false

0001533998

0001533998

2025-02-24

2025-02-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of

Earliest Event Reported): February 24, 2025

DARIOHEALTH CORP.

(Exact name of registrant as specified in its charter)

| Delaware | |

001-37704 | |

45-2973162 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

322 W. 57th St, #33B

New

York, New York 10019

(Address of Principal Executive Offices)

972- 4-770-6377

(Issuer’s telephone

number)

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

DRIO |

|

The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Lawrence

Leisure to Board of Directors

On February 25, 2025, on the

recommendation of the Nominating Committee of the Board of Directors, or the Board, of DarioHealth Corp., or the Company, appointed Lawrence

Leisure as a member of the Board, effective immediately.

Mr. Leisure, 74, has extensive

business experience consulting and advising in the senior living, provider services, value based care and technology enabled services

sectors. Since January 2014, Mr. Leisure has served as the Co-Founder and Co-Managing Partner of Chicago Pacific Founders, a private equity

firm focused on senior living, provider services, value based care, and technology enabled services. Since December 2021, Mr. Leisure

has served on the Board of Directors, and the compensation committee, of P3 Health Partners Inc. (NASDAQ: PIII), a publicly traded health

management company. Mr. Leisure has also served on the boards of directors of several private companies backed by Chicago Pacific Founders

as well as several venture capital backed companies. Since 2009, he has served as Co-Founder and Chairman of Healthspottr, a strategic

networking and consulting firm focused on health innovation and collaboration in the healthcare industry and he also served as the Co-Founder

of the Employer Health Innovation Roundtable since 2015. Prior to Chicago Pacific Partners, Mr. Leisure held senior management roles at

Accenture, PricewaterhouseCoopers, Towers Perrin, Kaiser Foundation Health Plans and UnitedHealth Group. Mr. Leisure was also employed

by the venture capital firm, Kleiner Perkins, as an Operating Partner within the Life Sciences & Digital Health Practice.

Mr. Leisure received a M.B.A.

in Finance from the University of California, Los Angeles, and an A.B. in Economics from Stanford University. Mr. Leisure brings to the

Board valuable experience from his career in healthcare serving in senior venture capital, private equity, management consulting and industry

operating roles.

Mr. Leisure is also a Member

of NearWater Growth, LLC, or NearWater, which has provided investment and business consulting services to the Company since 2021 pursuant

to a consulting agreement, as amended, by and between the Company and NearWater effective as of September 3, 2021, or the Consulting Agreement.

As remuneration for such services, the Company agreed to pay NearWater a monthly cash retainer upon the successful completion of an equity

financing resulting in gross proceeds in excess of $25 million and the Company further agreed to issue NearWater shares of the Company’s

common stock as equity compensation if certain milestones are met such as NearWater introducing entities to the Company for acquisition

or partnership purposes, provided certain revenue milestones are met. Further, the Consulting Agreement provides for the payment to NearWater

of 150,000 shares of the Company’s common stock which shall vest quarterly over a four year period. To date, NearWater has received

approximately 258,000 shares of the Company’s common stock and common stock purchase warrants to purchase up to 125,000 shares of

common stock. On February 24, 2025, NearWater and the Company entered into a Second Amendment to the Consulting Agreement pursuant to

which the Company agreed to pay NearWater a monthly retainer of $10,000. Mr. Leisure has in interest in, and will receive, the compensation

due to NearWater.

As remuneration for his service

as a director, Mr. Leisure will receive the same fees as the Company’s other non-executive directors. There is no arrangement or

understanding between Mr. Leisure and any other person pursuant to which he was elected as a director, and except as otherwise described

herein, there are no transactions in which Mr. Leisure has an interest requiring disclosure under Item 404(a) of Regulation S-K.

The foregoing descriptions

of the Consulting Agreement, the Amendment to the Consulting Agreement and the Second Amendment to the Consulting Agreement do not purport

to be complete and are qualified in their entirety by reference to the full text of the Consulting Agreement, the Amendment to the Consulting

Agreement and the Second Amendment to the Consulting Agreement, which are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to this

Current Report on Form 8-K and incorporated herein by reference.

Resignation of Jon Kaplan

from Board of Directors

On February 24, 2025, Jon

Kaplan voluntarily resigned from his position as a member of the Board. Mr. Kaplan did not resign as a result of any disagreement with

the Company on any matter relating to the Company’s operations, policies or practices.

On

February 27, 2025, the Company issued a press release announcing the appointment of Mr. Leisure to its Board. A copy of the press release

is furnished with this Current Report on Form 8-K as Exhibit 99.1.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

Number |

|

Description |

| 10.1* |

|

Consulting Agreement by and between the Company and NearWater Growth, LLC, dated September 3, 2021. |

| 10.2* |

|

Amendment to Consulting Agreement by and between the Company and NearWater Growth, LLC, dated June 5, 2023. |

| 10.3* |

|

Second Amendment to Consulting Agreement by and between the Company and NearWater Growth, LLC, dated February 27, 2025. |

| 99.1 |

|

Press release dated February 27, 2025. |

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

* Certain confidential portions of this exhibit

have been omitted pursuant to Item 601(b) of Regulation S-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Dated: February 27, 2025 |

DARIOHEALTH CORP. |

| |

|

| |

|

| |

By: |

/s/ Zvi Ben David |

| |

Name: |

Zvi Ben-David |

| |

Title: |

Chief Financial Officer, Treasurer and Secretary |

Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL AND (ii) IS THE TYPE THAT DARIOHEALTH CORP. TREATS AS PRIVATE OR CONFIDENTIAL. OMISSIONS

ARE DENOTED IN BRACKETS WITH ASTERISKS THROUGHOUT THIS EXHIBIT.

