- Total revenues grew 66% y-o-y to $109.1 million for the fourth

quarter of 2024 and 50% y-o-y to $399.0 million for the full-year

2024; Full-year 2025 revenue guidance of $560 million to $590

million

- VYVGART® and VYVGART Hytrulo® sales reached $30.0 million for

the fourth quarter of 2024 and $93.6 million for the full-year

2024

- Loss from operations decreased 45% y-o-y to $67.9 million for

the fourth quarter of 2024 and 23% y-o-y to $282.1 million for the

full-year 2024

- Early clinical data from the global Phase 1 SCLC trial

highlights first- and best-in-class potential for ZL-1310 (DLL3

ADC) with ORR of 74%; Zai Lab holds global rights to ZL-1310 and

expects to present updated SCLC data at a major medical conference

and to explore its potential in other neuroendocrine tumors in the

first half of 2025

- Key regional programs advancing, including NDA acceptance of

KarXT for schizophrenia; Zai Lab’s immunology franchise bolstered

with late-stage assets including povetacicept in IgAN

Conference call and webcast today, February 27,

2025, at 8:00 a.m. ET (9:00 p.m. HKT)

Zai Lab Limited (NASDAQ: ZLAB; HKEX: 9688) today announced

financial results for the fourth quarter and full-year 2024, along

with recent product highlights and corporate updates.

“2024 was a defining year for Zai Lab, marked by strong sales

growth, financial strength, and significant pipeline progress. As

we look ahead, 2025 is set to be a transformative year with

VYVGART’s continued momentum, three new product launches, progress

with ZL-1310, and potential regulatory milestones for key assets,”

said Dr. Samantha Du, Founder, Chairperson, and Chief Executive

Officer of Zai Lab. “The VYVGART franchise generated $93.6 million

in net product revenue in its exceptional first full year of

launch, highlighting the strong demand for innovative therapies in

China. With the recent acceptance of KarXT’s New Drug Application

(NDA) by China’s National Medical Products Administration (NMPA) in

January, we are one step closer to bringing this novel medicine to

patients in need in China. Meanwhile, our global asset, ZL-1310,

demonstrated strong safety and efficacy data, reinforcing its

potential as a first- and best-in-class DLL3 antibody-drug

conjugate (ADC) for the treatment of small cell lung cancer (SCLC).

Zai Lab is stronger than ever, with the infrastructure, innovation,

and execution needed to bring medicines to patients around the

world and create value for our shareholders.”

“Our total revenue for the fourth quarter and full-year 2024

grew 66% and 50% y-o-y, respectively, driven by the continued

strong uptake of VYVGART along with continued growth in ZEJULA® and

NUZYRA® sales,” said Josh Smiley, President and Chief Operating

Officer of Zai Lab. “Looking ahead, we expect substantial topline

growth, targeting $2 billion in revenue by 2028, fueled by the

VYVGART franchise for generalized myasthenia gravis (gMG) and

chronic inflammatory demyelinating polyneuropathy (CIDP) as well as

upcoming potential blockbuster launches, including KarXT for

schizophrenia and bemarituzumab for gastric cancer. Our innovative

pipeline with global rights remains a key focus, with multiple data

readouts expected this year and the potential for U.S. Food and

Drug Administration (FDA) approval of ZL-1310 as early as 2027.

Additionally, we significantly improved our financial position,

delivering a substantial reduction in operating loss and advancing

towards our goal of achieving profitability1 in the fourth quarter

of 2025. With a robust cash position2, we are well-funded to reach

this milestone while continuing to invest in high-impact growth

opportunities.”

1 Profitability refers to adjusted income from operations

(non-GAAP), calculated as GAAP income (loss) from operations

adjusted to exclude certain non-cash expenses, including

depreciation, amortization, and share-based compensation. For

additional information on this adjusted profitability measure,

refer to the “Non-GAAP Measures” section. 2 Cash position includes

cash and cash equivalents, current restricted cash, and short-term

investments.

