Directors

Effective June 29, 2018, Mr. Jones was appointed by the Board as a director. Immediately thereafter, our previous sole director, William R. Nichols, resigned from the Board leaving Mr. Jones currently as the sole director sitting on the Board and our President, Chief Executive Officer and Chief Financial Officer. The following is a brief description of the background and business experience of Mr. Jones:

Frederick P. Jones

, 71, has been involved in international commodity trading, energy infrastructure, real estate, and oil and gas businesses for approximately 45 years. Mr. Jones was one of the early investors in U.S. shale gas. For approximately the past five years, Mr. Jones has served, and continues to serve, as the Chief Executive Officer of Fairwood Peninsula Energy Corporation (“Fairwood”), a midstream liquefied natural gas company. Fairwood is a stockholder of our majority stockholder, Delfin. Mr. Jones was a founder of Fairwood and is currently a stockholder of Delfin. He was also a founding stockholder in Marc Rich + Co A.G., Switzerland, now known as Glencore Plc.

Mr. Jones’ principal business address is c/o Fairwood Peninsula Energy Corporation, 5949 Sherry Lane, Suite 950, Dallas, TX 75225.

Mr. Jones was not provided with any compensation in connection with his appointment, and will serve in his roles without any compensation. We may in the future determine to enter into a compensatory arrangement with Mr. Jones.

We are not aware of any arrangement or understanding between Mr. Jones and any other person pursuant to which he was elected or appointed to his current positions. Neither Mr. Jones, Mr. Nichols, nor any of their immediate family members have been a participant in any transaction or currently proposed transaction with the Company that is reportable under Item 404(a) of Regulation S-K.

4

Due to his status as a stockholder of Delfin, which is our majority stockholder, and his willingness to serve without compensation, we believe Mr. Jones is in the best position to serve as our director until such time that our majority stockholder determines the direction of the Company.

Executive Officers

Effective June 29, 2018, our previous sole executive officer, William R. Nichols, resigned from his positions and Mr. Jones was appointed to his positions. Mr. Jones is currently our President, Chief Executive Officer and Chief Financial Officer.

Involvement in Certain Legal Proceedings

The Company is not aware of any legal proceedings in which any director, officer, or any record or beneficial owner of more than 5% of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company, or security holder, is a party adverse to the Company or has a material interest adverse to the Company.

Certain Relationships and Related Transactions

The following is a summary of transactions, since December 31, 2016, to which we have been a party, in which the amount involved exceeded the lesser of $120,000 or 1% of the average of our total assets at December 31, 2017 and December 31, 2018, and in which any of our directors, executive officers, beneficial holders of more than 5% of our capital stock or certain other related persons had or will have a direct or indirect material interest.

Delfin Purchase Agreement

On December 20, 2017, Michael S. Egan, our former Chief Executive Officer and majority stockholder, and certain of our other stockholders (each a “Seller” and collectively the “Sellers”) entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) with Delfin. Pursuant to the terms of the Purchase Agreement, Delfin agreed to purchase from the Sellers an aggregate of 312,825,952 shares of our Common Stock, representing approximately 70.9% of the issued and outstanding shares of our Common Stock. The closing of the purchase and sale transaction occurred on December 31, 2017. In connection with the transaction, we terminated the Master Services Agreement we had entered into with an entity controlled by Mr. Egan and satisfied all promissory notes and other borrowings under the credit line with respect to indebtedness owed to related parties.

Delfin is our majority stockholder and beneficially owns an aggregate of 312,825,952 shares of our Common Stock, representing approximately 70.9% of our issued and outstanding Common Stock. Mr. Jones is the Chief Executive Officer of Fairwood. Fairwood is a stockholder of Delfin equal to 30.71% of its stock ownership.

Services Agreement

On September 29, 2008, we (i) sold the business and substantially all of the assets of our Tralliance Corporation subsidiary to Tralliance Registry Management Company LLC and (ii) issued 229,000,000 shares of our Common Stock to The Registry Management Company, LLC (the “Tralliance Purchase Transaction”). In connection with the closing of the Tralliance Purchase Transaction, we entered into a Master Services Agreement (“Services Agreement”) with Dancing Bear Investments, Inc. (“Dancing Bear”), an entity which is controlled by Michael S. Egan, our former Chairman and Chief Executive Officer. Under the terms of the Services Agreement, for a fee of $20,000 per month ($240,000 per annum), Dancing Bear provided personnel and services to the Company so as to enable it to continue its existence as a public company without the necessity of any full-time employees of its own. The Services Agreement had an initial term of one year and was renewed for additional one year terms during 2009 through 2017. Services under the Services Agreement included, without limitation, accounting, assistance with financial reporting, accounts payable, treasury/financial planning, record retention and secretarial and investor relations functions. We recognized related party transactions expenses related to the Services Agreement in our Consolidated Statement of Operations in the amount of $240,000 during the year ended December 31, 2017. In connection with the transactions contemplated by the Purchase Agreement, effective as of December 31, 2017, the closing date, the Services Agreement was terminated, and the balances related to the Services Agreement that we owed to Dancing Bear were satisfied. For more information, see the Form 10-K.