CONSULTING AGREEMENT

This Consulting

Agreement (this “Agreement”) is effective as of September 3rd, 2021 (the “Effective Date”) by and

between DarioHealth Corp. with offices located at 142 W. 57th St., 8th Floor, New York, New York 10019 (the “Company”),

and NearWater Growth, a LLC with an address at [***] (the “Consultant”).

WHEREAS,

Company wishes to engage Consultant to perform certain executive Services (as defined in Exhibit A) to pursue and arrange for business

introductions to the Company and to provide access to Consultant’s relationships who can help grow the Company; and

WHEREAS,

Consultant has expertise in consulting regarding introducing the Company to key bankers and investors as well to other strategic partners.

NOW THEREFORE,

in consideration of the mutual promises contained herein, and other good and valuable consideration the parties agree as follows:

1. SERVICES

1.1 Services.

Company hereby engages Consultant to perform, and Consultant shall perform the Services as requested by the Company and as defined and

set forth on Exhibit A. Consultant is being engaged to perform, and Consultant shall perform the Services in compliance with the

terms and conditions of this Agreement, Company’s compliance policies, and all applicable federal, state, and local laws, rules,

and regulations, including without limitation, federal and state securities laws, the federal anti-kickback statute and its implementing

regulations, 42 U.S.C. § 1320a-7b(b), general standards of Consultant’s profession and relevant industry guidelines and codes

of ethics. Consultant will devote sufficient time, intellect, and best efforts to undertake and complete the Services in a timely and

diligent manner in accordance with the descriptions specified herein and Consultant’s professional expertise and independent judgment.

Consultant shall be responsible for maintaining, at its own expense, a place of work, any necessary equipment and supplies, and appropriate

communications facilities needed to perform the Services. Entering into this Agreement in no way obligates Company to retain Consultant

to perform additional services.

1.2 Reports

and Cooperation. Consultant further agrees to provide Company with all cooperation and assistance reasonably requested in connection

with the Services. Consultant will comply with Company’s rules, policies, and security procedures whenever working on Company premises.

1.3 Records.

Consultant shall maintain complete, accurate, and legible records, notes, and accounts obtained or generated in the course of providing

Services under this Agreement, including all computerized records and files, in a secure area. During the Term of this Agreement and for

a period of one (1) year thereafter, and upon reasonable advance notice and during normal business hours, Company or its representatives

shall have the right to review such records to verify and assess Consultant’s compliance with this Agreement. Consultant shall reasonably

cooperate in any audit conducted hereunder, and shall provide reasonable access to any and all, agents and other representatives of Consultant

and to Consultant’s books, records, agreements, and other documents necessary to assess Consultant’s compliance with this

Agreement.

2. PAYMENT

2.1 Compensation.

(a) The Company will compensate Consultant as set forth on Exhibit B. The parties represent that the amounts set forth on Exhibit

B represent the fair market value of the Services to be provided by Consultant to Company, negotiated in an arm's-length transaction.

Company will compensate Consultant only to the extent that (i) the Services are performed in accordance with this Agreement, and (ii)

Consultant provides Company with monthly invoices for services rendered, to be paid by the Company within 15 days of receipt. In addition,

the parties have negotiated that certain travel and other expenses incurred by Consultant directly related to the Services provided may

be submitted for reimbursement, provided that Consultant presents detailed documentation of such expenses, along with the invoice for

a given month period, and the Company pays such expenses within 15 days of receipt.

(b) Nothing contained in this Agreement requires or will be construed in any manner as an obligation or inducement for Consultant to

(i) purchase, use, order, or recommend any services or products developed, manufactured, distributed or otherwise commercialized by Company

or its affiliates, nor as a reward for any such purchase, order, prescription, or recommendation; nor (ii) refer any patient, physician

or health organization to any health care organization to which Company or its affiliates supplies products or services.

3. INTELLECTUAL PROPERTY

3.1 Pre-existing

Intellectual Property. Ownership of inventions, technologies, processes, techniques, algorithms, programs, discoveries, improvements,

drugs, pharmaceuticals, biologics, products, concepts, designs, drawings, prototypes, samples, models, technical information, materials,

drawings, specifications, computer object or source code, and other works of authorship existing as of the Effective Date, and all patents,

patent applications, copyrights, trade secret rights and other intellectual property rights therein (collectively, “Pre-existing

Intellectual Property”), is not affected by this Agreement, and neither party shall have any claims to or rights in any Pre-existing

Intellectual Property of the other party. Without limiting the foregoing, nothing contained in this Agreement nor the disclosure or provision

to Consultant of any Confidential Information (as defined in Section 4.1 below) shall be deemed to transfer or grant to, Consultant,

any right, title, interest, or license in, to or under any intellectual property or other proprietary right of Company.