Fourth Quarter and Full-Year

2024

Financial Results

- Product revenue, net was $108.5 million in the fourth

quarter of 2024, compared to $65.8 million for the same period in

2023, representing 65% y-o-y growth at both actual exchange rate

and constant exchange rate (CER); and was $397.6 million in

full-year 2024, compared to $266.7 million for the same period in

2023, representing 49% y-o-y growth and 50% y-o-y growth at CER.

This revenue growth was primarily driven by increased sales for

VYVGART and was also supported by increased sales for ZEJULA and

NUZYRA.

- VYVGART and VYVGART Hytrulo were $30.0 million in

the fourth quarter of 2024, compared to $5.1 million for the same

period in 2023; and was $93.6 million in full-year 2024, compared

to $10.0 million for the same period in 2023. This growth was

driven by increased sales of VYVGART since its launch in September

2023 and listing on China’s National Reimbursement Drug List (NRDL)

for the treatment of gMG effective January 1, 2024.

- ZEJULA was $48.4 million in the fourth quarter of 2024,

an increase of 16% y-o-y from $41.6 million; and was $187.1 million

in full-year 2024, an increase of 11% y-o-y from $168.8 million.

ZEJULA sales remained strong as it continued to be the leading PARP

inhibitor in hospital sales for ovarian cancer in mainland

China.

- NUZYRA was $11.0 million in the fourth quarter of 2024,

an increase of 81% y-o-y from $6.1 million; and was $43.2 million

in full-year 2024, an increase of 99% y-o-y from $21.7 million.

This growth was supported by the inclusion in the NRDL for its IV

formulation in January 2023 and its oral formulation in January

2024 for the treatment of community-acquired bacterial pneumonia

(CABP) and acute bacterial skin and/or skin structure infections

(ABSSSI). The NRDL listing for the IV formulation of NUZYRA was

renewed in January 2025.

- Research and Development (R&D) expenses were $52.3

million in the fourth quarter of 2024, compared to $81.9 million

for the same period in 2023; and were $234.5 million for full-year

2024, compared to $265.9 million for the same period in 2023. These

decreases were primarily driven by the progress of existing

studies, partially offset by increases in licensing fees.

- Selling, General and Administrative (SG&A) expenses

were $82.6 million in the fourth quarter of 2024, flat compared to

the same period in 2023. SG&A expenses were $298.7 million for

full-year 2024, compared to $281.6 million for the same period in

2023, primarily due to higher general selling expenses related to

the launch of VYVGART and growing sales for NUZYRA, partially

offset by a decrease in selling expenses for other products and a

decrease in general and administrative expenses.

- Loss from operations was $67.9 million and $282.1

million in the fourth quarter of 2024 and full-year 2024,

respectively, $47.6 million and $199.6 million, respectively, when

adjusted to exclude non-cash expenses, including depreciation,

amortization, and share-based compensation. Loss from operations

was $124.0 million and $366.6 million in the fourth quarter of 2023

and full-year 2023, respectively. A reconciliation of loss from

operations (GAAP) to adjusted loss from operations (non-GAAP) is

included at the end of this release.

- Net loss was $81.7 million in the fourth quarter of

2024, or a loss per ordinary share attributable to common

stockholders of $0.08 (or loss per American Deposit Share (ADS) of

$0.80), compared to a net loss of $95.4 million for the same period

in 2023 or a loss per ordinary share of $0.10 (or loss per ADS of

$0.98). The net loss was $257.1 million for full-year 2024, or a

loss per ordinary share attributable to common stockholders of

$0.26 (or loss per ADS of $2.60), compared to a net loss of $334.6

million for full-year 2023, or a loss per ordinary share of $0.35

(or loss per ADS of $3.46). These decreases in net loss were

primarily due to product revenue growing faster than net operating

expenses, offset by decreased interest income and increased foreign

currency loss.

- Cash and cash equivalents, short-term investments and

current restricted cash totaled $879.7 million as of December

31, 2024, compared to $806.5 million as of December 31, 2023.