5

Loans

In

March 2018, the Company executed a Promissory Note with Delfin, which was amended and restated in May 2018 to $150,000, on

November 2, 2018 to increase the principal amount to up to $350,000, and then on June 3, 2019 to increase the principal amount

to $465,000 to pay certain accrued expenses, accounts payable, and to allow the Company to have working capital. Interest

accrues on the unpaid principal balance at a rate of 8% per annum, and is payable on the maturity date, calculated on a

365/366-day year, as applicable. The Promissory Note is due upon demand. It may be prepaid in whole or in part at any time

prior to the maturity date. The Company expects continued funding from Delfin over the next twelve months. For more

information, see the Form 10-K.

Review, Approval or Ratification of Transactions with Related Persons

While the Company has not adopted formal written policies or procedures for consideration of related party transactions, the Board routinely reviews potential transactions with those parties it has identified as related parties prior to the consummation of the transaction. Each transaction is reviewed to determine that a related party transaction is entered into by the Company with the related party on an “arm’s length” basis, or pursuant to normal competitive negotiation.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file certain reports regarding ownership of, and transactions in, our securities with the SEC. Such officers, directors, and 10% stockholders are also required to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of copies of Forms 3 and 4 and any amendments furnished to us pursuant to Rule 16a-3(e) and any written representations referred to in Item 405(b)(2)(i) of Regulation S-K stating that no Forms 5 were required, we believe that, during the 2018 fiscal year, our officers, directors and all persons owning more than 10% of a registered class of our equity securities have complied with all Section 16(a) applicable filing requirements, except that the Form 3 for Mr. Nichols was not timely filed.

Corporate Governance

Board Leadership Structure and Role in Risk Oversight

As set forth in our Certificate of Incorporation and By-Laws, all directors of the Company hold office until the next annual meeting of stockholders or until their successors have been duly elected and qualified or their earlier death, removal or resignation.

We have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined and we do not have a lead director. We have traditionally determined that, due to the small size of the Company and the fact that it currently has no operations, it is in the best interests of the Company and its stockholders to combine these roles. Effective June 29, 2018, the Company’s former Chairman and Chief Executive Officer, William R. Nichols, resigned from all positions and Frederick Jones was appointed to his positions.

Our Board, which is currently comprised of one person, our Chief Executive Officer, is responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from auditors, legal counsel, and others, as considered appropriate regarding our Company’s assessment of risks. The Board focuses on the most significant risks facing our Company and our Company’s general risk management strategy, and also attempts to ensure that risks undertaken by our Company are consistent with the Board’s tolerance for risk.

Director Independence

Our Common Stock is traded on the OTC Markets, OTC Pink, under the symbol “TGLO.” The OTC Pink electronic trading platform does not maintain any standards regarding the “independence” of the directors for our Board or require that any of our directors be “independent.” We do not believe either persons that served as our sole director during our last fiscal year qualified or qualifies, as applicable, as “independent directors” under the Nasdaq Stock Market’s listing standards

due to their status as CEO or former CEO of the Company. We are not aware of any arrangement or understanding between Mr. Jones

and any other person pursuant to which he or she is to be elected or appointed to an officer or director position at the

Company.

6

Board Meetings and Attendance

Including unanimous written actions of the Board, the Board met 6 times in 2018. Neither Mr. Jones nor Mr. Nichols attended less than 75% of the total number of all meetings of the Board during the time period in 2018 that such person served as director.

The Board encourages, but does not require, its directors to attend the Company’s annual meeting of stockholders, if any. The Company did not hold an annual meeting last year.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. As a shell company, we believe that it is not necessary to have such committees at this time because the Board can adequately perform the functions of such committees.

Audit

. We believe that our Board can adequately perform the functions of an audit committee. As a smaller reporting company with no material operations or assets, and due to the lack of financial resources available to us, we do not have a Board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as “independent” within the meaning of applicable Nasdaq Stock Market listing standards, including any heightened independence requirements specific to audit committee members. We believe that retaining an independent director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given our lack of material operations or assets.

Compensation

. Because the Company currently has no material operations and neither of its executive officers that served in 2018 received a salary, we do not believe it is necessary to have a compensation committee at this time. We believe that our Board can adequately perform the functions of a compensation committee. Due to his status as an officer of the Company, our sole director is not “independent” within the meaning of applicable Nasdaq Stock Market listing standards, including any heightened independence requirements specific to compensation committee members.

