SSR Mining Inc. (Nasdaq/TSX: SSRM, ASX: SSR) ("SSR Mining" or

the “Company") reports consolidated financial results for the

second quarter ended June 30, 2024, as well as an update on the

February 13, 2024 incident at the Ç�pler mine (the “Ç�pler

Incident” or the “Incident”).

�pler

Update

The primary focus following the �pler Incident was the recovery

and return of our missing colleagues to their families. All nine of

the individuals who were lost as a result of the Incident have now

been recovered. We want to thank all of those who worked tirelessly

to locate and return these individuals to their families. We

continue to provide support to the families, our colleagues and the

community members impacted by the tragic events of February 13,

2024, and to-date we have retained a full complement of salaried

staff at �pler.

Immediately following the Incident, in partnership with the

Turkish authorities, several steps were taken to ensure containment

of the Incident. All of the containment infrastructure, including

the grout curtain, coffer dam, and buttress, as well as pumping

systems and the Sabırlı Creek diversion, are successfully in place.

Public statements from the Turkish government have continued to

affirm that there has been no recordable contamination to local

soil, water or air in the sampling locations being monitored.

Over 13 million tonnes of displaced heap leach material at

�pler have been moved since the Incident, including more than 9

million tonnes from the Sabırlı Valley. As previously guided, all

displaced material is expected to be removed from the Sabırlı

Valley into temporary storage areas by the end of the third quarter

of 2024. From the start of the second quarter of 2024 onwards,

estimates for the cost of site remediation are between $250 to $300

million, including legal contingencies, material movement and

construction costs. In the second quarter, $55 million was spent on

remediation activities at �pler. With total cash of $358 million

at the end of the second quarter, total available liquidity in

excess of $850 million, and ongoing free cash flow generation from

Marigold, Seabee and Puna, SSR Mining’s balance sheet remains

strong.

The investigations into the cause of the �pler Incident

continue and we are cooperating fully with the relevant authorities

in Türkiye. The Company has commissioned independent third parties

to review the design, construction and operation of the heap leach

pad. Although the review is ongoing, to date, these reviews have

not identified any material non-conformance with the construction

or operation of the heap leach pad relative to the third-party

engineered design parameters.

SSR Mining continues to work closely with the relevant

authorities to secure the required permits for the East Storage

Facility and the restart of the �pler mine. Once all necessary

regulatory approvals, including the Environmental Impact Assessment

(EIA) and operating permits, are reinstated, it is anticipated that

initial operations at �pler will consist of processing stockpiled

ore through the sulfide plant while Ç�pler’s mining team remains

focused on completing the remediation work. As of the end of 2023,

sulfide stockpiles contained approximately 706,000 ounces. SSR

Mining expects the �pler Sulfide Plant could process the

stockpiles economically while the remediation work is

completed.

At this time, the Company is not able to estimate when and under

what conditions operations will resume at �pler.

More information related to the �pler Incident is included in

the Company’s Annual Report on Form 10-K filed on February 27, 2024

and in the Company’s Quarterly Reports on Form 10-Q filed on May 8,

2024 and July 31, 2024. Further updates on the �pler Incident, as

and when available, will continue to be provided through press

releases and posts to the Company’s website.

Second Quarter 2024

Update (1)

In the second quarter of 2024, SSR Mining produced 76,102 gold

equivalent ounces at cost of sales of $1,357 per payable ounce and

AISC of $2,116 per payable ounce, which includes $17.3 million in

care and maintenance costs incurred at �pler. First half

consolidated production of 155,864 gold equivalent ounces from

Marigold, Seabee and Puna is in line with expectations for a

second-half weighted production profile. Full-year 2024 production

guidance of 340,000 to 380,000 gold equivalent ounces for Marigold,

Seabee and Puna remains unchanged.

(1)

The Company reports non-GAAP financial

measures including all-in sustaining costs (“AISC”) per ounce sold

(a common measure in the mining industry), to manage and evaluate

its operating performance at its mines. See "Cautionary Note

Regarding Non-GAAP Financial Measures" for an explanation of this

financial measure and a reconciliation to cost of sales, which is

the most comparable GAAP financial measure.

Second Quarter 2024 Summary: (2) (All figures are in US

dollars unless otherwise noted)

- Operating results: Second quarter 2024 production was

76,102 gold equivalent ounces at cost of sales of $1,357 per

payable ounce and AISC of $2,116 per payable ounce. During the

second quarter of 2024, operations at �pler remained suspended

following the February 13, 2024 incident. For the first half of

2024, SSR Mining produced 177,691 gold equivalent ounces at a

consolidated cost of sales of $1,244 per ounce and AISC of $1,789

per ounce. First half 2024 production from Marigold, Seabee and

Puna was 155,864 gold equivalent ounces. The three operations

remain on track for the previously stated consolidated production

guidance of 340,000 to 380,000 gold equivalent ounces at unchanged

cost expectations.

- Financial results: Net income attributable to SSR Mining

in the second quarter of 2024 was $9.7 million, or $0.05 per

diluted share, and adjusted attributable net income in the second

quarter of 2024 was $7.5 million, or $0.04 per diluted share. In

the second quarter of 2024, operating cash flow was negative $78.1

million, or negative $23.1 million before working capital

adjustments, and free cash flow was negative $116.3 million, or

negative $61.3 million before working capital adjustments.

- Cash and liquidity position: As of June 30, 2024, SSR

Mining had a cash and cash equivalent balance of $358.3 million and

a net cash position of $128.4 million. In addition, the Company has

an undrawn revolving credit facility, providing total liquidity of

$858.4 million.

- Marigold operations: Gold production was 25,691 ounces

in the second quarter of 2024 at cost of sales of $1,542 per

payable ounce and AISC of $2,065 per payable ounce. In the first

half of 2024, Marigold produced 60,371 ounces of gold at cost of

sales of $1,417 per payable ounce and AISC of $1,690 per payable

ounce. As previously guided, year-to-date operating results reflect

increased waste stripping to support near-term development

activities at Red Dot, which are a key focus for 2024 and 2025.

Marigold remains on track for full-year 2024 production guidance of

155,000 to 175,000 ounces of gold at mine site cost of sales of

$1,300 to $1,340 per payable ounce and AISC of $1,535 to $1,575 per

payable ounce. The fourth quarter of 2024 is expected to be

Marigold’s strongest production and lowest cost quarter.

- Seabee operations: Gold production was 16,709 ounces in

the second quarter of 2024 at cost of sales of $1,150 per payable

ounce and AISC of $1,626 per payable ounce. In the first half of

2024, Seabee produced 40,482 ounces of gold at cost of sales of

$959 per payable ounce and AISC of $1,488 per payable ounce. Seabee

remains on track for full-year 2024 production guidance of 75,000

to 85,000 ounces of gold at mine site cost of sales of $990 to

$1,030 per payable ounce and AISC of $1,495 to $1,535 per payable

ounce.