3.2 Data

and Inventions. All data, reports, and other work product made, reduced to practice, or developed by Consultant which result from

any work performed by Consultant for Company (collectively, “Data”), shall belong to Company and be the exclusive property

of Company. Consultant acknowledges that Company holds the copyright to all materials provided to Consultant for use in connection with

performing the Services, except where such material is expressly attributed to third parties. Consultant acknowledges that Data and all

copyrightable materials developed or produced by Consultant during the performance of the Services constitute works made for hire. Further,

all rights to any method, discovery, invention, know-how, or improvement, made, developed, discovered, designed, conceived or reduced

to practice by Consultant, in whole or in part, alone or with others, and whether during normal business hours or otherwise, which result

from, relate to, or are otherwise derived from any Confidential Information (as defined in Section 4.1 below) or any work performed

by Consultant for Company, (each, an “Invention”), shall be the exclusive property of Company. Consultant will promptly,

fully, and accurate disclose all Data and Inventions to Company in writing.

3.3 In

consideration for the compensation provided herein, Consultant hereby irrevocably transfers and assigns to Company: (a) any and all

of its intellectual and proprietary right, title, and interest throughout the world in and to Data and Inventions (including but not

limited to all copyrights, patent rights, trade secrets and trademarks); and (b) all rights of action and claims for damages and

benefits arising due to past and present infringement of said rights. Consultant will cooperate with and assist Company to apply

for, and to execute any documents reasonably necessary to Company to secure, perfect, effectuate, and preserve Company’s

rights throughout the world in the Data and Inventions as Company deems appropriate.

3.4

The Company and Consultant acknowledge that it is not contemplated that Consultant will advise on intellectual property

matters.

4. CONFIDENTIAL INFORMATION

4.1 Definition

of Confidential Information. “Confidential Information” shall be the confidential and proprietary information

of Company, and shall mean the terms and conditions of this Agreement, and all confidential and proprietary information disclosed or

otherwise made available to Consultant by or on behalf of Company, its affiliates, or representatives, or developed or acquired by

Consultant in providing the Services hereunder, including but not limited to all information relating to Company’s research,

development, manufacturing, commercialization or marketing plans or strategies, financing debt arrangements, or related including

any associated pricing, business and product or service plans, clinical or research data, financial projections and plans, business

forecasts, sales and merchandising, engineering or manufacturing plans, Company’s Pre-existing Intellectual Property,

intellectual property and proprietary rights, Data, Inventions, communications to and from any governmental or regulatory agency

(“Agency”) and communications to and from any investors, clients, customers, suppliers and other consultants of

Company or any of its affiliates. Confidential Information will not include, however, any information which is or becomes part of

the public domain through no breach of this Agreement or other wrongful acts of Consultant.

4.2 Obligations. Consultant

and its agents will (a) hold and keep all Confidential Information in strict confidence; (b) not disclose nor permit the disclosure

of Confidential Information, in whole or part, to any third party except as allowed or required by other provisions in this

Agreement; (c) not use nor permit the use of Confidential Information, directly or indirectly for any purpose, commercially or

otherwise, other than to perform the Services; and (d) not allow any unauthorized persons to access or use such Confidential

Information. Consultant will take all actions reasonably necessary and satisfactory to Company to protect the confidentiality of the

Confidential Information including, without limitation, implementing and enforcing operating procedures to minimize the possibility

of unauthorized use, copying or loss of the Confidential Information.

4.3 Compelled Disclosure.

Nothing herein shall be construed to prevent disclosure of Confidential Information as may be required by applicable law or

regulation, or pursuant to the valid order of a court of competent jurisdiction or an authorized government agency, provided that

the disclosure does not exceed the extent of disclosure required by such law, regulation or order. Consultant agrees to provide

written notice of any such order to an authorized officer of the Company within five (5) days of receiving such order, but in any

event sufficiently in advance of making any disclosure to permit the Company to contest the order or seek confidentiality

protections, as determined in the Company's sole discretion.

5. TERM AND TERMINATION

5.1 Term. This Agreement will

take effect on the Effective Date and shall continue for a period ending on January 31, 2023 (the “Initial

Term”).

5.2 Termination.

| (a) | Company may terminate this Agreement at any time after the Initial Term upon thirty (30) days’ prior written notice to the Consultant. |

| (b) | Consultant may terminate this Agreement at any time during the Term upon thirty (30) days’ prior

written notice to Company. |

5.3 Effect

of Termination. Upon the expiration or termination of this Agreement, Consultant will promptly return or destroy, at

Company’s option, all Confidential Information. Company will continue to compensate Consultant for any introductions made

prior to the termination of the Agreement, so long as the signing of the Deal or the Partnership (each as defined in Exhibit

B), the hiring, or other relevant event triggering the compensation occurs within 12 months following the termination of

this Agreement; provided, that it is possible that the amount of compensation may not be determinable until after such 12-month

period. By way of example, in the event that Consultant introduces an entity prior to termination that results in the signing of a

Deal (as defined in Exhibit B) within the 12 month period following termination of this

Agreement, but that closes after 12 months following the termination of this Agreement, Consultant shall be entitled to 22,500

restricted shares of the Company’s common stock plus an additional 7,000 restricted shares of the Company’s common stock

in the event that the relevant revenue target is met, notwithstanding termination of this Agreement. The election by either party to

terminate this Agreement in accordance with its terms shall not be deemed an election of remedies, and all other remedies provided

by this Agreement or available at law or in equity shall survive any termination. In addition to any provisions that by their nature

survive expiration or termination of this Agreement, Sections 1.3, 3, 4, 5, 6, and 8-13 shall

survive any termination or expiration of this Agreement for any reason.

6. COMPLIANCE

Both parties to this Agreement

agree to comply with all applicable federal, state, and local laws, including relevant securities laws and regulations in performing their

obligations under this Agreement. Both parties to this Agreement expressly acknowledge that the federal anti-kickback statute, 42 U.S.C.

