Report of Foreign Issuer (6-k)

January 17 2019 - 3:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JANUARY 2019

TIM S.p.A.

(Translation of registrant’s name into English)

Via Gaetano Negri 1

20123 Milan, Italy

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

FORM

20-F ☒ FORM

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.

YES ☐ NO ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82-

TIM PRESENTS THE FY 2018 PRELIMINARY RESULTS AND 2019 PRELIMINARY BUDGET

Rome, 17 January 2019

TIM’s Board of Directors met

today in Rome chaired by Fulvio Conti and was informed about the preliminary results for 2018.

Organic EBITDA of the Domestic Business Unit is expected

to be lower

(mid-single

digit) compared to the previous year, notwithstanding TIM’s greater resilience compared to the market. Supported by the improved performace of the Brazil Business Unit, the overall

consolidated organic figure is expected to be approximately 8.1 billion euro. The trend of the Group organic revenues is confirmed. Adjusted consolidated net financial debt is expected to be approximately 25.2 billion euro, after the

payment of 513 million euros for licences.

The operational figures have not yet been checked by the external auditor. In addition, since the

activities to produce the consolidated Financial Statements for 2018 are still underway, these operational figures must not be considered definitive and could change.

The Board of Directors also discussed the preliminary 2019 budget. The initial outlook of the Domestic Business Unit shows an operating performance that

reflects the competitive dynamics that impacted 2018 (already commented in detail with the interim financial statement at 30 September 2018) and are expected to influence also 2019, especially the first semester.

The 2019-2021 Plan will be presented for approval to the Board of Directors on 21 February next, together with the final FY 2018 Financial Statements.

TIM Press Office

+39 06 3688 2610

www.telecomitalia.com/media

Twitter: @TIMnewsroom

TIM Investor Relations

+39 06 3688 2807

www.telecomitalia.com/investor_relations

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the United States Private

Securities Litigation Reform Act of 1995.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking

statements. The Group’s interim financial report as of and for the nine months ended September 30, 2018 included in this Form

6-K

contains certain forward-looking statements. Forward-looking

statements are statements that are not historical facts and can be identified by the use of forward-looking terminology such as “believes,” “may,” “is expected to,” “will,” “will continue,”

“should,” “seeks” or “anticipates” or similar expressions or the negative thereof or other comparable terminology, or by the forward- looking nature of discussions of strategy, plans or intentions.

Actual results may differ materially from those projected or implied in the forward-looking statements. Such forward-looking information is based on certain

key assumptions which we believe to be reasonable but forward-looking information by its nature involves risks and uncertainties, which are outside our control, that could significantly affect expected results.

The following important factors could cause our actual results to differ materially from those projected or implied in any forward-looking statements:

|

|

1.

|

our ability to successfully implement our strategy over the 2018-2020 period;

|

|

|

2.

|

the continuing effects of the global economic crisis in the principal markets in which we operate, including,

in particular, our core Italian market;

|

|

|

3.

|

the impact of regulatory decisions and changes in the regulatory environment in Italy and other countries in

which we operate;

|

|

|

4.

|

the impact of political developments in Italy and other countries in which we operate;

|

|

|

5.

|

our ability to successfully meet competition on both price and innovation capabilities of new products and

services;

|

|

|

6.

|

our ability to develop and introduce new technologies which are attractive in our principal markets, to manage

innovation, to supply value added services and to increase the use of our fixed and mobile networks;

|

|

|

7.

|

our ability to successfully implement our internet and broadband strategy;

|

|

|

8.

|

our ability to successfully achieve our debt reduction and other targets;

|

|

|

9.

|

the impact of fluctuations in currency exchange and interest rates and the performance of the equity markets in

general;

|

|

|

10.

|

the outcome of litigation, disputes and investigations in which we are involved or may become involved;

|

|

|

11.

|

our ability to build up our business in adjacent markets and in international markets (particularly in Brazil),

due to our specialist and technical resources;

|

|

|

12.

|

our ability to achieve the expected return on the investments and capital expenditures we have made and

continue to make in Brazil;

|

|

|

13.

|

the amount and timing of any future impairment charges for our authorizations, goodwill or other assets;

|

|

|

14.

|

our ability to manage and reduce costs;

|

|

|

15.

|

any difficulties which we may encounter in our supply and procurement processes, including as a result of the

insolvency or financial weaknesses of our suppliers; and

|

|

|

16.

|

the costs we may incur due to unexpected events, in particular where our insurance is not sufficient to cover

such costs.

|

The foregoing factors should not be construed as exhaustive. Due to such uncertainties and risks, readers are cautioned not

to place undue reliance on such forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements which may be made to reflect events or

circumstances after the date hereof, including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: January 17, 2019

|

|

|

|

|

TIM S.p.A.

|

|

|

|

|

BY:

|

|

/s/ Umberto Pandolfi

|

|

|

|

Umberto Pandolfi

|

|

|

|

Company Manager

|

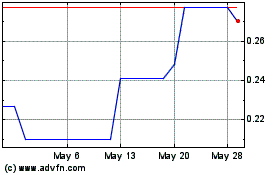

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Feb 2025 to Mar 2025

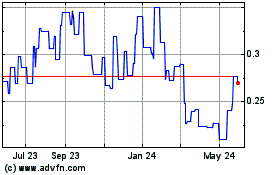

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Telcom Italia SPA New (PK) (OTCMarkets): 0 recent articles

More Tim S.p.a. News Articles