- Puna operations: Silver production was 2.7 million

ounces in the second quarter of 2024 at cost of sales of $16.10 per

payable ounce of silver and AISC of $15.19 per payable ounce of

silver. Quarterly process plant throughput averaged over 5,150

tonnes per day, a record for the mine. In the first half of 2024,

Puna produced 4.6 million ounces of silver at cost of sales of

$16.41 per payable ounce and AISC of $15.36 per payable ounce. Puna

remains on track for full-year 2024 production guidance of 8.75 to

9.50 million ounces of silver at mine site cost of sales of $16.50

to $18.00 per payable ounce and AISC of $14.75 to $16.25 per

payable ounce.

- Hod Maden: During the second quarter of 2024, initial

site establishment and engineering activities continued at Hod

Maden as the Company advances the project towards a construction

decision.

- Sale of the non-core San Luis project completed: On May

23 2024, the Company announced that it had closed the sale of the

San Luis project to Highlander Silver Corp. following the receipt

of all required regulatory approvals and satisfaction of all

closing conditions. As consideration for the sale, SSR Mining

received $5 million in cash and may also receive up to $37.5

million in contingent payments payable in cash. A 4.0% net smelter

return (“NSR”) royalty on the San Luis project was also granted to

SSR Mining concurrently with the closing of the transaction.

(2)

The Company reports non-GAAP financial

measures including adjusted attributable net income, adjusted

attributable net income per share, cash generated by operating

activities before working capital adjustments, free cash flow, free

cash flow before changes in working capital, net cash (debt), cash

costs and AISC per ounce sold (a common measure in the mining

industry), to manage and evaluate its operating performance at its

mines. See "Cautionary Note Regarding Non-GAAP Financial Measures"

for an explanation of these financial measures and a reconciliation

of these financial measures to the most comparable GAAP financial

measures.

Financial and Operating Summary

A summary of the Company's consolidated financial and operating

results for the three and six months ended June 30, 2024 and June

30, 2023 are presented below:

(in thousands of US dollars, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Financial Results

Revenue

$

184,841

$

301,026

$

415,075

$

615,640

Cost of sales

$

96,582

$

170,640

$

222,483

$

369,937

Operating income (loss)

$

10,720

$

52,929

$

(365,704)

$

89,914

Net income (loss)

$

2,464

$

122,376

$

(355,698)

$

151,380

Net income (loss) attributable to SSR

Mining shareholders

$

9,693

$

74,866

$

(277,389)

$

104,679

Basic net income (loss) per share

attributable to SSR Mining shareholders

$

0.05

$

0.37

$

(1.37)

$

0.51

Diluted net income (loss) per share

attributable to SSR Mining shareholders

$

0.05

$

0.35

$

(1.37)

$

0.49

Adjusted attributable net income (3)

$

7,489

$

75,103

$

29,999

$

96,376

Adjusted basic attributable net income per

share (3)

$

0.04

$

0.37

$

0.15

$

0.47

Adjusted diluted attributable net income

per share (3)

$

0.04

$

0.35

$

0.15

$

0.45

Cash generated by (used in) operating

activities

$

(78,132)

$

80,343

$

(53,501)

$

83,310

Cash generated by (used in) operating

activities before changes in working capital (3)

$

(23,093)

$

104,265

$

9,164

$

195,134

Cash generated by (used in) investing

activities

$

(31,684)

$

(179,860)

$

(68,462)

$

(231,741)

Cash generated by (used in) financing

activities

$

1,488

$

(72,945)

$

(9,332)

$

(111,134)

Operating Results

Gold produced (oz)

42,400

128,902

122,680

251,723

Gold sold (oz)

40,470

124,916

129,749

251,027

Silver produced ('000 oz)

2,731

2,269

4,646

4,284

Silver sold ('000 oz)

2,489

1,857

4,148

4,238

Lead produced ('000 lb) (4)

13,291

10,193

23,289

21,554

Lead sold ('000 lb) (4)

12,385

9,805

21,050

23,175

Zinc produced ('000 lb) (4)

859

1,748

2,076

4,227

Zinc sold ('000 lb) (4)

1,419

1,033

1,929

4,720

Gold equivalent produced (oz) (5)

76,102

156,625

177,691

303,518

Gold equivalent sold (oz) (5)

71,190

147,705

178,864

302,262

Average realized gold price ($/oz

sold)

$

2,378

$

1,963

$

2,160

$

1,932

Average realized silver price ($/oz

sold)

$

30.22

$

24.61

$

27.01

$

23.92

Cost of sales per gold equivalent ounce

sold (5)

$

1,357

$

1,155

$

1,244

$

1,224

Cash cost per gold equivalent ounce sold

(3,5)

$

1,192

$

1,108

$

1,137

$

1,157

AISC per gold equivalent ounce sold

(3,5)

$

2,116

$

1,633

$

1,789

$

1,663

Financial Position

June 30, 2024

December 31, 2023

Cash and cash equivalents

$

358,307

$

492,393

Current assets

$

1,021,938

$

1,196,476

Total assets

$

5,175,554

$

5,385,773

Current liabilities

$

288,551

$

170,573

Total liabilities

$

1,234,412

$

1,081,570

Working capital (6)

$

733,387

$

1,025,903

(3)

The Company reports non-GAAP financial

measures including adjusted attributable net income, adjusted

attributable net income per share, cash generated by operating

activities before changes in working capital, cash costs and AISC

per ounce sold to manage and evaluate its operating performance at

its mines. See “Non-GAAP Financial Measures” at the end of this

press release for an explanation of these financial measures and a

reconciliation of these financial measures to net income (loss)

attributable to SSR Mining shareholders, cost of sales, and cash

generated by operating activities, which are the most comparable

GAAP financial measures. Cost of sales excludes depreciation,

depletion, and amortization.

(4)

Data for lead production and sales relate

only to lead in lead concentrate. Data for zinc production and

sales relate only to zinc in zinc concentrate.

(5)

Gold equivalent ounces are calculated by

multiplying the silver ounces by the ratio of the silver price to

the gold price, using the average London Bullion Market Association

(“LBMA”) prices for the period. The Company does not include

by-products in the gold equivalent ounce calculations.

(6)

Working capital is defined as current

assets less current liabilities.