§ 1320a-7b(b), prohibits the payment or receipt of remuneration as an inducement or reward for the referral, purchase, or ordering

of items or services for which payment may be made in whole or in part under a federal health care program. It is the intention of the

parties that this Agreement be performed in accordance with the anti-kickback statute and its implementing regulations. If any portion

of this Agreement is found, by any court or Agency with jurisdiction over the subject matter of the Agreement, not to be in compliance

with the anti-kickback statute, that portion of the Agreement shall be deemed to be retroactively amended and reformed as necessary to

comply with the statute, and the parties shall cooperate in taking any steps necessary to ensure such compliance.

7. REPRESENTATIONS AND WARRANTIES

7.1 Consultant

represents and warrants that Consultant: (a) is, and each of its agents is, skilled and experienced in providing the Services, and

will perform the Services in a professional and workmanlike manner customary in the industry; (b) will, and each of its agents will,

perform the Services in accordance with normally accepted standards and in compliance with the terms and conditions of this

Agreement and all applicable laws, ordinances and regulations; (c) has not, and none of its agents has, been subject to any

disciplinary actions by any applicable financial accrediting bodies including Nasdaq, the Securities and Exchange Commission (SEC),

Financial Industry Regulatory Authority (FINRA), and related, or other similar entities, nor been subject to any other restrictions

or sanctions related to allegations of professional misconduct; (d) is free to enter into this Agreement, and is under no obligation

to any third party which would prevent Consultant from carrying out the duties and obligations contemplated hereunder; (e) does not

have any other conflict of interest which might interfere with Consultant’s independent judgment or objectivity in the

performance of Services hereunder; (f) possesses all relevant licenses and authorizations, and is fully compliant with all laws and

regulations, including all relevant U.S. securities laws and regulations, that may be required in order to perform the Services, and

to receive the Compensation as set forth in Section 2; and (g) the Consultant is, and on each date on which it exercises any

warrants, it will be an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7) or (a)(8) under the

Securities Act of 1933, as amended.

7.2 Consultant

shall immediately notify Company in writing if, at any time during the term of this Agreement, (a) any representation or warranty of

Consultant contained in this Agreement shall no longer be true and correct, or (b) Consultant becomes aware of any known, suspected,

or alleged violation of law or breach of agreement by Company, by Consultant, or by any third party relating to the Services or the

Company.

8. INDEMNIFICATION

8.1 Indemnification.

Consultant will indemnify, defend and hold harmless Company, its affiliates and their respective officers, directors and employees from

and against all claims, damages, losses, liabilities and expenses, including court costs and reasonable attorney fees, which arise from

or are related to Consultant’s or its agent’s: (a) negligent acts or omissions or willful misconduct in performance of the

Services; (b) breach of this Agreement; or (c) failure to comply with any applicable laws, rules, statutes, ordinances, or regulations

in performance of the Services. Company will provide Consultant with prompt notice of any such claim, and will reasonably cooperate with

Consultant and its legal representatives in the investigation of any matter regarding the subject of the indemnification at Consultant’s

expense. Consultant shall not enter into any non-monetary settlement or admit fault or liability on Company’s behalf without Company’s

prior written consent. Consultant shall not be required to indemnify the Company in an amount in excess of the aggregate compensation

paid to the Consultant by the Company hereunder.

9. RELATIONSHIP OF PARTIES

9.1 Independent

Contractor. Consultant is an independent contractor and is not an agent or employee of, and has no authority to bind, Company by

contract or otherwise. Nothing in this Agreement shall be construed to render Consultant or any of its agents an employee, partner,

agent of, or joint venture with Company for any purpose. Consultant and its agents will make no representations, warranties or

commitments binding Company without Company’s prior written consent. Consultant has the sole discretion to determine the

manner and means by which the Services are accomplished, subject to the requirement that Consultant and its agents shall at all

times comply with applicable law and professional standards. The Company has no right to and shall not direct or control the manner

or means by which Consultant performs the Services.

9.2 Employment

Taxes and Benefits. Consultant will report as self-employment income all compensation received by Consultant pursuant to this

Agreement, and is solely responsible for paying all applicable taxes or contributions imposed on such compensation, including but

not limited to social security taxes, self-employment taxes, unemployment insurance payments and workers’ compensation

insurance payments. The Company will issue a Form 1099 to Consultant in respect of the payments made under this Agreement.

Consultant and its agents will not be entitled to receive any vacation, sick or other paid time off payments, or to participate in

any plans, arrangements, or distributions by Company pertaining to any fringe benefits, bonus, stock option, profit sharing,

insurance or similar benefits for Company’s employees (collectively, “Benefits”). Consultant will indemnify

Company and hold it harmless from and against all claims, damages, losses and expenses, including reasonable fees and expenses of

attorneys and other professionals, relating to any obligation imposed by law on Company to treat Consultant or its agents as an

employee instead of an independent contractor, including without limitation, any obligation to pay any withholding taxes, social

security, unemployment or disability insurance, or similar items in connection with any Benefits.

9.3 Non-Exclusive

Engagement. Company may from time to time (i) engage other persons and entities to act as consultants to Company and perform services

for Company, including services that are similar to the Services, and (ii) enter into agreements similar to this Agreement with other

persons or entities, in all cases without the necessity of obtaining approval from Consultant. Consultant may from time to time (i) accept

any engagement from other persons or entities including for services that are similar to the Services and/or from competitors of the Company,

and (ii) enter into agreements similar to this Agreement with other persons or entities, in all cases without the necessity of obtaining

approval from Company.