2025 Strategic

Priorities

Zai Lab will focus on the following strategic priorities in 2025

to drive innovation and growth in China and beyond:

Commercial Execution and Readiness

- Drive the ramp-up of VYVGART in gMG and VYVGART Hytrulo in gMG

and CIDP through new patient acquisition and expansion of duration

of treatment

- Maintain ZEJULA leadership position in ovarian cancer in

China

- Prepare for launch of potential blockbuster products including

bemarituzumab in gastric cancer and KarXT in schizophrenia

Clinical Development

- Rapidly advance the global Phase 1 study for ZL-1310 (DLL3 ADC

with global rights) in SCLC and explore its potential in other

neuroendocrine tumors

- Advance other assets with global rights including ZL-6201

(LRRC15 ADC) and ZL-1503 (IL-13/IL-31R) into Phase 1

development

- Within our regional immunology franchise, accelerate the

clinical development of efgartigimod (FcRn), povetacicept

(APRIL/BAFF), and ZL-1108 (IGF-1R) with several indications in

registrational stage

Clinical Data and Regulatory Actions

- Data readouts for ZL-1310 (DLL3 ADC) in second-line+ and

first-line SCLC

- Data readouts for Phase 3 studies of bemarituzumab in

first-line gastric cancer; and potential Biologics License

Application (BLA) submission to NMPA in the first half of 2025

- Potential NMPA submissions for Tumor Treating Fields (TTFields)

in second-line+ non-small cell lung cancer (NSCLC) and first-line

pancreatic cancer

2025 Guidance

Zai Lab expects continued rigorous financial discipline and:

- Total revenue to be in the range of $560 million to $590

million for full-year 2025

- On a non-GAAP basis, achieve profitability1 in the fourth

quarter of 2025

1 Profitability refers to adjusted income from operations

(non-GAAP), calculated as GAAP income (loss) from operations

adjusted to exclude non-cash expenses, including depreciation,

amortization, and share-based compensation. For additional

information on this adjusted profitability measure, refer to the

“Non-GAAP Measures” section.

Corporate Updates

Below are key corporate updates since our last earnings

release:

- We expanded and strengthened our global and regional pipelines

through synergistic business development activities, including a

strategic collaboration and worldwide license agreement with

MediLink to use MediLink’s TMALIN ADC platform for the development

of ZL-6201, a novel potential first-in-class LRRC15 ADC consisting

of an antibody discovered by Zai Lab, for the treatment of certain

solid tumors; a strategic collaboration with Vertex for the license

of povetacicept, a potential best-in-class treatment for

immunoglobulin A nephropathy (IgAN) and other B-cell mediated

diseases, in mainland China, Hong Kong, Macau, Taiwan, and

Singapore; and the license of ZL-1108, or veligrotug, a

differentiated humanized monoclonal antibody targeting IGF-1R from

Zenas BioPharma for the treatment of thyroid eye disease (TED) in

mainland China, Hong Kong, Macau, Taiwan, and Singapore.

- We also entered into a strategic collaboration with Pfizer on

the novel antibacterial drug XACDURO® (Sulbactam-Durlobactam),

which was launched in mainland China in January 2025. Through this

collaboration, Zai Lab will leverage the industry-leading

commercialization infrastructure of Pfizer’s affiliated companies

in the anti-infective therapeutic area to help accelerate access to

this important therapy for patients in need in mainland China.

- NRDL Updates: In November 2024, Zai Lab announced the

inclusion of AUGTYRO® (repotrectinib) for ROS1+ NSCLC as well as

the successful renewals of NUZYRA (omadacycline) for CABP and

ABSSSI and QINLOCK® (ripretinib) for fourth-line+ gastrointestinal

stromal tumor (GIST) patients in China’s NRDL.

- Capital Markets: In November 2024, Zai Lab completed a

public offering of ADSs, which resulted in aggregate net proceeds

to the Company of approximately $215.1 million, after deducting

underwriting discounts and commissions and other offering expenses

payable by the Company.

Recent Pipeline

Highlights

Below are key product updates since our last earnings

release:

Oncology Pipeline

- ZL-1310 (DLL3 ADC): In January 2025, the FDA granted

Orphan Drug Designation to ZL-1310 for the treatment of SCLC.