Marigold, USA

Three Months Ended June

30,

Six Months Ended June

30,

Operating Data

2024

2023

2024

2023

Gold produced (oz)

25,691

60,443

60,371

112,422

Gold sold (oz)

25,450

60,389

62,319

111,686

Ore mined (kt)

7,474

5,042

13,196

10,409

Waste removed (kt)

18,778

15,648

39,365

32,678

Total material mined (kt)

26,252

20,690

52,561

43,086

Strip ratio

2.5

3.1

3.0

3.1

Ore stacked (kt)

7,474

5,042

13,196

10,409

Gold grade stacked (g/t)

0.20

0.52

0.17

0.47

Average realized gold price ($/oz

sold)

$

2,391

$

1,950

$

2,203

$

1,933

Cost of sales costs ($/oz gold sold)

$

1,542

$

1,059

$

1,417

$

1,061

Cash costs ($/oz gold sold) (7)

$

1,542

$

1,063

$

1,418

$

1,065

AISC ($/oz gold sold) (7)

$

2,065

$

1,656

$

1,690

$

1,659

(7)

The Company reports the non-GAAP financial

measures of cash costs and AISC per ounce of gold sold to manage

and evaluate operating performance at Marigold. See "Cautionary

Note Regarding Non-GAAP Financial Measures" at the end of this

press release for an explanation of these financial measures and a

reconciliation to cost of sales, which are the comparable GAAP

financial measure. Cost of sales excludes depreciation, depletion,

and amortization.

For the three months ended June 30, 2024 and 2023, Marigold

produced 25,691 and 60,443 ounces of gold, respectively. For the

six months ended June 30, 2024 and 2023, Marigold produced 60,371

and 112,422 ounces of gold, respectively. During the second quarter

of 2024, Marigold reported cost of sales of $1,542 per payable

ounce and AISC of $2,065 per payable ounce. As planned, the first

half of 2024 results include increased waste stripping to support

near-term development activities at Red Dot, which is a key focus

for 2024 and 2025. As previously guided, first half 2024 cost of

sales of $1,417 per payable ounce and AISC of $1,690 per payable

ounce were above the full-year cost guidance ranges. Costs are

expected to meaningfully improve in the second half of 2024,

particularly in the fourth quarter.

Full-year 2024 production guidance for Marigold is 155,000 to

175,000 ounces of gold at mine site cost of sales of $1,300 to

$1,340 per payable ounce and AISC of $1,535 to $1,575 per payable

ounce.

Seabee, Canada

Three Months Ended June

30,

Six Months Ended June

30,

Operating Data

2024

2023

2024

2023

Gold produced (oz)

16,709

16,428

40,482

32,196

Gold sold (oz)

15,020

15,330

43,470

32,130

Ore mined (kt)

115

119

219

218

Ore milled (kt)

103

105

218

218

Gold mill feed grade (g/t)

5.40

5.25

5.99

4.91

Gold recovery (%)

95.5

96.9

96.0

96.5

Average realized gold price ($/oz

sold)

$

2,355

$

1,960

$

2,169

$

1,931

Cost of sales ($/oz gold sold)

$

1,150

$

1,192

$

959

$

1,293

Cash costs ($/oz gold sold) (8)

$

1,152

$

1,192

$

960

$

1,294

AISC ($/oz gold sold) (8)

$

1,626

$

1,690

$

1,488

$

1,960

(8)

The Company reports the non-GAAP financial

measures of cash costs and AISC per ounce of gold sold to manage

and evaluate operating performance at Seabee. See "Cautionary Note

Regarding Non-GAAP Financial Measures" at the end of this press

release for an explanation of these financial measures and a

reconciliation to cost of sales, which are the comparable GAAP

financial measure. Cost of sales excludes depreciation, depletion,

and amortization.

For the three months ended June 30, 2024 and 2023, Seabee

produced 16,709 and 16,428 ounces of gold, respectively. For the

six months ended June 30, 2024 and 2023, Seabee produced 40,482 and

32,196 ounces of gold, respectively. During the second quarter of

2024, Seabee reported cost of sales of $1,150 per payable ounce and

AISC of $1,626 per payable ounce. During the first half of 2024,

the Company reported cost of sales of $959 per payable ounce and

AISC of $1,488 per payable ounce.

Full-year 2024 production guidance at Seabee is 75,000 to 85,000

ounces of gold at mine site cost of sales of $990 to $1,030 per

payable ounce and AISC of $1,495 to $1,535 per payable ounce. As

previously guided, processed grades are expected to average between

5.0 and 6.0 g/t over 2024.

Puna, Argentina

Three Months Ended June

30,

Six Months Ended June

30,

Operating Data

2024

2023

2024

2023

Silver produced ('000 oz)

2,731

2,269

4,646

4,284

Silver sold ('000 oz)

2,489

1,857

4,148

4,238

Lead produced ('000 lb)

13,291

10,193

23,289

21,554

Lead sold ('000 lb)

12,385

9,805

21,050

23,175

Zinc produced ('000 lb)

859

1,748

2,076

4,227

Zinc sold ('000 lb)

1,419

1,033

1,929

4,720

Gold equivalent sold ('000 oz) (9)

30,720

22,789

49,115

51,235

Ore mined (kt)

668

510

931

859

Waste removed (kt)

1,519

1,524

3,029

3,508

Total material mined (kt)

2,187

2,034

3,959

4,367

Strip ratio

2.3

3.0

3.3

4.1

Ore milled (kt)

470

419

887

834

Silver mill feed grade (g/t)

186.3

175.5

168.5

166.5

Lead mill feed grade (%)

1.34

1.18

1.25

1.25

Zinc mill feed grade (%)

0.18

0.36

0.22

0.40

Silver mill recovery (%)

97.0

96.1

96.7

96.0

Lead mill recovery (%)

95.7

93.4

94.9

93.9

Zinc mill recovery (%)

46.4

52.7

48.0

57.8

Average realized silver price ($/oz

sold)

$

30.22

$

24.61

$

27.01

$

23.92

Cost of sales ($/oz silver sold)

$

16.10

$

18.02

$

16.41

$

18.95

Cash costs ($/oz silver sold) (10)

$

11.38

$

14.40

$

11.75

$

14.41

AISC ($/oz silver sold) (10)

$

15.19

$

17.41

$

15.36

$

16.84

(9)

Gold equivalent ounces are calculated

multiplying the silver ounces by the ratio of the silver price to

the gold price, using the average LBMA prices for the period. The

Company does not include by-products in the gold equivalent ounce

calculations.

(10)

The Company reports the non-GAAP financial

measures of cash costs and AISC per ounce of silver sold to manage

and evaluate operating performance at Puna. See "Cautionary Note

Regarding Non-GAAP Financial Measures" at the end of this press

release for an explanation of these financial measures and a

reconciliation to cost of sales, which are the comparable GAAP

financial measure. Cost of sales excludes depreciation, depletion,

and amortization.

