Greenpro Capital Corp. (NASDAQ: GRNQ) (“Greenpro” or the

“Company”), a multinational conglomerate with a diversified capital

portfolio, today announced that it has entered into a Strategic

Cooperation Agreement (the “Agreement”) with Gang Tai Holdings

Limited (“Gang Tai”), a conglomerate organization in Chengdu, on

April 18th 2019, to launch Greenpro Capital financial services to

cover the South Western Region of China.

Gang Tai, as a reputable conglomerate

organisation in Chengdu, is expected to help generate great

economic advantages for Greenpro through its successful businesses

and strong resources and connections in Chengdu. Gang Tai’s strong

existence and resources can help Greenpro to build, develop and

grow its financial services in the South Western Region

rapidly.

Greenpro’s development of the ADAQ (Asian

Digital Automated Quotation platform), an integrated financial

information market which identifies, builds, and streamlines

corporate values for sustainable development, aims to help

enterprises in the South Western Region of China comprised of

Chengdu, Chongqing, Xian, Guiyang and Kunming, and other ASEAN

countries, utilize the platform for opportunities to meet

international financiers for sources of capital, to help

internationalize their business, to help enterprises to go global

and develop in accordance to social values that emphasize

innovation and social responsibility.

Greenpro’s Southwest Headquarters in China will be setup

with the following entities:

- Greenpro Venture Capital

and Incubating Centre: The centre will cooperate with local

government-led funds to assist new-technology, new-financial and

new-business companies to enhance their capital sourcing and

management capabilities.

- Greenpro One-Belt-One-Road (OBOR)

Southwest Roadshow Centre: With support from the Greenpro

Global OBOR Fund the centre will provide enterprises with a place

to promote themselves to attract capital and talents.

- Greenpro Capital Greater China

Southwest Headquarters: The headquarters will provide regional

enterprises with a full range of financial solutions, which

includes overseas listing, investors matching, corporate

management consulting, venture capital, trust management, financial

management, asset management and wealth management.

Greenpro plans to nurture a closely knit

Start-up + Financial ecosystem in Chengdu, which is highly

populated, that will enable the city to host a community of

companies that all have the same vision to be listed in overseas.

With that, Chengdu will become more closely connected to the

international community and we believe will put Chengdu on a path

to develop into one of the most favoured cities in China, by

international investors.

Greenpro Venture Capital Fund will cooperate

with local government-led funds to empower enterprises with capital

solutions. Under the current sophisticated fund management model -

“Fund Accumulation, Capital Deployment, Portfolio Management,

Return Harvesting”, the fund will focus in developing strategic

advantages in the following five areas: Business

Restructuring, Product Financing Integration, Business

Strategic Alliance, Merger and Acquisition,

and Capability-driven strategies.

Over the next three years, Greenpro’s incubator

has a target to support and incubate approximately 200 enterprises

through ADAQ; Greenpro will organise six cross-border resources

integration workshops, helping 30 enterprises completing 1-to-1

resources integration in each workshop; Greenpro will help 100

enterprises complete international securitisation, creating a

target of RMB100 billion market capitalisation; Greenpro will

host three OBOR Southwest Resource Matching Conferences,

together with two overseas study tours for entrepreneurs. Through

the creation of bases for science & technology, financial, and

literature & arts, Greenpro will create the Southwest financial

centre that will improve the regional investment environment for

technological, medical and health care, financial and tourism

industries.

Greenpro Capital Corp. was listed on the NASDAQ

Capital Market on 13 June 2018, possesses comprehensive set of

licenses in Hong Kong, with rich experience in cross-border

financing and international listing, Greenpro has assisted more

than 40 enterprises listing overseas. In supporting this

initiative, the government of Chengdu has provided great support to

the plan, including granting investment incentives for enterprises

in the incubator program, strong support for commercial bank loans,

government subsidies and policy supports on several investment

initiatives.

About Greenpro Capital

Corp.

Headquartered in Hong Kong with strategic

offices across Asia, Greenpro Capital Corp. (the “Company”)

(NASDAQ: GRNQ), is a multinational conglomerate with a diversified

capital portfolio. With 30 years of experience in the industry,

Greenpro has been assisting and supporting businesses and

High-Net-Worth-Individuals (HNWIs) to capitalize their value on a

global scale through the provision of cross-border business

solutions and accounting outsourcing services to small and

medium-sized businesses located in Asia. The comprehensive range of

cross-border business services include, but not limited to, trust

and wealth management, fund and financial management, cross boarder

listing advisory services, transaction services, record management

services, accounting outsourcing services and tax planning. We also

operate venture capital businesses including a business incubator

for start-up and high growth companies to support such companies

during critical growth periods, including education and support

services, investment opportunities in selected start-up and high

growth companies, and rental activities of commercial properties

and the sale of investment properties. For further information

regarding the Company, please

visit http://www.greenprocapital.com

Forward-Looking Statements

This press release contains information about

the Company’s view of its future expectations, plans and prospects

that constitute forward-looking statements. Actual results may

differ materially from historical results or those indicated by

these forward-looking statements as a result of a variety of

factors including, but not limited to, risks and uncertainties

associated with its ability to raise additional funding, its

ability to maintain and grow its business, variability of operating

results, its ability to maintain and enhance its brand, its

development and introduction of new products and services, the

successful integration of acquired companies, technologies and

assets into its portfolio of products and services, marketing and

other business development initiatives, competition in the

industry, general government regulation, economic conditions,

dependence on key personnel, the ability to attract, hire and

retain personnel who possess the technical skills and experience

necessary to meet the requirements of its clients, and its ability

to protect its intellectual property. The Company encourages

you to review other factors that may affect its future results in

the Company’s registration statement and in its other filings with

the Securities and Exchange

Commission.

For more information, please

contact:Company Contact:Vincent Tan,

Senior Vice PresidentGreenpro Capital

Corp.Email: vincent.tan@greenprocapital.comPhone:

+86-755-2558-7791

Investor Relations Contact:Tina Xiao Ascent

Investor Relations LLC Email: tina.xiao@ascent-ir.com Phone:

+1-917-609-0333

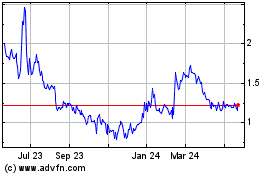

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

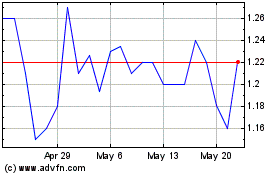

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Feb 2024 to Feb 2025