SAVENCIA FROMAGE & DAIRY : 2024 Full Year Financial Results

March 06 2025 - 11:00AM

UK Regulatory

SAVENCIA FROMAGE & DAIRY : 2024 Full Year Financial Results

Thursday, March 06,

2025

PRESS RELEASE: 2024 Full Year Financial

Results

- Sales growth of +5.1%

- Slight increase of the Current Operating Profit

|

Key figures in € million

|

31/12/24

|

% of sales

|

31/12/23

|

% of sales

|

Changes in % |

|

Total |

Structure |

Change &

IAS 29 |

Organic Growth (1) |

|

|

Sales |

7 140 |

|

6 791 |

|

5.1 |

1.1 |

0.9 |

3.1 |

|

|

- Cheese Products |

4 055 |

56.8 |

4 079 |

60.1 |

-0.6 |

0.0 |

-1.1 |

0.5 |

|

|

- Other Dairy Products |

3 328 |

46.6 |

2 923 |

43.0 |

13.9 |

2.7 |

3.4 |

7.8 |

|

|

- Unallocated |

-244 |

-3.4 |

-211 |

-3.1 |

|

|

|

|

|

|

Current Operating Profit |

232.3 |

3.3 |

212.9 |

3.1 |

|

|

Other operating costs and income |

-28.4 |

-0.4 |

-43.6 |

-0.6 |

|

Operating result |

203.9 |

2.9 |

169.3 |

2.5 |

|

Financial result |

-21.5 |

-0.3 |

-18.0 |

-0.3 |

|

Result on monetary position |

-9.1 |

|

3.1 |

|

|

Corporate taxes |

-48.6 |

-0.7 |

-50.3 |

-0.7 |

|

Net income, Group share |

107.0 |

1.5 |

96.5 |

1.4 |

|

Net debt (excluding IFRS

16) |

347 |

|

439 |

|

|

Equity |

1 993 |

|

1 818 |

|

2024 annual financials

As of December 31, 2024, Savencia Fromage &

Dairy recorded a +5.1% increase in revenue, in a global economic

environment marked by strong inflation in milk prices, particularly

in France. The group's organic growth is +3.1%, largely driven by a

significant +7.8% increase in Other Dairy Products, with an

acceleration in the fourth quarter. The exchange rate effect

contributed positively by +0.9%, while the integration of Williner

in Argentina contributed by +1.1% to total growth as a structural

effect.

The current operating profit reached €232.3 million reflecting an

increase of +€19.4 million compared to last year. This evolution is

the result of major achievements in mix management, effective

management of inflation and improved operational competitiveness.

This performance was achieved despite margin pressure in a context

of continued milk prices inflation and declining industrial product

quotations. As a result, the Group's operating margin improved

slightly by 20bps to +3.3% compared to +3.1% last year.

Other operating costs and income include asset

impairments, costs related to optimization projects, as well as

various claims and litigation; they totaled -€28.4 million, showing

an improvement compared to 2023.

The Group’s net income reached €107 million,

representing 1.5% of revenue, up from €96.5 million (1.4%) in

2023.

Dividend

The Board of Directors will propose at the

Annual General Shareholders Meeting on Thursday April 24, the

distribution of a dividend of €1.60 per share, compared to €1.40

per share last year.

The Group's CSR commitments

In 2024, the Group continued to build its global performance model

and pursued the deployment of its projects in both the social and

environmental fields.

Particular attention was paid to reducing water

consumption and Greenhouse Gas (GHG) emissions with the

construction of roadmaps by subsidiary, in line with the group's

SBTi 1.5° commitment to come. The partnership signed in France with

Agrial Cooperative in October 2024 notably demonstrates the

commitment to significantly improve the environmental footprint of

upstream dairy within a value chain logic.

In social matters, the Savencia Group continued its efforts in

supporting its employees, recognized by the "TOP EMPLOYER" Europe

certification, as well as in 17 other countries, with 90% of

Savencia Group employees now working in Top Employer certified

countries.

Outlook for 2025

Outlook for 2025 remains marked by a volatile and uncertain

environment:

- Evolving consumption context and

continued pressure on milk prices, combined with increased

competition on different markets both in France and

internationally.

- Geopolitical tensions and potential economic paradigm shifts

leading to a slowdown in global growth.

In response to these challenges, the Savencia Fromage & Dairy

Group is pursuing a model of specialty strategy and maintaining its

efforts to improve its competitiveness; the Group will keep

investing to develop the complementarity of its various businesses

and the growth of its brands. To navigate market uncertainties, the

Group will rely on the quality of its products, on strong

trust-based relationships with all its partners, as well as the

commitment and quality of all its teams, in line with its mission:

"Leading the way to Better Food”.

(1) Explanatory note on the change in

aggregate formats

The definitions and terms of the aggregates

of "organic growth" and "currency effects" have changed as of

January 1, 2024, as specified below. The definition of the

aggregate "structure effect" has not changed. The definition is

included in the group's financial report.

Since January 1, 2024, the performance of Argentina, a country

with a hyperinflationary economy, is included in the organic

changes as follows: the share of revenue growth in this country

above approximately 26% per year (on average an annual inflation

level of 26% over 3 years requires the application of the

hyperinflation restatement within the meaning of IFRS) is excluded

from the calculation of the organic growth effect of net sales and

integrated with the impacts of the hyperinflation-related

restatement (IAS 29) on currency effects.

The audit procedures are carried out and the

audit report for the certification is in the process of being

issued. The definitions and methods of aggregates such as

structure, exchange rate, organic growth or net debt have not

changed.

They are defined in the Group's financial report.

Further information

can be found on the website savencia-fromagedairy.com

- Savencia SA - 2024 Annual results

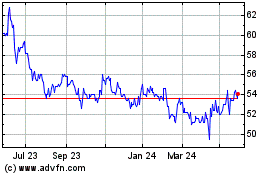

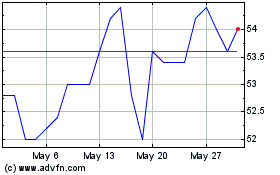

Savencia (EU:SAVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Savencia (EU:SAVE)

Historical Stock Chart

From Mar 2024 to Mar 2025