For the three months ended June 30, 2024 and 2023, Puna produced

2.7 and 2.3 million ounces of silver, respectively with the

year-over-year increase primarily driven by more ore tonnes milled

and higher mill feed grade. Quarterly process plant throughput

averaged over 5,150 tonnes per day, a record for the mine. For the

six months ended June 30, 2024 and 2023, Puna produced 4.6 and 4.3

million ounces of silver, respectively. During the second quarter

of 2024, Puna reported cost of sales of $16.10 per payable ounce

and AISC of $15.19 per payable ounce. During the first half of

2024, the Company reported cost of sales of $16.41 per payable

ounce and AISC of $15.36 per payable ounce.

Full-year 2024 production guidance at Puna is 8.75 to 9.50

million ounces of silver at mine site cost of sales of $16.50 to

$18.00 per payable ounce and AISC of $14.75 to $16.25 per payable

ounce.

Ç�pler, Türkiye (amounts presented on 100% basis)

Operations at �pler were suspended following the �pler

Incident on February 13, 2024. During the suspension, care and

maintenance expense has been recorded which represents direct costs

not associated with the environmental reclamation and remediation

costs and depreciation. No production was recorded in the second

quarter of 2024.

Three Months Ended June

30,

Six Months Ended June

30,

Operating Data

2024

2023

2024

2023

Gold produced (oz)

—

52,031

21,827

107,105

Gold sold (oz)

—

49,197

23,960

107,211

Ore mined (kt)

—

1,184

266

2,363

Waste removed (kt)

—

4,841

3,571

10,216

Total material mined (kt)

—

6,025

3,837

12,579

Strip ratio

—

4.1

13.4

4.3

Ore stacked (kt)

—

154

184

342

Gold grade stacked (g/t)

—

1.46

1.17

1.33

Ore milled (kt)

—

680

343

1,404

Gold mill feed grade (g/t)

—

2.34

2.39

2.40

Gold recovery (%)

—

89.1

78.9

88.4

Average realized gold price ($/oz

sold)

$

—

$

1,979

$

2,013

$

1,934

Cost of sales ($/oz gold sold)

$

—

$

1,117

$

1,019

$

1,209

Cash costs ($/oz gold sold) (11)

$

—

$

1,107

$

1,020

$

1,196

AISC ($/oz gold sold) (11)

$

—

$

1,384

$

2,507

$

1,404

(11)

The Company reports the non-GAAP financial

measures of cash costs and AISC per ounce of gold sold to manage

and evaluate operating performance at �pler. See "Cautionary Note

Regarding Non-GAAP Financial Measures" at the end of this press

release for an explanation of these financial measures and a

reconciliation to cost of sales, which are the comparable GAAP

financial measure. Cost of sales excludes depreciation, depletion,

and amortization.

Conference Call Information

This news release should be read in conjunction with the

Company’s Quarterly Report on Form 10-Q for the quarter ended June

30, 2024, filed with the U.S. Securities and Exchange Commission

(the “SEC”) and available on the SEC website at www.sec.gov or

www.ssrmining.com.

- Conference call and webcast: Wednesday, July 31, 2024, at 5:00

pm EDT.

Toll-free in U.S. and Canada:

+1 (844) 763-8274

All other callers:

+1 (412) 717-9224

Webcast:

‘http://ir.ssrmining.com/investors/events

- The conference call will be archived and available on our

website. Audio replay will be available for two weeks by

calling:

Toll-free in U.S. and Canada:

+1 (855) 669-9658, replay code 0747

All other callers:

+1 (412) 317-0088, replay code 0747

About SSR Mining

SSR Mining is listed under the ticker symbol SSRM on the Nasdaq

and the TSX, and SSR on the ASX.

Cautionary Note Regarding Forward-Looking Information and

Statements:

Except for statements of historical fact relating to us, certain

statements contained in this news release (including information

incorporated by reference herein) constitute forward-looking

information, future oriented financial information, or financial

outlooks (collectively “forward-looking information”) within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and are intended to

be covered by the safe harbor provided for under these sections.

Forward-looking information may be contained in this document and

our other public filings. Forward-looking information relates to

statements concerning our outlook and anticipated events or results

and, in some cases, can be identified by terminology such as “may”,

“will”, “could”, “should”, “expect”, “plan”, “anticipate”,

“believe”, “intend”, “estimate”, “projects”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts, as well as statements

written in the future tense. When made, forward-looking statements

are based on information known to management at such time and/or

management’s good faith belief with respect to future events. Such

statements are subject to risks and uncertainties that could cause

actual performance or results to differ materially from those

expressed in the Company's forward-looking statements. Many of

these factors are beyond the Company's ability to control or

predict. Given these uncertainties, readers are cautioned not to

place undue reliance on forward-looking statements.

The key risks and uncertainties include, but are not limited to:

local and global political and economic conditions; governmental

and regulatory requirements and actions by governmental

authorities, including changes in government policy, government

ownership requirements, changes in environmental, tax and other

laws or regulations and the interpretation thereof; developments

with respect to global pandemics, including the duration, severity

and scope of a pandemic and potential impacts on mining operations;

risks and uncertainties resulting from the incident at �pler

described in our Annual Report on Form 10-K for the year ended

December 31, 2023 and in our quarterly report on Form 10-Q for the

quarter end June 30, 2024; and other risk factors detailed from

time to time in our reports filed with the Securities and Exchange

Commission on EDGAR at www.sec.gov the Canadian securities

regulatory authorities on SEDAR at www.sedarplus.ca and on our

website at www.ssrmining.com.

Forward-looking information and statements in this news release

include any statements concerning, among other things: all

information related to the Company’s Ç�pler operations, including

timelines, outlook, preliminary costs, remediation plans, and

possible restart plans; forecasts and outlook; preliminary cost

reporting in this document; timing, production, operating, cost,

and capital expenditure guidance; our operational and development

targets and catalysts and the impact of any suspensions on

operations; the results of any gold reconciliations; the ability to

discover additional ore; the generation of free cash flow and

payment of dividends; matters relating to proposed exploration;

communications with local stakeholders; maintaining community and

government relations; negotiations of joint ventures; negotiation

and completion of transactions; commodity prices; Mineral

Resources, Mineral Reserves, conversion of Mineral Resources,

realization of Mineral Reserves, and the existence or realization

of Mineral Resource estimates; the development approach; the timing

and amount of future production; the timing of studies,

announcements, and analysis; the timing of construction and

development of proposed mines and process facilities; capital and

operating expenditures; economic conditions; availability of

sufficient financing; exploration plans; receipt of regulatory

approvals; timing and impact surrounding suspension or interruption

of operations as a result of regulatory requirements or actions by

governmental authority; renewal of NCIB program; and any and all

other timing, exploration, development, operational, financial,

budgetary, economic, legal, social, environmental, regulatory, and

political matters that may influence or be influenced by future

events or conditions.

