Redfin reports there were 3.7 months of

for-sale supply on the market in January, the most in six years

(NASDAQ: RDFN) — The U.S. housing market has tilted in favor of

buyers for the first time this decade, with 3.7 months of for-sale

supply sitting on the market in January. That’s the most since

February 2019 and up from 3.3 months a year ago, according to a new

report from Redfin (redfin.com), the technology-powered real estate

brokerage.

It’s worth noting that the picture looks different across

different areas of the country, with buyers favored across Sun Belt

metros, while sellers generally have more power in the Northeast

and Midwest.

Historically, four to six months of supply has indicated a

buyer’s market, and January was the closest the U.S. housing market

has come to four months of supply since 2019.

There are a range of other data points signaling favorability

for buyers ahead of the spring homebuying season:

- Sales are slow: Pending sales fell 6.3% in January to

the lowest mark since the early days of the pandemic in April

2020.

- Listings are sitting longer: The typical home sold in

January had been on the market for nearly two months (56 days), the

longest period since February 2020.

- Price growth is slowing: The median U.S. home price was

up 4.1% year over year in January, the slowest growth since

September and more in line with the rate experienced in the late

2010s.

- More negotiation is possible: The typical home sold for

1.8% less than its final asking price in January, the biggest

discount in nearly two years.

- Deals are falling through: Home purchases were canceled

at the highest January rate since at least 2017 last month.

“Historically, a buyer’s market has been defined as when months

of supply reaches 4-6 months—but old definitions don’t fit the

reality of today’s market,” said Redfin Economics Research Lead

Chen Zhao. “Many buyers don’t feel like they are in a buyer’s

market, with home prices at near-record highs and mortgage rates

elevated. But we are more than halfway through the decade and this

is the first time we can say that buyers have as much, if not more,

power than sellers.”

Zhao cautioned that even though the pendulum may have swung in

favor of buyers, these conditions may not last long. More buyers

may start to move off the sidelines when they realize there’s more

inventory available.

Sun Belt metros dominate list of buyer’s markets, while

sellers are still favored in the Northeast

There is more inventory for buyers to choose from—and therefore

more room for negotiation—across the Sun Belt states. This is

particularly the case in Florida, which has six of the top 10 major

metros with the most months of supply.

Cape Coral, FL tops the list, with 11.6 months of supply in

January, up from 8.6 months a year ago. Next comes Miami (11.4

months of supply, +3 months year over year), McAllen, TX (10.5

months, +2.5 months YoY), Fort Lauderdale, FL (10.3 months, +2.9

months YoY) and West Palm Beach, FL (9.6 months, +1.8 months

YoY).

Florida tops the list of buyer’s markets because the

pandemic-driven construction boom has increased housing supply as

buyer demand dries up due to the relative lack of affordability.

Demand has also dropped because of the increased risk of natural

disasters and subsequent higher insurance costs.

“It’s 100% a buyer’s market right now,” said Bryan Carnaggio, a

Redfin Premier agent in Jacksonville, FL. “There’s a ton of

inventory. Everywhere you go, there’s a house for sale. Most

sellers here know the market is bad and it’s not advantageous to

sell right now, but either they’re tired of waiting for things to

improve, or they really have to sell because they are moving out of

state. For buyers, this means there are more opportunities to

negotiate on price and terms.”

Top Buyer’s Markets (January

2025)

Review of 100 most populous metro areas,

ranked by months of supply

Rank

Market

Months of Supply

Months of Supply YoY

(in months)

1

Cape Coral, FL

11.6

+3

2

Miami, FL

11.4

+3

3

McAllen, TX

10.5

+2.5

4

Fort Lauderdale, FL

10.3

+2.9

5

West Palm Beach, FL

9.6

+1.8

6

New Orleans, LA

8.1

+0.3

7

North Port, FL

7.3

+0.6

8

Honolulu, HI

6.4

+0.6

9

Jacksonville, FL

6.3

+1.1

10

San Antonio, TX

6

+0.4

At the other end of the spectrum, major markets across the

Northeast still tilt in favor of sellers, with limited supply

available due to higher buyer demand.

Rochester, NY had 1.1 months of supply in January (-0.1 months

year over year), the least amount of the 100 most populous metros

Redfin analyzed. Next came Buffalo, NY (1.2 months of supply, -0.2

months YoY), Hartford, CT (1.4 months of supply, -0.3 months YoY),

Grand Rapids, MI (1.5 months of supply, no change YoY) and

Worcester, MA (1.6 months of supply, no change YoY).

Top Seller’s Markets (January

2025)

Review of 100 most populous metro areas,

ranked by months of supply

Rank

Market

Months of Supply

Months of Supply YoY

(in months)

1

Rochester, NY

1.1

-0.1

2

Buffalo, NY

1.2

-0.2

3

Hartford, CT

1.4

-0.3

4

Grand Rapids, MI

1.5

0

5

Worcester, MA

1.6

0

6

San Jose, CA

1.7

0.1

7

Montgomery County, PA

1.7

0

8

Albany, NY

1.7

-0.5

9

Allentown, PA

1.7

-0.2

10

Boston, MA

1.8

-0.2

"Rochester's seller's market is driven by a severe shortage of

homes for sale, and few homeowners have chosen to list during this

year's cold, snowy winter," said Kimberly Hogue, a Redfin Agent in

Rochester. "Home listings that are in decent shape and in

sought-after neighborhoods are met with a flurry of buyers. These

homes typically go quickly and for well over list price."

To view the full report, including methodology and additional

metro-level insights, please visit:

https://www.redfin.com/news/buyers-market-february-2025

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, and title insurance services. We run the

country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Our rentals business

empowers millions nationwide to find apartments and houses for

rent. Since launching in 2006, we've saved customers more than $1.6

billion in commissions. We serve approximately 100 markets across

the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219498020/en/

Contact Redfin Redfin Journalist Services: Kenneth Applewhaite

press@redfin.com

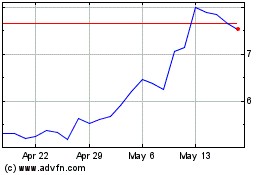

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2024 to Feb 2025