Grid Dynamics Announces Proposed Public Offering

November 12 2024 - 3:40PM

Business Wire

Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) (“Grid Dynamics”), a

leader in technology consulting, platform and product engineering,

AI, and digital engagement services, today announced the launch of

a proposed underwritten public offering of 5,000,000 shares of its

common stock. All of the shares to be sold in the offering are to

be sold by Grid Dynamics. In addition, Grid Dynamics expects to

grant the underwriters a 30-day option to purchase up to 750,000

additional shares of its common stock. The offering is subject to

market and other conditions, and there can be no assurance as to

whether or when the offering may be completed, or the actual size

or terms of the offering.

J.P. Morgan Securities LLC, William Blair & Company, L.L.C.

and TD Cowen are acting as joint book-running managers for the

offering. Needham & Company is acting as a co-manager for the

offering.

The shares are being offered by Grid Dynamics pursuant to an

automatic shelf registration statement on Form S-3 (File No.

333-283149), which became effective upon filing. The offering of

the shares will be made only by means of a preliminary prospectus

supplement, final prospectus supplement (when available) and

related base prospectus. Copies of the preliminary prospectus

supplement, final prospectus supplement (when available) and

related base prospectus may be obtained, when available, from J.P.

Morgan Securities LLC, Attention: c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 or by email

at prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com or William Blair &

Company, L.L.C., Attention: Prospectus Department, 150 North

Riverside Plaza, Chicago, Illinois 60606, by telephone at (800)

621-0687 or by email at prospectus@williamblair.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Grid Dynamics

Grid Dynamics (NASDAQ: GDYN) is a leading provider of technology

consulting, platform and product engineering, AI, and digital

engagement services. Fusing technical vision with business acumen,

we solve the most pressing technical challenges and enable positive

business outcomes for enterprise companies undergoing business

transformation. A key differentiator for Grid Dynamics is our 8

years of experience and leadership in enterprise AI, supported by

profound expertise and ongoing investment in data, analytics,

application modernization, cloud & DevOps, and customer

experience. Founded in 2006, Grid Dynamics is headquartered in

Silicon Valley with offices across the Americas, Europe, and

India.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are not historical facts, and involve risks and

uncertainties that could cause actual results of Grid Dynamics to

differ materially from those expected and projected. Grid Dynamics

intends such forward-looking statements to be covered by the safe

harbor provisions contained in the Private Securities Litigation

Reform Act of 1995 and includes this statement, in part, for the

purposes of complying with such safe harbor provisions. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words “believes,”

“estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,”

“will,” “potential,” “projects,” “predicts,” “continue,” or

“should,” or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include,

without limitation, statements about the terms and size of the

offering and the timing and manner of the offering. Most of the

factors that could cause actual results of Grid Dynamics to differ

materially from those expected and projected are outside Grid

Dynamics’s control and are difficult to predict. Factors that may

cause such differences include, but are not limited to: (i) Grid

Dynamics has a relatively short operating history and operates in a

rapidly evolving industry, which makes it difficult to evaluate

future prospects and may increase the risk that it will not

continue to be successful and may adversely impact our stock price;

(ii) Grid Dynamics may be unable to effectively manage its growth

or achieve anticipated growth, particularly as it expands into new

geographies, which could place significant strain on Grid Dynamics’

management personnel, systems and resources; (iii) Grid Dynamics’

revenues are highly dependent on a limited number of clients and

industries that are affected by seasonal trends, and any decrease

in demand for outsourced services in these industries may reduce

Grid Dynamics’ revenues and adversely affect Grid Dynamics’

business, financial condition and results of operations; (iv)

macroeconomic conditions, inflationary pressures, and the

geopolitical climate, including the Russian invasion of Ukraine,

have and may continue to materially adversely affect our stock

price, business operations, overall financial performance and

growth prospects; (v) Grid Dynamics’ revenues are highly dependent

on clients primarily located in the United States, and any economic

downturn in the United States or in other parts of the world,

including Europe or disruptions in the credit markets may have a

material adverse effect on Grid Dynamics’ business, financial

condition and results of operations; (vi) Grid Dynamics faces

intense and increasing competition; (vii) Grid Dynamics’ failure to

successfully attract, hire, develop, motivate and retain highly

skilled personnel could materially adversely affect Grid Dynamics’

business, financial condition and results of operations; (viii)

failure to adapt to rapidly changing technologies, methodologies

and evolving industry standards may have a material adverse effect

on Grid Dynamics’ business, financial condition and results of

operations; (ix) failure to successfully deliver contracted

services or causing disruptions to clients’ businesses may have a

material adverse effect on Grid Dynamics’ reputation, business,

financial condition and results of operations; (x) risks and costs

related to acquiring and integrating other companies; and (xi)

other risks and uncertainties indicated in Grid Dynamics filings

with the U.S. Securities and Exchange Commission (the “SEC”). Grid

Dynamics cautions that the foregoing list of factors is not

exclusive. Grid Dynamics cautions readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. Grid Dynamics does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based. Further

information about factors that could materially affect Grid

Dynamics, including its results of operations and financial

condition, is set forth under the “Risk Factors” section of Grid

Dynamic’s quarterly report on Form 10-Q filed October 31, 2024 and

in other periodic filings Grid Dynamics makes with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112708438/en/

Grid Dynamics Investor Relations:

investorrelations@griddynamics.com

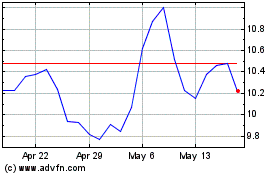

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

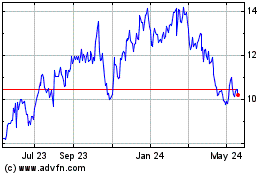

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Nov 2023 to Nov 2024