Such forward-looking information and statements are based on a

number of material factors and assumptions, including, but not

limited in any manner to, those disclosed in any other of our

filings on EDGAR and SEDAR, and include: any assumptions made in

respect of the Company’s Ç�pler operations; the inherent

speculative nature of exploration results; the ability to explore;

communications with local stakeholders; maintaining community and

governmental relations; status of negotiations of joint ventures;

weather conditions at our operations; commodity prices; the

ultimate determination of and realization of Mineral Reserves;

existence or realization of Mineral Resources; the development

approach; availability and receipt of required approvals, titles,

licenses and permits; sufficient working capital to develop and

operate the mines and implement development plans; access to

adequate services and supplies; foreign currency exchange rates;

interest rates; access to capital markets and associated cost of

funds; availability of a qualified work force; ability to

negotiate, finalize, and execute relevant agreements; lack of

social opposition to our mines or facilities; lack of legal

challenges with respect to our properties; the timing and amount of

future production; the ability to meet production, cost, and

capital expenditure targets; timing and ability to produce studies

and analyses; capital and operating expenditures; economic

conditions; availability of sufficient financing; the ultimate

ability to mine, process, and sell mineral products on economically

favorable terms; and any and all other timing, exploration,

development, operational, financial, budgetary, economic, legal,

social, geopolitical, regulatory and political factors that may

influence future events or conditions. While we consider these

factors and assumptions to be reasonable based on information

currently available to us, they may prove to be incorrect.

Such factors are not exhaustive of the factors that may affect

any of the Company’s forward-looking statements and information,

and such statements and information will not be updated to reflect

events or circumstances arising after the date of such statements

or to reflect the occurrence of anticipated or unanticipated

events. Forward-looking information and statements are only

predictions based on our current estimations and assumptions.

Actual results may vary materially from such forward-looking

information. Other than as required by law, we do not intend, and

undertake no obligation to update any forward-looking information

to reflect, among other things, new information or future events.

The information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document.

Cautionary Note Regarding Non-GAAP Financial Measures

We have included certain non-GAAP financial measures to assist

in understanding the Company’s financial results. The non-GAAP

financial measures are employed by us to measure our operating and

economic performance and to assist in decision-making, as well as

to provide key performance information to senior management. We

believe that, in addition to conventional measures prepared in

accordance with GAAP, certain investors and other stakeholders will

find this information useful to evaluate our operating and

financial performance; however, these non-GAAP performance measures

– including total cash, total debt, net cash (debt), cash costs,

all-in sustaining costs (“AISC”) per ounce sold, adjusted net

income (loss) attributable to shareholders, cash generated by (used

in) operating activities before changes in working capital, free

cash flow, and free cash flow before changes in working capital –

do not have any standardized meaning. These performance measures

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. Our definitions of

our non-GAAP financial measures may not be comparable to similarly

titled measures reported by other companies. These non-GAAP

measures should be read in conjunction with our consolidated

financial statements.

Non-GAAP Measure – Net Cash

(Debt)

Net cash (debt) are used by management and investors to measure

the Company's underlying operating performance. The Company

believes that net cash (debt) is a useful measure for shareholders

as it helps evaluate liquidity and available cash.

The following table provides a reconciliation of cash and cash

equivalents to net cash:

As of

(in thousands)

June 30, 2024

December 31, 2023

Cash and cash equivalents

$

358,307

$

492,393

Restricted cash

$

101

$

101

Total cash

$

358,408

$

492,494

Face value of 2019 convertible note

$

230,000

$

230,000

Other debt

$

—

$

920

Total debt

$

230,000

$

230,920

Net cash (debt)

$

128,408

$

261,574

In addition to net cash and net debt, the Company also uses

Total liquidity to measure its financial position. Total liquidity

is calculated as Cash and cash equivalents plus Restricted cash and

borrowing capacity under current revolving credit facilities,

including accordion features. As of June 30, 2024 and as of

December 31, 2023, the Company’s $400 million credit facility was

undrawn, with a $100 million accordion feature.

The following table provides a reconciliation of Cash and cash

equivalents to Total liquidity:

As of

(in thousands)

June 30, 2024

December 31, 2023

Cash and cash equivalents

$

358,307

$

492,393

Restricted cash

$

101

$

101

Total cash

$

358,408

$

492,494

Borrowing capacity on credit facility

$

400,000

$

400,000

Borrowing capacity on accordion feature of

credit facility

$

100,000

$

100,000

Total liquidity

$

858,408

$

992,494

Non-GAAP Measure - Cash Costs and

AISC

Cash Costs and All-In Sustaining Costs (“AISC”) per payable

ounce of gold and respective unit cost measures are non-U.S. GAAP

metrics developed by the World Gold Council to provide transparency

into the costs associated with producing gold and provide a

standard for comparison across the industry. The World Gold Council

is a market development organization for the gold industry.

The Company uses cash costs per ounce of precious metals sold

and AISC per ounce of precious metals to monitor its operating

performance internally. The most directly comparable measure

prepared in accordance with GAAP is cost of sales. The Company

believes this measure provides investors and analysts with useful

information about its underlying cash costs of operations and the

impact of by-product credits on its cost structure. The Company

also believes it is a relevant metric used to understand its

operating profitability. When deriving the cost of sales associated

with an ounce of precious metal, the Company includes by-product

credits, which allows management and other stakeholders to assess

the net costs of gold and silver production.

AISC includes total cost of sales incurred at the Company's

mining operations, which forms the basis of cash costs.

Additionally, the Company includes sustaining capital expenditures,

sustaining mine-site exploration and evaluation costs, reclamation

cost accretion and amortization, and general and administrative

expenses. This measure seeks to reflect the ongoing cost of gold

and silver production from current operations; therefore, growth

capital is excluded. The Company determines sustaining capital to

be capital expenditures that are necessary to maintain current

production and execute the current mine plan. The Company

determines growth capital to be those payments used to develop new

operations or related to projects at existing operations where

those projects will materially benefit the operation.

The Company believes that AISC provides additional information

to management and stakeholders that provides visibility to better

define the total costs associated with production and better

understanding of the economics of the Company's operations and

performance compared to other producers.

In deriving the number of ounces of precious metal sold, the

Company considers the physical ounces available for sale after the

treatment and refining process, commonly referred to as payable

metal, as this is what is sold to third parties.