Director Nominations

. As noted above, the Board does not have a separate nominating committee. Rather, our Board considers and nominates directors for election. We do not believe the Company would derive any significant benefit from a separate nominating committee. Due to his status as an officer of the Company, our sole director is not “independent” as defined in the applicable Nasdaq Stock Market listing standards.

In recommending director candidates in the future (including director candidates recommended by stockholders), the Board intends to take into consideration such factors as it deems appropriate based on the Company’s current needs. These factors may include diversity, age, skills, decision-making ability, inter-personal skills, experience with businesses and other organizations of comparable size, community activities and relationships, and the interrelationship between the candidate’s experience and business background, and other Board members’ experience and business background, whether such candidate would be considered “independent,” as such term is defined in the Nasdaq Stock Market listing standards, as well as the candidate’s ability to devote the required time and effort to serve on the Board.

The Board will consider for nomination by the Board director candidates recommended by stockholders if the stockholders comply with the following requirements. Under our By-Laws, if a stockholder wishes to nominate a director at the annual meeting, we must receive the stockholder’s written notice not less than 60 days nor more than 90 days prior to the date of the annual meeting, unless we give our stockholders less than 70 days’ notice of the date of our annual meeting. If we provide less than 70 days’ notice, then we must receive the stockholder’s written notice by the close of business on the 10th day after we provide notice of the date of the annual meeting. The notice must contain the specific information required in our By-Laws. A copy of our By-Laws may be obtained by writing to the Company. If we receive a stockholder’s proposal within the time periods required under our By-Laws, we may choose, but are not required, to include it in our proxy statement. If we do, we may tell the other stockholders what we think of the proposal, and how we intend to use our discretionary authority to vote on the proposal. All proposals should be made in writing and sent via registered, certified or express mail, to our executive offices, 5949 Sherry Lane, Suite 950, Dallas, Texas 75225 Attention: Frederick Jones.

7

The Board will consider properly submitted stockholder recommendations for director candidates. Director candidates recommended by stockholders will be given the same consideration as candidates suggested by directors and executive officers. The Board has the sole authority to select, or to recommend, the nominees to be considered for election as a director. The Board does not presently have any formal policy or procedures with regard to the consideration of any director candidates recommended by stockholders.

Stockholder Communications with the Board of Directors

. Any stockholder who wishes to send communications to the Board should mail them addressed to the intended recipient by name or position in care of: theglobe.com, inc., 5949 Sherry Lane, Suite 950, Dallas, Texas 75225 Attention: Frederick Jones. Upon receipt of any such communications, Mr. Jones will determine the identity of the intended recipient and whether the communication is an appropriate stockholder communication. Then Mr. Jones will send all appropriate stockholder communications to the intended recipient. An “appropriate stockholder communication” is a communication from a person claiming to be a stockholder in the communication, the subject of which relates solely to the sender’s interest as a stockholder and not to any other personal or business interest.

In the case of communications addressed to the Board, the Company will send appropriate stockholder communications to the Board. In the case of communications addressed to any particular directors, the Company will send appropriate stockholder communications to such director.

Additional Information

The Company is subject to the information and reporting requirements of the Exchange Act and, in accordance with that Act, files periodic reports, documents and other information with the SEC. These reports and other information are available to you on the SEC’s website at

www.sec.gov

.

Delivery of Documents to Stockholders Sharing an Address

Unless we have received contrary instructions from a stockholder, we are delivering only one information statement to multiple stockholders sharing an address. This practice, known as “householding,” is intended to reduce our printing and postage costs. We will, upon request, promptly deliver a separate copy of the information statement to a stockholder who shares an address with another stockholder. A stockholder who wishes to receive a separate copy of the information statement may direct such request to theglobe.com, inc., 5949 Sherry Lane, Suite 950, Dallas, TX 75225 Attention: Frederick Jones or (214) 369-5695. Stockholders who receive multiple copies of the information statement at their address and would like to request that only a single copy of communications be delivered to the shared address may do so by making either a written or oral request to the address listed above.

8

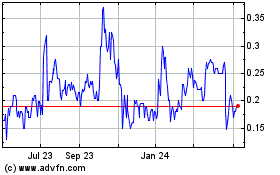

TheGlobe com (PK) (USOTC:TGLO)

Historical Stock Chart

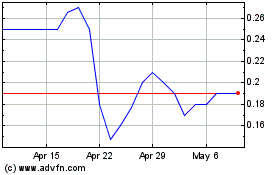

From Nov 2024 to Dec 2024

TheGlobe com (PK) (USOTC:TGLO)

Historical Stock Chart

From Dec 2023 to Dec 2024