10. NO MATERIAL CONFLICTS

Consultant

represents and warrants that (a) Consultant’s execution and delivery of this Agreement does not, and Consultant’s performance

of Consultant’s obligations hereunder will not conflict with, result in the breach of any provisions of, or constitute a default

under any agreement or other obligation to which Consultant is a party or may otherwise be bound, and Consultant will not enter into any

such agreement or obligation during the term of this Agreement; (b) Consultant does not have any material financial interest or any other

material conflict of interest which might materially interfere with Consultant’s independent judgment or objectivity in the performance

of Services hereunder except as disclosed by Consultant to the Company in writing, which shall be updated and confirmed by Consultant

at least annually; (c) Consultant has fully complied with any obligations to disclose and obtain approval of Consultant’s acting

as a consultant for Company and of the duties required of Consultant under this Agreement.

11. LIMITATION OF LIABILITY

IN NO EVENT SHALL EITHER PARTY

BE LIABLE TO THE OTHER PARTY FOR ANY SPECIAL, INCIDENTAL, CONSEQUENTIAL, INDIRECT OR LIQUIDATED DAMAGES ARISING FROM OR IN RELATION TO

THIS AGREEMENT OR THE SERVICES PROVIDED HEREUNDER (WHETHER IN CONTRACT, TORT, NEGLIGENCE, STRICT LIABILITY, BY STATUTE OR OTHERWISE).

THIS LIMITATION SHALL APPLY EVEN IF THE PARTIES HAVE BEEN ADVISED OR MADE AWARE OF THE POSSIBILITY OF SUCH DAMAGES. COMPANY’S MAXIMUM

AGGREGATE LIABILITY TO CONSULTANT FOR ANY CLAIM RELATED TO, OR IN CONNECTION WITH, THIS AGREEMENT OR THE SERVICES SHALL BE LIMITED TO

AN AMOUNT EQUAL TO THE TOTAL AMOUNT OWED BY COMPANY TO CONSULTANT UNDER THIS AGREEMENT.

12. NOTICES

Any notices

under this Agreement will be in writing and delivered to the parties at the postal addresses set forth below, or to the postal address

subsequently provided by a party in accordance with this Section 12, by (a) first class certified mail, return receipt requested,

with notice deemed given upon the date of receipt as indicated on the return receipt; or (b) a nationally-recognized overnight courier

service, with notice deemed given on the date of receipt as indicated on the courier’s receipt:

If to Company:

8 HaTokhen Street

142 W. 57th St., 8th Floor,

New York, New York 10019

Attn: Erez Raphael, Chief Executive Officer

If to Consultant:

NearWater Growth LLC

[***]

Attn: [***]

13. MISCELLANEOUS

13.1 Jurisdiction,

Governing Law. This Agreement and the rights and obligations of the parties hereunder shall be governed by and interpreted,

construed, and enforced in accordance with the laws of New York, exclusive of its choice of law rules. Any legal suit, action or

proceeding arising out of or related to this Agreement or the matters contemplated hereunder shall be instituted exclusively in the

federal courts of the United States or the courts of the State of New York in each case located in the city of New York and County

of New York, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding

and waives any objection based on improper venue or forum non conveniens. Service of process, summons, notice or other document by

mail to such party's address set forth herein shall be effective service of process for any suit, action or other proceeding brought

in any such court.

13.2 Assignment.

Consultant may not assign or otherwise transfer this Agreement, or any rights or obligations hereunder, in whole or in part, whether by

operation of law or otherwise, without Company’s prior written consent. Any attempted sale, pledge, assignment, sublicense, or other

transfer without such consent will be void and of no force and effect.

13.3 Successors

and Assigns. All of the provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their

respective heirs, successors, and assigns.

13.4 Modification

or Amendment. This Agreement may only be modified or amended in a writing signed by Company and Consultant.

13.5 Waiver.

Waiver by one party hereto of breach of any provision of this Agreement by the other shall not operate or be construed as a continuing

waiver.

13.6 Severability

of Provisions. If any section, provision, or part of this Agreement is held to be illegal, invalid or unenforceable, such

section, provision, or part shall be fully severable. The remainder of this Agreement shall remain in full force and effect.

13.7 Headings.

Section headings are not to be considered a part of this Agreement and are not intended to be a full and accurate description of the contents

hereof.

13.8 Counterparts.

This Agreement and any amendments hereto may be executed in one or more counterparts. All such counterparts shall constitute one and the

same Agreement and shall become effective when a copy signed by each party has been delivered to the other party. Delivery of an executed

counterpart of a signature page of this Agreement by facsimile transmission, by electronic mail in “portable document format”

(“.pdf” format), or by any other electronic means intended to preserve the original graphic and pictorial appearance of a

document, or by a combination of such means, shall be effective as delivery of a manually executed counterpart of this Agreement.

13.9 Entire

Agreement. This Agreement and all Exhibits attached hereto, all of which are hereby incorporated by reference herein, constitute the

entire agreement between the parties with respect to the subject matter herein, and supersede all prior agreements, arrangements and understandings.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have executed this

Agreement as of the Effective Date.

| DarioHealth Corp. |

|

NearWater Growth LLC |

| |

|

|

| By: |

/s/ Erez Raphael |

|

By: |

/s/ Jeffrey P Leisure |

| Name: Erez Raphael |

|

Name: Jeffrey P Leisure |

| Title: CEO |

|

Title: Managing Partner |

EXHIBIT A

General Description of Services

Consultant to support the Company with introductions

to potential investors, banks and other strategic partners in the United States (the “Services”).

