Ecoslops - 2022 Turnover and Significant Events

January 31 2023 - 10:59AM

Ecoslops - 2022 Turnover and Significant Events

Paris, January 31st, 2023,

VERY STRONG COMMERCIAL MOMENTUM, DRIVEN

BY:• THE FIRST YEAR OF OPERATION OF THE MARSEILLE

UNIT• AN HISTORIC PERFORMANCE OF THE SINES

UNITTurnover in M€ * 2021 2022 Var . M€ Var. %

| Turnover in M€

* |

2021 |

2022 |

Var M€ |

Var % |

| |

|

|

|

|

| Refined products -

Sines |

6,30 |

12,33 |

6,03 |

96% |

| Refined products -

Marseille |

0,22 |

4,31 |

4,09 |

+ 1868% |

|

Subtotal Refined Products |

6,52 |

16,64 |

10,12 |

155% |

| Industrial equipments -

Scarabox® |

3,73 |

0,27 |

-3,47 |

- 93% |

| Port services &

others |

2,20 |

2,13 |

-0,06 |

- 3% |

| |

|

|

|

|

| Total |

12,45 |

19,03 |

+6,59 |

+ 53% |

Ecoslops has achieved a turnover of €19M in 2022

compared to €12.5M in 2021, an increase of

+53%.

The group’s turnover for the 2022 financial year benefited from

the strengthening of its Refined Productsbusiness, +155%, with:• A

strong increase in sales volume, +51%, representing 29,500 tonnes

(compared to 19,500 in 2021)• Correlated to a very significant

increase in the average selling price of +69% linked to :• Very

favourable conditions on the energy markets (+57% linked to the

rise in Brent and $)• Results of operational improvements in the

units: +12% linked to the product mix.

Sines unit in Portugal

Ecoslops Portugal’s turnover increased by 70% from

€8.5M in 2021 to €14.5M in 2022. The Port Services business is

stable at €2.1M, while the Refined Products business has seen a

doubling of itsturnover to €12.3M in 2022 from €6.3M in 2021. The

unit produced 24,509 tonnes of refined products over the

period, compared to 21,960 tonnes in 2021, and sold 22,165 tonnes,

compared to 18,968 tonnes the previous year. In 2023, Ecoslops

Portugal expects to produce 25,000 tonnes, representing a

turnover of around €13M (including port services) based on current

prices (Brent at $85/bbl).

Marseille unitEcoslops Provence (owned 75%

by Ecoslops and 25% by TotalEnergies) has continued to ramp

up its operations in parallel with the development of its

customer portfolio. The unit was delivered in July 2021 and went

into production at the end of 2021. Its turnover thus increased

from €0.2M in 2021 (514 tonnes sold) to €4.3M in 2022 (7,319

tonnes sold). It should be noted that the end of year

activity was penalized by the social movement within the

French refineries (lasting 3 weeks on the La Mède platform). In

2023, Ecoslops Provence expects a production of 15,000 tons, i.e. a

turnover of around €7M based on current prices.

Scarabox®The construction of

the first Scarabox® (destined for Kribi in Cameroon, for the client

Valtech Energy) was completed in the first half of 2022,

allowing the recognition of €0.3M of revenue (100% completion vs

93% at 31 December 2021). During the completion of the

integration work carried out by Valtech Energy on its operating

site, the unit was transported to its port of destination at the

end of the year. Commissioning of the unit is scheduled for the

first half of 2023.

Other projectsIn addition, the company continues to work

on the development projects it has already communicated, i.e.

Antwerp, the Suez Canal and the deployment of the Scarabox® in

other countries.

Cash positionAt 31 December 2022, the Group had cash of

€6.8M compared with €6.3M at 31 December 2021 and net debt of

€23.4M (compared with €22.6M at 31 December 2021).

Corporate Social ResponsibilityAs a player in the

circular economy, Ecoslops attaches major importance to

environmental issues, in addition to societal and governance

issues. In this context, the Group published its third sustainable

development report on 30 May 2022.The Group’s commitment to a

continuous improvement approach is illustrated by the new

progression of the ESG rating resulting from the Gaïa Research

2022 Campaign. The company has confirmed its performance, as it is

now ranked 39th/371 (compared to 170th/390th in the previous

campaign) in the total panel, and 14th/126 on the panel of

companies with less than €150M in turnover.

Next appointmentPublication of the 2022 annual results on

12 April 2023 after market close.

ABOUT ECOSLOPSEcoslops is listed on Euronext

Growth in ParisCode ISIN : FR0011490648 - Ticker : ALESA / PEA-PME

eligibleInvestor Relations : ir@ecoslops.com - 01 83 64 47

43Ecoslops is the cleantech that brings oil into the circular

economy thanks to an innovative technology allowing the company

toupgrade oil residues and used lub oil into new fuels and light

bitumen. The solution proposed by Ecoslops is based on a

uniquemicro-refining industrial process that transforms these

residues into commercial products that meet international

standards. Ecoslopsoffers an economic and more ecological solution

to port infrastructure, waste collectors and ship-owners through

its processing.https://www.ecoslops.com

- PR31jan2023_202é_ECOSLOPS_OPERATIONAL_RECORD

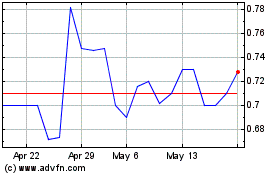

Ecoslops (EU:ALESA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ecoslops (EU:ALESA)

Historical Stock Chart

From Jan 2024 to Jan 2025