0000890564false00008905642025-03-042025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 4, 2025 (March 1, 2025)

ASGN Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35636 | | 95-4023433 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

4400 Cox Road, Suite 110

Glen Allen, Virginia 23060

(Address, including zip code, of Principal Executive Offices)

(888) 482-8068

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock | ASGN | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2025, the Company announced the appointment of Sadasivam (Shiv) Iyer as the Company’s President, effective as of March 1, 2025.

Mr. Iyer, age 52, brings over two decades of consulting experience to the Company. He most recently led Accenture’s Consulting and Industry X business across the U.S., Canada, and Latin America, scaling the company’s functional, industry, and technological advisory capabilities. Mr. Iyer also served as Managing Director at Alvarez & Marsal, a global consulting firm, from November 2020 to March 2021. Prior to his tenure at Alvarez & Marsal, Mr. Iyer joined Accenture in 2010 as a managing director in the Products industry vertical, before serving as Market Unit Lead, US Midwest. Mr. Iyer began his career at Wipro Infotech in India. Mr. Iyer holds his bachelor's and master's degrees from the University of Mumbai and an MBA from the Kelley School of Business at Indiana University.

In connection with joining the Company, Mr. Iyer entered into an employment agreement (the “Employment Agreement”) as described in more detail below. The description below is not complete and is qualified in its entirety by reference to the Employment Agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2025.

Under the Employment Agreement, Mr. Iyer is entitled to receive an initial base salary (the “Base Salary”) of $850,000 per year, and Mr. Iyer is eligible to receive a target annual cash incentive bonus (an “Annual Bonus”) opportunity equal to 125 percent of his base salary in effect for the relevant year, with the maximum cash performance bonus equal to 200 percent of the target bonus in effect for the relevant year. The Employment Agreement further provides that Mr. Iyer is eligible for a monthly automobile allowance in the amount of $500, an annual physical examination allowance up to $1,500, tax preparation and financial planning services up to $2,500 annually, and reimbursement of up to $10,000 in legal fees incurred in connection with the negotiation of the agreement.

The Employment Agreement provides that Mr. Iyer is eligible to receive annual long-term equity awards in accordance with the Company’s long-term compensation plan applicable to senior executives, with a target annual equity award value equal to $1,750,000, which may be adjusted subject to the sole discretion of the Compensation Committee of the Board. The specific terms and conditions of any annual equity award, including vesting and performance conditions, will be determined by the Compensation Committee of the Board. In addition, Mr. Iyer will receive a long-term equity award upon signing with a value of $4,000,000; the vesting terms and conditions will be the same as his 2025 annual equity awards.

If Mr. Iyer’s employment is terminated by the Company without “cause” or by Mr. Iyer for “good reason” (each, a “Qualifying Termination”), then:

•the Company will pay Mr. Iyer an amount equal to 12 months of the Base Salary in effect on the date of termination, payable in substantially equal installments over a 12-month period following the Executive’s separation from service; and

•the Company will provide, during the 12-month period commencing on the date of termination, Mr. Iyer and Mr. Iyer’s eligible dependents with Company-subsidized coverage under its group health plans.

If Mr. Iyer incurs a separation from service by reason of Mr. Iyer’s death or disability, then Mr. Iyer will receive the same separation payments and benefits as upon a Qualifying Termination. Further, per his equity grant agreements, upon his death or disability, his time-vesting restricted stock units ("RSUs") will be accelerated, and his performance-based RSUs will not be forfeited as if the executive had provided service for the entire performance period, to be paid out upon certification of performance.

The separation payments and benefits described above are subject to Mr. Iyer’s (or Mr. Iyer’s estate, if applicable) execution and non-revocation of a general release of claims in favor of the Company, and continued compliance with certain restrictive covenants, including confidentiality, non-compete, and non-solicitation covenants.

Pursuant to the Employment Agreement, during the employment period Mr. Iyer will be eligible to participate in the ASGN Incorporated Amended and Restated Change in Control Severance Plan (the “CIC Plan”) at the level of “President,” as such plan may be amended from time to time in accordance with its terms.

Other than as described above, Mr. Iyer has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor are any such transactions currently proposed. There are no arrangements or understandings between Mr. Iyer and any other persons pursuant to which he was appointed as an executive officer of the Company, and there are no family relationships between Mr. Iyer and any director or executive officer of the Company.