EXHIBIT B

Compensation

In consideration

for the Consultant’s Services hereunder, the Company will issue the Consultant an option to purchase 25,000 shares of the company’s

common stock at an exercise price per share equal to the closing price of the stock on the date prior to the approval of the Company’s

board.

In addition,

the Consultant shall be entitled to receive the following performance grants of restricted shares of the Company’s common stock

due to any direct introduction of parties by the Consultant as set forth below:

| Area |

Comp |

Criteria |

| Talent – game changer hiring |

5,000-12,000 shares |

·

· |

[***] shares for each C level hire introduced by the

Consultant to the Company

[***] shares for each SVP level hire introduced

by the Consultant to the Company |

| Acquisition - Dario Health acquired company |

22,500 shares- 29,500 shares |

·

· |

[***] shares upon the Consultant introducing the Company

to an entity for the purposes of the Company acquiring such entity and the Company acquires such entity by merger, purchase of substantially

all of such entity’s assets, or purchase of substantially all of such entity’s stock (the “Deal”)

In the event that the Company's aggregate gross revenue

during the four full calendar quarters immediately following the closing of the Deal is at least [***]% of the Company's aggregate gross

revenue during the four full calendar quarters immediately preceding the closing of the Deal (where, in all cases, gross revenue is determined

in accordance with US GAAP, consistently applied), the Consultant shall receive an additional [***] shares on top of the [***] shares

|

| Alliance – “Game Changer” Alliance |

22,500 shares |

· |

22,500 shares under the following criteria:

o The Consultant introduces the

Company to an entity for partnership purposes, and (1) the Company forms a partnership with such entity (“Partnership”), with

the Company's aggregate gross revenue during the four full calendar quarters immediately following the closing of the Partnership potentially

reaching [***]% of the Company's aggregate gross revenue during the four full calendar quarters immediately preceding the closing of the

Partnership (where, in all cases, gross revenue is determined in accordance with US GAAP, consistently applied), or (2) the Partnership

increases the Company’s branding

|

| Special one-time bonus |

25,000-30,000 shares |

· |

25,000-30,000 shares for a sufficiently important introduction by the Consultant to the Company to be mutually agreed in writing by both the Consultant and the Company. |

| Exit – Dario is being sold |

25,000-50,000 shares |

· |

Upon the Consultant introducing the Company to an entity for the purposes of the Company being acquired by such entity, (1) [***] shares in case the Company is sold to such entity for not less than $500 million and below $800 million, (2) [***] shares in case the Company is sold to such entity for $800 million to $1.8 billion, or (3) [***] shares in case the Company is sold to such entity for $1.8 billion or more |

Exhibit 10.2

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL AND (ii) IS THE TYPE THAT DARIOHEALTH CORP. TREATS AS PRIVATE OR CONFIDENTIAL. OMISSIONS

ARE DENOTED IN BRACKETS WITH ASTERISKS THROUGHOUT THIS EXHIBIT.

DarioHealth Corp.

NearWater Growth, LLC

| Re: | Amendment to Consulting

Agreement dated September 3, 2021 |

Dear Sir:

Reference

is made to that certain Consulting Agreement dated September 3, 2021 (the “Consulting Agreement”) by and between DarioHealth

Corp. a Delaware corporation (the “Company”) and NearWater Growth, LLC, with an address at [***] (“NW”)

pursuant to which the Company agreed to engage NW to provide certain consulting and advisory services on certain terms and conditions.

The purpose of this letter agreement is to amend and modify the Consulting Agreement.

The Company and NW hereby

agree to amend and modify the Consulting Agreement as follows:

The table attached as exhibit

be to the agreement dated September 3, 2021 is replaced in its entirety by the table attached as Exhibit A to this amendment.

This Amendment Letter shall

become effective as of the date hereof. There are no conditions precedent or subsequent to the effectiveness of this Amendment Letter.

Except as modified by the terms of this Amendment Letter, the terms and provisions of the Consulting Agreement shall remain unmodified

and in full force and effect. Other than as stated herein, this Amendment Letter shall not operate as a waiver of any condition or obligation

imposed on the parties under the Consulting Agreement. In the event of any conflict, inconsistency, or incongruity between any provision

of this Amendment Letter and any provision of the Consulting Agreement, the provisions of this Amendment Letter shall govern and control.

This Amendment shall not be changed or modified orally, but only by an instrument in writing signed by the parties.

Please execute this Amendment Letter in the space

provided below in order to evidence your agreement with the terms hereof.

| Sincerely, |

|

| |

|

| DARIOHEALTH CORP. |

|

| |

|

| |

|

| By: |

/s/ Erez Raphael |

|

| Name: Erez Raphael |

|

| Title: Chief Executive Officer |

|

| |

|

| |

|

| ACCEPTED AND AGREED: |

|

| |

|

| |

|

| NEAR WATER GROWTH LLC |

|

| |

|

| |

|

| By: |

/s/ Jeffrey Leisure |

|

| Name: Jeffrey Leisure |

|

| Title: Managing Director |

|

EXHIBIT A

Fees: NW shall earn a monthly retainer fee of $10,000

beginning the first day of the month following the completion of a Qualified Financing (as defined below) and NW will advise the Company

on fundraising strategy.