The following tables provide a reconciliation of Cost of sales

to Cash costs and AISC:

Three Months Ended June 30,

2024

(in thousands, unless otherwise noted)

�pler

Marigold

Seabee

Puna

Corporate

Total

Cost of sales (GAAP) (12)

$

—

$

39,237

$

17,275

$

40,070

$

—

$

96,582

By-product credits

$

—

$

(61)

$

(14)

$

(13,783)

$

—

$

(13,858)

Treatment and refining charges

$

—

$

74

$

45

$

2,038

$

—

$

2,157

Cash costs (non-GAAP)

$

—

$

39,250

$

17,306

$

28,325

$

—

$

84,881

Sustaining capital expenditures

$

4,602

$

12,432

$

6,201

$

3,550

$

—

$

26,785

Sustaining exploration and evaluation

expense

$

—

$

274

$

—

$

—

$

—

$

274

Care and maintenance (13)

$

17,283

$

—

$

—

$

—

$

—

$

17,283

Reclamation cost accretion and

amortization

$

493

$

605

$

922

$

5,926

$

—

$

7,946

General and administrative expense and

stock-based compensation expense

$

—

$

—

$

—

$

—

$

13,452

$

13,452

Total AISC (non-GAAP)

$

22,378

$

52,561

$

24,429

$

37,801

$

13,452

$

150,621

Gold sold (oz)

—

25,450

15,020

—

—

40,470

Silver sold (oz)

—

—

—

2,489,064

—

2,489,064

Gold equivalent sold (oz) (14)

—

25,450

15,020

30,720

—

71,190

Cost of sales per gold ounce sold

N/A

1,542

1,150

N/A

N/A

N/A

Cost of sales per silver ounce sold

N/A

N/A

N/A

16.10

N/A

N/A

Cost of sales per gold equivalent ounce

sold

N/A

1,542

1,150

1,304

N/A

1,357

Cash cost per gold ounce sold

N/A

1,542

1,152

N/A

N/A

N/A

Cash cost per silver ounce sold

N/A

N/A

N/A

11.38

N/A

N/A

Cash cost per gold equivalent ounce

sold

N/A

1,542

1,152

922

N/A

1,192

AISC per gold ounce sold

N/A

2,065

1,626

N/A

N/A

N/A

AISC per silver ounce sold

N/A

N/A

N/A

15.19

N/A

N/A

AISC per gold equivalent ounce sold

N/A

2,065

1,626

1,231

N/A

2,116

Three Months Ended June 30,

2023

(in thousands, unless otherwise noted)

�pler

Marigold

Seabee

Puna

Corporate

Total

Cost of sales (GAAP) (12)

$

54,949

$

63,965

$

18,272

$

33,454

$

—

$

170,640

By-product credits

$

(500)

$

(37)

$

(14)

$

(10,462)

$

—

$

(11,013)

Treatment and refining charges

$

—

$

276

$

19

$

3,749

$

—

$

4,044

Cash costs (non-GAAP)

$

54,449

$

64,204

$

18,277

$

26,741

$

—

$

163,671

Sustaining capital expenditures

$

10,511

$

31,312

$

6,872

$

2,477

$

—

$

51,172

Sustaining exploration and evaluation

expense

$

1,354

$

3,829

$

—

$

2,299

$

—

$

7,482

Reclamation cost accretion and

amortization

$

427

$

666

$

761

$

765

$

—

$

2,619

General and administrative expense and

stock-based compensation expense

$

1,326

$

—

$

—

$

37

$

14,899

$

16,262

Total AISC (non-GAAP)

$

68,067

$

100,011

$

25,910

$

32,319

$

14,899

$

241,206

Gold sold (oz)

49,197

60,389

15,330

—

—

124,916

Silver sold (oz)

—

—

—

1,856,600

—

1,856,600

Gold equivalent sold (oz) (14)

49,197

60,389

15,330

22,789

—

147,705

Cost of sales per gold ounce sold

1,117

1,059

1,192

N/A

N/A

N/A

Cost of sales per silver ounce sold

N/A

N/A

N/A

18.02

N/A

N/A

Cost of sales per gold equivalent ounce

sold

1,117

1,059

1,192

1,468

N/A

1,155

Cash cost per gold ounce sold

1,107

1,063

1,192

N/A

N/A

N/A

Cash cost per silver ounce sold

N/A

N/A

N/A

14.40

N/A

N/A

Cash cost per gold equivalent ounce

sold

1,107

1,063

1,192

1,173

N/A

1,108

AISC per gold ounce sold

1,384

1,656

1,690

N/A

N/A

N/A

AISC per silver ounce sold

N/A

N/A

N/A

17.41

N/A

N/A

AISC per gold equivalent ounce sold

1,384

1,656

1,690

1,418

N/A

1,633

(12)

Excludes depreciation, depletion, and

amortization.

(13)

Care and maintenance expense only includes

direct costs not associated with environmental reclamation and

remediation costs, as depreciation is not included in the

calculation of AISC.

(14)

Gold equivalent ounces are calculated by

multiplying the silver ounces by the ratio of the silver price to

the gold price, using the average LBMA prices for the period. The

Company does not include by-products in the gold equivalent ounce

calculations. Gold equivalent ounces sold may not add based on

amounts presented in this table due to rounding.

Six Months Ended June 30,

2024

(in thousands, unless otherwise noted)

�pler

Marigold

Seabee

Puna

Corporate

Total

Cost of sales (GAAP) (15)

$

24,423

$

88,308

$

41,708

$

68,044

$

—

$

222,483

By-product credits

$

(345)

$

(62)

$

(39)

$

(22,848)

$

—

$

(23,294)

Treatment and refining charges

$

351

$

147

$

80

$

3,520

$

—

$

4,098

Cash costs (non-GAAP)

$

24,429

$

88,393

$

41,749

$

48,716

$

—

$

203,287

Sustaining capital expenditures

$

9,689

$

14,737

$

21,106

$

6,909

$

—

$

52,441

Sustaining exploration and evaluation

expense

$

—

$

628

$

—

$

—

$

—

$

628

Care and maintenance (16)

$

24,961

$

—

$

—

$

—

$

—

$

24,961

Reclamation cost accretion and

amortization

$

978

$

1,540

$

1,849

$

8,075

$

—

$

12,442

General and administrative expense and

stock-based compensation expense

$

—

$

—

$

—

$

—

$

26,312

$

26,312

Total AISC (non-GAAP)

$

60,057

$

105,298

$

64,704

$

63,700

$

26,312

$

320,071

Gold sold (oz)

23,960

62,319

43,470

—

—

129,749

Silver sold (oz)

—

—

—

4,147,685

—

4,147,685

Gold equivalent sold (oz) (17)