A copy of the press release is furnished as Exhibit 99.1 to this Report. The information included in Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the company under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | | | | |

| Exhibit No. | | Description |

99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | ASGN Incorporated | |

| | | |

| Date: March 4, 2025 | | /s/ Jennifer Hankes Painter | |

| | Jennifer Hankes Painter | |

| | Senior Vice President, Chief Legal Officer and Secretary | |

ASGN Incorporated Announces Closing of the Acquisition of TopBloc

Shiv Iyer Officially Becomes President

RICHMOND, VA., March 4, 2025 -- ASGN Incorporated (NYSE: ASGN), a leading provider of IT services and professional solutions across the commercial and government sectors, announced today that it has closed its previously announced acquisition of TopBloc, LLC (“TopBloc” or “the Company”) for a total consideration of $340 million in cash and equity. TopBloc’s experienced team has become part of ASGN’s Consulting Services.

“We are pleased to announce the successful closing of our acquisition of TopBloc,” said ASGN’s Chief Executive Officer, Ted Hanson. “This acquisition is a significant step in our ongoing strategy to align with in-demand solutions and strong technology alliance partners, thereby extending their capabilities across ASGN’s deep customer base. As ERP platforms are crucial to managing financial and human capital information across enterprises, they’ve become even more essential with the expansion of GenAI use cases that rely on clean, auditable, and secure data. Acquiring TopBloc ideally positions ASGN to enhance our services and immediately capitalize on these emerging opportunities in the ERP and Workday marketplace.”

ASGN is also pleased to announce that Shiv Iyer has officially assumed the role of President, effective immediately. Iyer succeeds Rand Blazer, who has transitioned into the role of Executive Vice Chairman. Iyer brings extensive consulting experience to ASGN. Most recently, he led Accenture’s Consulting and Industry X solutions across the United States, Canada, and Latin America.

“Having gotten to know Shiv over the past few months, I am delighted to officially welcome him to ASGN as our new President,” said Hanson. “Shiv’s approach to serving enterprise accounts by bringing innovative solutions across a large account portfolio aligns perfectly with ASGN’s business philosophy. With Rand’s ongoing support on key strategic initiatives and Shiv’s proven track record, I am confident in a seamless leadership transition.”

In connection with the closing of the acquisition, ASGN is granting restricted stock unit (“RSU”) awards to 41 key TopBloc employees covering approximately 150,000 shares today. These awards vest: (a) one-half on the second anniversary of the grant date, and (b) 25 percent on each of the third and fourth anniversaries of the grant date. Further, in connection with his hire, Mr. Iyer: (a) received an award of 44,162 RSUs on March 3, 2025, which vest in equal installments on the first, second, and third anniversaries of the grant, and (b) will receive a value of $2.875 million of performance-based RSUs when the Compensation Committee sets the target, which will vest on December 31, 2027, subject to certification of performance. All of the RSUs are subject to continued service through the vesting dates and are granted as employment inducement awards pursuant to the New York Stock Exchange rules.

About ASGN Incorporated

ASGN Incorporated (NYSE: ASGN) is a leading provider of IT services and solutions across the commercial and government sectors. ASGN helps corporate enterprises and government organizations develop, implement, and operate critical IT and business solutions through its integrated offerings. For more information, please visit asgn.com.

Safe Harbor

Certain statements made in this news release are “forward-looking statements” within the meaning of Section 27A of the Securities Exchange Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and involve a high degree of risk and uncertainty. Forward-looking statements include statements, amongst others, regarding our anticipated financial and operating performance and that of TopBloc. All statements in this news release, other than those setting forth strictly historical information, are forward-looking statements. Forward-looking statements are not guarantees of future performance and actual results might differ materially. For a full list of risks and discussion of forward-looking statements, please see our Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on February 24, 2025. We specifically disclaim any intention or duty to update any forward-looking statements contained in this news release.

Contact:

Kimberly Esterkin

Vice President, Investor Relations

kimberly.esterkin@asgn.com

v3.25.0.1

Document and Entity Information

|

Mar. 04, 2025 |

| Document Information [Line Items] |

|

| Document Period End Date |

Mar. 04, 2025

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 04, 2025

|

| Entity Registrant Name |

ASGN Inc

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35636

|

| Entity Tax Identification Number |

95-4023433

|

| Entity Address, Address Line One |

4400 Cox Road, Suite 110

|

| Entity Address, City or Town |

Glen Allen,

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23060

|

| City Area Code |

888

|

| Local Phone Number |

482-8068

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ASGN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000890564

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

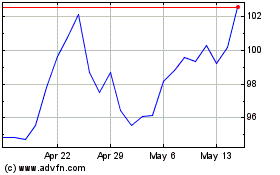

ASGN (NYSE:ASGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Mar 2025