“Qualified Financing” shall mean an equity

(whether common or preferred equity) financing round completed by Company where the gross proceeds of the round are no less than twenty-five

(25) million dollars.

| Area |

Comp |

Criteria |

| Time based |

150,000 Shares |

The shares will vest quarterly over a 4 year period subject to the consultant providing continuous services to the Company |

| |

|

|

|

| Acquisition - Dario Health acquired company |

45,000 shares |

· |

45,000 shares upon the Consultant introducing the Company to an entity for the purposes of the Company acquiring such entity and the Company acquires such entity by merger, purchase of substantially all of such entity’s assets, or purchase of substantially all of such entity’s stock (the “Deal”) |

| |

|

· |

In the event that the Company's aggregate gross revenue during the four full calendar quarters immediately following the closing of the Deal is at least [***]% of the Company's aggregate gross revenue during the four full calendar quarters immediately preceding the closing of the Deal (where, in all cases, gross revenue is determined in accordance with US GAAP, consistently applied), the Consultant shall receive an additional 7,000 shares on top of the 45,000 shares |

| Alliance – “Game Changer” Alliance |

45,000 shares |

· |

45,000 shares under the following criteria:

o

The Consultant introduces the Company to an entity for partnership purposes, and (1) the Company forms a partnership with such entity

(“Partnership”), with the Company's aggregate gross revenue during the four full calendar quarters immediately following

the closing of the Partnership potentially reaching [***]% of the Company's aggregate gross revenue during the four full calendar quarters

immediately preceding the closing of the Partnership (where, in all cases, gross revenue is determined in accordance with US GAAP, consistently

applied), or (2) the Partnership increases the Company’s branding |

| Special one-time bonus |

25,000-30,000 shares |

· |

25,000-30,000 shares for a sufficiently important introduction by the Consultant to the Company to be mutually agreed in writing by both the Consultant and the Company. |

| Exit – Dario is being sold |

70,000-100,000 shares |

· |

Upon the Consultant introducing the Company to an entity for the purposes of the Company being acquired by such entity, (1) [***] shares in case the Company is sold to such entity for not less than $500 million and below $800 million, (2) [***] shares in case the Company is sold to such entity for $800 million to $1.8 billion, or (3) [***] shares in case the Company is sold to such entity for $1.8 billion or more |

| Special Award |

100,000 shares |

· |

In addition to the specific performance stock awards described above, the CEO at his sole discretion may award up to 100,000 to consultant for extraordinary contribution(s) to the organization that reflect consultant’s impact on Dario’s commercial positioning and prominence, critical capability & go to market partnerships, management team development, and other activities that enhance the value of the enterprise. |

Exhibit 10.3

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL AND (ii) IS THE TYPE THAT DARIOHEALTH CORP. TREATS AS PRIVATE OR CONFIDENTIAL. OMISSIONS

ARE DENOTED IN BRACKETS WITH ASTERISKS THROUGHOUT THIS EXHIBIT.

DarioHealth Corp.

Near Water Growth LLC

[***]

| Re: | Second Amendment to Consulting Agreement dated September

3, 2021 |

Dear Sir:

Reference is made to that

certain Consulting Agreement dated September 3, 2021, as amended on June 5, 2023 (the “Consulting Agreement”) by and

between DarioHealth Corp. a Delaware corporation (the “Company”) and Near Water Growth LLC (“NW”)

pursuant to which the Company agreed to engage NW to provide certain consulting and advisory services on certain terms and conditions.

The purpose of this letter agreement (this “Amendment Letter”) is to amend and modify the Consulting Agreement.

The Company and NW hereby

agree to amend and modify the Consulting Agreement as follows:

| 1. | Adding a Section 2.1(c) to the Consulting Agreement which shall provide as follows: |

“In addition

to the compensation payable to the Consultant as provided herein, commencing on September 1, 2024 the Company agrees to pay the Consultant

a monthly retainer of $5,000 (the “Retainer”). Commencing on January 1, 2025, the Company agrees to increase the Retainer

payable to the Consultant to $10,000 per month during the Term.”

This Amendment Letter shall

become effective as of the date hereof. There are no conditions precedent or subsequent to the effectiveness of this Amendment Letter.

Except as modified by the terms of this Amendment Letter, the terms and provisions of the Consulting Agreement shall remain unmodified

and in full force and effect. Other than as stated herein, this Amendment Letter shall not operate as a waiver of any condition or obligation

imposed on the parties under the Consulting Agreement. In the event of any conflict, inconsistency, or incongruity between any provision

of this Amendment Letter and any provision of the Consulting Agreement, the provisions of this Amendment Letter shall govern and control.

This Amendment shall not be changed or modified orally, but only by an instrument in writing signed by the parties.

Please execute this Amendment

Letter in the space provided below in order to evidence your agreement with the terms hereof.

| Sincerely, |

|

| |

|

| DARIOHEALTH CORP. |

|

| |

|

| |

|

| By: |

/s/ Erez Raphael |

|

| Name: Erez Raphael |

|

| Title: Chief Executive Officer |

|

| |

|

| |

|

| ACCEPTED AND AGREED: |

|

| |

|

| |

|

| NEAR WATER GROWTH LLC |

|

| |

|

| |

|

| By: |

J.P. Leisure |

|

| Name: J.P. Leisure |

|

| Title: Member |

|

Exhibit 99.1

DarioHealth Appoints Healthcare Industry Leader

Larry Leisure to Board of Directors

Healthcare innovator and former Accenture executive

brings deep industry relationships to advance Dario's AI-driven chronic care platform

NEW YORK, Feb. 27, 2025 -- DarioHealth Corp. (Nasdaq: DRIO) (“Dario”

or the “Company”), a leader in AI-driven digital health solutions, today announced the appointment of Lawrence (Larry) B.