23,960

62,319

43,470

49,115

—

178,864

Cost of sales per gold ounce sold

1,019

1,417

959

N/A

N/A

N/A

Cost of sales per silver ounce sold

N/A

N/A

N/A

16.41

N/A

N/A

Cost of sales per gold equivalent ounce

sold

1,019

1,417

959

1,385

N/A

1,244

Cash cost per gold ounce sold

1,020

1,418

960

N/A

N/A

N/A

Cash cost per silver ounce sold

N/A

N/A

N/A

11.75

N/A

N/A

Cash cost per gold equivalent ounce

sold

1,020

1,418

960

992

N/A

1,137

AISC per gold ounce sold

2,507

1,690

1,488

N/A

N/A

N/A

AISC per silver ounce sold

N/A

N/A

N/A

15.36

N/A

N/A

AISC per gold equivalent ounce sold

2,507

1,690

1,488

1,297

N/A

1,789

Six Months Ended June 30,

2023

(in thousands, unless otherwise noted)

�pler

Marigold

Seabee

Puna

Corporate

Total

Cost of sales (GAAP) (15)

$

129,595

$

118,506

$

41,537

$

80,299

$

—

$

369,937

By-product credits

$

(1,367)

$

(74)

$

(24)

$

(28,476)

$

—

$

(29,941)

Treatment and refining charges

$

—

$

459

$

49

$

9,247

$

—

$

9,755

Cash costs (non-GAAP)

$

128,228

$

118,891

$

41,562

$

61,070

$

—

$

349,751

Sustaining capital expenditures

$

17,214

$

64,434

$

20,007

$

5,307

$

—

$

106,962

Sustaining exploration and evaluation

expense

$

2,115

$

683

$

—

$

3,371

$

—

$

6,169

Reclamation cost accretion and

amortization

$

854

$

1,311

$

1,416

$

1,530

$

—

$

5,111

General and administrative expense and

stock-based compensation expense

$

2,062

$

—

$

—

$

89

$

32,652

$

34,803

Total AISC (non-GAAP)

$

150,473

$

185,319

$

62,985

$

71,367

$

32,652

$

502,796

Gold sold (oz)

107,211

111,686

32,130

—

—

251,027

Silver sold (oz)

—

—

—

4,238,140

—

4,238,140

Gold equivalent sold (oz) (17)

107,211

111,686

32,130

51,235

—

302,262

Cost of sales per gold ounce sold

1,209

1,061

1,293

N/A

N/A

N/A

Cost of sales per silver ounce sold

N/A

N/A

N/A

18.95

N/A

N/A

Cost of sales per gold equivalent ounce

sold

1,209

1,061

1,293

1,567

N/A

1,224

Cash cost per gold ounce sold

1,196

1,065

1,294

N/A

N/A

N/A

Cash cost per silver ounce sold

N/A

N/A

N/A

14.41

N/A

N/A

Cash cost per gold equivalent ounce

sold

1,196

1,065

1,294

1,192

N/A

1,157

AISC per gold ounce sold

1,404

1,659

1,960

N/A

N/A

N/A

AISC per silver ounce sold

N/A

N/A

N/A

16.84

N/A

N/A

AISC per gold equivalent ounce sold

1,404

1,659

1,960

1,393

N/A

1,663

(15)

Excludes depreciation, depletion, and

amortization.

(16)

Care and maintenance expense only includes

direct costs not associated with environmental reclamation and

remediation costs, as depreciation is not included in the

calculation of AISC.

(17)

Gold equivalent ounces are calculated by

multiplying the silver ounces by the ratio of the silver price to

the gold price, using the average LBMA prices for the period. The

Company does not include by-products in the gold equivalent ounce

calculations. Gold equivalent ounces sold may not add based on

amounts presented in this table due to rounding.

The following tables provide a reconciliation of cost of sales

to cash costs and AISC used in the calculation of 2024 cost

guidance for the Marigold, Seabee and Puna operations and corporate

office:

(operating guidance) (18)

Marigold

Seabee

Puna

Corporate

Gold Production

koz

155 – 175

75 – 85

—

—

Silver Production

Moz

—

—

8.75 – 9.50

—

Gold Equivalent Production

koz

155 – 175

75 – 85

110 – 120

—

Gold Sold

koz

155 – 175

75 – 85

—

—

Silver Sold

Moz

—

—

8.75 – 9.50

—

Gold Equivalent Sold

koz

155 – 175

75 – 85

110 – 120

—

Cost of Sales (GAAP) (19)

$M

201 – 235

75 – 85

140 – 162

—

By-Product Credits + Treatment &

Refining Costs

$M

—

—

(45)

—

Cash Cost (non-GAAP) (20)

$M

202 – 235

75 – 85

96 – 117

—

Sustaining Capital Expenditures (21)

$M

37

40

17

—

Reclamation Cost Accretion &

Amortization

$M

3

3

13

—

General & Administrative

$M

—

—

—

60 – 65

All-In Sustaining Cost (non-GAAP) (20)

$M

241 – 274

118 – 128

125 – 147

60 – 65

Cost of Sales per Ounce (GAAP)

(19)

$/oz

1,300 – 1,340

990 – 1,030

16.50 – 18.00

—

Cash Cost per Ounce (non-GAAP)

(20)

$/oz

1,300 – 1,340

990 – 1,030

11.50 – 13.00

—

All-In Sustaining Cost per Ounce

(non-GAAP) (20)

$/oz

1,535 – 1,575

1,495 – 1,535

14.75 – 16.25

—

Growth Capital Expenditures

$M

1

2

—

—

Growth Exploration and Resource

Development Expenditures (22)

$M

9

15

10

4

Total Growth Capital

$M

10

17

10

4

(18)

Figures may not add due to rounding.

(19)

Excludes depreciation, depletion, and

amortization.

(20)

SSR Mining reports the non-GAAP financial

measures of cash costs and AISC per payable ounce of gold and

silver sold to manage and evaluate operating performance at

Marigold, Seabee and Puna. AISC includes reclamation cost accretion

and amortization and certain lease payments.

(21)

Includes sustaining exploration and

evaluation expenditures. Includes approximately $1 million in

expensed sustaining exploration at Marigold and $24 million in

underground mine development at Seabee.

(22)

All growth exploration and resource

development spend is expensed. Growth exploration includes project

studies and evaluation.

Non-GAAP Measure - Adjusted Attributable

Net Income (loss) and Adjusted Attributable Net Income (Loss) Per

Share

Adjusted attributable net income (loss) and adjusted

attributable net income (loss) per share are used by management to

measure the Company's underlying operating performance. We believe

this measure is also useful for shareholders to assess the

Company’s operating performance. The most directly comparable

financial measures prepared in accordance with GAAP are net income

(loss) attributable to SSR Mining shareholders and net income

(loss) per share attributable to SSR Mining shareholders. Adjusted

attributable net income (loss) is defined as net income (loss)

adjusted to exclude the after-tax impact of specific items that are

significant, but not reflective of the Company's underlying

operations, including the expected impacts of �pler Incident;

inflationary impacts on tax balances; transaction, integration; and

other non-recurring items.