Receiving an Orphan Drug Designation for ZL-1310 reflects its

potential to treat patients with SCLC, and ZL-1310 will be eligible

for certain development incentives, including the potential to

receive a seven-year U.S. market exclusivity period granted by the

FDA upon product approval.

- Tumor Treating Fields (TTFields): In December 2024, Zai

Lab and partner Novocure announced that the pivotal Phase 3

PANOVA-3 trial for pancreatic cancer met its primary endpoint,

demonstrating a statistically significant improvement in median

overall survival versus control group. PANOVA-3 is the first and

only Phase 3 trial to demonstrate a statistically significant

benefit in overall survival specifically in unresectable, locally

advanced pancreatic cancer. Zai Lab participated in the study in

Greater China and plans to file for regulatory approval in China in

the second half of 2025.

- Tisotumab Vedotin (Tissue Factor ADC): In January 2025,

Zai Lab announced positive topline results from the China

subpopulation of the global Phase 3 innovaTV 301 study,

demonstrating a clinically meaningful improvement in overall

survival with TIVDAK® treatment for patients with previously

treated recurrent or metastatic cervical cancer compared to

chemotherapy. Zai Lab plans to submit an NDA to the NMPA in the

first quarter of 2025 and will leverage its commercial footprint of

ZEJULA in women’s cancer to accelerate patient access to this

therapy in China if approved.

- Repotrectinib (ROS1/TRK): In February 2025, China’s NMPA

granted priority review to repotrectinib for the treatment of

patients with advanced solid tumors that have an NTRK gene fusion.

Zai Lab plans to submit a supplemental NDA to the NMPA in the first

half of 2025.

Immunology, Neuroscience, and Infectious Disease

Pipeline

- Efgartigimod (FcRn): In November 2024, Zai Lab partner

argenx announced the decision to advance clinical development of

the subcutaneous formulation of efgartigimod (efgartigimod SC) in

the ongoing Phase 2/3 ALKIVIA study for the treatment of idiopathic

inflammatory myopathies (IIM, or myositis), following analysis of

topline data from the Phase 2 portion of the study. Zai Lab is

participating in the study in Greater China.

- Xanomeline and Trospium Chloride (KarXT)

(M1/M4-agonist): In January 2025, China’s NMPA accepted the NDA

for KarXT for the treatment of schizophrenia in adults. If

approved, KarXT has the potential to redefine the treatment

landscape for patients with schizophrenia in mainland China.

Anticipated Major Milestones in

2025

Upcoming Potential NMPA Submissions

- Tisotumab Vedotin (Tissue Factor ADC): BLA submission in

recurrent or metastatic cervical cancer following progression on or

after chemotherapy in the first quarter of 2025.

- Bemarituzumab (FGFR2b): BLA submission in first-line

gastric cancer in the first half of 2025.

- Repotrectinib (ROS1/TRK): supplementary NDA submission

in NTRK+ solid tumors in the first half of 2025.

- Tumor Treating Fields (TTFields): Marketing

Authorization Application submissions in second-line+ NSCLC

following progression on or after platinum-based chemotherapy and

in first-line pancreatic cancer.

Expected Clinical Developments and Data Readouts in

2025

Global Pipeline

ZL-1310 (DLL3 ADC)

- Second-Line+ Extensive-Stage SCLC (ES-SCLC): Zai Lab to present

updated data at a major medical conference in the first half of

2025. Zai Lab plans to initiate a pivotal study in 2025.

- First-Line ES-SCLC: Zai Lab to provide data readout for dose

escalation of ZL-1310 doublet in combination with atezolizumab and

initiate dose escalation for ZL-1310 triplet in combination with

atezolizumab and platinum-based chemotherapy.

- Other neuroendocrine tumors: Zai Lab to initiate a global Phase

1 study in the first half of 2025.

ZL-1102 (IL-17 Humabody®)

- Zai Lab to provide interim analysis in the global Phase 2 study

in chronic plaque psoriasis in the first half of 2025.

