Rockpool Acquisitions PLC Successful Refinancing of Greenview Gas Limited (5693E)

November 06 2020 - 10:14AM

UK Regulatory

TIDMROC

RNS Number : 5693E

Rockpool Acquisitions PLC

06 November 2020

Press release 6 November 2020

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Rockpool Acquisitions Plc

("Rockpool" or "the Company")

Refinancing of Greenview Gas Limited ("Greenview")

As reported in the Chairman's Statement included in the

Company's annual report for the year ended 31 March 2020, Greenview

has been in negotiations to refinance its existing debt facilities

("the Existing Debt") with ExWorks and one other lender. The Board

is pleased to be able to announce that the refinancing process has

been successfully completed. Greenview has now drawn down GBP4.5m

of debt from alternative lender BOOST&Co, which has allowed it

to fully refinance the Existing Debt and leave it with some

additional working capital. The new facility, which has been

provided under the government's CBILS programme amortises over a

period of 5 years. It carries an interest rate that is considerably

lower than the rate originally payable on the Existing Debt.

The new facility is secured by first ranking security over the

assets of Greenview and the over the assets of the active trading

subsidiaries of Greenview. Security previously created in favour of

Rockpool by certain of those companies is fully subordinated to and

ranks after the corresponding security in favour of the new lender

pursuant to the terms of a deed of priorities (which restricts any

enforcement of security by Rockpool subject to limited exceptions

whilst the new lender's security remains outstanding). The deed of

priorities provides that the proceeds from any enforcement of any

of the security is to be applied first in discharge of indebtedness

due to the new lender before application towards the Rockpool

indebtedness.

Greenview was advised on the funding by LGF Partners and legal

advice was provided by leading next generation City law firm,

McCarthy Denning.

Now that the refinancing has completed, the Board and the

management of Greenview will turn their attention to the timing of

the process of completing the acquisition of Greenview by the

Company and the preparation and submission for approval of a

prospectus allowing for Rockpool's shares to be readmitted to the

Official List.

The Board of the Company will update the market further as and

when necessary.

Ends -

For further information please contact:

Rockpool Acquisitions Plc

Mike Irvine, Non-Executive Director mike@cordovancapital.com

www.rockpoolacquisitions.plc.uk

Shard Capital (Broker)

Damon Heath / Erik Woolgar Tel: +44 (0)20 7186 9952

Abchurch (Financial PR)

Julian Bosdet Tel: +44 (0)20 4594 4070

julian.bosdet@abchurch-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFSEFMMESSEFF

(END) Dow Jones Newswires

November 06, 2020 11:14 ET (16:14 GMT)

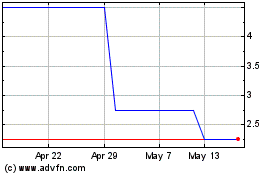

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Jan 2025 to Feb 2025

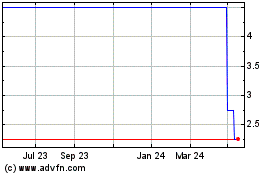

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Feb 2024 to Feb 2025