The following table provides a reconciliation of Net income

(loss) attributable to SSR Mining shareholders to adjusted net

income (loss) attributable to SSR Mining shareholders:

(in thousands of US dollars, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss) attributable to SSR

Mining shareholders (GAAP)

$

9,693

$

74,866

$

(277,389)

$

104,679

Interest saving on convertible notes, net

of tax

$

—

$

1,236

$

—

$

2,456

Net income (loss) used in the calculation

of diluted net income per share

$

9,693

$

76,102

$

(277,389)

$

107,135

Weighted-average shares used in the

calculation of net income (loss) and adjusted net income per

share

Basic

202,133

204,680

202,244

205,723

Diluted

202,407

217,320

202,244

218,347

Net income per share attributable to SSR

Mining shareholders (GAAP)

Basic

$

0.05

$

0.37

$

(1.37)

$

0.51

Diluted

$

0.05

$

0.35

$

(1.37)

$

0.49

Adjustments:

Effects of the �pler Incident (23)

$

—

$

—

$

321,954

$

—

Artmin transaction and integration

costs

$

—

$

377

$

—

$

377

Change in fair value of marketable

securities

$

(3,602)

$

746

$

(6,419)

$

(1,120)

Loss (gain) on sale of mineral properties,

plant and equipment

$

—

$

810

$

—

$

1,050

Income tax impact related to above

adjustments

$

573

$

(109)

$

1,021

$

30

Inflationary impacts on tax balances

$

825

$

(1,587)

$

(9,168)

$

(10,741)

Other tax adjustments (24)

$

—

$

—

$

—

$

2,101

Adjusted net income attributable to SSR

Mining shareholders (Non-GAAP)

$

7,489

$

75,103

$

29,999

$

96,376

Adjusted net income per share attributable

to SSR Mining shareholders (Non-GAAP)

Basic

$

0.04

$

0.37

$

0.15

$

0.47

Diluted (25)

$

0.04

$

0.35

$

0.15

$

0.45

(23)

The effects of the �pler Incident

represent the following unusual and nonrecurring charges: (1)

reclamation costs of $9.0 million and remediation costs of $209.3

million (amounts are presented net of pre-tax attributable to

non-controlling interest of $50.1 million); (2) impairment charges

of $91.4 million related to plans to permanently close the heap

leach pad (amount is presented net of pre-tax attributable to

non-controlling interest of $22.8 million); and (3) contingencies

of $12.3 million (amount is presented net of pre-tax attributable

to non-controlling interest of $3.0 million). Refer to Note 3 to

the Condensed Consolidated Financial Statements for further details

related to the impact of the �pler Incident.

(24)

Represents charges related to a one-time

tax imposed by Türkiye to fund earthquake recovery efforts, offset

by a release of an uncertain tax position.

(25)

Adjusted net income (loss) per diluted

share attributable to SSR Mining shareholders is calculated using

diluted common shares, which are calculated in accordance with

GAAP. For the six months ended June 30, 2024, $1.2 million interest

saving on 2019 Notes, net of tax, and potentially dilutive shares

of approximately 12.9 million were excluded from the computation of

diluted loss per common share attributable to SSR Mining

shareholders in the Condensed Consolidated Statement of Operations

as they were antidilutive. These interest savings and shares were

included in the computation of adjusted net income (loss) per

diluted share attributable to SSR Mining shareholders for the six

months ended June 30, 2024.

Non-GAAP Measure - Free Cash Flow, Cash

Flow from Operating Activities before Changes in Working Capital,

and Free Cash Flow before Changes in Working Capital

The Company uses free cash flow, cash flow from operating

activities before changes in working capital, and free cash flow

before changes in working capital to supplement information in its

condensed consolidated financial statements. The most directly

comparable financial measures prepared in accordance with GAAP is

cash provided by operating activities. The Company believes that in

addition to conventional measures prepared in accordance with US

GAAP, certain investors and analysts use this information to

evaluate the ability of the Company to generate cash flow after

capital investments and build the Company's cash resources. The

Company calculates free cash flow by deducting cash capital

spending from cash generated by operating activities. The Company

does not deduct payments made for business acquisitions.

The following table provides a reconciliation of cash provided

by operating activities to free cash flow:

(in thousands of US dollars, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash provided by operating activities

(GAAP)

$

(78,132)

$

80,343

$

(53,501)

$

83,310

Expenditures on mineral properties, plant,

and equipment

$

(38,176)

$

(57,935)

$

(72,211)

$

(117,177)

Free cash flow (non-GAAP)

$

(116,308)

$

22,408

$

(125,712)

$

(33,867)

We also present operating cash flow before working capital

adjustments and free cash flow before working capital adjustments

as non-GAAP cash flow measures to supplement our operating cash

flow and free cash flow (non-GAAP) measures. We believe presenting

both operating cash flow and free cash flow before working capital

adjustments, which reflects an exclusion of net changes in

operating assets and liabilities, will be useful for investors

because it presents cash flow that is actually generated from the

continuing business. The Company calculates cash generated by (used

in) operating activities before changes in working capital by

adjusting cash generated by (used in) operating activities by the

net change in operating assets and liabilities. The Company also

calculates free cash flow before changes in working capital by

deducting cash capital spending from cash flow from operating

activities before changes in working capital.

The following table provides a reconciliation of cash provided

by operating activities to cash generated by (used in) operating

activities before changes in working capital, and free cash flow

before changes in working capital:

(in thousands of US dollars, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash generated by (used in) operating

activities (GAAP)

$

(78,132)

$

80,343

$

(53,501)

$

83,310

Net change in operating assets and

liabilities

$

55,039

$

23,922

$

62,665

$

111,824

Cash generated by (used in) operating

activities before changes in working capital (non-GAAP)

$

(23,093)

$

104,265

$

9,164

$

195,134

Expenditures on mineral properties, plant,

and equipment

$

(38,176)

$

(57,935)

$

(72,211)

$

(117,177)

Free cash flow before changes in working

capital (non-GAAP)

$

(61,269)

$

46,330

$

(63,047)

$

77,957

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730317807/en/

SSR Mining: SSR Mining Inc.

E-Mail: invest@ssrmining.com Phone: +1 (888) 338-0046

To receive SSR Mining’s news releases by e-mail, please register

using the SSR Mining website at www.ssrmining.com.

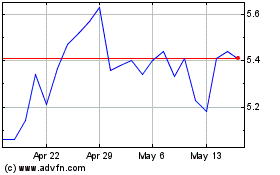

SSR Mining (NASDAQ:SSRM)

Historical Stock Chart

From Dec 2024 to Jan 2025

SSR Mining (NASDAQ:SSRM)

Historical Stock Chart

From Jan 2024 to Jan 2025