ZL-1503 (IL-13/IL-31R)

- Zai Lab to provide preclinical data update and initiate a

global Phase 1 study in moderate-to-severe atopic dermatitis.

ZL-6201 (LRRC15 ADC)

- Zai Lab to provide preclinical data update and initiate a

global Phase 1 study in sarcoma.

Regional Pipeline

Bemarituzumab (FGFR2b)

- Zai Lab partner Amgen to provide data readout from the Phase 3

FORTITUDE-101 study of bemarituzumab combined with chemotherapy

versus chemotherapy alone in first-line gastric cancer in the first

half of 2025. Zai Lab is participating in the study in Greater

China.

- Zai Lab partner Amgen to provide data readout from the Phase 3

FORTITUDE-102 study of bemarituzumab plus chemotherapy and

nivolumab versus chemotherapy and nivolumab in first-line gastric

cancer in the second half of 2025. Zai Lab is participating in the

study in Greater China.

Efgartigimod (FcRn)

- Seronegative gMG: Zai Lab partner argenx to provide topline

results from the Phase 3 ADAPT-SERON study in seronegative gMG. Zai

Lab participated in the study in Greater China.

- Lupus Nephritis (LN): Zai Lab to provide topline results from

the Phase 2 study in LN.

Conference Call and Webcast

Information

Zai Lab will host a live conference call and webcast today,

February 27, 2025, at 8:00 a.m. ET (9:00 p.m. HKT). Listeners may

access the live webcast by visiting the Company’s website at

http://ir.zailaboratory.com. Participants must register in advance

of the conference call.

Details are as follows:

Registration Link:

https://register.vevent.com/register/BI628d3dd054cb4c45b3d01b61fa5779b1

All participants must use the link provided above to complete

the online registration process in advance of the conference call.

Dial-in details will be in the confirmation email which the

participant will receive upon registering.

A replay will be available shortly after the call and can be

accessed by visiting the Company’s website.

About Zai Lab

Zai Lab Limited (NASDAQ: ZLAB; HKEX: 9688) is an innovative,

research-based, commercial-stage biopharmaceutical company based in

China and the United States. We are focused on discovering,

developing, and commercializing innovative products that address

medical conditions with significant unmet needs in the areas of

oncology, immunology, neuroscience, and infectious disease. Our

goal is to leverage our competencies and resources to positively

impact human health in China and worldwide.

For additional information about Zai Lab, please visit

www.zailaboratory.com or follow us at

https://x.com/ZaiLab_Global.

Non-GAAP Measures

In addition to results presented in accordance with GAAP, we

disclose growth rates that have been adjusted to exclude the impact

of changes due to the translation of foreign currencies into U.S.

dollars. We have also presented a measure of adjusted loss from

operations that adjusts GAAP loss from operations to exclude the

impact of certain non-cash expenses including depreciation,

amortization, and share-based compensation, which we refer to as

“profitability.” These adjusted growth rates and adjusted loss from

operations are non-GAAP measures. We believe that these non-GAAP

measures are important for an understanding of the performance of

our business operations and financial results and provide investors

with an additional perspective on operational trends and greater

transparency into our historical and projected operating

performance. Although we believe the non-GAAP financial measures

enhance investors’ understanding of our business and performance,

these non-GAAP financial measures should not be considered an

exclusive alternative to accompanying GAAP financial measures.

Zai Lab Forward-Looking Statements

This press release contains certain forward-looking statements,

including statements relating to our strategy and plans; potential

of and expectations for our business, commercial products, and

pipeline programs; our goals, objectives, and priorities and our

expectations under our growth strategy (including our expectations

regarding our commercial products and launches, clinical stage

products, revenue growth, profitability, and cash flow); clinical

development programs and related clinical trials; clinical trial

data, data readouts, and presentations; risks and uncertainties

associated with drug development and commercialization; regulatory

discussions, submissions, filings, and approvals and the timing

thereof; the potential benefits, safety, and efficacy of our

products and product candidates and those of our collaboration

partners; the anticipated benefits and potential of investments,

collaborations, and business development activities; our

profitability and timeline to profitability; our future financial

and operating results; and financial guidance, including with

respect to our planned sources and uses of cash and our expected

path to profitability. All statements, other than statements of

historical fact, included in this press release are forward-looking

statements, and can be identified by words such as “aim,”

“anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,”

“goal,” “intend,” “may,” “plan,” “possible,” “potential,” “will,”

“would,” and other similar expressions. Such statements constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not guarantees or assurances of future performance.

