Less Than One-Third of U.S. Home Purchases Were Made With Cash in 2024, a 3-Year Low

February 18 2025 - 7:00AM

Business Wire

Redfin reports the share of home purchases made

in cash fell to a three-year low as the total number of all-cash

purchases dropped to its lowest level in a decade

(NASDAQ: RDFN) — Just under one-third (32.6%) of U.S. home

purchases were made in cash in 2024, down from 35.1% the year

before and the lowest share since 2021. That’s according to a new

report from Redfin (redfin.com), the technology-powered real estate

brokerage. Still, all-cash sales made up a bigger piece of the

homebuying pie than before the pandemic, when the share ranged from

25% to 30%.

Redfin’s report is based on its analysis of county-level home

purchase records across 40 of the most populous U.S. metropolitan

areas going back through 2014. Redfin defines an all-cash purchase

as a home purchase with no mortgage loan information on the

deed.

One reason the share of cash purchases fell was because

investors—who make up a significant proportion of all-cash

buyers—bought fewer homes than they did during the past few

years.

“The rate of all-cash sales remains high because when housing is

expensive—like it is now—wealthier Americans who can afford to pay

cash are more likely than lower-income Americans to be buying

homes,” said Redfin Senior Economist Sheharyar Bokhari. “We are

unlikely to see the share of all-cash purchases fall much lower in

2025, unless mortgage rates drop enough to drive a significant

increase in sales.”

The number of all-cash home sales dropped to its lowest level in

at least a decade in 2024 as total home sales fell to historic

lows.

Florida metros recorded highest share of cash purchases, but

the rate is dropping

Florida metros had the highest share of cash homebuyers out of

the metros Redfin analyzed. First comes West Palm Beach, where just

under half (49.6%) of home purchases were made in cash in 2024.

U.S. Metros With Highest Share of

All-Cash Purchases (2024)

Metro

Share of All-Cash Purchases

(2024)

2023→2024 YoY Change

(percentage points)

West Palm Beach, FL

49.6%

-1.2 ppts

Jacksonville, FL

40.6%

-6.4 ppts

Cleveland, OH

40.0%

-8.3 ppts

Fort Lauderdale, FL

38.9%

-2.5 ppts

Miami, FL

38.1%

-3.8 ppts

Next came Jacksonville, FL (40.6%), Cleveland (40%), Fort

Lauderdale, FL (38.9%) and Miami (38.1%). While the percentage of

cash sales remains high, all of those metros saw the share fall in

2024.

Expensive coastal metros had the lowest share of all-cash

buyers, led by San Jose, CA where only 18.1% of home purchases were

made in cash. Next came Oakland, CA (18.6%), Seattle (20.6%),

Virginia Beach, VA (21.9%) and Los Angeles (22.2%).

U.S. Metros With Lowest Share of

All-Cash Purchases (2024)

Metro

Share of All-Cash Purchases

(2024)

2023→2024 YoY Change

(percentage points)

San Jose, CA

18.1%

-0.8 ppts

Oakland, CA

18.6%

1 ppt

Seattle, WA

20.6%

0.1 ppts

Virginia Beach, VA

21.9%

-0.7 ppts

Los Angeles, CA

22.2%

0.2 ppts

The share of all-cash purchases increased most from a year

earlier in Pittsburgh (+2.1 ppts), followed by Oakland, CA (+1 ppt)

and New York (+1 ppt). Cleveland (-8.3 ppts), Baltimore (-6.8 ppts)

and Jacksonville, FL (-6.4 ppts) saw the share of cash purchases

fall most.

To view the full report, including charts, additional

metro-level data and full methodology, please visit:

https://www.redfin.com/news/all-cash-sales-annual-2024

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, and title insurance services. We run the

country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Our rentals business

empowers millions nationwide to find apartments and houses for

rent. Since launching in 2006, we've saved customers more than $1.6

billion in commissions. We serve approximately 100 markets across

the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218326934/en/

Redfin Journalist Services: Angela Cherry press@redfin.com

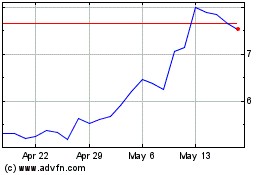

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2024 to Feb 2025