Leisure to its Board of Directors, bringing four decades of healthcare leadership, managed care expertise, and digital health innovation

to the company’s governance. Mr. Leisure’s extensive experience working with health plans, health systems, consultants, and

employer coalitions, combined with his deep understanding of health policy, reimbursement, and value-based care models, will be instrumental

in guiding Dario’s continued expansion within the payer and employer markets.

Mr. Leisure began his professional career in benefits consulting ultimately

serving as National Practice Leader at Towers Perrin (aka Willis Towers Watson) then transitioning to management consulting first as a

Senior Partner at PricewaterhouseCoopers and later as a Managing Partner at Accenture. He went on to serve in senior leadership

roles at Kaiser Foundation Health Plan and UnitedHealth Group's OptumInsight unit. His pivot to health care investing started with his

joining the venture capital firm of Kleiner Perkins as an Operating Partner. In 2014, he co-founded Chicago Pacific Founders, a

health care focused private equity firm.

As an ardent advocate for innovation in healthcare, Mr. Leisure co-founded

the Employer Health Innovation Roundtable, a coalition representing over six million lives. Mr. Leisure is Chairman of the UCSF Rosenman

Institute, member of the UCLA Anderson School of Management Board of Advisors, and a Senior Advisor at the Mussalem Center for BIODESIGN

at Stanford University.

He received his BA in Economics from Stanford University and his MBA

in Finance from the UCLA Anderson School of Management. He resides in Atherton, California with his wife, Bren.

“We are honored to welcome Larry to Dario’s Board of Directors,”

said Erez Raphael, CEO of Dario. “His deep expertise across the healthcare ecosystem—from payers and employer groups and healthcare

innovators—will provide invaluable insight as we continue to scale our solutions and strengthen our value-based partnerships. Larry’s

leadership in advancing healthcare technology and his track record of driving meaningful industry change align perfectly with Dario’s

mission to deliver better health outcomes through AI-driven, personalized care.”

About DarioHealth Corp.

DarioHealth Corp. (Nasdaq: DRIO) is a leading digital health company

revolutionizing how people with chronic conditions manage their health through a user-centric, multi-chronic condition digital therapeutics

platform. Dario’s platform and suite of solutions deliver personalized and dynamic interventions driven by data analytics and one-on-one

coaching for diabetes, hypertension, weight management, musculoskeletal pain and behavioral health.

Dario’s user-centric platform offers people continuous and customized

care for their health, disrupting the traditional episodic approach to healthcare. This approach empowers people to holistically adapt

their lifestyles for sustainable behavior change, driving exceptional user satisfaction, retention and results and making the right thing

to do the easy thing to do.

Dario provides its highly user-rated solutions globally to health plans

and other payers, self-insured employers, providers of care and consumers. To learn more about Dario and its digital health solutions,

or for more information, visit http://dariohealth.com.

Cautionary Note Regarding Forward-Looking Statements

This news release and the statements of representatives and partners

of DarioHealth Corp. related thereto contain or may contain forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Statements that are not statements of historical fact may be deemed to be forward-looking statements. For example,

the Company is using forward-looking statements in this press release when it discusses its belief that adding Mr. Leisure as a member

of the Board will be instrumental in guiding Dario’s continued expansion within the payer and employer markets and to advance Dario's

AI-driven chronic care platform. Without limiting the generality of the foregoing, words such as "plan," "project,"

"potential," "seek," "may," "will," "expect," "believe," "anticipate,"

"intend," "could," "estimate" or "continue" are intended to identify forward-looking statements.

Readers are cautioned that certain important factors may affect the Company's actual results and could cause such results to differ materially

from any forward-looking statements that may be made in this news release. Factors that may affect the Company's results include, but

are not limited to, regulatory approvals, product demand, market acceptance, impact of competitive products and prices, product development,

commercialization or technological difficulties, the success or failure of negotiations and trade, legal, social and economic risks, and

the risks associated with the adequacy of existing cash resources. Additional factors that could cause or contribute to differences between

the Company's actual results and forward-looking statements include, but are not limited to, those risks discussed in the Company's filings

with the U.S. Securities and Exchange Commission. Readers are cautioned that actual results (including, without limitation, the timing

for and results of the Company's commercial and regulatory plans for Dario™ as described herein) may differ significantly from those

set forth in the forward-looking statements. The Company undertakes no obligation to publicly update any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by applicable law.

DarioHealth Corporate Contact

Mary Mooney

VP Marketing

mary@dariohealth.com

+1-312-593-4280

DarioHealth Investor Relations Contact

Kat Parrella

Investor Relations Manager

kat@dariohealth.com

+315-378-6922

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

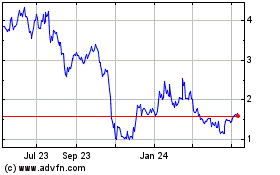

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Feb 2025 to Mar 2025

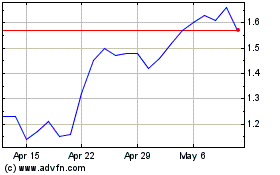

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Mar 2024 to Mar 2025