Forward-looking statements are based on our expectations and

assumptions as of the date of this press release and are subject to

inherent uncertainties, risks, and changes in circumstances that

may differ materially from those contemplated by the

forward-looking statements. We may not actually achieve the plans,

carry out the intentions, or meet the expectations or projections

disclosed in our forward-looking statements, and you should not

place undue reliance on these forward-looking statements. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors, including but not limited to (1) our ability to

successfully commercialize and generate revenue from our approved

products; (2) our ability to obtain funding for our operations and

business initiatives; (3) the results of our clinical and

pre-clinical development of our product candidates; (4) the content

and timing of decisions made by the relevant regulatory authorities

regarding regulatory approvals of our product candidates; (5) risks

related to doing business in China; and (6) other factors

identified in our most recent annual and quarterly reports and in

other reports we have filed with the U.S. Securities and Exchange

Commission (SEC). We anticipate that subsequent events and

developments will cause our expectations and assumptions to change,

and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as may be required by law.

These forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Our SEC filings can be found on our website at

www.zailaboratory.com and on the SEC’s website at www.SEC.gov.

Zai Lab Limited

Consolidated Balance Sheets

(in thousands of U.S. dollars (“$”), except for number of

shares and per share data)

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

449,667

790,151

Restricted cash, current

100,000

—

Short-term investments

330,000

16,300

Accounts receivable (net of allowance for

credit losses of $25 and $17 as of December 31, 2024 and 2023,

respectively)

85,178

59,199

Notes receivable

4,233

6,134

Inventories, net

39,875

44,827

Prepayments and other current assets

41,527

22,995

Total current assets

1,050,480

939,606

Restricted cash, non-current

1,114

1,113

Long-term investments

3,115

9,220

Prepayments for equipment

18

111

Property and equipment, net

47,961

53,734

Operating lease right-of-use assets

21,496

14,844

Land use rights, net

2,907

3,069

Intangible assets, net

56,027

13,389

Long-term deposits

1,284

1,209

Value added tax recoverable

1,351

—

Total assets

1,185,753

1,036,295

Liabilities and shareholders’

equity

Current liabilities

Accounts payable

100,906

112,991

Current operating lease liabilities

8,048

7,104

Short-term debt

131,711

—

Other current liabilities

58,720

82,972

Total current liabilities

299,385

203,067

Deferred income

31,433

28,738

Non-current operating lease

liabilities

13,712

8,047

Other non-current liabilities

325

325

Total liabilities

344,855

240,177

Commitments and contingencies

Shareholders’ equity

Ordinary shares (par value of $0.000006

per share; 5,000,000,000 shares authorized, 1,082,614,740 and

977,151,270 shares issued as of December 31, 2024 and 2023,

respectively; 1,077,702,540 and 972,239,070 shares outstanding as

of December 31, 2024 and 2023)

7

6

Additional paid-in capital

3,264,295

2,975,302

Accumulated deficit

(2,453,083

)

(2,195,980

)

Accumulated other comprehensive income

50,515

37,626

Treasury stock (at cost, 4,912,200 shares

as of both December 31, 2024 and 2023)

(20,836

)

(20,836

)

Total shareholders’ equity

840,898

796,118

Total liabilities and shareholders’

equity

1,185,753

1,036,295

Zai Lab Limited

Consolidated Statements of

Operations

(unaudited for the three months ended

December 31, 2024 and 2023)

(in thousands of $, except for number

of shares and per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenues

Product revenue, net

108,512

65,830

397,614

266,719

Collaboration revenue

558

—

1,374

—

Total revenues

109,070

65,830

398,988

266,719

Expenses

Cost of product revenue

(41,782

)

(25,237

)

(147,118

)

(95,816

)

Cost of collaboration revenue

(309

)

—

(742

)

—

Research and development

(52,252

)

(81,948

)

(234,504

)

(265,868

)

Selling, general and administrative

(82,618

)

(82,626

)

(298,741

)

(281,608

)

Gain on sale of intellectual property

—

—

—

10,000

Loss from operations

(67,891

)

(123,981

)

(282,117

)

(366,573

)

Interest income

9,088

10,304

37,105

39,797

Interest expenses

(904

)

—

(2,254

)

—

Foreign currency losses (gains)

(23,418

)

11,465

(15,137

)

(14,850

)

Other income, net

1,441

6,783

5,300

7,006

Loss before income tax and share of loss

from equity method investment

(81,684

)

(95,429

)

(257,103

)

(334,620

)

Income tax expense

—

—

—

—

Net loss

(81,684

)

(95,429

)

(257,103

)

(334,620

)

Loss per share — basic and diluted

(0.08

)

(0.10

)

(0.26

)

(0.35

)

Weighted-average shares used in

calculating net loss per ordinary share — basic and diluted

1,026,815,280

972,239,070

989,477,730

966,394,130

Zai Lab Limited

Consolidated Statements of

Comprehensive Loss

(unaudited for the three months ended

December 31, 2024 and 2023)

(in thousands of $)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Net loss

(81,684

)

(95,429

)

(257,103

)

(334,620

)

Other comprehensive income (loss), net of

tax of nil:

Foreign currency translation

adjustments

22,245

(10,326

)

12,889

11,941

Comprehensive loss

(59,439

)

(105,755

)

(244,214

)

(322,679

)

Zai Lab Limited

Non-GAAP Measures

(unaudited)

($ in thousands)

Growth on a Constant Exchange Rate

(CER) Basis

Three Months Ended

December 31,

Year over Year %

Growth

Year Ended

December 31,

Year over Year %

Growth

2024

2023

As

reported

At CER*

2024

2023

As

reported

At CER*

Product revenue, net

108,512

65,830

65

%

65

%

397,614

266,719

49

%

50

%

Loss from operations

(67,891

)

(123,981

)

(45

)%

(45

)%

(282,117

)

(366,573

)

(23

)%

(23

)%

* The growth rates at CER were calculated assuming the same

foreign currency exchange rates were in effect for the current and

prior year periods.

Reconciliation of Loss from Operations

(GAAP) to Adjusted Loss from Operations (Non-GAAP)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

GAAP loss from operations

(67,891

)

(123,981

)

(282,117

)

(366,573

)

Plus: Depreciation and amortization

expenses

3,032

2,459

11,856

9,029

Plus: Share-based compensation

17,238

20,470

70,651

79,634

Adjusted loss from operations

(47,621

)

(101,052

)

(199,610

)

(277,910

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227759111/en/

For more information, please contact:

Investor Relations: Christine Chiou / Lina Zhang +1 (917)

886-6929 / +86 136 8257 6943 christine.chiou1@zailaboratory.com /

lina.zhang@zailaboratory.com

Media: Shaun Maccoun / Xiaoyu Chen +1 (415) 317-7255 /

+86 185 0015 5011 shaun.maccoun@zailaboratory.com /

xiaoyu.chen@zailaboratory.com

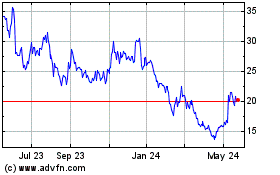

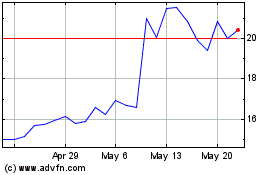

Zai Lab (NASDAQ:ZLAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Zai Lab (NASDAQ:ZLAB)

Historical Stock Chart

From Mar 2024 to Mar 2025